Annex D. China’s e-waste treatment fund1

1. Description of EPR set-up

-

Legal context

The Administrative Measures on Prevention and Control of E-waste Pollution was initiated in 2007 to promote the development of the e-waste recycling industry (e.g. formal e-waste recycling plants were established). From 2009 to 2011 the National Old-for-New Home Appliance Replacement Scheme (HARS) was implemented and gave the opportunity for consumers to buy new electronic appliances with a 10% discount if they sold their e‐waste to certified recycling facilities. To replace this programme, an e-waste disposal fund was set up in July 2012 under the Ordinance for Administration of Collection and Disposal of Waste Electronic and Electrical Products. The scheme was jointly implemented by the Ministry of Finance (MoF), the Ministry of Environmental Protection (MEP), the National Development and Reform Commission (NDRC), the Ministry of Industry and Information Technology (MIIT), the General Administration of Customs (GAC) and the State Administration of Taxation (SAT). These bodies published the Measures for the Collection and Administration of the Funds for the Recovery and Disposal of Waste Electronic and Electrical Products. Five common household electronic and electrical appliances are covered by these Measures namely televisions, refrigerators, washing machines, air conditioners and personal computers.

-

Governance and Enforcement

MEP develops certifications for recyclers which include four aspects (differentiated between the eastern, central region (relatively more developed) and the western region): 1) sufficient capacity and infrastructure, including qualified treatment and recycling, workshops and storage; 2) central monitoring systems and facilities to deal with emergencies, including 24-hour surveillance; 3) compliance with environmental management regulations, including waste water discharges, waste gas and noise emissions and, if necessary, solid waste must be sent to certified landfill sites, and 4) sufficient technical support specialised in safety and health, quality control and environmental protection (i.e. each recycler must have at least three technicians). To obtain a certification, a recycler must submit an application to the local environmental agency who will publish the report publically ten working days before receiving the final approval. MoF, MEP, NDRC and MIIT make the final decision and publish the list of recyclers who are eligible to receive the fund subsidy. The national government also encourages producers to set up their own recycling facilities by providing a faster track procedure for the establishment and certification of their recycling operations. The certified recyclers must report the types and quantity of e-waste recycled to the local environmental protection agency on a quarterly basis. They are also required to submit reports including records on the products going in and out of warehouses,- on the recycled e-waste, disassembly operations, disassembled products obtained from e-waste, and the corresponding sale vouchers (invoices) and treatment certification of these final products. The reports are collected and verified by the local environmental protection agency and sent to MEP for final verification before the subsidy is endorsed. Producers, importers and recyclers who receive subsidies can face legal actionif they fail to fulfil their reporting obligations.

To ensure high quality collection, proper utilization of the subsidies and avoid cheating, the following measures are employed: 1) MEP has established an on-line administrative information system to monitor production and the sale of electronic and electrical appliances, recycling and disposal of e-waste, where recyclers connect their monitoring systems with the government’s main data base (some recyclers have established open on-line websites where they publish their data regularly, e.g. Beijing Hua Xin Green Spring Environmental Co. Ltd; 2) the tax and customs authorities are responsible for monitoring and inspecting the fund to ensure that the fees are effectively collected; 3) the local environmental protection agencies check the data provided by recyclers and comparing it with the data of the on-line administrative information system, and 4) the National Audit Office also supervises collection and the fund. Public supervision is also welcome. All statistics are published online to ensure transparency.

-

Allocation of responsibilities (distribution of roles, financial flows)

MEP is the general coordinator who is responsible for developing policies for WEEE collection and treatment. MoF is the general administrator responsible for coordinating the collection, utilization and administration of the fund. SAT and GAC collect the fees from producers and importers from their agencies across PRC. MEP is also the recyclers’ administrator responsible for developing and implementing criteria for certification of e‐waste recyclers and monitoring their environmental compliance by verifying the data provided by the recyclers (aided by the local environmental protection agencies). The National Audit Office also provides supervision to ensure the scheme runs smoothly. Producers and importers of electronic and electrical products must pay for each unit produced or imported. Producers must declare and pay into the fund on a quarterly basis (via the tax authority) and importers pay their obligation to the customs authority. Certified recyclers can be eligible for a subsidy if they provide their output figures.

