Ireland

SMEs in the national economy

SMEs comprised 99.6% of all employer firms in 2012 and employed approximately 68% of the labour force, whereas large enterprises comprised only 0.4% of the labour force, but accounted for approximately 32% of employment.

SME lending

The financial and economic crisis in Ireland can be largely attributed to a decade of unsustainable, construction-led growth up to 2008. Irish banks concentrated significantly on the construction and property sectors which differ considerably from the “core” SME sector. Therefore, for the purposes of reflecting more accurately the credit situation of SMEs in the real economy, these sectors have been removed from the Irish scoreboard data. As is the usual case in the OECD scoreboard, the data pertain only to non-financial enterprises.

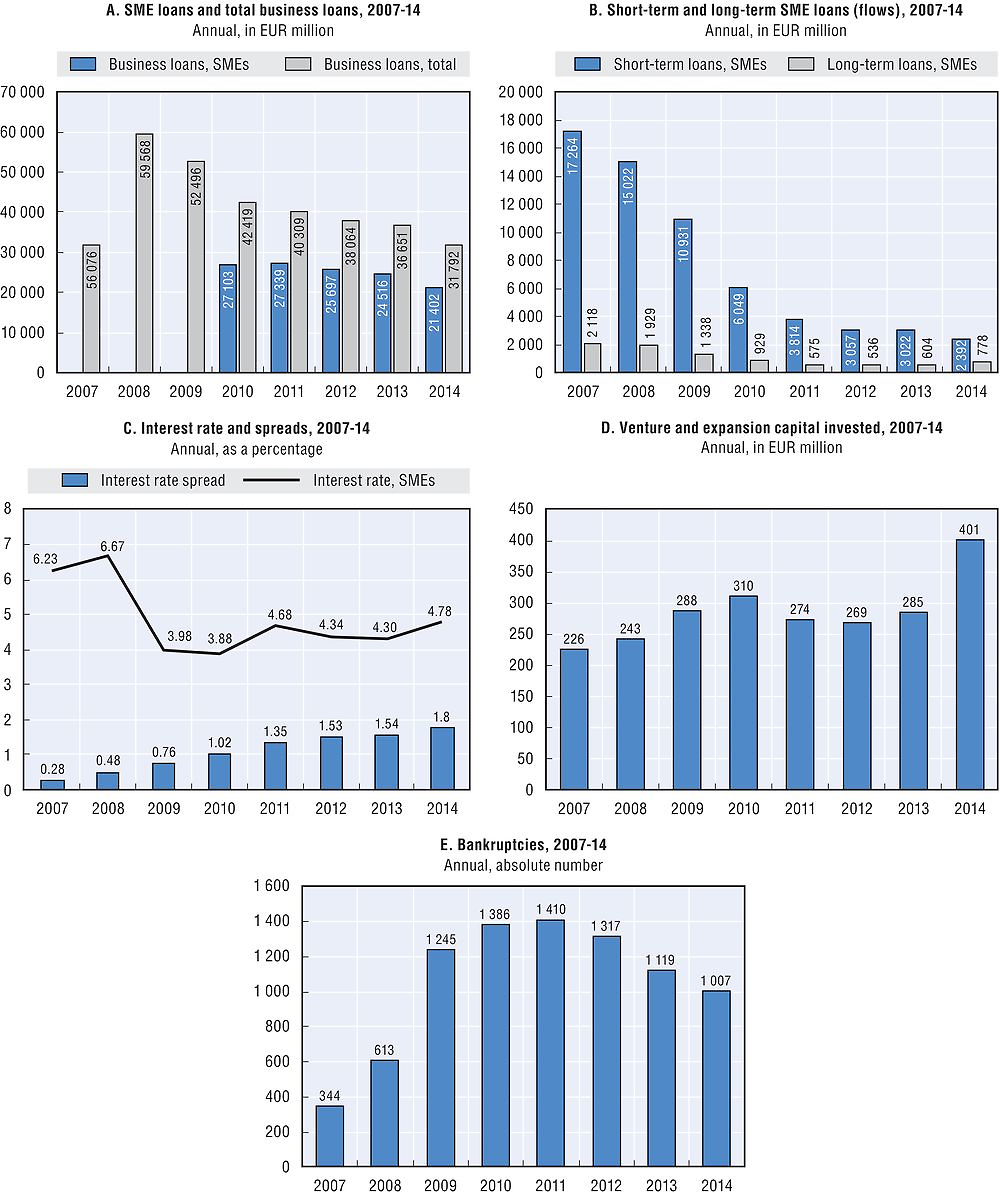

Ireland suffered a severe financial and economic shock following the financial crisis. Given the high level of credit growth during the boom phase (2003-08), corporates have been deleveraging steadily since 2008. Total business lending (outstanding loan balances) declined every year between 2008 and 2014. More recently, the rate of decline has eased considerably as growth has begun to return. Business lending dropped by more than 38% over this period. SME loan data are available only since 2010. Despite the drop in overall lending, SME lending declined less than overall business lending, leading to a rise of the SME loan share in total business loans from 63.9% in 2010 to 67% in 2013.

