Portugal

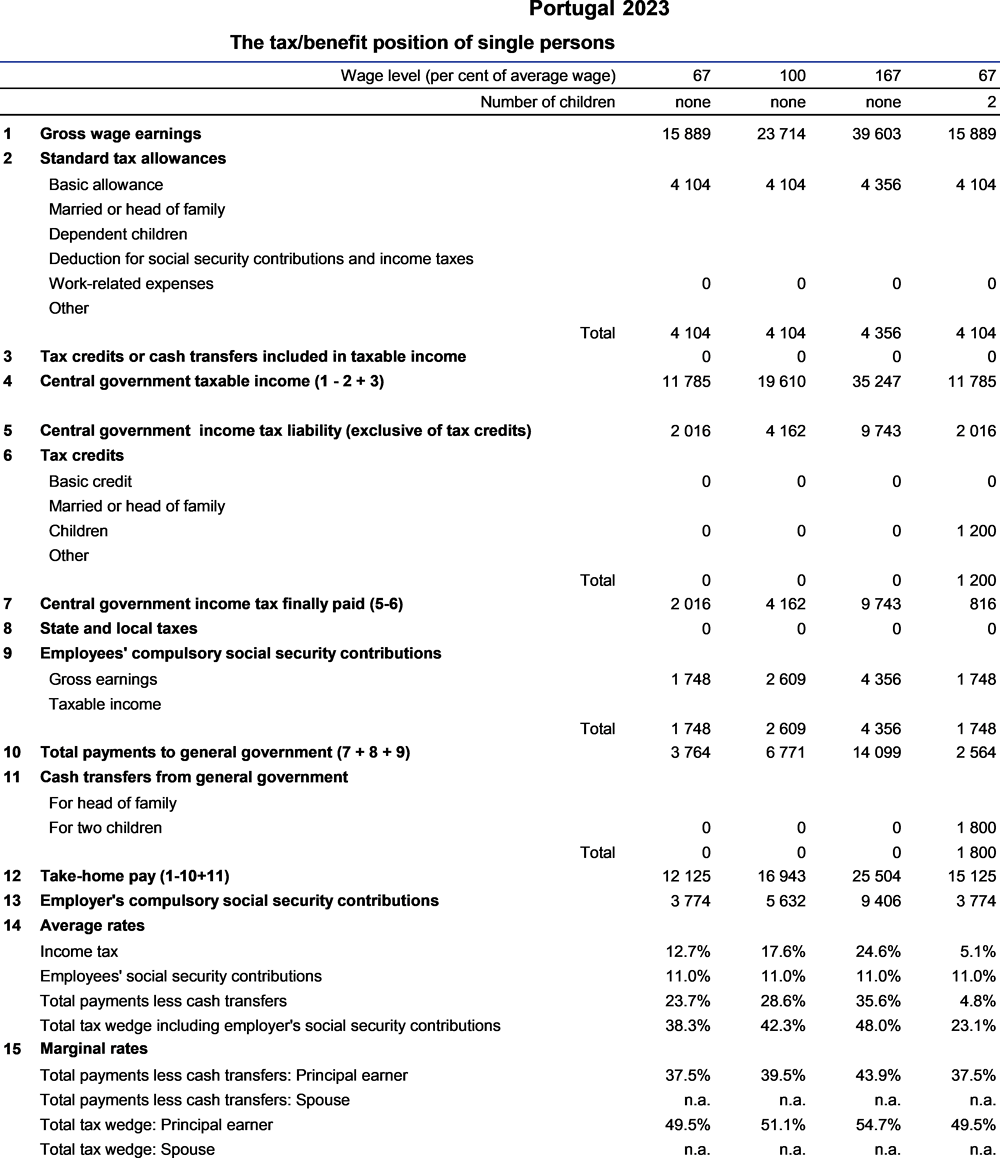

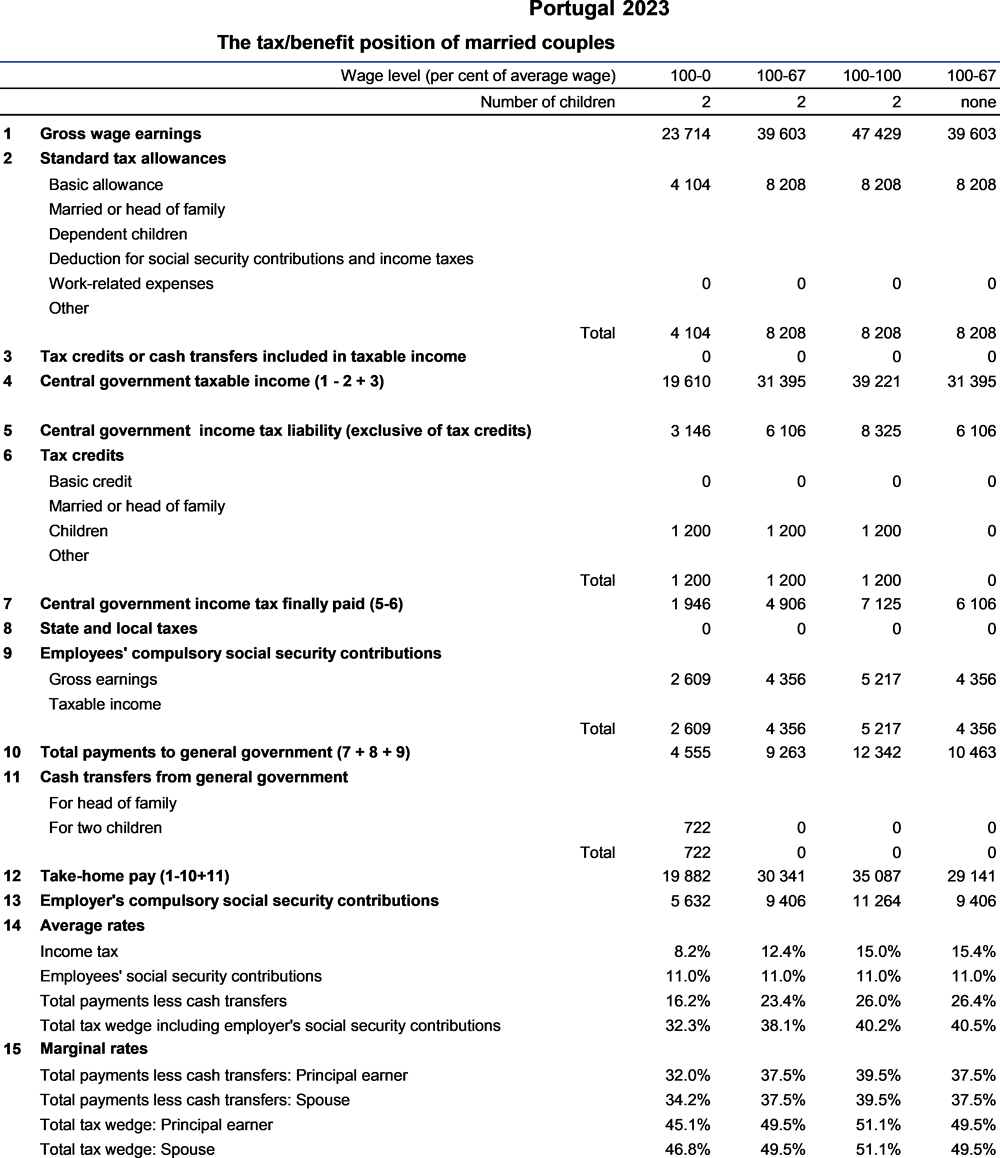

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Euro (EUR). In 2022, EUR 0.96 equaled USD 1. The Secretariat has estimated that in that same year the average worker earned EUR 23 714 (Secretariat estimate).

1.1. Taxes levied by central government.

1.1.1. Tax unit

The standard rule is separate taxation. However, families may opt for joint taxation. Income includes the income of any dependent children. Tax is computed on aggregate net income in the various categories of income, i.e., after the deductions specific to each category and standard and non-standard reliefs.

1.1.2. Standard and non-standard reliefs and tax credits

1.1.2.1. Standard reliefs

Standard deduction of EUR 4 104. If compulsory contributions to social protection schemes and statutory sub-schemes for health care exceed that limit, the deduction will equal the amount of those contributions.

1.1.2.2. Non-standard reliefs

For income received from 1 January 1999 onwards, the majority of the standard reliefs have been replaced by tax credits (see Section 1.1.4.).

Non-standard reliefs still in effect:

A deduction is provided for the portion of trade union dues not constituting consideration for benefits in the realm of health care, education, assistance for the elderly, housing, insurance or social security, up to 1% of the taxpayer’s gross income, increased by 50%. These dues are not taken into account in the calculations underlying this Report.

