Executive Summary

-

The economic outlook looks strong …

-

… but the economy faces risks, including overheating of the labour market

-

The high stock of inward FDI has bolstered GDP, but leaves unaddressed challenges …

-

Upskilling, mobility and stronger regional growth are needed for securing equitable growth

-

Population ageing is creating policy challenges

The economic outlook remains strong…

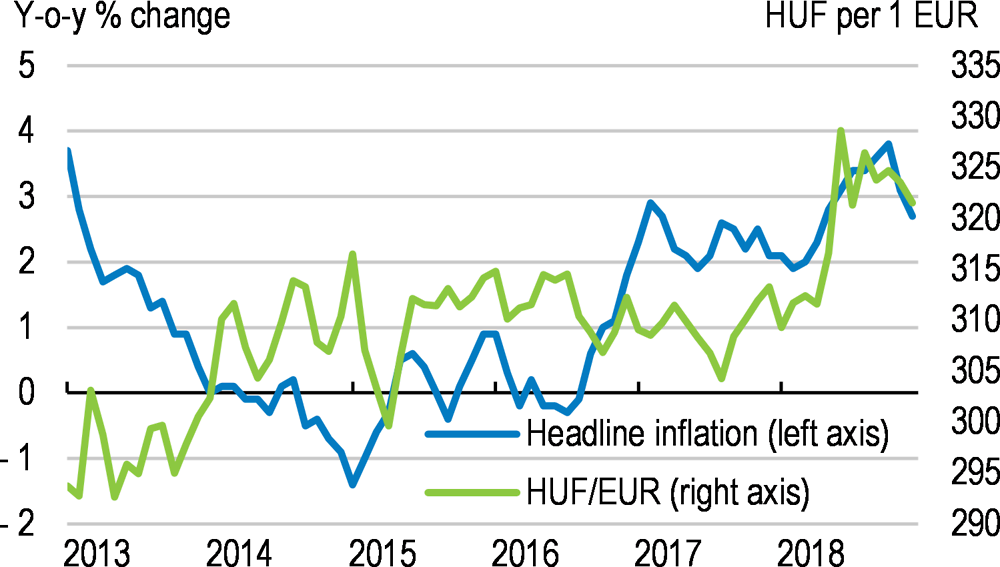

The economy is prospering. Growth is expected to have risen further to 4½ per cent in 2018, following past strong performance. Domestic demand is fuelled by strong private consumption, reflecting high real income gains, and dynamic business and housing investments. The unemployment rate has fallen to a historically low level and labour shortages have emerged. This has been, accompanied by strong and broad-based wage increases, helping to preserve a high level of income equality, and restarting income convergence. Inflation reached 3.8% in the autumn of 2018, partly as the result of higher energy and food prices, before coming down again (Figure A). Productivity growth has accelerated, although it remains well below real wage growth and the rate prevailing in the decade prior to the international financial crisis.

Output growth is projected to lose some momentum in 2019, as capacity constraints bite and demand is increasingly met by imports. Nonetheless, domestic demand will continue to benefit from rising wages and employment. The latter is, together with demography weighing on labour supply, reducing unemployment. Private investment will be bolstered by the continued expansion of production capacity, EU funds and high housing demand. Exports will benefit from new production capacity, but fast-rising imports will put downward pressure on the current account surplus. Inflation is projected by the OECD to continue to rise towards the central bank's upper bound of the 3 % inflation target with a +/-1% tolerance band. Nonetheless, macroeconomic policy is expected to remain expansionary in 2019: the central bank has announced that it is prepared for a gradual and cautious normalisation of monetary policy while maintaining policy rates, and fiscal policy will remain supportive.

…but the economy faces risks, including overheating of the labour market

Risks are both external and domestic. Hungary is vulnerable to the escalation of international trade disputes, which could cause a shock to exports, and particularly to the important vehicle sector, and would undermine investors’ confidence. Continued high wage increases could erode cost competitiveness and unhinge inflation expectations, thus requiring an abrupt change in policy stances, exaggerating the boom-bust business cycle pattern. On the other hand, stronger-than-expected productivity gains would bolster the capability to absorb rapid wage gains. Turbulence in international financial market could reduce domestic banks' willingness to lend, reducing growth.

The high stock of inward FDI has bolstered GDP, but leaves unaddressed challenges

