China (People’s Republic of)

SMEs in the national economy

In China, micro, small and medium enterprises (SMEs) comprise 97% of all firms, accounting for 80% of urban employment, and for 60% of total GDP in 2013. In 2013, there were about 11.7 million small and micro enterprises and about 44.4 million self-employed entrepreneurs; accounting for 94.2% of all firms. 60.2% of small businesses (excluding self-employed) operate in the services sector (with 36.5% in wholesale, retail and catering; 10.2% in tenancy and business services; 2.5% in information transmission services; 2.5% in real estate industries; and 8.5% in other service industries). In addition, 18.5 of small businesses operate in manufacturing and processing, 5% in construction, and 3.2% in agriculture-related industries.

The definition of an SME varies by sector and is contingent on both, the production value and the number of employees (see Table 8.2 for details). Chinese economic policy has been more and more focused on the development of small and micro businesses in recent years.

In 2014, the Chinese government reformed the commercial registration system, and shortened registration procedures. The responsible Chinese authority, the State Administration for Industry and Commerce, loosened regulations on commercial registration of new businesses by implementing the commitment-to-pay registered capital system to substitute the paid-in registered capital system, cancelling requirements such as a minimum registered capital amount limit, initial paid-in capital, as well as subscription time limitation. That means that a new business has the right to decide on the volume of registered capital without limitations of minimum requirements on paid-in capital before registration. The new business also has the right to decide on the initial ratio of paid-in capital and following paid-in progress of registered capital. Besides, the applicant of a new business registration does not need to submit capital verification reports either. The Chinese authorities also loosened the requirement of establishing an operation site for newly registered businesses. According to previous regulation, new businesses should have a qualified operation site, usually commercial real estate, for which rent tends to be expensive. Now, new businesses have more freedom to choose suitable operation sites. These reforms had a big impact on business creation. The number of company registrations totalled 12.9 million in 2014, up by 14.2% compared to 2013. About 10 600 new companies are thus created every day in China. The new registered capital amounted to RMB 20.7 trillion in 2014, a year-on-year increase of 87.9%. The number of newly registered companies equalled 3.7 million and the number of self-employed was 9 million in 2014, an increased by 45.9% and 5.1%, respectively year-on-year. The industrial distribution of new business creation implies that the quality of entrepreneurship is steadily improving. About 78.7% of new registered companies are in the service sector. Information transmission, software and IT service, education service, culture, sport and entertainment, science and technology service are recorded as fast growing industrial sectors with increase rates ranging between 70%-97% in 2014. Foreign Direct Investments companies’ registration has also increased by 5.8% after two-years of decline.

Entrepreneurship and innovation were being highly advocated by the Chinese government in 2014. The Chinese education system is more willing to offer necessary training for young entrepreneurs, and gradually take on more responsibilities to foster entrepreneurship. The development of a new generation of start-ups, especially in hi-tech and innovative fields, is promising. The success of Alibaba stimulated high-quality entrepreneurship in IT (Information Technology), e-commerce and the internet economy. The social image of entrepreneurship has also improved in recent years as a consequence. However, there is still a long way to go to foster entrepreneurship as the start-up rate and the success rate of new ventures are both still at low levels in China.

Lack of access to finance is a main obstacle of entrepreneurship, as well as a major factor causing business failure of SMEs. Private SMEs are often required to provide collateral of their own assets or credit guarantee from another company when they apply for bank loans. To satisfy these requirements of bank lending and obtain sufficient resources, private SMEs tend to help each other by providing mutual financing support via credit guarantees and inter-firm lending. As a result, SMEs in one region are embedded into networking circles, in which SMEs are interconnected with other actors. In this context, credit default of one firm is easily transmitted to another company, and may trigger further business failure. In early 2014, there was an outbreak of credit risk among SMEs and related cascading bankruptcies in several provinces, such as Zhejiang, Henan, Shanxi, Sichuan, Hebei etc. SMEs suffered from a tightened cash flow and a diminishing profit margin in 2014. To prevent a small-scale, regional debt crisis, the Chinese government released credit control to a certain extent and implemented significant reforming measures to improve financial access of SMEs (see the section on government policy response).

