Overview: Priorities to make digitalisation work for all in Africa

The economic recession triggered by the COVID-19 pandemic is hitting African countries hard. Most of them are facing their first recession in 25 years: gross domestic product (GDP) growth will likely decrease in 41 of the 54 countries in 2020, according to an International Monetary Fund forecast (October 2020). By contrast, when the global financial crisis hit the continent in 2009, only 11 countries went into recession. The crisis has affected Africa’s growth through various external and domestic channels (Table 1). For example, the plunge in oil prices in the first quarter of 2020 has severely struck commodity-based economies. The shutdown of the global tourism industry, which employs 24.3 million people on the continent, has harshly affected tourism-dependent countries. Domestic demand and regional trade have suffered from confinement measures. At least 42 countries have imposed partial or full lockdowns on economic activities and the movements of people (UNECA, 2020). The crisis has also led to the postponement of the implementation phase of the African Continental Free Trade Area until 2021.

The global crisis is likely to derail Africa from its pre-COVID-19 development trajectory. The crisis could push some 23 million sub-Saharan Africans into extreme poverty in the course of 2020. Africa’s capital accumulation and productivity could remain below their pre-COVID 19 trajectories until 2030 (Djiofack, Dudu and Zeufack, 2020). The most consequential disruptions in national economies could be productivity decline, reduced capital utilisation and increased trade costs. Added to these are losses in educational achievement and health, which could hinder the ability of the current generation to earn higher incomes and improve its well-being. These disturbances will slow down Africa’s productive transformation and, consequently, the achievement of the African Union’s Agenda 2063: The Africa We Want.

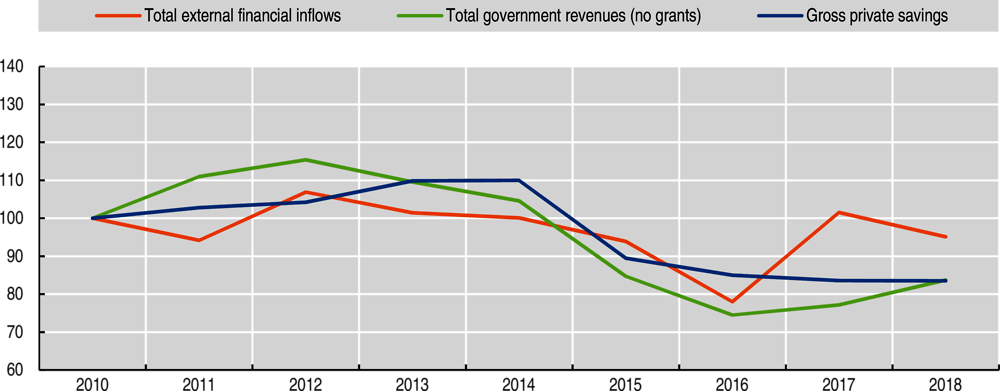

Africa’s governments are facing the COVID-19 pandemic with lower financial resources per capita than during the 2008 global financial crisis. The amount of financing per capita decreased during the 2010-18 period for both domestic revenues and external financial flows, by 18% and 5% respectively (Figure 1). On average, African countries had public revenues of USD 384 per capita in 2018, compared with USD 2 226 for countries in Latin America and the Caribbean, USD 1 314 for developing countries in Asia, and over USD 15 000 for European and other high-income countries. Tax-to-GDP ratios had already been stagnating at 17.2% since 2015 in 26 African countries, despite important tax reforms (OECD/ATAF/AUC, 2019).

Public revenue will contract even further. The ratio of tax to GDP should contract by about 10% in at least 22 African countries between 2019 and 2020; total national savings could drop by 18%, remittances by 25% and foreign direct investment (FDI) by 40%. Donors have pledged to maintain official development assistance (ODA) at their pre-crisis levels. However, fiscal deficits will probably double in 2020. As a result, Africa’s debt will likely soar to about 70% of GDP in current US dollars, up from 56.3% in 2019. While this average remains sustainable, the debt-to-GDP ratio is likely to exceed 100% of GDP in at least seven countries. The G20 debt moratorium that began in April 2020 provides necessary respite for African countries, but it remains insufficient. Suspending and, in some cases, restructuring the debt may prove necessary to free up critical resources to achieve the African Union’s Agenda 2063. Where possible, debt negotiations should include the growing group of private sector lenders (see Chapter 8). Finally, the COVID-19 crisis makes accelerating Africa’s productive transformation and continental integration processes all the more imperative.

