Confronting inflation and low growth

After a stronger-than-expected start to 2023, helped by lower energy prices and the reopening of China, global growth is expected to moderate. The impact of tighter monetary policy is becoming increasingly visible, business and consumer confidence have turned down, and the rebound in China has faded.

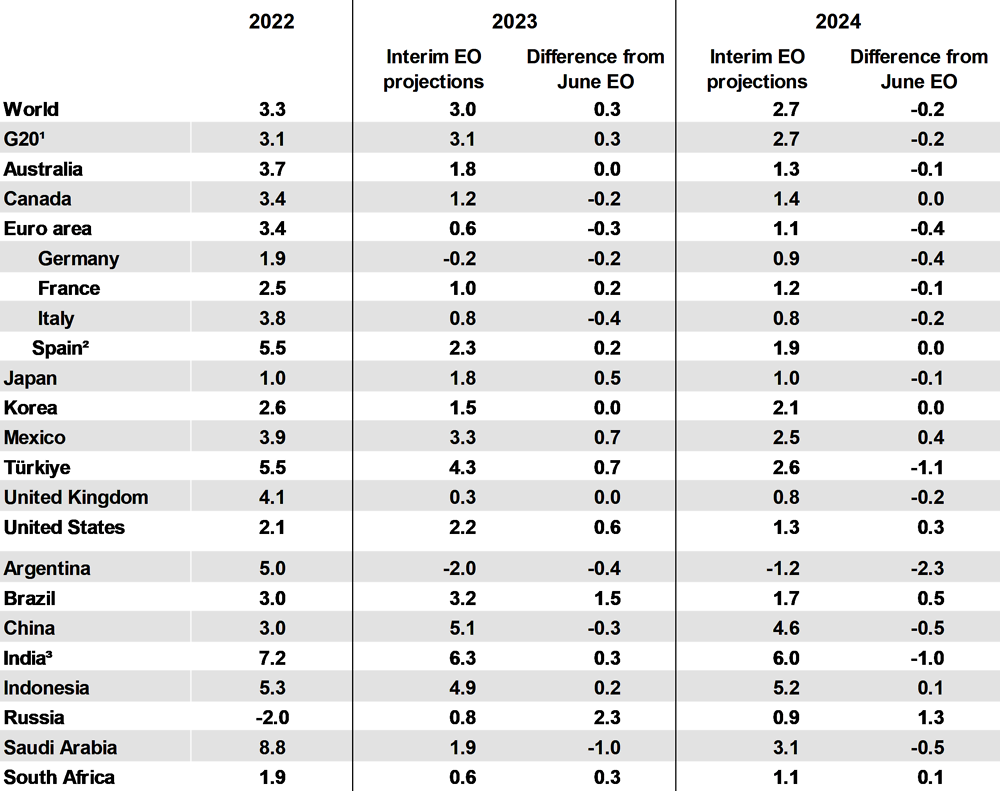

Global GDP growth is projected to remain sub-par in 2023 and 2024, at 3% and 2.7% respectively, held back by the macroeconomic policy tightening needed to rein in inflation.

Annual GDP growth in the United States is expected to slow from 2.2% this year to 1.3% in 2024, as tighter financial conditions moderate demand pressures. In the euro area, where demand is already subdued, GDP growth is projected to ease to 0.6% in 2023, and edge up to 1.1% in 2024 as the adverse impact of high inflation on real incomes fades. Growth in China is expected to be held back by subdued domestic demand and structural stresses in property markets, easing to 5.1% in 2023 and 4.6% in 2024.