Small business lending

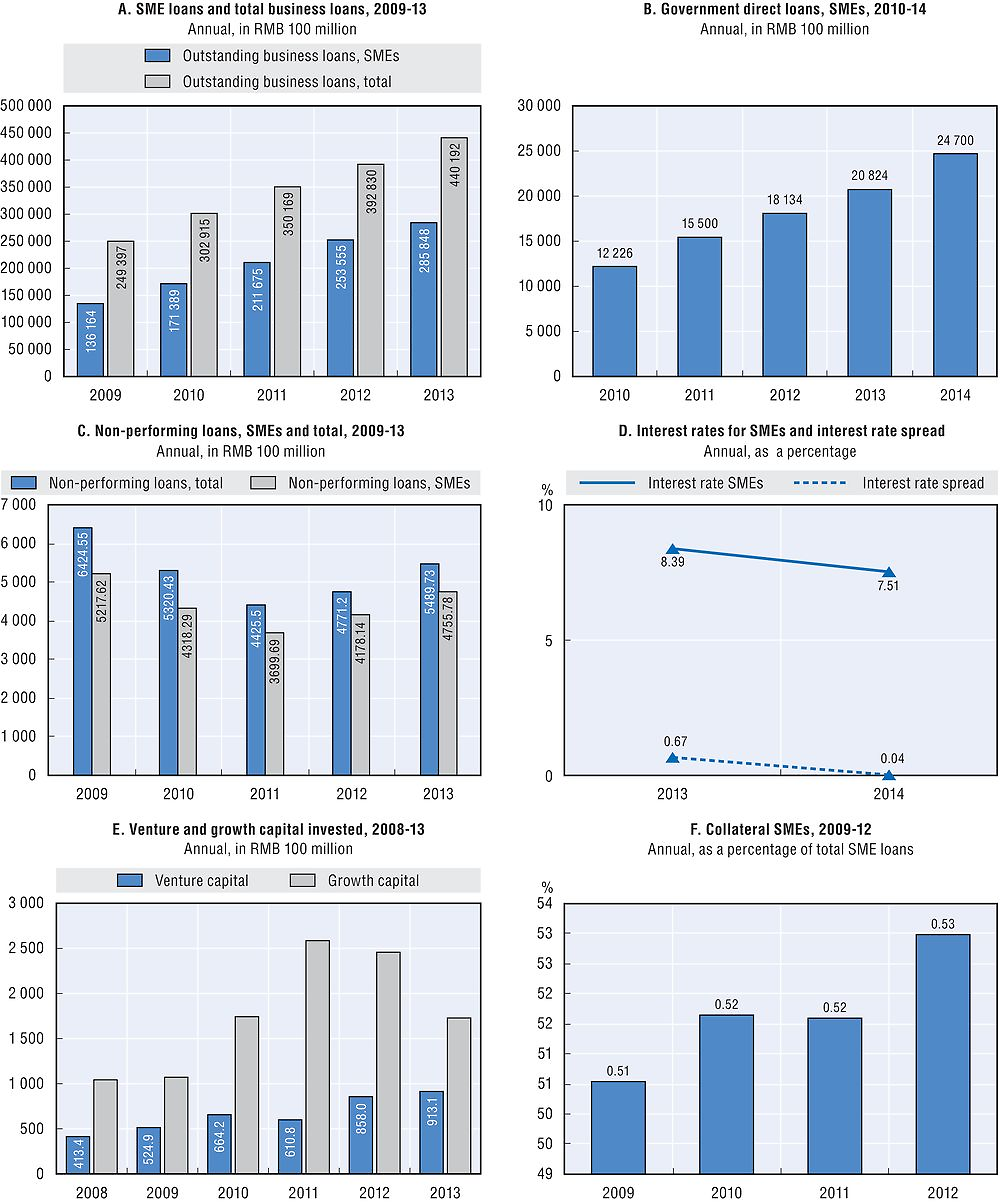

The stock of SME loans increased to RMB 285 848 trillion. SME and total business loans increased by 209.9 % and by 176.5%, respectively over the 2009-13 period. As loan growth for SMEs outpaced total business loan growth, the SME loan share increased from 54.6% to 64.9% over the same period. The Chinese government has generally implemented a relatively loose credit policy since the global financial crisis, and issued broad incentive policies to encourage state-owned banks to support SMEs. In 2013, SME and total business loans increased by 12.7% and 12.1%, respectively, in real terms with respect to the previous year and the share of SME loans as a proportion of all business loans increased slightly.