African economies are undergoing a steady process of digitalisation

Digitalisation – the use of digital technologies, data and interconnection to change existing activities or create new ones − is well underway in all five African regions. The continent boasts several headline successes and dynamic ecosystems. The mobile money revolution is a well-known example: with 300 million accounts – the highest number in the world – mobile money has begun transforming Africa’s job markets, expanding financial services to the underserved and unlocking innovative business models for local small and medium-sized enterprises (SMEs). Africa’s telecom industry, which forms the core of the digital transformation, has shown a robust growth in subscribers, revenues and capital expenditures. To date, more than 500 African companies provide technology-enabled innovation in financial services (fintech). Johannesburg and Cape Town in South Africa, Nairobi in Kenya and Lagos in Nigeria rank among the top 100 cities for fintech ecosystems worldwide. Entrepreneurial and digitally savvy Africans are turning digital technologies and Africa’s specific needs to their advantage to deploy fast-growing business models. Some African start-ups’ valuations now exceed USD 1 billion (Chapter 1). Over 640 tech hubs and incubators are active across the continent, up from 314 in 2016. However, in order to achieve the objectives of Agenda 2063 and create a massive number of jobs for the youth, digital transformations must expand beyond those islands of success.

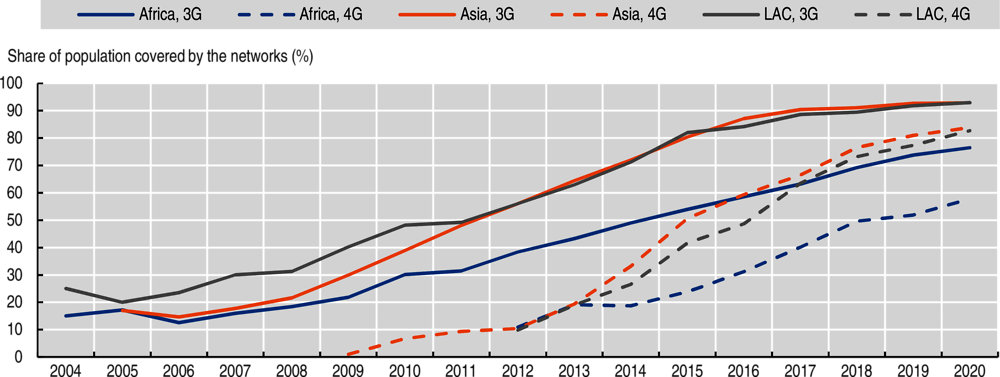

Information and communications technology (ICT) infrastructures have developed steadily, and prospects for new projects remain robust. In 2018, financing for digital infrastructure was USD 7 billion, 80% of which came from private investors (ICA, 2018). Africa’s total inbound international Internet bandwidth capacity increased by more than 50 times in just ten years to reach 15.1 terabytes per second (Tbps) in December 2019, up from only 0.3 Tbps in 2009 (Hamilton Research, 2020). The operational fibre-optic network extended from 278 056 kilometres (km) in 2009 to 1.02 million km in June 2019. Mobile cellular subscriptions more than doubled in a decade to reach 88 per 100 people in 2018. About 58% of the population now live in an area covered by 4G networks (Figure 2). Through its Agenda 2063 flagship programmes, the African Union has 114 ICT infrastructure projects which aim to upgrade key Internet exchange points, build new broadband fibre infrastructure and upgrade existing terrestrial fibre backbones (AUDA-NEPAD, 2020).