Data for SME short and long-term loans are not available by firm size but by loan size. According to that data set, new short-term SME loans fell by 86% between 2007 and 2014, from EUR 17.3 billion to EUR 2.4 billion.

Credit conditions

A number of independent surveys on credit conditions have been conducted on behalf of the Irish Government. They covered the period from June 2008 to September 2015. Loan approval rates declined from 76% to 70% in the 2008 to September 2011 period, but have improved since then, reaching 85% in September 2015. These included applications which were both fully approved as well as those which were only partially approved. The latter accounted for between 2% and 6% of all the applications in the period concerned.

The independent surveys also covered collateral requirements. 40% of the SMEs were asked for specific collateral for their loans. According to the most recent survey covering the six month period to September 2015, the collateral required most often was real estate and land.

The data from these surveys is also broken down according to the size of the SME, distinguishing between micro-enterprises with less than 10 employees, small firms with the number of employees ranging between 10 and 49, and medium-sized enterprises with a total number of employees between 50 and 250. One recurring finding throughout the survey is that micro-enterprises consistently report facing more difficulties in accessing bank finance and financing conditions, although this trend has been less pronounced in recent surveys.

Data for interest rates are available by loan size. In line with the reductions in ECB policy rates, SME interest rates fell sharply from 2008 to 2009, and modestly in 2010. However, since 2011, there has been an increasing trend in interest rates for SMEs, despite some declines in late 2011-12. Interest rates in 2014 (circa 4%-5%) are still relatively high, both compared with 2010, as well as relative to other European countries where interest rates continued to decline over the 2010-14 period. The spread between large and small loans increased throughout the 2007-14 period from 0.3% in 2007 to 1.8% in 2014. The drop of the ECB’s interest rates thus appeared to benefit large firms.

Equity financing

The data for venture capital was provided by the Irish Venture Capital Association and includes both, funding by business angels as well as venture capital funds. Total venture capital has been relatively stable over most of the period, but reached record levels in 2014. Growth capital fell drastically between 2008 and 2009, but has recovered significantly since. Indeed, the figure more than doubled from 2013 to 2014.

Other indicators

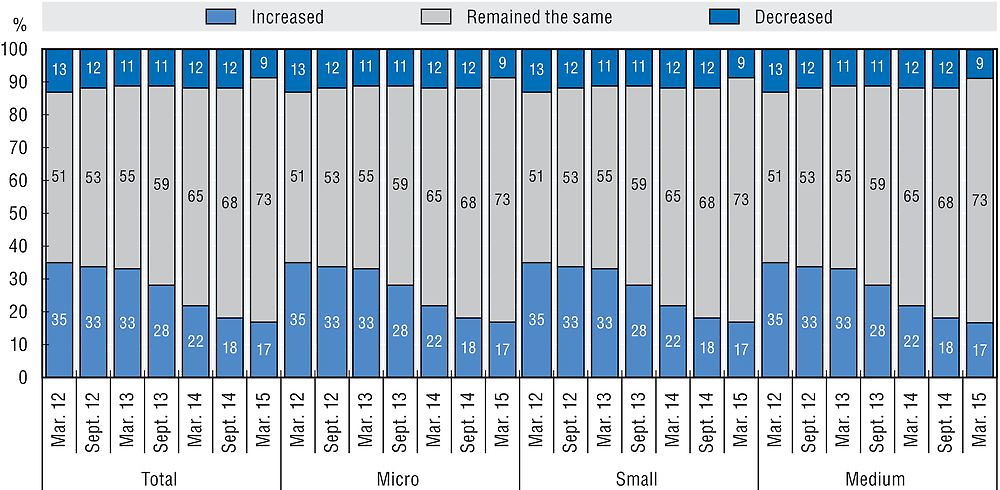

The demand survey enquires about the average number of days in which enterprises received payments from customers, but only in respect to the direction of movement rather than the number of days. Between September 2011 and March 2012, the number of days increased for 35% of the SMEs surveyed, while 13% of the SMEs reported a decrease. Since then, the number of respondents who reported an increase in payment days dropped, with the latest survey of September 2015 showing just 17% of all surveyed SMEs communicating an increase in the average number of payment days.

