3. Addressing climate change

Iceland relies far more on renewable geothermal and hydropower energy than any other OECD country. Even so, the country’s per capita carbon (or greenhouse gas) emissions remain above the OECD average, partly because of emission-intensive aluminium smeltering. The government committed to reduce emissions from their 2005 level by 40% by 2030 and in 2020 updated its climate action plan covering 48 individual policy measures. This chapter presents a policy framework to reach the climate targets in a sustainable, cost-efficient and inclusive way. Climate action should first and foremost rely on comprehensive carbon pricing, via a carbon tax or an emission trading system. All sectors and carbon emission sources should be covered, and the government should commit to a gradual increase of the carbon tax rate. The government should support innovation and investment in green infrastructure, particularly in carbon capture technology, low-carbon fishing vessels and soil conservation. To ease the transition to a low-carbon economy, Iceland should remove entry barriers for new and innovative firms, foster the creation of green jobs, and invest in adequate skills. To garner political support, proceeds from carbon pricing could be redistributed to households and firms, at least partly.

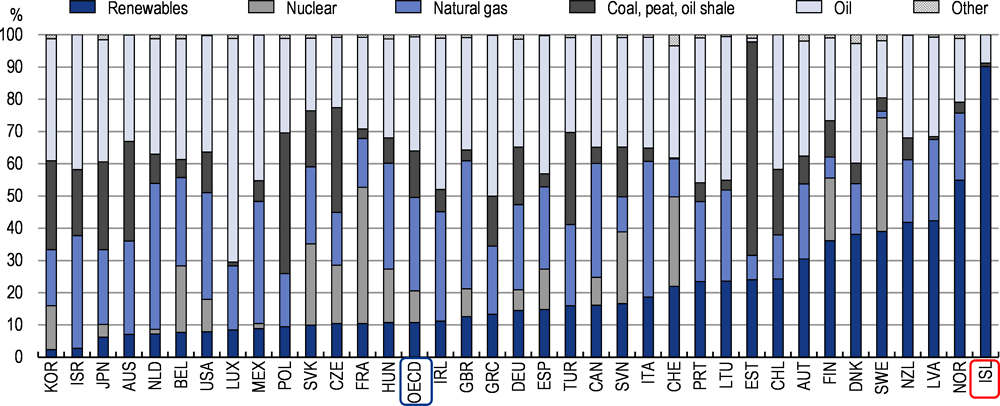

At first glance, Iceland’s impact on climate change may look insignificant. The country produces around 0.01% of worldwide greenhouse gases, less than a mid-sized city anywhere on the globe. Iceland is thinly populated, boasts pristine wilderness, and enjoys excellent air and water quality. At around 90%, Iceland relies far more on renewable energy sources than any other OECD country, with hydropower and geothermal energy warming up houses and fuelling energy-intensive industries (Figure 3.1. ). Fossil fuels are mostly used for land transport and the fishing fleet. This is why relative to GDP, energy-related CO2 emissions are lower than elsewhere in the OECD and declining.

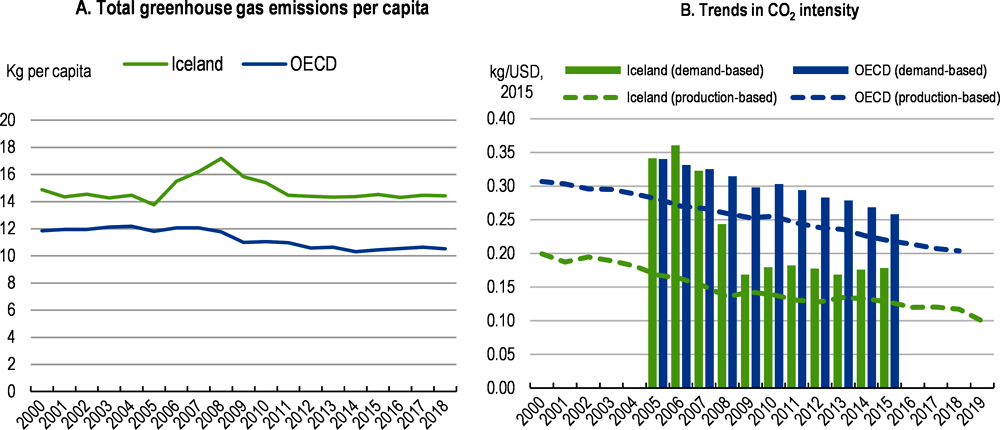

Even so, Iceland’s role in climate change is not negligible. Abundant low-cost energy has given Iceland a comparative advantage in energy-intensive aluminium smeltering, which (although overall being less carbon-intensive than in other countries thanks to the recourse to renewable energy) contributes substantially to greenhouse gas emissions. Per capita greenhouse gas emissions – often referred to as “carbon emissions” and excluding emissions from land use, land use change and deforestation - remain above the OECD average, with the gap higher than before the recession of 2009/10 (Figure 3.2 A). CO2 intensity is below the OECD average and declining, mainly because of the important role of hydro for electricity generation and of geothermal water for heating. The data also suggest that like other OECD countries Iceland produces many “clean” goods while importing the “dirtier” variants (Figure 3.2 B).

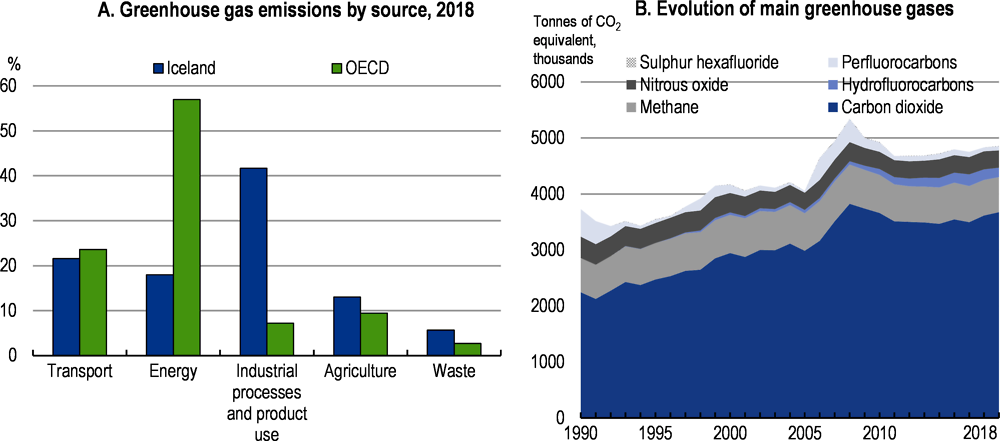

Iceland’s emission profile is unique both in terms of contributing sectors and the composition of greenhouse gases (Figure 3.3). Industry makes up for an outsized share of emissions given the activities of three large aluminium smelters and the fossil fuel-based fishing fleet, while emissions from energy production – mainly carbon leakage from geothermal harnessing - are small. Carbon emissions of land transport remain close to the OECD average. Agricultural emissions, mostly methane and nitrous oxides, are above OECD average, reflecting the importance of sheep and cattle raising.

Iceland signed the UN convention on climate change in 1993 and adopted a climate law in 2012 (Government of Iceland, 2019[1]). The climate law requires the government to regularly publish a climate action plan and to provide information on policies and measures to reduce greenhouse gas emissions (Ministry for the Environment and Natural Resources, 2018[2]). The 2018 climate action plan lists 34 individual measures to reach “carbon neutrality” – or zero net emissions – by 2040. In 2020, the government published an updated version of the climate action plan, adding 15 measures and bringing the total to 48. The plan relies on extensive consultation with stakeholders and civil society, suggesting that targets and policies have broad political support. In April 2021, the parliament passed legislation to allow companies additional depreciation of assets that qualify as green, reducing the cost of green investment.

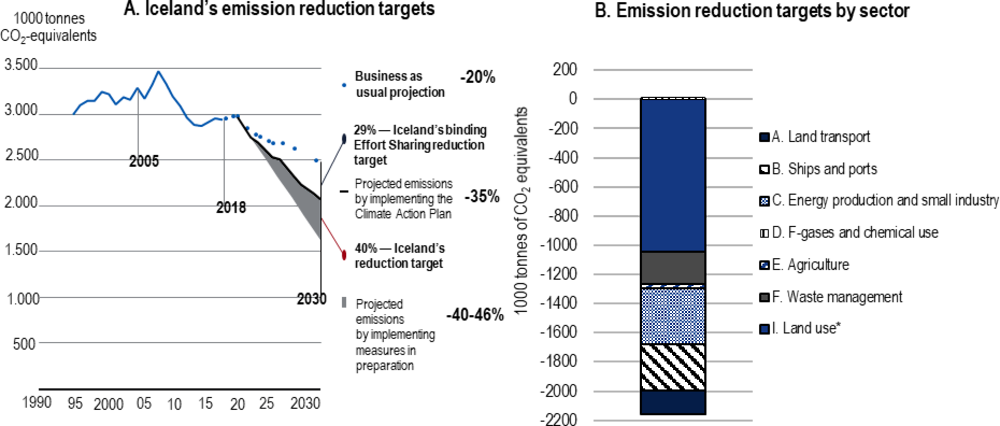

The climate action plan presents targets and measures in considerable detail. In the baseline scenario, Iceland aims to reduce emissions by 35% in 2030 compared to 2005, as against a “business as usual and no measures” scenario with emissions declining by 20% (Figure 3.4A). The strongest contributions to carbon neutrality are projected in the area of land use and land use change – in particular carbon sequestration through reforestation and restoration of wetlands – followed by energy production, the maritime sector, waste management and land transport (Figure 3.4B). Households are not listed, because the climate action plan’s classification is production- rather than consumption-based and because emission-free geothermal water heats most dwellings. The 48 measures cover all sectors but with a focus on cross-sectoral measures and land transport.

