3. Argentina

Argentine export taxes depress domestic prices received by producers, leading to negative support to the agricultural sector. The limited payments producers receive focus on input support, provided mainly in the form of credit at preferential rates.

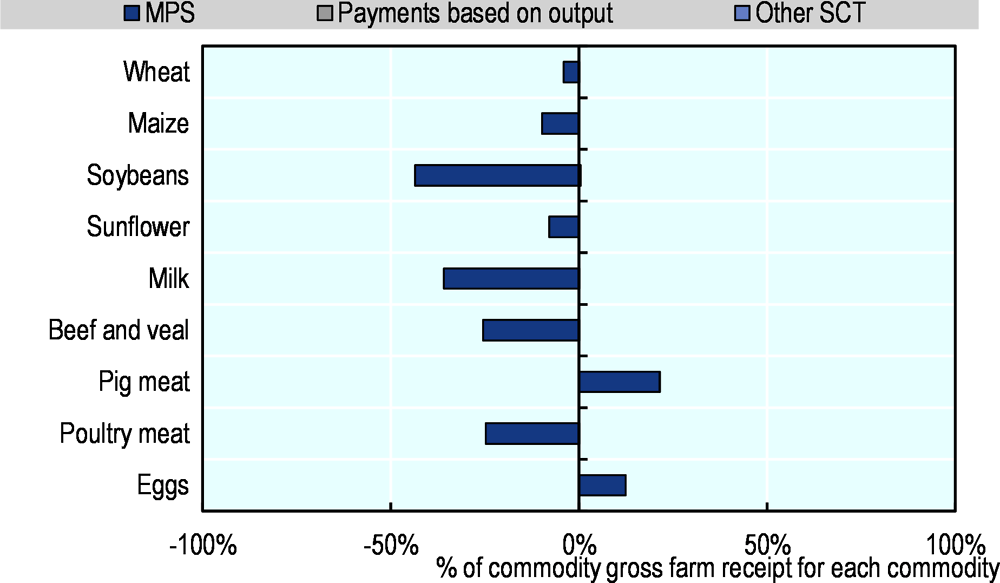

Support to producers has been negative since the beginning of the 2000s, with fluctuations due to changes in export tax rates, also influenced by unstable macroeconomic conditions such as the depreciation of the peso since 2018. The most extreme negative value was -51.1% of gross farm receipts in 2008, rising to -10.3% in 2017, but more negative since the beginning of the 2018 recession, at -23.4% in 2018-20. Negative market price support is the main component of the Producer Support Estimate (PSE) and, as a result, 98% of policy transfers were most-distorting in 2018-20. The ratio of producer to border price (NPC) was as low as 0.80 in 2018-20, making producers’ prices on average 20% below world market prices. Negative market price support is dominated by soybeans, the main export product, with the highest export tax rate and the most negative Specific Commodity Transfers (STC), comprising 50% of commodity gross farm receipts. Some grains and several livestock products also have significantly negative SCT, while price support and SCT are positive for pig meat and eggs.

The support to general services (GSSE) relative to agricultural value-added increased from 0.8% in 2000-02 to 1.6% in 2018-20. Most of this was spent on agricultural innovation systems. Agricultural production and exports in Argentina grew dynamically in the last two decades due to an innovative private sector and to public services, particularly for knowledge, research and extension, and sanitary inspection.

Most of Argentina’s budgetary support to the sector goes to these GSSE. Total budgetary support to farmers and the sector overall (TBSE) was 0.1% of GDP, well below the absolute value of negative market price support, making the total support estimate to agriculture (TSE) also negative: -1.1% of GDP in 2000-02 and -2.3% in 2018-20.

Since December 2019, agricultural policies in Argentina have shifted to more active export restrictions, in particular reintroducing taxes that were reduced or eliminated between 2015 and 2018. In March 2020, export taxes for soybean and soybean products increased from 30% to 33%, though from October to December 2020, the tax temporarily reverted to 30%. In December 2020, export tax rates were set at 0% for non-pampas products such as olives, honey, fruits, tea, yerba mate and eggs. To ensure feed inputs for the domestic food supply, maize exports were banned between December 2020 and January 2021. After negotiation with the private sector, in which the maize value chain guaranteed domestic supply at lower prices, the government lifted the export restrictions.