Source: Red C SME Credit Demand Survey, April – September 2015.

Corporate “bankruptcies” in Ireland are dealt with under three different processes: liquidation, examinership and receivership. In Ireland a company may be liquidated by:

-

resolution of the members of the company following a declaration of solvency

-

a resolution of the members ratified by the creditors

-

an order of the court

Bankruptcies increased in the period to 2011, but have fallen annually since then.

Government policy response

The government imposed SME lending targets on the two main domestic banks for the three calendar years of 2011 to 2013. Each bank was required to sanction lending of at least EUR 3 billion in 2011, EUR 3.5 billion in 2012, and EUR 4 billion in 2013 for new or increased credit facilities to SMEs. Both banks achieved their targets. Having completed a process of deleveraging, both Allied Irish Bank and the Bank of Ireland are now concentrating on growing their balance sheets. In this context, both banks recognise the need to increase business lending in the period up to 2016, and have put on record their commitment to the SME sector. Although the targets were a useful policy intervention, the focus has now shifted towards the monthly collation and examination of more granular data related to the funding of SME activities from AIB and the Bank of Ireland, the wider banking sector and increasingly the non-bank funding sector.

The SME State Bodies Group, chaired by the Department of Finance and attended by State agencies with an interest in access to finance for SMEs, was established in 2012 to both, develop key policy initiatives to support SME access to credit and other forms of finance, and to ensure their implementation. There is a chapter on access to finance contained in the annual “Action Plan for Jobs” and the SME State Bodies Group ensures that the commitments contained therein are implemented. The Group engages intensively in addressing issues associated with SME funding and financing in conjunction with the relevant stakeholders through the SME Funding Consultation Committee.

Credit Guarantee Scheme

In October 2012, the government introduced a Credit Guarantee Scheme to address situations where SMEs fall outside the risk appetite of banks. This can arise because of the SME’s lack of collateral or the banks’ lack of understanding of the business model, external market conditions, developments within the sector, or due to issues related to technology. The three main SME lenders are all participating in the Guarantee scheme. The objective is to provide an additional EUR 150 million in lending per annum, which is guaranteed by the Ministry for Jobs, Enterprise and Innovation. A review of the Credit Guarantee Scheme was undertaken and laid before the Oireachtas in July 2014. As a result of the review, a new Credit Guarantee Scheme has been introduced in 2015, in accordance with the terms of the Credit Guarantee Act of 2012, which allows guarantees for refinancing loans where an SMEs’ bank has exited or is exiting the Irish SME market. This new Scheme also increases the maximum length of guarantees under the Credit Guarantee Scheme from 3 to 7 years.

In addition, work is continuing on amending the primary legislation and once this is completed, a new Credit Guarantee Scheme will be introduced, which will include the following improvements: a wider range of financial products to be covered, not just traditional credit products, an increase in the level of guarantees on individual loans from 75% to the maximum permissible under State Aid rules of 80%, an increase in the portfolio cap and the removal of the annual portfolio cap. The Department of Jobs, Enterprise and Innovation is also working with the Department of Finance and the Strategic Banking Corporation of Ireland (SBCI) to enable the delivery of the Ministerial guarantee through the SBCI.

From 24 October 2012 to 30 June 2015, 208 loans were sanctioned under the Credit Guarantee Scheme with a value of EUR 31.3 million. While the level of lending has been lower than anticipated, the jobs dividend reported has been much higher than expected with 864 new jobs created and 601 jobs maintained. The Department of Jobs, Enterprise and Innovation has conducted a review of this scheme and will shortly introduce a revised scheme that is more user-friendly with broader parameters which should further increase the utilisation rate of the scheme.

Micro-enterprise loan fund scheme

The Microenterprise Loan Fund was established to lend up to EUR 25 000 to viable micro-enterprises who had been declined bank credit, have commercially viable proposals to sustain, and create jobs. Microfinance Ireland was set up to administer the Fund on behalf of the Minister for Jobs, Enterprise and Innovation. From 1 October 2012 to 30 June 2015, the Fund has provided loans to 606 micro-enterprises to the value of EUR 9.3 million, supporting 1 355 net jobs. A review of this scheme was recently completed by the Department of Jobs, Enterprise and Innovation which will ensure that more microenterprises can avail of the Fund by making changes, such as removing the requirement for a bank loan refusal.

