copy the linklink copied!10. Colombia

copy the linklink copied!Key Facts on SME financing

Access to finance is one of the main conditions for strengthening entrepreneurship and growth of SMEs. It allows them to prosper and make investments in order to increase their productivity and competitiveness. It is more difficult for these companies to invest, to modernise their operations, and to innovate or cope with crises when they do not have sufficient access to formal financing.

Since 2006, the National Association of Financial Institutions (ANIF) has been running the Great SME Survey (Anif - Asociación Nacional de Instituciones Financieras, 2019), which gathers the opinion of a sample of SME entrepreneurs from the largest sectors, namely industry, trade and services.

The SME indicator Anif – IPA is constructed with the results of this survey. The indicator constitutes the main thermometer for the economic climate for formal and informal SMES. It compares the evolution of the following variables: economic situation, sales volumes, general performance expectations and sales expectations.

It is estimated that two out of three SMEs are informal in Colombia, according to the study “Demand for Financial Inclusion in Colombia” (Superintendencia Financiera de Colombia, 2015). Having made this clarification, results from the Great SME Survey – GEP1, which is conducted on a sample of the business fabric that is considered to be formal, are presented.

According to the results of the last survey round, bank credit has remained the main source of financing for formal SMEs. On average and in the three largest sectors, 40% of SMEs companies requested credit to the financial system. This percentage amounted to 39% in the industrial sector, 41% in the commerce sector and 40% in the services sector. Loan applications remained stable during the last year.

Moreover, 45% of SMEs did not have recourse to alternative sources of financing during the second half of 2018. For the remaining 55%, external providers were the most important source of alternative funding, followed by own resources. Leasing, reinvestment of profits, factoring and the non-banking market did not exceed 8% for any macro sector. In addition, the survey reveals that resources from private equity funds or entrepreneurial support have marginal importance.

During the first half of 2018, resources were allocated by SMEs as follows: working capital (63%), consolidation of liabilities (22%), purchase or leasing of machinery (11%) and remodelling or adjustments (9%).

With a business fabric such as that made up of SMEs in Colombia, it is important to highlight the benefits of access to credit. These include greater growth in sales, greater margins of production and investment in machinery and equipment compared to the companies that do not have access to credit. SMEs that cannot enter the financial system are often forced to resort to informal sources of financing, such as non-bank loans that do not adapt to their needs and have high costs.

The Great SME Survey showed that SMEs are not requesting credit for several reasons. The main reason put forward is that they do not need it; next, SMEs invoke the high costs associated with interest and commissions; and third, they mention the number of procedures for obtaining it, coupled with their distrust in the financial system. SMEs’ lack of recourse to credit is considered a problem of self-exclusion associated with different factors, including the belief that the loan application will be rejected and the ignorance of the importance of financial products for the development of their activity. SMEs often do not perceive financing as a necessity despite the fact that this business segment has a high financial dependence. All these factors highly correlated with the weak financial education of SMEs.

copy the linklink copied!SMEs in the national economy

SMEs constitute the basis of the country's economic growth. According to information from Confecámaras2, 1 532 290 formal companies were registered in the Single Business and Social Registry - RUES3 (Confecámaras, 2018) in 2017; of which 92.7% are microenterprises and 6.7% are small and medium enterprises, constituting 99.4% of the business fabric in the country. According to the National Statistics Department - DANE4, SMEs generate about 67% of employment and about 28% of GDP (Departamento Administrativo Nacional de Estadística - DANE, 2017).

The classification presented in Table 10.2 will be valid until December 2019, when Decree 957 of 2019 enters into force, by means of which a new classification of business size will be established, based on the single criterion of income from ordinary activities. This new provision is closer to the reality of the business fabric, as it recognises sectoral differences and therefore defines classification ranges for three macroeconomics sectors: manufacturing, services and commerce.