In 2019 Iceland together with Norway agreed with the European Union to jointly reduce emissions by at least 40% between 1990 and 2030 (Norwegian Ministry of Climate and Environment, 2019[3]). In 2020 the government established a working group to explore funding needs for green investment. The group’s main objective is to select green projects, develop a sustainable investment funding framework and the conditions needed for green bond issuance (Government of Iceland, 2021[4]). In the wake of the COVID-19 crisis, the government established a five-year investment initiative, including additional investment in energy transition and other climate-related projects to reach around 0.5% of annual GDP (OECD, 2020[5]). In 2020 Iceland’s central bank became a member of the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), whose aim is to highlight the macroeconomic and financial stability impacts of climate change and to develop frameworks for addressing climate-related risks. Finally, the Ministry of Finance was one of the founding members of the Coalition of Finance Ministers for Climate Action.

Despite the recent burst of activity, Iceland could do more to develop effective climate policies. Iceland’s climate action lacks prioritisation and sequencing and builds largely on a set of technical measures in the various sectors. While the environmental agency carried out a few rough cost-benefit-analyses in the land transport sector, assessment and evaluation of the measures should be improved, to clarify their true emission reduction potential and their potential cost. Finally, effective climate action needs tight integration in the wider policy framework, with economic and fiscal policies supporting sustainable productivity and employment along the low-carbon transition. Against this background, this chapter presents a policy framework that could help achieve climate targets in a cost-efficient, sustainable and inclusive manner.

The transition towards a low-carbon economy should rely on a consistent policy framework that guides scope, priorities, and sequencing of actions and measures. Carbon pricing can help reach climate targets in a cost-efficient manner, aided by support of innovative green technology and public infrastructure. In some cases subsidies and regulation to foster climate-friendly activities might have to be included. As such, the policy framework can be divided into for main areas (OECD, 2020[6]); (de Serres, Murtin and Nicoletti, 2010[7]):

Carbon pricing: a carbon tax or emission trading system covering all carbon (or greenhouse gas) emissions across all or most economic sectors.

Spending support framework: investment in research and development and in green infrastructure, especially those subject to market externalities or high risks. Spending support includes the development of green finance frameworks and green budgeting.

Financial support to households and firms to accelerate green transition: subsidies and tax incentives for the adoption of green technology, justified by path-dependency, learning effects or market externalities such as network effects, or considerations of inclusiveness.

Regulation: appropriate regulation and environmental standard setting can help benefit from policy complementarities and overcome political economy obstacles

Policies to reduce carbon interact. Acting in one area may require less action in the other. For example, bold carbon pricing increases the effect of public investment or subsidies for clean technologies as private actors invest in their own interest. In turn, broad-based public spending on low-carbon infrastructure can dampen the need for carbon tax increases. Finally, implementation should be adequately sequenced, to reduce overall abatement cost and avoid rebound effects (e.g. electrification of transport could entail additional emissions from power generation). Against this background, assessing interactions in a low-carbon policy framework is crucial.

Designing Iceland’s carbon pricing path

Pricing carbon is a cost-effective policy measure to reach emission targets and steer the economy towards and along carbon neutrality (Nordhaus, 2019[8]). A price on carbon fosters emission abatement where it is cheapest and helps detect the low-hanging carbon fruits. It reduces the need for regulation and standard setting since it changes households’ and firms’ behaviour towards low-carbon activities. In a dynamic perspective, pricing carbon encourages green innovation and adoption of green technologies. The revenues from carbon pricing can be redistributed to make the low-carbon transition more inclusive. There are basically two pricing models: a carbon tax and an emission trading system. Trading systems directly address the emission target to be achieved, but tend to be associated with carbon price volatility facing households and firms (Flues and van Dender, 2020[9]).

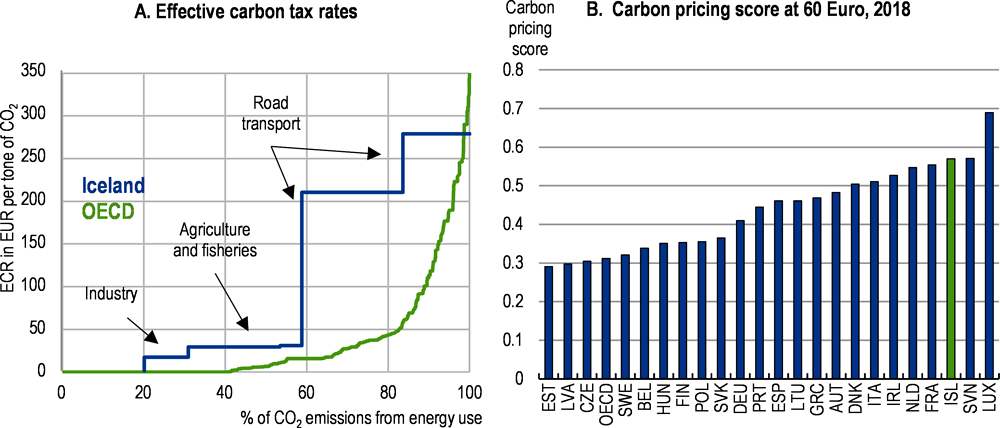

Iceland introduced a tax on CO2 embedded in fossil fuel taxation in 2010 at around 7 Euro/tonne, rising to 13 Euro/tonne in 2012 and 15 Euro/tonne in 2015. Starting from 2018 the tax was increased in three steps to reach around 30 Euro/tonne in 2021. In 2020 taxation was extended to include fluor-carbonates. In 2008, Iceland joined the European Emission Trading System (EU-ETS), thus subjecting greenhouse-gas-intensive aluminium smelters to carbon pricing; initial emission allowances were allocated for free. Among non-ETS emissions, agriculture, the main producer of methane, is not taxed, like geothermal energy and waste. Low-carbon vehicles are temporarily exempt from the value-added tax, and the government plans to introduce a distance-based car tax. Overall, with 57% of carbon taxed at 60 Euro/tonne or more through the combined effect of the trading system, the carbon tax and excise taxes on energy use, Iceland boasts one of the boldest pricing regimes OECD-wide (Figure 3.5).

Iceland should continue raising carbon prices consistent with reaching climate targets. Appropriate design helps achieve targets better while avoiding excessive cost to households and firms:

Broad coverage: carbon pricing should be applied to a broad base (Flues and van Dender, 2020[9]). The more emission sources they cover, the better they are at reducing emissions cost-effectively. The government should extend carbon pricing to all carbon emissions including methane and nitrous oxide, and it should include energy production and agriculture.

Carbon tax versus tradeable emission permits: carbon taxes should apply to all sectors not covered by an emission trading system and vice versa in general. Since the two systems interact, they should be well-coordinated. Some activities may be put under either system. Iceland may consider replacing the carbon tax by a tradeable permits in the fisheries sector, given that a tradeable quota system for fishing rights is already in place (Haraldsson and Carey, 2011[10]). Pricing methane in agriculture may also work through a permit system or taxation.

Commitment to a gradual phasing in: committing to gradually phasing in higher carbon prices raises investor confidence and fosters investment to adapt to a low-carbon environment (Agrawala, Dussaux and Monti, 2020[11]). Higher environmental policy uncertainty is associated with lower investment, especially in capital-intensive and high-productivity firms ( (Dechezleprêtre and Kruse, forthcoming[12])). A gradual approach is also needed to avoid running down “dirty” capital too fast, ending up with stranded assets, and stifling investment (Jin, van der Ploeg and Zhang, 2020[13]). To reduce uncertainty for firms and households and to unlock investment in green capital, the government should commit to a gradual and politically well-supported carbon tax increase trajectory (Box 3.1).

The credibility of carbon price trajectories is key to enabling long-term investment in low-carbon assets, Enshrining a carbon price trajectory into law creates credibility and reassures investors. To avoid that laws are changed after a new government is taking over, efforts to build a broad based consensus around carbon pricing will be important.

Several countries have committed to carbon price increases including price trajectories:

Canada

The Pan-Canadian Pricing on Carbon Pollution guarantees a coherent carbon price ambition across Canadian provinces, but leaves the choice to provinces whether to implement a tax or trading system. Provinces implementing a carbon levy should start at a minimum price level of CAD 20/tonne in 2019 that increases over time by CAD 10/tonne annually to reach CAD 50/tonne per tonne in 2022, when a review of the overall pricing approach is scheduled.

Germany

Germany decided to implement national carbon pricing in sectors that are not covered by the EU ETS, in particular heating and transport. The national trading system will enter into force in 2021 with a fixed price of EUR 25/tonne. Prices will rise subsequently according to a predefined corridor, reaching EUR 55-65 per tonne in 2026.

The Netherlands

The Dutch government proposed a national carbon levy for industry, taking the form of a floor price to the EU ETS price for emissions that exceed a tax-free base per facility. The total carbon levy includes a price trajectory set to start at EUR 30/tonne in 2021 and to rise in a straight line to EUR 125-150/tonne in 2030.

