Malaysia

SMEs in the national economy

Small and medium enterprises (SMEs) have long been recognised as the backbone of the Malaysian economy, as they outnumber the large enterprises, both in terms of number and employment. According to the latest 2011 Economic Census, SMEs account for 97.3% or 645 136 of total business establishments. The majority of SMEs operate in the services sector (90%), followed by manufacturing (6%), construction (3%), agriculture (1%) and the remaining 0.1% are found in the mining and quarrying sector. In 2014, SMEs contributed close to 36% of the country’s gross domestic product (GDP), to 65% of total employment, and to 17.8% of total exports.

The SME development agenda has been driven mainly by the government through the National SME Development Council (NSDC) for more than a decade. Chaired by the Honourable Prime Minister, the Council, which was established in 2004, is the highest body that charts the long term SME policy direction and also seeks to ensure a more coordinated effort in SME development across the country. Among the key milestones of NSDC have been the adoption of a standard SME definition nationwide; the establishment of a Central Coordinating Agency, i.e. SME Corporation Malaysia, to coordinate, streamline and monitor SME development initiatives, as well as to propose overall SME policies; the introduction of an annual plan on SME programmes and the publication of an SME Annual Report to assess the progress and development of SMEs; and enhancement to the SME financing landscape.

This comprehensive approach to SME development has shown encouraging results. Since 2004, SME GDP growth has consistently outpaced the country’s overall economic growth. In the period 2005-14, the average compounded annual growth rate (CAGR) of SMEs was 7.1%, which was higher than the 4.9% CAGR of the overall economy. As a result, SME contribution to GDP increased from 29.6% in 2005 to 35.9% in 2014. Despite the positive performance of SMEs in recent years, contribution of Malaysian SMEs to the overall economy remains relatively small compared with their counterparts in advanced and other high middle income countries. Therefore, the government launched the SME Masterplan in 2012 with the aim to chart the development of SMEs in line with Malaysia’s aspiration to become a high-income country by 2020.

To achieve the target, the Masterplan introduced a new SME development framework premised upon innovation-led and productivity-driven growth. Under the Masterplan, the focus will be on addressing key constraints to growth in the six focus areas which include innovation and technology adoption, human capital development, access to financing, market access, legal and regulatory framework, as well as infrastructure. Altogether, there are 32 initiatives proposed under the Masterplan, including six High Impact Programmes (HIPs) which are expected to yield significant outcomes towards achieving the goals of the Masterplan.

Over the years, SME development in Malaysia has come a long way to become more holistic, not only looking at financing, but also other issues. In the area of financing, commendable progress has been made by financial institutions, particularly in strengthening the existing infrastructure and institutional framework to adequately address the needs of SMEs. These included establishing dedicated units at financial institutions to deal with SME customers in terms of advisory, complaints, and outreach; thus transforming development financial institutions to become more focused; rationalising government funds; setting up credit information systems; establishing an avenue for debt resolution; as well as introducing new microfinance schemes and guarantees with the aim of making them overall more effective in serving the SME community. The Central Bank of Malaysia also seeks to enhance financial inclusion and reach out more actively to underserved segments of the society, and to rural communities.

Going forward, the focus is to enhance the non-banking avenues for financing to support start-ups and innovative SMEs, particularly through the capital market. Efforts are also being undertaken to develop new and innovative financing platforms such as crowdfunding.

