Czech Republic

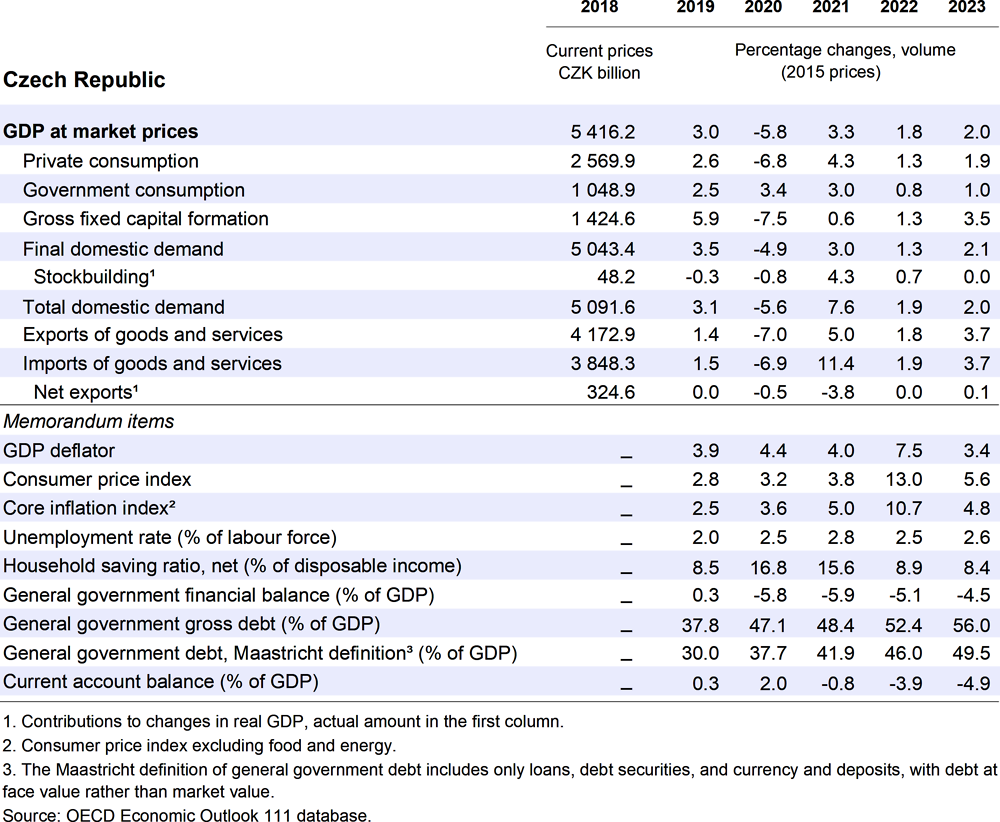

The Czech economy is projected to grow by 1.8% in 2022 and 2% in 2023. The recovery is facing headwinds from further supply disruptions, rising prices and overall uncertainty related to the war in Ukraine. Trade and manufacturing output will slow. A tight labour market will buttress private incomes, but weaker sentiment and rising prices will weigh on domestic demand. Inflation is expected to increase further, before gradually returning towards the tolerance band around the 2% target.

Since June 2021, the Czech National Bank has cumulatively raised its policy interest rate by 550 basis points, to 5.75% in May 2022 and further rate rises are assumed until the summer of 2022. A gradual fiscal consolidation in structural terms is planned from this year onwards. Targeted income-support measures are appropriate to protect the vulnerable from rising energy prices. A stronger framework for immigration policy and programmes to support the integration of refugees into the labour market would help ease recurring labour shortages.

