Australia

Tourism in the economy

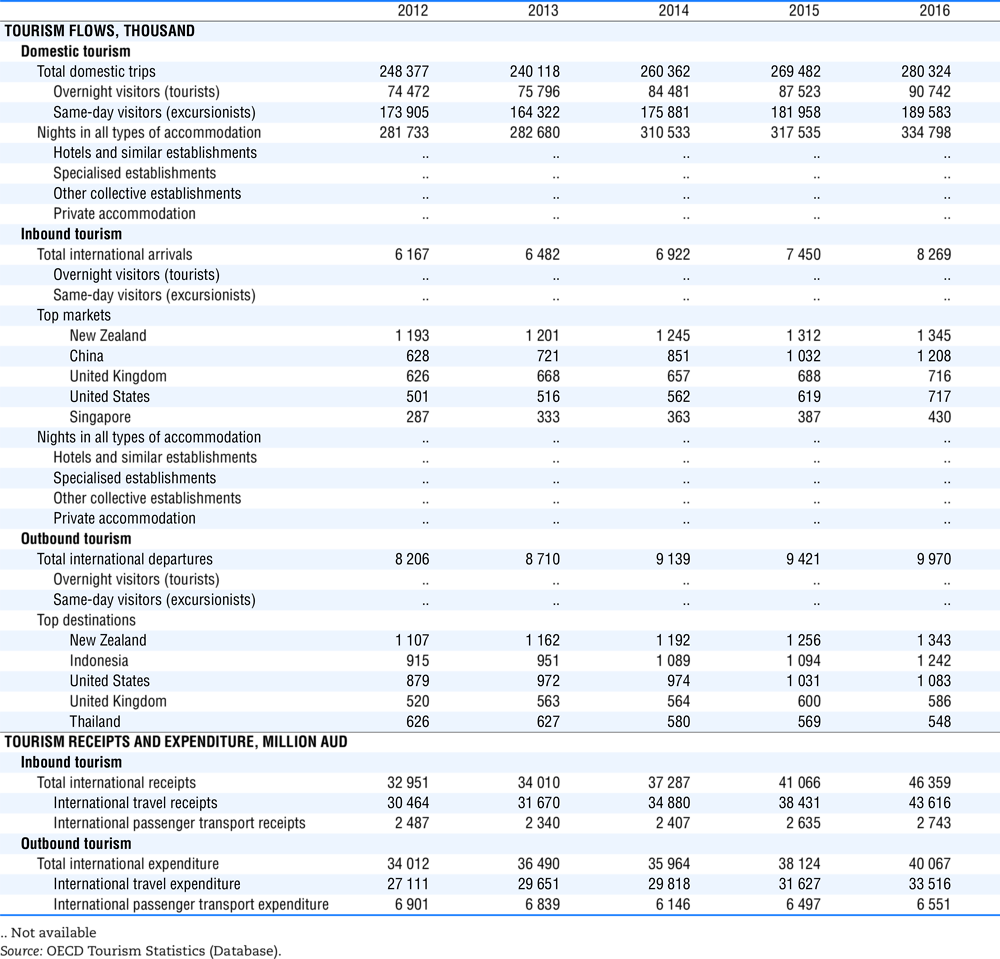

Australia is experiencing a strong surge in both international and domestic visits, generating a positive climate for tourism investment. Much of this growth has been spurred on by a lower exchange rate, increasingly competitive airfares and the growing Asian middle class, enhancing Australia’s price competitiveness as a tourism destination for international travel, while reducing that of overseas travel by Australians.

In 2016, there were 90.7 million overnight domestic trips by Australians, up 3.7% on 2015, while international visitor arrivals reached a record 8.3 million, up 11% on 2015. This calendar year growth in arrivals was the highest in two decades, a period which included the pinnacle international event, the 2000 Olympic Games in Sydney.

Increased volumes were reflected in solid expenditure growth in 2016, with international visitor expenditure up 6.8% to AUD 39.1 billion, domestic overnight expenditure up 6.0% to AUD 61.0 billion and domestic same day expenditure up 6.8% to AUD 19.8 billion. Expenditure by Chinese visitors, now Australia’s leading market by value, rose 11% to AUD 9.2 billion in 2016. Other large markets showing strong growth included Japan (up 29%), South Korea (up 17%), India (up 9%), Germany (up 8%) and the United States (up 7%).