SME lending

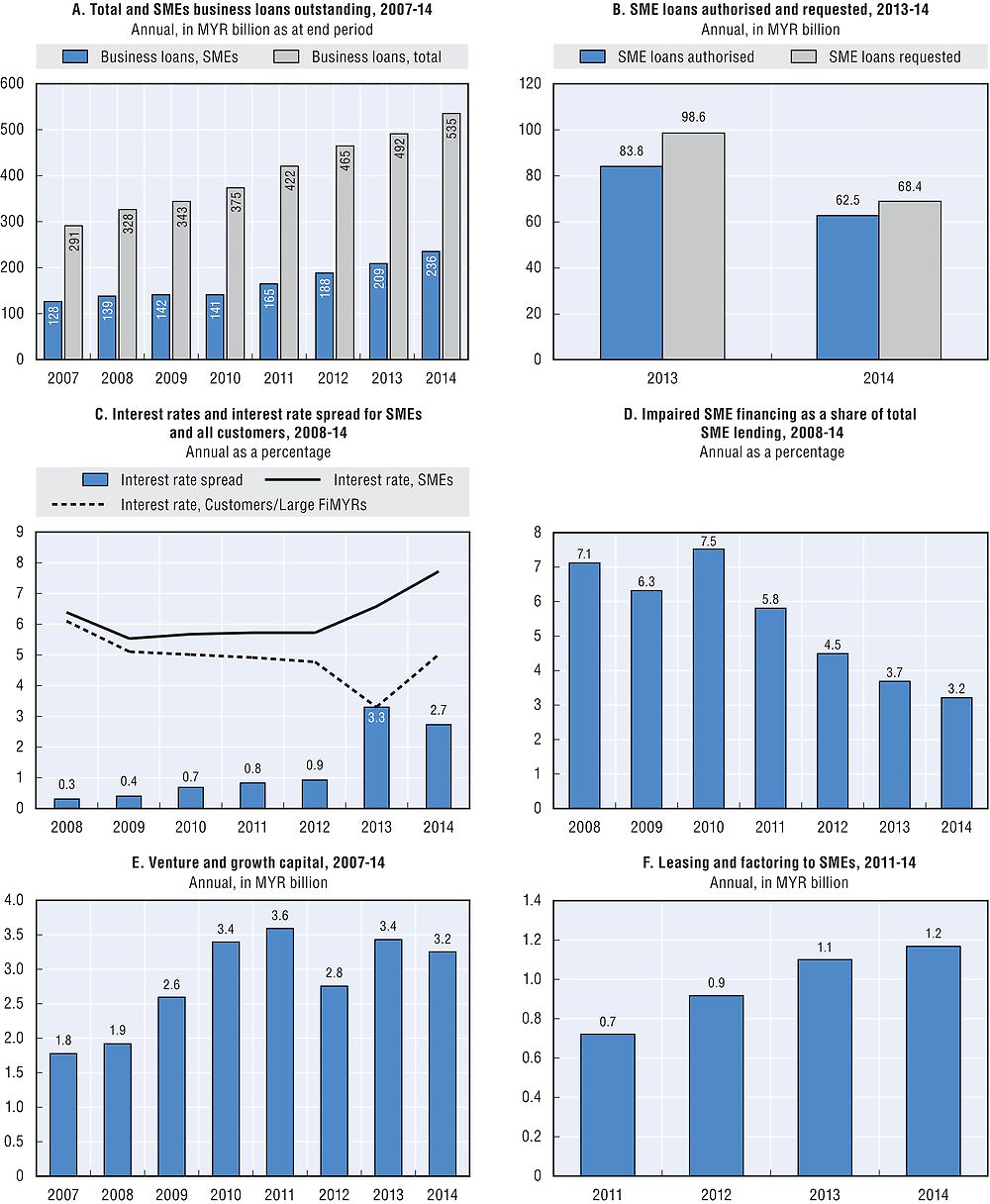

Financial institutions (FIs), which comprise banking institutions (BIs) and development financial institutions (DFIs), continue to represent the main source of external funding, accounting for about 90%-95% of total SME financing in recent years. The supportive role played by the banking system was reflected in the double-digit expansion of 13.1% in total financing outstanding, amounting to MYR 236.5 billion at end of 2014, compared to 11.5% or MYR 209.1 billion in 2013. Consequently, the share of SME financing from total business financing had increased to 44.2% in 2014 from 42.5% in the previous year.

FIs also play a significant role in meeting the long-term financing needs of SME, as short-term financing only accounted for 2.6% of the overall outstanding business loans in 2014. SMEs need long-term financing generally for assets and projects, while short-term financing is typically used for continuing operations. As of end-2014, impaired financing of the overall banking sector stood at 3.1% of total business loans, amounting to MYR 16.5 billion, compared to 3.5% or MYR 17.2 billion in 2013. Despite the rapid expansion of bank credit to SMEs, impaired financing of SMEs substantively decreased from 7.5% in 2010 to 3.2% in 2014.

In addition to FIs, SMEs have access to other sources of finance, such as venture capital and private equity; factoring and leasing; government funds; as well as micro-financing and pawn broking. These diverse sources are further reinforced by a comprehensive framework, covering guarantee schemes to enhance the credit standing of SMEs without collateral, as well as a debt restructuring avenue for firms facing difficulties in repaying their debt.

The Credit Guarantee Corporation Malaysia Berhad (CGC) has been actively supporting potentially viable SMEs to obtain financing from FIs for almost four decades. As of end-2014, CGC had guaranteed a total of MYR 56.1 billion to 429 424 SMEs. The year 2014 saw a remarkable growth, both in terms of the number and value of loans approved by CGC. A total of 6 839 loans was approved during the year, representing a significant increase of 189% from 2 368 loans approved in 2013. Similarly, the amount of loans approved rose by 105% to MYR 3.2 billion from MYR 1.5 billion in 2013. The strong growth was attributed to aggressive moves by CGC to market its schemes to its strategic bank partners. Recognising the need to be proactively responsive to the rising expectations of SMEs, CGC stepped up its SME outreach efforts in product innovation, process simplification and the forging of strategic alliances with FIs, which has enabled businesses to secure financing faster and at greater ease. In 2014, CGC signed three new Portfolio Guarantee (PG) deals, leading to the approval of 4 985 loans worth MYR 2.1 billion, which represented the bulk of the total number and value of loans approved.