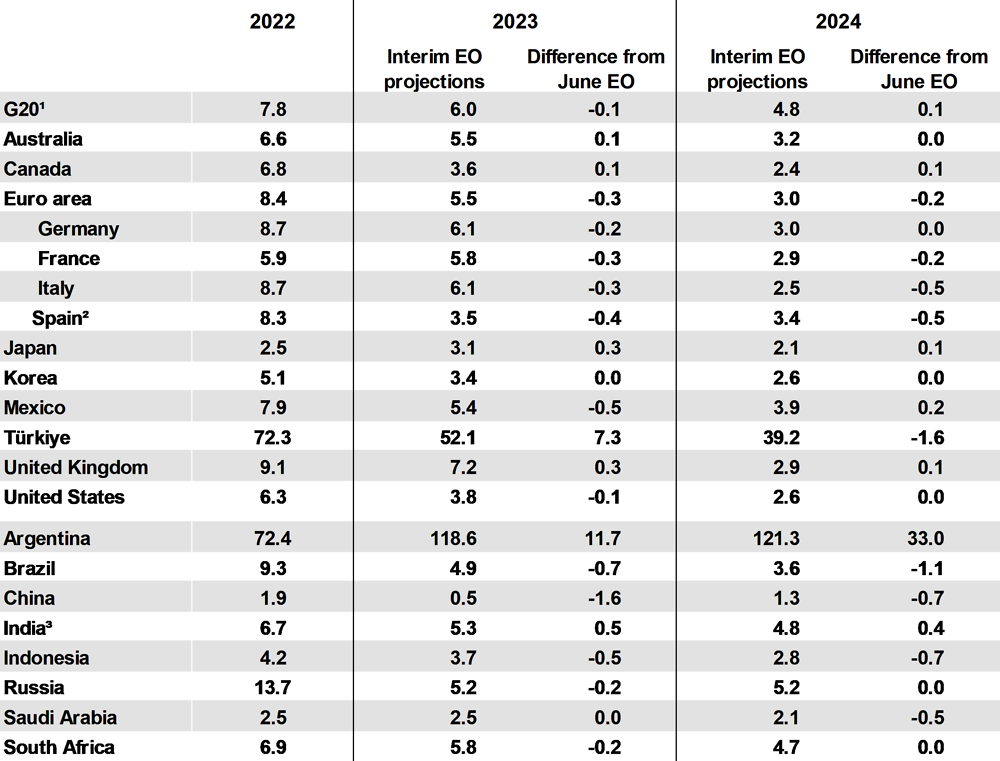

Headline inflation is declining, but core inflation remains persistent in many economies, held up by cost pressures and high margins in some sectors.

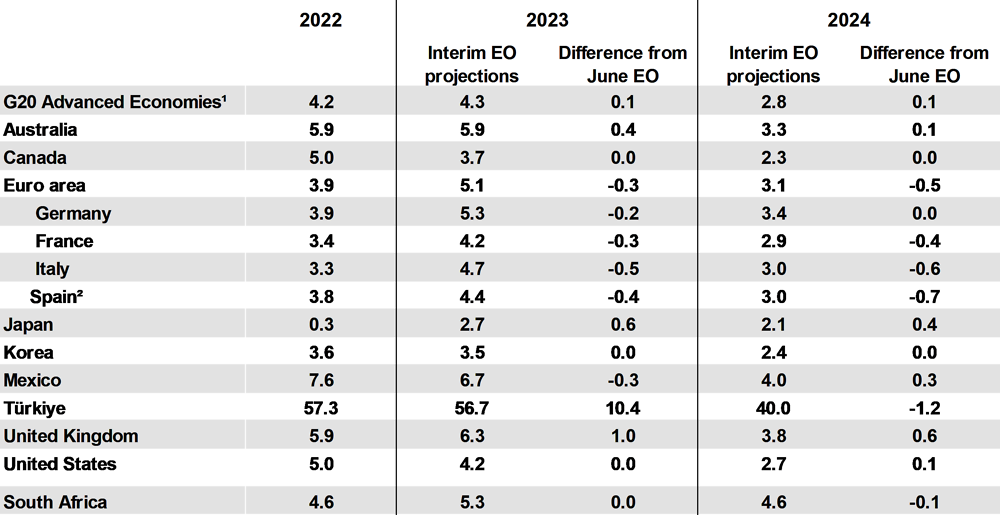

Inflation is projected to moderate gradually over 2023 and 2024, but to remain above central bank objectives in most economies. Headline inflation in the G20 economies is projected to ease to 6% in 2023 and 4.8% in 2024, with core inflation in the G20 advanced economies declining from 4.3% this year to 2.8% in 2024.

Risks remain tilted to the downside. Uncertainty about the strength and speed of monetary policy transmission and the persistence of inflation are key concerns. The adverse effects of higher interest rates could prove stronger than expected, and greater inflation persistence would require additional policy tightening that might expose financial vulnerabilities.

A sharper-than-expected slowdown in China is an additional key risk that would hit output growth around the world.

Monetary policy needs to remain restrictive until there are clear signs that underlying inflation pressures have durably abated. Policy interest rates appear to be at or close to a peak in most economies, including the United States and the euro area, with policy judgements more finely balanced as the effects of higher interest rates become visible.

Governments are faced with mounting fiscal pressures from rising debt burdens and additional spending on ageing populations, the climate transition and defence. Enhanced near-term efforts to rebuild fiscal space and credible medium-term fiscal plans are needed to better align near-term macroeconomic policies and help ensure debt sustainability.

