Executive summary

Adjusting to lower oil incomes and monitoring the property-market boom

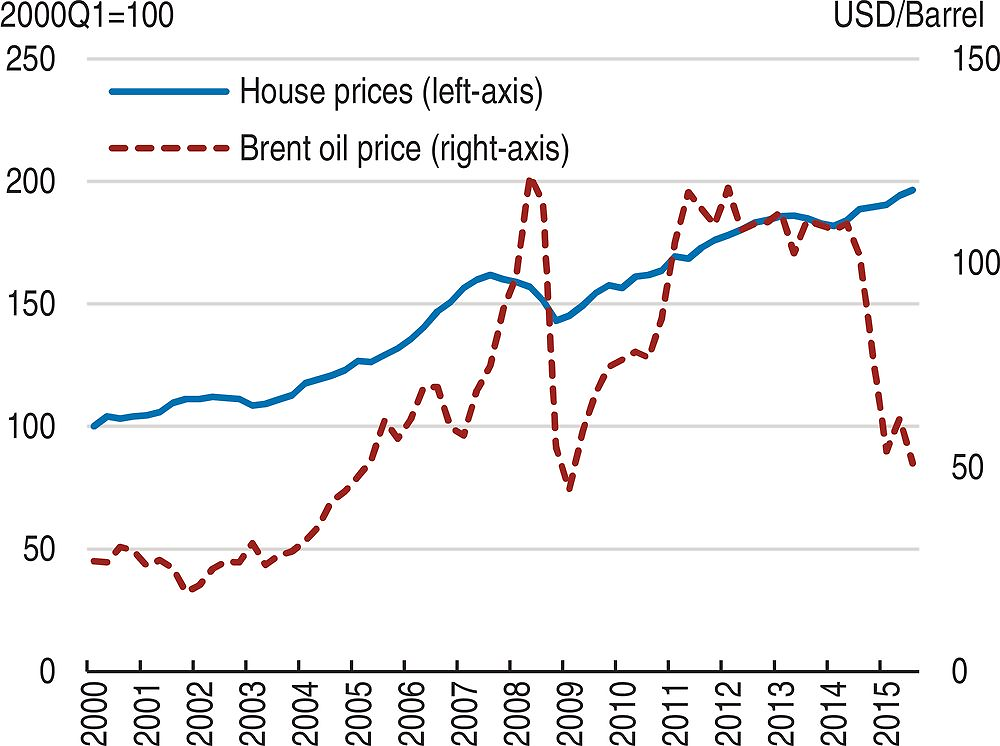

Norway has very high material living standards and scores well on other aspects of well-being, thanks to a mix of natural resources wealth, good policy making and inclusive and egalitarian social values, including active efforts to break down barriers to women’s careers. However, the substantial oil-price falls since 2014 have been a reminder of Norway’s exposure to external risks and consequently the importance of a flexible and competitive mainland economy. Norway continues to experience strong property-price momentum, raising concerns for macroeconomic stability. Also, the long-standing fiscal rule risks being inappropriately expansionary.