CGC also introduced a new rebate mechanism on its guarantee fee as a reward to its customers for timely repayment and good conduct of their loans. The rebate incentive was initiated as one of its proactive measures to ease the cost of borrowing for SMEs in light of the overall escalation in the cost of doing business. It was also intended to inculcate a sound credit culture among SMEs. Apart from that, CGC conducts advisory and consultancy activities and provides relevant information on how to start a business, as well as on the importance of cash-flow management and good credit practices. Moving forward, CGC plans to explore and expand its outreach to a broader spectrum of the SME segment with a focus on providing financing via small-sized loans to ensure that more SMEs are able to benefit from its guarantee schemes.

Credit conditions

The average annual lending rate of SME financing by banking institutions has increased significantly in recent years from 5.7% in 2012 to 6.6% in 2013 and to 7.7% in 2014. The interest rate spread between the average interest rate for an SME loan and the average rate charged to a large enterprise, rose notably between 2007 and 2013. In 2008, the spread stood at 0.3%, rising to 0.9% in 2012, and then peaking at 3.3% in 2013. In 2014, the spread narrowed again to 2.7%.

Equity and asset-based financing

Total venture capital investments fell by 5.4% to MYR 3.3 billion as of end-2014, compared to MYR 3.4 billion as of end-2013, mainly due to divestment by investment companies. During the year 2014, a total of 74 investee companies received a total of MYR 318 million, an increase of 20.5% from MYR 264 million in 2013 for 56 investee companies. At the same time, 59 investee companies were divested, amounting to MYR 421 million, compared to 33 companies divested, amounting to MYR 287 million in 2013. Divestments occurred mainly through share redemptions and trade sale. While the data on asset-based financing, namely leasing and factoring, is based on an annual e-survey and may therefore not be representative for the overall industry, the available data suggests that asset-based financing is becoming more widely used, with volumes increasing by almost 63% between 2011 and 2014.

Government policy response

Malaysia has one of the most developed financial markets among ASEAN countries, in part as a result of broad-based reforms in the aftermath of the Asian financial crisis of 1997-98. As part of these reforms, Malaysia has consolidated its banking sector, gradually liberalised its financial markets (including by allowing foreign FIs to operate within its borders), and implemented banking regulations in line with international standards. The low level of impaired financing, as well as a sound level of bank credits to deposits, both illustrate the health of the Malaysian banking system (OECD, 2013b).

The Asian financial crisis also highlighted the importance of a credit information infrastructure. In 2010, Malaysia introduced the Credit Reporting Agencies Act, thereby providing a regulatory framework for private entities carrying out credit reporting. Aside from private credit reporting agencies, the Malaysian Government has introduced a centralised public credit registry system since 2001. The ambition of these reforms is to ease access to finance, in particular to SMEs without jeopardising rights to privacy and data protection (OECD, 2013b).

Since its inception more than 30 years ago, Islamic finance in Malaysia has developed into a comprehensive and sophisticated finance marketplace. Malaysia pioneered the development of the global sukuk market with the launch of the first sovereign five-year global sukuk, worth USD 600 million in 2002. Since then, the sukuk market has experienced unprecedented growth with Malaysia firmly established as one of the largest issuers of sukuk over the years.

The regulatory and supervisory framework of Malaysia enters a new development stage as the Financial Services Act 2013 (FSA) and Islamic Financial Services Act 2013 (IFSA) came into force on 30 June 2013. The FSA and IFSA are the culmination of efforts to modernise the laws that govern the conduct and supervision of FIs in Malaysia, and to ensure that these laws continue to be relevant and effective in order to maintain financial stability, support inclusive growth in the financial system and the economy as a whole, as well as to provide adequate protection for consumers. Among key features of the new legislation are greater clarity and transparency in the implementation and administration of the law; a clear focus on Shariah compliance and governance in the Islamic financial sector; strengthened business conduct and consumer protection requirements to promote consumer confidence in the use of financial services and products; as well as strengthened provisions for effective and early enforcement and supervisory intervention. The FSA and IFSA amalgamate several separate laws to govern the financial sector under a single legislative framework for the conventional and Islamic financial sectors, respectively, namely, the Banking and Financial Institutions Act 1989 (BAFIA), the Islamic Banking Act 1983, the Insurance Act 1996 (IA), the Takaful Act 1984, the Payment Systems Act 2003, and the Exchange Control Act 1953, which were all repealed on the same date.