Structural policy efforts need to be reinvigorated to strengthen growth prospects. Reducing barriers in labour and product markets and enhancing skills development would help to boost investment, productivity and labour force participation, and make growth more inclusive.

A key priority is to revive global trade, which is an important source of long-term prosperity for both advanced and emerging-market economies. Concerns about economic security should not prevent advantage being taken of opportunities to lower trade barriers, especially in service sectors.

Enhanced international co-operation is needed to ensure better coordination and faster progress in carbon mitigation efforts.

The pick-up in global growth in the first half of 2023 may prove short-lived

1. Global GDP advanced at an annualised pace of 3.2% in the first half of 2023 compared to the second half of 2022 (Figure 1, Panel A), somewhat stronger than expected a few months ago. Growth was comparatively robust in the United States and Japan, but weak in most of Europe, particularly Germany. Amongst the G20 emerging-market economies, growth surprises have mostly been positive so far this year, especially in Brazil, helped by favourable weather-related agricultural outcomes, India and South Africa. Growth in China has however lost momentum, with the initial impetus from reopening fading and structural problems in the property sector continuing to weigh on domestic demand.

2. Contrary to global output, trade volumes have risen more slowly than expected in the first half of this year, with trade intensity declining (Figure 1, Panel B). Merchandise trade volumes have been particularly weak, especially in the major advanced economies, with global trade in goods falling by 2½ per cent over the year to June. Services trade has held up better, helped by tourism continuing to rebound strongly from the steep drop in the early part of the COVID-19 pandemic.

Recent signals, especially from survey indicators, point to a loss of momentum

3. High-frequency activity indicators across the largest economies present a mixed picture, but on balance signal a loss of momentum in the second half of 2023. Labour markets generally remain tight, with unemployment rates at or near multi-year lows and vacancy rates still high by historical standards in most major advanced economies. However, the number of vacancies has fallen steadily, job growth has slowed and quit rates have started to ease. Declines in headline inflation are now helping to stabilise or improve household real disposable incomes, but real wage losses over the past two years and tighter financial conditions continue to restrain consumer spending in most advanced economies, with the United States a notable exception. Industrial production has continued to stagnate in many economies, despite some signs of an upturn in tech-related activity.

4. Weakness is most marked in some survey indicators. At a global level, PMI indicators of output and new orders in manufacturing are at levels normally consistent with stagnation or contraction in that sector (Figure 2). Service sector indicators are stronger but have also softened recently. There are signs of growing cross-country divergence as well, with notable strength in August PMIs in some emerging-market economies, especially India, but moderation in the United States and China, and weakness in the euro area and the United Kingdom. The gradual recovery in consumer confidence over the past year has also stalled in many countries, with confidence still lower than pre-pandemic norms.

5. A key factor shaping global growth is the rise in interest rates in most major economies since early 2022. Financial conditions have become more restrictive, borrowing rates for firms and households have risen (Figure 3, Panel A), credit conditions have tightened, and asset price growth has moderated or turned negative. Forward-looking real interest rates have now become positive in most economies, with Japan an exception, encouraging saving and making investment more expensive. In the United States real interest rates are at their highest level since 2005 (Figure 3, Panel B). Even if policy rates are not raised further, the effects of past rises will continue to work their way through economies for some time, as the rates on existing mortgage loans are adjusted or as corporate loans are rolled over. Bank lending has slowed sharply in the euro area, a relatively bank-dependent economy, particularly to households. Some countries are already seeing rising loan and credit card delinquency rates and increases in corporate insolvencies. As already seen with the US bank failures in March and the takeover of Credit Suisse, risks remain that the high interest rates needed to lower inflation may also produce stresses in the financial system that will require prompt policy responses to stabilise financial conditions.

6. House prices have fallen substantially from their peaks in some G20 countries, including Korea, Germany and the United Kingdom, and housing investment has declined sharply, especially in the United States and Canada. However, some signs of stabilisation have begun to appear in recent monthly data. Supported by structural factors including robust population growth and a limited inventory of houses for sale, prices have turned back up in a number of countries, including the United States, Canada, and Australia. Across the major advanced economies as a whole, risks remain that falling house prices prompt households to curb consumption substantially or trigger a surge in mortgage defaults, though so far these have not materialised. At the same time, most countries have seen a sharp reduction in the volume of transactions and lending for house purchases (Figure 4), which may presage further weakness in housing markets. In the United States, the euro area and the United Kingdom, these declines are comparable in percentage terms to those seen at the time of the global financial crisis.

