3. Carbon price signals through taxes

This chapter focuses on the taxation of combustible energy sources, and establishes the extent to which tax-based carbon price signals are aligned with a low-end carbon benchmark. The chapter compares tax-based carbon price signals across countries, sectors, and fuels. Special emphasis is placed on the relative taxation of coal and natural gas, as well as on the taxation of aviation and maritime transport. The chapter annex present carbon tax profiles for all 44 OECD and Selected Partner Economies.

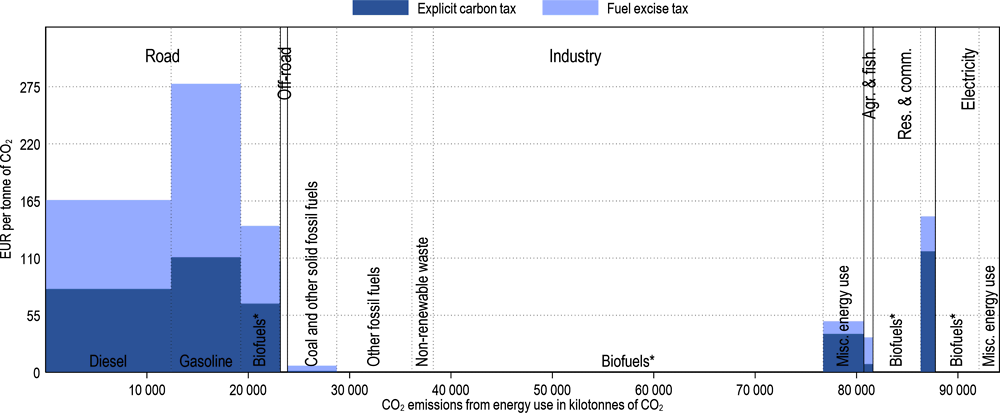

Effective carbon taxes – i.e. the sum of explicit carbon taxes and fuel excise taxes, net of applicable exemptions, rate reductions and refunds – currently fail to provide broad-based carbon price signals. Figure 3.1 shows that most non-road emissions remain entirely untaxed. When non-road emissions are taxed, effective carbon taxes rarely reflect even a low-end estimate of the damage that CO2 emissions impose on society (EUR 30 per tonne of CO2). Specifically, 82% of non-road emissions are entirely untaxed, and 97% are taxed at less than EUR 30 per tonne of CO2. Effective carbon taxes tend to be higher in the road sector, but this is a sector where non-climate externalities are relatively high (see Chapter 2).

In the absence of carbon price signals, citizens and businesses lack the economic incentives to take the cost to the climate that their actions impose on society into account. As a direct consequence, citizens and businesses consume too many carbon-intensive goods and services, and spend too little on low- or zero carbon activities. In addition, overinvesting in carbon-intensive assets today risks creating high adjustment costs in the future. This carries systemic financial risk as the value of carbon-intensive capital could drop dramatically once countries take the necessary measures to drive deep decarbonisation in line with the goals of the Paris Agreement (OECD, 2018[1]).

The present lack of carbon price signals puts clean technology firms at a competitive disadvantage vis-à-vis polluting firms – frequently the incumbents. Businesses thus continue to invest in more carbon-intensive technologies than what would be in the interests of society, as prices fail to reflect the climate cost of products and services. Because of technological advances in clean technologies, many low- or zero carbon technologies, such as wind and solar, are increasingly competitive nonetheless. However, policy can and should do a better job at levelling the playing field, which would also help mobilise private and public finance for the technologies and infrastructure of the future (OECD/The World Bank/UN Environment, 2018[2]).

Extending carbon price signals to all sectors of the economy would help to ensure that abatement decisions are taken where they cost the least. Only those emitters that find it cheaper to cut emissions than pay the tax (or buy a certificate in the case of a trading system) will decide to invest in abatement technologies. In addition, abatement decisions would be taken by those who know the best – the polluters.3 Carbon price signals would thus take into account the fundamental information asymmetry between governments, companies and citizens. As opposed to one-off measures such as a fuel-economy standard, carbon pricing would provide for a continued incentive to cut emissions. As a result, carbon pricing has a track record of outperforming non-price instruments, such as emission standards, which tend to come with substantially higher cost per tonne of CO2 avoided (OECD, 2013[3]) and lead to rebound effects (see Chapter 2).

