South Africa

Tourism in the economy

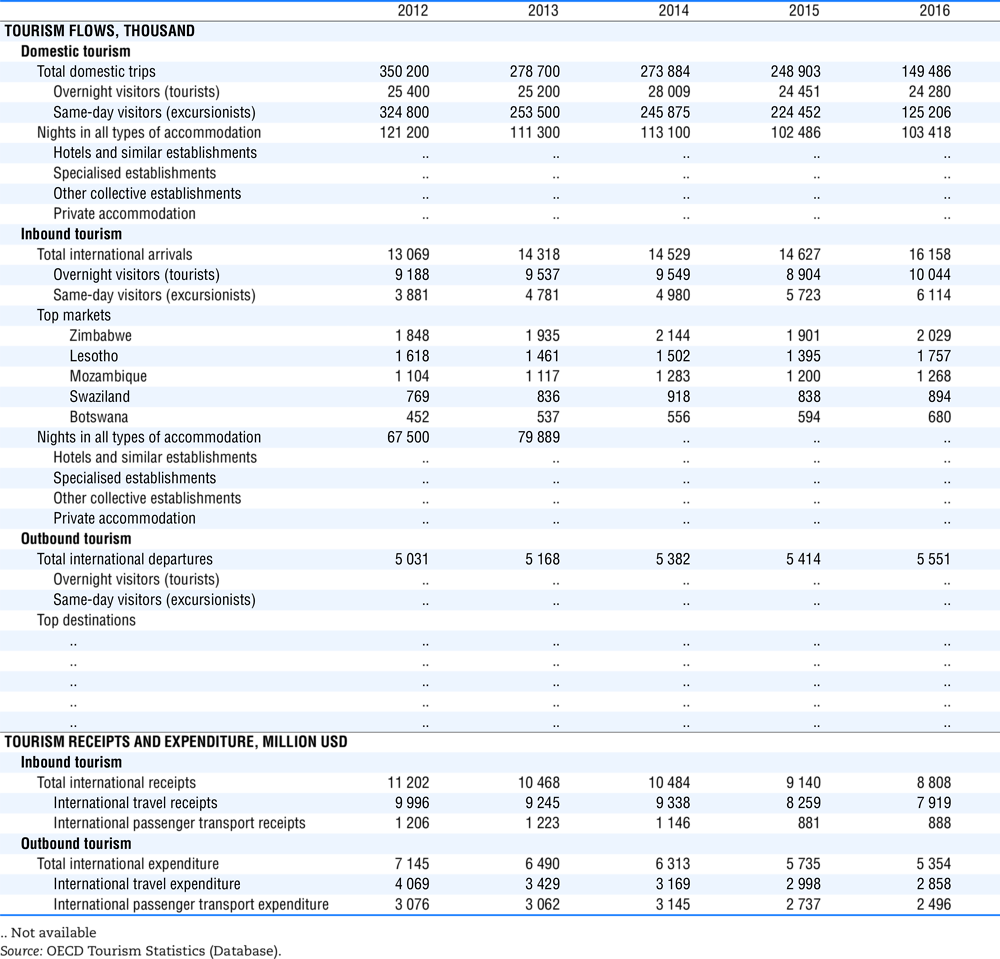

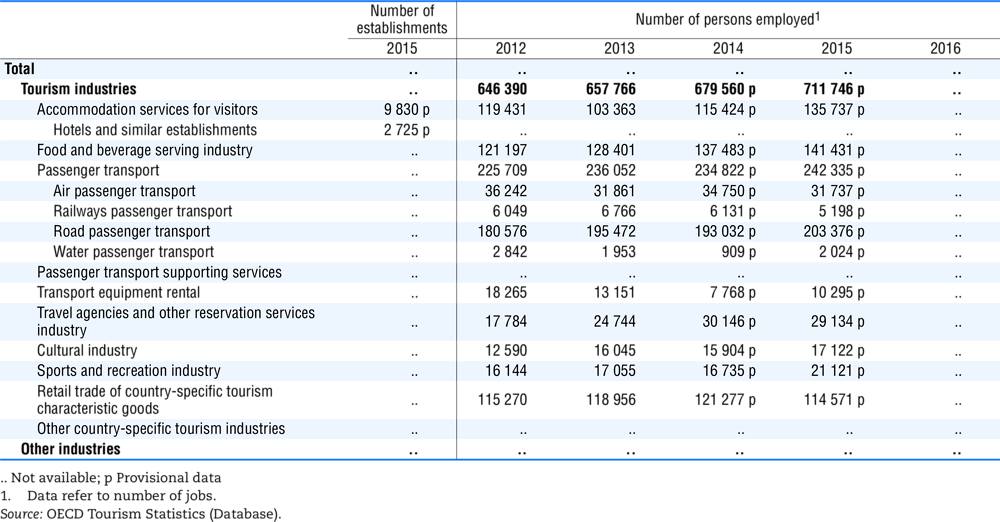

Tourism is a growth sector which is envisaged to play a major role in supporting national economic growth in South Africa. In 2016, direct tourism GDP was estimated to be ZAR 127.9 billion (up 7.8%), representing approximately 3% of total GDP. Tourism is also a key contributor to employment, with 711 746 jobs (up 4.7%) directly attributable to tourism in 2015, accounting for 4.5% of total employment.