In China, standard loans from public banks are the most widespread source of finance for small firms (ADB-OECD, 2013). Both, development banks and other state-owned commercial banks are important institutions for providing financial support to SMEs. Partial efforts are conducted by development banks, and more efforts are implemented by other state-owned, commercial banks. Only 7.3% of total SME loans are issued by the Chinese Development Bank. The Chinese Development Bank is a policy bank, which assumes responsibility to provide financing support for national strategic targets, including supporting urban renewal, cross-border business, infrastructure, basic and pillar industries, regional development in Central and Western China, innovation and inclusive development, as well as SME development. A current debate evolves around whether SME financing would be enhanced by the establishment of a new finance organisation that assumes policy responsibility to provide targeted financing support to small businesses. Limited government loan guarantees are provided by a very dispersed system of local, state-owned guarantee companies.

Small business credit conditions

The credit cost of SME loans has lowered due to the slacker macro-policy environment. In 2014, China lowered its deposit reserve ratio to targeted financial institutions twice and cut its interest rate. The basic 1-year lending rate has decreased from 6% in 2013 to 5.6% in 2014 and the lending rate for SMEs and large firms decreased from 8.4% and 7.7% to 7.5% and 7.5%, respectively. The decrease of interest rates for SMEs and large firms stood at respectively 0.9 and 0.3 percentage points. The credit conditions for SMEs improved significantly in recent years, as illustrated by the interest spread between SMEs and large firms, which decreased from 0.7% in 2013 to 0.04% in 2014.

In addition to the interest cost, there are extra fees for obtaining a bank loan in many occasions. In 2014, SMEs were on average charged about 1.4% of the total value of bank loans as extra loan fees, down by 2.3% with respect to the previous year. The change is assumed to be due to a number of policy adjustments involving farmer-related loans, national SME funds, prevision for SME credit losses, administrative fees of bank lending, and general SME tax abatement etc., aiming to cut the comprehensive cost of SME financing by China’s central government.

Collateral is likely to be required for an SME loan in China. In 2014, about 54.5% of SME bank loans required collateral. This ratio has steadily increased in recent years, from 50.6% in 2009 to 54.5% in 2014. Stricter collateral requirements make it more difficult for SMEs to obtain a bank loan, which, in turn, results in lower willingness of SMEs to invest in production. The utilisation rate of SME bank loans remained at a high level of 94.8%, which slightly increased with respect to the previous year and suggests that demand for credit for SMEs is not entirely met. The ratio of short-term loans to total loans for SMEs decreased from 56.1% in 2013 to 49.2% in 2014. The term structure change coincided with stronger collateral requirements, implying that SMEs with quality assets find it easier to obtain more credit, while others struggle.

In general, credit conditions for small business have been improving in 2014. This is supported by survey data on lending rates, the interest spread, loan fee information, and the ratio of short-term loans to total loans to SMEs. The average ratio of authorised loans to requested loans for SMEs in primary application is 67.9%, with an increase by 8.3 percentage points, implying that the rejection rate decreased to 32.1%. However, in terms of the case number of SME loan applications, the rejection rate increased to 12% in 2014 (see breakdown details in Table 8.3). Small businesses with quality assets and high growth (prospects) are more favoured by the Chinese bank system to the detriment of other businesses. In fact, medium-sized enterprises are important clients who are highly sought after by Chinese banks. Small businesses, especially micro businesses, are most likely to be rejected when applying for a loan. This implies that a part of small businesses does not benefit from the generally improving credit conditions, rather to the contrary. Neither in survey method based on curtail in loan amount requested or in substitute method based on rejection to application case, the rejection rate of micro businesses is obviously higher than that of medium businesses.

Equity financing

Although equity financing still only represents a marginal share of all SME finance, the market for SMEs has become more active in recent years. In January 2014, the Chinese equity market reopened for IPOs (Initial Public Offerings) after a nearly two-year suspension. The equity financing amounted to RMB 706 billion for all kinds of firms. There are three institutions that provide alternative equity financing instruments for SMEs: a SME Board in the Shenzhen Stock Exchange (since 2004), a Venture Board (since 2009), and another National Equities Exchange and Quotations (NEEQ, since 2013). Both the SME Board and Venture Board provide bonds and equity finance for high-growth SMEs and/or high-quality start-ups. In 2014, SMEs obtained RMB 169.9 billion from the Shenzhen SME Board, and RMB 50.0 billion from Shenzhen Venture Board. In total, 82 small businesses are listed in the SME Board and Venture Board in 2014.

