Israel

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Tourism in the economy

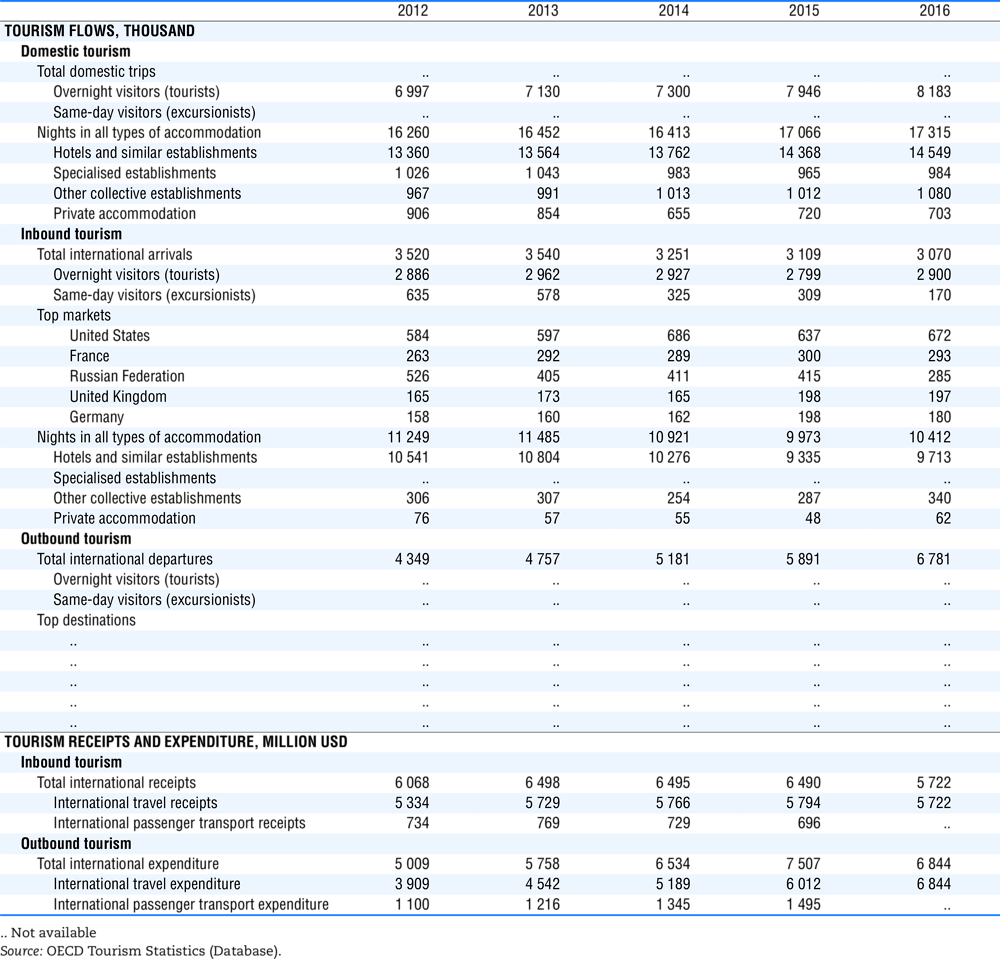

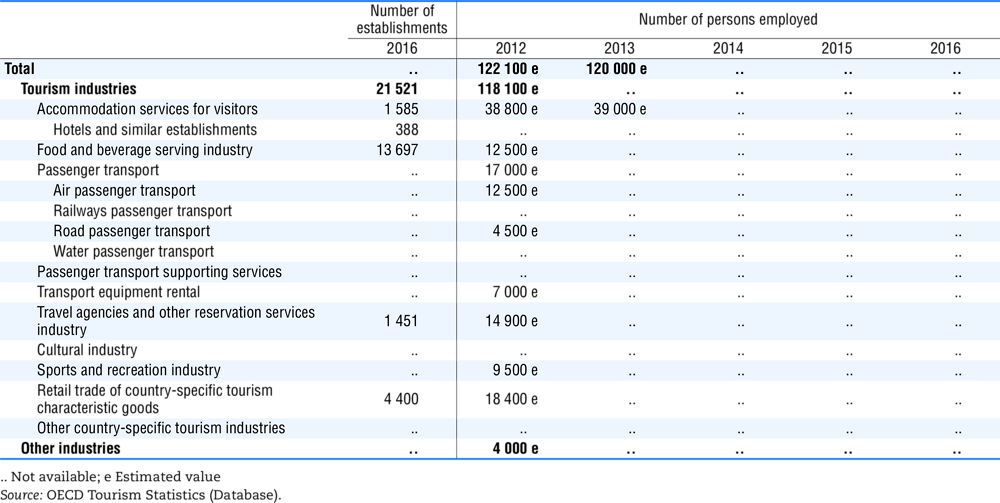

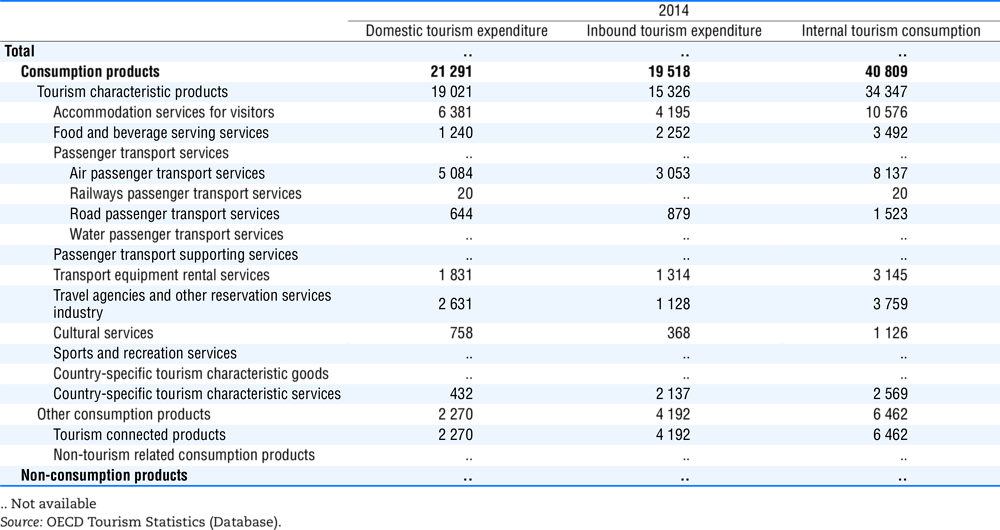

Tourism accounts directly for 2.8% of Israel’s GDP and about 3.5% of total employment. The combined total of direct and indirect tourism jobs is estimated at 230 000, representing just over 6% of total employment.

In 2016, there were 2.9 million international tourist arrivals, 3.6% more than in 2015. There were also 169 800 same-day visitors. Domestic tourism accounted for about 62% of all person/nights in all types of accommodation.

International tourism receipts are estimated at USD 4.7 billion. Israel’s most important international source markets are, in decreasing order of size, the United States, the Russian Federation, France, the United Kingdom and Germany, together accounting for 54% of all tourist arrivals.

Revenues from incoming tourism are estimated to account for 15% of services exports and 5% of total exports in 2016. In the first half of 2017 international tourist arrivals increased by approximately 25% compared with the first half of the 2016, mainly due to the positive effects of geopolitical stability in the region and intensive marketing effort, specifically in Europe.

