Executive summary

Managing the gradual slowdown

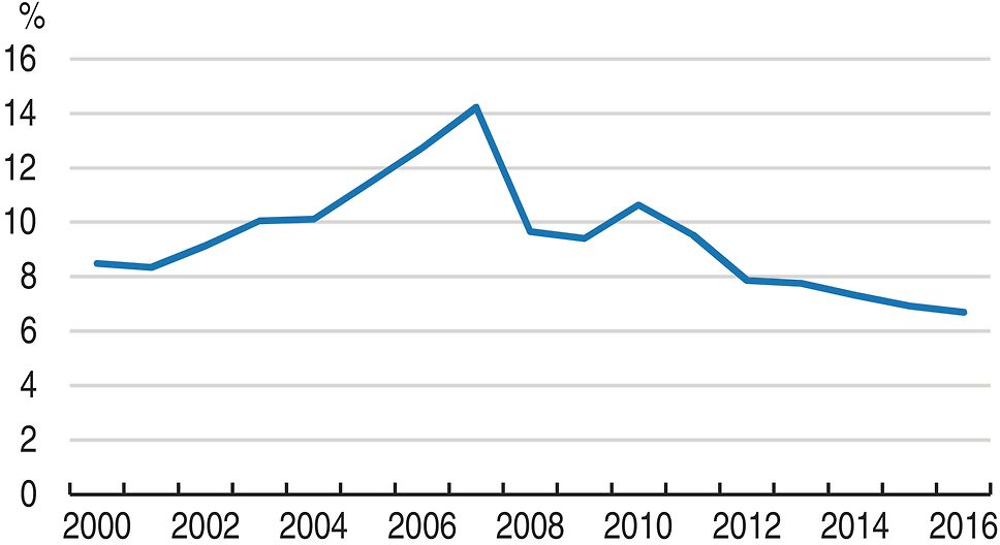

Source: OECD Economic Projections 100 Database.

Growth remains high but is gradually moderating as the population ages and the economy rebalances from investment to consumption, from external to internal demand and from manufacturing to services. Orderly rebalancing requires addressing corporate over-leveraging, overcapacity in real estate and heavy industries, and debt-financed over-investment in asset markets. Fostering innovation and moving to more efficient and less energy-intensive production is key to raising productivity as well as to improving the quality of growth and making it more sustainable. At the same time, growth needs to become more inclusive. To measure progress on those fronts, better and more timely data provision is crucial.

Boosting corporate dynamism and performance

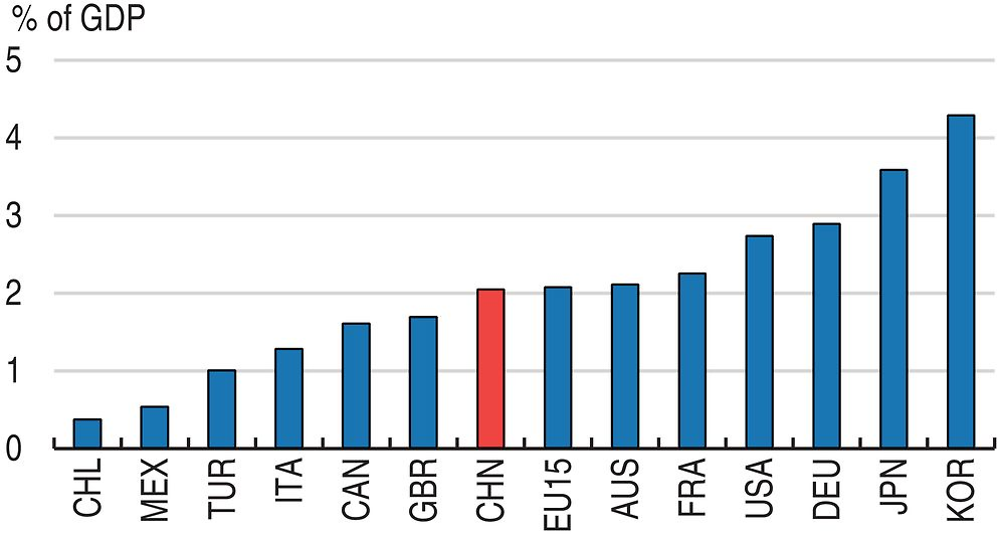

Source: OECD MSTI database.

Spending on research and development is far above countries with similar GDP per head, though it remains behind the United States and Japan. Patent numbers are soaring on the back of generous subsidies but the share of invention patents is small. Business creation has been made easier through the removal and unification of licenses, but too many firms are unviable. Corporate governance is being strengthened, including for state-owned enterprises, through enhanced external monitoring and internal control, though on-the-ground progress needs to accelerate. Stepped-up efforts to curb corruption will improve the quality and resilience of growth.

Ensuring inclusive growth by enhancing opportunities

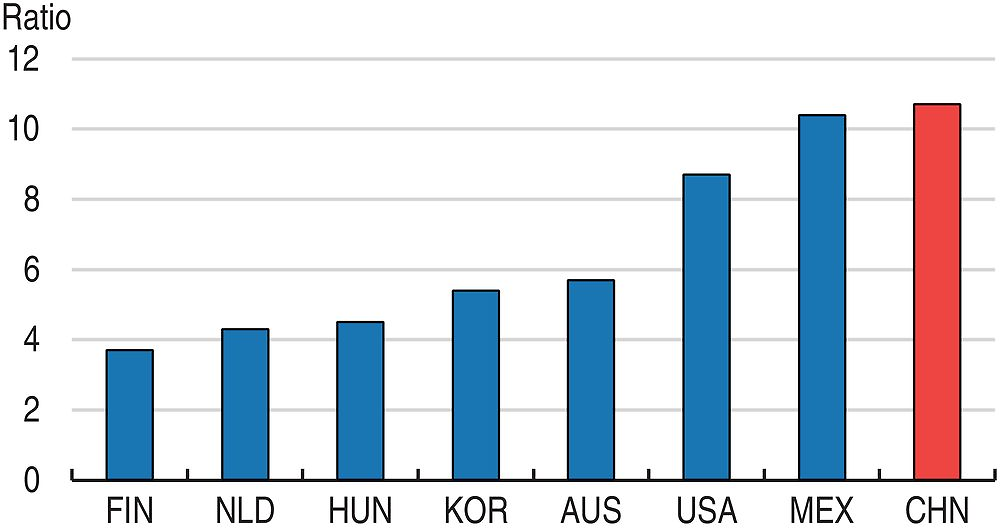

Source: China National Bureau of Statistics, OECD Income Distribution Database.

Income inequality has declined and poverty even more so. Nevertheless, the income gap between the richest and poorest remains large. Policy reforms can greatly enhance the redistributive impact of the tax-and-transfer system, strengthen education and skills and improve the labour market opportunities of marginalised groups. Improving the adequacy and accessibility of healthcare and pensions would reduce the high household saving rate and benefit both individual well-being and economic growth.