The recovery is slowing

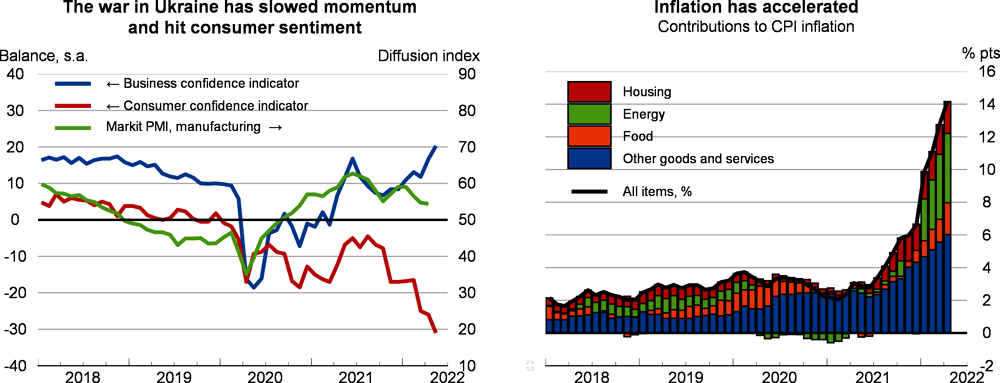

Adverse impacts on global trade and supply chains and upward pressures on energy and commodity prices from the war in Ukraine have slowed the recovery. The growth of manufacturing activity and exports has eased. Economic sentiment has deteriorated in some sectors, notably for households who face steep rises in consumer prices. Consumer price inflation reached 14.2% in April and exchange rate volatility rose. The labour market remains tight, with the unemployment rate at 2.4% in the first quarter of 2022. Yet, nominal wages have grown more slowly than consumer prices, and real wages are falling.

Due to its specialisation in manufacturing – the automotive sector in particular – the Czech Republic is highly vulnerable to disruptions in global supply chains and rising prices of raw materials. It also relies heavily on energy imports from Russia. Moreover, in its efforts to phase out coal, the Czech Republic planned to rely increasingly on natural gas. Until end-May 2022, the Czech Republic issued the status of temporary protection to around 350 000 Ukrainian refugees (3% of the total population). The authorities have introduced a “humanitarian benefit” targeted on the refugees, and made their employment administratively easier. Around 50 000 refugees have already found employment.

Fiscal policy has room to protect the most vulnerable

Given accelerating inflation and signs of de-anchoring of inflation expectations, the Czech National Bank (CNB) raised the policy interest rate from 0.25% to 5.75% between June 2021 and May 2022. The CNB has also intervened in the foreign exchange market to stave off depreciation pressures. The projections assume that the policy interest rate will rise further, to 6.25% in June. In addition, the CNB decided to increase the countercyclical capital buffer rate for exposures located in the Czech Republic in incremental steps from 0.5% to 1% (effective from 1 July 2022), with subsequent intermediate steps to 2.5% from April 2023. The CNB also reintroduced limits on new mortgage loans (based on debt-to-income and debt service-to-income ratios) to limit risks accumulating in the housing market. To protect households and firms from rising prices, and energy costs in particular, a variety of fiscal measures have been introduced. These include a temporary reduction in the excise duty on diesel and petrol, state guarantees for loans to the SMEs affected by rising energy costs, a delay of VAT payments for firms in the transport sector, and increased and extended housing allowances. Moreover, the necessary public support services for refugees also require additional expenses. Overall, however, the government has set out to tighten fiscal policy over the medium term, and fiscal consolidation in structural terms is projected for 2022 and 2023, as budgeted.

Growth will remain moderate in 2023

GDP growth will slow in 2022. Trade and private investment will weaken due to global supply disruptions. Weaker sentiment and rising prices will damp private consumption, although still elevated savings and a tight labour market will support it. After rising further in 2022, inflation will start to subside in the second half of 2022. The decline in inflation will be only gradual due to further oil price increases – in early 2023 – related to the oil embargo. GDP growth will remain moderate in 2023. The impact of the Ukraine crisis on global supply chains and prices will fade and exports and investment will pick up, but rising prices will continue to hinder domestic demand. Uncertainty is very high. Prolonged pressures on global supply chains would raise inflation further and depreciate the exchange rate, which could force the CNB to tighten monetary policy even more forcefully. A prolonged energy crisis – even higher energy prices or a disruption to energy supplies – and additional large influx of refugees could result in higher pressures on public spending.

Unleashing labour supply and greening the economy would support growth

The CNB has appropriately tightened monetary policy to counter the rapid pick-up in consumer prices and concerns about inflation expectations. On the fiscal side, support measures to cushion rising energy prices should balance the immediate need for energy security and protection of disposable incomes with getting on the path towards a decarbonised economy. Moreover, it is important that public debt be put on a sustainable path in the long-term, notably by reforming the pension system. Boosting domestic labour supply (through increased employment of mothers and older workers), better matching skills provision with skills needs and using immigration policy more effectively would help attract and retain a productive and skilled labour force. Investment into renewable energy and electro mobility would decrease reliance on the gas and oil markets and help the recovery.