Source: (OECD, 2020[14]).

The carbon price level needed to reach emission targets depends on the reaction of households and firms to carbon price increases (Dechezleprêtre, Nachtigall and Venmans, 2018[15]). Since such elasticities are country-, sector- and even firm-specific and depend on policies, few general conclusions on their size can be made. Case studies suggest a tax elasticity of between -0.3 and -0.7 (i.e. a 10% increase in carbon prices entails a 3% to 7% percent reduction in carbon emissions (Sen and Vollebergh, 2019[16]). A preliminary study of the University of Iceland suggests that tax elasticity of fuel consumption is around -0.35 for Icelandic households and -0.30 for most sectors except maritime transport where elasticities are estimated at -0.90 (Institute of Economics at the University of Iceland, 2020[17]). Based on these elasticities, a modelling exercise for this Survey assumes that a carbon tax consistent with 2030 emission targets would have to reach between 30% and 60% of the current fuel price (Box 3.2).

The government’s baseline scenario is to reduce carbon emission by 40% between 2005 and 2030 in areas not covered by the European Union emission trading system (EU-ETS). Between 30% and 35% are projected to be brought about by implementing the measures included in the climate action plan, depending on the speed of the transition to electric cars. As such, additional measures such as a rise of the carbon tax would be needed to reach the government’s target (i.e. to go from a 30-35% to a 40% cut).

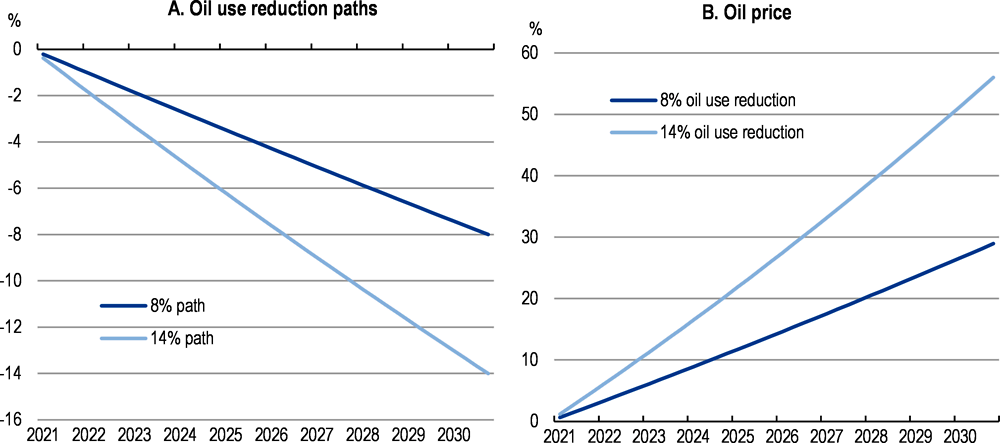

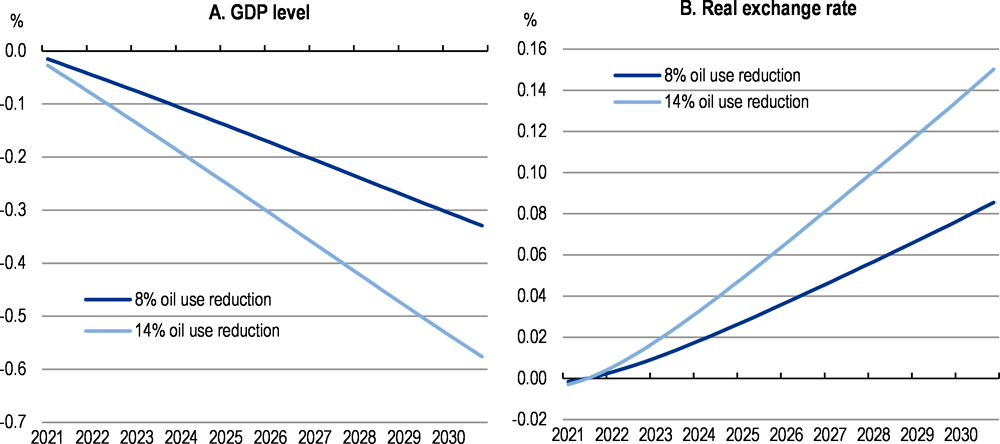

Against this background, the Economics Institute of the University of Iceland carried out an analysis of the carbon tax increases needed to reach the climate target. Two scenarios relative to business-as-usual are estimated, achieving an additional reduction of fuel consumption by 8% and 14% respectively. The fuel price elasticity is estimated at 0.27, obtained from earlier Icelandic research. To reach the respective reduction of fuel consumption, the fuel price would have to rise gradually by between 30% and 55% (Figure 3.6), implying a petrol price hike from currently around 1.65 EUR/litre to between 2.15 EUR and 2.60 EUR/litre. The carbon price would be between 230 EUR/tonne and 420 EUR/tonne. Since the carbon price is based on the carbon content of fuels, it will be different for different fuel types.

The analysis assumes that fuel price elasticities remain constant over the entire period, i.e. businesses will react in the same way to price increases as in the past. The share of green infrastructure spending in GDP remains constant, as well as the capital depreciation rate. The pattern of technological innovations is also assumed to remain constant. The analysis excludes households.

Source: (Institute of Economics at the University of Iceland, 2021[18]); (Institute of Economics at the University of Iceland, 2020[17]).

Investing in green capital

Investing in “green capital” covers a range of support policies such as research and development, innovation in and deployment of green technology as well as the set-up and support of low-carbon infrastructure. Public investment in network infrastructures such as energy or transport could also be included as well as policies that help reduce the financial barriers that households and small businesses may face in acquiring green equipment or technology (de Serres, Murtin and Nicoletti, 2010[7]). Backing innovation efforts can be justified on the grounds of positive externalities of green technologies, particularly when combined with commitments to a strong carbon price.

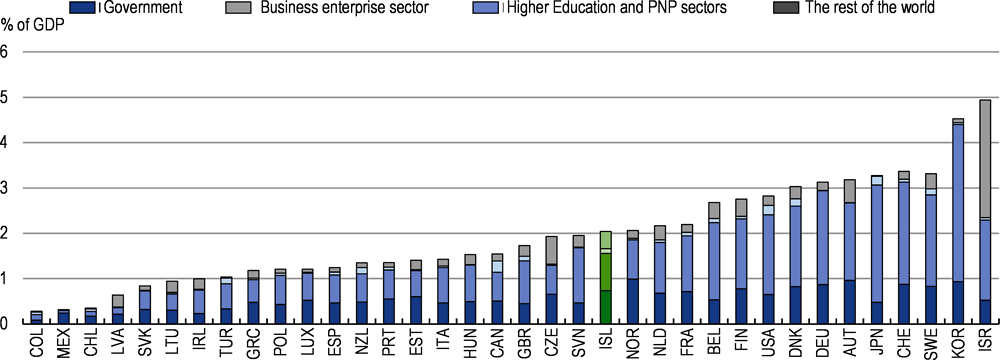

Iceland’s research and development spending is close to the OECD average, although recent data on “green” R&D is not available (Figure 3.7). Investment in intangibles has declined in recent years, patents and trademark applications rank below the EU average, and the share of knowledge-intensive services in exports is below the OECD-average (see chapter on innovation). This can be explained, to an extent, by the structure of the economy and the importance of imported innovation in Iceland. Still the government could increase spending on green research and development in some niche areas such as geothermal carbon capture or low-carbon fishing vessels. To benefit from scale, Iceland should participate in international research consortia and strengthen research collaboration between the business sector and higher education.

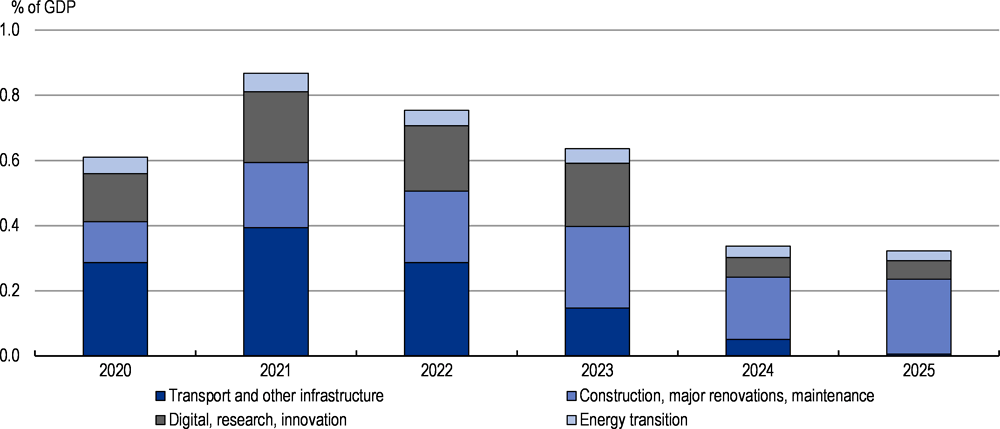

The government plans to considerably step up spending on green infrastructure such as a low-carbon transport infrastructure, energy transition and digital transformation (Figure 3.8). To increase spending efficiency and quality, Iceland needs to evaluate investment projects comprehensively and apply thorough cost-benefit analysis, as noted in previous Surveys (OECD, 2019[19]). Cost-benefit-analysis should cover all public investment including small-scale investment and help assess where the emission reduction potential is largest for a given amount of investment. Systematic cost-benefit analysis may help to estimate the overall costs of the transition towards a low-carbon economy, building on comprehensive carbon “shadow-pricing” and other methods (Box 3.3).

