Korea

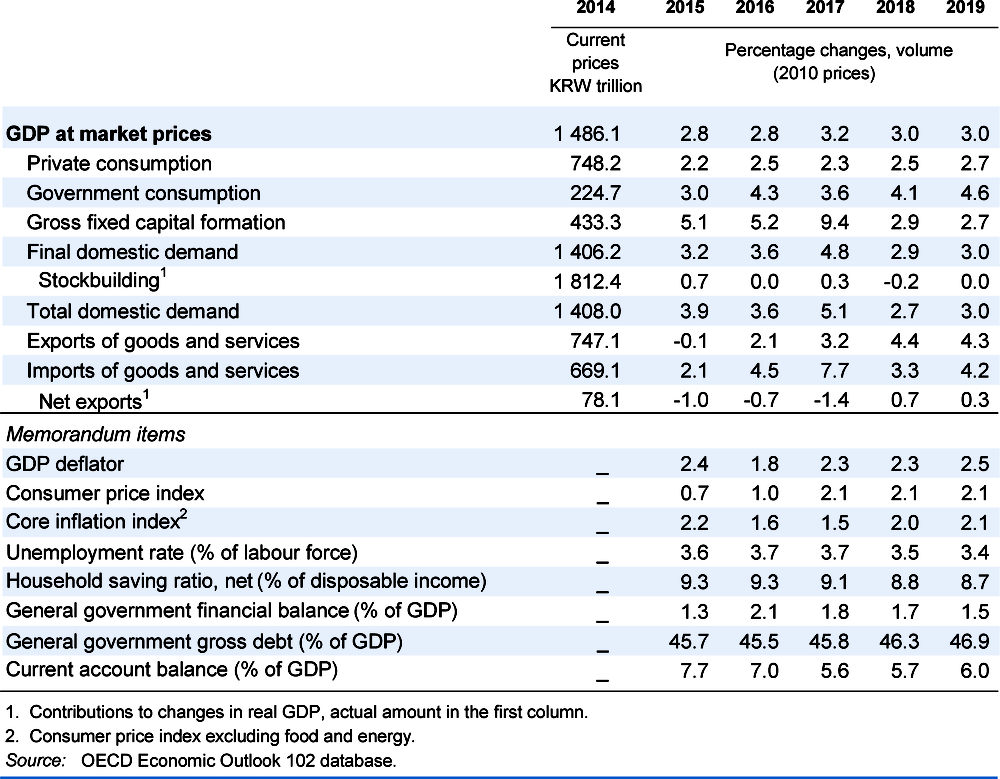

The rebound in international trade and greater fiscal support are projected to sustain output growth at around 3% through 2019, even though construction investment is projected to slow following tighter regulations on housing and mortgage lending. High household debt and weak employment growth continue to hold back private consumption. Inflation is projected to remain close to 2%, while the current account surplus will edge up to 6% of GDP.

The government's strategy of “income-led growth”, driven by public employment, a sharp rise in the minimum wage and increased social spending, needs to be supported by reforms to raise productivity. Fiscal policy, which is increasingly focused on income redistribution, also needs to place greater emphasis on productivity. Gradually reducing the degree of monetary accommodation by raising the policy interest rate from a record-low 1¼ per cent would help keep inflation in check and contain household debt.