2. Environmental effectiveness

-

Collection and recycling rates

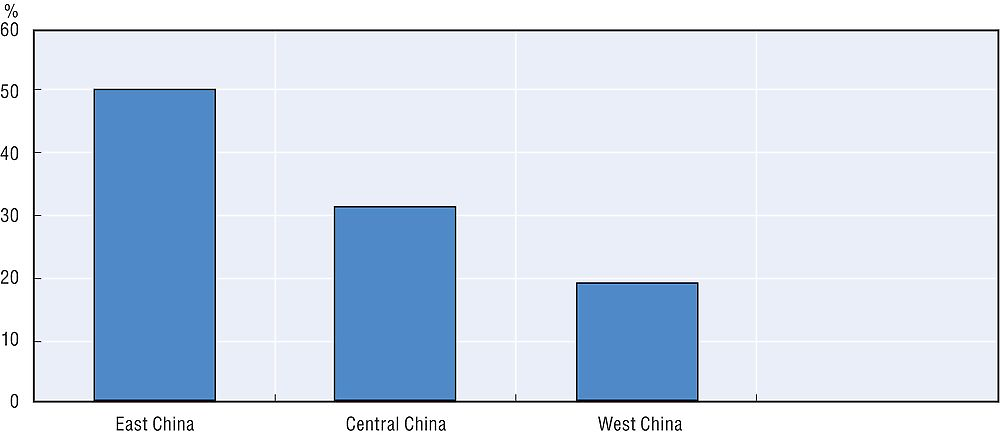

There are currently 106 WEEE recycling facilities. Among the 31 main cities, provinces and autonomous regions excluding Chinese Taipei, Hong Kong, China and Macau, 29 of them have certified recycling companies. Only the Hainan Province has not received any certification, and the Tibet Autonomous Region has no plan to establish recycling facilities. Among the 106 certified companies, 32 are from areas in the eastern part of China, accounting for 50%; 20 are from areas in the central part of China accounting for 31.25%, and only 12 are from areas in the western part of China accounting for 18.75%. In total, 81.25% of the certified recycling companies are from the relatively more developed areas (see Figure D.1).

Television sets represent the majority of e-waste (see Figure D.2). A number of reasons explain this factor: 1) PRC households are switching to LCD sets in large quantities; 2) television sets are more easily collected by the certified recyclers than the other four products, and 3) collecting and recycling television sets is more profitable than other e-waste products because the subsidy rate for television sets is higher than for any other subsidized e-waste product.

After on-site inspection, 7 678 989 units were verified until mid-2013 (accounting for 85.1% of the total declared), and the television sets accounted for 93.9% of the total collected e-waste. In 2014, the figures were 81.80% for TV sets, 2.24% for refrigerators, 4.68% for washing machines, 0.16% for air conditioners and 11.1% for computers.

-

DfE

Producers are encouraged to design products in a way to facilitate the comprehensive utilization of the natural resources and innocent treatment. Moreover, they are proposed to use environment-friendly, easily recycled and reused materials to produce their electrical and electronic equipment.

3. Economic efficiency

-

Cost efficiency

The State Administration of Taxation collects the charges from producers of electrical and electronic equipment, and the General Administration of Customs collects charges from the importers or their agents. The fee and subsidy rates were set after several consultations with all the relevant stakeholders, and may be adjusted depending on changes in the costs of collection and disposal of e-waste. The rate is lower than the subsidy in order to avoid any surplus (see Table D.1). The subsidy is based on the basic cost for disposing and recycling the e-waste, and does not include the collection.

The fund raised to CNY 854 million in the second half of 2012 since the scheme began, and was expected to increase to CNY 2.8 billion in 2013, when this case study was elaborated. MEP conducts on-site visits in order to facilitate the disbursement of subsidies.

-

Leakages and free riders

Issues to do with free riders and orphan products should be limited because the e-waste subsidies apply to all products entering the waste stream, independent of their type or production date.

4. Key issues and possible reforms

The e-waste fund will require a significant increase in recycling capacity in the future. Ultimately, each province should have at least one certified recycling facility to promote quality and efficiency through competition. By way of comparison, the theoretical e-waste recycling capacity is about 2 kg/capita/a, compared to that of 4 to 16 kg/capita/a in the EU, which is 2-8 times more (for comparison, GDP per capita in China is USD 6 000 compared to USD 40 000 in France, i.e. a factor of only 6.5).

The current quantities of e-waste collected and recycled are still insufficient, as the informal sector profits from e-waste recycling. In fact, the informal sector captures the majority of the e-waste products included in the scheme, except television sets. The incentive structure will need to be reformed to increase collection and recycling for the four remaining products, while taking into account the impact on the informal sector. One possibility would be to give producers more responsibility and to encourage the creation of a PRO. The scope needs to be broadened to include more products – e.g. the sales of mobile phones and cars (batteries) are increasing rapidly.

In March 2013, the Ministry of Commerce published the Measures on the Administration of Circulation of Old Electronic and Electrical Products to regulate the second-hand market of these goods. The China COOP is now involved in collecting and recycling, and setting itself high targets. Their operations are spread across PRC with 150 000 depots and 1 million employees. DfE needs to be further incentivized, on which the MIIT is currently working.

Note

← 1. Full source available at: Liu, C. (2014), “How does the Chinese E-waste Disposal Fund scheme work?”, Case study prepared for the OECD, www.oecd.org/env/waste/gfenv-extendedproducerresponsibility-june2014.htm.