Innovation Fund Ireland

Innovation Fund Ireland is a Government initiative designed to attract leading international venture capital fund managers to Ireland. Innovation Fund Ireland works in partnership with Enterprise Ireland (EI) and the National Pension Reserve Fund (NPRF). Both EI and NPRF/ISIF bring approximately EUR 125 million each to the table and make commitments to international Venture Fund Managers. These commit to establishing a presence in the Irish market and agree to invest, at a minimum, the equivalent of EI’s contribution in Irish companies or companies with significant operations in Ireland.

The Innovation Fund Ireland has been created to increase the availability of risk capital for early-stage and high-growth companies, and is central to the Irish Government’s strategy for economic recovery. A number of funds have now been operating in the Irish market and a proportion of them continue to seek investment in new opportunities. The main objectives of Innovation Fund Ireland are to:

-

increase the number and scale of innovation driven and high-growth businesses in Ireland

-

increase the availability of smart risk capital for early stage and high-growth companies

-

attract top-tier venture capital fund managers to Ireland; attract, leverage and develop entrepreneurial talent

Credit Review Office

The Credit Review Office (CRO) was established in 2010 to review cases where credit facilities up to EUR 3 million are refused, withdrawn, or offered to SMEs at unreasonable conditions by the participating banks. Up to May 2015, 55% of appeals have been found in favour of borrowers and this has resulted in EUR 31.4 million in credit being made available to SMEs and farms, helping to protect or create 2 222 jobs. The May 2015 report from the CRO was the most positive since the inception of the Office, as the impact of the economic recovery is reflected in improving financial figures regarding businesses which have asked for their case to be reviewed.

Ireland Strategic Investment Fund (ISIF)

The Ireland Strategic Investment Fund (“ISIF” or “the Fund”) was formally commenced on 22 December 2014. On commencement the ISIF absorbed the NPRF’s global portfolio and its directed investments. The total Fund size at the transition date was EUR 20.5 billion, with EUR 13.4 billion in Directed Investments and EUR 7.1 billion in the Discretionary Portfolio. The overarching purpose of the ISIF is to invest “on a commercial basis in a manner designed to support economic activity and employment in the State”. This mandate reflects a shift from being a Sovereign Wealth Fund focussed solely on wealth creation to a Sovereign Development Fund with a “Double Bottom Line” objective – in other words, ISIF’s success will be measured by both, investment returns and economic impact achieved.

Other key elements of the mandate as set out in the NTMA Amendment Act, 2014 are:

-

the NTMA will be the controller and manager of the ISIF

-

investment performance goal is to exceed average cost of Government debt

-

long-term timeframe: no withdrawals before 2025, after that dividend-type payment of up to 4% p.a. to the Exchequer

-

investments must not have a negative impact on the net borrowing of the general government of the State for any year

In preparation for the ISIF, significant progress was made refocusing the Fund towards commercial investment in Ireland within the constraints of the NPRF’s statutory mandate. A number of investment areas of strategic importance were identified and investments were completed under its mandate in the areas of infrastructure, water, long-term financing for SMEs (both credit and equity), and venture capital.

The ISIFs first Economic Impact Report, published recently, shows that at the end of December 2014:

-

The ISIF had committed EUR 1.4 billion to investments in Ireland, with EUR 726 million already drawn down.

-

79 Irish companies with an annual turnover of EUR 472 million benefit from ISIF investment.

-

Approximately 8 362 jobs are supported directly and indirectly by ISIF investments.

ISIF SME Fund Investments

-

The EUR 450 million BlueBay SME Credit Fund has completed 11 loan transactions totalling approximately EUR 190 million. The BlueBay SME Credit Fund continues to be active in the Irish lending market and has a strong transaction pipeline. It is focused on deployment of the remainder of its capital pool.

-

The EUR 292 million Carlyle Cardinal Ireland (CCI) SME Equity Fund has concluded 4 transactions in Lily O’Briens, GSLS, Carroll Cuisine and Payzone. The CCI SME Equity Fund continues to be active in the Irish lending market and has a strong transaction pipeline. It is focused on deployment of the remainder of its capital pool.

-

The Better Capital “Turnaround Fund” expired at the end of December 2014 and its investment period was not extended.

