Turkey

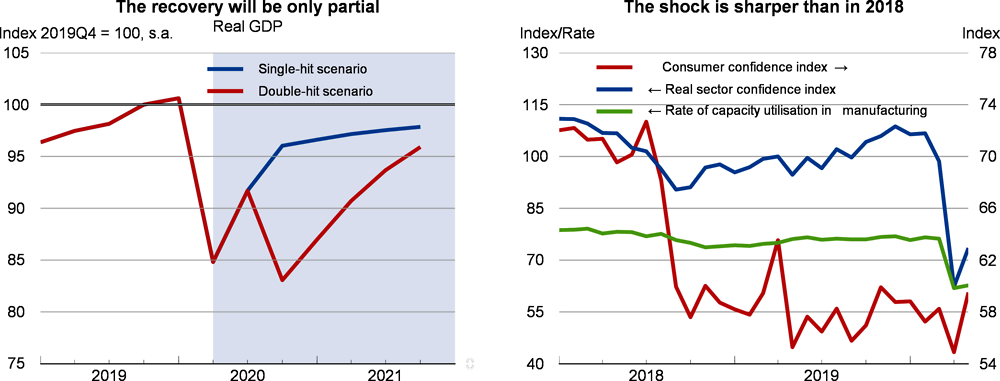

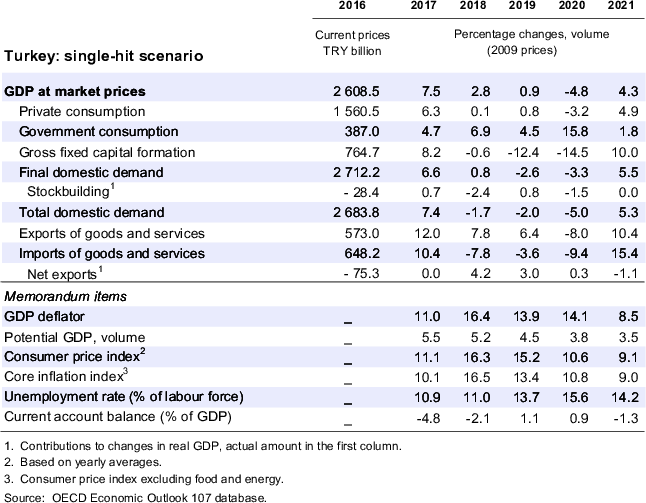

After positive growth in the beginning of the year, Turkey’s output is projected to contract by nearly 5% to 8% in 2020, depending on whether a new virus outbreak later this year is avoided (the single-hit scenario) or not (the double-hit scenario), due to employment losses, sharp income shortfalls and a fall in external demand. As a result of the relatively modest social safety net and firms’ debt burdens, the recovery after the waiving of the containment measures is expected to be gradual. In the double-hit scenario, renewed lockdown measures would lead to a sharper investment and output decline in 2020 and a more gradual recovery in 2021.

A wide range of fiscal, quasi-fiscal and monetary measures have been implemented simultaneously to alleviate liquidity pressures. More inclusive aid should be offered to households in need, including to wage earners and the self-employed in the informal sector. Long-term and solvency-enhancing financial support, preferably through non-debt creating instruments, to over-leveraged and sound firms of all sizes would improve their post-shock growth potential. Strengthening the transparency and credibility of fiscal, monetary and financial policies would help to address the weak macroeconomic fundamentals and contribute to reducing Turkey’s vulnerability to external shocks.

The pandemic spread fast but targeted lockdowns and complementary measures were effective

The pandemic started in Turkey in the second half of March and diffused at a fast pace. According to available information, contagion cases peaked at the end of April. Turkey’s health system has a relatively low average number of physicians and hospital beds per capita, but is well-prepared to public health emergencies, thanks, notably, to a strong intensive care infrastructure. The authorities put in place targeted lockdowns and curfews dedicated to special age groups, towns and neighbourhoods. Sectors closed by administrative decision were narrow in international comparison, and not more than 40% of the population was formally locked down, except during national curfews over weekends and public holidays. International and domestic passenger traffic was shut down. Quarantines across regions and intense testing and tracing activities were implemented. Wearing masks in all public places was made obligatory.