1.1.3. Social security contributions

Social security contributions are totally deductible if they exceed EUR 4 104.00 per taxpayer, in which case the deduction for the contributions replaces the standard earned income deduction (see Section 1.1.2.1.).

1.1.4. Tax credits

EUR 600 for each dependent child. This tax credit is increased by EUR 126 for dependent children whose age does not exceed 3 years old. The value is increased to EUR 300 and EUR 150 for the second and following whose age does not exceed 6 years old.

EUR 525 for each ascendant whose income does not exceed the minimum pension benefit. When there is only one ascendant, the tax credit increases by EUR 110.

35% of household general expenses up to a limit of EUR 250, per taxpayer; this limit is increased to 45% and EUR 335, respectively, for single parents.

Non-reimbursed health care costs, not covered by Social Security: 15% of health care costs, with a limit of EUR 1 000.

Expenditures for educating the taxpayer or the taxpayer’s dependents: 30% of outlays, up to EUR 800.

Costs for sanatoria or retirement homes for taxpayers, their ascendants and collaterals up to the third degree whose income does not exceed the national minimum wage: 25% of expenses up to EUR 403.75.

15% of the amount spent (up to EUR 296.00) on interest regarding the acquisition, construction or improvement of the taxpayer’s primary residence, or leasing contracts (applicable to contracts up to 31/12/2011); 30% of the amount spent (up to EUR 300) on rents paid by students under 25 years old, studying more than 50km away from home; and 15% of the amount spent (up to EUR 502) on rents paid by a tenant for his permanent residence under an agreement typified by the law. The EUR 296 is also increased for taxpayers in the first tax rate bracket and for taxpayers with income above the first-rate bracket upper limit and below EUR 30.000, according to the formula below.

The EUR 502 is also increased for taxpayers in the first tax rate bracket and for taxpayers with income above the first-rate bracket upper limit and below EUR 30.000, according to the formula below.

20% of alimony payments compulsory under court order or court-approved agreement.

30% of education expenditures and 25% of life insurance premiums, up to a limit of 15% of the tax liability, for handicapped taxpayers or dependents.

15% of VAT paid for certain services (restaurants, lodging, hairdressers, and auto-repair), 35% of VAT paid for veterinarian medicines an 100% of VAT paid for public transport use up to a limit of EUR 250. This benefit is not included on the limits referred to on the next page. Tax credits from tax benefits

Individual Retirement Savings Plans (PPRs): 20% of amounts invested, for unmarried taxpayers or for each spouse, up to:

Social Security Individual Accounts: 20% of amounts invested, for unmarried taxpayers or for each spouse, up to a limit of EUR 350.

Donations granted on the conditions stated in the statutes governing charities (grants to central, regional or local government, special “social solidarity institutions”, museums, libraries, schools, institutes, educational or research associations, public administrative bodies, etc.): 25% of donations, limited in certain cases to 15% of the donor’s tax liability. However, the total of tax credits related to health care costs, education and training, alimony, retirement homes, VAT paid, house expenses and tax benefits cannot exceed the values of the following amounts:

Limits are increased in 5% for each dependent, for households with three or more dependents.

1.1.5. Family status- determination of taxable income

The default status is individual taxation. Couples can opt for joint taxation based on the income-splitting system as it is described below. In the Taxing Wages calculations, the most favourable system is chosen.

1.1.6. Tax rate schedule (applicable to 2023 income)

The minimum income reference value is EUR 10640. Starting in 2024 the reference value will be the maximum between EUR 10640 and 1.5*14*(Social Benefits Index) until this second value reaches the first.

For residents in the Autonomous Regions of the Azores, reduced tax rates are applicable. Tax calculation formula (I = Income tax due:

Un married taxpayers: I = R x T - K - C

Married taxpayers can opt for joint taxation based on the income splitting method (with one or two earned incomes/see Section 1.1.5):

R= Taxable income, after deduction of standard and non-standard reliefs (see Sections 1.1.2)

T = Tax rate corresponding to the taxable income bracket

K = Amount to be deducted from each bracket

C = Tax credits (see Section 1.1.4)

An additional surtax, solidarity tax rate, was introduced by the 2012 State Budget and is applicable on highest income bracket. The surtax tax rate is now 2.5% applicable to taxable income between EUR 80 000 and EUR 250 000 and 5% for taxable income above EUR 250 000.

