copy the linklink copied!Executive summary

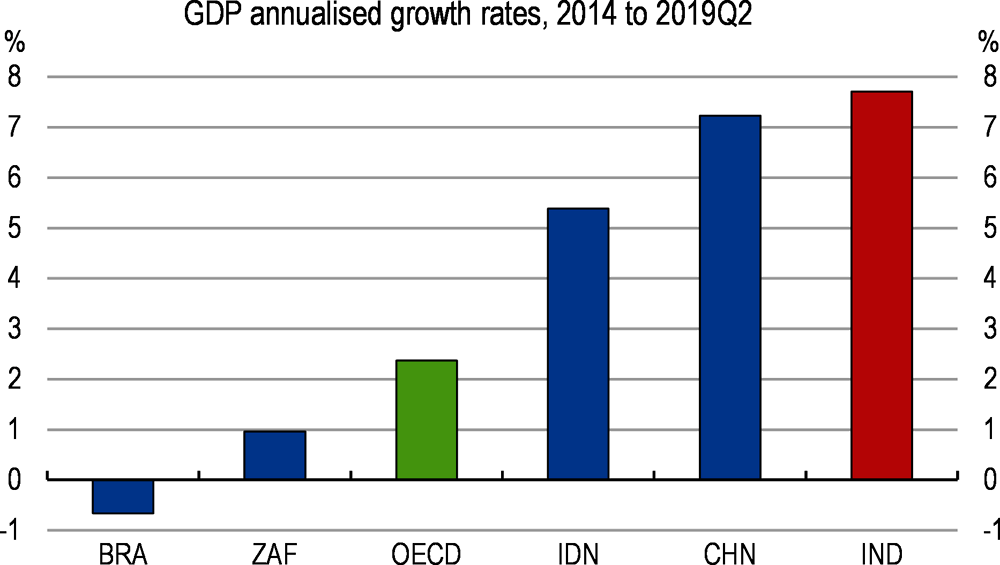

Income has increased fast in recent years but private investment has lagged behind and, recently, activity has slowed. Growth has been driven mainly by consumption. Industrial production and corporate investment have yet to adjust fully to measures to improve the ease of doing business and banks’ ability to lend.

Inflation has declined, but lending rates have not adjusted fully. The inflation-targeting regime adopted in 2016, combined with lower oil prices and improved functioning of agricultural markets, has brought down inflation from close to 10% in 2013 to below the 4% target since August 2018. Interest rates adjusted for inflation suggest still slow transmission and some room for accommodation in monetary policy.

The public debt-to-GDP ratio remains relatively high. The central government deficit and, more recently, state deficits have declined. However, off-budget financing has increased. Public sector borrowing needs have risen, at close to 8% of GDP according to OECD estimates (which exclude surplus from public financial corporations), potentially putting pressure on smaller companies’ borrowing costs.

Ambitious reforms have been passed; implementing them fully would boost incomes and wellbeing. The Goods and Services Tax (GST) has replaced a pile of indirect taxes, reducing domestic trade barriers and input costs. Together with cuts in corporate taxes, it should spur investment and productivity. Measures to simplify tax forms and processes are reducing compliance costs. Further streamlining GST exemptions and reducing the number of rates would promote tax compliance. Reforms in the real estate sector have increased transparency and governance to protect homebuyers. The Insolvency and Bankruptcy Code has reduced non-performing loans and should speed up the reallocation of resources from low productivity firms and sectors to more promising ones. Complying fully with the Code timelines would require increasing further the number of judicial professionals and benches.

The creation of quality jobs, under-employment and income inequality remain challenges. The employment rate has declined and is low, especially for women. When women have a job, they are often paid less. Labour laws are complex; some are particularly stringent for industrial firms, and most of them kick in when firms grow, deterring formal job creation. In practice, most workers are not covered by core labour laws and social security. Recent efforts to streamline labour regulations into four codes are welcome. To boost job creation and thus improve equity, efforts to modernise labour regulations should continue.

The government has launched various social welfare policy initiatives and envisages others. To eliminate open defecation, almost 100 million toilets have been built since October 2014, improving health outcomes. To empower women, a programme to reduce female infanticides and educate girls was introduced. Electricity reached all villages in 2018, though not all houses, and electricity outages remain frequent in some areas. The government has promised to bring piped drinking water to every home by 2024 and will accelerate the rural roads programme to better connect the poor in remote areas. The government has announced more generous hospital and retirement insurance schemes for informal workers and the creation of primary health care centres. The new income-support scheme for farmers, which comes over and above subsidies on fertilisers and other inputs, will reduce poverty in rural areas but may leave behind tenant farmers and labourers.

Access to public services is getting better but there is scope to improve their quality. The reform of price subsidies has made household support fairer. However, public resources invested in health and education are low. Training more doctors, nurses and teachers is urgent to raise wellbeing and productivity. The costs could be financed by increasing revenue from income and property taxes. There is also scope to continue to target subsidies better through direct cash transfers.

India’s participation in the global economy is high and rising, with outstanding performances in some services. Exposure to trade has surged after the reduction in tariff barriers in the early 1990s. In the information and technology sector, India’s export market share has boomed, creating many skilled employment opportunities and attracting foreign investment. India is also performing well for some complex, skill- and capital-intensive, goods such as pharmaceuticals and transport vehicles. The diaspora – the largest in the world – is an asset in developing new markets.