The National Equities Exchange and Quotations (NEEQ) is another national securities exchange specific for SMEs established in September 2012. NEEQ offers financing instruments specific for small businesses. Small companies have still many difficult to get access into the traditional Chinese securities market that favours large-scale and state-owned companies. In 2012, 200 small businesses were listed in NEEQ in total, and the number increased to 356 in 2013. The equity financing amount remains relatively small, with about RMB 0.86 billion in 2012, down from RMB 1 billion in 2013. In 2014, the NEEQ market experienced a tremendous growth, however. In total, 1 572 small businesses were listed in the NEEQ market in 2013, with a recorded financing amount of RMB 13 billion. The fast expansion of the NEEQ market was fuelled by transition to national implementation (pilot in Beijing before 2013), the revision of a full set of exchange regulatory and inflow of securities traders and related venture capital.

Venture investment was impacted by a slowing down of Chinese economic growth. The venture capital invested in seed and early stage companies is still growing at a relatively stable rate and recorded about RMB 91.3 billion in 2014, a 6.4% year-to-year growth. The venture capital invested in the growth stage is declining after experiencing an investment peak in 2011. It should be noted that venture capital investments continue to be very small compared with other funding sources such as bank lending, equity financing in stock markets, and NEEQ.

Alternative financing and other indicators

Non-bank finance instruments, such as factoring and leasing, are gaining more traction as important alternative sources for SME finance. In 2012, China released regulation on commercial factoring. Commercial factoring business is has been experiencing an extraordinary development since. The numbers of newly established companies providing commercial to factoring businesses were 11 in 2010, 19 in 2011, 44 in 2012, 200 in 2013 and 845 in 2014. In 2012, the factoring volume totalled EUR 34.4 billion, about 0.05% of Chinese GDP. Considering a total of RMB 10 trillion of account receivables of industrial companies in 2014, the factoring market is still not very prominent in China. In May 2014, there were 24 major finance-leasing companies with RMB 1.1 trillion of assets. Small businesses acquired RMB 109.1 billion by way of leasing in 2014. The uptake of these non-bank instruments is still relatively small and limited to a small subset of SMEs, especially medium-sized businesses. However, the fast growth of these instruments shows promise and suggests that asset-based finance may soon become a viable finance solution for more SMEs in China.

In China, small businesses, especially micro businesses, are regarded as victims of financial repression in a state-owned bank system. Those small businesses that experience difficulties in getting bank loans often seek alternative financing from the so-called shadow banking system. Small businesses usually first seek small-scale, cheap financing support from family members. When market-based private lending is involved, there is a huge gap of lending conditions between the formal financing system and the informal shadow banking system. In 2014, the benchmark interest rate of a 1-year bank loan stood at about 6% (February to November) and 5.4% (from November), while the average lending rate in the shadow banking system was about 11%-26% (see Table 8.4). This source of finance is therefore only acquired by businesses in critical moments of their life cycle, such as cash-flow crises and only when denied access by the formal financing system. Though the shadow banking system comprises only a small part of overall SME financing, many cascading bankruptcy crises in China were triggered by their inability to repay punitive interest rate charges, and therefore constitutes a high risk for the well-being of the SME sector in China. There is no official indicator of the national interest rate for private lending, since the private lending market is secretive and regional in China. Wenzhou City is regarded as highly active central node in the Chinese shadow banking system. The region is thus also a comprehensive reforming zone of private financing approved by Chinese central government. The Wenzhou private finance index, published since 2012, is a well-known “barometer” for the regional and national private financing market.

Online finance is quickly becoming popular in China, and is possibly reshaping the SME financing environment. In China, online financing can be roughly divided into three major types: online payment, online financing and online sales of finance products. Since the first P2P (peer-to-peer financing) company was established in 2007, the P2P business has increased tremendously. In 2014, there were over 1 600 online P2P platforms, with a transaction amount of RMB 252.8 billion, and outstanding P2P loans of about RMB 103.6 billion. Crowdfunding can also be described as distribution-based crowdfunding whereby investors will be rewarded with physical products or services, and equity-based crowdfunding whereby investors will be rewarded by equities of start-ups. In 2014, 5 997 distribution-based crowd-funding projects raised RMB 0.3 billion; and 3 091 equity-based crowdfunding projects raised RMB 1 billion. Online financing is a promising instrument for SMEs because of its cheapness and high efficiency. Of course, more comprehensive regulations and a stricter risk-control system are important for its growth.

In 2014, payment delays for the B2B (business to business) and B2C (business to customer) sectors changed for the better, along with an improvement of credit conditions for SME financing. The B2B payment delay decreased from 95.9 days to 72.3 days, implying cash flow along supply chains generally releasing, and the B2C payment day also decreased from 48.4 days to 42.6 days. Chinese B2B and B2C payment delays to some extent affect SMEs’ cash flow and financing capability.

