Executive Summary

The economy has rebounded strongly from the COVID-19 pandemic and has proven resilient to the repercussions of Russia’s war of aggression against Ukraine. Timely policy support, a fast vaccination campaign, the strength of the high-tech sector and self-sufficiency in natural gas have mitigated both shocks. Growth is set to moderate but remain robust. Risks are elevated.

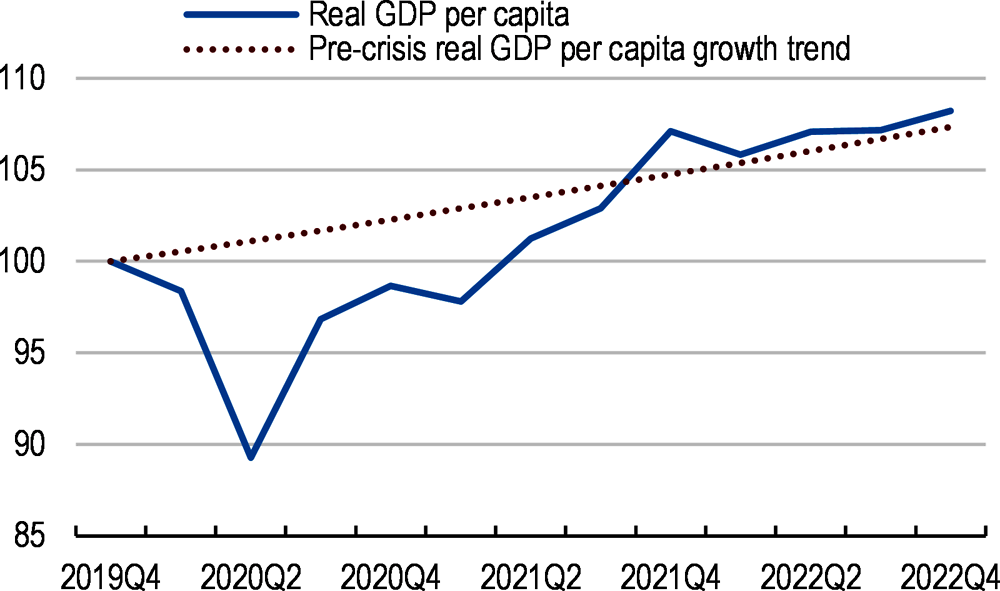

The economy has recovered but inflationary pressures emerged. Buoyant exports from the high-tech sector helped activity to rebound swiftly from the pandemic (Figure 1). The labour market has recovered and is tight despite some recent easing. Inflation has increased above the central bank’s 1-3% target range, and is broad-based. The authorities have mitigated some of the impact of the rise in the cost of living through income and energy price support measures.

Growth is set to moderate but will remain robust (Table 1). Israel’s self-sufficiency in natural gas mitigates global energy price pressures. Nevertheless, elevated inflation will slow real private consumption growth. The global slowdown is set to weaken demand from trading partners. Increasing interest rates will weigh on investment growth. Risks are skewed to the downside, related to high global and domestic uncertainty.

Monetary policy has tightened. Quantitative easing measures ended in late 2021 and the policy rate has been raised from 0.1% to 4.25% between April 2022 and February 2023. Given above-target inflation and robust domestic demand, tight monetary policy conditions should be maintained to bring inflation back into the target range.

Risks from the real estate sector should continue to be closely monitored. Non-performing loans are low and capital ratios exceed regulatory minima, but property prices have been rising fast. The high exposure of banks to the real estate sector requires close monitoring.

The budget balance has improved. The strong rebound has boosted revenues and the decline in morbidity allowed the authorities to withdraw pandemic support measures. Revenue growth has started to slow as the recovery moderates and some transitory factors, for example related to high real estate valuations, wane. Maintaining a neutral fiscal policy stance would avoid adding to inflationary pressures. Additional support to households and firms, if needed, should be temporary, targeted and maintain incentives for energy savings. Much higher tax rates of non-residential properties compared to residential properties discourage municipalities from expanding housing supply.