Labour-intensive exports are lagging behind. In the garment sector, India’s market share in world exports has stalled, despite clear comparative advantages and know-how.

Addressing domestic structural bottlenecks is key to supporting India’s competitiveness. Efforts to improve the quality and reliability of electricity provision, roads and ports should continue. Further modernising labour regulations will allow firms to grow and exploit economies of scale. India has improved the ease of doing business and is loosening restrictions on foreign investment. Extending success stories from states and special economic zones to the rest of the country would promote further India’s competitiveness and attract investors.

Further reduction in trade barriers would boost manufacturing exports and jobs and improve living standards. Import duties disproportionately affect low-income households’ purchasing power and weigh on firms’ competitiveness. Although India has preferential trade agreements, their depth is limited.

Restrictions to services trade imposed both by trading partners on India’s exports and by India on its imports are high. Because services are key inputs for other sectors, restrictions have a negative impact, in particular on manufacturing and more widely on income. OECD estimates suggest that India would be the single largest beneficiary of a multilateral cut in services trade restrictions. In the absence of a multilateral move, OECD simulations suggest that modernisation of India’s regulations affecting services trade would contribute to the success of the Make in India initiative despite restrictions in its exports in partner markets. However, political economy considerations are a constraint.

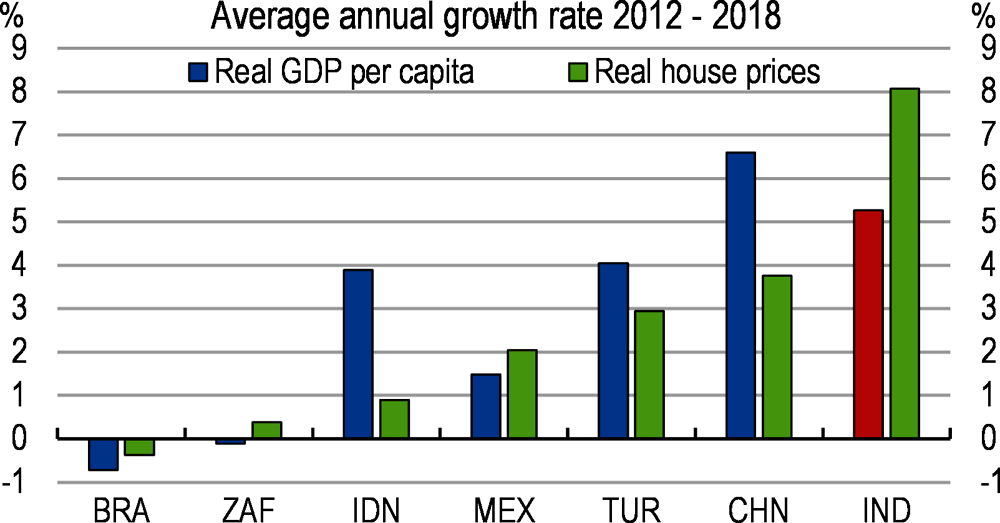

Despite the implementation of many housing programmes, the housing shortage remains and ongoing urbanisation will add new pressures. Many households still live in precarious conditions. In 2015, about 40 million households faced housing shortages according to government estimates. Population growth will add pressure on the housing market, in particular in urban areas. At the same time, many dwellings are vacant.

Affordability is a key concern. Housing prices are relatively high, pushed up by high construction and transaction costs and stringent zoning regulations in the context of a high population density. Under the Housing for All programme, the government aims to provide housing for all people by 2022. Access to finance is difficult, especially for low-income earners. A key concern is how to provide housing to the extreme poor.

The housing market has excess demand for low-end dwellings and an oversupply of high-end housing, especially in urban areas. Despite progress in simplifying regulations, land acquisition remains complicated, partly reflecting inefficiencies in land titling. This often adds to delays and costs for housing projects. Rigid building codes also constrain supply, especially in city centres. The floor space index imposes tight limits on the height of buildings, resulting in mass-produced homes on peri-urban land far from jobs, and thus more traffic congestion and pollution. Integrating housing policies with other urban policies is key.

Developing the rental market would improve mobility. Most government initiatives have favoured ownership. Rental housing is key to spatial mobility as it helps people move closer to the places where they can find a job. The rental market is small because of rent controls and renter protection laws that, while making housing more affordable, limit returns to investment and incentives for maintenance. The government has released the draft Model Tenancy Act 2019. States are strongly encouraged to implement it. Developing social rental housing would help expand the rental market and address the needs of migrants, youth and low-income people.

Air pollution is high and will increase in the absence of bold action. India is vulnerable to climate change. Most Indians are exposed to high air pollution. Out of the ten cities most affected by air pollution in the world, as measured by the concentration of fine particulates, nine are Indian. The poor often burn wood, dung and crop residues to cook, contributing to indoor and outdoor air pollution – a major cause of premature deaths, also harming child development. Power plants, industry, transport and agriculture also contribute.

Energy consumption may more than double by 2040 and the government has committed to reach 40% of renewables by then. Investment in renewable electricity generation, mostly from solar and wind, has topped investment in fossil fuel-fired generation and the government has committed to expand it further. The government has introduced a bio-fuel programme and revised technical standards for thermal power plants and vehicles. It also subsidises clean gas connections for the poor.