Only a few countries provide substantial tax-based carbon price signals for non-road emissions. Whereas all but three countries tax road emissions at EUR 30 per tonne of CO2 on average (Figure 3.2, Panel A), only four out of 44 countries do so for non-road emissions. Paradoxically, the four countries are Switzerland, the Netherlands, Denmark, and Norway, which additionally participate in emissions trading systems (OECD, 2018[1]).

Fuel excise taxes continue to dominate explicit carbon taxes. This holds for all countries in the road sector. In non-road sectors, by contrast, explicit carbon taxes tend to play a relatively more important role. Specifically, in a number of countries – Canada, Chile, Finland, France, Iceland, Ireland, Mexico, Sweden, Switzerland – explicit carbon taxes account for most of the tax-based carbon price signal (Figure 3.2).

Little progress has been made in extending tax-based carbon price signals since 2015 – the year analysed in the last edition of Taxing Energy Use (OECD, 2018[4]). Figure 3.2 shows that there was no fundamental shift towards providing greater carbon price signals in either road (Panel A) or non-road sectors (Panel B). Nevertheless, in the road sector, average effective carbon tax rates increased substantially in a number of countries. In particular, Belgium, Estonia, Finland and Iceland saw the greatest increase in real terms – in all of these countries rates increased by more than EUR 30 per tonne of CO2. In relative terms, increases were largest in Russia, followed by India and Iceland.4

Some countries have made progress in extending carbon pricing to non-road emissions. Effective carbon tax rates increased by more than ten euros on average in the Denmark, the Netherlands and Switzerland. In relative terms, increases were largest in Chile, Australia and Portugal, albeit starting from relatively low baseline rates. In Chile, this is due to the entering into force of the Green Tax for fixed emissions sources, which is equivalent to USD 5 per tonne of CO2. Canada’s recent progress as part of the federal carbon pricing backstop initiative is not reflected in the figure, as the backstop entered into force in 2019 only.

Carbon prices are effective – countries that levy higher effective carbon taxes are less carbon-intensive. Figure 3.3 shows that this correlation holds for both road (Panel A) and non-road sectors (Panel B). It is clear that CO2 emission intensities differ across countries for reasons that are unrelated to carbon tax levels, such as emission standards. Raising effective carbon taxes might also be politically easier in countries that are already less emission intensive (see also, Chapter 2). Nevertheless, the economic evidence is equally clear – carbon taxes are effective at reducing CO2 emissions – as recently confirmed in a study that estimated the long-run effects of a broad-based carbon tax on carbon emissions from fossil fuel consumption (Sen and Vollebergh, 2018[5]).5

Raising carbon price signals for non-road emissions is appealing for governments seeking to cut emissions fast. The reason is that carbon taxes tend to be more effective at reducing emissions outside the road sector, where carbon taxes generally have a relatively larger impact on retail prices. Specifically, increasing carbon prices by EUR 30 per tonne of CO2 (see Table 3.1) would roughly double coal prices, but it would only increase end prices for gasoline and diesel used as road fuels by approximately five to seven percent (IMF, 2019[6]).6

Investing in public transport and other low-carbon infrastructure, such as electric vehicle charging stations, can further increase the effectiveness of carbon taxes in reducing emissions. Research shows, for instance, that consumers’ responsiveness to fuel prices tends to be larger if citizens have access to public transport, such as in Denmark (Gillingham and Munk-Nielsen, 2019[7]). This may thus be one of the reasons for which road emissions in Denmark are lower than what the country’s average effective carbon tax rate on road emissions alone would predict (Figure 3.3).

Extending tax-based carbon price signals to all emissions would generate substantial revenues. Raising effective carbon taxes to EUR 30 per tonne of CO2 for all energy-related CO2 emissions would generate revenues corresponding to approximately 1% of GDP of the 44 countries covered in TEU, and would roughly double current revenues from carbon pricing (Marten and Van Dender (2019[8])).

The revenues from such broad tax-based carbon price signals could not only remain stable, but increase further in the medium term, provided that governments raise rates progressively as the carbon tax base declines gradually. By contrast, in the absence of rate increases, carbon tax revenues will decrease over time as energy-use patterns adjust in response to carbon price signals. Assuming rising rates, carbon tax revenues would eventually decline, but in a matter of decades, not years (Marron, Toder and Austin, 2015[9]).

