Denmark

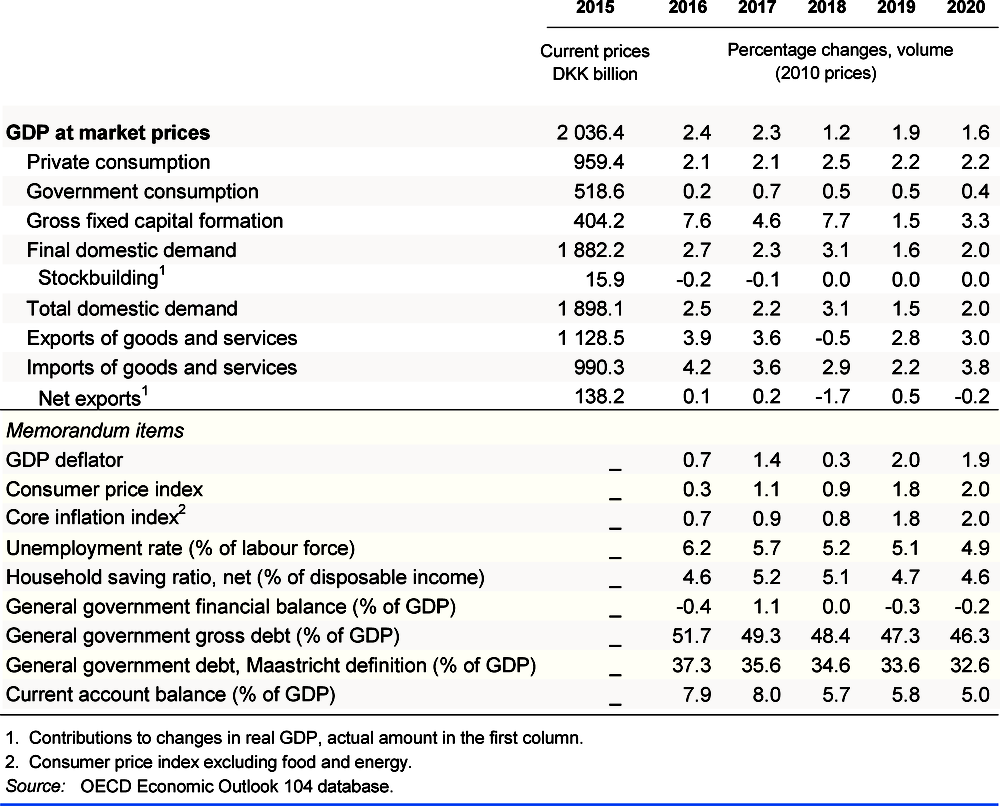

The broad-based economic expansion is projected to continue in 2019 and moderate in 2020. Strong real income growth and continued employment gains will support private consumption. Labour shortages are expected to intensify and result in faster wage growth and a pick-up in inflation. Strong domestic demand will bolster imports and help to reduce the very large current account surplus.

The fiscal stance is expansionary in the near term, reflecting previous policy initiatives, after which it will become broadly neutral. Highly accommodative monetary conditions, resulting from the pegging of the krone to the euro, are expected to continue, which warrants prudent fiscal measures if capacity constraints tighten further. Shifting the tax burden further away from labour and corporate incomes would strengthen incentives to work more hours.

Steady expansion is being led by domestic demand

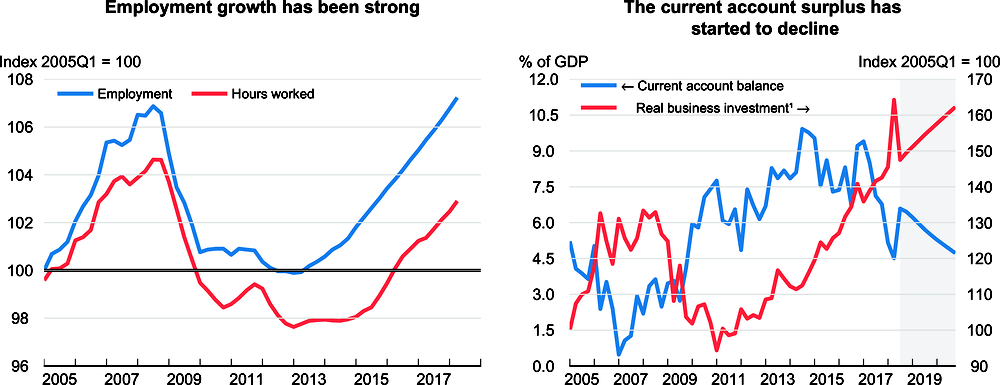

The economy is on a steady upturn, increasingly supported by private consumption and business investment. Consumer and business confidence is high and rising in manufacturing and construction. Strong employment growth has pushed unemployment well below its estimated structural level and resulted in emerging wage growth. Nevertheless, consumer price inflation remains low, especially due to food prices. GDP data have been distorted by the statistical recording of the export of a single Danish patent, pushing growth up in 2017 and down in 2018. Slowing exports and rising imports are reducing the growth contribution of net exports.

Further structural reforms would help to sustain inclusive growth

Fiscal policy is currently supporting growth, but is set to become neutral to reach the government’s target of a structural balance after 2020. The tightening labour market calls for prudent economic policy to reduce the risk of accelerating wage and price inflation, especially given continued low interest rates, which could fuel a spike in private consumption and overheat the economy. The exceptionally low interest rates pose an ideal opportunity to reduce the tax deductibility of interest payments further, which would mitigate vulnerabilities deriving from excessive household balance sheet expansion.

Sustaining growth, and ensuring sufficient access to labour resources, requires further reforms of the tax mix to boost investment and average hours worked, which are lower than in most OECD countries. Lowering marginal taxes on income further and reducing the debt-bias in corporate income taxation will help in this regard. The statutory retirement age will increase from 65 to 67 during 2019-2022, which will support labour force growth. Previous pension and benefit reforms have been successful in boosting labour market inclusiveness. Stepping up efforts to maintain seniors with reduced work capacities in work and bringing groups with low labour market attachment into jobs could yield additional employment gains in the buoyant labour market. A recent trial integration programme for refugees and migrants, managed with social partners, should be further improved and made permanent, as it has proven to be successful in addressing barriers posed by high entry wages.

Growth is projected to moderate

The economy is projected to grow by around 2% in 2019 followed by a slowdown in 2020. Private consumption will be an important driver of growth, supported by rising real wages and the implementation of income tax reductions. Business investment will continue as capacity constraints intensify. Inflation is set to pick up and return to a level around 2% by the end of 2020. Downside risks to the outlook are large. A hard Brexit would cause substantial disruption given the importance of the United Kingdom as a main trading partner. Recent disclosure of a massive money laundering scandal in the Estonian branch of the largest Danish bank could escalate and trigger financial sector turmoil with consequent economic distress.