Bolstering competitiveness on a wide range of fronts

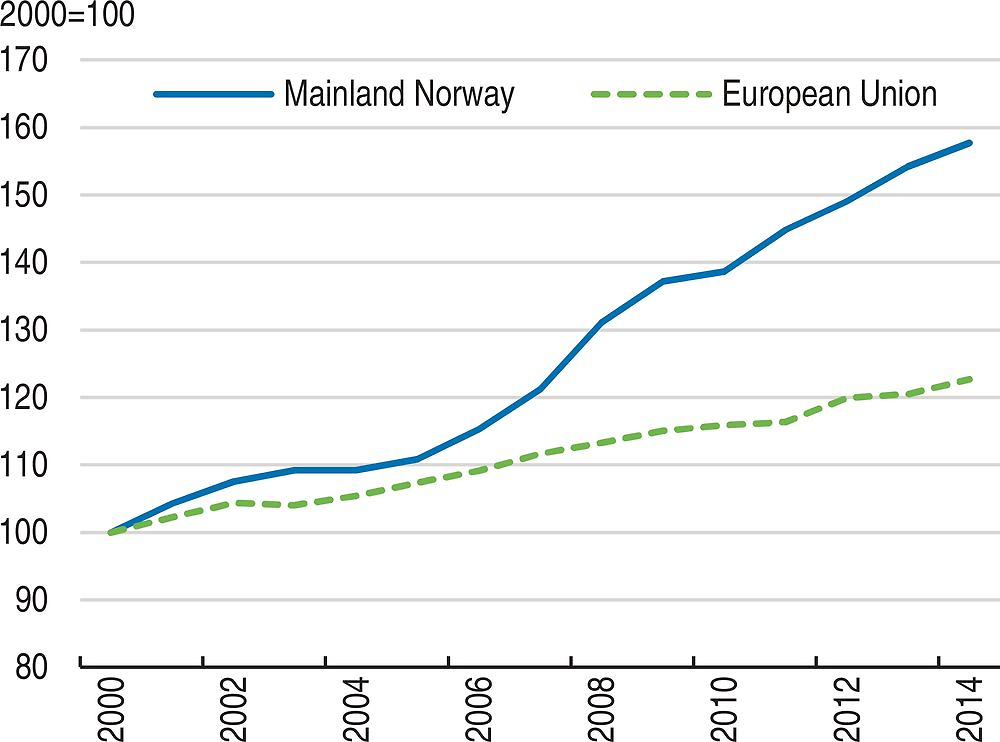

Norway lost some competitive edge in the past 10-15 years and trend productivity growth has been slowing. Improving the framework conditions to address these issues is key. Recent reform initiatives by the current government are welcome and should continue. Taxation needs to be scaled back and better tuned to growth, and public-sector efficiency reforms need to be pursued vigorously. Furthermore, campaigns to reduce bureaucracy need to continue. Some sectors, notably agriculture, need to be less sheltered from international competition. Agriculture and rural policy needs to focus more strongly on economic sustainability.

Improving skills to help productivity and inclusiveness

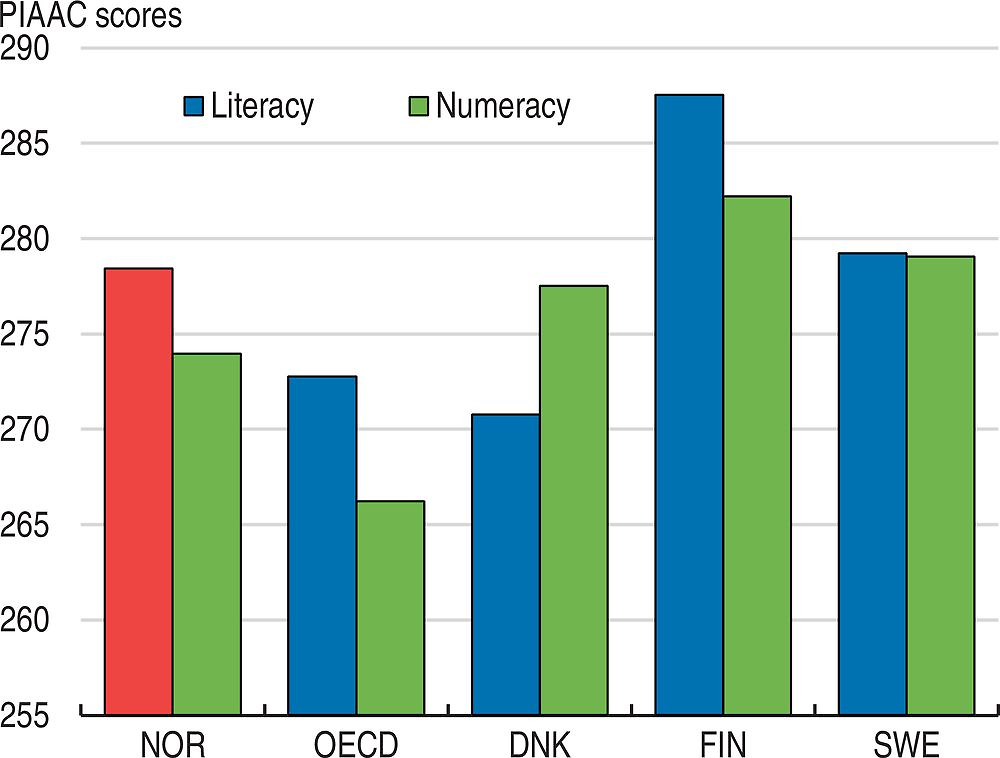

Reforms that enhance skills are also important for economic success and social well-being. Further improvements to both compulsory and tertiary education in terms of quality and efficiency are essential. Tertiary-education policy needs to examine the structure of provision and the incentives that drive student decisions on what to study and the pace of study. Programmes addressing the longstanding problems of the sickness and disability system that discourage labour supply need to continue.