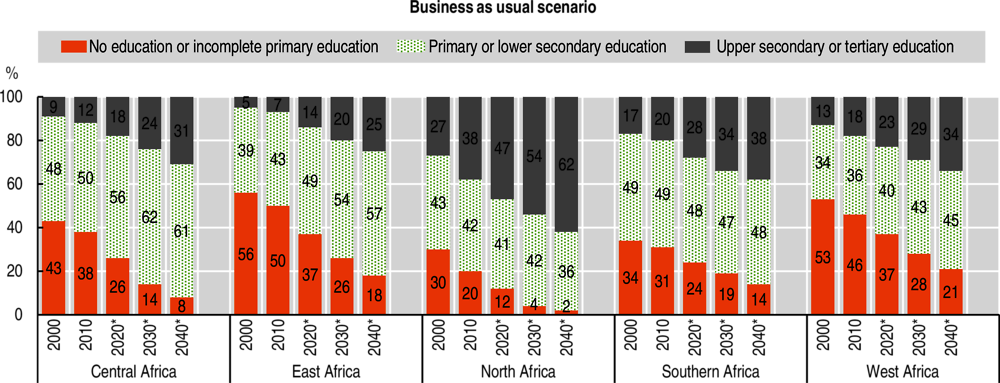

Africa’s young and increasingly educated population is another asset for accelerating the continent’s digital transformation. The number of Africans aged 15-29 with an upper secondary or tertiary education has risen from 47 million in 2010 to 77 million in 2020. Progress is most notable in North Africa, where 47% of the youth have at least an upper secondary education (Figure 3). Under business-as-usual scenarios, this number will increase to 165 million by 2040. In relative terms, the proportion of African youth completing an upper secondary or tertiary education could reach 34% by 2040, close to the proportion in Asia and up from 23% today. If African countries follow the same trajectory as projected for Korea in a fast-track scenario, this proportion could even reach 73% (233 million) by 2040.

Few benefit from the job opportunities of digital transformation

Despite the progress mentioned above, those who benefit from job opportunities created by Africa’s digital transformation are too few. Telecom companies and the 20 fastest-growing African start-ups employ about 300 000 staff. Taken on its own, the digital sector is glaringly insufficient to provide education and jobs for the 29 million youth who will turn 16 years old every year between now and 2030.

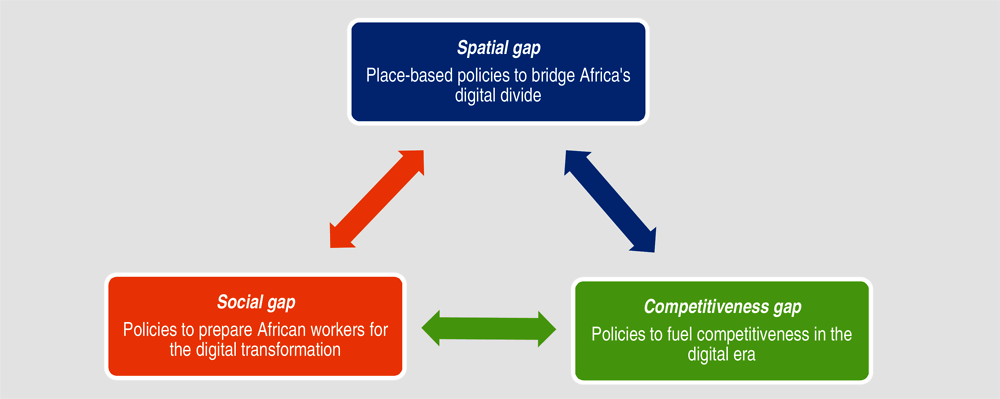

Strong inequalities in labour markets limit the potential of the digital transformation to create quality jobs. The gap in digital access and capability manifests itself across three inter-related dimensions: spatial, social and competitiveness:

The concentration of the digital economy in the continent’s larger cities increases the spatial mismatch between jobs and people. Although about 70% of Africa’s young people (i.e. 1.4 billion people) reside in rural areas, only 25.6% of African rural dwellers have Internet access compared to 35.2% in Asia and 40.1% in Latin-America (Gallup, 2019).

The informal sector remains the main gateway to job markets for the vast majority of Africa’s working-age population. This is the case for 75% of graduates aged 15-29 and for 88% of women. Informal workers have low digital adoption: only 16% of self-employed workers use the Internet regularly, compared to 58% of people in waged jobs.

Despite a great number of early-stage entrepreneurs across the continent, the funding ecosystem remains fragile. High-potential entrepreneurs face a weak regulatory environment to scale up their activities and innovate. This hinders private sector competitiveness, especially among micro, small and medium-sized enterprises.

Most future employment opportunities will come through indirect channels, rather than through direct employment in the digital sectors. The real potential for large-scale job creation lies in spreading digital innovations from lead firms to the rest of the economy. The role of governments is to create an environment that enables the many private sector actors to benefit from digitalisation. Spreading digital innovations to the whole economy will empower the private sector to create more jobs.