A shadow price, or shadow price trajectory, puts a monetary value on the future emissions of an activity, providing information on where the emission reduction potential of a policy is the greatest. In 2019, the French “Quinet Commission II” published the “Value for Climate Action” report to guide socio-economic analysis of public policies and investment choices by the government. It sets out a trajectory for shadow carbon prices to ensure the country reaches carbon neutrality in 2050, updating the results of a previous commission in 2009. The United Kingdom Treasury regularly publishes an updated set of carbon values for policy appraisal and evaluation. Through a review in 2009, the government moved away from applying values based on the damage associated with carbon emissions towards using carbon values that are consistent with the government’s greenhouse gas emissions targets.

Shadow-pricing is graphically represented by so-called Marginal abatement cost curves (MACs). MACs show the cost associated with each emission reduction measure in ascending order of cost per tonne of carbon cut. By linking all measures together, MACs show the overall cost to reach a specific emission reduction target. MACs can be constructed for a single firm, for an industrial sector or for an entire economy. Since MACs are context-specific and do not take interactions between different policies and technologies into account, researchers have started to use more sophisticated approaches such as scenario analysis or “energy-system-modelling”, which operate using an array of assumptions including those for price developments. All approaches should use a uniform carbon shadow price.

Source: (OECD, 2020[14]); (Agrawala, Dussaux and Monti, 2020[11]) (Johnsson, Normann and Svensson, 2020[20]), (Goldmann Sachs, 2020[21]).

Reducing carbon emissions abroad

Carbon has a worldwide impact, no matter where it is released, hence it makes sense to reduce emissions where that is least costly. The Paris Agreement allows countries to invest in foreign emission cuts and credit them against their own emission targets (OECD/IEA, 2019[22]). Similarly, the European Effort Sharing Regulation (ESR) allows countries to credit their participation in joint emission reduction against their national targets. Well-designed internationally transferred mitigation projects have the additional advantage of fostering innovation and green technology transfer, underpinning local environmental and health benefits, and providing government revenue (OECD/IEA, 2012[23]).

Given its peculiar economic structure and energy production profile, carbon reduction is likely more expensive in Iceland than elsewhere. Iceland should consider participating in international carbon mitigation and abatement projects. This would help the country to accelerate emission cuts, reduce the overall cost of reaching emission targets and strengthen innovation and technology transfer to emerging market economies. Iceland could collaborate with other countries in planning and implementing international abatement projects. For instance, Iceland could use the flexibility offered by the ESR to finance emission reductions in other countries, e.g. transition economies in Eastern Europe (European Commission, 2013[24]).

Border carbon adjustment

Border carbon adjustment (BCA) is a policy to tax imports according to their carbon content. Border carbon adjustment is thought to address adverse competitiveness effects for domestic carbon-intensive sectors and to avoid emission leakage to economies with lower carbon prices (OECD, 2020[25]). The effectiveness of a BCA in a small open economy like Iceland is debated: while it might help contain emission leakage, it could adversely affect the domestic economy since firms would on aggregate face higher costs for imported intermediate goods (Burniaux, Château and Duval, 2010[26]). Some research suggests that overall environmental and economic effects of BCA are small (Koźluk and Timiliotis, 2016[27]). In view of its small size and the political economy obstacles to unilateral measures, Iceland should closely align BCAs with the European Union, its main trading partner.

Improving environmental regulation

Regulation of carbon-emitting activities - such as technology and performance standards or bans on certain products – might be necessary for a green transition. However, regulation imposes a burden on firms and households, notably by increasing barriers to entry, distorting competition or raising costs related to permits and licenses. Some regulations may even prevent the development of efficient low-carbon technologies. Well-designed environmental regulation can help reduce the burden on the economy. Environmental targets need not suffer from lighter regulation: OECD research suggests that more stringent environmental objectives can be reached without imposing a higher regulatory burden on the economy (Berestycki and Dechezleprêtre, 2020[28]).

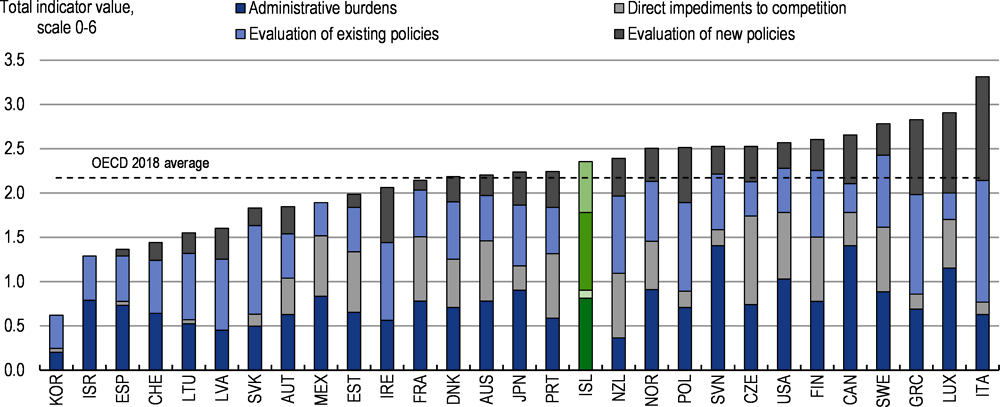

Iceland’s environmental regulation stringency is slightly above the OECD average (Berestycki and Dechezleprêtre, 2020[28])). The regulatory impact on competition and firm entry is small, while the administrative burden to cope with complex regulation is large (Figure 3.9). The quality of environmental policy evaluation is average. Against this background, Iceland should carefully evaluate the need for new environmental regulation and remove those elements that impose disproportionate costs on firms and households. Since uncertainty about new environmental regulation is associated with lower investment, the government should also increase transparency and predictability of environmental policy-making (Dechezleprêtre and Kruse, forthcoming[12])].

A successful transition towards a low-carbon economy should be facilitated by a supporting economic and fiscal policy framework. Policies to improve the business climate, build up new skills, strengthen resilience of firms, and support digital access will help underpin the deep structural transformation needed to reach carbon-neutrality. Some sectors such as the fisheries, transport or agriculture could undergo considerable changes, hence supporting resource reallocation will be a central driver of decarbonisation. As such, policies that reduce entry barriers for new firms, strengthen competition, and facilitate access to new occupations and jobs will help the economy to move towards the new low-carbon normal.

The impact on productivity and employment is likely small

The views on the impact of a low-carbon transition on productivity, employment and growth are contrasted. Some see the transition as a burden on economic activity, raising costs and reducing asset values without increasing output and restricting the set of consumption choices and production technologies. Competitiveness might decline as some activity will move to countries with more lenient climate policies. Others instead argue that well-designed environmental policies can encourage innovation, bring about gains in profitability and productivity that outweigh the costs of the transition. The current empirical results suggest that overall effects are relatively small, especially relative to other changes in the economy, although results are driven by a few sectors and firms and there have been few bold policy reforms so far (Box 3.4).

The OECD has carried out many studies on decarbonisation and economic performance. Most conclude that the economic impact of more stringent decarbonisation policies is small, although evidence is limited because bold policy reforms have been limited to a few countries so far. Design matters, with structural reforms such as a carbon tax or the removal of harmful subsidies being more beneficial than regulation and standard setting.

Productivity: environmental policy tightening has no impact on productivity growth, positive or negative. Tightening of environmental policies is followed by a temporary increase in productivity, fading within less than five years. The temporary productivity effect is stronger for market-based than for regulatory instruments (Albrizio et al., 2014[29]). Withdrawal of harmful subsidies and a price on CO2 emissions would raise productivity and strengthen natural capital (Brandt, Schreyer and Zipperer, 2014[30]).

Competitiveness: carbon prices cause emissions to decline, but seem to have no significant competitiveness effects (Flues and van Dender, 2020[9]). The policy framework matters, with market-based instruments being more favourable. Firms benefitting from preferential treatment do not fare better (Arlinghaus, 2015[31]). Superior economic performance, as measured by stock market returns, is associated with better environmental performance. Greener firms seem to be able to attract more productive employees and face smaller capital costs, and introducing green products enhances firms’ profitability (Dechezleprêtre and Kruse, 2018[32]). Finally, higher domestic energy prices have a significant but small negative effect on foreign direct investment (Garsous and Kozluk, 2017[33]).

Investment: higher energy prices are associated with a small but statistically significant decrease in total investment across firms. In energy-intensive sectors, total investment actually increases following rising energy prices. Domestic investment declines following higher energy prices, in line with the pollution haven hypothesis (Dlugosch and Kozluk, 2017[34]).

Employment: a study on French firms suggests that the impact of a carbon tax rise on employment is negligible. Yet higher carbon taxes cause around 0.25% of overall jobs in the manufacturing sector to move from energy-intensive to less energy-intensive firms (Dussaux, 2020[35]).