copy the linklink copied!Lending to SMEs

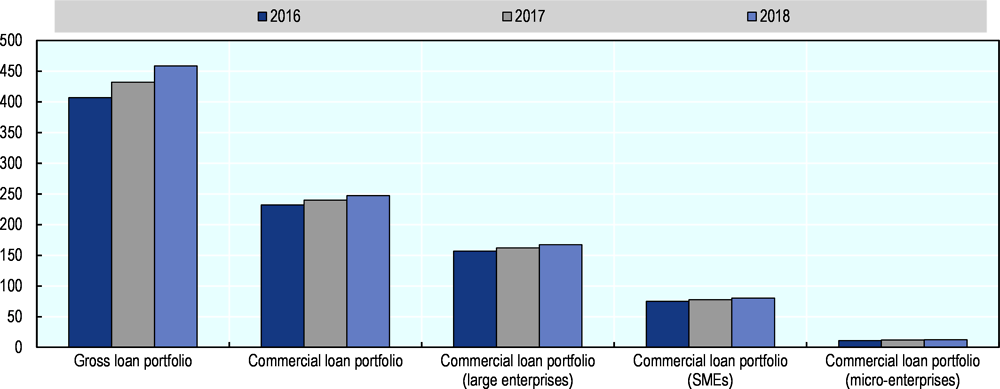

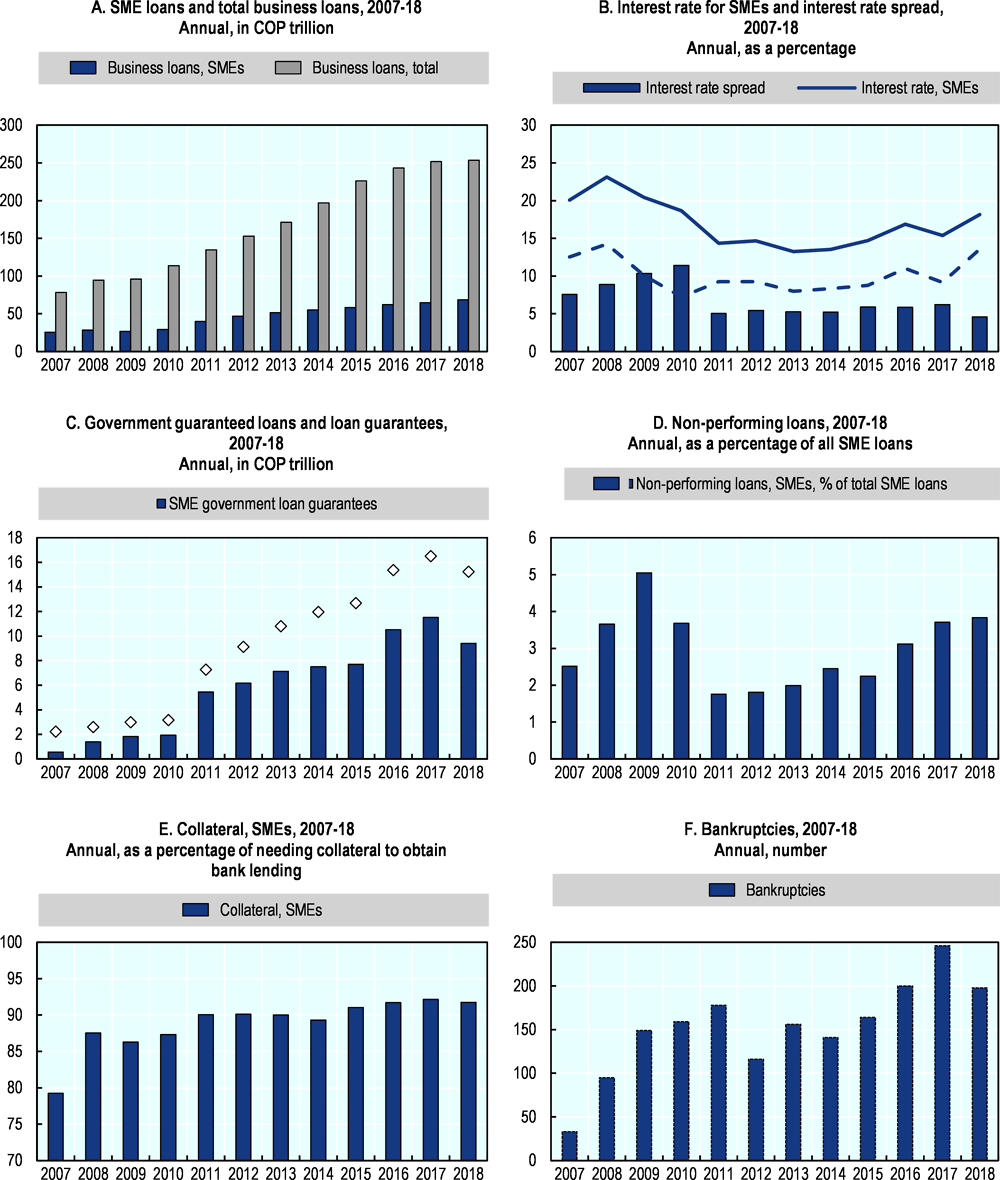

SMEs represented 54% of the total credit portfolio in Colombia in 2018 (Superintendencia de Colombia, 2018). This figure has shown stable growth over the past three years (Figure 10.1).