Long-term fiscal sustainability pressures need to be addressed. Demographic challenges, related to ageing and the rising share of population groups with weak labour market attachment will put pressure on spending. So will much-needed investment to boost infrastructure and skills. Maintaining long-term fiscal sustainability will require improved spending efficiency, gradually raising the retirement age, and increases in tax revenues. The fiscal framework can be strengthened including with a regular review of the fiscal rules to enhance their role as effective anchors of fiscal policy. A strong public integrity and anti-corruption framework is crucial to ensure the efficient use of public resources and foster business dynamism.

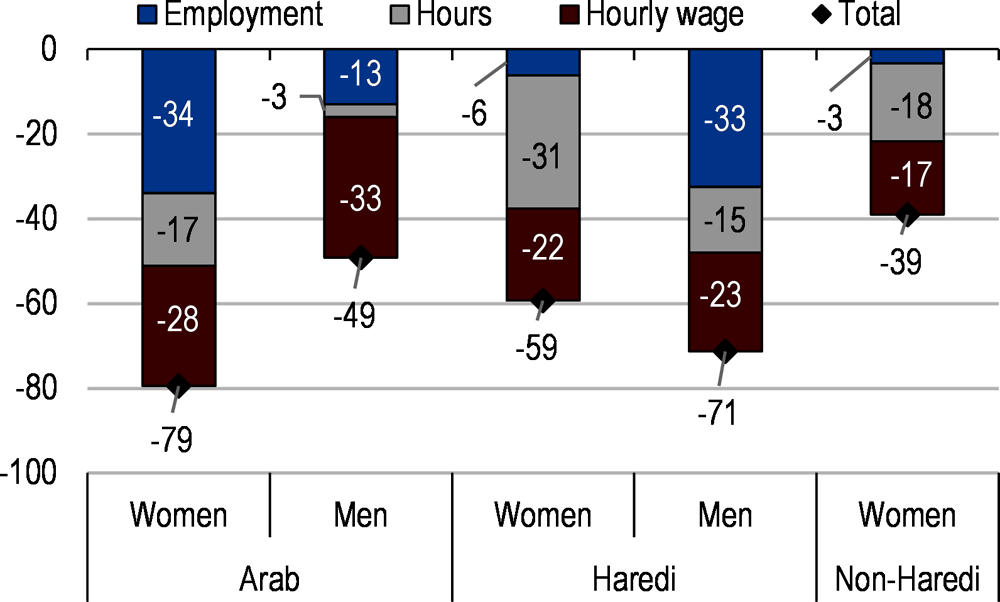

Employment gains have been strong and have supported progress in living standards in the past. Accelerating the integration of population groups with historically weak labour market attachment, which are projected to reach 50% of the population in 2060, from 30% today, is vital for future growth and fiscal sustainability. In addition, reducing large labour market income disparities (Figure 2) would improve opportunities for all and strengthen social cohesion.

Labour force participation has increased especially for women, but remains very low among Haredi (ultra-orthodox) men and Israeli-Arab women. Further expanding the earned income tax credit, especially for second earners, would support the working poor while strengthening incentives to work. Reforming childcare and seminary (yeshiva) student subsidies and conditions for draft exemptions would remove negative work incentives for Haredi men. Increasing the provision of child-care facilities in Arab municipalities would reduce participation barriers for Arab women.

The quality of schooling and skills varies widely, hampering labour market opportunities for a large share of the population and holding back productivity growth. Moderating the differences between the different school streams would improve employability and access to higher education. Strengthening work-based vocational training and pathways between educational levels, supported by a national qualifications framework, can improve opportunities for adults who left schools with inadequate skills for the labour market.

Reforms to foster labour mobility are needed to facilitate access to better-paying jobs. A comprehensive strategy to broaden the high-tech talent pool would alleviate the labour shortages of the sector and improve inclusiveness. Better transport, digital and housing infrastructure would help connect people to employment centres and tackle high costs of living in thriving regions.

Health outcomes are good overall and health spending is low, thanks to a young population and a focus on primary care. Ageing will aggravate doctor shortages especially in the northern and southern districts. The interaction between the public and private health care sector needs reform.

The number of domestically trained doctors is insufficient to meet the demands of strong population growth and ageing. Increasing the number of physicians can improve access to health care especially in the northern and southern districts, and mitigate wage pressures.

