Chapter. Czech Republic

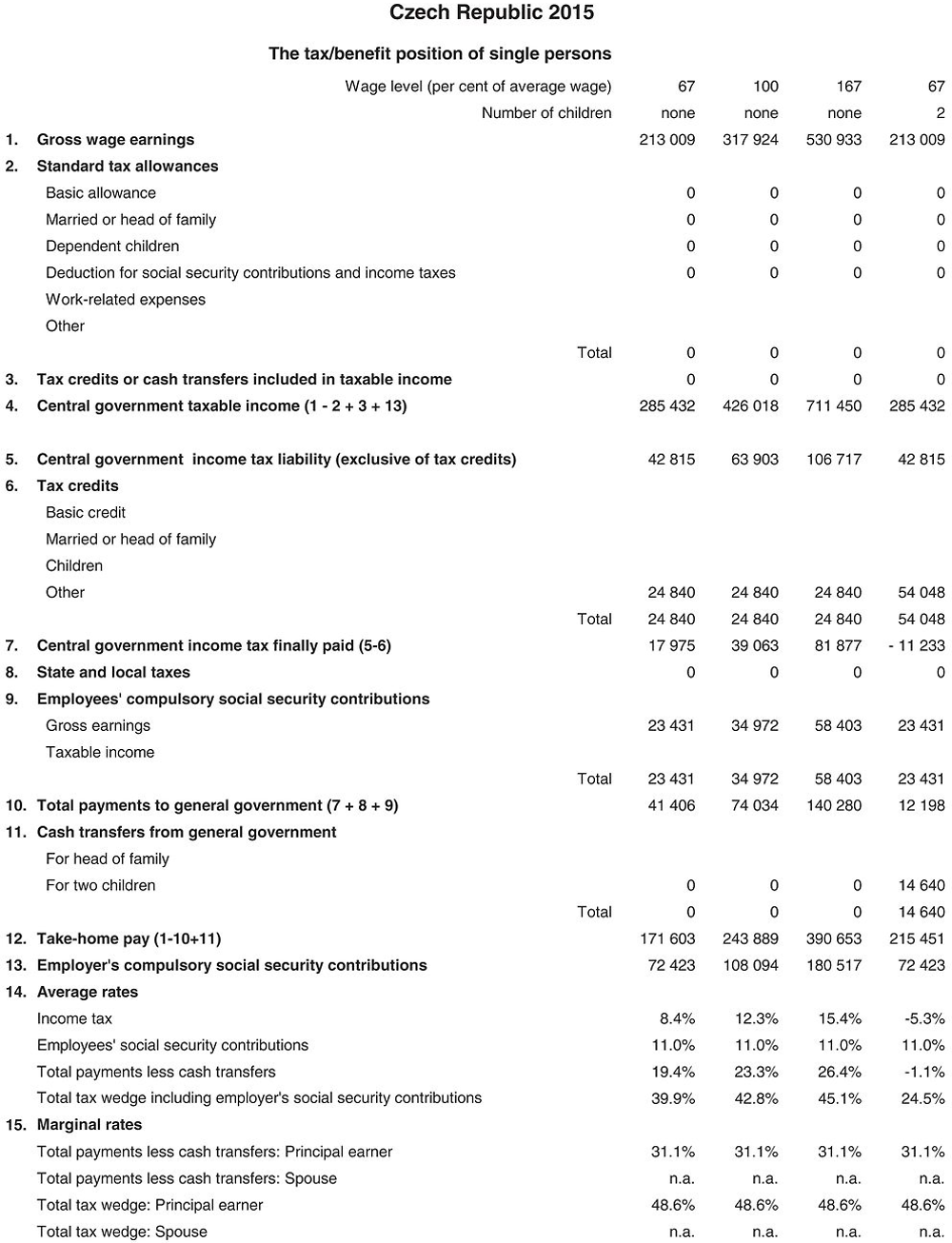

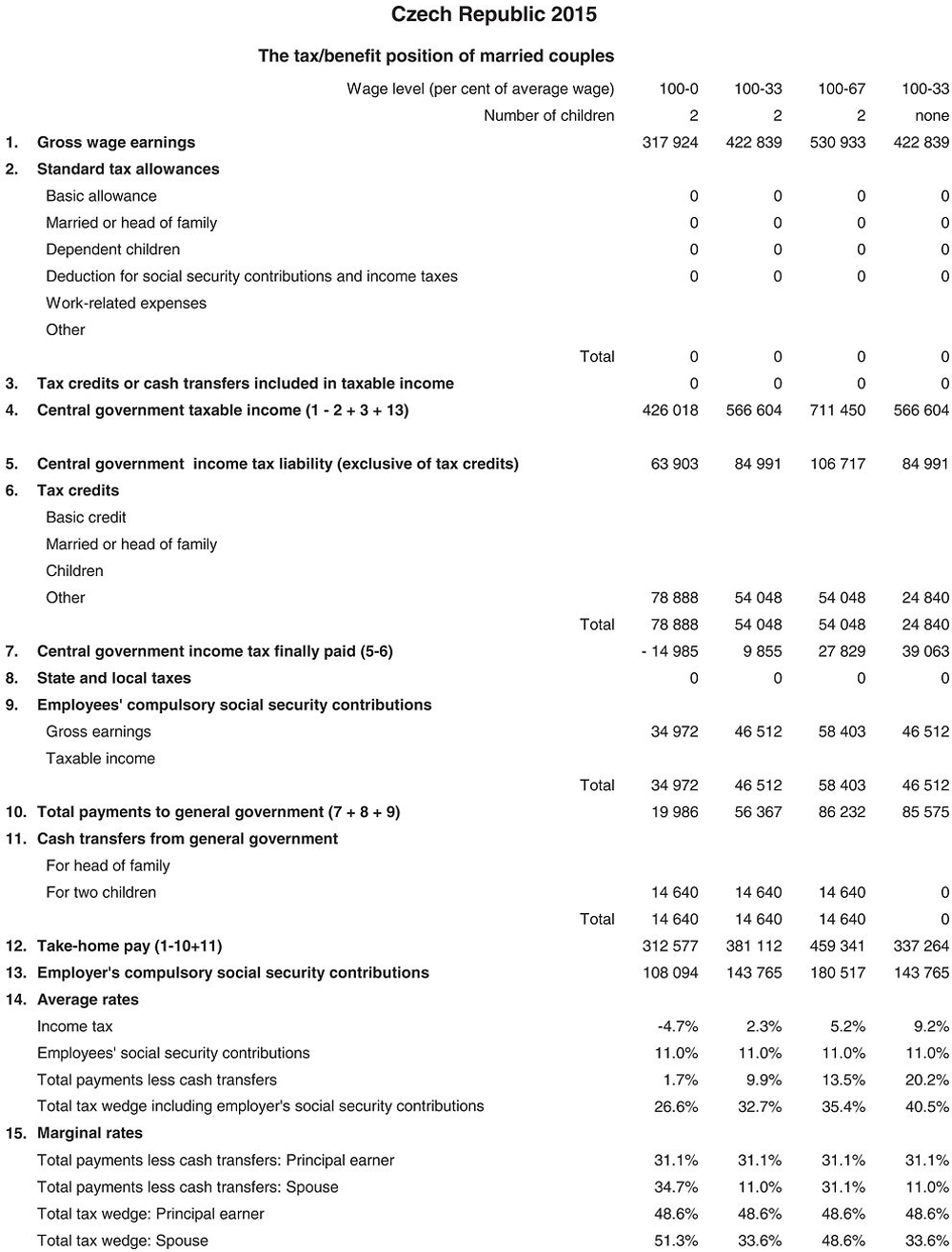

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Czech koruna (CZK). In 2015, CZK 24.59 was equal to USD 1. In that year, the average worker earned CZK 317 924 (Secretariat estimate).

1. personal income tax system

1.1. Central government income taxes

1.1.1. Tax unit

-

The tax unit is the individual.

1.1.2. Tax allowances and tax credits

1.1.2.1. Standard reliefs

-

Relief for social and health security contributions. Employees’ social security contributions (see Section 2.1) are not deductible for income tax purposes.

1.1.2.2. Main non-standard tax reliefs applicable to an AW

-

Charitable donations allowance: A tax allowance of up to 10% of taxable income is available for donations made to municipalities or legal entities for the financing of social, health, cultural, humanitarian, religious, ecological and sport activities. The minimum limit for donations is the lesser of 2% of taxable income or CZK 1 000. A similar procedure shall apply for gratuitous performance to finance the removal of the consequences of a natural disaster occurring in the territory of an EU Member State, Norway or Iceland. The total deduction may not exceed 15% of the tax base. As gratuitous performance for healthcare purposes, the value of one blood donation from an unpaid donor is valued at a sum of CZK 2 000 and the value of an organ donation from a living donor is valued at a sum of CZK 20 000.

-

Interest payments: Taxpayers may claim an allowance of up to CZK 300 000 for mortgage interest payments or other interest payments related to the purchase or the improvement of their house. The total sum of interest by which the tax base is reduced on all credits of payers in the same jointly managed household must not exceed CZK 300 000.

