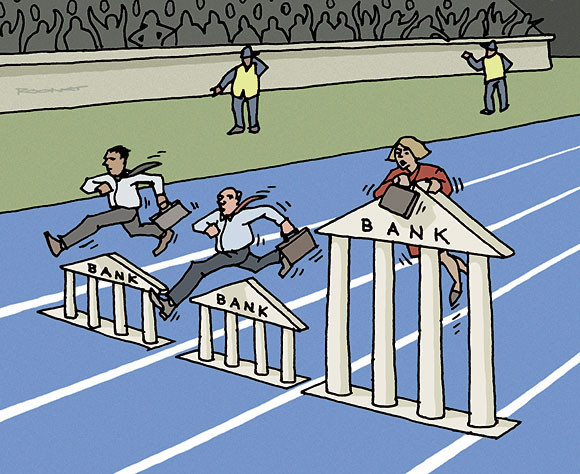

Can women win on the obstacle course of business finance?

About a decade ago, three academics silently sat in on and recorded 36 hours of closed-room discussion among a group of Swedish governmental venture capitalists made up of two women and five men. The venture capitalists (VC) were going over pitches made by 125 people to obtain financing for their businesses of which 99 were men and 26 women.

The conversations were analysed for the way in which women and men applicants were described by the financiers, but even the numbers alone told a story of gender bias in the venture capital world: in the rejection pile were 53% of applications made by women and 38% of applications made by men. Of the applications made by women that were accepted, 25% of the amount requested by women was awarded, and 52% applied for by men.

Gender discrimination, whether real or perceived, is just one factor that discourages women from starting and growing businesses. According to a survey, in 2012-16, 4.9% of women in the OECD area were actively trying to start a business, compared to 7.4% of men. Moreover, one in ten working women are self-employed in the OECD, which is almost half the rate of self-employed men.

Most women who do start their own businesses do so with less money than men, and rely heavily on personal savings or loans from friends and family . In fact, as many women start businesses in the services sector, they tend to have less earnings available to invest back into their companies. On top of this, women find it hard to obtain bank loans, overdrafts and credit lines, which are the next steps in the range of evermore sophisticated financing mechanisms for businesses. Some women may not have credit histories, for instance, while others may be reluctant to apply for loans because they feel they lack entrepreneurial experience. Others simply come up against gender-biased credit scoring. In OECD countries, only 26% of women believe they would be given access to the necessary finance to start or grow a business, against 34% of men. Now, the newly released 2018 OECD Scoreboard on SME and Entrepreneurship Finance shows that new lending to small and medium-sized enterprises (SMEs) fell from 2.6% in 2014-15 to -5.6% in 2015-16: women entrepreneurs have been trying to secure bank financing in an even tougher-than-usual climate.

What’s the policy move?

One way governments can help women business-owners is with loan guarantees. The French Fonds de garantie à l’initiative des femmes (FGIF), for instance, guarantees loans of up to €45,000 for women entrepreneurs. In 2015, this helped 2,075 women start businesses, which created 3,095 jobs. Similarly, governments can direct grants towards women-led businesses. And, incidentally, they can earmark public procurement contracts too, worth about 14% of GDP in the EU, to women. Right now, only 1% of public contracts around the world are awarded to women’s enterprises.

While bank loans and credit lines are difficult enough to obtain, the hurdles to other, often more substantial, forms of financing are even more daunting. And this is a problem because smaller businesses, whether owned by men or women, are not readily scaling up or making the leap into international trade. Easier access to more diversified sources of finance may make them more appealing to business-owners. In a survey conducted in the EU between October 2016 and March 2017, only 13% of SMEs even considered equity financing for their business, and that is not good news for growth.

Not all women entrepreneurs want to expand their businesses, but for those who do, there are increasingly dedicated support programmes available to them. There is growth-oriented training, individual coaching and mentoring, and networking, both face-to-face and online. Often all of this and more, like financial and legal advice, workshops on subjects such as loan applications, pitching, and different options for financing are physically put together in one-stop, government-supported women-only business incubator programmes, accelerators and clusters. Ireland has taken its support of women-led ventures even further by investing in them: Competitive Start Fund for Female Entrepreneurs invests up to €50,000 in women-led tech or manufacturing ventures in Ireland in exchange for an equity stake of up to 10%.