1.1.7. Special family situations

1.1.7.1. Handicapped taxpayer/spouse, with a disability rating of 60% or more:

A tax credit corresponding to 4 times the social benefits index is granted for each taxpayer or spouse.

Rates and ceilings: social security contributions are levied on gross pay and are not subject to any ceiling.

2.1. Employee contributions

As a rule, the rate of employee contributions is 11% of gross pay, with no ceiling.

3.1. Benefits for dependent children

The basic principle is to grant higher monthly social benefits to lower-income households.

There are six different levels of monthly allowances for dependent children, depending on the family’s reference income. This reference income is determined by dividing the family’s annual gross income, including vacation and Christmas allowances, by the number of dependent children plus one.

Monthly social benefits per child are as follows (in 2023 the social benefit paid to already receiving beneficiaries are the same as below; for beneficiaries applying in 2023 the brackets considered are estimated according to the 2022 social benefits index, i.e., EUR 443.20):

Level 1: Families whose reference income is under 50% of 14 times the reference value (i.e., under EUR 3 071.67).

Level 2: Families whose reference income is under 50% and under 100% of 14 times the reference value (i.e., over EUR 3 071.87 and under EUR 6 143.34).

Level 3: Families whose reference income is over 100% and under 170% of 14 times the reference value (i.e., over EUR 6 143.84 and under EUR 10 443.68).

Level 4: Families whose reference income is over 170% (i.e., over EUR 10 443.68).

Each level is also divided according to the age of the dependent child. Benefits are higher during the first 12 months of a child’s life.

Monthly social benefits per child are as follows:

There is a EUR 100 monthly guarantee for children over 36 months and under 18 years old in risk of extreme poverty, i.e., additional EUR 50.

Monthly social benefits per child in a single-parent family are increased between 35% and 50% depending on income level.

In September, families with dependent school children aged between 6- and 16-years receiving child benefits in level 1 receive an additional amount equal to the regular monthly benefit.

An amount equal to the cash benefits for dependent children under 12 months is attributed for each unborn child after the first month following that of the 13th week of gestation.

The relief for disabled taxpayers was restructured. Former partial exemptions and allowances were replaced by tax credits.

Tax credits for higher income households were limited or abolished.

The fiscal autonomy of local authorities (municipalities) increased. They may set the level of their share in the revenue from personal income tax, up to 5% of their resident taxpayers’ tax liability. If this rate is set below 5%, the difference will be credited against the taxpayers’ tax liability.

Tax credits for handicapped taxpayers and dependants were increased.

Social benefits for dependent children were increased for low-income families, single-parent families and families with 2 or more children.

A family coefficient was introduced in 2015 and abolished in 2016.

From 2016, the tax unit is the individual. However, couples can opt for joint taxation.

5.1. Method used to identify and compute gross wages of the average worker.

The operative concept of monthly compensation is that of amounts paid to full time staff before deductions for tax and compulsory contributions. It therefore includes wages and basic salaries of staff paid by the hour, by the job, or by tasks; benefits in kind or housing, if they are considered an integral part of compensation; cash subsidies for meals, housing, or transport; bonuses for regular night shifts and seniority, as well as incentive pay and rewards for diligence and productivity; family allowances, compensation for overtime and work on holidays. Benefits, subsidies and bonuses are taken into account only if paid regularly at each pay period.

Payments in kind are incorporated into the concept of compensation. The statistics record such advantages in kind at their taxable value.

All managerial and supervisory workers are included in the computations.

Average annual pay is based on the average of monthly earnings for April and October multiplied by an adjustment coefficient representing the share of annual bonuses and allowances (including vacation subsidies and the Christmas allowance), which is provided by the labour cost survey.

5.2. Description of the employer’s main contributions to private retirement, health insurance schemes, etc.

Outside the social security system, employers are required to insure their employees against work-related accidents (with private insurance companies). They may also provide their employees with life insurance, although this is optional.

The equations for the Portuguese system in 2020 are calculated on individual basis. Couples can opt for joint taxation based on the income-splitting system. In the Taxing Wages calculations, the two systems are modelled and the most favourable system is chosen.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

Key to range of equation B calculated separately for both principal earner and spouse P calculated for principal only (value taken as 0 for spouse calculation) J calculated once only on a joint basis.