While many African countries have digitalisation strategies, these generally focus on the digital sector only. Most strategies aim to expand the coverage of communication infrastructure networks, promote hubs and tech clusters, and implement regulatory reforms to attract leading companies. They target only specific sectors and tend to overlook the potential to use digitalisation to transform non-digital sectors.

New digitalisation strategies can address the spatial, social and competitiveness gaps in the labour market and bring digital solutions to the non-digital economy (Figure 4). To reduce those gaps, the report recommends that policy makers pay particular attention to three sets of policies: i) spreading digital innovations beyond large cities, ii) helping informal workers become more productive and iii) empowering enterprises for digital competition. Chapters 1 to 7 of the report examine a wide range of policies that can fill the gaps in current strategies in order to create quality jobs in the five African regions.

Closing the spatial gap: Connecting intermediary cities and spreading digital innovations for rural development

Bridging spatial inequalities is a cost-efficient policy to respond to the interrelated dimensions of Africa’s digital divide, including gender and socio-economic inequalities in accessing digital tools.Figure 5 compares inequalities in access to mobile phone and Internet usage. On the one hand, vulnerable groups in rural areas and small towns have much lower access to digital opportunities than in larger cities. For instance, only 17% of self-employed workers living in rural areas use the Internet, compared to 44% for those in urban areas (Afrobarometer, 2019). On the other hand, digital innovation concentrates in too few places: only five African cities host almost half of the most dynamic start-ups: Cape Town (12.5%), Lagos (10.3%), Johannesburg (10.1%), Nairobi (8.8%) and Cairo (6.9%) (AUC/OECD, 2019), and 85% of the venture capital funding for Africa’s start-ups went only to four countries despite sevenfold growth between 2015 and 2019.

Extending digital technologies to remote areas can be cost-effective. Improving agricultural extension services and connecting the rural-urban supply chains can generate big wins in fighting pockets of poverty and informality in rural areas. A stock-taking exercise highlighted that the focus of the so-called Disruptive Agricultural Technologies (i.e. agritech) in Africa ranges from enhancing agricultural productivity (32%) to improving market linkages (26%) and, to a lesser extent, data analytics (23%) and financial inclusion (15%) (Kim et al., 2020). Over 83% of these innovative agricultural technology solutions do not require high connectivity and can operate with intermediate connectivity.

Developing broadband infrastructure in intermediary cities can yield high returns, as 73% of Africans will continue to live in intermediary cities and rural areas by 2040. In Central Africa, only 5% of the intermediary cities are within ten kilometres of the high-speed terrestrial fibre-optic network, and 20% in West Africa. Intermediary cities can act as transmission hubs that serve the rural hinterland, strengthen rural-urban linkages and drive rural transformation. Place-based policies are necessary to spread the costs of digital innovations effectively and to enhance regional competitiveness beyond large cities. In all five regions of Africa, place-based policies can articulate sectoral policies locally to tap underutilised potential.

Universal access to communication technologies and Internet services partially depends on affordable prices. Only 17% of Africa’s population can afford one gigabyte of data, compared to 37% in Latin America and the Caribbean and 47% in Asia. The costs are the lowest in North Africa and the highest in Central Africa.

Governments can make prices affordable through policies that i) create new public-private alliances for rural connectivity, ii) improve the use of Universal Service and Access Funds (USAFs) and iii) ensure fair competition among telecommunication providers. In Algeria, Ghana, Kenya and Nigeria, the public sector partnered with mobile telecom companies and with the telecommunications equipment providers to bring cost-effective mobile broadband services to their rural populations. To upgrade rural broadband networks, Malawi and four other Southern African countries have successfully tested reallocating vacant spectrum bands, previously used by television broadcasting, for Internet transmission over long distances (see Chapter 3). While 37 African countries have created USAFs, a recent review found that USD 408 million, or 46% of funds collected, were still unspent by end-2016 (Thakur and Potter, 2018). Benin, Ghana and Rwanda make good use of their USAFs by focusing them on skills acquisition programmes for women entrepreneurs.

