copy the linklink copied!United Kingdom

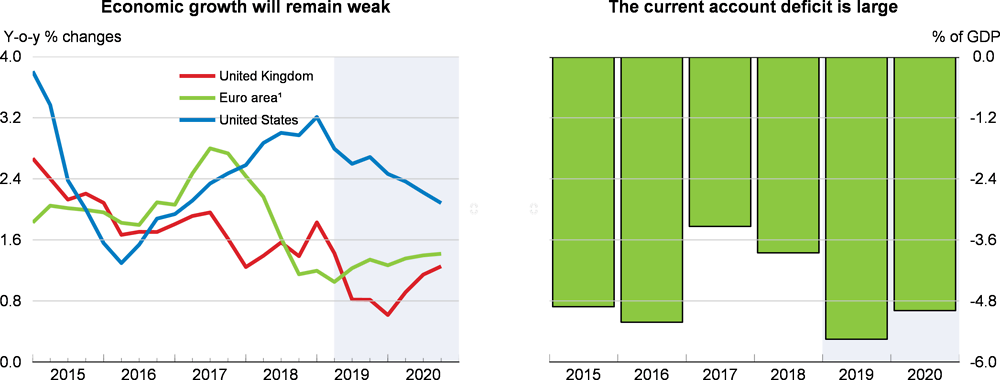

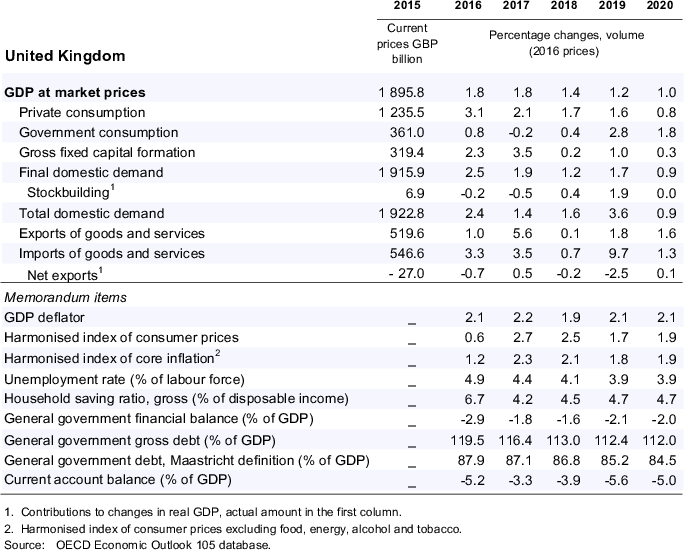

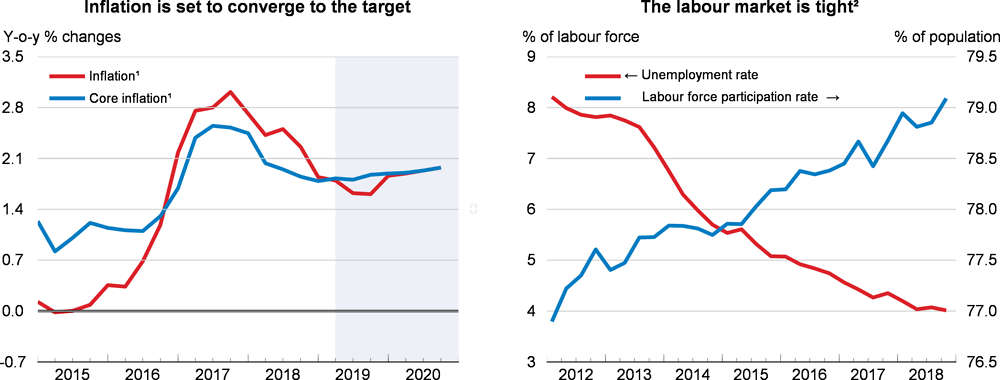

Economic activity is expected to grow slightly above 1% this year and next under the assumption that there is a smooth transition and exit from the European Union after 2020. Brexit-related uncertainties will keep holding back investment until there is clarity about future trading arrangements. Consumption will decelerate in line with slower employment gains. The economy should nonetheless benefit from a supportive fiscal stance this year and the modest recovery in global growth in 2020. Inflation should converge to 2% by the end of 2020.