-

The Turnaround Fund was focused on turnaround investing in troubled companies as the Irish economy was dealing with the financial crisis. A short investment period of two years was set due to the expectation that distressed turnaround investment opportunities would only be available for a limited period. In the context of improving market conditions, financial institutions and business owners experienced a reduced need for restructuring capital investment into distressed businesses, as compared with initial expectations. This meant that the Turnaround Fund did not complete any transactions. The investment period expired at the end of December 2014 and, by mutual agreement between the NTMA and Better Capital, was not extended.

Enterprise Ireland Seed & Venture Capital Scheme

The Government has committed EUR 175 million under the Seed and Venture Capital Scheme 2013-18, with the aim of leveraging a further EUR 525 million from the private sector for investment in high potential start-up and scaling companies. The first, open competitive call for expressions of interest saw significant funding committed to VC funds focusing on investing in innovative companies, operating in the ICT and Life Sciences sectors. A second call for expressions of interest was issued in June 2015 which focused on committing capital to seed and early stages funds.

Development Capital Scheme

The Development Capital Scheme is aimed at addressing a funding gap for mid-sized, high-growth, indigenous companies with significant prospects for job and export growth. The Scheme was established to create funds that would invest between EUR 2 million and EUR 5 million in medium sized, established companies by way of equity, quasi equity and/or debt. Initially in 2012, the government allocated EUR 50 million of Exchequer funding with the intention of leveraging a further EUR 100 million of private sector investment. The original scheme was extended in December 2012 and an additional EUR 25 million was allocated to the Scheme. This allocation was targeted to leverage a further EUR 50 million from the private sector over the duration of the scheme, making a total of EUR 225 million in funding available. This target has been exceeded and there are now three funds actively investing in the Irish market. The funds are managed by private sector fund managers who make their own commercial investment decisions in the context of an agreed investment strategy.

“Supporting SMEs” Online Tool

SMEs and entrepreneurs are often unaware of all the existing state supports available to them. The “Supporting SMEs” online tool consists of eight questions which, when answered, directs the business to the state supports for which they may qualify. Members of the SME State Bodies Group are attending relevant events nationwide to promote this valuable guide. The tool is available at: https://www.localenterprise.ie/smeonlinetool/.

Strategic Banking Corporation of Ireland

The Strategic Banking Corporation of Ireland (SBCI) is a key part of Ireland’s financial infrastructure and is playing an important role in Ireland’s recovery by improving funding mechanisms for the real economy, particularly with regard to access to finance for Irish SMEs. The core purpose of the SBCI is to enhance the supply of credit to SMEs by using existing channels and encourage new entrants to the market. It is achieving this by using its funds of up to EUR 800 million initially, to lend to SMEs via other financial institutions called ‘on-lenders’. These on-lenders, which can be retail banks or other organisations that have capital and the ability to assess SMEs’ loan proposals, then lend the money on to SMEs. Key advantages of the SBCI are its mandate to introduce better and more flexible products to the market and its ability to access lower cost funding, which is passed on to SMEs via its on-lending partners. The SBCI is facilitating loans of longer duration and with more flexible terms than were typically available before its foundation.

The SBCI was incorporated in September 2014 and since then it has made considerable progress in building relations with on lending partners and in constructing the complex operational capability required to bring products to market. These include establishing operational capability with funders and lending partners, building internal systems and business processes, and establishing a team to safely and effectively manage the funding provided on behalf of the state. The SBCI launched its products to the market on 9 March 2015 through Ireland’s largest banks, AIB and BOI. At end June of 2015, it had lent an excess of EUR 44.6 million to eligible SMEs across all regions of Ireland. 90% of loans have been issued for investment purposes and the average loan size is EUR 27 500. The SBCI is currently working closely with other potential lending partners so that they will become on-lenders during 2015, thereby facilitating further competition in the SME finance market.

Sources: Charts A, B, and C: Central Bank of Ireland. Chart D: Irish Venture Capital Association. Chart E: Department of Jobs, Enterprise and Innovation.

References

Central Bank of Ireland.

Central Statistics Office.

Credit Review Office.

Department of Finance, Red C SME Credit Demand Survey April – September 2015.

Department of Jobs, Enterprise and Innovation: Companies Registration Office Data, Enterprise Ireland, Microfinance Ireland.

Irish Venture Capital Association.

National Treasury Management Agency, Ireland Strategic Investment Fund.

SME State Bodies Group.

Strategic Banking Corporation of Ireland.

Note

← 1. The duration of bankruptcy has reduced from 12 years to 3 years since 3 December 2013.