A total of 10 million inbound overnight arrivals were recorded in 2016, a 12.8% increase from 2015. The three leading origin markets were Zimbabwe, Lesotho, and Mozambique, together accounting for over half of total overnight international arrivals (50.3%).

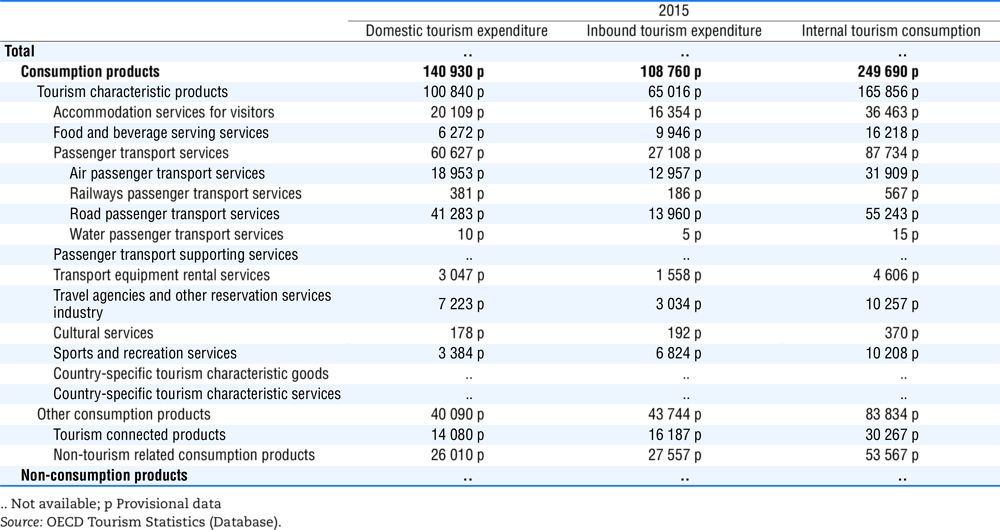

In the domestic market, there were 24.3 million overnight visitors in 2016 (down 0.7%), who stayed 103.4 million nights in all forms of accommodation (up 0.9%), generating ZAR 26.5 billion in domestic travel receipt (up 12.3% on 2015).