The trend for venture capital is less positive. In the US, it is estimated that only 15% of venture capital investment went to women-owned businesses in 2014, with the number diving to a little over 2% in 2016. And in the Swedish study we began with, women were not only awarded less venture capital, they applied for less too. Says Laurence Mehaighnerie, a woman, who co-founded the Paris-based venture capital firm Citizen Capital in 2008, “I sense that women entrepreneurs feel they can do more on their own and need less money, which can mean less growth and success in the end.”

Venturing out

If traditional venture capital firms are not investing in women, then women-run funds which focus on financing women-owned start-ups are picking up the slack. Springboard Enterprises in the US is an example. Rising Tide Europe, a group of 93 successful business women from 25 countries who have pooled €1 million to invest in early-stage women-owned companies in Europe, is another. Ms Mehaignerie’s Citizen Capital, which specialises in social ventures, has so far funded two women’s businesses out of nine, and is looking to do more.

In an experiment run by Wharton School, Harvard Business School and MIT’s Sloan School of Management in 2014, findings showed that men pitching for venture capital did 60% better than women pitching the exact same ideas (and, as an aside, good-looking men were even more successful by 36%). But while women lose out in traditional pitch competitions, they do better than men in the online crowdfunding arena. Crowdfunding stats reveal that women on average get 1.3 more contributors than men and raise an average of 10.8% more money. Women-specific crowdfunding platforms like Symbid in the Netherlands, which serves Dutch women entrepreneurs and provides them with financial and legal assistance, may boost those numbers even higher.

Small and medium-sized businesses, those with fewer than 250 employees, account for 70% of jobs in OECD countries. They’re the ones with the good, new ideas, generating some 20% of biotech patents in Europe, for instance. Women should start more of these businesses, especially in areas such as technology, engineering or finance. And they should be able to grow their businesses-- if they want. But expanding internationally, hiring more people, and integrating new technology require copious amounts of capital. Women need to be convinced to take that on. A tailored support system and gender-enlightened investment decision-making make the pitch to women entrepreneurs all the more persuasive.

Read about the 2018 OECD SME Ministerial Conference www.oecd.org/cfe/smes/ministerial/

Find out more about the OECD-INADEM workshop on women entrepreneurs www.oecd.org/cfe/smes/ministerial/programme/oecd-inadem-workshop-on-women-entrepreneurs.htm

The Missing Entrepreneurs 2017 https://doi.org/10.1787/9789264283602-en

Read the OECD’s policy brief on women's entrepreneurship www.oecd.org/cfe/smes/Policy-Brief-on-Women-s-Entrepreneurship.pdf

Entrepreneurship at a Glance 2017 https://doi.org/10.1787/entrepreneur_aag-2017-en

Malmström, Malin; Johansson, Jeaneth; Wincent, Joakim, “Gender Stereotypes and Venture Support Decisions: How Governmental Venture Capitalists Socially Construct Entrepreneurs’ Potential”, Entrepeneurship Theory and Practice https://onlinelibrary.wiley.com/doi/full/10.1111/etap.12275

Farber, Madeline, “Exclusive: Only 1% of Female Founders Have Used VC Money to Fund Their Business”, Fortune http://fortune.com/2017/04/26/women-venture-capital-funding/

“Survey on the Access to Finance of Enterprises in the euro area October 2016 to March 2017”, European Central Bank https://www.ecb.europa.eu/pub/pdf/other/ecb.accesstofinancesmallmediumsizedenterprises201705.en.pdf?17da4ff2a730b7ababea4037e4ce8cae

Read “Study: Attractive men fare best in gaining venture capital” http://news.mit.edu/2014/study-says-attractive-men-fare-best-in-gaining-venture-capital