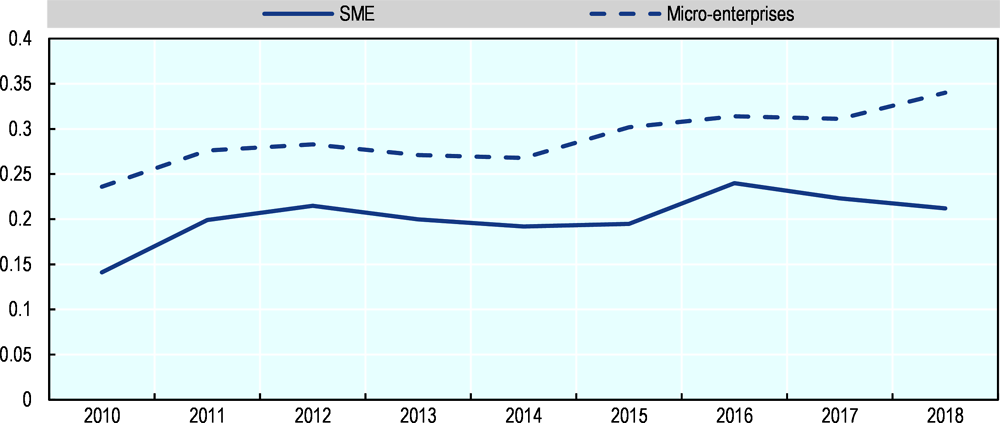

Despite its stability, the SME portfolio has been affected by the slowdown in economic activity since 2014, thus demonstrating these firms’ high sensitivity to changes in macroeconomic conditions. There has been a decrease in demand generated by the economic slowdown in the country since 2014, mostly due to the decrease in the price of international oil prices. Moreover, there was an increase in the interest rate of SMEs which has had a sustained growth since 2014 (Figure 10.3).

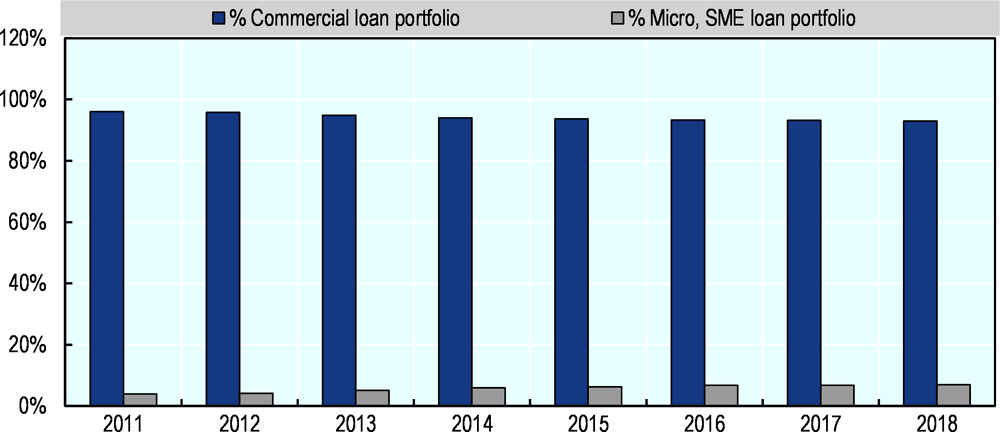

A point to highlight in the evolution of credit to SMEs is that more and more micro-enterprises have micro-credits and commercial credits at the same time, confirming their accession to formal financing and therefore progress in formalisation.

Although 93% of SMEs have only one commercial loan, the number of micro-enterprises that have a micro-credit and an SME loan has grown by more than 41% in the last three years (Figure 10.2).

copy the linklink copied!Credit conditions

Interest rates and credit conditions have seen a favourable adjustment during the last three years. After having suffered a significant rebound in 2016, interest rates are well above the credit to natural persons and far from the interest rates charged to large companies; there is still a high perception of risk concerning these companies (Figure 10.3).

Financing of SMEs by the financial sector

According to the results of the last Great SME Survey - GEP (Anif - Asociación Nacional de Instituciones Financieras, 2019), on average and in the three macro sectors, 40% of SMEs requested credit. Credit approval rates, however, showed a slight decrease on average (-2.5%) in of industry and commerce.