The Compensation and Stimulus Programme was created to compensate small soybean producers for revenue losses with export tax refunds. Also, the federal revenues agency (AFIP) allowed companies in the Register of Micro, Small and Medium Enterprises to postpone export duty payments for 60 days. This measure was extended until the end of 2020.

In response to the COVID-19 pandemic, the Ministry of Agriculture, Livestock and Fisheries gave a bonus to beneficiaries of the Food Cards that provide food assistance to vulnerable populations. The government also launched the “Programme of critical assistance to family and indigenous farmers” to provide support to smallholder producers affected by the COVID-19 pandemic.

Government and chambers of commerce collaborated on defining good practices and protocols for food-related enterprises in order to avoid disruptions in the food chain and international trade. Argentina’s main exporting ports along the Paraná River suffered disruptions during 2020. In March, ships were unable to dock in Rosario, the main port for soybean meal and oil exports, as procedures to clear crews for contagious diseases were suspended by the COVID-19 pandemic. Traffic resumed after a few days, following a government decision exempting export-related workers from pandemic restrictions.

Taxes and other restrictions on exports create distortions and uncertainty. In response to the macroeconomic turmoil in September 2018, a new tax was established on all exports and, since December 2019, export restrictions target specific agricultural commodities, with increased tax rates for some products and a temporary export ban on maize. The use of export restrictions should be phased out as part of a long-term plan to integrate the sector into an economy-wide tax system and enhance policy certainty with alternative sources of fiscal revenue. In the current environment, it will be crucial to reduce policy uncertainty and find the balance between the long-term objective to reduce export taxes and short-term needs to raise fiscal revenues. Historically, Argentine policies are unpredictable and biased against agriculture. Agricultural policy could be better anchored in broad legislation, such as a sector-specific framework and an economy-wide tax reform, moving towards more neutral, stable, predictable and targeted policies.

The stimulus for small soybean producers seeks to compensate for revenue losses due to export taxes, by providing direct payments and postponing those export duties. Gradually reducing and eliminating export taxes as part of a long-term strategy would be a more transparent approach and provide certainty to the sector.

“Argentina against hunger” provides monthly financial support through an electronic card, proven as a useful tool in providing additional food assistance to vulnerable populations in the context of the COVID-19 pandemic. The approach to support consumers through such social policies is more effective and efficient than trade measures that depress domestic prices of primary food commodities that represent only a small share of food expenditures. However, these food assistance programmes need to target the population in need in order to tackle food poverty, and require effective monitoring of their implementation.

The COVID-19 crisis highlighted the importance of keeping markets working, combining guidelines and protocols to govern the agro-food sector with monitoring and rapid action to keep ports and critical market and trade infrastructures operative. Looking to the post-COVID-19 era, the contribution of all public policy (including taxes, payments, market regulations and investment in infrastructure) to the resilience and responsiveness of the food system deserves systematic evaluation.

Improving the environmental performance of agriculture will require improved monitoring and information systems for better policy design. In order to deliver research, extension and other public goods required for agricultural innovation, Argentina needs to develop systematic monitoring of efforts and results in agricultural R&D and innovation, and define and implement strategic priorities. Innovation policy should focus on providing public goods in areas where the private sector has difficulties to deliver, such as those related to sustainability and less-developed value chains, or for regional economies outside the pampas region.

The Special Tobacco Fund (FET), with a budget similar to that of the National Institute for Agricultural Technology (INTA), should be reformed. Output payments to tobacco producers should be phased out, with the resources used to diversify poor tobacco-producing areas through investment in human and physical capital. The reform should include monitoring and evaluation of all initiatives implemented by the provinces.

In December 2020 Argentina submitted its second Nationally Determined Contributions (NDC) under the Paris Agreement on Climate Change, committing to further reductions of total greenhouse gas (GHG) emissions of 25.7% compared to the previous NDC submitted in 2016. The new submission is welcome, including actions in the agriculture and livestock sector such as sustainable and resilient practices, prevention and climatic risk transfer, and research and capacity building. The NDC implementation plans under development should be applicable, concrete and verifiable.