-

Supplementary pension scheme contributions: In a period of taxation, the tax base may be reduced by a contribution, in the maximum total amount of CZK 12 000, paid by a taxpayer to their supplementary pension insurance with a State contribution under a contract on supplementary pension insurance with a State contribution entered into between the payer and a pension company; the sum that may be deducted in this manner equals the total amount of contributions paid by the payer for their supplementary pension insurance with a State contribution in the period of taxation, reduced by CZK 12 000.

-

Private life insurance premiums: Taxpayers may claim an allowance of up to CZK 12 000 for premiums paid according to a contract between the taxpayer and an insurance company if the benefit (lump sum or recurrent pension) is paid out 60 months after the signature of the contract and in the year in which the taxpayer reaches the age of 60.

1.1.2.3. Tax schedule

From January 2008, a progressive system of taxation is replaced by a single rate of 15%. The tax base, reduced by the non-taxable part of the tax base (see 1.122 – Main non-standard tax reliefs), rounded down to whole hundreds of CZK is subject to tax at the rate of 15%. After that, tax credits (see 1.124) can be used to directly reduce a person’s tax liability.

1.1.2.4. Tax credits

-

Credit of CZK 24 840 per taxpayer, the tax shall not be reduced for a payer that receives a retirement pension from pension insurance or from foreign compulsory insurance of the same kind as of 1 January of the period of taxation.

-

Credit of CZK 24 840 per spouse (husband or wife) living with a taxpayer in a common household provided that the spouse’s own income does not exceed CZK 68 000 in the taxable period.

-

Credit of CZK 13 404 for first child, credit of CZK 15 804 for second child, credit of CZK 17 004 for third and each additional child (irrespective of the child’s own income) living with a taxpayer in a common household on the territory of a Member State of the EU, Norway or Iceland, if the child satisfies one or more of the following criteria:

-

age below 18 year of age,

-

age below 26 year of age and receiving full-time education,

-

age below 26 year of age and physically or mentally disabled provided that the child is not in receipt of a state disability payment

-

If the child is a ”ZTP-P” card holder (the child with a certain type of disabilities), the tax credit is CZK 26 808. The taxpayer can claim the tax credit in the form of tax reliefs or tax bonuses or their combination.

-

Credit of CZK 2 520 if the taxpayer is in receipt of a partial disability pension or is entitled to both an old-age pension and a partial disability pension

-

Credit of CZK 5 040 it the taxpayer is in receipt of a full disability pension, or another type of pension conditional on his full disability pension, or if the taxpayer is entitled to both old-age pension and full disability pension or deemed to be fully disabled under statutory provisions, but his application for a full disability pension was rejected for reasons other than that he was not fully disabled (handicapped).

-

Credit of CZK 16 140 if the taxpayer is a ”ZTP-P” card holder.

-

Credit of CZK 4 020 if the taxpayer takes part in a systematic educational or training programme under statutory provisions in order to prepare for his future vocation (profession) by means of such studies or prescribed training until completion of his/her 26 or 28 years (Ph.D. programme).

-

New tax abatement (credit) which can be applied in case that a maintained child of a taxpayer is placing in a pre-school facility. The tax abatement can be applied in the amount of pre-school facility fees, which is really paid for maintained child, however at maximum up to the amount of minimum wage for a maintained child. Tax abatement may only be used if the maintained child lives with the taxpayer in a jointly managed household. Introduction of this relief is a part of the Act on provision of childcare in a child society.

The non-standard tax reliefs, tax abatement and special solidarity surcharge of 7 % for income from employment and entrepreneurship exceeding 48 times the average salary within the calendar year are not included in the tax equations underlying the Taxing Wages results.

1.2. State and local income tax

There are no regional or local income taxes.

2. Compulsory social security contributions to schemes operated within the government sector

The maximum annual earnings used to calculate social security contributions are 48 times the national average monthly wage. The maximum ceiling for social security contributions is CZK 1 277 328 for the year 2015. The maximum ceiling for health insurance has not existed since 2013.

2.1. Employees’ contributions

Compulsory contributions of 11% of gross wages and salaries are paid by all employees into government operated schemes. The total is made up as follows (in %):

2.2. Employers’ contributions

The total contribution for employers is 34% of gross earnings.

The contribution consists of the health insurance contribution (9% of gross wages and salaries) and social insurance (25%).

3. Universal cash transfers

3.1. Transfers related to marital status

None.