As indicated by the same survey, less than 8% of SMEs use financing alternatives other than credit as factoring. It is currently estimated that the size of the factoring market in Colombia is around 2.8% of GDP (Anif - Asociación Nacional de Instituciones Financieras, 2019). This low level of activity is largely explained by the high rate of informality referred to above, by the cost of operation and by low financial education.

copy the linklink copied!Alternative sources of SME financing

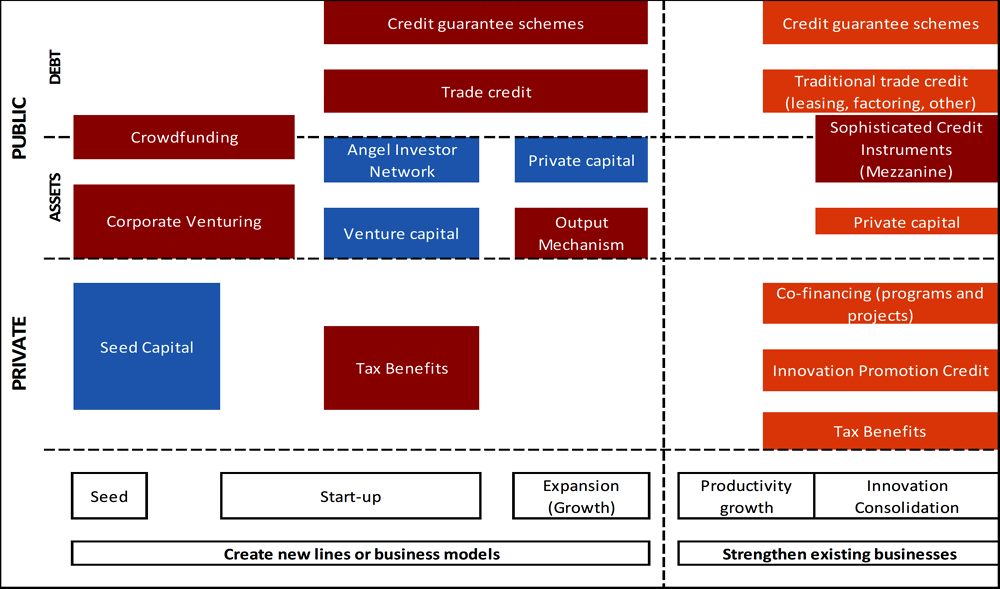

Despite the limited access to alternative sources of financing, there is a relatively well-developed framework for strengthening ongoing businesses (see instruments represented in dark blue in Figure 9.5). A similar structure for new instruments and business models (instruments represented in red and light blue) is pending. However, the aforementioned limitations (informality, cost and financial education) limit their use. Figure 10.4 shows an outline of the funding structure adapted from (OECD, 2013) and cited by the National Planning Department (Departamento Nacional de Planeación, 2016)

copy the linklink copied!Other Indicators

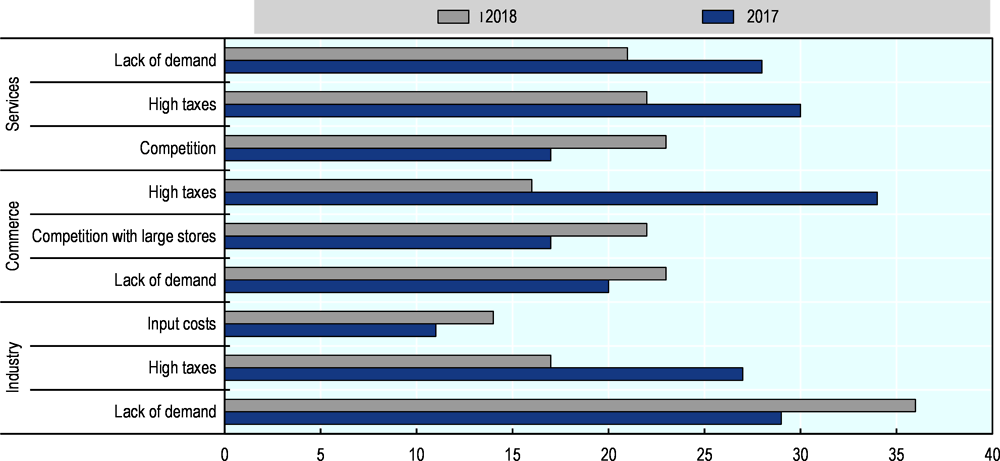

One of the benefits of using the Great SME Survey - GEP 2018 (Anif - Asociación Nacional de Instituciones Financieras, 2019) is the access to SMEs’ direct perception of the situation of the national economy in the selected study period. As a complement to the information related to access to financing, the survey presents other indicators reporting the main problems faced by SMEs other than access to financing. In the year 2018, the country was starting to recover after poor performance due to the decrease in international oil prices, which negatively impacted a large part of industry and commerce.

