Economic context and the SME sector in the Western Balkans and Turkey

Economies were hit hard by the COVID-19 pandemic but rebounded steadily

The COVID-19 crisis significantly impacted the Western Balkans and Turkey (WBT), as the lockdown measures adopted to contain the pandemic severely disrupted economic activity across the region.

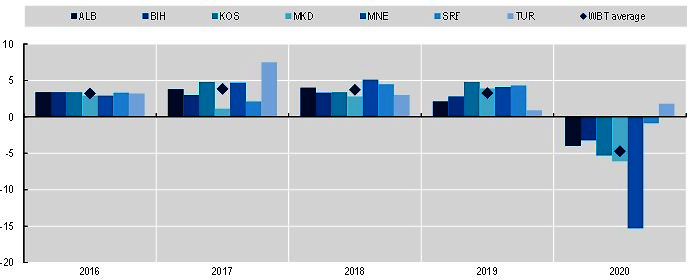

In 2020, the Western Balkans’ gross domestic product (GDP) contracted by 3.3% on the back of falling domestic demand, investment and exports. Higher consumption by the region’s public sector and lower imports partially offset the output losses, preventing a larger economic contraction (European Commission, 2021[1]). However, the degree to which each economy has been affected by the COVID-19 crisis has depended on key economic fundamentals, the strength of the fiscal response, as well as the relative strength of the pandemic wave (OECD, 2021[2]). Montenegro was by far the most badly affected economy in the region due to its high dependence on tourism and its limited fiscal scope for stronger support measures in light of its high level of public debt. As a result, Montenegro’s annual GDP declined by 15.2% in 2020 (Figure 1). Turkey, on the other hand, recorded a GDP growth of 1.8%, primarily driven by a sizeable policy stimulus focused on lending. Annual credit growth accelerated significantly to 35.4% in 2020, from 24% in 2019 (European Commission, 2021[1]). This growth, however, increased inflation, widened the current account deficit and created concerns about fiscal sustainability (OECD, 2021[3]).

In 2021, following the relaxation of COVID-19 containment measures, the Western Balkans and Turkey had recorded solid economic performance, underpinned by strong external and domestic demand. The Western Balkans’ GDP expanded by 7.6%, boosting employment growth and narrowing current account deficits. The current account deficit in the Western Balkans stood at 4.8% of GDP in 2021, the lowest level in the last ten years. The average rate of employment growth was 1.2%, compared to a decline of 1.5% in 2020 (European Commission, 2022[4]).

A similar performance was also observed in Turkey. The Turkish economy grew by 11% in 2021, boosted by strong exports and high consumer spending. Exports of goods reached a record high in 2021, with Turkey benefiting from supply-chain disruption in Asia and the lira depreciation. Domestic demand has been continuously supported by strong credit growth and facilitated by expansionary monetary policy despite high inflation. Employment has recovered to pre-pandemic levels, helped by the rebound in economic activity (OECD, 2022[5]).

Recovery from COVID-19 was cut short by another shock caused by the Russian aggression against Ukraine

After a strong recovery in 2021, growth is expected to moderate in the Western Balkans and Turkey as a result of the Russian invasion of Ukraine. Despite the uncertainty concerning the duration of the conflict and evolving political developments, the region is poised to experience negative economic implications from the war and of the sanctions imposed on the Russian Federation (hereafter “Russia”), threatening the momentum of continued economic recovery from the pandemic.

The Western Balkan economies are particularly vulnerable to the war’s economic impact due to their relatively small size, openness and dependence on imports. The increased commodity prices will squeeze household budgets, lowering consumption. Amid the uncertain global economic outlook, investment and capital flows to the region are expected to reduce in the short term. Trade disruptions will negatively affect business activity, particularly in sectors more closely integrated in the global value chains (GVCs), such as automotive. Moreover, tourism revenues for Albania and Montenegro may dwindle as there will be a drop in Russian and Ukrainian tourists and potentially less global travel. All these factors will put downward pressure on the region’s economic growth.