Overview of policy trends

For many decades, Argentine agricultural policy alternated between free trade and import substitution under different economic policy frameworks (OECD, 2019[1]). Argentina liberalised trade in the late 1970s and explored ways to increase trade with its neighbours and others from the second half of the 1980s. The Argentine economy became more integrated into the international system with the creation of MERCOSUR1 in 1991 and the 1994 WTO Agreement.

After the financial crisis in 2001, Argentina increased tariffs, established price controls and re-introduced export taxes on agricultural products such as soybeans in order to raise revenue and reduce basic food prices. Further export restrictions in the form of quotas for wheat, corn, milk, and beef were imposed in 2008 introducing uncertainty in transactions. Between 2007 and 2011, a consumer price subsidy was put in place. The agency ONCCA provided payments to processors selling wheat, maize, soybeans and sunflower products on the local market.

In 2015, the government reduced export taxes on soybeans and soybean oil, and eliminated those on all other agricultural and livestock products. It also eliminated all export quotas and free-floated the exchange rate of the Argentine peso to other currencies. However, after the 2018-19 peso depreciation, followed by economic recession, export taxes were re-established, applying to all exports rather than targeting agricultural ones.

The change of government in December 2019 resulted in an agricultural policy shift. Specific export taxes that had been eliminated or reduced in December 2015 were re-instated for most products in early 2020, while exchange-rate controls since the beginning of 2020 resulted in a widening gap between the official and the market exchange rate.

While agricultural trade policies and their effect on farm prices change back and forth, long lasting agricultural institutions created since the 1950s remain relevant to the sector’s development. For instance, the National Institute of Agricultural Technology (INTA), created in the mid-1950s, continues to provide general services to research and extension. The long-established animal and plant health institutes were merged into SENASA in 1996. In the private sphere, innovative service providers to farmers were created, such as AACREA in 1960 and AAPRESID in 1989 (Table 3.2).

Prior to the economic crisis of 2001, producer support fluctuated around zero. With the reintroduction of export taxes and other trade restrictions after the 2001-02 financial crisis, the PSE turned negative due to substantial negative market price support, and in the absence of any significant budgetary support to farmers. Negative producer support peaked with price spikes in world markets in 2008, reaching -51.6% of gross farm receipts. The reduction in export taxes in 2015 resulted in reductions of the negative support. While market price support continued to be negative, budgetary support to farmers remained limited and mainly in the form of subsidies for tobacco (Figure 3.4). Around 60% of total expenditures on agriculture in the last ten years financed general services to the sector. From 2007 to 2010, Argentina provided subsidies to food processors (primary consumers), to compensate for high prices of agricultural products.

Main policy instruments

In contrast to most countries covered by this report, producers of Argentina’s main agricultural products are implicitly taxed through negative price support. Export taxes are by far the most important public intervention in agricultural markets in Argentina. Additional measures include quantitative export restrictions on maize, wheat, beef meat, and milk. These had and continue to have major impact by depressing domestic prices below international references and creating negative transfers to producers.

In addition to the Ministry of Agriculture, Livestock and Fisheries, which implements specific programmes and defines quantitative restrictions on exports, other government agencies implement policy providing support to agriculture. The Ministry of Finance designs and implements export taxes, the major source of policy-driven transfers away from the agricultural sector. The government adjusts export tax rates by decree.

To a limited extent, Argentina provides input subsidies, mostly in the form of implicit interest rate subsidies through preferential credit provided by FINAGRO. These credits finance investment and working capital in the production a range of productions. A new fund, FONDAGRO created in 2017, also finances investment in the sector at preferential interest rates, but its scope is limited. There are almost no other forms of budgetary support to Argentine producers. Small amounts of direct payments are provided as disaster assistance in response to extreme weather events, mainly droughts. There are no national direct payments for agri-environmental services, and few at provincial level. The Agricultural Provincial Services Programme (PROSAP), financed with loans by the Inter-American Development Bank (IADB) and managed by the Ministry of Agriculture, Livestock and Fisheries, invests mainly in large-scale agricultural irrigation infrastructure.