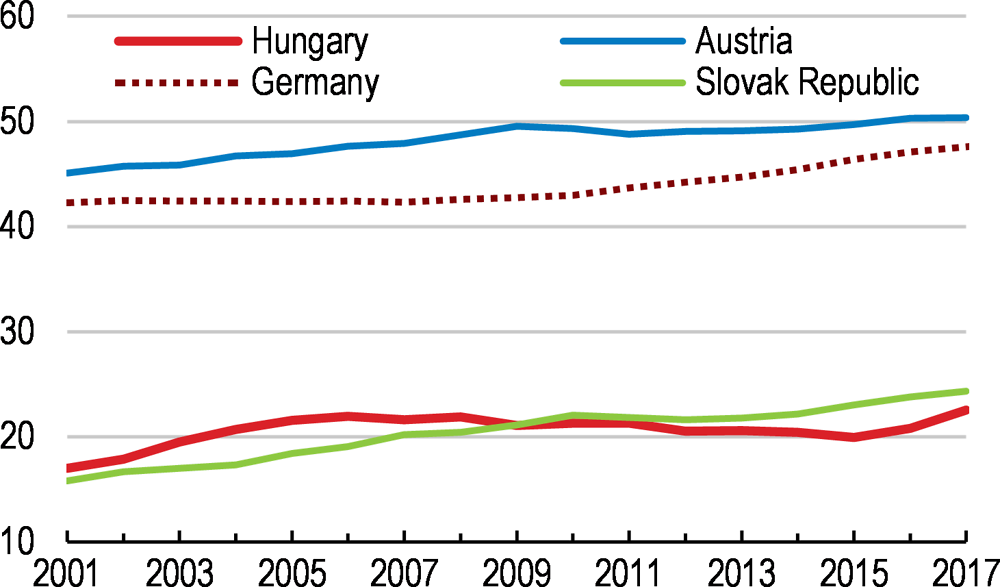

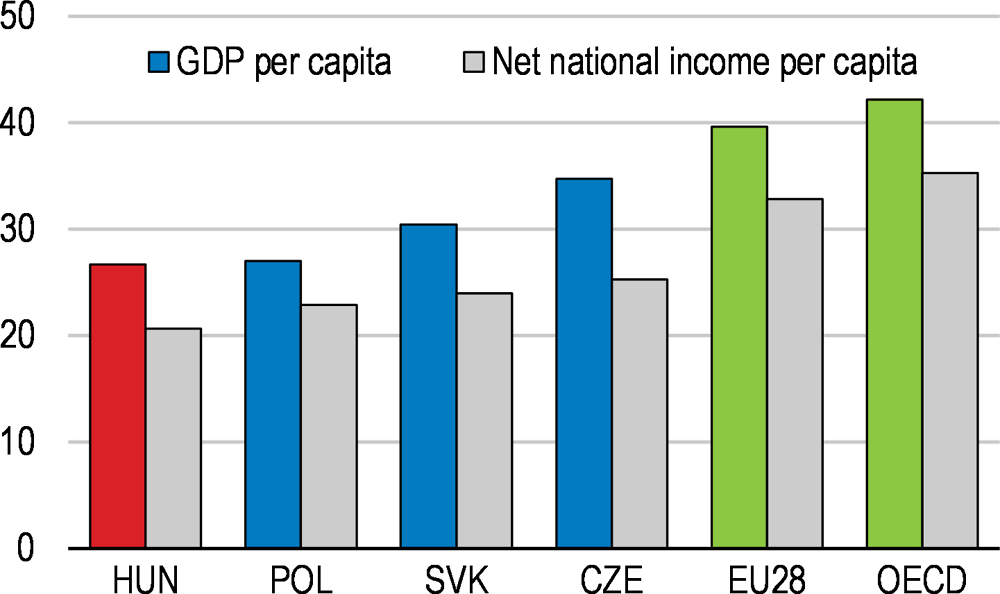

Hungary continues to successfully attract large inflows of FDI, which have expanded production capacity and boosted integration into global supply chains. This has mostly benefited western and central regions of the country, but the model has its limits: other regions have not shared the same benefits, local insourcing has been modest, wages are rising but remain low (Figure B), and the gap between GDP and net national income is relatively high, as among Hungary’s peers, due to profit remittances (Figure C).

Strong agglomeration effects and demand for business services have boosted growth in the capital region. In contrast, many poor rural regions have been left behind as their economic activity focuses on small-scale farming or used to rely on outdated mining and heavy industries, leaving them with little integration into local or national supply chains. Income differences have been further aggravated by the emigration of young skilled workers, leaving behind less skilled and older workers, many of whom have few prospects in the local labour market. The main government intervention to address these problems is public work schemes, which have successfully reduced poverty. However, the schemes have limited impact on employability, with exit rates remaining low.

Overall, the pattern of growth has led to higher employment rates for most groups in the labour market, although the rates for low-skilled and older workers and women with small children remain markedly lower.

Recognising the need for revisiting the growth model, in 2017 the government established a National Competitiveness Council to identify structural reform that can accelerate productivity, growth and income convergence. In this respect, a priority should be to encourage greater labour mobility and upskilling so as to bring workers closer to economic centres. Another key goal is the development of local networks to integrate domestic firms into regional and national supply chains.