Raising revenues through carbon taxes creates opportunities for fiscal reform, which can substantially alter the distributional effects of a carbon tax (Goulder et al., 2019[10]).7 The most socially productive and politically expedient use of these revenues depends on local circumstances. Reform options include modifying the tax mix to foster inclusive growth, e.g. through lowering personal and corporate income taxes; increased investment, e.g. in education, health and infrastructure; and decreasing the level of public debt. Revenues can also fund direct transfers to households.

Using carbon tax revenues for R&D and other climate policy measures is another option, considering that the failure to price in the climate externality is not the only climate-related market failure. Such “fresh spending”, e.g. Bowen (2015[11]), could in turn strengthen support for carbon taxes, not only with constituencies that strongly favour climate action, but also with voters that doubt the effectiveness of carbon pricing as a behavioural signal but support climate spending (Klenert et al., 2018[12]).

Creating stable, predictable and credible carbon price signals is key to providing citizens and businesses with certainty for their long-term investment decisions. While short-term carbon price signals can sometimes be effective, and for instance lead to the dispatch of cleaner gas-fired power plants as opposed to coal-based generation, most low-carbon technologies, such as wind and solar, are relatively capital intensive (Dressler, Hanappi and van Dender, 2018[13]). Their long-run business case will improve as expectations about future carbon prices increase. Fuel excise and carbon taxes, which have historically remained stable over time (see also, Figure 3.2), are in principle able to provide carbon price predictability. Against this background, agreeing on predictable rate schedules does not only make sense to ensure fiscal sustainability; it also decreases the risk of stranded assets in the future.8

Overall, taxes fail to provide meaningful carbon price signals for coal and natural gas, which account for more than half of non-road emissions. Granted, the picture shown in Figure 3.4 would be somewhat less bleak if emissions trading systems had been included in the analysis, as in Effective Carbon Rates (OECD, 2018[14]). Coal, in particular, is mainly used for electricity production and in industries, and in countries that operate or participate in emissions trading systems such as the EU ETS, most of these emissions face a carbon price resulting from the ETS.

From a climate perspective, the effective carbon rate per tonne of CO2 should be the same irrespective of the fossil fuel from which the emissions result. Figure 3.4 demonstrates that at least with respect to tax-based carbon price signals, as measured by effective carbon tax rates, this is not the case in OECD countries. In the partner economies, coal is taxed at a higher rate than natural gas on average, but tax rates are far below the low-end carbon benchmark of EUR 30 per tonne of CO2.

From a broader environmental perspective, coal ought to be taxed at a higher effective carbon rate per tonne of CO2 than natural gas, as air pollution costs from coal tend to be higher (see also Chapter 2). By contrast, whereas some countries tax coal at a higher rate than natural gas, most countries tax coal at a discount relative to natural gas. In line with what environmental considerations would suggest, the United Kingdom, India, Israel and Mexico effectively levy a surcharge on coal use (per tonne of CO2). Other countries, on the other hand, either do not tax either of the two, or tax coal less than natural gas.

Taxes on coal and natural gas also vary across sectors, and so does their use. Figure 3.6 shows that most coal and natural gas emissions take place in the electricity and industry sectors (where they may be subject to carbon price signals provided by emissions trading systems (OECD, 2018[14])). Natural gas is the main fossil fuel used in the residential and commercial sector, where coal only plays a minor role (and emissions trading systems are less common). Whereas taxes on coal tend to be low across all sectors, natural gas is taxed at relatively higher rates, on average, when it is used in the residential and commercial sector. Annex 3.A reports the profile shown in Figure 3.6 for all countries covered.

An increasing number of jurisdictions levy explicit carbon taxes (Ramstein et al., 2019[15]).9 Figure 3.7 shows all jurisdictions within the 44 countries covered that had an explicit carbon tax in place as at 1 July 2018. Sweden is the country with the highest standard carbon tax rate, followed by Switzerland, Finland and Norway.

For a number of reasons, the coverage of explicit carbon taxes varies substantially across countries. It is worth noting, for instance, that the average explicit carbon tax rate is higher in Switzerland than in Sweden, even though Sweden levies a higher standard rate. If countries applied a uniform carbon tax to all energy-related CO2 emissions, standard and average rate would be the same. However, this “carbon tax ratio”, i.e. the average rate divided by the standard rate, rarely exceeds 50%, and is typically even lower.

