copy the linklink copied!Fees charged to members of defined contribution plans

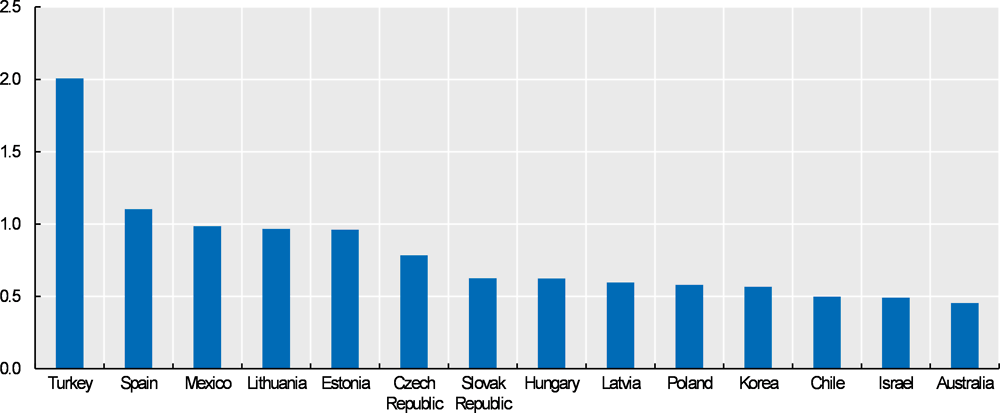

Pension providers charge fees to members to cover their operating expenses for running pension plans. Most countries cap fees, generally fees on assets, which can be charged to members. Other initiatives to reduce the fees charged by the industry include auction mechanisms based on fees such as in Chile and in New Zealand (along with other criteria). Regardless of the fee structure, members paid the lowest amount of fees in 2018 in Australia, Chile and Israel (0.5% of assets).

Pension providers charge fees to their members to cover their operating expenses. Operating expenses include marketing the plan to potential participants, collecting contributions, sending contributions to investment fund managers, keeping records of accounts, sending reports to participants, investing the assets, converting account balances to annuities, and paying annuities.

Pension providers charge fees to members in different ways depending on the country. Fees can be charged on contributions or on salaries directly (e.g. Chile), on assets (e.g. Estonia, Spain), on performance, or a combination (e.g. the Czech Republic where pension funds can charge fees on assets and profits). On top of regular fees, members in some countries may be charged fees when they join, switch or leave a pension provider (e.g. the Czech Republic).

Most countries - 12 out of 20 reporting OECD countries - capped some of the fees that pension providers can charge to members. Most of these 12 countries capped fees on assets, which is one of the most widespread way for pension providers to charge members. Some have been lowering their cap on fees recently (e.g. Estonia, the Slovak Republic, Spain). In Estonia, the cap for management fees of mandatory pension funds became 1.2% for all pension funds from 2 September 2019 (while before, the cap was 1.2% for conservative funds only, 2% for the other funds). Spain recently reduced the cap on custody fees (from 0.25% to 0.2%) and the cap on management fees for fixed income funds (from 1.5% to 0.85%) and for equity funds (from 1.5% to 1.3%).

Other initiatives to reduce the fees charged by the industry include auction mechanisms based on fees such as in Chile and New Zealand (along with other criteria). Pension providers in Chile bid on fees charged to members. The winning pension provider receives all new eligible entrants. In New Zealand, default providers are selected based on a range of selection criteria that include fees. These mechanisms intend to drive the fees down.

The amount of fees charged to members was heterogeneous across countries at the end of 2018. Regardless of the fee structure, the highest fees charged to members relatively to the amount of assets under management were recorded in Turkey (2.0% in 2017) and Spain (1.1%) among reporting OECD countries. By contrast, members paid the lowest amount of fees in Australia, Chile and Israel (0.5% of assets).

Definition and measurement

The term "funded and private pensions" actually refers to private pension arrangements (funded and book reserves) and funded public arrangements (e.g. ATP in Denmark).

Some fees may not be fully reported in all the cases. Data may underestimate the actual charges on the pension pot paid by members in some countries (e.g. through indirect costs reducing investment returns). For example, in Chile pension funds that invest in international mutual funds deduct management costs directly from the fund. These costs are reported separately by each pension fund administrator to the Superintendence of Pensions. However, they are not included in the fees charged to members.

Further reading

IOPS (2018), 2018 Update on IOPS work on fees and charges, IOPS Working Papers on Effective Pensions Supervision, No.32

OECD (2018), OECD Pensions Outlook 2018, OECD Publishing, Paris.

Metadata, Legal and Rights

https://doi.org/10.1787/b6d3dcfc-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.