7. Energy prices remain important for both growth and inflation in G20 economies. Sharp declines in the prices of oil, gas and coal since their 2022 peaks contributed to the upturn in growth and decline in inflation in the first half of 2023. However, the OPEC+ economies have implemented output cuts, and with inventories at relatively low levels oil prices have risen by over 25% since the end of May. This upward move in oil prices has pushed up the contribution of energy to consumer price inflation in many G20 countries.

8. The signs of a slowdown in Chinese economic activity are also a concern given China’s importance for global growth, trade and financial markets. High debt, and the scale of the ailing real estate sector provide significant challenges. Consumer spending has been slow to recover after reopening, with high precautionary saving in the absence of broad social safety nets, and the property sector remains very weak. Numerous policy initiatives have been announced recently to support activity, including small reductions in policy interest rates, but it remains unclear how effective these will be. The marked fall in the dollar price of Chinese exports this year has helped to lower import prices and global inflation, but the scope to offset subdued domestic demand with stronger export volume growth may be limited given weak external demand and the ongoing restructuring of trade and value chains.

Headline inflation is declining but core price inflation is persistent

9. Largely reflecting a steep drop in energy prices from late 2022 through mid-2023, the fall in headline inflation has been somewhat steeper than previously expected. At the same time, there remains a wide divergence in inflation rates across major economies: headline inflation is close to zero in China but above 50% in Türkiye and over 100% in Argentina. It remains well above central bank targets in almost all G20 economies. Core inflation (excluding energy and food) has also begun to decline, but at a more moderate pace, and in several countries has yet to turn down (Figure 5, Panel A). Goods price inflation is declining steadily, but services price inflation remains persistent and is set to remain so based on survey indicators (Figure 5, Panel B). In part, this reflects the larger role of labour costs in service sectors, as well as the time needed for the rise in energy prices during 2021-22 to fully pass through into the prices of other goods and services. In some countries, particularly the United States, the sizeable weight of housing rental prices in consumer price inflation is also important, with rent inflation tending to exhibit a high degree of inertia.

10. Although labour markets generally remain tight in the advanced economies, with low unemployment rates and elevated levels of job vacancies, there are signs that pressures are easing, with falling vacancy rates and lower levels of quits. The pace of wage gains is also moderating in many countries. Nonetheless, in most countries nominal wage growth remains above rates that would be consistent with inflation being in line with the central bank’s target over the medium term, given current and prospective productivity developments. However, inflation could continue to ease even with temporarily elevated wage inflation if higher labour costs are absorbed in corporate profit margins.

Growth is projected to remain moderate while inflation subsides

11. Global growth is expected to dip both this year and next, remaining below trend throughout the period. Growth in most advanced economies will continue to be held back by the macroeconomic policy tightening needed to rein in inflation and place the public finances on a sustainable path. Structural strains in the Chinese economy are expected to result in a slowdown of growth in 2023-24. The full effects of the policy tightening in advanced economies are now seen as coming through with a longer lag than previously thought. As a result, annual global GDP growth is now expected to slow from 3% this year to 2.7% in 2024 (Table 1; Figure 6). The cooling of demand pressures is expected to help ease headline and core inflation in most G20 countries, broadly in line with earlier expectations. With the sharper slowdown in China, inflation pressures there are expected to be weak this year and next.

12. The US economy has so far proved unexpectedly resilient to the steep rise in policy interest rates, with household spending supported by a run-down of excess savings accumulated during the pandemic. As this fades the effects of tighter financial conditions are expected to become increasingly visible. Calendar year GDP growth is projected to ease from 2.2% in 2023 to 1.3% in 2024, with growth through 2024 slowing to around 1%, well below potential. Activity has already weakened in the euro area and the United Kingdom, reflecting the lagged effect on incomes from the large energy price shock in 2022 and the comparative importance of bank-based finance in many European economies. GDP growth in the euro area in 2023 and 2024 is projected to be 0.6% and 1.1% respectively, with the corresponding numbers for the United Kingdom being 0.3% and 0.8%. Japan is the only advanced economy in the G20 without any increase in policy interest rates so far. Improving wage growth and strong service exports are expected to help boost GDP growth to 1.8% this year, before growth moves back closer to trend in 2024, at 1%.

13. Among the G20 emerging-market economies, China largely stands apart as having its own cyclical and structural stresses. While most large emerging-market economies have followed the major advanced economies in raising interest rates, in part to avoid unwanted depreciation of their currencies against the US dollar, China has been easing monetary policy to address the slowdown in domestic demand growth. Growth in China is seen as slowing through this year and next after an initial rebound in early 2023 from reopening. In contrast, GDP growth in the other major Asian emerging-market economies, India and Indonesia, is projected to remain relatively steady in 2023 and 2024: around 6% for India and 5% for Indonesia. The growth outlook in the rest of the G20 emerging-market economies is quite varied, depending importantly on specific national circumstances such as the challenges of high inflation in Argentina and Türkiye, and fluctuations in commodity prices. In general, however, excluding China, a modest improvement in growth is seen among the G20 emerging-market economies over 2023-24.