The Argentinian legal framework on intellectual property rights on seeds dates from 1973 and differs from those in other major exporting countries. There is no constraint on “own use” of seeds in Argentina. This is particularly relevant for self-pollinating crops such as soybeans, wheat, cotton and rice, where seeds used by farmers are not produced by hybridisation, and farmers do not pay royalties for those. The National Institute for Seeds (INASE) sets conditions for farmers to benefit from this exemption and monitors its implementation. There is also a private extended royalty system under which farmers pay for certain varieties of seeds.

The Special Tobacco Fund (Fondo Especial del Tabaco) provides a supplementary payment to market prices and other support to tobacco producers. Created in 1972, FET provides additional revenue to tobacco producers in the northern provinces of Jujuy, Salta, Misiones, Tucuman, Corrientes, Chaco and Catamarca. The fund is mainly financed by a tax of 7% on tobacco retail prices (excluding VAT) and directly managed by the Ministry of Agriculture, Livestock and Fisheries. The federal government transfers 80% of collected funds to tobacco producing provinces proportional to their share of production. After the signature of the WTO agreement in 1994, Argentina committed to reduce this support as part of its Aggregate Measurement of Support (AMS) commitment. FET payments to tobacco producers shrank to USD 75 million, with the rest of the funds spent on technical assistance, to invest in local infrastructure, and to provide social and health assistance.

Most expenditure finances general services to the sector such as the agricultural knowledge and innovation system, or inspection control services. Research and development and extension services are mainly provided by INTA, while animal and plant health and input control services are provided mainly by SENASA.

For instance, SENASA Resolution 67/2019 approved the National Plan for the Control and Eradication of Bovine Brucellosis, mandatory throughout the national territory, except in the Province of Tierra del Fuego, Antarctica and South Atlantic Islands.2 For dairy production, the Good Practices Programme for Farming in primary dairy production was created in 2019.3 In 2019, Argentina signed the Rotterdam Declaration, which implies commitment to a comprehensive approach to the sustainability of dairy systems, considering social, economic, health and environmental dimensions.4

SENASA defines phytosanitary regulations applied to the registration of plant-based products.5 Since 2018, a new national regulation (Law No. 27279) for the management of pesticide containers created enforcement authorities in 20 provinces.

Agri-environmental regulations are mostly decided at provincial level. Córdoba province has a Law of Good Agricultural Practices setting standards for sustainable agricultural production. This was the first regulation at a provincial level and is part of a Good Agricultural Practices Program launched by the Province in 2017.6 Compliance with the programme gives farmers access to lump-sum payments, with an annual budget of ARS 180 million (USD 2.9 million) in 2020. The province of Entre Ríos enacted a Law on Soil Conservation in December 2018. The new standard declares mandatory soil conservation for any area with soil degradation. Farmers are subject to mandatory conservation and management practices up to 15% of their production area. Compliance permits farmers temporary and partial exemptions from provincial rural property taxes.7

The agriculture and livestock sector contributes up to 26% of total GHG emissions in Argentina. Argentina’s goal is to reduce these by 39% in 2030 with respect to projected emissions for that year. The National Plan for Agriculture and Climate Change is the public policy designed to comply with the objectives of the United Nations Framework Convention on Climate Change under the Paris Agreement. The plan includes adaptation measures for the sector based on risk management, and three GHG mitigation measures.8 An inventory of greenhouse gases from the agriculture, livestock and forestry industry9 was completed to perform evaluation and monitoring of GHG emissions by sector.

The Biofuel Law 26.093 approved in 2006 established compulsory fuel blend mandates since 2010, starting at 5% and increasing to 10% for diesel and 12% for gasoline. The law is scheduled to end in May 2021. In October 2020, the Senate approved its extension to 2025. This extension will be discussed by the Deputies Chamber in 2021.

