Switzerland

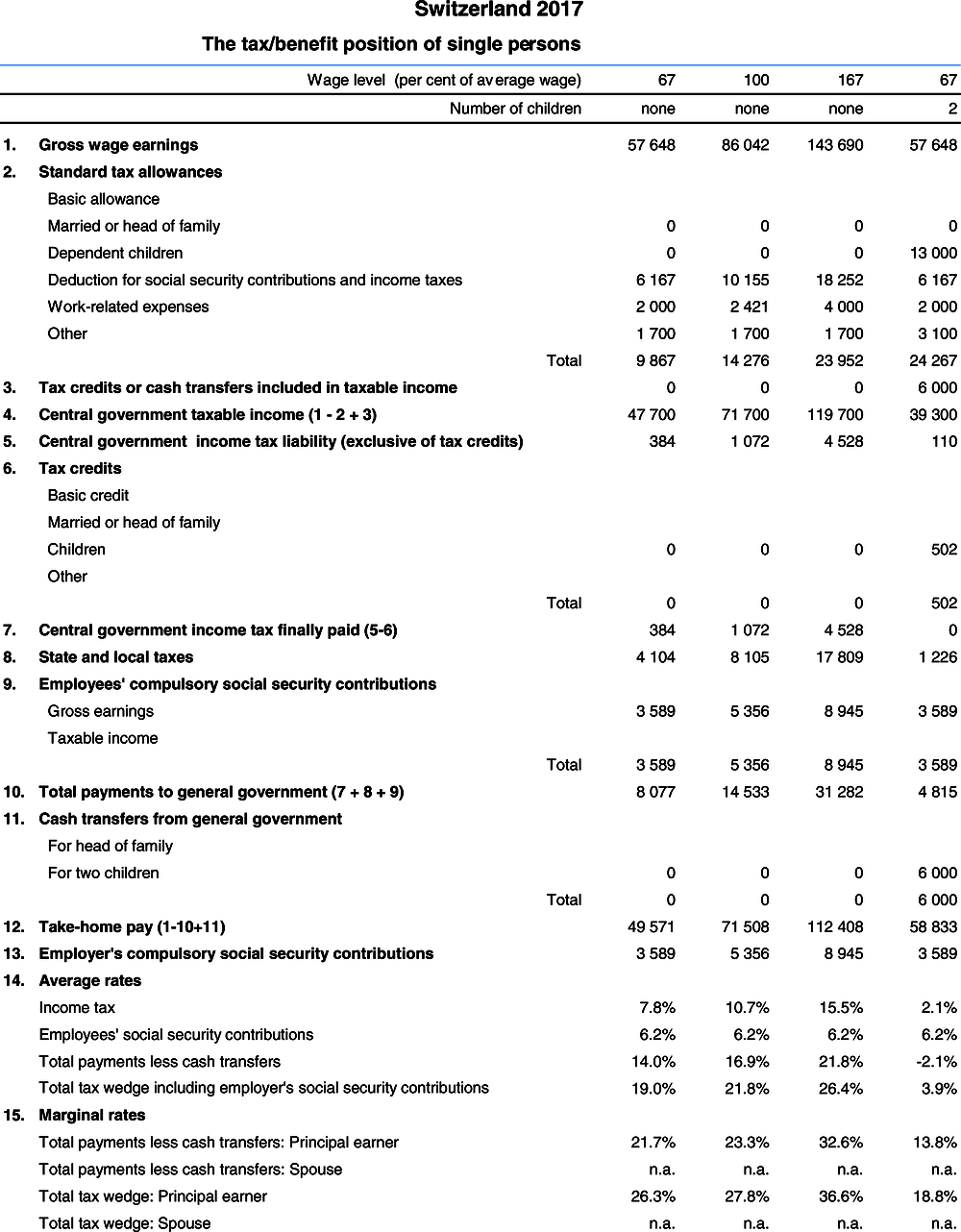

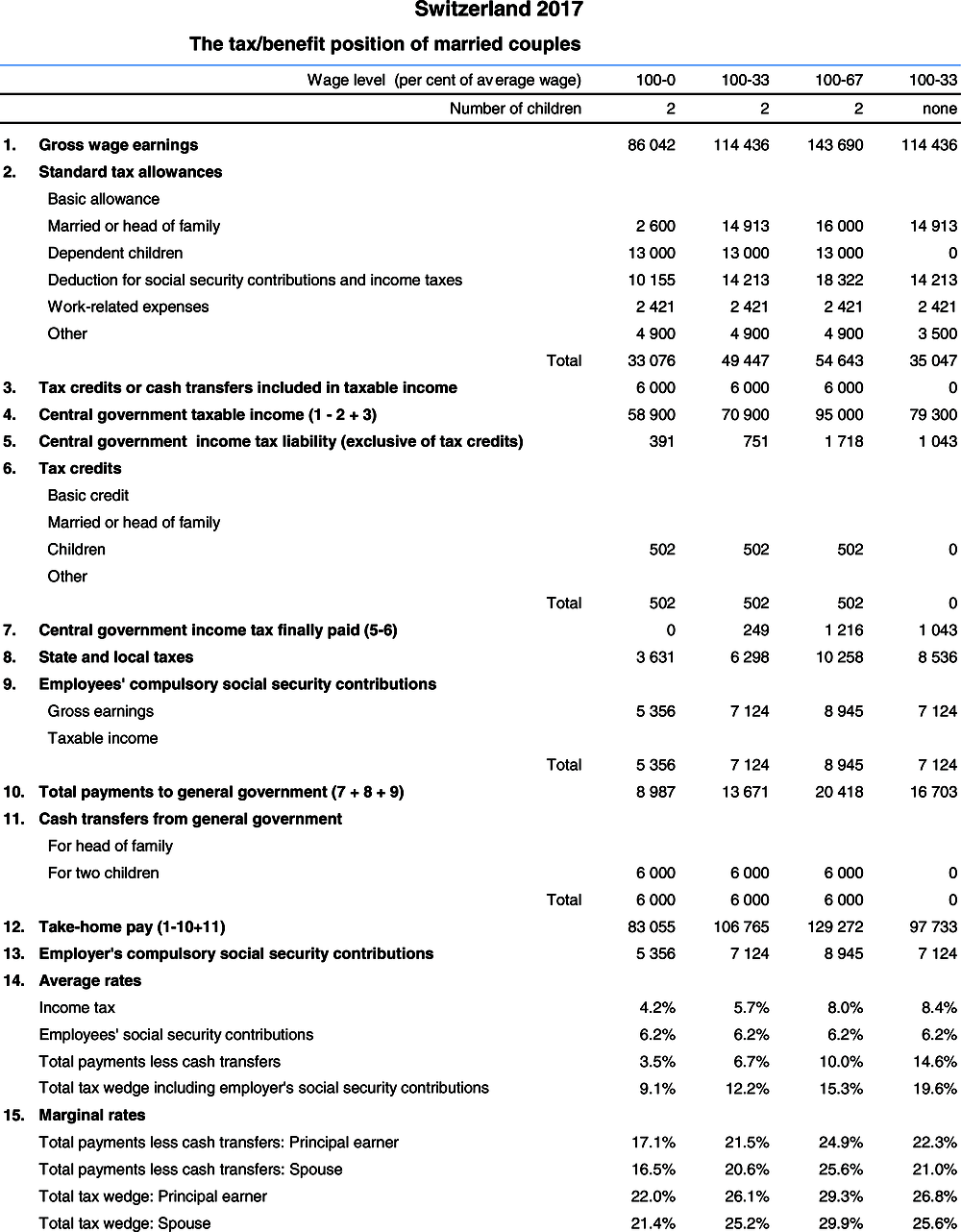

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Swiss franc (CHF). In 2017, CHF 0.98 equalled USD 1. The Secretariat has estimated that in that same year the average worker earned CHF 86 042 (Secretariat estimate).

Cantonal and communal income taxes are very substantial in relation to direct federal tax. Here, the canton and commune of Zurich have been selected as an example of the tax system of the 26 cantons. Local income tax is not deductible when calculating federal income tax.

1. Personal income tax systems

1.1. Income tax collected by the federal government (Confederation)

1.1.1. Tax unit

The income of spouses living together is taxed jointly, regardless of the property regime under which they were married. Income of children living under parental authority is added to the income of their custodian. Children’s labour income is taxed separately and in some cases, as in Zurich, is exempt from tax.