Trade and global value chains: environmental policies are not found to be a major driver of international trade patterns, but have some significant effects on specialisation. More stringent domestic policies are linked to a comparative disadvantage in “dirty” industries, and a corresponding advantage in “cleaner” industries. The effects are stronger for the domestic component of exports than for gross exports, yet notably smaller than the effects of trade liberalisation for example (Koźluk and Timiliotis, 2016[27]).

Inequality: the distributional effects of higher energy prices on household income differ by energy carrier. On average, taxes on transport fuels are not regressive. Taxes on heating are slightly regressive, and taxes on electricity are more regressive than taxes on heating fuels. However, there is considerable heterogeneity across countries given varying tax design and household spending composition (Flues and Thomas, 2015[36]).

Source: as cited.

The impact of a sizeable carbon tax rise on the Icelandic economy seems to be slightly negative but small (see Box 3.5). The result relies on a number of assumptions about developments in trade-exposed sectors such as aluminium and fisheries. Energy-intensive aluminium smelting is integrated into the European Union’s ETS, sheltering it partly from domestic policy shocks. The fisheries sector is subject to a domestic quota system, suggesting that higher carbon pricing would reduce profits rather than labour productivity and employment, although engagement in export markets makes the sector highly sensitive to domestic price developments.

A carbon price increase is likely to have an impact on the domestic economy. Comprehensive carbon pricing will affect household income and consumption, business investment, exports and imports. Firms adapt their capital stock and consumption of fuel. Given Iceland’s exposure to international trade and capital markets, interest rates and exchange rates are also likely to adapt.

To assess the economic impact of a carbon tax rise, the Economics Institute of the University of Iceland ran a dynamic stochastic general equilibrium (DSGE) model of the Icelandic economy. The analysis includes the external sector and real exchange rate developments. Model runs suggest that a rise in the carbon tax as estimated in Box 3.2 would imply a reduction in the level of GDP of 0.3% to 0.6% by 2030 as a result of rising factor cost. The króna would depreciate a bit in real terms, reflecting the relative rise of import prices.

It should be noted that the assumptions underlying the model runs are similar to those for the carbon tax rise estimations: behavioural responses to carbon price changes are assumed to remain the same as in the past, and so are the productivity increases through green and other innovation. Even a small acceleration in the pace of technological progress could turn the GDP effect positive. Structural factors such as the regulatory framework, government spending or else the EU’s climate policy are also assumed to remain unchanged.

Source: (Thorarinsson, 2020[37]), (Institute of Economics at the University of Iceland, 2021[18]).

Increasing openness could ease the green transition

The transition to a low-carbon economy, the diffusion of new technologies and the associated know-how can be facilitated by a business-friendly climate. Radical innovations often come from new firms, in particular those that challenge the business models of incumbents, hence barriers to entry should be low (OECD, 2015[38]). Competitive pressures tend to stimulate technology adoption and innovation; and more competition is associated with stronger capital formation, technology adoption and productivity growth (Andrews, Criscuolo and Gal, 2016[39]). Strengthening competition to facilitate the entry of “clean” firms and the exit of “dirty” firms will help to move towards a low-carbon economy. Against this background, Iceland should adopt the policy recommendations of the recent OECD competition assessment (OECD, 2020[40]).

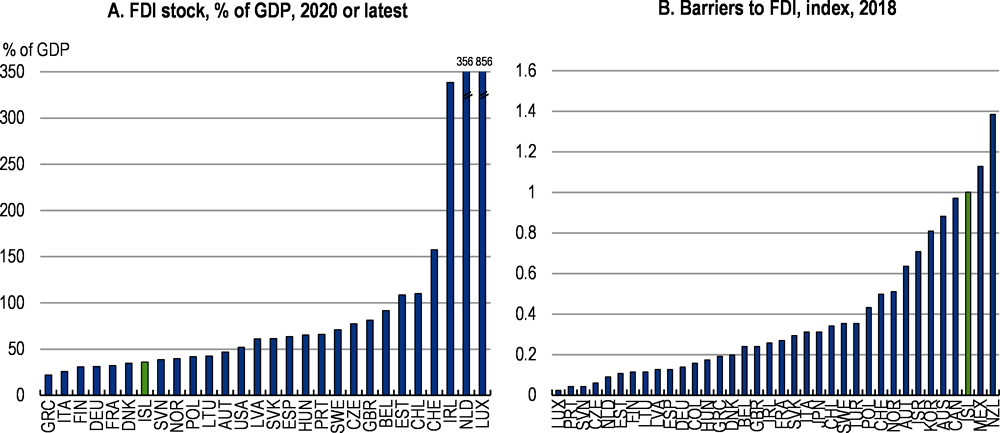

Foreign direct investment (FDI) could also help ease the green transition, e.g. in energy generation. Iceland is less exposed to international trade and capital flows than other small economies, and its FDI stock is comparatively small (see chapter 1). A higher share of FDI could help diffuse green innovation and contribute to reaching Iceland’s emission targets faster.. To encourage the diffusion of new technologies and the associated know-how, especially in capital-intensive industries, Iceland should remove barriers to FDI to the largest extent possible.

Fostering green jobs and skills is key

Fostering skills and worker reallocation is essential to move towards a low-carbon economy. Due to labour cost and technology characteristics, clean energy development in Iceland tends to be capital-intensive and relies on skilled, well compensated jobs. Labour shortages could become a major issue as green job creation could represent up to 5% of the total labour force (International Energy Agency, 2020[41]).

Against this background, Iceland should strive to (see also chapter 1):

Foster green skills. The transition towards a low-carbon economy requires skills that respond to rapidly changing labour markets. Policies to foster green skills should include: investment in tertiary education, especially in technological areas; stronger vocational education and training, in particular stronger firm-based learning in firms adopting green technologies; and stronger life-long and adult learning programmes on the green transition.

Remove regulatory barriers. Regulation of the service sector and occupational licencing are tighter than in most OECD countries, stifling the transition towards greener jobs and employment, especially in the construction sector (see chapter 1). Removing these barriers could facilitate the reallocation of workers and help affected sectors and professions to adapt more rapidly to a greener economy.

Promote public-private collaboration in tertiary education. Iceland’s corporate sector contributes little to research and development in universities (OECD, 2019[19]). More green finance from the private sector, including from abroad, and better public-private collaboration could foster tertiary education and strengthen ties between research institutions and businesses in sectors with a large greening potential.

The benefits and costs of a low-carbon transition centred on carbon pricing do not accrue to all households and firms alike. Higher carbon taxation may have disproportionate impacts on some social groups, certain jurisdictions, and individual economic sectors. Moreover, the cost of the transition tend to become apparent immediately, while the benefits are uncertain and accrue in the future. As such, political resistance to bold environmental policy reform may be considerable, with a high risk that planned reform is aborted (OECD, 2010[42]). One possible way forward to address resistance to higher carbon pricing is to redistribute a large part of the proceeds to households and firms, as is done in Switzerland (Box 3.6). Currently, carbon tax receipts enter Iceland’s central government budget and are neither redistributed nor earmarked for low-carbon purposes.

In 2008, Switzerland introduced a CO2 tax on heating fuels, which is currently set at CHF 96 (around USD 105) per tonne. The measure triggered an intense debate. Many households and businesses saw this tax as regressive, as affecting competitiveness and as an unwarranted increase in tax pressure. To take account of these concerns, the government adopted a mechanism to redistribute the proceeds as follows:

Two-thirds of the total proceeds are directly redistributed to households and firms relative to the tax receipts from each sector. Each person is reimbursed via a reduction in social security contributions, while firms are reimbursed according to their wage bill.

One third of the total proceeds are earmarked for investment in federal and cantonal (state-level) energy savings and buildings retrofitting programmes. Some 2% to 3% of total tax receipts are allocated to a technology fund to promote innovative firms.

In 2019, each person was reimbursed around CHF 100, while each firm received around 1% of its wage bill. Overall CO2 tax receipts make up 0.2% of GDP. In a legislative vote in June 2021, the population rejected a broadening of the tax base to include transport fuels and a gradual increase of the tax rate up to 210 EUR/tonne.

Source: (Office fédéral (suisse) de l'environnement, 2020[43]).

Against this background, one option for making the transition to a low-carbon economy palatable for Icelandic voters could be to redistribute – at least partly - carbon pricing proceeds without undermining the low-carbon objective. The redistribution might address distributional issues by favouring poorer over wealthier households. Redistribution may also take regional aspects into account, as households living in remote areas may be more affected by a rise of fuel prices than those living in urban agglomerations. The scope for redistribution is substantial as a uniform Icelandic carbon tax of at least 60 Euro/tonne could yield revenues of around 0.5% of GDP. Another option is to reduce economically distorting taxes. Redistributing carbon tax proceeds or tax reform is more effective than loading carbon pricing with special exemptions, differentiated rates or complex compensation mechanisms which raise administrative and enforcement costs, while potentially undermining their environmental effectiveness (Antosiewicz et al., 2020[44]).

Carbon pricing faces additional political barriers, even if proceeds are redistributed. The costs of a carbon tax are more visible than those indirectly passed on to consumers under more stringent regulation. This visibility is compounded by the psychological phenomenon of loss aversion which suggests that households’ appreciation of any reimbursement is unlikely to match their resentment of new taxes, even when the two are of the same magnitude (Kahnemann, Knetsch and Thaler, 1991[45]). More bluntly, perceptions do not necessarily match the actual effects. Still perceptions may change if a carbon tax reform is considered “fair” (Harrison, 2013[46]). As such, a well-managed reform process, in particular wide and open communication of the long-term benefits of carbon pricing, without concealing the negative effects for some groups, can help garner political support (OECD, 2010[47]).