In Turkey, increased commodity prices will also lead to high inflation, limiting consumer spending. At the time of writing, with 72%, Turkey had the highest inflation projection for 2022 among OECD countries. Investment will be held back by uncertainty about geopolitical factors and financial conditions. Moreover, Turkey is likely to experience a drop in the number of Russian and Ukrainian tourists, which account for about 15% of its overall tourism revenues (OECD, 2021[3]).

SMEs remain dominant in the region

In 2020, small and medium-sized enterprises (SMEs) made up 99.7% of all enterprises in the WBT region, with microenterprises accounting for the vast majority (90.1%).

There is a trend of increasing SMEs per inhabitant, with an average increase of 13.1% in the WBT region since 2017 (Table 1). This potentially points to an improved business environment, most notably to simplified procedures for starting a business and measures tackling informality, as well as to a maturing entrepreneurial culture. However, some caution is warranted in interpreting the data, as the scale of permanent business closures due to the COVID-19 crisis may yet to be fully reflected in official statistics. There is, however, some preliminary evidence that government measures across the region may have prevented a massive wave of business closures. However, as support will be phased out, businesses that have hung on may eventually collapse on the back of increasing debt.

Montenegro has the largest number of SMEs per inhabitant, followed by Serbia and Turkey. Montenegro’s SME landscape is dominated by a large number of microenterprises in services, commensurate with the large contributions of the tourism sector to the economy.

Moreover, there is some evidence indicating increased productivity of the WBT region’s SMEs since 2017, as their share of total value added increased, whereas their share in total business employment decreased. They accounted for an average of 71.9% of business employment, a slight decrease of 1.3 percentage points since 2017. However, 65% of the business sector’s value added in 2020 was up by 0.6 percentage points over 2017.

Nevertheless, SMEs’ contributions to employment and value added vary heavily between economies, with spreads of 18.5 percentage points and 24.2 percentage points respectively. SMEs in Bosnia and Herzegovina contribute the least to overall business employment, at approximately 63.1% of total business employment. This attests to the over-presence of large state-owned enterprises, which employ approximately 80 000 people and account for an estimated 11% of national employment in Bosnia and Herzegovina. By contrast, Albania’s SMEs account for 81.6% of the economy’s total business employment. On average, an Albanian SME, excluding entrepreneurs, employs 5.5 persons, the highest in the WBT region, which raises concerns about the SMEs’ productivity.

Meanwhile, the value added of SMEs in Turkey only accounts for 52.8% of GDP, down from 54.1% in 2017, highlighting the pandemic’s disproportionately negative impact on SMEs. Amongst the WBT economies, only SMEs in Turkey had a lower share in value added than the EU average of 53.0% (European Commission, 2021[6]). By contrast, Montenegro’s SMEs contribute 77% of value added to GDP, up by 6.5 percentage points in the same period.

SMEs’ share of exports in the WBT region experienced a sharp decline of 8.4% during the assessment period, pointing to SMEs’ difficulties in exporting goods during the COVID-19 pandemic (see Dimension 10. Internationalisation of SMEs). This is partially expected, as there is an above average representation of SMEs in sectors hit hardest by the COVID-19 crisis (e.g. manufacturing, wholesale and retail trade), while SMEs in the most affected sectors are relatively likelier to export than larger firms (OECD, 2020[7]). In the Western Balkans and Turkey, SMEs’ limited adoption of digital technologies may have further hindered their capacity to diversify export markets.

Across the region, the only exception is Albania, where SMEs have increased their export share by 4.5%. The economy’s large clothing and footwear exports, mostly by SMEs, have remained relatively resilient during the pandemic, potentially benefitting from supply-chain disruptions in Asia. Moreover, out of all WBT economies, Albanian SMEs enjoyed the highest share of exports, amounting to 64% in 2020.

Table 2 provides detailed data on the characteristics of the SME sector in the WBT region.

The WBT region’s enterprises remain oriented towards services, with SMEs’ sectoral distribution strongly clustered in wholesale, transportation, accommodation and food, and real estate (Table 3). Manufacturing SMEs make up close to 13% of all enterprises in the entire region, with North Macedonia having the highest share (24.7%).