Since 2016, Argentina is party to the International Treaty on Plant Genetic Resources for Food and Agriculture (ITPGRFA) for the conservation and sustainable use of all plant genetic resources for food and agriculture, following guidelines of the Convention on Biological Diversity. The National Advisory Committee on Genetic Resources for Food and Agriculture (CONARGEN) co-ordinates public agencies on biodiversity issues related to the sector. The Application Authority of the ITPGRFA is in the Ministry of Agriculture, Livestock and Fisheries, whereas the Political Focal Point is in the Ministry of Foreign Relations, International Trade and Cult. The Instituto Nacional de Tecnología Agropecuaria (INTA) is developing projects supported by the Benefit Sharing Fund of the ITPGRFA and the Global Crop Diversity Trust.

The National Forest Management Plan with Integrated Livestock (MBGI) is a joint plan created in 2015 by the Ministry of Environment and Sustainable Development, the Ministry of Agriculture and the National Institute for Agricultural Technology (INTA). The MBGI develops technical guidelines for native forest management and livestock management in the framework of the Native Forest Law.10 The National Forestry Strategy 2030 (ForestAR 2030) has been implemented since 2019.11 This programme aims to protect native forests and promote forest plantations, and the entire wood value chain in order to achieve the objectives in the Paris Agreement and the 2030 Agenda.12 It foresees the creation of Manuals of Good Practices and guidelines for strategic assessment of forest plantations, as well as of the Argentine Forest Certification System CERFOAR.

Domestic policy developments in 2020-21

Since January 2020, a new social programme “Argentina against hunger (AUH)” provides financial support for children, pregnant women and disabled people. Support is channelled through an electronic food card (ALIMENTAR Card) to be used in any food product store. The food card is received by AUH beneficiaries with children under 6 years old and pregnant women that receive the universal pregnancy allowance (AUE). The programme reached 1.5 million adult beneficiaries and 2.8 million children in 2020. The average monthly expenditure for this programme in 2020 was USD 80 million. Beneficiaries receive between USD 50 and USD 100 per month, depending on the number of children in the family.

In October 2020, the new “Compensation and Stimulus Programme” for small soybean producers was created under the administration of the MoA (decree 786/2020). The scheme will compensate soybean producers with total sales under ARS 20 million (USD 325 000) in 2019. Under this programme, farmers receive “export tax refunds” depending on their cultivated area from 1 hectare to a maximum of 400 hectares. Farmers in the Pampean region receive between ARS 441 and ARS 1 543 (USD 7.2 and USD 25.1) per tonne, and outside the Pampean region between ARS 661 and ARS 2 205 (USD 10.7 and USD 35.8) per tonne, for a total ARS 12 billion (USD 195 million) in 2020, benefiting 41 293 producers and 10 million hectares. The first payment was made in November 2020 for sales made between February and September 2020.

Argentina implements the bioethanol and biodiesel mandates by setting production quotas and the official prices that biofuel producers can charge fuel companies to fill the mandate. In October 2020, the Ministry of Economy in Argentina increased the price of maize-based ethanol used in fuel blending and sugarcane bioethanol by 9.7% to ARS 32.7 per litre (USD 0.53 per litre) (Resolution 4/2020). At the same time, the Secretariat of Energy increased the domestic market price of biodiesel by 10% to ARS 48 533 per tonne (USD 788 per tonne) (Resolution 5/2020).

In August 2020, the Ministry of Agriculture, Livestock and Fisheries created the National Direction of Agro-ecology (DNA) aimed at the design and implementation of policies, programmes and projects that promote intensive and extensive primary production based on agro-ecological principles.

In December 2020 Argentina submitted its second Nationally Determined Contributions (NDCs) under the Paris Agreement on Climate Change, committing to further reductions of total GHG emissions, not exceeding the net emission of 359 million tonnes of CO2 equivalent (MtCOe) in 2030. This is the equivalent of a total decrease in emissions of 19% by 2030, compared to the historical peak reached in 2007, and a reduction of 25.7% compared to the previous NDC submitted in 2016. The second NDC includes economy wide mitigation and adaptation efforts, which include action in the agriculture and livestock sector such as sustainable and resilient practices, prevention and climatic risk transferring, and research and capacity building. Sectorial plans for the implementation of the NDC are being defined under the National Cabinet of Climate Change.