14. Headline consumer price inflation has fallen somewhat faster than expected in most G20 economies, helped by the reversal of the surge in energy and food commodities in 2022 triggered by Russia’s invasion of Ukraine. Average G20 inflation in 2023 and 2024 is now projected to be 6% and 4.8% respectively, down from 7.8% in 2022 (Table 2; Figure 7). It remains the case, however, that headline inflation would still be above medium-term objectives in most G20 economies in late 2024.

15. Headline inflation in most G20 advanced economies has roughly halved from peaks seen in 2022 to the latest month. Japan is an exception, with a depreciation of over 20% of the yen against the US dollar since the beginning of 2022 raising inflation via import prices. Japanese headline inflation is little changed over the latest six months, and the average rate for 2023, at 3.1%, is projected to be higher than last year, in contrast with all the other G20 advanced economies. Core inflation (excluding food and energy prices) has yet to turn down decisively in most G20 advanced economies. For the G20 advanced economies as a group, annual average core inflation in 2023 is projected to be 4.3% (Table 3), marginally higher than in 2022 despite a declining profile through this year, before receding to 2.8% in 2024 as cost pressures diminish and profit margins moderate.

16. Inflation varies widely among the G20 emerging-market economies. Nevertheless, the same major factors affecting inflation in the advanced economies – the fall back in energy and food prices and policy tightening in most major economies – also bear on the emerging-market economies. Headline consumer price inflation for the G20 emerging-market economies as a group is projected to fall from 9.1% in 2022 to 7.2% in 2023 and 6.6% in 2024, with inflation declining to under 4% in Brazil, Indonesia and Mexico, and remaining very low in China.

17. Risks to the near-term global outlook remain tilted to the downside. With uncertainty about the strength and speed of monetary policy transmission and the persistence of inflation, a key question is whether the policy tightening that has already been undertaken is sufficient to bring inflation smoothly back towards target. Calibrating monetary policy is always difficult, but the factors contributing to the current inflationary episode complicate the task further, with the exceptional circumstances of the pandemic and national policy responses, and the economic consequences of Russia’s war of aggression in Ukraine adding complexity to the situation. Persisting cost pressures or renewed signs of an upward drift in inflation expectations would compel central banks to keep policy rates higher for longer than expected and potentially expose financial vulnerabilities in the balance sheets of financial institutions that could trigger an abrupt reassessment of liquidity, duration and credit risks. Conversely, the eventual impact from past interest rate rises and more restrictive credit standards could prove stronger than anticipated, with rising debt service burdens leading to a more severe slowdown in spending, rising unemployment and higher bankruptcies. Tighter-than-expected global financial conditions would also intensify vulnerabilities in emerging-market and developing economies, particularly for borrowers relying on foreign lenders, and add to the risk of additional financial and economic volatility in lower-income countries that are already facing significant challenges in financing their debts.

18. A related risk is that adverse supply shocks in global commodity markets might reoccur. Food and energy prices have a large weight in the consumer price indices of many countries and are an important determinant of households’ inflation expectations. Energy prices are a long way from their peaks in 2022 in the wake of Russia’s invasion of Ukraine, but energy markets remain tight and the potential for disruptions to supply in oil, coal and gas markets remains high (Figure 8). A renewed spike in energy prices would give new impetus to headline inflation and hurt growth in commodity-importing economies. There is also a risk that a resurgence of food prices and shortages could worsen food security in a number of emerging and developing economies. The El Niño event that began in June is likely to adversely affect some food crops in the coming year, and export restrictions by some key producers are limiting supply in global markets, especially rice, where global prices are at a 15-year high. The war in Ukraine also retains the potential to generate renewed pressures on the prices of wheat, corn, edible oils, and fertilisers, with the Black Sea Grain Initiative having ended and uncertainty persisting about the scope for Ukraine to use alternative supply routes through Europe.

