Spain

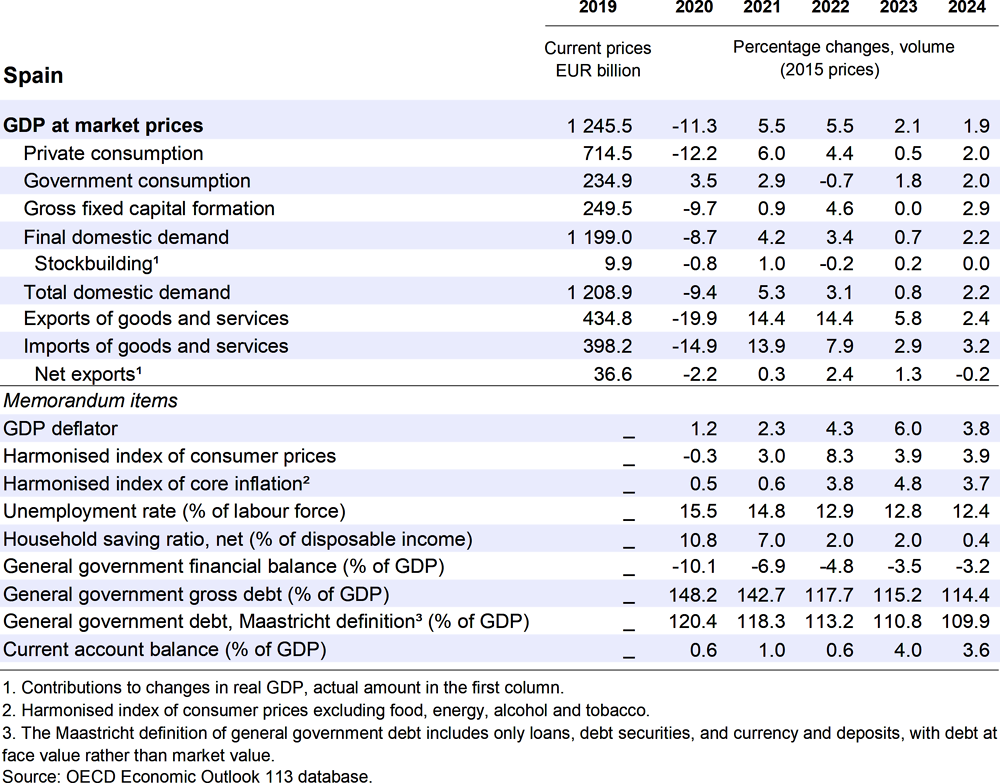

GDP growth is projected to slow to 2.1% in 2023 and 1.9% in 2024, after two years of strong post-COVID growth of 5.5%. Lower inflation and a resilient labour market will support households’ consumption. Stronger external demand will underpin export growth. Better demand prospects will encourage private business investment, notwithstanding the rise in the cost of financing. Headline inflation will edge down to 3.9% in 2024 on the back of declining energy prices and monetary policy tightening.

The fiscal stance is expected to tighten to address high debt. As inflation recedes, fiscal support measures to mitigate the impact of high energy prices should be phased out. The implementation of the Recovery Plan, largely relying on Next Generation EU funds, will induce significant public investments, and can raise growth potential. Continuing to tackle low productivity growth and reduce fossil-fuel dependence should be a priority.