The Financial Sector Blueprint (Blueprint) was released in 2011 for the period of 2011-20. The Blueprint aims to develop a financial ecosystem that will best serve a high value-added, high-income Malaysian economy, while also assuming an increasingly important role in meeting the growing financial needs of the emerging Asian continent. The recommendations in the Blueprint are focused on nine major areas, supported by 69 recommendations and more than 200 initiatives. The nine key areas are effective intermediation for a high value-added, high-income economy; the development of deep and dynamic financial markets; greater shared prosperity through financial inclusion; strengthening regional and international financial integration; internationalisation of Islamic finance; safeguarding the stability of the financial system; achieving greater economic efficiency through electronic payment; empowered consumers; and talent development in the financial sector. Over the next decade, the financial sector is envisioned to evolve beyond its role as an enabler of growth, and become a key driver and catalyst of economic growth, with growth in the financial system firmly anchored to growth in the real economy.

Given that the bulk, i.e. 90%-95%, of SME financing has traditionally been extended by FIs, efforts in recent years have focused on developing more avenues for risk capital. This is in line with the growing needs of the economy, where the traditional form of financing offered by FIs may not be able to meet the needs of the more risky segment of SMEs, such as start-ups and SMEs in new activities which have high growth potential and are innovative in nature. More recently, the policy focus of the authorities has been to further expand the non-bank avenues for risk capital, particularly to enhance access to finance for SMEs that are innovative, high-growth and active in new growth areas.

Country definition

Malaysia has adopted a revised definition for SMEs, effective since January 2014. Sales turnover and number of full-time employees continue to be used as the two main criteria in determining the definition with the “OR” basis as follows:

-

Manufacturing sector : Sales turnover not exceeding MYR 50 million OR full-time employees not exceeding 200. -

Services and other sectors : Sales turnover not exceeding MYR 20 million OR full-time employees not exceeding 75.

Detailed definition by the three categories namely Micro, Small and Medium are as follows:

Source: See Table 23.4.

References

Central Bank of Malaysia, (2013a), “Financial Services Act 2013”, http://www.bnm.gov.my/index.php?ch=en_legislation&pg=en_legislation_act&ac=1079.

Central Bank of Malaysia, (2013b), “Islamic Financial Services Act 2013”,

Central Bank of Malaysia, “Supply-Side Data” from Central Credit Reference Information System, http://www.bnm.gov.my/documents/act/en_ifsa.pdf.

Central Bank of Malaysia, (2011), “Financial Sector Blueprint 2011 – 2020”, http://www.bnm.gov.my/index.php?ch=en_publication_catalogue&pg=en_publication_blueprint&ac=7&lang=en.

Credit Guarantee Corporation Malaysia Berhad (CGC), “Annual Report 2007-2014”, https://www.cgc.com.my/publications/.

Credit Guarantee Corporation Malaysia Berhad (CGC) (2013), “Catalysing SME growth”, https://www.cgc.com.my/wp-content/themes/crystalline/doc/CGC_Info%20Booklet.pdf.

Department of Statistics Malaysia (DOSM) (2014), “Economic Census 2011 - Profile of Small & Medium Enterprise”, https://newss.statistics.gov.my/newss-portalx/ep/epProductFreeDownloadSearch.seam.

Department of Statistics Malaysia (DOSM) (2012), “National Accounts Small & Medium Enterprises”, https://newss.statistics.gov.my/newss-portalx/ep/epFreeDownloadContentSearch.seam?cid=3170.

Malaysia International Islamic Financial Centre (MIFC), http://www.mifc.com/index.php?ch=ch_footer&pg=pg_footer_glossary&sort=S&nhmxl1=20&stmxl1=60.

OECD (2013a), Southeast Asian Economic Outlook 2013: With Perspectives on China and India, OECD Publishing, Paris, https://doi.org/10.1787/saeo-2013-en.

OECD (2013b), “Financial sector development”, in OECD Investment. Policy Reviews: Malaysia 2013, OECD Publishing, Paris, https://doi.org/10.1787/9789264194588-13-en.

Securities Commission Malaysia (SC), “2014 Annual Report”, http://www.sc.com.my/home/sc-annual-report/.

SME Corporation Malaysia (SME Corp.) (2015), “SME Annual Report 2014/15”, http://www.smecorp.gov.my/vn2/node/1856.

SME Corporation Malaysia (SME Corp.) (2012), “SME Masterplan 2012-2020”, http://www.smecorp.gov.my/vn2/node/190.