Iceland’s peculiar economic structure and carbon emission profile warrant a closer look into a few individual sectors. Industry including fisheries accounts for a share in both exports and emissions widely above the OECD average, while cuts seem to be available at below-average cost in land transport and agriculture, including changes to land use. The following sections will take a closer look at selected activities. Still the government should aim for well-coordinated policies across sectors, avoid setting overly stringent sectoral emission targets and allow for an integrated, effective and cost-efficient approach towards carbon cuts.

Energy generation

Iceland’s energy generation relies almost fully on renewables, with hydropower accounting for around 70% and geothermal energy for 30% of total electricity production. Yet while hydropower is carbon-neutral, geothermal power is not. Carbon and other gases leak into the atmosphere when the magma chambers below the exploited area are harnessed. Hence the climate action plan foresees further support to technical measures to capture and re-inject the gases discharged during the production process. Geothermal carbon capture is assumed to contribute more than any other sector to emissions reduction, with around 40% of the total reduction projected in the climate action plan. Iceland has developed cutting-edge carbon capture technology and should enhance investment in research and development, implement new technologies at home and help disseminate them abroad.

Energy markets are prone to considerable cost pass-through of carbon pricing (Fabra, 2021[48]). Depending on technology and market structure, it tends to be substantial in the European power sector, reaching between 60% and over 100% (Arlinghaus, 2015[31]). Iceland’s electricity generation is separated from European or North American transmission networks, handing over considerable market power to domestic providers (although taken alone a connection to Europe’s networks would likely raise domestic energy prices given low production cost, thereby creating additional rents to energy producers). While Iceland follows European Union regulation by separating production, transmission and distribution of electricity since 2003, the market remains dominated by a few mostly public players, either state- or municipally-owned. Against this background, the government should strengthen competitive forces in power generation and ensure that carbon price hikes are not unduly passed onto consumers.

Finally, the low-carbon transition might require an increase in electricity production. Electrification of all road transport including buses and trucks would require 500-700 MW of additional electricity, corresponding to around three mid-sized hydro-electric power plants (Landsnet, 2016[49]). The government published a long-term sustainable energy strategy assuming an extension of power production, with one option being a stronger reliance on wind farms (Government of Iceland, 2020[50]). Given some resistance against new wind and hydro projects on the grounds of nature and landscape protection, a part of new electricity demand might have to be covered by increasing the efficiency of existing plants, transmission networks and, finally, electricity-consuming devices.

Fisheries and port infrastructure

Iceland’s fisheries sector represents around 28% of total exports, making it the country’s largest export sector. The sector is highly productive and internationally competitive, but might be sensitive to price developments such as a rising carbon tax. Carbon emissions from fishing vessels and coastal shipping have fallen sharply since peaking in the mid-1990, partly because of lower catch and the use of larger, more efficient vessels (Working Group on the Fisheries, 2021[51]). The quota system, developed in the 1990s, has supported the sustainability of fishing practices and helped develop cutting-edge technologies to save on fuel. Quotas are basically transferable between fishing entities of different size, with a few limitations. Since smaller ships run shorter distances closer to the coast than the large high-sea trawlers, the relative effect of a higher carbon tax on the cost per catch for different types of vessel remains unclear.

The climate action plan projects a decline in emissions from ships and ports by around 20% between 2018 and 2030. Reductions are to be achieved through technological innovations such as the electrification of ports, including support services to harbouring ships, and the introduction of electrical ferries. Further actions include a ban on heavy fuel and further energy savings in state-owned ships. The plan remains vague about whether reduction objectives can be achieved by technological innovation of vessels alone, admitting that they are less rapidly developed than, e.g., for land transport. An empirical investigation suggests that a tax rise to cut emissions by 10% would have little impact on the industry’s competitiveness, while a 20% cut could inflict some harm (Box 3.7). Given the strong international exposure of Iceland’s fishing industry, the government should step up investment in research and development of efficient low-carbon ship propulsion technologies.

Between 2005 and 2019 overall fuel consumption of fishing vessels in Iceland fell by almost 35%, mainly because of technological innovations, the use of larger ships, and a smaller catch. The total number of vessels went down by around 11%. The government plans to cut emissions from the fisheries sector further, by another 10% to 30%. Fishing vessels are currently around 30 years old on average, suggesting that further savings could be achieved by renewing the fleet in the coming years.

To assess the impact of a carbon tax rise on the fishing industry, the University of Iceland ran an empirical estimation (translog cost function) based on panel data for six different types of vessels. The overall long run elasticity is estimated at a bit less than -0.3, meaning that a 10% rise in the price of fuel would induce around 3% less consumption. This estimate is close to recent estimates for the fishing industry in other countries.

The minimum 10% emission cut as planned by government is estimated to induce around 5% higher total factor cost for fishing companies, assuming no change of productivity and innovation patterns. The rents created by the current fishing quota system are expected to absorb such a cost increase, with little impact on competitiveness. However, a carbon tax increase consistent with a 20% emission cut could harm the industry unless more rapid technological innovations provide for considerably cheaper abatement.

Source: (Institute of Economics at the University of Iceland, 2021[18]); (OECD, 2018[52])

Aquaculture is complementary to coastal and high-sea fishing and could actually help reduce carbon emissions from the fisheries sector. It has been the world’s fastest growing food production method in recent decades, giving some indication of the potential of the industry. Aquaculture’s share in Iceland’s exports is raising rapidly, from 0.5% in 2013 to 2% in 2020. Its carbon intensity depends on production practices, essentially on how the different species are fed. Extensive practices are less carbon-emitting than intensive ones, but they use more other resources such as land and water (Asche, 2012[53]). Also, wild fish populations are threatened by lice infections from aquaculture. The government should provide a regulatory framework for aquaculture to prosper, subject to maintaining standards for water quality and biodiversity.

Land transport

Land transport is the largest source of greenhouse gases under Iceland's direct policy responsibility (Figure 3.3), accounting for around 30% of non-EU-ETS regulated emissions. The climate action plan provides for a large number of carbon abatement measures, including the provision of low-carbon transport infrastructure (e.g. charging stations), financial incentives for low-emission cars, fostering public transport and a ban on new diesel and fuel cars from 2030. The government should carefully evaluate the extent to which it co-funds low-carbon infrastructure and ensure neutrality between different low-carbon technologies such as electric, fuel cell or hybrid cars. Moreover, Norway’s experience suggests that granting tax exemptions for low-carbon vehicles can be costly in terms of foregone fiscal revenues, implying high abatement costs (OECD, 2019[54]). The government should phase tax exemptions out as planned.

The transition towards low-carbon vehicles will require Iceland to rethink transport pricing more broadly. As in most OECD countries, revenues from diesel and gasoline taxation are set to decline with the advent of low-carbon vehicles (Box 3.8). In 2019 the government tasked a working group to develop proposals for use- or distance-based vehicle taxation. Reforming transport pricing could also help address rising congestion and infrastructure shortages in the capital area (OECD, 2019[19]). To help reduce emissions and fund infrastructure, the Norwegian government introduced road-pricing schemes in medium-sized cities such as Bergen or Trondheim as early as the 1980s (International Transport Forum, 2010[55]). In this vein Iceland should aim for a transport pricing reform that helps reduce environmental damage, manage transport demand, and provides funding for new infrastructure across the country.

Transport fuel duties represent a significant share of tax revenue in most OECD countries. This revenue base will shrink as fuel efficiency improves and the electrification of the transport sector progresses. Against this background, the OECD has analysed the implications of declining fossil fuel consumption and investigated potential policy options in the case of Slovenia, finding that:

With fuel-efficiency improving in line with European standards and with alternative technologies accounting for roughly 60% of new cars in 2050, total fuel tax revenues will drop by more than 50% by 2050.

Modest, gradually rising distance-based pricing on motorways may cover the revenue loss from fuel taxation. Assuming motorway use evolves as expected, this charge would start at a level of EUR 0.007 per kilometre in 2020 and increase to EUR 0.046 per kilometre in 2050.

The existing distance-based pricing systems for trucks can be improved to manage demand and external costs more efficiently, by differentiating rates by time and place to account for congestion and pollution.

Complementary measures can encourage alternative travel modes such as public transport, or support households that are disproportionally affected by the reform.

Maintaining total transport tax revenue is not considered to be the foremost objective of a sustainable transport pricing strategy.

Source: (OECD/ITF, 2019[56]).

Agriculture

Agriculture produces around 13% of Iceland’s carbon emissions, mostly methane following enteric fermentation (burps and farts) of ruminant animals, reflecting the important role of livestock raising. There are currently few technologies to reduce methane emissions from sheep and cattle, and those that exist are costly (Henderson, Frezal and Flynn, 2020[57]). Greater use of nitrification inhibitors is assumed to both reduce nitrous oxide emissions and increase farm profitability, but this has not materialised yet (Bibbee, 2011[58]). Iceland’s climate action plan projects modest emission cuts of around 5%, mainly relying on measures such as higher production of vegetables, improved use of fertilizers and feeding of livestock to reduce the effects of fermentation. The sector is not subject to methane taxation, although methane is the second greenhouse gas after carbon dioxide.