1.1.2. Tax reliefs and tax credits

1.1.2.1. Standard reliefs for “postnumerando” taxation [i.e. annual taxation on the basis of actual earned income, assessed at the end of the year]

-

Basic deduction

-

There is a basic deduction of CHF 2 600 for married couples for direct federal tax.

-

Deduction for children

A CHF 6 500 deduction is allowed for each child under 18 years of age; the deduction is allowed for older children if they are apprentices or still in school.

-

Tax credit for children

A CHF 251 deduction from the tax liability is allowed for each child under 18 years, the deduction is allowed for older children if they are apprentices or still in school.

-

Deductions for social insurance contributions and other taxes

Premiums for old age and disability insurance (5.125% of gross earned income) and for unemployment insurance (1.1% for income up to CHF 148 200, 0.5% for income over CHF 148 200) are deductible in full. Compulsory contributions of approximately 7.82% to private pension funds are also fully deductible. Health and life insurance premiums are deductible from federal income tax up to CHF 3 500 for married persons and CHF 1 700 for taxpayers who are widow(er)s, divorced or single (such premiums are not considered social contributions). These amounts are increased by CHF 700 for each dependent child.

-

Work-related expenses

Taxpayers are allowed a deduction corresponding to 3% of net income (i.e. gross income less contributions for old age and disability insurance, unemployment insurance and work-related provident funds). This deduction may be no less than CHF 2 000 and no more than CHF 4 000.

-

Deduction for two-income couples

50% of the smaller income can be deducted, but no less than CHF 8 100 and no more than CHF 13 400.

1.1.2.2. Main non-standard reliefs available to the average worker

-

Interest payments on qualifying loans

This is the main non-standard relief available to the average worker. It is allowed for all sorts of loans.

-

Medical expenses

Expenses incurred as a result of illness, accidents or disability of the taxpayer or one of its dependants are deductible if the taxpayer bears the expenses personally and they exceed 5% of his or her net income.

1.1.3. Tax base

In addition, for the married taxpayer with 2 children, there is a tax credit for 2 dependent children amounting to CHF 502, thus reducing the tax liability by CHF 502.

1.1.4. Tax schedules

1.1.4.1. Rates for persons living alone

1.1.4.2. Rates for spouses living together and for widowed, separated, divorced taxpayers or unmarried taxpayers living with their own children.

1.2. Taxes levied by decentralised authorities (Canton and commune of Zurich)

1.2.1. General description of the system

The system of cantonal and communal taxation has the same features as that of direct federal tax.

The tax base is comprised of income from all sources.

Once the basic amount of tax is set, cantons, communes and churches levy their taxes by applying a multiple, which may change from year to year. In 2012, for example, the canton applied a multiple of 1.0, the commune of Zurich 1.19 and the reformed church 0.10. The basic amount of tax is therefore multiplied by a total of 2.29. However, following the decision no longer to include church tax in Revenue Statistics, it is no longer included in the calculations for Taxing Wages. The basic amount of tax is therefore multiplied by a total of 2.19.

1.2.2. Tax base

1.2.3. Postnumerando tax rates

Cantonal income tax (Zurich)

a) Basic income tax rates for married, divorced, widowed or single taxpayers living with children:

b) Basic income tax rates for other taxpayers (single without children).

c) Annual multiple as a percentage of basic tax rates:

A personal tax of CHF 24 is added.

1.2.4. Tax rates used for this study

This study uses the rates of tax levied by the federal, cantonal and communal tax authorities.

2. Compulsory social security contributions to schemes operated within the government sector

2.1. Employee contributions

2.1.1. Retirement pensions

5.125% of gross income for old age insurance.

2.1.2. Health insurance

–

2.1.3. Unemployment

1.1% on the portion of income up to CHF 148 200; 0.5% for income over CHF 148 200.

2.1.4. Work-related accidents

–

2.1.5. Family allowances

–

2.1.6. Other

–

2.2. Employer contributions

2.2.1. Retirement pensions

5.125% of gross income for old age insurance.

2.2.2. Health insurance

–

2.2.3. Unemployment

1.1% on the portion of income up to CHF 148 200; 0.5% for income over CHF 148 200.