One reason is that many jurisdictions additionally operate emissions trading systems, and often exempt emissions already subject to emissions trading from the carbon tax. Alberta, for instance, operates an output-based trading system for large emitters, mainly from industry and power sectors. Low-carbon tax ratios do not necessarily imply a lack of carbon price signals in general (see OECD (2018[1])), but may reflect that only a share of emissions are subject to tax-induced carbon price signals.

In addition, countries generally do not subject CO2 emissions from biofuels to explicit carbon taxes. This drives down the average explicit carbon tax rate, which is particularly relevant for countries such as Sweden that rely more strongly on biofuels to meet their decarbonisation objectives (see also, Figure 3.9).

Another noteworthy design feature is that countries do not always impose carbon taxes on all fossil fuels. Argentina and Mexico, for instance, exempt natural gas, which is generally considered the cleanest fossil fuel. Iceland, on the other hand, exempts coal, even though it is among the most polluting fossil fuels. Note, however, that Iceland only uses coal in the industry sector (see also, Annex Figure 3.A.18), and generally has a very clean energy mix (see also, Annex 2 A).

Finally, some countries exempt certain energy users from the carbon tax or offer reduced rates or refunds. The carbon tax in the United Kingdom, for instance, only applies to the power sector. Such measures are often justified on competitiveness or affordability grounds. There are, however, in principle better policy instruments available to address competiveness and affordability issues than rate reductions and exemptions. Nevertheless, more targeted compensation instruments, such as lump sum transfers, may be challenging to implement effectively in practice, e.g. due to information and administrative constraints (Sallee, 2019[16]).

The tax base of explicit carbon taxes is rarely carbon content or CO2 emissions. Instead, most countries administer explicit carbon taxes in the same way as fuel excise taxes. Countries that follow this fuel-based approach do not actually tax CO2 directly, but rather calculate the corresponding rate in common commercial units, for instance by reference to kilograms for solid fuels, litres for liquid fuels, and cubic metres for gaseous fuels. For illustration purposes, Table 3.1 shows how high a carbon tax set to EUR 30 per tonne of CO2 is when expressed in common commercial units.

Explicit carbon taxes can be collected from fuel suppliers in the same way as pre-existing fuel excise taxes. As a result, the administrative and compliance costs of such an approach are generally low (Pavel and Vítek, 2012[17])

There are a number of countries that tax CO2 directly. Countries that pursue such an emissions-based approach include Chile, Estonia and Latvia. Under this approach, carbon taxes tend to resemble emissions trading systems and are only applied to emitters above a certain emissions threshold or to installations that fulfil certain technological criteria. The functional reason for this is that under emissions-based approaches, emissions need to be measured (or calculated), which would be challenging to implement downstream for small emitters.

Emissions-based approaches have the advantage that they can readily be extended to non-energy and non-CO2 emissions, e.g. in agriculture or industry. Administrative and compliance costs tend to be somewhat higher than with fuel-based approaches. Whether such differences in administrative and compliance costs are relevant in practice may depend on pre-existing reporting obligations for other purposes. Specifically, the additional effort of reporting carbon emissions for tax purposes may be negligible for facilities that have reporting obligations for other reasons. More generally, administrative and compliance costs become relatively less important as carbon tax levels increase.

In practice, the choice between a fuel-based and emissions-based carbon taxes will also be influenced by political and legal/ constitutional considerations. In many countries, fuel-based carbon taxes fall under the responsibility of finance ministries, whereas emissions-based carbon taxes (and emissions trading systems) may be under the remit of environment ministries. In addition, legal arguments may favour fuel-based or emissions-based approaches.

Aviation and maritime transport are major and growing sources of CO2 and other emissions. At present, aviation causes approximately 2.8% of all emissions covered in TEU, whereas maritime shipping accounts for roughly 2.6% (see Figure 3.1 and Figure 3.8). Aviation activity is expected to grow strongly in the coming decades as passenger kilometres could roughly double by 2030 (ITF, 2019[18]). Seaborne trade is estimated to grow by around 3% annually in the coming years (Balcombe et al., 2019[19]). Decoupling activity growth from emissions will therefore be necessary to limit the contribution of aviation and maritime to climate change.