This fragility in the economy between 2016 and 2018 is reflected in the four problems reported by SMEs, as follows: lack of demand, high taxes, competition and cost of supplies – the latter only in the macro industry sector (Figure 10.6). These problems illustrate the business sector’s moderate recovery, after two years of macroeconomic tensions generated by the international oil price crisis.

copy the linklink copied!Government policy response

Increased and deepened lending support

Since the end of 2017 and throughout 2018, Bancóldex5 defined a strategy to stimulate disbursements through different strategic focuses: strengthening the rediscount scheme, a new line of direct credit operations and a strengthening of the policy for Microenterprise Oriented Entities (EOCM). The most important results of this strategy are detailed below (Bancóldex , 2018).

Increases in disbursements

In 2018, Bancóldex disbursements grew by 37%, increasing from COP 3.5 billion to COP 4.81 billion and benefiting more than 111 000 entrepreneurs. These results were achieved thanks to the relationship with different actors relevant to the business sector, such as chambers of commerce, unions and business associations. Together with the Ministry of Commerce, Industry and Tourism, credit lines were designed with special conditions to support micro-enterprises and small enterprises.

Strengthening of microenterprises

During 2018, eleven new microfinance companies joined the EOCM network, which reached a number of 79 entities. This allowed for an extension of the coverage of the Bancóldex network and resulted in 107 593 credit operations.

Green growth

Under this scheme, Bancóldex established a credit line aimed exclusively at projects for sustainable development and energy efficiency of the business sector. In parallel, the bank decided not to finance means of transport that use polluting fuels.

Strengthening of the Colombian export sector

Bancóldex continued to exercise its role as a promoter of foreign trade, supporting the internationalisation of the economy with an emphasis on market diversification and taking advantage of the opportunities generated by the Free Trade Agreements – FTA, for which COP 1.52 billion were disbursed, benefiting 978 exporting companies.

Bancóldex Capital Program

In 2018, two new investment commitments were made in entrepreneurial capital funds aimed at social and environmental impact. Likewise, the existing commitment to the entrepreneurial capital fund “Amerigo Venture Pacífico” was extended. Thanks to these investments, 67 companies have benefited from investments in different sectors and stages of growth.

Other initiatives

In recent years, Colombia has been advancing in policies to advance SME formalisation and to reduce their tax burden. The Financing Law of 2018 establishes a simplified tax regime called the SIMPLE regime, which promotes the formalisation of SMEs by reducing the costs of such formalisation and simplifying compliance with tax obligations.

At the beginning of 2019, the Public Policy for Business Formalisation was established. It proposes a medium-term action plan to improve the cost-benefit ratio of becoming formal and is put in place through strategies to reduce the regulatory burden for formal companies. However others activities are being strengthening, for example inspection, surveillance and control. It also introduces a formality measurement strategy through a multidimensional process. These dimensions are as follows: the operating requirements associated with production factors such as the use of labour and land use; the requirements associated with production and marketing, such as quality standards, sanitation, etc.; and finally tax formalisation, as the last link or stage of the formalisation process.

Another initiative is the one that has been implemented through the simplification of procedures and requirements, through a Unique Business Data base - VUE. Through the corresponding digital platform, procedures, requirements and obligation (commercial, tax and social security) are made clear to entrepreneurs.

A constant obstacle for SMEs is their lack of liquidity, which prevents the normal functioning of these companies, hindering productive investments and limiting their growth and development. Given this situation, the Government presented the Bill for Prompt Payment before the Congress of the Republic in the first half of 2019. This piece of legislation is supplemented by the regulation of the Electronic Invoice, which is planned for the third quarter of 2019. Through these two responses, the government seeks to develop a strong factoring market as an immediate liquidity instrument for SMEs, which allows the approach to formal financial market

The Bill for Prompt Payment seeks to regulate the payment terms of large companies to SMEs. This project includes three main aspects. Firstly, all commercial transactions, except for leases and other contracts, payment for services and products, must take place within a maximum of 45 days after receipt of the invoice. Secondly, this obligation will apply to all actors of trade, except when it is made between large companies, which due to their liquidity and level of commercialisation, can agree on different terms. Thirdly, this law will have a gradual application in time, as follows: within 3 years after it becomes law, payment must be made within a maximum of 60 days and from the fourth year in 45 days. The electronic invoice has experienced gradual development since 2016; as of 2019, the speed in its implementation has increased thanks to the issuance of the decree that regulates its use.