Governments need to identify and support the most promising digital innovations for rural development. Agritech and data-related start-ups are on the rise across the continent (Table 2). Governments can collaborate with tech companies to spread the best farming practices. New technologies such as smart contracts, real-time payment solutions and distributed ledger technologies (also known as blockchain) can fundamentally transform the agricultural sector and help address the specific challenges of small-scale farmers. Other promising innovations for agricultural development include shared-economy models and digital tools for land rights.

Closing the social gap: E-skilling the workforce and preparing the labour markets for digital transformation

By 2040, own-account and family workers in Africa will represent 65% of employment under current trends. Their number could increase by 163%, to reach 529 million people in 2040, compared to an estimated 325 million people in 2020. Even in the best-case scenario where manufacturing and digital sectors expand substantially, own-account work will likely remain the mainstay for the majority of Africa’s youth. A significant proportion of the continent’s young labour force is outside the education and training systems, is jobless or works in the informal sector. Policies need to help them embrace digital transformation and guarantee social protection.

Making digitalisation benefit informal and own-account workers requires increasing opportunities for lifelong learning and skill development. In Morocco, the Federation of Information Technology, Telecommunications and Offshoring is seeking to boost employability in the information technology sector by creating training courses and vocational qualification certificates in partnership with the National Agency for the Promotion of Employment and Skills. In May 2018, Facebook launched NG_HUB in Lagos in collaboration with the Co-creation Hub to provide 50 000 young Nigerians with skills for own-business development and to nurture a strong mutual learning community of entrepreneurs (Oludimu, 2018). Other interesting initiatives focus on technical and vocational education and training for women. This is the case for Women and Digital Skills (Ghana), W.TEC (Nigeria) and WeCode (Rwanda). The regional chapters in this report provide details on other initiatives. For example, in North Africa, triangular collaboration policies between governments, universities and the private sector are facilitating the establishment of technology hubs and incubation centres for skill development (see Chapter 6).

The emergence of new forms of own-account work via the use of e-platforms and digital applications calls for improving regulatory frameworks and social protection schemes to prevent precarious working conditions. In South Africa, for example, the number of gig workers is growing over 10% each year and could reach the millions within the next decades. Global evidence from 75 countries between 2015 and 2017 suggests that gig workers often face precarious working conditions, including low and unpredictable revenues and poor social protection. Policies should support collective action to help better regulate platform work. An example of such action exists in Kenya, where a group of online workers came together to set up an association in 2019. Setting international standards and promoting certification for responsible business conduct for lead platform companies could also help eliminate unfair practices and hold these platforms accountable without putting at risk this livelihood option for local workers.

Closing the competitiveness gap: Empowering African start-ups and SMEs to compete and innovate in the digital era

African enterprises have difficulty scaling up and innovating in the digital era. Today, only 17% of Africa’s early-stage entrepreneurs expect to create at least six jobs, the lowest percentage globally. This, although the African population boasts the world’s highest rate of entrepreneurship at about 22% of the labour force (AfDB/OECD/UNDP, 2017). In spite of having promising business ideas, many early-stage entrepreneurs face obstacles in obtaining loans from local banking systems. Only 5.4% of the total funds raised go to start-ups younger than five years old. Women-led start-ups only receive 2% of funding, although more women in Africa are entrepreneurs than in other world regions.1

Governments can help dynamic enterprises tap digital-enabled trade, facilitate intellectual property registration and strengthen financing opportunities for start-ups. Key policy areas to support them include the following:

