Slovak Republic

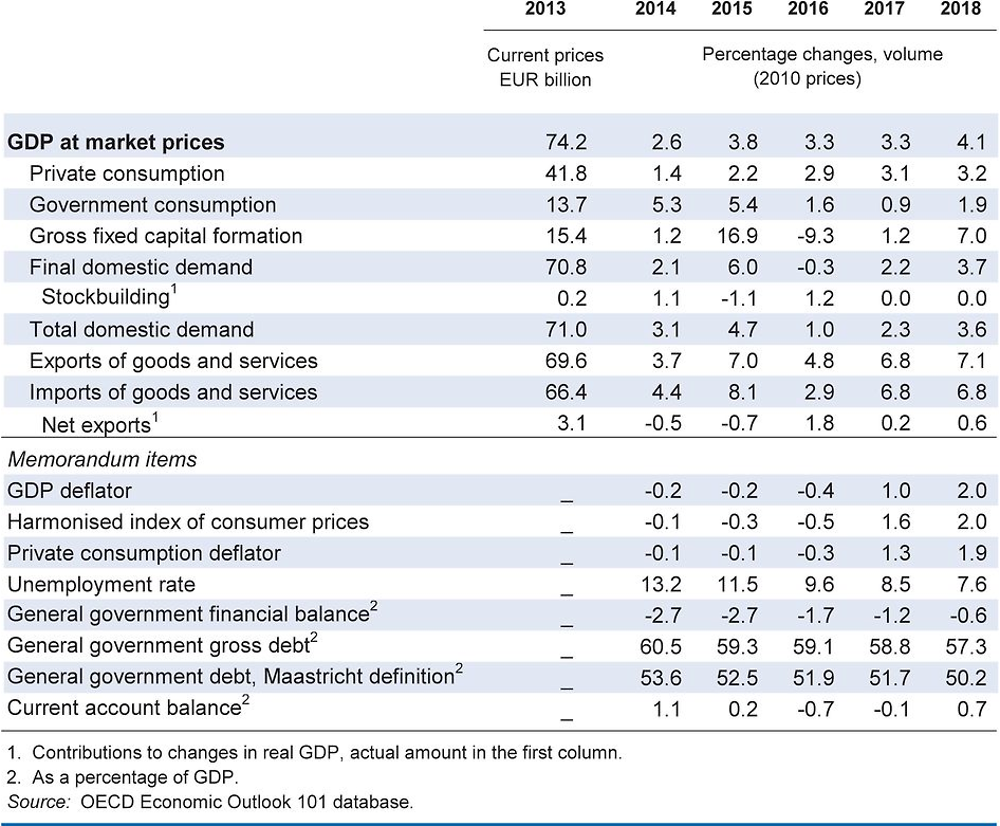

The economy is projected to remain robust, growing 3.3% in 2017 and 4.1% in 2018, led by persistently strong domestic demand. The strengthening labour market and rising incomes will further raise household consumption. Unemployment may fall to near 7½ per cent in 2018, the lowest level since independence. Exporters are projected to continue to gain market share, allowing the current account to reach a modest surplus. Consumer price inflation is expected to rise gradually, as energy prices pick up and the labour market tightens.

The government appropriately intends to reach a balanced budget by 2019 to maintain the soundness of the public finances. In order to finance much needed inclusiveness-friendly reforms, the government should continue to enhance tax collection and improve public sector efficiency.

Large FDI inflows have helped integrate the Slovak Republic into global value chains and boosted exports and productivity, resulting in one of the OECD's fastest growth rates in the past decade. However, the benefits of growth have not been equitably shared. Therefore, there is a need for education, health care and labour market reforms to make growth more inclusive, particularly for the Roma population and the long-term unemployed.

Domestic demand is supporting growth

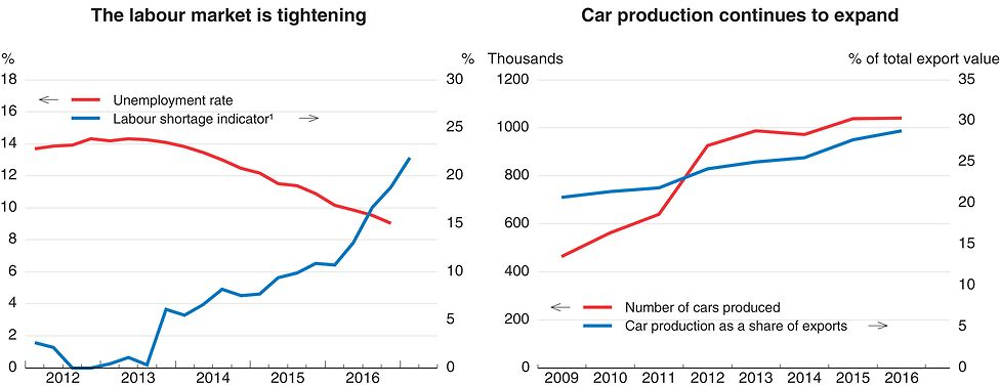

Economic growth remains robust, as household consumption continues to grow on the back of labour market buoyancy and strong consumer confidence. The unemployment rate has been falling and labour shortages are spreading. Investment has been affected by a significant drop in public investment due to the slower disbursement of EU structural funds in the new funding cycle. On the other hand, business investment continues to grow due to accommodative financial conditions and new foreign direct investments. Exports have also performed well, benefiting from favourable developments in the important automotive industry, which now produces over one million cars per year. Consumer prices have picked up due to higher food prices, rising demand pressures, and the end of last year's energy price decline.

1. Percentage of manufacturing firms pointing to labour shortage as a factor limiting production.

Source: OECD Economic Outlook 101 database; Statistical Office of the Slovak Republic; Zväz automobilového priemyslu Slovenskej republiky; and European Commission.

Reforms are needed to make growth inclusive

Fiscal policy is projected to remain contractionary, as the government plans to reach a balanced budget by 2019 in order to continue decreasing public debt and to deal with the medium-term challenges from population ageing. On the other hand, financial conditions will remain supportive, reflecting expansionary euro area monetary policy. With house prices and household debt rising fast, the central bank has adopted several macro-prudential measures to reduce the risks of a housing bubble and strengthen financial stability.

Large foreign direct investment, particularly in the automotive and electronics sectors, has led to a growing participation in global value chains. This has helped to boost exports and productivity and contributed to faster economic convergence vis-à-vis the OECD average. However, the benefits of high economic growth have not been equally shared across society. Long-term unemployment remains high by international standards, and the Roma population are not well integrated, with many of them either in or at risk of poverty. As a consequence, labour shortages are spreading, despite relatively high unemployment. In order to make growth more inclusive, the government needs to pursue much needed reforms in education and skill development and Roma integration.

Growth is projected to stay robust

Growth is projected to exceed 4% in 2018, underpinned by strong domestic demand and exports. With the unemployment rate historically low and excess capacity eliminated, inflation is expected to reach 2% in 2018. Investment spending is projected to improve, supported by the implementation of the government's infrastructure agenda and strong business investment. Higher demand from trading partners and the launch of a new car production line will boost exports, pushing the current account into surplus.

Exports (notably of cars) could suffer from a disorderly Brexit. Rising tensions on capacity, if they persist, could lead to some overheating and deterioration in international competitiveness. On the upside, supportive financial conditions and the strong labour market could strengthen private domestic demand even more than projected. Faster-than–expected progress in policy reforms would strengthen economic growth further.