The COVID-19 pandemic threatened the survival of SMEs while accelerating their digital transformation

In 2020, sudden loss of demand and revenue induced by the COVID-19 containment measures hit enterprises in the WBT region hard. The situation was more severe for SMEs than for larger enterprises, as they traditionally have limited financial resources to withstand a long-lasting crisis. To address SMEs’ cash-flow problems and prevent them from going bankrupt, the six Western Balkan economies and Turkey introduced financial instruments to contribute to covering enterprises’ operations costs, such as staff salaries and rents, during the pandemic. They also introduced measures to defer various payments, such as income tax or value-added tax, which eased SMEs’ liquidity constraints (OECD, 2020[9]).

SMEs across the region also had a lower capacity to shift to teleworking and digital work processes. They were thus more likely to experience shortages in labour and to face difficulties in ensuring operational continuity in the context of movement restrictions. In fact, about half of enterprises in the Western Balkans had to temporarily discontinue their business activity due to COVID-19.1 The pandemic brought about the need for SMEs to embrace digital technologies, which triggered a digitalisation push in the Western Balkans and Turkey. The region’s governments introduced various measures to help SMEs tap into the economic benefits of digital transformation and strengthen their resilience against future shocks (Box 1).

The digital transformation carries significant potential to strengthen SME productivity and competitiveness, as the increased adoption of digital tools allows businesses to save time, reach customers more efficiently, drive innovation and adopt increasingly flexible practices (OECD, 2021[10]). Given the importance of SMEs for the EU and WBT economies, ensuring that they capture the benefits of the digital transition is essential to enhancing their overall competitiveness, in line with the European Union’s Digital Agenda and its targets (EC, 2020[11]).

The COVID-19 pandemic accelerated businesses’ adoption of digital technologies, propelling SMEs in the WBT region to increasingly adopt digital tools. SMEs in the region are starting to close the gap with larger companies. For example, in Serbia in 2012, only 70.3% of small enterprises had a website, compared to 89.3% of large enterprises. In 2021, the share of businesses with a website increased to 81.6% for small enterprises and 96.6% for large enterprises (Republic Statistical Office, 2022[12]).1 Moreover, in 2020, 14% of SMEs in Turkey, 13% in Montenegro, 10% in Bosnia and Herzegovina and 9% in Serbia started or increased their efforts to sell goods on line, in line with the EU average of 11% (Eurostat, 2022[13]).

However, despite this positive trend, SMEs in the WBT region are lagging behind their counterparts in the European Union when it comes to adopting more advanced digital transformation technologies. The average share of SMEs using cloud computing services in the WBT region was 17% in 2020, below the EU average of 40% (Eurostat, 2022[14]). Similarly, the share of SMEs analysing big data internally was lower in the WBT region in 2020, at 7.8%, compared to the EU average of 12% (Eurostat, 2022[15]). The percentage of SMEs using artificial intelligence in 2021 was also lower in the region (on average 2.4%) than in the European Union (on average 7%) (Eurostat, 2022[16]).

Given the general importance of digitalisation of businesses and the impulse that came with the pandemic, governments in the WBT economies have started to put an increased focus on SME digitalisation:

Montenegro’s Programme for Advancing the Competitiveness of the Economy, implemented by the Ministry of Economic Development, allocates financial support to the digitalisation of SMEs and subsidises SME procurement of information and communication technology (ICT) software and ICT skills trainings. From 2020 to 2022, the budget allocated for digitalisation doubled from EUR 200 000 in 2020 to EUR 400 000 in 2022 (Ministry of Economic Development, 2022[17]).

Since 2019, North Macedonia has been implementing its Programme for Competitiveness, Innovation and Entrepreneurship, implemented by the Ministry of Economy. The programme consists of subsidies, grants, and services that aim to support SMEs in adopting digital tools and practices. Following the COVID-19 pandemic outbreak, the Government of North Macedonia provided additional support to SMEs through grants, including through the procurement of digital tools and the digitalisation of their business practices.