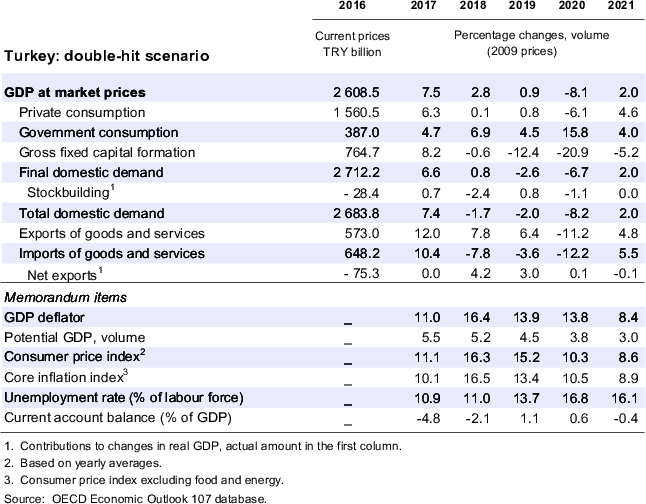

The demand contraction has been very large

Despite comparatively limited restrictions, the employment and demand contraction has been large. Available high-frequency indicators hint at a sharp decline in private consumption and investment from April – at a rate of 20% or more. The weakening of external demand and of domestic business and household sentiment has amplified the downturn. Tourism was hit particularly hard. The hospitality sector employs 8% of all workers, generates massive demand for other products and services, and secures one fifth of total export revenues. Local and regional demand fell twice as rapidly in touristic regions as in others. Customer visits to formally open shopping centres collapsed (they subsequently closed). Social safety nets, including formal unemployment insurance and short-term work schemes and unpaid leave subsidies introduced during the crisis are modest in size, and available only to wage earners in the formal sector (less than 60% of the labour force). Income losses of informal workers and the self-employed who draw their daily revenues from activities like public transportation, retail trade and catering added to weak demand.

A wide-range of support measures draw on quasi-fiscal channels

The government has put in place a wide range of support measures. Emergency aid of TRY 1 000 (around USD 150) per family was offered to 5.3 million households, addressing situations of extreme distress, but supporting their living standards and aggregate demand only to a limited extent. Support to businesses is being provided mainly via tax and loan deferrals and additional credits, principally by public but also private banks, incentivised by expanded government loan guarantees and newly-introduced lending and prudential regulations. The support avoided a surge in business bankruptcies but did not address mounting insolvency pressures. Public banks also offer subsidised credit lines to the self-employed and households in need. The central bank is supporting the lending capacity of the financial system through widened liquidity windows, additional asset discount facilities for banks and an expanded export-credit facility. The expansive monetary policy stance, implying negative real interest rates on the basis of market inflation expectations, has however weakened the exchange rate. The limit for government securities in the central bank’s balance sheet was lifted from 5% to 10% in order to support fiscal policy. The Sovereign Wealth Fund was authorised to take large-scale equity shares in businesses, borrowing from domestic and international markets. Customs fees were increased on around 4800 product lines to support adversely affected domestic industrial sectors. Some of these measures were included in the 2% of GDP support package announced in March, but others remain off-budget and their fiscal cost is hard to quantify. The Ministry of Finance announced in May that the aggregate face value of tax deferrals, concessional credits, loan postponements and cash transfers will amount to 5.5% of GDP.

Recovery prospects are complicated by debt burdens

While activity will pick up as the public health situation improves, the recovery will be gradual given the income losses experienced by households and businesses and the resulting increase in their debt burdens. Firm balance sheets were indeed impaired and only partly rehabilitated after the 2018 shock. Export growth will be weak. The business situation is particularly difficult in the tourism sector due to the sharp fall of visitors. Aggregate capital formation may contract by up to 15% in 2020, holding back the long-term supply potential of the economy – an effect which would be deeper under the double-hit scenario. In this double-hit trajectory, investment would decline through the projection period and GDP might decline by 8% in 2020, before a rebound of around 2% in 2021. In the single-hit scenario, GDP is set to contract by around 5% in 2020 before rebounding by around 4% in 2021.

Turkey remains exposed to external shocks. Macroeconomic fundamentals are weak, due to high inflation, exchange rate volatility, volatile capital movements, and financial risks raised by extremely rapid credit growth in parts of the banking system. Geo-political uncertainties are also significant. The need to fight the COVID-19 crisis with strong measures did not facilitate the task of clarifying and consolidating the fiscal and monetary policy frameworks. Public financial institutions’ ongoing expansion and public banks’ domination of the credit market under concessional policies generate challenges for resource allocation efficiency and asset quality in the financial sector. They also increase government contingent liabilities. Against this background, Turkey’s risk premia and external borrowing costs reached substantially higher levels than in peer countries. Total external funding needs are estimated to reach USD 170 billion, 23% of 2019 GDP, in the coming 12 months. Rolling over USD 55 billion of bank, non-financial business and government debt may be challenging under unstable international capital conditions and weak foreign currency reserves - even if the slow projected recovery and lower commodity prices may improve external balances in the short term.

Mainstream reforms and effective policy targeting will be key

Turkey needs to further support workers and businesses while activity remains low and disrupted. Efforts to postpone liquidity pressures should be completed with measures strengthening the solvency and financial sustainability of firms and households. Top priorities include consolidating the macroeconomic policy framework by maintaining a positive real policy interest rate, and implementing a credible medium-term economic programme encompassing all fiscal and quasi-fiscal activities. Supports should be focused on households and firms most in need. Structural reforms to permit the flexible functioning of the formal labour market, the level-playing field and resilient operation of the financial sector and predictable external trade conditions to help Turkish firms to fully participate in global value chains would foster the post-shock growth potential. On the health policy front, the lifting of containment measures should be accompanied with strict enforcement of distancing to avoid widespread lockdowns if the pandemic hits for a second time. The ongoing intense testing and tracking efforts should continue, and cases and fatalities should be monitored according to the best-practice international norms.