Against this background, it is disconcerting that neither international aviation nor international maritime transport are subject to fuel excise and carbon taxes – effective carbon tax rates are zero everywhere, as shown in Figure 3.8 and Figure 3.9.10 If international aviation (excluding domestic aviation) and international maritime transport (excluding domestic navigation) were countries, they would be the world’s 12th and 9th largest emitters of CO2, respectively, as shown in Figure 3.9. Also note that aviation and maritime transport exclusively burn fossil fuels; there is no reported use of biofuels, which would decrease the sectors’ carbon footprint if sourced sustainably (see Chapter 2).

Domestic aviation makes a sizeable contribution to the sector’s carbon footprint as well. With 38% of total emissions from aviation (Figure 3.8), domestic aviation (grouped with the individual countries in Figure 3.9) is thus also a major source of CO2 emissions. Domestic navigation is responsible for 18% of overall emissions from domestic navigation and international maritime transport.

Few countries tax domestic aviation and domestic navigation. Figure 3.10 shows, for instance, Ireland, which taxes aviation gasoline for both private and commercial use, but exempts aviation kerosene for commercial use, is at present the only EU member state that taxes an aviation fuel that is used for commercial purposes. Non-EU countries do better. Japan, in particular, has levied a fuel tax on commercial domestic aviation since 1972, which has reduced CO2 emissions (González and Hosoda, 2016[20]). Argentina, Norway, and Switzerland also tax domestic aviation at rates that exceed the low-end carbon benchmark of EUR 30 per tonne of CO2. Taxes on domestic navigation are similarly rare as taxes on domestic aviation.

This annex provides carbon tax profiles for all 44 countries covered in TEU 2019. General assumptions are explained in Chapter 1. For country-specific assumptions and more fine-grained data, please consult the online country notes. Notice that vertical axes vary widely across countries, depending on how high tax rates are.

References

[19] Balcombe, P. et al. (2019), “How to decarbonise international shipping: Options for fuels, technologies and policies”, Energy Conversion and Management, Vol. 182, pp. 72-88, https://doi.org/10.1016/j.enconman.2018.12.080.

[11] Bowen, A. (2015), Carbon pricing: how best to use the revenue?, http://www.lse.ac.uk/grantham/ (accessed on 16 May 2019).

[13] Dressler, L., T. Hanappi and K. van Dender (2018), “Unintended technology-bias in corporate income taxation: The case of electricity generation in the low-carbon transition”, OECD Taxation Working Papers, No. 37, OECD Publishing, Paris, https://dx.doi.org/10.1787/9f4a34ff-en.

[7] Gillingham, K. and A. Munk-Nielsen (2019), “A tale of two tails: Commuting and the fuel price response in driving”, Journal of Urban Economics, Vol. 109, pp. 27-40, https://doi.org/10.1016/j.jue.2018.09.007.

[20] González, R. and E. Hosoda (2016), “Environmental impact of aircraft emissions and aviation fuel tax in Japan”, Journal of Air Transport Management, Vol. 57, pp. 234-240, https://doi.org/10.1016/j.jairtraman.2016.08.006.

[10] Goulder, L. et al. (2019), “Impacts of a carbon tax across US household income groups: What are the equity-efficiency trade-offs?”, Journal of Public Economics, Vol. 175, pp. 44-64, https://doi.org/10.1016/j.jpubeco.2019.04.002.

[6] IMF (2019), “Fiscal Policies for Paris Climate Strategies—from Principle to Practice”, https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/05/01/Fiscal-Policies-for-Paris-Climate-Strategies-from-Principle-to-Practice-46826 (accessed on 17 May 2019).

[18] ITF (2019), ITF Transport Outlook 2019, OECD Publishing, Paris, https://dx.doi.org/10.1787/transp_outlook-en-2019-en.

[12] Klenert, D. et al. (2018), “Making carbon pricing work for citizens”, Nature Climate Change, Vol. 8/8, pp. 669-677, https://doi.org/10.1038/s41558-018-0201-2.

[21] Larsson, J. et al. (2019), “International and national climate policies for aviation: a review”, Climate Policy, pp. 1-13, https://doi.org/10.1080/14693062.2018.1562871.