In 2020, the Republika Srpska Chamber of Commerce established a Centre for Digital Transformation. The centre provides support to businesses through trainings on adopting digital processes and developing ICT skills.

Going forward, to fully capitalise on the benefits of the digital transition, the WBT economies would benefit from stepping up partnerships with business associations and chambers of commerce. This co-operation would, among others, help the governments better adapt education curricula and upskilling initiatives to businesses’ digital needs. Moreover, comprehensive support for digitalisation would require additional financial resources. As such, partnerships with international development co-operation partners and financial institutions will be key to ensuring the availability of funding to support firms’ digitalisation (OECD, 2021[2]).

← 1. Montenegro’s share increased from 53.1% in 2012 for all enterprise size classes to 84.6% in 2021 (Monstat, 2022[18]). In Turkey, from 2012 to 2019, it increased from 58% to 66.6%, although a large difference is still observable between small, medium and large enterprises (TUIK, 2022[19]).

Sources: (EC, 2020[11]); (OECD, 2021[10]); (Republic Statistical Office, 2022[12]); (Monstat, 2022[18]); (TUIK, 2022[19]); (Eurostat, 2022[14]); (Ministry of Economic Development, 2022[17]); (OECD, 2021[2]); inputs provided by the WBT economies as part of the assessment.

In addition to the massive drop in turnovers and labour shortages, SMEs that were dependent on imported components and raw materials to produce final products also encountered supply-chain disruptions, further aggravating their challenges. This particularly affected SMEs with high levels of exposure within GVCs. Companies in North Macedonia and Serbia, particularly those operating in the automotive and machinery sectors, have the highest level of integration across sectors. Conversely, enterprises in Albania and Bosnia and Herzegovina remain without a strong link to GVCs (World Bank, 2020[20]).

The Russian aggression against Ukraine presents a new set of challenges for SMEs

With the relaxation of COVID-19 containment measures, the demand for products and services rebounded in the WBT economies, supporting SMEs’ recovery from the pandemic. However, the Russian invasion of Ukraine and the sanctions imposed on Russia will create new challenges for enterprises.

Most crucially, surging prices of key commodities will increase the operational costs and negatively affect the liquidity of businesses, exacerbating their financial challenges. With their limited scope to rely on self-financing and difficulties in accessing traditional bank finance, SMEs will be particularly hard hit by the war’s inflation shock. Securing additional financing to avoid cash-flow problems comes at a difficult time for the region’s SMEs. Due to the pandemic, the debt burden of businesses has already been on the rise across the region. In 2020 alone, domestic credit to the private sector, as a percentage of GDP, increased, on average, by close to 5.5 percentage points (OECD, forthcoming).2

The war’s economic impact on rising oil and gas prices poses a particular risk for businesses in energy-intensive sectors (e.g. automotive, chemicals and metals) and for which transport costs constitute a high share of their total operating costs. With one-third of all SMEs operating in the manufacturing and transportation sectors, surging energy prices will be more challenging for SMEs in North Macedonia and Turkey (Table 3)

Given price increases of energy and other key inputs, increased implementation of resource efficiency and conservation, and more broadly of sustainable operations, will become key to enterprises’ competitiveness in the Western Balkans and Turkey. The region’s governments’ recent initiatives, broadly grouped under their “Green Deal” strategies, are a good step in the right direction to strengthen SMEs’ resilience against future external shocks (Box 2).

In 2020, the European Commission approved the European Green Deal, introducing a set of policy initiatives with the objective of making the European Union climate neutral in 2050. Based on the same set of principles of the European Green Deal, the European Commission unveiled the Green Agenda for the Western Balkans in 2021, whereas Turkey launched its own Green Deal Action Plan the same year. These strategies and action plans aim to align the Western Balkans and Turkey with the European Green Deal and facilitate the region’s transition to sustainable economic models.