With inflation close to target but with large uncertainties remaining, the policy interest rate should be kept constant until there are clear signs of accelerating prices. The fiscal authorities should stand ready to respond, should growth weaken significantly as a result of Brexit. To lower economic uncertainties and reassure investors the government should clarify its preferred option for the future trade relationship with the European Union, which should ensure the closest possible trading relationship and high access for financial services to overseas markets.

Economic uncertainty has held back business investment

Brexit-related uncertainties have risen in the past few months, further deteriorating business confidence and holding back investment. Firms have been meeting demand by hiring rather than investing. Tight labour markets and receding inflation have supported household consumption. The saving rate has been volatile, increasing on average in the most recent period. Growth has slowed in major trading partners. The current account deficit has been widening, nearing 4½ per cent of GDP, reflecting worsening trade, particularly in the car sector, and deteriorating income balances. There has been massive stockpiling in the first quarter of 2019, which is likely to be mostly imported goods.

Policy measures will be needed to smooth the exit from the European Union

The projections assume that the extension of the Article 50 period to October 2019 will allow the United Kingdom to smoothly leave the European Union after 2020 following a transition period. The nature of the future relationship with the European Union and its implications for trade, investment and labour mobility still needs to be defined. To lower economic uncertainties, the UK authorities should clarify their position, both in terms of exit date and of the nature of the relationship as soon as possible. The government should strive to forge an agreement that will ensure the closest possible trading relationship with the European Union and high access for financial services to overseas markets.

The Monetary Policy Committee has appropriately paused the normalisation process in the context of large uncertainties. It has indicated that gradual and limited increases in the policy interest rate may be warranted, if the UK economy grows broadly in line with its latest economic projections. Monetary policy conditions should remain accommodative until there are clear signals of strengthening price pressures. In the OECD projections, interest rates are assumed to start rising in 2020.

After several years of consolidation, fiscal policy has become accommodative. Higher projected income tax receipts and lower interest payments have increased fiscal space. Increases in health spending, infrastructure and defence, together with cuts in household income tax and other taxes, are expected to support the economy this year, adding some 0.3 percentage point to growth. The government should be ready to react should the economy markedly decelerate due to Brexit. In addition to letting the fiscal automatic stabilisers fully operate, they should focus on measures that foster productivity and inclusive growth in the long term, such as increasing spending on digital infrastructure and providing good ICT training to low-skilled workers. Government policies should seek to support workers, not particular sectors or jobs, should trade and production shift as a result of Brexit.

Growth is projected to remain weak

Activity is expected to pick up but to grow below trend in both 2019 and 2020. Investment growth should recover slowly as uncertainties regarding the nature of Brexit gradually diminish. Consumption growth is expected to weaken as employment-related incomes slow and monetary policy starts to normalise. Inflation will move up gradually to the 2% target. With high economic uncertainty and fragile consumer confidence, housing activity and prices are likely to remain subdued in the short term. The unemployment rate is anticipated to remain broadly stable. The public debt-to-GDP ratio is projected to decline marginally from its peak. The current account deficit should narrow but remain large.

An exit without a deal and associated financial disruptions remains a tail risk. Political uncertainty and its impact on investment could also damp growth more strongly or for longer than projected. Investment prospects could recover faster should the United Kingdom and the European Union agree on a closer economic relationship than currently envisaged. Stockpiling observed at the eve of Brexit is also likely to unwind at some point.

Metadata, Legal and Rights

https://doi.org/10.1787/b2e897b0-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.