Reasons for travel show a mixed picture. Leisure travel expenditure was up 7.4% and education related travel up 12.0%, while travel for business and employment purposes increased by only 2.3%, substantially below its long term average rate of growth.

In 2015-16, the direct effects of tourism accounted for a 3.2% share of GDP. Tourism’s contribution to GDP increased by 7.4% on 2014-2015, to AUD 53 billion, significantly faster than the overall growth in GDP. Tourism is also gaining an increasing share of exports, from 9.5% in 2014-15 to 11% in 2015-16.

The economic benefits of tourism are widespread, with an estimated 43% of all tourism expenditure occurring outside Australian capital cities and the Gold Coast in year ending June 2017.

Tourism governance and funding

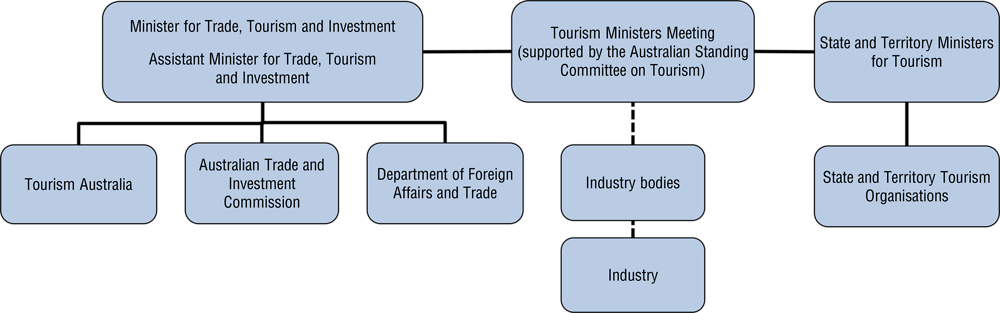

The Australian Trade and Investment Commission (Austrade) works closely with Tourism Australia (TA) and the Department of Foreign Affairs and Trade (DFAT) to coordinate the delivery of “whole-of-government” tourism objectives. Austrade is responsible for tourism policy, projects, programs and research. Within Austrade, Tourism Research Australia (TRA) provides international and domestic tourism intelligence. Formed under the Tourism Australia Act 2004, TA is the Australian Government agency responsible for attracting international visitors to Australia for leisure and business events. DFAT works to strengthen bilateral tourism relationships with key tourism markets. All state and territory governments in Australia incorporate tourism into relevant areas of portfolio responsibility to ensure effective tourism promotion and industry development.

Source: OECD, adapted from the Australian Government, 2018.

Tourism Ministers’ Meetings (TMM) bring together tourism ministers from the Australian, state and territory governments to discuss tourism policy matters of mutual interest and has collective responsibility for implementing the national tourism strategy, Tourism 2020. TMM is supported by the Australian Standing Committee on Tourism (ASCOT), chaired by Austrade, with representatives from TA, DFAT and each state and territory tourism organisation. Tourism industry bodies are invited to attend ASCOT and TMM meetings as required.

In 2016-17, TA was provided with AUD 156.8 million for tourism and area promotion, comprising AUD 140.3 million for international marketing, AUD 14 million for Asia marketing and AUD 2.5 million for Working Holiday Maker marketing. In addition, AUD 10.4 million was allocated to the Tourism Demand-Driver Infrastructure programme. Other additional resource allocations include AUD 4 million to the Queensland Tourism Tropical Cyclone Debbie Recovery Package, AUD 5 million to the Tasmanian Tourism Growth Package and AUD 2.6 million to the Approved Destination Status Scheme to provide tour quality monitoring arrangements that underpin the Chinese inbound tourism market.

Tourism policies and programmes

Australia’s Tourism 2020 Strategy has guided the tourism industry through a period of impressive growth in visitation and expenditure. Nonetheless, the industry faces a range of challenges to ensure that this pace of growth can continue in a sustainable way. Key challenges include:

-

Maintaining an adequate supply of labour and skills,

-

Securing a greater share of high yielding tourists and a higher rate of repeat visitation,

-

Targeting investment to improve the diversity, quality, and spread of accommodation and attractions,

-

Expanding air routes and agreements, and developing supporting infrastructure,

-

Increasing dispersal of visitors into the regions,

-

Facilitating increased visitation by reducing regulation and streamlining visa processes.