The new Programme for the promotion of Local Work, Holding and Supply (PROTAAL) seeks to generate new jobs, strengthen rural livelihoods, and increase production of family farmers13 in communities of less than 50 000 inhabitants (Resolution 163/2020 the Ministry of Agriculture, Livestock and Fisheries). The programme promotes the formation of associations of family farmers providing benefits for the unemployed, under-employed and small producers.

The cultivation of a drought-resistant GM wheat variety (HB4) was authorised by the Ministry of Agriculture, Livestock and Fisheries in Argentina (Resolution 41/2020). However, its marketing has not yet been authorised, largely subject to pending Brazil’s assessment and import approval, as the country accounts for 40% of Argentina’s wheat exports.

In 2020, the MoA launched a National Plan for Access to Water (Plan Nacional de Acceso al Agua) with a particular focus on small producers. The Plan is implemented through the Secretariat of Family, Peasant and Indigenous Agriculture (SAFCI), the General Directorate of Sectorial and Special Programs and Projects (DIPROSE) and the National Institute of Agricultural Technology (INTA).

Domestic policy responses to the COVID-19 pandemic

Social distancing measures escalated after mid-March 2020 following the Decree 260/2020 declaring a public health emergency and followed by Decree 297/2020 of mandatory quarantine that was extended in successive stages until 6 November 2020. The decrees enabled the Health Ministry to adopt the measures needed to fight the outbreak, authorised the reallocation of funds and the adoption of measures to prevent shortages of key sanitary products. The quarantine included mandatory self-isolation measures, except for essential services such as health, pharmacies and the food industry and commerce. The production, transportation and trading of food and agricultural inputs such as fertilisers were in the list of essential sectors not subject to the limitations by lockdown measures.

The Ministry of Agriculture launched the “Programme of critical assistance to family and indigenous farmers” (Programa de Asistencia Crítica y Directa para la Agricultura Familiar, Campesina e Indígena, Resolution 138/20), with a total budget of USD 420 000. The initiative will support smallholder producers affected by the COVID-19 pandemic with direct financial support.

Some measures were also taken in specific fruit sectors. A programme was put in place to assist producers of pears and apples in main producing provinces, delaying social security payments and extending the timeframe of the existing emergency programmes (Decree 615/220). The Law 27.507 of emergency in the citric sector was also extended for an additional year and expanded to additional provinces.

The government and chambers of commerce worked together on a harmonised set of protocols to be used in all food related enterprises. Good practices protocols per branch of activity were designed for agriculture, food industries, fisheries, family farming, cattle farming, poultry production, and fruit and vegetable production among others.14

The National Institute for Agricultural Technology (INTA) made available four laboratories in different parts of the country (Castelar in Buenos Aires; Marco Juarez in Cordoba; Concepcion del Uruguay in Entre Rios and Balcarce in Buenos Aires) to perform PCR tests for the detection of COVID-19. The laboratories were adapted under the biosafety protocols and the staff was trained for this task.

Policy interventions focused on restoring households’ incomes and supporting firms, especially small and medium businesses, and with some income maintenance support measures for poor households and for people receiving the minimum pension. At the beginning of the COVID-19 outbreak the government announced the following specific measures to strengthen Argentina’s social programmes:

A bonus for beneficiaries of AUH (universal child allowance) and for retirees that earn the minimum pension.

An emergency subsidy (Ingreso Familiar de Emergencia - IFE) of ARS 10 000 (USD 125) in April 2020 for those who are unemployed, for informal workers and for independent workers with the lowest incomes.

A bonus for beneficiaries of the Food Card (Tarjeta Alimentaria).

Price ceilings for some groceries, cleaning products, medicines and medical inputs.

The government also announced different measures to relieve companies of non-essential industries that are hit by the pandemic, and to protect the disposable income of their workers. In March 2020, the government decided to partially subsidise wage payments, and postpone or significantly reduce payroll taxes.15 The relief package is expected to cost 3% of GDP (ARS 850 billion – USD 12 billion).