[23] Larsson, J. et al. (2019), “International and national climate policies for aviation: a review”, Climate Policy, Vol. 19/6, pp. 787-799, https://doi.org/10.1080/14693062.2018.1562871.

[22] Markham, F. et al. (2018), “Does carbon pricing reduce air travel? Evidence from the Australian ‘Clean Energy Future’ policy, July 2012 to June 2014”, Journal of Transport Geography, Vol. 70, pp. 206-214, https://doi.org/10.1016/j.jtrangeo.2018.06.008.

[9] Marron, D., E. Toder and L. Austin (2015), “Taxing Carbon: What, Why, and How”, SSRN Electronic Journal, https://doi.org/10.2139/ssrn.2625084.

[8] Marten, M. and K. van Dender (2019), “The use of revenues from carbon pricing”, OECD Taxation Working Papers, No. 43, OECD Publishing, Paris, https://dx.doi.org/10.1787/3cb265e4-en.

[1] OECD (2018), Effective Carbon Rates 2018: Pricing Carbon Emissions Through Taxes and Emissions Trading, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264305304-en.

[14] OECD (2018), Tax Policy Reforms 2018: OECD and Selected Partner Economies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264304468-en.

[4] OECD (2018), Taxing Energy Use 2018: Companion to the Taxing Energy Use Database, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264289635-en.

[24] OECD (2017), Tax Policy Reforms 2017: OECD and Selected Partner Economies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264279919-en.

[25] OECD (2016), Tax Policy Reforms in the OECD 2016, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264260399-en.

[3] OECD (2013), Effective Carbon Prices, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264196964-en.

[2] OECD/The World Bank/UN Environment (2018), Financing Climate Futures: Rethinking Infrastructure, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264308114-en.

[17] Pavel, J. and L. Vítek (2012), “Transaction costs of environmental taxation”, in Milne. Janet E. and M. Andersen (eds.), Handbook of Research on Environmental Taxation, Edward Elgar, Cheltenham, United Kingdom.

[15] Ramstein, C. et al. (2019), State and Trends of Carbon Pricing 2019, The World Bank, https://doi.org/10.1596/978-1-4648-1435-8.

[16] Sallee, J. (2019), Pigou Creates Losers: On the Implausibility of Achieving Pareto Improvements from Efficiency-Enhancing Policies, National Bureau of Economic Research, Cambridge, MA, https://doi.org/10.3386/w25831.

[5] Sen, S. and H. Vollebergh (2018), “The effectiveness of taxing the carbon content of energy consumption”, Journal of Environmental Economics and Management, Vol. 92, pp. 74-99, https://doi.org/10.1016/j.jeem.2018.08.017.

Notes

← 1. Specifically, approximately 12% of energy-related emissions were covered by emissions trading systems. For 8% of emissions, the ETS was the only price-based policy instrument that applies.

← 2. In addition to European Union member countries, Iceland, Lichtenstein and Norway also participate in the EU ETS.

← 3. Polluters are, for instance, better informed than policy makers on whether to close down coal plants or invest in CCS technologies. Banning coal shuts down the second abatement option.

← 4. The large decrease in average effective carbon taxes in Turkey and the United Kingdom is largely due to the fact that these countries’ currencies depreciated relative to the euro. Tax policy changes that have occurred between 2015 and 2018 are, for instance, described in OECD’s Tax Policy Reforms publication series (OECD, 2016[25]) (OECD, 2017[24]) (OECD, 2018[14]).

← 5. Their estimation results that are based on an instrumental variables identification strategy, applied to TEU data, suggest that a ten euro increase in effective carbon taxes reduces CO2 emissions by 7% in the long run.

← 6. The IMF calculations are based on a carbon tax benchmark of USD 35.

← 7. The following two paragraphs are based on Marten and Van Dender (forthcoming).

← 8. There may be constitutional constraints for such rate schedules. In Norway, for instance, the Constitution does not allow tax rates to be fixed several years in advance; they have to be adopted separately each year by the Parliament.

← 9. The focus is on jurisdictions and not countries because in cases where standard carbon tax rates differ across subnational jurisdictions, it would be unclear as to which rate should be considered as the standard rate.

← 10. Trading systems could also price emissions from international transport, and that they do so to some extent as flights within the European Economic Area are covered by the EU ETS, but these emissions represent a small share of global emissions from international transport (Larsson et al., 2019[23])