19. A sharper-than-expected slowdown in China has again become a key risk. Weak consumer confidence and significant ongoing problems in the property market, with low sales generating liquidity shortages and default risks for highly-leveraged real estate developers, are key sources of concern. The scope for, and effectiveness of, offsetting policy support may also be more limited than in the past. Elevated public debt, especially for local government investment vehicles, limits the scope for large scale fiscal initiatives, and the weakness in the housing market impairs a key channel of monetary policy easing. Illustrative scenarios suggest that an unanticipated one-year decline of 3 percentage points in China’s domestic demand growth could directly lower global GDP growth by 0.6 percentage points, and potentially by over 1 percentage point in the event of a significant tightening of global financial conditions (Box 1).

Illustrative scenarios, using the NiGEM global macroeconomic model, highlight the potential near-term implications of an unexpectedly sharp slowdown in domestic demand growth in China. The scenarios consider a one-year decline of 3% in domestic demand (relative to baseline), with household consumption declining by 1%, business investment by 5% and housing investment by close to 8%. Such a slowdown would be a relatively unusual event, though Chinese annual domestic demand growth slowed by a similar extent through 2014 and in 2017, with even larger declines during the pandemic. Policy interest rates remain endogenous in all economies, helping to cushion the impact of the shocks in each scenario.

The shock to Chinese domestic demand would directly lower global GDP growth by 0.6 percentage points, and world trade volumes by 1¼ percentage point (Figure 9). GDP in China would drop by 2% relative to baseline, with weaker domestic demand offset in part by lower import volumes. Output in other Asian economies and commodity-producing economies would be relatively hard-hit, reflecting their comparatively strong trade links with China. The trade impact in North America would also be relatively large, but the GDP impact would be small, reflecting the low share of trade in economic activity in the United States.

If the slowdown in China was accompanied by tighter global financial conditions due to risk repricing, as seen in some earlier slowdowns, the impact would be greater, especially in advanced economies. In a scenario with a 10% decline in global equity prices and higher investment risk premia, global GDP growth could be lowered by 1.1% in the first year of the shock, with world trade volumes lowered by just under 2¾ per cent relative to baseline. The combined shocks would also be deflationary, reducing global inflation by around 0.4 percentage point by the end of the first year.

20. On the upside, the global economy and financial markets have so far proved relatively resilient to the generalised tightening of monetary policy. It is possible that global growth will continue to surprise on the upside with inflation returning to its target range in the major economies without significant disruptions in labour markets. In the United States, wage pressures have already stabilised this year despite continued above-trend growth and only a small upturn in unemployment, with firms so far choosing to retain rather than lay off workers. A continuation of this pattern would imply better-than-expected growth in 2024 while inflation eases. Another key factor is the willingness of households to spend excess savings accumulated during the pandemic. There is considerable uncertainty about the remaining extent of such savings in the advanced economies, as well as about the willingness of consumers to use such savings for consumption, but this is one possible source of stronger-than-expected activity in the coming quarters, though it might also prolong inflation persistence. Other upside risks include stronger and more effective policy stimulus in China to reverse the recent slowing of domestic demand growth there, or a renewed fall in energy prices if the recent reduction in global oil production is unwound. The latter would constitute a tailwind for inflation reduction efforts as well.

Monetary policy

21. Policy interest rates have risen further in most advanced economies in recent months, with the exception of Japan, where the policy stance remains accommodative, but the pace of rate increases has slowed. Central bank balance sheet reductions have also continued, along well-communicated paths, adding upward pressure on long-term interest rates. Monetary policy judgements have become more finely balanced as headline inflation recedes and the impact of higher interest rates becomes visible in credit and housing markets. Forward-looking long-term and short-term real interest rates are now positive in the euro area and at the highest levels since 2007 in the United States, and the full effects of the cumulative tightening over the past two years have yet to be felt.

22. Monetary policy needs to remain restrictive until there are clear signs that underlying inflationary pressures are durably lowered, with near-term inflation expectations moderating further and excess resource pressures fading in labour and product markets. This is likely to limit scope for any policy rate reductions until well into 2024 in most advanced economies (Figure 10). Some additional rate rises could still be needed where underlying inflation pressures are particularly persistent, but policy rates appear to be at or close to their peak in most economies. In the event of additional financial market stress, full use should be made of the financial policy instruments available to central banks to enhance liquidity and minimise contagion risks.

23. Policy decisions will need to remain data-dependent and be communicated clearly given the uncertainty about the effects of the rapid rise in interest rates after many years of very accommodative policy, and the speed and channels through which these will appear. Changes in economic structure – such as the increased prevalence of fixed or semi-fixed debt in some housing markets – and financial markets, with the increased role of non-bank financial institutions, affect the transmission of monetary policy. The rapid and simultaneous tightening that has been implemented around the world also makes the transmission mechanism more complex and uncertain, especially for smaller open economies, with weaker global demand becoming a more important driver of disinflation relative to changes in exchange rates from domestic policy actions.