In this context, SMEs play a key role in achieving the net-zero goal for greenhouse gas emissions (GHG). Though their individual emissions are generally small, SMEs account for 50% of the world’s total GHG emissions (ICT, 2021[21]). Nevertheless, they usually lack the knowledge and necessary financial resources to reduce emissions and adopt green business models. External shocks like the COVID-19 pandemic and the Russian invasion of Ukraine have also shifted the focus away from greening efforts, when SMEs’ priority has been to keep their businesses afloat.

Greening operations is not necessarily a cost of doing business; SMEs have much to benefit from participating actively in this transition. New green markets, such as the circular economy, can create new business opportunities for SMEs. Given their agility, they are better placed than large enterprises to be a source of innovation and solutions to develop the technologies needed to address environmental challenges. However, even without moving into new markets, SMEs can potentially improve their business performance by realising efficiency gains and cost reductions by greening their products, services and processes.

Greening efforts have recently gained momentum within the region, particularly for the six Western Balkan economies, as Turkey has been the regional frontrunner in this regard. The share of SMEs offering green products or services has increased in almost all WBT economies, reaching 36% of SMEs in North Macedonia, an even higher proportion than the EU average. The majority of the region’s SMEs took at least one action to become more resource-efficient, in particular minimising waste or saving energy or water. Turkey’s SMEs performed better than those of the European Union in undertaking resource efficiency measures, in particular by saving materials (74%), minimising waste (73%) and saving water and energy (65% each).

Environmental policies targeting SMEs are increasingly included in WBT economies’ strategic documents and are implemented accordingly:

Circular economy frameworks are incrementally being developed, with Montenegro and Serbia having prepared their roadmaps towards circular economy, serving as guiding documents for the development of respective strategic documents. The promotion of circular economy concepts is starting, in particular in Serbia, with its digital platform (https://circulareconomy-serbia.com) and in Turkey, through regular workshops by the economy’s SME Development Agency (KOSGEB).

Financial incentives for SME greening have multiplied, most of which target energy efficiency and renewable energy projects. Financial instruments are made available by governments, public financial institutions and international support programmes as well as via Green Funds (Montenegro and North Macedonia have established theirs since 2019, with a EUR 1.6 million budget in 2021 and an expected budget of EUR 36.3 million, respectively), mainly through interest rate loans or grants.

Information-based tools for the greening of businesses have been scaled up in the region. Chambers of commerce and business associations are increasingly involved in providing advice and guidance to SMEs, particularly in Montenegro through its Committee on Energy Efficiency, and Serbia through its web-based guidance tools and digital platforms. In Turkey, business associations, such as the Business Council for Sustainable Development (SKD Turkey), have their own SME greening policies.

Green public procurement is envisaged in laws and strategies in the majority of WBT economies and can play a significant role in creating demand for green products and services. While this option has been insufficiently used in practice, trainings and awareness-raising activities aimed at public administrations and enterprises to encourage the use of green public procurement have been conducted in Montenegro and Serbia.

Sources: European Commission (2020[22]), (2022[23]); Government of Turkey (2021[24]); inputs provided by the WBT economies as part of the assessment.

References

[11] EC (2020), Communication: Shaping Europe’s Digital Future, https://ec.europa.eu/info/sites/default/files/communication-shaping-europes-digital-future-feb2020_en_4.pdf.

[4] European Commission (2022), EU Candidate Countries’ and Potential Candidates’ Economic Quarterly (CEEQ) Q1 2022, https://ec.europa.eu/info/sites/default/files/economy-finance/tp056_en.pdf.

[23] European Commission (2022), Eurobarometer: SMEs, Resource Efficiency and Green Markets, European Commission, Brussels, https://europa.eu/eurobarometer/surveys/detail/2287.

[1] European Commission (2021), EU Candidate Countries’ & Potential Candidates’ Economic Quarterly (CCEQ) – Q1 2021, https://doi.org/10.2765/76194.

[6] European Commission (2021), SME Annual Report 2020/21, https://ec.europa.eu/docsroom/documents/46062 (accessed on 13 June 2022).

[22] European Commission (2020), Green Agenda for the Western Balkans, https://ec.europa.eu/neighbourhood-enlargement/system/files/2020-10/green_agenda_for_the_western_balkans_en.pdf.