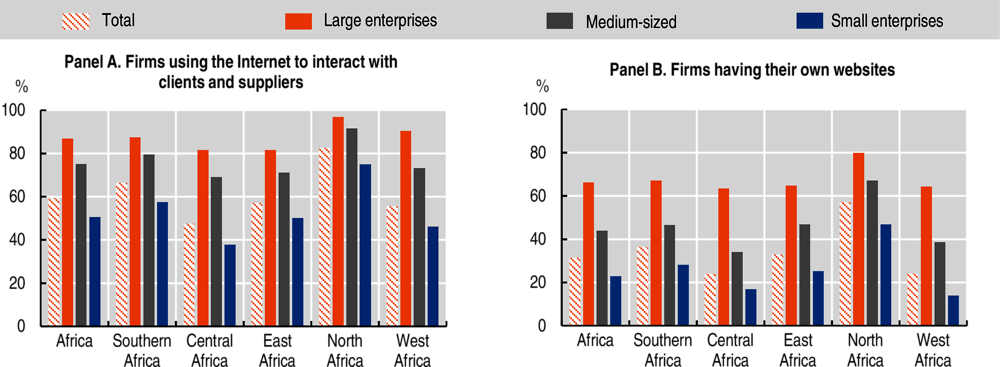

Stronger digital adoption will increase company growth and resilience, especially if policies also encourage the spread of digital innovation among SMEs (Figure 6). For example, governments need to overcome bottlenecks in cross-border e-commerce by supporting international e-payments, cross-border deliveries, standards and certification. Firms can become more competitive by ramping up their online presence and their after-sale services. Africa’s entrepreneurs can use digital connectivity to enter new niches. One example is the rapid online growth of Nigeria’s Nollywood, a film industry that employs about 1 million people.

Governments can encourage entrepreneurs to register intellectual property by streamlining application procedures, reducing the cost of intellectual property registration and adapting enforcement mechanisms. For instance, Kenya’s patent registration fees are 13.3 times its GDP per capita (the ratio is 10.2 in Senegal and 7.9 in Ethiopia), compared to 0.4 for Malaysia.

Improving risk assessment methods, acceleration programmes for entrepreneurs, public procurements and public guarantees mechanisms can increase the financing available for local start-ups in all countries. Countries with a sovereign wealth fund should consider setting up small venture capital funds within their investment structures to support the development of start-up and SME ecosystems. Examples include the FSDEA (Fundo Soberano de Angola) in Angola, the Okoumé Capital fund in Gabon and the Teranga Capital fund in Senegal.

Without greater regional and continental co-ordination, national strategies will not achieve digital transformation. The rise of digital technologies poses new and complex challenges to country-level regulators, including taxation in the digital age, digital security, privacy, personal data protection and cross-border flows of data. The fast development of technologies, their global reach and their cross-border nature − to which governments need to respond with “fit-for-purpose” regulatory frameworks and enforcement mechanisms − magnify these challenges (OECD, 2019). Most national strategies aim at turning a country into a “regional digital hub” but do not prioritise regional and continental co-operation. National regulatory agencies cannot deal with technology-related challenges in isolation. If governments do not fix the issues at the regional and continental levels, they may not be able to realise the full potential of digital transformation for African firms and job creation. As of today, only 28 countries in Africa have personal data protection legislation in place, while 11 have adopted substantive laws on cybercrime. Serianu (2017) estimates that the cost of cybercrime in Africa was about USD 3.5 billion in 2017.

The joint AUC/OECD 2020 Expert Survey carried out for this report identified three policy areas for regional and continental co-operation to help create more and better jobs (Figure 7):

Tackling these issues at the regional and continental levels will enable Africa’s governments to reap the broader benefits of their digitalisation strategies. For example, the expansion of physical infrastructure should go hand-in-hand with regulatory policies promoting affordable access to bandwidth. Accelerating co-operation on roaming services, data regulation and digital security will increase intra-African trade and productive integration. Progress in these three areas will pave the way for achieving a pan-African digital single market by 2030 and for implementing the African Union Commission’s Digital Transformation Strategy for Africa (DST) 2020-2030. The DST envisions an “integrated and inclusive digital society and economy in Africa that improves the quality of life of Africa’s citizens, strengthen[s] the existing economic sector, enable[s] its diversification and development, and ensure[s] continental ownership with Africa as a producer and not only a consumer in the global economy”.

References

AfDB/OECD/UNDP (2017), African Economic Outlook 2017: Entrepreneurship and Industrialisation, OECD Publishing, Paris, https://doi.org/10.1787/aeo-2017-en.

Afrobarometer (2019), Afrobarometer (database), https://afrobarometer.org/fr (accessed 13 October 2020).

AUC/OECD (2019), Africa’s Development Dynamics 2019: Achieving Productive Transformation, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/c1cd7de0-en.

AUDA-NEPAD (2020), “PIDA projects dashboard”, Virtual PIDA Information Centre, Programme for Infrastructure Development in Africa and African Union Development Agency-NEPAD, www.au-pida.org/pida-projects/ (accessed 20 July 2020).