References

Anaya, H. O. (2006). Análisis Financiero Aplicado y Principios de Administración Financiera. Bogotá: Universidad Externado de Colombia.

Anif - Asociación Nacional de Instituciones Financieras. (2019). La Gran Encuesta Pyme, lectura nacional. Bogotá: Centro de Estudios Económicos Anif.

Asociación Nacional de Instituciones Financieras - Anif. (Mayo de 2019). La factura electrónica: Instrumento pro formalización y de impulso al mercado de capitales. Coyuntura pyme(64), 38-44.

Banca de las Oportunidades. (20 de Mayo de 2017). Banca de las Oportunidades. Acesso em 20 de Mayo de 2019, disponível em http://bancadelasoportunidades.gov.co/es/reportes/%2A

Bancóldex . (2018). Informe de la Junta Directiva y del Presidente a la Asamblea General de Accionistas. Bogotá.

Colombia Compra Eficiente. (23 de Diciembre de 2013). Manual para determinar y verificar los requisitos habilitantes en los Procesos de Contratación. Fonte: https://www.colombiacompra.gov.co/manuales-guias-y-pliegos-tipo/manuales-y-guias

Comisión Económica para América Latina y el Caribe - CEPAL. (13 de Mayo de 2018). La inclusión financiera para la inserción productiva y el papel de la banca de desarrollo. Acesso em 20 de Mayo de 2019, disponível em https://repositorio.cepal.org/bitstream/handle/11362/44213/1/S1800568_es.pdf

Confecámaras. (Diciembre de 2018). Nuevos hallazgos de la supervivencia y crecimiento de las empresas en Colombia. Fonte: http://www.confecamaras.org.co/phocadownload/2018/Cuadernos_An%C3%A1lisis_Econ%C3%B3mico/Cuaderno_demografia_empresarial/Cartilla17.pdf

Departamento Administrativo Nacional de Estadística - DANE. (22 de Marzo de 2017). Encuesta de Microestablecimientos . Fonte: https://www.dane.gov.co/files/investigaciones/boletines/microestablec/Bol_micro_2016.pdf

Departamento Nacional de Planeación. (26 de Mayo de 2015). Decreto 1082. Bogotá, Colombia.

Departamento Nacional de Planeación. (2016). Política Nacional de Desarrollo Productivo. Bogotá. Acesso em 18 de julio de 2019

OECD. (2013). Promoviendo a las startups en Colombia", in Startup América Latina: Promoviendo la innovación en la región. (P. OECD Publishing, Ed.) doi:https://doi.org/10.1787/9789264202320-13-es.

Silbernagel, C., & Vaitkunas, D. (2010). Mezzanine Capital. Vancouver: Bond Capital Mezzanine Inc.

Superintendencia de Colombia. (2018). Dinámica de la cartera regional y financiacion formal a la pyme. Bucaramanga.

Superintendencia Financiera de Colombia. (2015). Reporte de Inclusión Financiera 2014. Bogotá.

Zuleta, L. A. (2016). Inclusión financiera de la pequeña y mediana empresa en Colombia. Santiago de Chile: Comisión Económica para América Latina y el Caribe (CEPAL). Acesso em 20 de Mayo de 2019

Notes

← 1. The Survey was carried out in the months of September to November 2018. In this reading, 1 640 SMEs from the macro sectors of industry, commerce and services were interviewed, which in turn belong to the 21 economic subsectors with the greatest share of small and medium-sized businesses.

← 2. Confecámaras is a national organisation that coordinates and provides assistance in the development of its functions to the Colombian Chambers of Commerce, among others the public functions delegated by the State. It has worked for more than four decades of its existence based on the general interests of the Colombian business sector.

← 3. Unique registry of companies created under article 11 of law 590 of 2000.

← 4. The National Administrative Department of Statistics - DANE, is the official statistical agency of Colombia.

← 5. Bancóldex - Banco de Comercio Exterior de Colombia S.A. created as a development bank of Colombia by Law 7 of 1991 and Decree 2505 of 1991.

Metadata, Legal and Rights

https://doi.org/10.1787/061fe03d-en

© OECD 2020

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.