Trade policy developments in 2020-21

Following the Law 27.541 (Article 52) that authorised the government to modify the export tax of soya and other agricultural products to a maximum of 33% and 15%, respectively, in March 2020, Argentina (Decree 230/2020) modified certain export tax rates (Table 3.3). Export taxes for soybeans and soybean products increased from 30% to 33%, while they were reduced for maize and wheat flour, sunflower and peanuts. In turn, export taxes for a range of products were kept constant: maize, wheat, milk, beef and paddy rice. Export taxes on other products from outside the Pampean region such as wine, pears, apples, grapes, cotton and lemon were also kept constant at 5%.

From October to December 2020, a temporary reduction in export taxes for soybeans and soybean products from 33% to 30% was implemented through Decree 789/2020 to incentivise farmers and exporters to sell. After 31 December 2020, the export tax for soybeans returned to 33% but for soybean products (oil and flour) was increased only to 31%. In December 2020, Decree 1060/20 fixed export tax rates at 0% for an important number of non-Pampean products such as olives, honey, fruits, tea, yerba mate and eggs. On 30 December 2020, the Ministry of Agriculture announced a ban on maize exports until 28 February 2021 as part of the government’s policy to ensure feed inputs for the domestic food supply. In January 2021, after negotiations with private representatives of the maize value chain, it was agreed to allow exports and guarantee domestic supply at lower domestic prices but without imposing explicit bans or quantitative export restrictions.

In June 2019, the European Union and Mercosur reached a free trade agreement involving EU Member States and the members of Mercosur (Argentina, Brazil, Paraguay and Uruguay). The agreement includes a “Trade and Sustainable Development” chapter obliging to “implement measures to combat illegal logging and related trade” without detailing what these measures should comprise. During 2020, the agreement was under legal revision and public debate, and continues its process to be approved by the European Union Parliament and the Parliaments of the European Union Member States and Mercosur countries.

Drought has led to historically low water levels in the Paraná River, a key transportation route for grains and oilseeds from the Argentine main port in Rosario. The low levels hamper river trade, and from 10 to 12 May 2020, ships from Rosario had to reduce their freight by 22% to 39 million tonnes after an obstruction of the navigation channel for several days. On 16 May, Brazil agreed to release water from the Itaipú dam to alleviate Parana River’s water level. Strikes at grain ports in protest against the deadlock in wage re-negotiations affected the shipment and unloading of grain in San Lorenzo and Rosario in November 2020.

Trade policy responses to the COVID-19 pandemic

The Southern Agricultural Council (joining Argentina, Brazil, Bolivia, Chile, Paraguay and Uruguay) made a joint declaration on 24 March guaranteeing the secure transit of trucks across their borders.

In June 2020, the Federal Revenue Agency (Administración Federal de Ingresos Públicos-AFIP) issued the Resolution 4728/2020 that allows the postponement of the payment of export duties for 60 days for companies registered in the Register of Micro, Small and Medium Enterprises (MiPyMEs Law 24,467). The measure was later extended until the end of December 2020. A similar exemption was applied to the export of leather products (Decree 549/2020).

On 16 March 2020, ships were not able to dock along the Paraná River in Rosario, the main port for soybean meal and oil exports in Argentina as procedures to clear the crew from contagious diseases was suspended due to the COVID-19 pandemic. On 19 March 2020, Timbues, another main port town announced the closure of ports and mills until 2 April in order to prevent the spread of the COVID-19. Only a few days later port terminals in Argentina were reopened to cargo following a government decree exempting export-related workers from preventive isolation. During the period of closure, shipments are reported to have been unaffected thanks to the reserves kept by companies at key terminals.