Tourism governance and funding

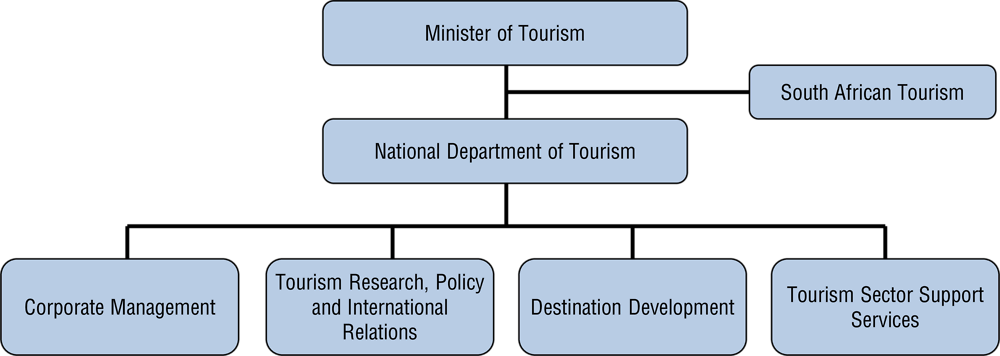

The Ministry of Tourism has had oversight of the tourism portfolio since its establishment in 2009. This involves crafting policies and sector strategies as appropriate, working closely with public and private sector stakeholders. Oversight is also exercised over South African Tourism (SAT), the public entity responsible for the country’s destination marketing at home and abroad.

At the provincial level, a Member of the Executive Council in each of South Africa’s nine provinces is charged with responsibility for tourism. Each province also has a provincial tourism marketing organisation, complementing the activities of SAT.

Horizontal coordination is undertaken through the National Tourism Stakeholder Forum of the Department of Tourism, which consists of representatives of key ministries and institutions with an impact on tourism, such as Statistics South Africa, the Airline Association of Southern Africa and the Tourism Business Council of South Africa. Further bi-lateral arrangements are in place with other ministries such as the Ministry of Home Affairs and the Ministry of Transport. These involve tourism officials working in key policy fora convened by the ministries to ensure the consideration of tourism impacts of any policy proposals at their formulation stage.

The Department of Tourism’s budget for the fiscal period 2017-18 is ZAR 2.1 billion of which 53% (ZAR 1.1 billion) is allocated to SAT. The remaining ZAR 1 billion is distributed amongst tourism incentives, an expanded public works programme (including skills development), destination development, enterprise development and visitor support services.

The SAT budget is deployed towards increasing the country’s global market share and growing the domestic tourism market in a manner that promotes inclusive growth.

Source: OECD, adapted from the Department of Tourism, 2018.

Tourism policies and programmes

The Tourism Act of 2014 provides the overarching legislative context within which tourism development and growth is pursued. The key framework document guiding both public and private sector action since 2011 is the National Tourism Sector Strategy (NTSS).

A draft revised NTSS has now been published for public comment after which it will be processed through the government system for approval by the Cabinet. It seeks to respond to developments in the domestic and international environment and keep up with global trends including changes in the demography of the tourist market and associated consumer needs. The new NTSS envisions a rapidly growing South African tourism economy that leverages the country’s competitive advantages in nature, culture and heritage supported by innovative products and service excellence. The goal is to attract 5 million additional tourists to South Africa within the next five years.

Five strategic pillars have been identified to underpin future work addressing both domestic and international tourism markets:

-

Effective marketing,

-

Facilitating ease of access,

-

Enhancing the visitor experience,

-

Improving destination management practices,

-

Ensuring inclusivity in all tourism endeavours.

Once the revised NTSS is approved, the pillars will inform collaborative planning and the implementation of agreed priority actions by the constituent parts of the sector.

A major new focus is the development of a system of destination management to increase the country’s competitiveness. Initiatives include the provision of infrastructure development, maintenance, and enhancement, and the diversification of tourism products, experiences and routes. The emphasis will be on coordination of the tourism investment portfolio and the prioritised projects to advance the establishment and enhancement of tourism infrastructure that supports the current and future growth of the sector. Targeted foreign and national investment opportunities including priority areas for tourism product development are being coordinated. Investment in the development of tourism products is critical for destination competitiveness and to meet the needs of both domestic and international visitors.

The Department of Tourism is also developing a framework for precinct development, with an emphasis on township and rural tourism. This framework will be implemented through an initial township precinct pilot project and thereafter replicated in other viable townships and rural areas across the country.

Following the launch of the Tourism Incentive Programme in the 2015/16 fiscal year, implementation remains focused on key areas of intervention, namely:

-

Market Access: assisting small businesses to access local and international markets through targeted exposure,

-

Tourism Grading: supporting small establishments to participate in the national grading system thereby improving their ability to offer quality services and compete efficiently in the market,

-

Energy Efficiency: supporting energy efficiency initiatives,

-

Universal Accessibility: promoting universal accessibility in tourism.