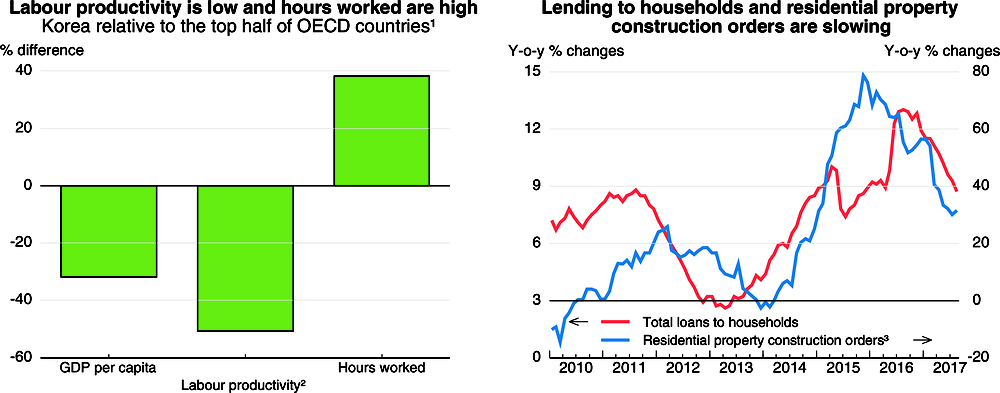

Household debt is high, at nearly 160% of household disposable income, and rising. The strengthening of macro-prudential regulations and housing taxes and regulations have slowed mortgage lending, but risk creating a downturn in residential construction. Measures to put household debt on a downward trend are a priority to promote inclusive growth, in part by addressing the high debt burdens of older persons, the self-employed and low-income workers.

Exports have underpinned growth in 2017

Construction investment, the key driver of growth since 2015, is slowing but exports have picked up. The semiconductor industry has led Korea's export recovery and accounted for three-quarters of business investment during the first eight months of 2017. However, capacity utilisation in manufacturing is low by historical standards, while wage and employment growth remain sluggish. The increase in inflation from 1% in 2016 to 2%, driven by food and energy prices, has curtailed real income gains and private consumption, despite a rebound in consumer sentiment following the election of a new president in May. The continuing rise in household debt also remains a headwind to private consumption, which has lagged output growth each year since 2006.

1. In 2015 using PPP exchange rates.

2. Per hour worked.

3. A 24-month moving average.

Source: OECD Going for Growth database; and Bank of Korea.

Fiscal policy has become more expansionary

In July, the government introduced a supplementary budget equivalent to 0.7% of annual GDP. In addition, the new Fiscal Management Plan raised spending growth to 5.1% annually over 2017-20, up from 2.6% in the previous Plan, financed in part by a hike in the corporate income tax rate. Spending will boost public employment by over 0.8 million by 2021 – a 30% increase – and enhance social welfare to promote a “people-centred economy”. Meanwhile, government investment in social overhead capital is to be cut by 20% in 2018, suggesting a need for more spending aimed at increasing productivity, given that labour productivity in Korea is 51% below the top half of OECD countries. Moreover, structural reforms in product and labour markets are needed to boost productivity growth, which increased at a 0.8% annual pace over 2011-15, below the OECD average.

Policies implemented since early 2016 to stabilise the housing market contributed to a small decline in house prices in real terms during the first half of 2017. The government lowered maximum loan-to-value and debt-to-income ratios further in July 2017 and cut them again in “overheated speculative districts” in August. These measures have reduced the growth of residential property construction orders and mortgage lending, helping to moderate the rise in household debt. Measures to stabilise household debt should be carefully calibrated to avoid a contraction in the housing market.

Growth is projected to edge down to 3% over 2018-19

Fiscal support and buoyant international trade in Asia are projected to sustain growth through 2019. The planned increase in public employment and social spending, while achieving the target of raising the minimum wage by 54% over 2017-20, is expected to boost household income and consumption, offsetting the continued deceleration in residential investment. Gradual hikes in the policy interest rate are projected to keep inflation near the 2% target, while the current account surplus remains large.

A broader-based export recovery that extends beyond key industries, notably semiconductors, and positive results from the government's measures to promote innovation would lead to faster output growth. However, rising wage costs driven by a hike in the minimum wage could weaken Korea's competitiveness if not accompanied by productivity gains. Another downside risk is sluggish business investment following hikes in corporate taxes, higher wages that weaken the profitability of smaller firms and the uncertainty created by the government's pledge to reform the large conglomerates that play a key economic role. Continued geo-political tension related to North Korea could weaken business and household confidence, with adverse implications for business investment and private consumption. The numerous housing-related measures could turn the slowdown in housing investment into an outright decline.