Upskilling, mobility and stronger regional growth are needed for securing equitable growth

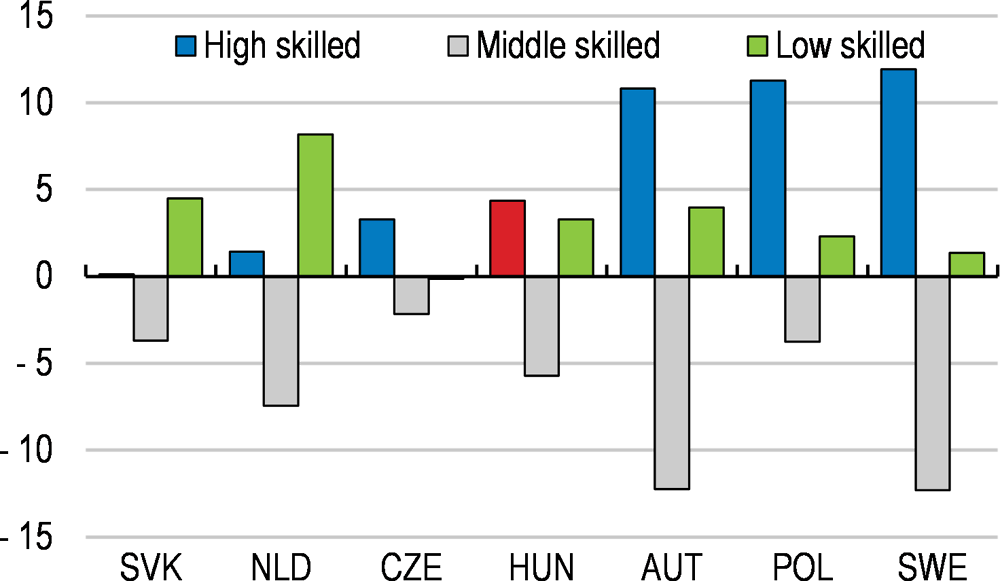

Employment is shifting towards higher-skilled jobs with the tighter integration of manufacturing into global value chains and the expansion of the service sector (Figure D). Integrating low-skilled workers from poor regions into today's labour market requires upskilling in line with skills demanded in the labour market. Many rural students do not fare well in the education system. Few enter tertiary education and most end up in vocational training and suffer from a relatively large drop-out rate, reflecting limited employment prospects upon graduation. Moreover, a rigid housing market and poor quality local road infrastructure mean that mobility in terms of moving and commuting is not sufficient to avoid pockets with high unemployment.

Despite the political autonomy of local governments, the public governance system is highly centralised. This means that policies are based on national and EU priorities with relatively little consideration for local conditions. Financing is mainly by central government or EU funds. There are few attempts to identify local economic advantages and develop local networks to integrate into regional or national supply chains. Both tourism and agriculture have the potential to provide jobs in poor rural areas. However, there are only few measures in place for either sector to integrate into other sectors or exploit networks to move up the value added chains.

Ageing will weigh on public finances and create challenges for service provisions. Population ageing will accelerate over the coming decades, leading to an old-age dependency ratio that is just above the EU’s. EU projections indicate, assuming a full alignment of the effective and statutory retirement ages by 2025, that pension spending as share of GDP should slightly fall until 2030, before rising by nearly 3 percentage points by 2070 (Table B).

These projections include the effects of a pension reform that is gradually increasing the statutory retirement age, with almost no possibilities for early retirement, and with pensions indexed to prices rather than wages.

However, 20% of pensioners receive pension benefits below the poverty line (although some have access to other benefits), reflecting problems for low-wage workers with too short careers to accumulate sufficient pension rights and the fact that the lowest receivable pension can be below one-third of the official poverty line. Moreover, the pension design and parameters, including non-linear accrual rates, make it difficult for workers to predict their future pensions. Particularly, the high volatility of wage growth leads to large differences in pension benefits for pensioners with similar work careers, but retiring at different times.

The centralised health care system has a strong focus on planning to adjust supply to changes in demand. However, it has low efficiency and uneven access, particularly in rural areas. The system is characterised by poor performance as reflected in high mortality from preventable causes, contributing, together with unhealthy lifestyles, to one of the lowest life expectancies in the OECD and the shortest time spent in good health after retirement.

Health care spending as a share of GDP is relatively low and is expected to remain so in the long-run, despite a projected 10 year increase in life expectancy and the demand changes arising from population ageing.

Despite the focus on planning, adjustment of the supply side is hampered by the nearly absent use of price signals in the hospital sector. The system of diagnosis related groups has not been fully updated since the 1990s. The hard budget constraint embedded in the hospitals' global budgets has become a soft constraint with the government's repeated reimbursement of hospital debt and the absence of performance related remuneration of hospital management. Moreover, some hospitals have been transformed into long-term care institutions, but many general hospitals remain in place.

Access to health care is uneven, reflecting high out-of-pocket payments and doctor shortages arising from emigration. Moreover, GPs provide many health services that elsewhere are provided by certified nurses and have few incentives for entering group practices. The high workload bolsters hospital referrals, challenging the role of GPs as gatekeepers and care coordinators.

The limited supply of long-term care is divided between social and medical services, and most such care is provided by families. Looking ahead, ongoing urbanisation will make this increasingly difficult.