More generally, Iceland’s above-average agricultural emissions are partly the result of a highly subsidised and protected sector. Much agricultural support continues to be provided through price support, which belongs to the economically most distorting and environmentally most damaging types of policy (OECD, 2014[59]). Market price support is complemented with a payment entitlements system, which is directly or indirectly coupled with production factors. Support to producers is only partly conditional on meeting environmental performance standards. Beyond carbon emissions, overgrazing contributes to soil erosion on half of the country’s surface, damaging biodiversity and weakening flood control. Agricultural research as a share of total agricultural spending has declined over the past few years. Overall, policy ambition is out of step with the agricultural sector’s potential to address climate change (OECD, 2019[60]).

Against this background, Iceland should follow a two-pronged approach to reduce emissions in agriculture. First, the government should introduce a methane emission pricing system as proposed in New Zealand (Box 3.9). Also, spending on agricultural research, especially on a more environmental-friendly agriculture, should be considerably increased. Second, the government should cut agricultural subsidies and couple the remaining ones to sustainable land management and to the production and preservation of amenities, thereby discouraging carbon-intensive production (Lankoski et al., 2018[61]). Supporting land conversion – e.g. reforestation, restoration of wetlands or highland pastures – could also foster the sector’s low-carbon transition at low economic cost. Iceland should continue to collaborate in international projects in these areas.

New Zealand’s agricultural sector and its carbon impact is in some respects comparable to Iceland’s. Livestock such as sheep and cattle accounts for a large part of agricultural production. Ruminants account for most of the sector’s 18% of total carbon and 90% of methane emissions, a higher share than in most OECD countries. Over the past years agriculture, one of the country’s main export sectors and, unlike Iceland’s, receiving little public support, has focused on improving productivity while abating carbon emissions. Innovative practices to cope with water shortages are also helping. Yet overall agricultural carbon emissions are declining only slowly.

Against this background New Zealand’s draft climate action plan, published in February 2021, devotes a considerable part to agriculture. It plans to reduce methane emissions by 20% from 2005 levels to reach the sector’s emission targets by 2030. The core instrument the climate commission proposes is a pricing mechanism, either a special methane levy or inclusion of agricultural emissions into New Zealand’s existing emission trading system (ETS), to take effect by 2022. Farm-level emission reporting will become compulsory in 2024. In addition, the climate commission suggests setting up a long-term plan for targeted research and development of technologies and practices to cut agricultural carbon, including genetic research and vaccines.

Modelling exercises suggest little impact on agricultural production, productivity and employment. Emissions are supposed to decline mainly because of less intensive farming methods such as a lower livestock, less fertilizing, and fewer breeding animals. Moving away from animal production towards vegetables would also reduce methane emissions. New technologies to capture methane are not assumed to be commercially available before 2035, so the impact on production beyond that date would depend on the viability of technologies such as a methane inhibitor or vaccine. Modelling also suggests that a bolder carbon policy would actually result in fewer agricultural job losses than in the no-action scenario, because it implies less land use change from animal farming to forestry.

Source: (Climate Change Commission (New Zealand), 2021[62]), (Bibbee, 2011[58]).

Industry

Iceland’s stationary industry is subject to the European Union emission trading system (EU-ETS) since 2008, leaving the country no direct policy lever over industrial carbon emissions, although a public company is active in developing innovative carbon capture technologies. EU-ETS is the Union's main instrument for the transition towards a low-carbon economy and should deliver a 43% reduction in European-wide emissions by 2030 compared to 2005. Iceland plans to participate in the international flight emission reduction scheme and to align it with the EU-ETS, which is welcome. In contrast, sectors regulated by the EU-ETS should be exempted from domestic emission pricing such as a carbon tax.

References

[11] Agrawala, S., D. Dussaux and N. Monti (2020), “What policies for greening the crisis response and economic recovery?: Lessons learned from past green stimulus measures and implications for the COVID-19 crisis”, OECD Environment Working Papers, No. 164, OECD Publishing, Paris, https://dx.doi.org/10.1787/c50f186f-en.

[29] Albrizio, S. et al. (2014), “Do Environmental Policies Matter for Productivity Growth?: Insights from New Cross-Country Measures of Environmental Policies”, OECD Economics Department Working Papers, No. 1176, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jxrjncjrcxp-en.

[39] Andrews, D., C. Criscuolo and Gal (2016), “The Best versus the Rest: The Global Productivity Slowdown, Divergence across Firms and the Role of Public Policy”, OECD Productivity Working Papers, No. 5,, https://doi.org/doi.org/10.1787/6362.

[44] Antosiewicz, M. et al. (2020), “Distributional Effects of Emission Pricing in a Carbon-intensive Economy: the Case of Poland”, IZA Discussion Paper 13481, http://www.iza.org.

[31] Arlinghaus, J. (2015), “Impacts of Carbon Prices on Indicators of Competitiveness: A Review of Empirical Findings”, OECD Environment Working Papers, No. 87, OECD Publishing, Paris, https://dx.doi.org/10.1787/5js37p21grzq-en.

[53] Asche, F. (2012), Green Growth in Fisheries and Aquaculture Production and Trade (Contribution to the OECD report on green growth).

[64] Babina, T. et al. (2020), “The Colour of Money: Federal versus Industry Funding of University Reserach”, National Bureau of Economic Research Working Papers Series 28160, http://www.nber.org/papers/w28160.

[65] Balistreri, E., D. Kaffine and H. Yonezawa (2019), “Optimal Environmental Border Adjustments Under the General Agreement on Tariffs and Trade”, Environmental and Resource Economics, Vol. 74, https://doi.org/doi.org/10.1007/s10640-019-00359-2.

[28] Berestycki, C. and A. Dechezleprêtre (2020), “Assessing the efficiency of environmental policy design and evaluation: Results from a 2018 cross-country survey”, OECD Economics Department Working Papers, No. 1611, OECD Publishing, Paris, https://dx.doi.org/10.1787/482f8fbe-en.

[58] Bibbee, A. (2011), “Green Growth and Climate Change Policies in New Zealand”, OECD Economics Department Working Papers, No. 893, OECD Publishing, Paris, https://dx.doi.org/10.1787/5kg51mc6k98r-en.

[30] Brandt, N., P. Schreyer and V. Zipperer (2014), “Productivity Measurement with Natural Capital and Bad Outputs”, OECD Economics Department Working Papers, No. 1154, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jz0wh5t0ztd-en.

[26] Burniaux, J., J. Château and R. Duval (2010), “Is there a Case for Carbon-Based Border Tax Adjustment?: An Applied General Equilibrium Analysis”, OECD Economics Department Working Papers, No. 794, OECD Publishing, Paris, https://dx.doi.org/10.1787/5kmbjhcqqk0r-en.

[70] Carattini, S. (2017), “Green Taxes in a Post-Paris World: Are Millions of Nays Inevitable?.”, Environmental and Resource Economics 68, https://doi.org/10.1007/s10640-017-0133-8.

[62] Climate Change Commission (New Zealand) (2021), Draft Advice for Consultation.

[67] Criscuolo, C., P. Gal and C. Menon (2014), “The Dynamics of Employment Growth: New Evidence from 18 Countries”, OECD Science, Technology and Industry Policy Papers, No. 14, https://doi.org/doi.org/10.1787/5jz417hj6hg6-en.

[7] de Serres, A., F. Murtin and G. Nicoletti (2010), “A Framework for Assessing Green Growth Policies”, OECD Economics Department Working Papers, No. 774, OECD Publishing, Paris, https://dx.doi.org/10.1787/5kmfj2xvcmkf-en.

[32] Dechezleprêtre, A. and T. Kruse (2018), “A review of the empirical literature combining economic and environmental performance data at the micro-level”, OECD Economics Department Working Papers, No. 1514, OECD Publishing, Paris, https://dx.doi.org/10.1787/45d269b2-en.

[12] Dechezleprêtre, A. and T. Kruse (forthcoming), “Measuring and Assessing the Effects of Environmental Policy Uncertainty”, OECD Economic Department Working Papers.

[15] Dechezleprêtre, A., D. Nachtigall and F. Venmans (2018), “The joint impact of the European Union emissions trading system on carbon emissions and economic performance”, OECD Economics Department Working Papers, No. 1515, https://doi.org/dx.doi.org/10.1787/4819b016-en.

[63] Dechezleprêtre, A., D. Nachtigall and F. Venmans (n.d.), “The joint impact of the European”.

[34] Dlugosch, D. and T. Kozluk (2017), “Energy prices, environmental policies and investment: Evidence from listed firms”, OECD Economics Department Working Papers, No. 1378, OECD Publishing, Paris, https://dx.doi.org/10.1787/ef6c01c6-en.

[69] Douenne, T. and A. Fabre (2019), “French attitudes on climate change, carbon taxation and other climate policies”, Ecological Economics 169.

[35] Dussaux, D. (2020), “The joint effects of energy prices and carbon taxes on environmental and economic performance: Evidence from the French manufacturing sector”, OECD Environment Working Papers, No. 154, OECD Publishing, Paris, https://dx.doi.org/10.1787/b84b1b7d-en.

[24] European Commission (2013), Renewable Energy Technologies and Kyoto Protocol Mechanisms.

[71] European Union (2018), The EU Reference Scenario 2016: Energy, transport and GHG emissions –Trends to 2050.