2.2.4. Work-related accidents

–

2.2.5. Family allowances

The employer pays a benefit for dependent children of an employee. The effective benefits paid depend on the Canton of residence and the respective employer. As of 1 January 2009, a new Swiss-wide minimum amount of CHF 2 400 (for children up to 16 years of age and CHF 3 000 for children in education between 16 and 25 years of age) has been established. In most cases, the benefit paid exceeds this minimum. The average family benefit is estimated to amount to CHF 3 000 per child per year.

This benefit is taxable along with other components of income.

The family allowance contributions are not included in the Taxing Wages results either as they are paid to a privately-managed fund. These contributions therefore qualify as non-tax compulsory payments (see also section 5.3).

2.2.6. Other

–

3. Universal cash benefits

3.1. Benefits linked to marital status

No such benefits are paid.

3.2. Benefits for dependent children

The employer pays a benefit of, on average, approximately CHF 3 000 per year for each dependent child of an employee. This benefit is taxable along with other components of income. See 2.25.

4. Main changes in the tax/benefit system since 1998

On 1 January 1999, the canton of Zurich switched from biennial praenumerando taxation to annual postnumerando taxation on individual income. As a result, the direct federal tax is based on annual postnumerando taxation as well.

As of 1 January 2008, the basic deduction for married couples and the deduction for two-income couples were introduced. These measures are intended to minimise the marriage penalty and to reduce the high taxation of secondary earners, thereby increasing labour force participation of skilled secondary earners.

As of 1 January 2012, the tax credit for children reduces the tax liability by CHF 251 per child.

5. Memorandum item

5.1. Identification of the average worker

The population includes men and women working in industry, arts and crafts. The stated income is for the average of workers in the same sector. The geographical scope is the entire country, whereas the amount of tax is computed in respect of the canton and commune of Zurich.

5.2. Method of calculation used

-

Unemployment benefits: not included;

-

Sick leave payments: not included;

-

Paid leave allowances: included;

-

Overtime: included;

-

Periodic cash bonuses: included;

-

Fringe benefits: not included;

-

Basic method used for calculation: monthly wages are multiplied by 12;

-

Close of the income tax year: 31 December;

-

Reference period for computing wages: from 1 January to 31 December of the year in question.

5.3. Calculation of non-tax compulsory payments

Switzerland imposes some important non-tax compulsory payments (NTCPs). These NTPCs are not included in the Taxing Wages models except when they qualify as standard personal income tax reliefs. Compulsory payments indicators, which combine the effect of taxes and NTCPs, are calculated by the OECD Secretariat and presented in the OECD Tax Database (See: www.oecd.org/ctp/taxdatabase). Switzerland levies the following employee and/ or employer NTCPs:

-

Contributions to the second pillar of the pension system (occupational pension funds): Occupational pension funds are mandatory for salaried persons earning at least CHF 21 150 annually. Old age insurance is based on individual savings. The savings assets accumulated by the insured person on his individual savings account over the years serve to finance the old age pension. The constituted capital is converted into an annual old age pension on the basis of a conversion factor. Contribution rates depend on the occupation and the pension fund. An estimated representative rate amounted to 7.82% for employees and 10.61% for employers in 2014.

-

Health insurance is compulsory for all persons domiciled in Switzerland. Every family member is insured individually, regardless of age. Health insurance contributions are lump sum contributions per capita depending on age, sex, canton of residence and insurer. The national average rates for 2017 amount to CHF 5 367 for adults and CHF 1 263 for children per year. Health insurance premiums can be reduced depending on the contributor’s income level and his family situation. Each canton has its own definition of the income thresholds and the reduction regime. The health insurance premium and reduction rates of the Canton of Zurich are used in the calculations.

-

Family allowance: Employers have to make family allowance contributions. The contribution rates differ among cantons and family contribution funds. A representative rate has to be estimated, for 2016 it amounts to 1.1%.

-

Accident insurance: Accident insurance is compulsory for every employee. Employees are automatically insured by their employer, whereas the employers are more or less automatically assigned to a particular insurance company depending on their branch of trade. The risk and associated costs of the respective business activity determines the insurance premiums. A representative rate would have to be estimated.

2017 tax equations

The equations for the Swiss system in 2017 are mostly calculated on a family basis.

Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.