Tourism governance and funding

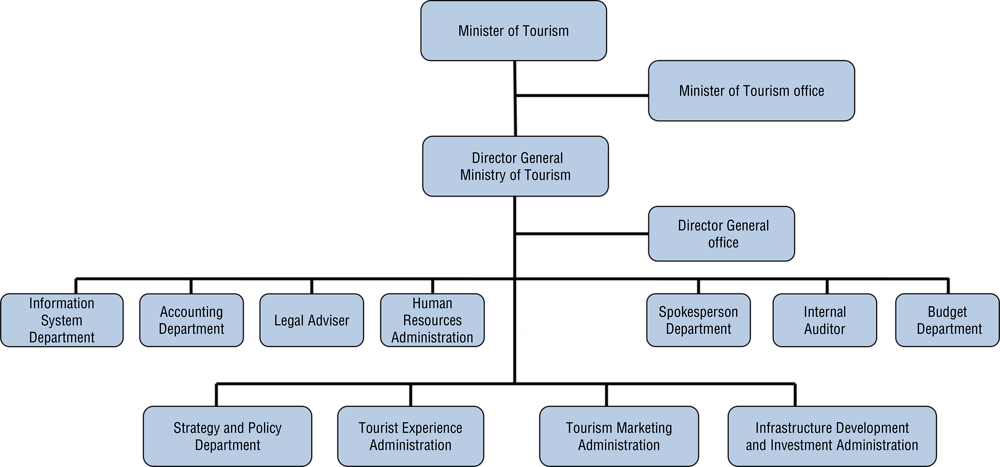

Tourism policy, marketing and development of the tourism sector are handled by the Ministry of Tourism, assisted by several other ministries, with a focus on infrastructure and site development, rural and agro tourism, SME development, and job training. These ministries include the Ministry of Environmental Protection, the Ministry for the Development of Negev and Galilee, Ministry of the Economy, and the Ministry of Agriculture.

There are also many regional and local organisations promoting tourism in Israel. The regional and local authorities have the following powers and responsibilities:

-

Examination by local planning committees of all building projects within their jurisdiction, including hotels and other tourism projects, and forwarding recommendations to the National Planning Committee, of which they are members,

-

Issuing construction permits,

-

Collecting local taxes, although during a crisis, or as means of encouragement, the tax burden on tourism projects may be eased,

-

Maintaining tourist sites,

-

Operating projects as joint ventures with the Ministry of Tourism, including: constructing tourism infrastructure (e.g. beach promenades and bike routes); domestic marketing campaigns; and organising and promoting local events and festivals.

In the resort cities and regions of Acre, Eilat, Jaffa, Jerusalem and Tel-Aviv, the Government has established Government Development Companies.

Source: OECD, adapted from the Ministry of Tourism, 2018.

In 2016, the general budget of the Ministry of Tourism was ILS 930 million. Of this total, some 43% was allocated to marketing, 24% to investment incentives, and 23% to public tourist infrastructure. All funding comes from the Government’s general budget. Marketing and infrastructure are funded by the Government and local authorities, while accommodation is funded by the private sector, although, sometimes with the support of government grants.

Tourism policies and programmes

The main issues and challenges for tourism in Israel are:

-

Diversification and improvement of the product and intensification of the tourist experience, including development of public infrastructure for tourism,

-

breaking into and development of new markets while preserving existing markets and visitor flows,

-

Creating and providing easy access to tourist information,

-

Adapting the product to visitors from new and emerging source markets.

Policy priorities include:

-

Expansion of hotel supply through investment,

-

Raising the competitiveness of tourism, in particular by lowering vacation prices through easing hotel regulations and promoting alternative types of accommodation,

-

Marketing and promotion, mainly through incentivising airlines to include Ben-Gurion, Ovda and the new Ilan Ramon (to open in 2018) Airports in their itineraries in order to increase the number of flights to Israel; and co-operation with on-line (OTA) and off-line travel agents, offering incentives according to the extent of increase in purchases of packages to Israel,

-

Improving the tourist experience, making information accessible on a digital level and supporting the creation of new tourism smartphone applications,

-

Developing new tourist products, such as the Desert Tourism product in the Negev area (Box 1.10).

Policies aimed at addressing these challenges and priorities include:

-

Placing emphasis on the tourist experience, building specific facilities (such as bicycle tracks and provision for camping), lowering prices and upgrading information bureaux,

-

Encouraging investment in tourism, including identification of, and engagement with, entrepreneurs,

-

Supporting negotiations with a range of OTAs and airlines,

-

Diversifying the types of accommodations, and increasing the number of hotel beds,

-

Streamlining innovative technological work,

-

Improving marketing activity: conducting familiarisation trips, hosting visits by journalists and others of influence, and increasing Ministry activity with digital campaigns,

-

Consolidating research tools and programs, and monitoring performance.