3.2. Transfers for dependent children

Non-taxable child allowances are the basic income-tested benefit provided to a dependent child with the objective to contribute to the coverage of costs incurred in his upbringing and sustenance. Entitlement to the child allowance is bound with certain income criteria. The central government pays this allowance in respect of each dependent child based on the family income level and provided that family’s income does not exceed 2.4 times the relevant family’s living minimum (LM). Family income includes the earnings of both parents net of income tax and the employees’ social security and health insurance contributions. Child allowances are provided at three levels depending on the age of the child and are paid as follows:

The monthly family’s LM for the AW-type family with children can be calculated by summing the following amounts (in CZK):

The LM is required by law. In case that family income (income of persons assessed together) don’t achieve the amount of family’s LM can be put in a request for state social support (housing benefit, family benefits, social assistance and other). The system applies the solidarity principle between the high-income families and low-income families, as well as between the childless families and those with children.

The term ”social allowance” was abolished from 1 January 2012. However, this fact has no effect on the tax-benefit system for low-income families. The system of personalized payment was simplified and extended. For examples, in case of loss of income (social allowance) some people may put in a request for increase care allowance up to CZK 2 000. This allowance is addressed for recipients who are dependent children below 18 years of age and parent of dependent children below 18 years of age if the income of the family is under 2.0 family’s living minimum. Protection in the housing sector is also addressed in the context of state social support system (housing allowances-benefit) and the system of assistance in material need as additional housing. Also foster care benefits create a separate benefit system; since 1 January 2013 they have ceased to be a component of the state social support system. These allowances (housing, care and foster care) are not included in the Taxing Wages models.

3.3. Additional transfers

Additional allowances (means-tested benefits in material need) are paid by the central government to low income families in adverse social and financial situation. The amount transferred is derived from the LM and varies according to total family income including family allowances and own efforts, opportunities and needs are taken into account. This allowance is not included in the computation.

4. Main changes in tax/benefit systems since 2015

In 2015, there were no changes that would have a significant effect on the current calculation of Taxing Wages.

List of main changes that have no impact on the current computation of TW:

-

A new tax credit which can be applied in case that a child of a taxpayer visits a nursery school (preschool children, including kindergarten up to start school attendance) is introduced. The tax credit can be applied in the amount of nursery school fees really paid for child, however at maximum up to the amount of minimum salary for a child. Introduction of this relief is a part of the Act on provision of childcare in a child society (see chapter 1.124).

-

Tax credit on second and third and next child has increased based on the Amendment (CZK 15 804 for second child, CZK 17.004 for third and each additional child) – see chapter 1.124.

-

Change regarding obligation to file personal income tax return in case of taxpayers underlying to solidarity tax. Newly, the obligation to file the personal income tax return occurs only when an annual limit for solidarity tax application is exceeded.

-

Based on ongoing amendments limitation of tax advantage of private life insurance in case of partial payment has been included in the Amendment. If a taxpayer receives compensation from his/her life insurance account before the given conditions are met, tax exemption of contributions paid by his/her employer as well as possibility to apply a tax deduction will be ceased. In such a case, the employee will be obliged to additionally taxations of this benefit through a personal income tax return. At the same time, tax advantage from life insurance will be newly applicable only in case of life insurance contracts allowing payments after meeting said conditions as of the moment of the contract’s termination.

-

As of 2015 notification obligation for taxpayers should be effective – individuals who receive tax exempted income of more than CZK 5mio. A taxpayer will be obliged to report such a situation to a tax administrator until deadline for filing the personal income tax return. There are penalties set by the Income Tax Act if the taxpayer breaches this obligation.

-

In reaction to the Constitutional Court’s case the Amendments again allows application of basic tax credit for working retirees. Based on this information the tax credit was applied retrospectively for 2013 and 2014. The impact of this application has no effect to the tax equations underlying the TW results but had impact on collection of IT in 2014 and 2015.

-

A new tax abatement has no effect to the tax equations underlying the TW result but has impact on collection of IT in 2015

5. Memorandum items

5.1. Identification of AW and valuation of earnings

The Ministry of Finance estimates the average earnings of the AW based on the data supplied by the Czech Statistical Office. The calculation of the average earnings AW is made by CZ-NACE division, which is compatible with ISIC classifications Ver. 4.

5.2. Employers’ contributions to private pension, health and related schemes

There are supplementary private pension schemes only, but employers’ contributions vary. Relevant information is not available.

2015 tax equations

The equations for the Czech system are on an individual basis. But the spouse tax credit is relevant only to the calculation for the principal earner and cash transfers are calculated only once. This is shown by the Range indicator in the table below.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables ”married” and ”children”. A reference to a variable with the affix ”_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes ”_princ” and ”_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with ”_spouse” values taken as 0.