Total non-performing loans equalled about RMB 549 billion in 2014, increasing by 15.1% in amount year-on-year, while non-performing loans for SMEs were at about RMB 475.6 billion, increasing by 13.8% year-on-year. The ratio of SME non-performing loans to total SME loans stood at 1.7%, increasing only slightly by 0.01 percentage points. The ratio of SME non-performing loans is still on a safe and controllable level.

Government policy response

In November 2013, China’s central government initiated broader activities restructuring the economic and social institutional system. As part of a reform strategy of the economic institutions system, China’s government adopted broader policies to support SME financing, aiming to reduce financing costs, facilitating access to bank lending, encouraging the development of innovative financial products and online financing. China’s central government is focussing on entrepreneurship and micro businesses in 2014.

China decreased income tax, value-added tax, administrative charges and fees for SMEs. In 2014, the government curtailed the tax burden by allowing calculating income tax at 20% tax rate (25% for general business) based on 50% of total taxable income for small business that taxable income is not more than RMB 100 000. Value-added-tax and business tax were also exempted for small businesses (including self-employed) that sale revenue is not more than 20-30 thousand RMB per month. In addition, 54 items of administrative fees were abolished. All these measures help improve the business environment for small businesses, and lower their cost burden.

The Chinese government focuses on the further development of NEEQ, and encourages small businesses to get financing from the market. China also reduced personal income tax of dividends and bonuses from NEEQ market transactions. According to revised regulatory, 50% and 75% of income tax of dividend and bonus from NEEQ market is exempted in case of holding period from 1 month to 1 year, in case of holding period over 1 year. NEEQ is a promising instrument for SME financing and is considered to be an important part of a multi-level equities market in the Chinese financial system, especially useful for small businesses’ equity financing.

China’s government continued to reform its bank system to broaden available SME financing channels in 2014. One strategy is to develop micro-finance companies specifically for small businesses. In 2014, 8 791 small credit companies were in operation, providing about RMB 942 billion of loans to small businesses. There were over 1 100 town banks, which are the basis of micro-finance in the Chinese bank system. In addition, other non-bank finance sources were increasing in importance, including 68 trust companies, 196 finance companies, 4 larger asset management companies, 30 larger finance-leasing companies, and 5 private banks were approved. In 2014, with the rising of online financing, Chinese authorities generally kept an open attitude to innovative products in this field. To avoid potential financial risks, China’s central bank put forward supervision and regulation policies for online payment and P2P products as a means to include innovative online financing into the financial supervision system, even though this poses great challenges.

The high lending cost, especially in the informal shadow banking system, is also on the radar of the Chinese government. Releasing financial repression in the formal bank system is deemed useful to avoid more small businesses making use of the informal financing system. As a response, China tends to enhance policies about SME loan and loan guarantee etc. In 2014, the government encouraged larger, state-owned banks to established specialised branches or departments to serve small businesses. More small-scale country bank and small credit companies were allowed to be set up. Five private banks were approved to be established in 2014. Some barriers impeding SME financing were removed or relieved. For example, collateral is broadened to include accounts receivable, inventory, property rights, equipment and patents. In addition, the government enhanced the development of state-owned guarantee companies by providing direct capital input, subsidies to the SME guarantee business, and compensation of risk loss in the SME guarantee business. Some unreasonable charges and fees involving SME bank loans were cancelled in the last years. The Shadow banking system is more strongly supervised, regulated and controlled. However, there is a long way to go to lower comprehensive lending costs for small businesses.

Source: See Table 8.7.

References

ADB-OECD (2013) “Enhancing Financial Accessibility for SMEs: Lessons from recent crises”, http://www.adb.org/publications/adb-oecd-study-enhancing-financial-accessibility-smes-lessons-recent-crises.

China Institute for Small and Medium Enterprises of Zhejiang University of Technology (2015), “Demand-side survey on Chinese SME financing conditions in 2014”.

Chinese Ministry of Industry and information technology, National Statistical Bureau, National Development and Reform Commission, Ministry of Treasury (2011) “Notice on Issuing the provisions of classification standard of the small and medium enterprises”, http://www.gov.cn/zwgk/2011-07/04/content_1898747.htm.

Financial Affairs of Wenzhou Municipal People’s Government (2015), “Monitoring of Wenzhou Private Finance Index”, http://www.wzpfi.gov.cn.

The National Bureau of Statistics (2010) “China Economic Census Yearbook 2008”, Beijing: China Statistics Press.

ZERO2IPO Research Group (2015), “China internet financing industry investment research report (2015)”, http://www.zero2ipo.com.cn/research/.