24. Monetary policy space in most emerging-market economies is constrained by tight global financial conditions and the need to keep inflation expectations anchored. Improved policy frameworks and prompt actions have enhanced the effectiveness of monetary policy in many major economies and helped to ensure that financial stress has so far been avoided. However, in some cases stronger prudential policies would further enhance resilience and increase monetary policy headroom. Policy rates have remained unchanged for some time in many major economies, including India, Indonesia, Mexico and South Africa, with inflation pressures at moderate levels, and rate reductions have already occurred in Brazil and a number of smaller economies where policy tightening was initiated at a relatively early stage. There is scope for some modest policy easing over the next year in all of these economies, provided inflation pressures remain well contained. In contrast, additional policy tightening is needed in Türkiye to help tackle stubbornly high inflation.

Fiscal policy

25. Governments face mounting fiscal pressures. Public debt levels are generally higher than before the pandemic (Figure 11, Panel A), and in many countries at levels relative to GDP seen before only in wartime, with the burden of servicing debt continuing to rise as low-yielding debt matures and is replaced by new higher-yielding issuance. The climate transition, the impact of ageing populations on health and pensions expenditure (Figure 11, Panel B), and plans to raise defence expenditure (Box 2) also add to future spending pressures. Public expectations of fiscal intervention to help offset economic shocks have also risen in the wake of the pandemic and the energy crisis. In the absence of adjustments to spending or increases in taxation, all these factors would imply significant future increases in government debt-to-GDP ratios.

26. Stronger near-term efforts to rebuild fiscal space and ensure debt sustainability would conserve scarce resources to meet future policy priorities and respond effectively to future shocks. This would also improve the near-term alignment of fiscal and monetary policies, reducing the burden on monetary policy to lower demand pressures and inflation. Many fiscal support measures, including remaining energy support schemes, need to be scaled back and become better targeted on those most in need, particularly vulnerable households inadequately covered by existing social protection systems. The necessary consolidation should not come at the expense of the investment needed to help foster the green and digital transitions or spending on other high-priority, productivity-enhancing measures such as skills acquisition. Reinforced and credible medium-term fiscal frameworks, with clear guidance about future spending and tax plans, and reassessments of the composition of public spending would help to address these challenges.

27. In many emerging-market economies, credible fiscal rules and decoupling of the public finances from the commodity cycle would enhance macroeconomic stabilisation, improve expenditure efficiency, and help alleviate debt-service pressures. Enhanced efforts to strengthen revenue collection, expand the tax base and reduce the burden of state-owned enterprises would provide scope to permanently broaden the coverage of social protection systems. The rise in debt distress among lower-income countries makes it particularly urgent that creditor countries and institutions take joint action to ensure that debt burdens are sustainable and mitigate the risk of significant setbacks to development.

Structural policy efforts need to be reinvigorated and trade policies refocused

28. Faced with lacklustre global growth outcomes in 2023 and 2024, the long-term decline in potential growth rates, and pressing challenges from ageing populations, the climate transition and digitalisation, there is a clear need for ambitious supply-boosting structural reforms to reinvigorate growth and improve its quality. As emphasised in the forthcoming edition of Going for Growth, renewed efforts to reduce constraints in labour and product markets, strengthen investment and labour force participation, and enhance skills development would improve productivity prospects and sustainable living standards and make growth more inclusive. Faster progress towards decarbonisation is also essential. Increasing green and digital infrastructure investment and support for innovation, strengthening standards to enable a reduction in emissions, and raising the scope and level of carbon pricing are key priorities for most economies.

29. Another key priority is to revive global trade. The world economy has now experienced more than a decade in which trade growth in volume terms has barely kept pace with output growth, and the cumulative burden of trade restrictions has steadily risen, especially since 2018 (Figure 12). This represents a foregone opportunity, particularly in many service sectors where trade restrictions remain sizeable. In an interconnected world, open and well-functioning international markets with resilient and efficient supply chains, under a rules-based global trading system, are an important source of long-term prosperity and productivity growth for both advanced and emerging-market economies.

30. At the same time, the pandemic and the war in Ukraine have highlighted the vulnerabilities that can arise from increasingly complex and concentrated supply chains, prompting concerns about the security of supply. A key challenge is to enhance the resilience of global value chains without eroding their benefits for efficiency. Geoeconomic fragmentation and a shift to more inward-looking trade policies would curtail the gains from global trade and hit living standards, especially in the poorest countries and households.

