Norway

Economic activity is projected to be weak in 2016 as petroleum investment falls, with spillovers on non-oil sectors. Output growth will pick up gradually as non-oil investment strengthens with improved external demand, aided by currency depreciation, and as new oil-investment projects commence. Unemployment will peak in 2016. Inflation will drift down as currency-depreciation effects wane and economic slack continues.

Monetary and fiscal policies should remain supportive. Appropriately, macro-prudential tools are being used to contain risks from the housing market and high household debt. A tax-mix that encourages business activity through heavier reliance on indirect taxation would promote transition to broader-based growth. Reforms of the sickness and disability programmes aimed at encouraging labour supply are important for inclusive growth and need to continue.

Enhancing skills is key to improving Norway’s productivity and well-being. Improvements in the quality and completion rates of secondary and tertiary education, including through measures to enhance teacher qualifications and better monitor the quality of outcomes, are essential. Further reductions in red tape and improved public-sector efficiency would also bolster productivity.

The economic slowdown continues

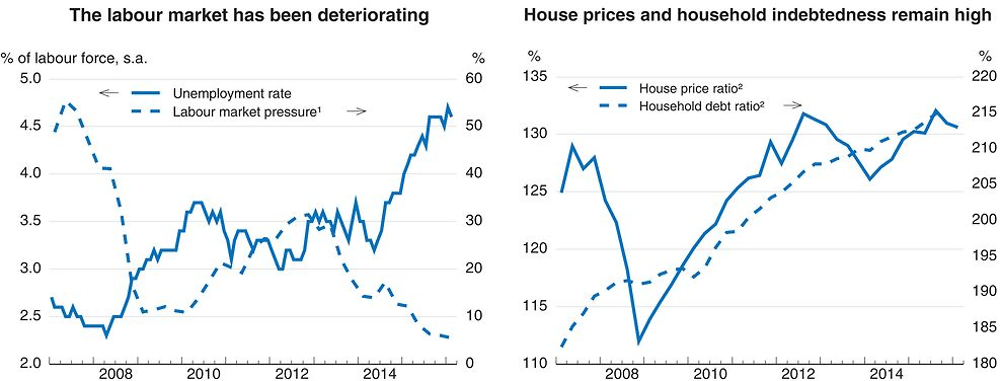

Declining petroleum investment continues to restrain mainland output growth through its impact on oil-related industries. The unemployment rate rose above 4½ per cent in early 2016, acting as a drag on consumption. However, low interest rates, rising housing wealth and an expansionary fiscal policy are supporting household spending, whereas currency depreciation and slowing wage growth are helping non-oil exports. The cyclical weakening is containing price pressures, notwithstanding pressures from imported inflation. House prices remain high relative to income, with widening regional disparities. Household debt is large and continues to rise.

1. The share of firms reporting that labour supply is a constraint on output growth.

2. Ratios to disposable income.

Source: Statistics Norway; Norges Bank.

Macroeconomic and structural policies support the transition to broader-based growth

The central bank reduced the policy rate in early 2016 to 0.50%. Economic slack has held inflation down, despite a depreciation of the currency. The new rules on mortgage lending practices have probably moderated household debt growth. However, their effectiveness needs to be closely monitored and assessed.

The revised 2016 budget provides a fiscal stimulus of 1.1 percentage points of trend mainland GDP, somewhat larger than initially budgeted. Most of this post-budget increase comes from higher expenditures on the integration of refugees, lower revenues, as well as new targeted policies to boost employment in regions most affected by the decline in oil prices. This expansionary stance is appropriate given the economic slowdown.

Boosting productivity through a more supportive business environment and stronger competition is essential for promoting a broader-based growth. Recent steps include a cut in the corporate tax rate and red-tape reduction, such as lighter reporting requirements for employers to the social security authorities and simplification in building and planning legislation. Advances on these fronts are welcome. In addition, efforts to boost productivity in public services, for instance through mergers of small municipalities, should be pursued further.

Enhancing skills is also crucial for boosting productivity and well-being. Current reforms focus appropriately on the quality and completion rates in upper-secondary and tertiary education. Announced measures to improve teaching quality through stricter entry requirements to teaching-degree courses and to expand opportunities for continuing education are welcome. Tertiary-education policy-makers should examine the factors driving student decisions on what to study and the pace of study, and the authorities should better monitor the quality of outcomes. Initiatives seeking to boost labour supply by addressing problems in the sickness and disability programmes are vital for inclusive growth.

Growth will pick up gradually

The mainland economy is projected to recover from the slowdown in 2016. Expansionary macroeconomic policies, buoyant non-oil exports, helped by currency depreciation, and a rebound in non-oil investment as external demand and domestic activity strengthen will underpin the recovery. Also, new petroleum investment projects are expected to start during the projection period. The unemployment rate will peak in 2016 at 4¾ per cent. Inflation is projected to drift down as currency-depreciation effects wane and economic slack continues.

Oil-sector developments remain a substantial source of uncertainty and risk to the mainland’s sizeable sector of oil-related companies. The speed of economic recovery is also sensitive to developments in Europe, through export demand. Domestically, high levels of household debt continue to pose real-side and financial risks. Progress in productivity-enhancing reforms currently underway provides some upside risk to the outlook.