Tourism infrastructure remains one of the Australian Government’s five investment priorities. This has been assisted by a structured set of investment incentives and assistance.

A review of the five-year tourism investment attraction partnership between Tourism Australia and Austrade found that it has delivered strong international interest in tourism assets, including investment in Australian tourism accommodation. Now in its second phase, the partnership is focusing on encouraging investment into regional tourism destinations.

Specific initiatives to support tourism investment include:

-

A whole of government commitment to attracting investment into the sector.

-

A Tourism Major Project Facilitation service, which assists selected significant tourism infrastructure projects to navigate approvals processes as well as provide information and pursue solutions to investment barriers (Box 3.7).

-

A Tourism Senior Investment Specialist, who works with states and territories to bring strategically important investment opportunities to fruition and to promote reinvestment by major investors.

-

A Tourism Demand-Driver Infrastructure program, which funds delivery of infrastructure projects that support the priorities of state and territory governments. The program increases the availability of quality tourism products and experiences and bolsters the services that underpin them, particularly in regional areas.

Within the framework of the Tourism 2020 Strategy, the Australian Government is pursuing a range of policy responses.

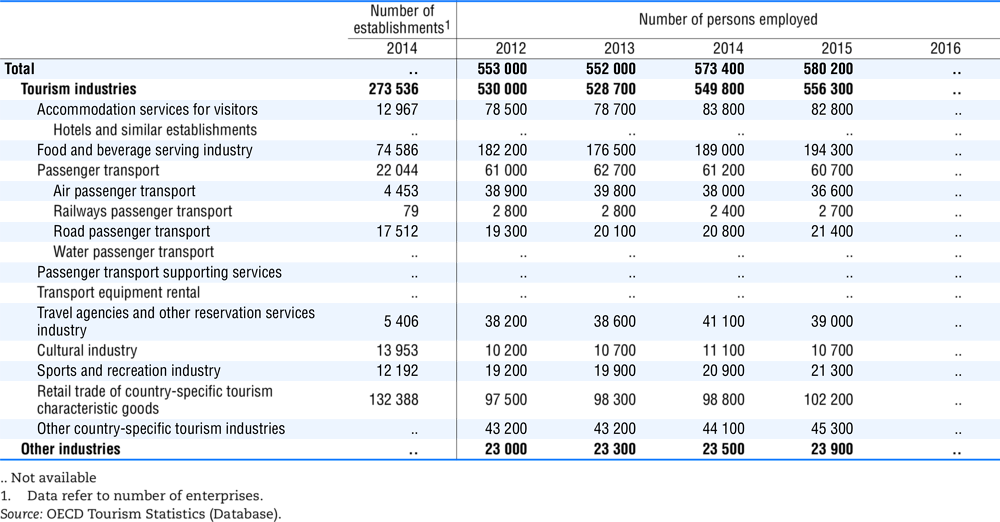

Tourism accounted for approximately one in 13 workers in Australia in 2015-16. Through the Tourism and Hospitality Labour and Skills Roundtable, the Government works with industry to address sector priorities, including career perceptions and vocational education and training.

As a long-haul destination, aviation plays a major role in transporting international visitors to and from Australia. The Australian Government’s approach is to continue to liberalise the international aviation market, supporting entry of Australian airlines into foreign markets and negotiating arrangements that remove barriers and ensure that aviation capacity can meet future demand.

As numbers continue to grow, efficient and secure traveller facilitation through international borders has become increasingly important. The Australian Government has recently completed implementation of an automated departure process at all eight major international airports, enabling processing of up to 150 people per hour per gate. The Outgoing Passenger card has also been removed, simplifying and speeding up processing at the border. More specific facilitation measures for key source markets include, trialling a 10 year multiple entry visitor visa for eligible Chinese nationals and three year multiple entry visas for nationals from India, Thailand, Viet Nam and Chile; online lodgement for applicants from China and India; and trialling a user-pays fast-track processing option in China, India and the United Arab Emirates. China is recognised as an important driver of tourism growth and 2017 was designated as the China-Australia Year of Tourism (Box 1.15).