Growth has proved resilient

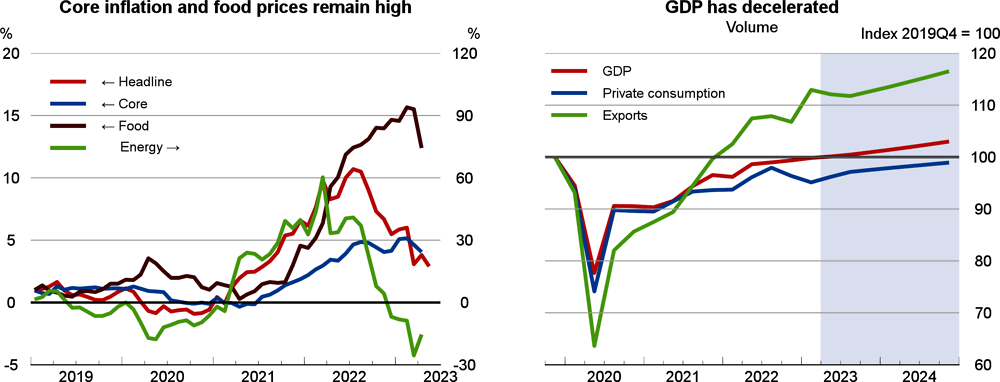

Faced with a challenging environment in the context of Russia’s war of aggression against Ukraine, the Spanish economy has held up remarkably well. GDP increased by 0.5% in the first quarter of 2023 compared to the previous quarter and was 3.8% higher than a year earlier. Business and consumer confidence have improved since the autumn, even if consumer confidence remains very low. The labour market is dynamic, with employment growth of 1.3% in the first quarter of 2023. The unemployment rate decreased slightly from 13.0% in December 2022 to 12.7% in April 2023. Headline inflation (harmonised index) fell to 2.9% in May, owing to lower energy prices. Core inflation stood at 4.1% and food inflation at 12.4% in April 2023. Nominal wages increased by 3.0% between the first quarter of 2022 and the same quarter of 2023.

Monetary policy tightening in the euro area is weighing on financing conditions and weakening the demand for loans. Housing credit to households and credit to firms decreased by 2.0% and 2.2% year-on-year in April 2023, respectively. The housing market is cooling, with a slowdown in housing sales. Households are highly exposed to rising interest rates, given the heavy concentration of variable-rate mortgages (75% of the stock), even if most new mortgages are contracted at fixed rates. This entails a risk of impairment losses for banks, which calls for close monitoring.

The fiscal deficit is set to improve

To support households and businesses with the high cost-of-living, the government approved new measures in December 2022 worth about 0.8% of GDP, including a VAT cut on essential food products, a EUR 200 cheque for low-income households and targeted support to specific sectors (agriculture and the ceramics industry). In addition, previous tax cuts on gas and electricity and some subsidies on transport fees have been prolonged. The 20 cent/litre fuel rebate has been refocused on hauliers, fishers and farmers and was halved in April 2023. Some of these measures are expected to end in June 2023, but the VAT cut on food and subsidies on transport fees are expected to be prolonged until the end of 2024. Tax cuts on energy are expected to be partly phased out in 2024. Overall, fiscal policy is assumed to be mildly restrictive over 2023-24. The government deficit is projected to decline to 3.5% of GDP in 2023 and 3.2% of GDP in 2024.

Steady GDP growth is expected to continue

GDP growth is expected to moderate from 5.5% in 2022 to 2.1% in 2023 and 1.9% in 2024. Inflation is projected to recede from 8.3% in 2022 to 3.9% in 2023 and 2024, which would support household consumption. Stronger external demand will underpin export growth. Better demand prospects will allow for a gradual improvement in business investment, although the rise in the cost of financing will limit its scope. High interest rates will also curtail housing investment, which is expected to decrease in 2023 and remain broadly stable in 2024. GDP growth will benefit from sizeable public spending linked to the Recovery Transformation and Resilience Plan (RTRP). There are several risks surrounding the outlook, including an escalation of the war in Ukraine that could push up energy prices, and increasing macro-financial vulnerabilities, as rapidly rising interest rates could increase the risk of financial contagion through the global financial system. On the upside, a faster-than-expected return of inflation to the target could allow central banks to loosen monetary policy, stimulating domestic demand.

Raising productivity growth and lowering fossil-fuel dependence are key

Continuous efforts are needed to boost productivity and innovation. Provided that good investment projects are selected and reforms implemented, the EU funds can raise growth potential. The effective implementation of prior reforms addressing the internal fragmentation of product markets, which can be a barrier to the entry and growth of innovative firms, can raise the impact of EU funds on economic activity. Improving skills and enhancing education outcomes can improve job prospects, especially for the youth, and should be prioritised, together with more efficient active labour market policies, for an inclusive recovery. Increasing the availability of good quality early childhood education and care for children under the age of three could help raise female labour force participation. Increasing girls’ interest and enrolment in STEM studies should be a priority. Increasing the energy efficiency of buildings, stepping up investment in sustainable transport and promoting a higher share of renewables, as planned, together with higher carbon taxes, would reduce dependence on fossil fuels and advance the green transition.