Djiofack, C. Z., H. Dudu and A. G. Zeufack (2020), “Assessing COVID-19’s economic impact in sub-Saharan Africa: Insights from a CGE model”, in COVID-19 in Developing Economies, VoxEU, CEPR Press, London, pp. 53-68, https://voxeu.org/content/covid-19-developing-economies (accessed 23 July 2020).

Gallup (2019), Gallup World Poll, www.gallup.com/analytics/232838/world-poll.aspx (accessed 15 December 2019).

GSMA (2020), GSMA Intelligence (database), www.gsmaintelligence.com/data/ (accessed 28 June 2020).

Hamilton Research (2020), “Africa: Africa’s operational fibre optic network reaches 1 million route kilometres”, Africa Bandwidth Maps, www.africabandwidthmaps.com/?p=6158.

ICA (2018), Infrastructure Financing Trends in Africa: 2018, Infrastructure Consortium for Africa, Abidjan, Côte d’Ivoire, www.icafrica.org/fileadmin/documents/IFT_2018/ICA_Infrastructure_Financing_Trends_in_Africa_-_2018_Final_En.pdf.

IMF (2020), World Economic Outlook, April 2020 Edition (database), International Monetary Fund, Washington, DC, www.imf.org/external/pubs/ft/weo/2020/01/weodata/index.aspx (accessed 9 July 2020).

Kim, J. et al. (2020), “Scaling up disruptive agricultural technologies in Africa”, International Development in Focus, World Bank, Washington, DC, https://doi.org/10.1596/978-1-4648-1522-5.

OECD (2019), Regulatory Effectiveness in the Era of Digitalisation, www.oecd.org/gov/regulatory-policy/Regulatory-effectiveness-in-the-era-of-digitalisation.pdf.

OECD/ATAF/AUC (2019), Revenue Statistics in Africa 2019: 1990-2017, OECD Publishing, Paris, www.oecd.org/tax/revenue-statistics-in-africa-2617653x.htm (accessed 8 July 2020).

OECD-DAC (2020a), International Development Statistics (database), www.oecd.org/dac/stats/idsonline.htm (accessed 5 July 2020).

OECD-DAC (2020b), Country Programmable Aid (database), www.oecd.org/dac/financing-sustainabledevelopment/development-finance-standards/cpa.htm (accessed 5 July 2020).

Oludimu, T. (2018), “2 years after Mark Zuckerberg came to Nigeria …”, Techpoint Africa, https://techpoint.africa/2018/08/30/mark-zuckerberg-nigeria-initiatives/ (accessed 19 July 2020).

Serianu (2017), Africa Cyber Security Report 2017: Demystifying Africa’s Cyber Security Poverty Line, Nairobi, www.serianu.com/downloads/AfricaCyberSecurityReport2017.pdf (accessed 27 July 2020).

Thakur, D. and L. Potter (2018), Universal Service and Access Funds: An Untapped Resource to Close the Gender Digital Divide, World Wide Web Foundation, Washington, DC, http://webfoundation.org/docs/2018/03/Using-USAFs-to-Close-the-Gender-Digital-Divide-in-Africa.pdf.

UNCTAD (2020), World Investment Report 2020, Statistical annex tables, United Nations Conference on Trade and Development, https://unctad.org/en/Pages/DIAE/World%20Investment%20Report/Annex-Tables.aspx (accessed 9 July 2020).

UNECA (2020), “COVID-19: Lockdown exit strategies for Africa”, United Nations Economic Commission for Africa, Addis Ababa, www.uneca.org/sites/default/files/PublicationFiles/ecarprt_covidexitstrategis_eng_9may.pdf (accessed 13 October 2020).

Wittgenstein Centre for Demography and Global Human Capital (2018), Wittgenstein Centre Data Explorer Version 2.0 (Beta) (database), www.wittgensteincentre.org/dataexplorer (accessed 13 October 2020).

World Bank (2020a), KNOMAD Remittances Data (database) www.knomad.org/data/remittances (accessed 1 May 2020).

World Bank (2020b), World Bank Enterprise Surveys (database), www.enterprisesurveys.org/en/data.

Note

← 1. Globally, the highest total entrepreneurial activity rates for women are found in sub-Saharan Africa (21.8% to 25.0%), followed by Latin America and the Caribbean (17.3%), while the global average rate is 10.2%. In Nigeria, nearly four in every ten working-age women are engaged in early-stage entrepreneurial activity (40.7%).