For several decades the so-called ‘peace dividend’ has allowed many governments to reduce the share of defence spending in total public expenditure, helping to create space to meet demands for additional public expenditure on social protection and health (Clements et al., 2021). Growing geopolitical tensions, vividly illustrated by Russia’s war of aggression against Ukraine, have recently prompted a significant reassessment of this strategy. Several countries have now announced plans to increase defence spending over the next few years. These plans, which are already being implemented in some countries, will compound the rising pressures on public expenditure and the sustainability of the public finances from ageing societies, the climate transition and rising debt-service costs. This box documents the dynamics of defence spending over the past decades across OECD and G20 countries and summarises planned spending increases for the coming years. It also briefly discusses the efficiency of military spending.

Across G20 countries as a whole, defence spending relative to GDP has declined in the past 50 years, from an average of about 3.8% in the 1970s to 2.4% in the 21st century (Figure 13). However, there has been wide cross-country heterogeneity in both the levels of outlays and their variation over time. The decline was particularly sizeable in the United States, the world’s largest spender in dollar terms, with defence expenditure falling from 6.0% of GDP in the 1980s to an average 3.9% of GDP since the turn of the century. In relative terms, the gains from the end of the cold war were even larger for other OECD countries who are longstanding NATO members, with joint spending declining from 2.8% of GDP in the 1980s to 1.6% of GDP since the year 2000. In contrast, military spending in non-NATO OECD members such as Australia, Japan and Mexico has been lower and more stable over time (Figure 14).

The reduction in spending has also been more modest in non-OECD G20 economies, a highly diverse group of countries. For instance, defence spending in China has become the second largest in the world in absolute terms, but relative to GDP is estimated to be close to the G20 median. In contrast, Russia’s spending in per cent of GDP has been internationally high since the mid-1990s, particularly over the past decade (Figure 13).

In recent years, especially 2022, many OECD countries have increased defence spending as a share of GDP.1 The increase was particularly strong in Greece and some Central and Eastern European countries, such as Finland, Latvia, Lithuania and Poland, but also occurred in many economies in Western Europe, partly reflecting military aid to Ukraine.

Further spending increases, sometimes sizeable, are likely in the coming years. France, Germany and Japan have started to implement detailed medium-term plans for that purpose, aiming at increases ranging between 0.4% of GDP (France) and almost 1% (Japan). In other countries, a long-term target exists that implies higher defence spending (for instance, 2% of GDP in Canada and Italy, as per NATO commitments, and 2.5% of GDP in the United Kingdom) but medium-term plans to reach these levels have not yet been released. In contrast, the two OECD G20 countries where military expenditures as a share of GDP are highest, the United States and Korea, do not currently plan to further increase that share. Non-OECD G20 countries have in general not increased defence spending as a share of GDP in the recent past (Russia is an exception), nor have they announced plans to do so in the medium term.

1. Abstracting from the widespread temporary increase in 2020 due to COVID-induced denominator effects.

Increasing the efficiency of defence spending can help to contain the budget costs of achieving the intended improvement in military effectiveness. The composition of spending is one of the drivers of efficiency. This varies widely across countries (Figure 15). The average share of defence budgets spent on investment in equipment is 20% and on personnel costs 48%, with an average 29% devoted to maintenance and single-use equipment and 4% to other spending items. In some countries, greater emphasis could be given to equipment upgrading. Expenditure on military R&D is currently very low in most countries (with the United States an exception); increasing this could potentially improve efficiency and generate positive growth spillovers through crowding-in of private R&D (Loannou et al., 2023; Moretti et al. 2021). Greater cross-country cooperation in areas like procurement and R&D might also strengthen efficiency by reducing fragmentation and duplication, and improving interoperability (EEAS, 2022).

References

Clements, B., S. Gupta and S. Khamidova (2021), “Military Spending in the Post-Pandemic Era”, Finance & Development, June, pp. 58-61.

EEAS (2022), “Investing more together in Europe’s defence”, European External Action Service.

Loannou, D., J. Pérez, I. Balteanu, I. Kataryniuk, H. Geeroms, I. Vansteenkiste, P.-F. Weber, M. G. Attinasi, K. Buysse and R. Campos (2023), "The EU’s Open Strategic Autonomy from a central banking perspective. Challenges to the monetary policy landscape from a changing geopolitical environment," Occasional Paper Series 311, European Central Bank.

Moretti, E., C. Steinwender and J. Van Reenen (2021), “The Intellectual Spoils of War? Defense R&D, Productivity and International Spillovers”, National Bureau of Economic Research Working Paper, No 26483.

NATO (2023), “Funding NATO”, North Atlantic Treaty Organisation.