Reimbursement systems in the health care sector are not sufficiently cost-reflective, which may create distortions in service delivery. Refining and regularly updating payment systems can improve efficiency and reduce long waiting times in the public health sector.

Interactions between the public and private health care system have led to efficiency and equity concerns. The private health care sector expanded strongly, financed by voluntary health insurance. While over 80% of the population is covered by voluntary health insurance, coverage is lower for low-income groups. Competitive advantages of the private sector have led to outmigration of scarce human resources from the public sector, raising pressures on health costs.

Business R&D spending is the highest in the OECD. The pandemic has accelerated the digital transformation but gaps in internet use across population groups remain wide and firms lag in the adoption of advanced digital technologies especially in traditional sectors. Reducing these gaps can boost productivity growth and narrow the productivity divide between the high-tech sector and the rest of the economy.

High-speed internet access is lagging behind other OECD countries but is expanding fast, and so are digital government services. The government should closely monitor the deployment of high-speed internet in underserved areas and align subsidies with actual deployment costs if needed. A more flexible public pay system could help attract IT specialists to the public sector to boost digital government services.

Digital skills need to be strengthened for a large part of the population. Enrolment in ICT training should be further encouraged, for example via personal training accounts, and targeted in particular to workers with the weakest skills.

Fostering competition can strengthen incentives to adopt new technologies. Despite significant progress, barriers to foreign trade and investment remain high, with Israel’s foreign trade exposure lower than in other small OECD countries.

Financial market imperfections can hinder investment in intangible assets. Targeted support for technology adoption, especially for small firms in traditional sectors, can help overcome financing constraints.

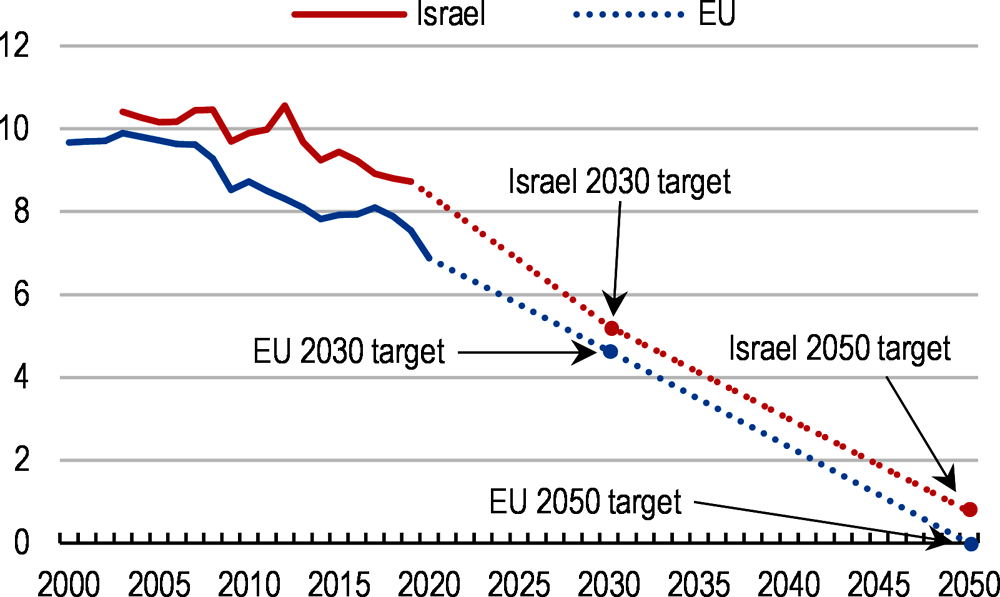

The carbon intensity of the economy declined but reaching the new and more ambitious national climate targets requires stepping up policy efforts (Figure 3)

Carbon prices outside the transport sector are too low to achieve environmental goals. Only 1% of Israel’s electricity-related carbon emissions are priced above EUR 5, one of the lowest shares across OECD countries. The planned increase of fuel excise taxes outside of transport should align carbon prices with environmental costs. Revenues can be used to mitigate distributional impacts, enhance energy efficiency and improve public transportation.

The share of renewable energy in electricity generation is one of the lowest in the OECD. Solar energy resources are abundant, but their expansion faces several barriers including available land, grid and storage capacity. Further developing the electricity wholesale market could strengthen investment incentives.