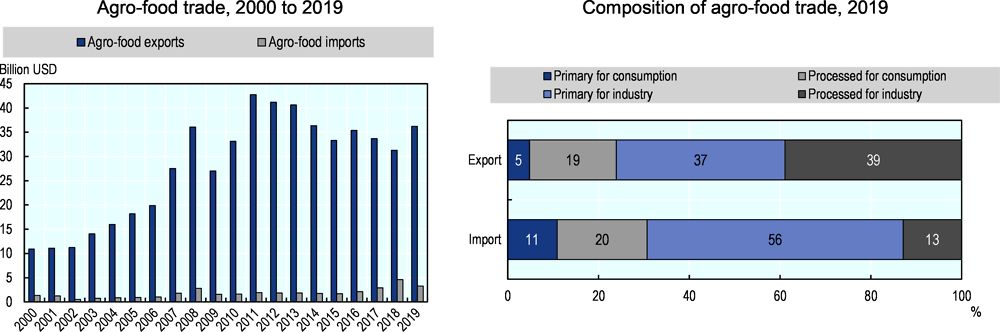

Argentina is an upper middle income country with an efficient agricultural sector that makes a growing contribution to the GDP, from 4.7% of the GDP in 2000 to 6.1% in 2019. In contrast, agriculture’s share of employment is decreasing and well below 1%, with a high degree of mechanisation of the production in the Pampas region. The country is one of the world’s largest agricultural exporters, and agro-food exports have been growing significantly in the last decades, representing 42% of total exports in 2000, and 56% in 2019. In contrast, agro-food imports represent only 7% of total imports.

Argentina has abundant agricultural land representing almost 5% of the total agricultural area of all countries covered in this report, although a large share constitutes pasture land. The share of livestock in the total value of production was 39% in 2019.

The Argentine economy began to stall when the peso came under pressure in April 2018. The value of the peso vis-à-vis the USD was reduced by 40% in 2018, and by 75% in the period 2018-2020, plunging the economy into recession and inducing high annual inflation rates above 40%. Subject to exchange rate controls, the electronic exchange market rate has diverged from the official rate. Adversely affected by COVID-19, the Argentine GDP declined by 13% in 2020

The agro-food trade surplus exceeded USD 30 billion in 2019. Most of agro-food exports (74%) are primary or processed products used as inputs in downstream industries abroad, whereas the much smaller bundle of agro-food imports is mostly composed of primary products for the industry.

Argentine agricultural production has grown at an annual rate of 2% between 2007 and 2016, similar to the world average. Within this total growth, 0.6% was due to an increase use of intermediate inputs, while the bulk of production growth (1.4%) was due to Total Factor Productivity (TFP) growth, that is, innovations and technical improvements in the way resources are used in production. The contribution of TFP to production growth is slightly below the world average.

Agricultural nutrient balances in Argentina are below the OECD average. The shares of agriculture in energy use and in greenhouse gas (GHG) emissions are, at 6.1% and 30.6% respectively, well above the OECD average, related to the importance of the sector in GDP and the large number of ruminants.

Reference

[1] OECD (2019), Agricultural Policies in Argentina, OECD Food and Agricultural Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264311695-en.

Notes

← 1. Mercosur is a free trade agreement among South American countries including large agricultural exporters like Argentina, Brazil, Paraguay and Uruguay.

← 2. http://www.senasa.gob.ar/normativas/resolucion-67-2019-senasa-servicio-nacional-de-sanidad-y-calidad-agroalimentaria.

← 3. https://www.boletinoficial.gob.ar/detalleAviso/primera/215569/20190905.

← 4. https://www.boletinoficial.gob.ar/detalleAviso/primera/220195/20191030.

← 5. http://www.senasa.gob.ar/normativas/resolucion-350-1999-senasa-servicio-nacional-de-sanidad-y-calidad-agroalimentaria.

← 7. https://www.entrerios.gov.ar/boletin/calendario/Boletin/2019/Enero/08-01-19.pdf.

← 8. https://www.argentina.gob.ar/agricultura/cambio-climatico.

← 9. https://datos.agroindustria.gob.ar/dataset/emisiones-de-gases-de-efecto-invernadero-provenientes-del-agro.

← 10. http://servicios.infoleg.gob.ar/infolegInternet/anexos/135000-139999/136125/norma.htm

← 11. https://www.argentina.gob.ar/forestar2030.

← 12. https://www.agroindustria.gob.ar/sitio/areas/sycf/.

← 13. A farm is defined as a family farm if some of assets belong to the farmer and the farmer’s household provides most of the labour.

← 14. https://www.argentina.gob.ar/agricultura/covid-19

← 15. https://www.argentina.gob.ar/noticias/los-ministros-de-economia-y-de-desarrollo-productivo-anunciaron-un-paquete-de-medidas-para.