[48] Fabra, N. (2021), “The Energy Transition: an Industrial Economics Pespective”, CEPR Working Paper 5705, http://www.cepr.org.

[36] Flues, F. and A. Thomas (2015), “The distributional effects of energy taxes”, OECD Taxation Working Papers, No. 23, OECD Publishing, Paris, https://dx.doi.org/10.1787/5js1qwkqqrbv-en.

[9] Flues, F. and K. van Dender (2020), “Carbon pricing design: Effectiveness, efficiency and feasibility: An investment perspective”, OECD Taxation Working Papers, No. 48, OECD Publishing, Paris, https://dx.doi.org/10.1787/91ad6a1e-en.

[33] Garsous, G. and T. Kozluk (2017), “Foreign Direct Investment and The Pollution Haven Hypothesis: Evidence from Listed Firms”, OECD Economics Department Working Papers, No. 1379, OECD Publishing, Paris, https://dx.doi.org/10.1787/1e8c0031-en.

[21] Goldmann Sachs (2020), Carbonomics: The green engine of economic recovery.

[4] Government of Iceland (2021), Interim report of the project group on green financing (in Icelandic).

[50] Government of Iceland (2020), A Sustainable Energy Future. Energy Policy Until 2050 (in Icelandic).

[1] Government of Iceland (2019), Report on Policies, Measures and Projections to Reduce Greenhouse Gas Emissions.

[10] Haraldsson, G. and D. Carey (2011), “Ensuring a Sustainable and Efficient Fishery in Iceland”, OECD Economics Department Working Papers 891, https://doi.org/dx.doi.org/10.1787/5kg566jfrpzr-en.

[46] Harrison, K. (2013), “The Political Economy of British Columbia’s Carbon Tax”, OECD Environment Working Papers, No. 63, OECD Publishing, Paris, https://dx.doi.org/10.1787/5k3z04gkkhkg-en.

[57] Henderson, B., C. Frezal and E. Flynn (2020), “A survey of GHG mitigation policies for the agriculture, forestry and other land use sector”, OECD Food, Agriculture and Fisheries Papers, No. 145, OECD Publishing, Paris, https://dx.doi.org/10.1787/59ff2738-en.

[18] Institute of Economics at the University of Iceland (2021), Technical Background Paper.

[17] Institute of Economics at the University of Iceland (2020), The effect of the carbon tax on households and firms (in Icelandic).

[41] International Energy Agency (2020), Sustainable Recovery, IEA, http://www.iea.org/reports/sustainable-recovery.

[55] International Transport Forum (2010), Implementing Congestion Charges, http://www.itf-oecd.org/road-pricing-roundtable.

[68] Jha, A., S. Karolyi and N. Muller (2021), “Polluting Public Funds: The Effect of Environmental Regulation on Municipal Bonds”, NBER Working Paper 28210, http://www.nber.org/papers/w28210.

[13] Jin, W., F. van der Ploeg and L. Zhang (2020), “Do We Still Need Carbon-Intensive Capital When Transiting to a Low-carbon Economy?”, CESifo Working Papers 8745, https://www.cesifo.org/en/wp.

[20] Johnsson, F., F. Normann and E. Svensson (2020), “Marginal Abatement Cost Curve of Industrial CO2 Capture and Storage – A Swedish Case Study”, Frontiers in Energy Research, https://doi.org/10.3389/fenrg.2020.00175.

[45] Kahnemann, D., J. Knetsch and R. Thaler (1991), “Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias”, Journal of Economic Perspectives 5.

[27] Koźluk, T. and C. Timiliotis (2016), “Do environmental policies affect global value chains?: A new perspective on the pollution haven hypothesis”, OECD Economics Department Working Papers, No. 1282, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jm2hh7nf3wd-en.

[49] Landsnet (2016), Possible Energy Change in Iceland (in Icelandic), https://landsnet.is/library/Skrar/M%C3%B6guleg%20orkuskipti%20%C3%A1%20%C3%8Dslandi%20-%20samantekt%20%C3%A1%20afl%C3%BE%C3%B6rf%20og%20sparna%C3%B0i%20%C3%AD%20losun%20CO2%20(002).pdf.

[61] Lankoski, J. et al. (2018), “Modelling Policy Coherence Between Adaptation, Mitigation and Agricultural Productivity”, OECD Food, Agriculture and Fisheries Papers, No. 111, OECD Publishing, Paris, https://dx.doi.org/10.1787/ee62a5ae-en.

[75] Lankoski, J. et al. (2018), “Modelling Policy Coherence Between Adaptation, Mitigation and Agricultural Productivity”, OECD Food, Agriculture and Fisheries Papers, No. 111, OECD Publishing, Paris, https://dx.doi.org/10.1787/ee62a5ae-en.

[2] Ministry for the Environment and Natural Resources (2018), Iceland’s Climate Action Plan for 2018-2030.

[74] Muehlegger, E. and D. Rapson (2020), “Correcting Estimates of Electric Vehicle Emissions Abatement: Implications for Climate Policy”, NBER Working Paper 27197, https://doi.org/10.3386/w27197.

[8] Nordhaus, W. (2019), “Climate Change: The Ultimate Challenge for Economics”, American Economic Review, Vol. 109/6.

[3] Norwegian Ministry of Climate and Environment (2019), Norway’s National Plan Related to the Decision of the EEA Joint Committee No. 269/2019 of 25 October 2019, https://www.regjeringen.no/contentassets/31a96bc774284014b1e8e47886b3fa57/norways-national-plan-related-to-the-decision-of-the-eea-joint-committee-no.-269-2019-of-25-october-2019.pdf.

[25] OECD (2020), Climate Policy Leadership in an Interconnected World.

[14] OECD (2020), Green budgeting and tax policy tools to support a green recovery, OECD Publishing, Paris, https://read.oecd-ilibrary.org/view/?ref=137_137215-2knww1hckd&title=Green-budgeting-and-tax-policy-tools-to-support-a-green-recovery.

[5] OECD (2020), Green Infrastructure in the Decade for Delivery: Assessing Institutional Investment, Green Finance and Investment, OECD Publishing, Paris, https://doi.org/doi.org/10.1787/f51f9256-en.

[6] OECD (2020), Making the Green Recovery Work for Jobs, Income and Growth.

[40] OECD (2020), OECD Competition Assessment Reviews: Iceland, OECD Publishing, Paris, http://www.oecd.org/daf/competition/oecd-competition-assessment-reviews-iceland.htm.

[72] OECD (2020), Taxing Energy Use: Using Taxes for Climate Action, OECD Publishing, Paris, https://doi.org/doi.org/10.1787/058ca239-en.

[19] OECD (2019), Economic Surveys: Iceland, OECD Publishing, Paris.

[60] OECD (2019), Enhancing Climate Change Mitigation through Agriculture, OECD Publishing, Paris, https://doi.org/doi.org/10.1787/e9a79226-en.

[54] OECD (2019), OECD Economic Surveys: Norway, OECD Publishing, Paris, https://doi.org/doi.org/10.1787/c217a266-en.

[52] OECD (2018), “Informing Fisheries-Related Trade Negotiations. Relative Effects of Fisheries Support Policies, Annex D.: Elasticities of substitution and factor supply in the fisheries sector”.

[38] OECD (2015), The Future of Productivity, OECD Publishing, Paris, https://doi.org/doi.org/10.1787/9789264248533-en.

[59] OECD (2014), OECD Environmental Performance Reviews: Iceland 2014, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264214200-en.

[42] OECD (2010), Making Reform Happen, Lessons from OECD Countries,, OECD Publishing, Paris.

[47] OECD (2010), Making Reform Happen: lessons from OECD countries, OECD Publishing, Paris.

[22] OECD/IEA (2019), “Designing the Article 6.4 Mechanism: assessing selected Baseline Approaches and their Impact”, Climate Change Expert Group Working Paper 5, http://www.oecd.org/environment/cc/ccxg.htm.

[23] OECD/IEA (2012), “Making Markets: Unpacking Design and Governance of Carbon Market Mechanisms”, Climate Change Export Group Working Paper 3, http://www.oecd.org/env/cc/ccxg.htm.

[56] OECD/ITF (2019), Tax Revenue Implications of Decarbonising Road Transport: Scenarios for Slovenia, OECD Publishing, Paris, https://doi.org/doi.org/10.1787/87b39a2f-en.

[43] Office fédéral (suisse) de l’environnement (2020), Taxe sur le CO2.

[66] Ormazabal, G. et al. (2020), “The Big Three and Corporate Carbon Emissions Around the World”, CEPR Discussion Papers 15522, http://www.cepr.org.

[16] Sen, S. and H. Vollebergh (2019), “The effectiveness of taxing the carbon content of energy consumption”, Journal of Environmental Economics and Management, Vol. 92, https://doi.org/dx.doi.org/10.1016/J.JEEM.2018.08.017.

[37] Thorarinsson, S. (2020), “DYNIMO – Version III. A DSGE Model of the Icelandic Economy”, Central Bank of Iceland Working Paper 84.

[51] Working Group on the Fisheries (2021), Green steps in the fishing industry (in Icelandic).

[73] Yonezawa, H. and T. Faehn (2020), “Emission Targets and Coalition Options for a Small, Ambitious Country: An Analysis of Welfare Costs and Distributional Impacts for Norway”, CEPR Working Papers.