[16] Eurostat (2022), Artificial Intelligence, https://ec.europa.eu/eurostat/databrowser/view/ISOC_EB_AI__custom_2794125/default/table?lang=en.

[15] Eurostat (2022), Big Data Analysis, https://ec.europa.eu/eurostat/databrowser/view/ISOC_EB_BD__custom_2635643/default/table?lang=en (accessed on 3 May 2022).

[14] Eurostat (2022), Cloud Computing Services, https://ec.europa.eu/eurostat/databrowser/view/ISOC_CICCE_USE__custom_2635520/default/table?lang=en (accessed on 3 May 2022).

[13] Eurostat (2022), COVID-19 Impact on ICT Usage, https://ec.europa.eu/eurostat/databrowser/view/ISOC_E_CVD__custom_2603416/default/table?lang=en (accessed on 28 April 2022).

[25] Eurostat (2021), Youth unemployment rate (age 15-24), https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Youth_unemployment.

[24] Government of Turkey (2021), Green Deal Action Plan.

[21] ICT (2021), SME Competitiveness Outlook 2021: Empowering the Green Recovery, International Trade Center, Geneva, https://www.intracen.org/publications/smeco2021/ITCSMECO2021.

[17] Ministry of Economic Development (2022), Programme for Improving the Competitiveness of the Economy 2022, https://www.gov.me/clanak/program-za-unapredenje-konkurentnosti-privrede-za-2022-godinu.

[8] Ministry of Economy of the Republic of Serbia (2020), Report on Small and Medium-sized Enterprises and Entrepreneurship, 2020.

[18] Monstat (2022), ICT use in enterprises, https://www.monstat.org/cg/page.php?id=1847&pageid=1847.

[5] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 1: Preliminary version, OECD Publishing, Paris, https://doi.org/10.1787/62d0ca31-en.

[2] OECD (2021), Competitiveness in South East Europe 2021: A Policy Outlook, Competitiveness and Private Sector Development, OECD Publishing, Paris, https://doi.org/10.1787/dcbc2ea9-en.

[3] OECD (2021), OECD Economic Outlook, Volume 2021 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/66c5ac2c-en (accessed on 9 June 2022).

[10] OECD (2021), OECD Entrepreneurship Papers: SME Digitalisation to “Build Back Better”, https://www.oecd-ilibrary.org/economics/sme-digitalisation-to-build-back-better_50193089-en;jsessionid=6ERNTSPdSIcslTA7o0cKrxpY.ip-10-240-5-148.

[7] OECD (2020), Coronavirus (COVID-19): SME Policy Responses - OECD, https://read.oecd-ilibrary.org/view/?ref=119_119680-di6h3qgi4x&title=Covid-19_SME_Policy_Responses (accessed on 13 June 2022).

[9] OECD (2020), The COVID-19 Crisis in the Western Balkans: Economic Impact, Policy Responses, and Short-term Sustainable Solutions, OECD, Paris, https://www.oecd.org/south-east-europe/COVID-19-Crisis-Response-Western-Balkans.pdf.

[12] Republic Statistical Office (2022), Enterprises using computer and internet in their business practices and enterprises that have a website, by enterprise size class, https://data.stat.gov.rs/Home/Result/270302?languageCode=sr-Cyrl (accessed on 28 April 2022).

[19] TUIK (2022), Enterprises which have website or home page by economic activity and size group, https://data.tuik.gov.tr/Kategori/GetKategori?p=Science,-Technology-and-Information-Society-102 (accessed on 3 May 2022).

[20] World Bank (2020), The Western Balkans should leverage Foreign Direct Investment to integrate in global value chains, https://blogs.worldbank.org/psd/western-balkans-should-leverage-foreign-direct-investment-integrate-global-value-chains.

Notes

← 1. The data comes from a business survey conducted in the Western Balkans in 2020 by the OECD.

← 2. Domestic credit to private sector data was retrieved from data.worldbank.org on 30 May 2022. The data includes the six Western Balkan economies and Turkey.