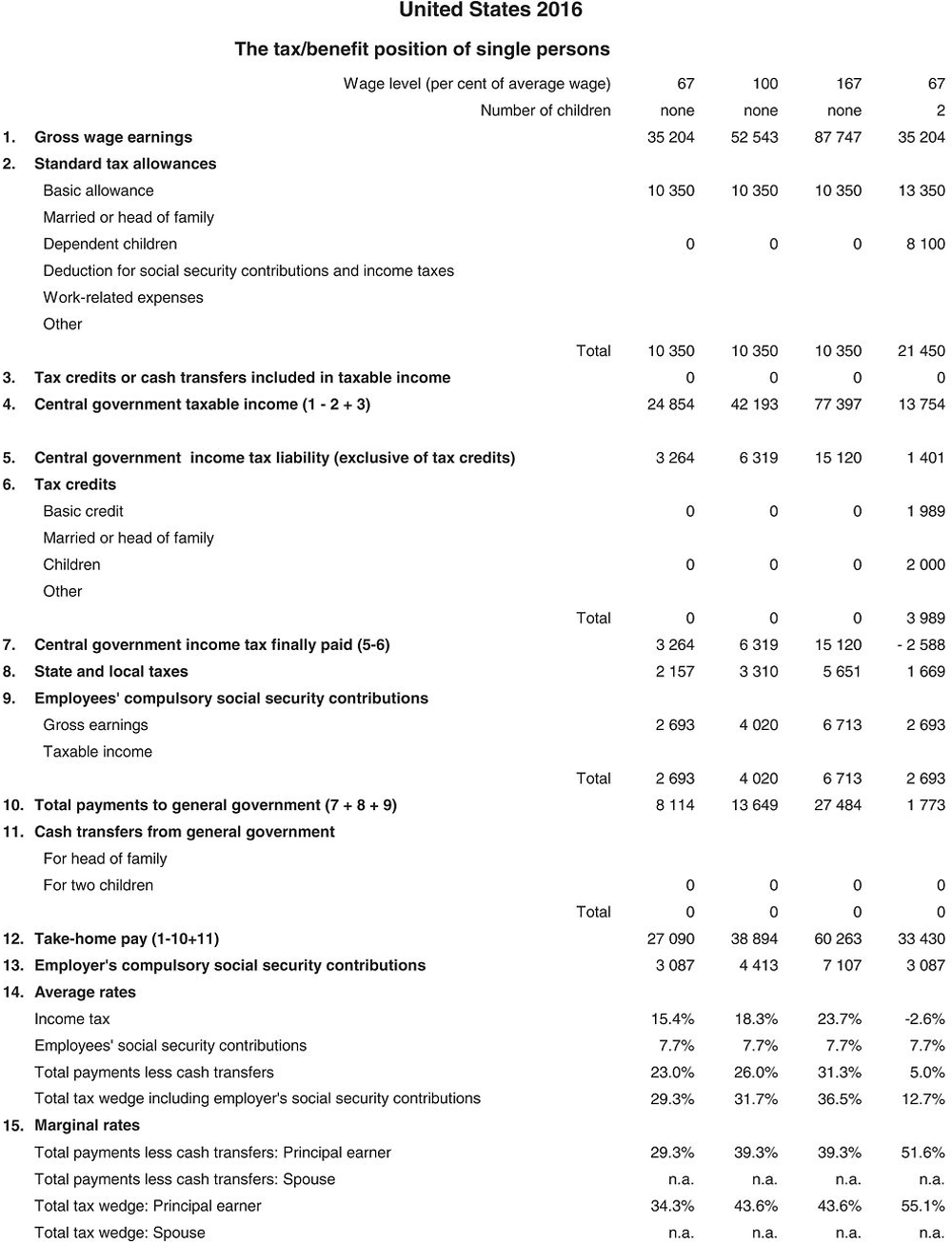

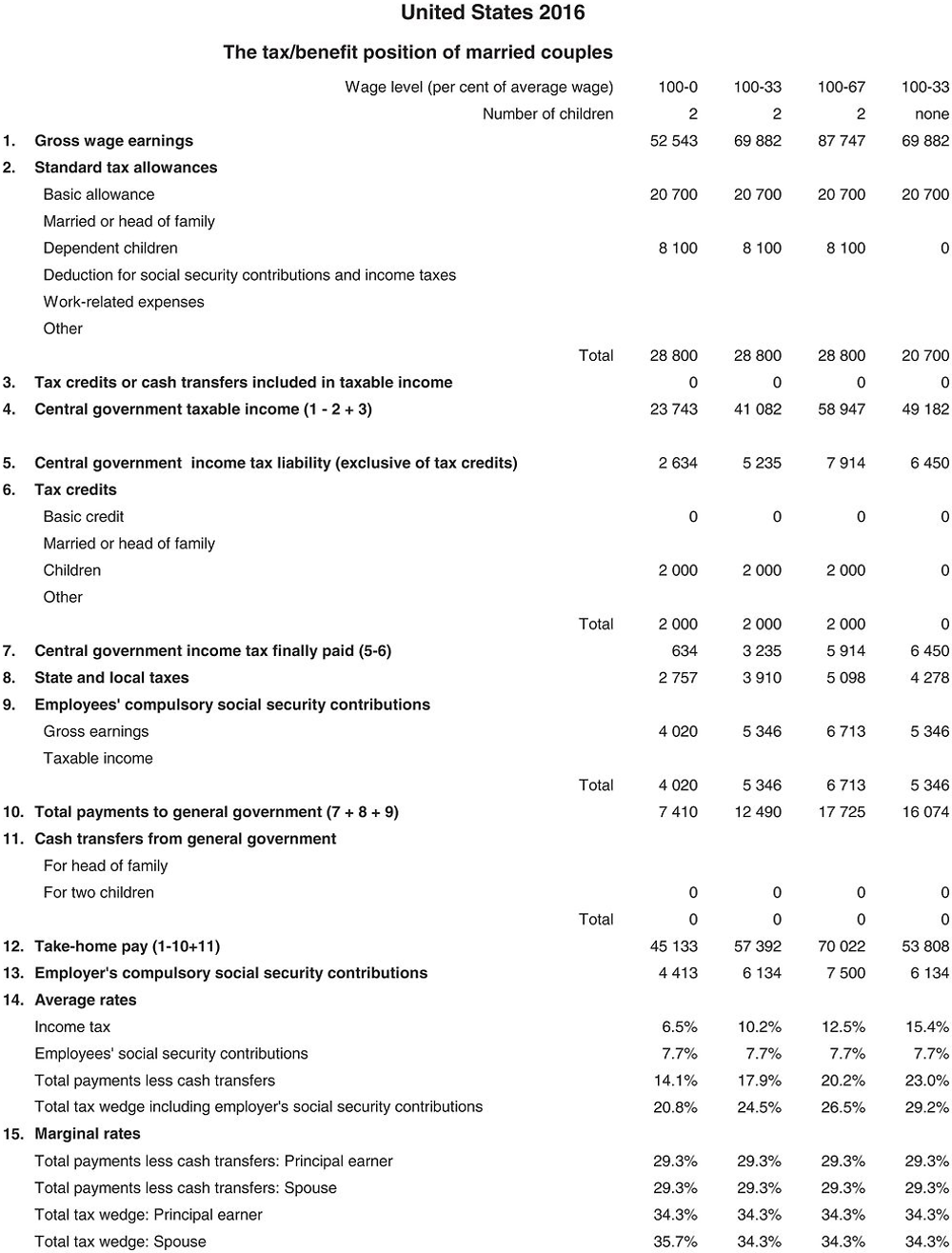

United States

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for Personal income tax systems, Compulsory social security contributions to schemes operated within the government sector, Universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the dollar (USD). In 2016, the average worker earned USD 52 543 (Secretariat estimate).

1. Personal income tax system

1.1. Central/federal government income taxes

1.1.1. Tax unit

Families are generally taxed in one of three ways:

-

As married couples filing jointly on the combined income of both spouses;

-

As married individuals filing separately and reporting actual income of each spouse; or

-

As heads of households (only unmarried or separated individuals with dependents).

All others, including dependent children with sufficient income, file as single individuals.

1.1.2. Tax allowances and tax credits

1.1.2.1. Standard reliefs

-

Basic reliefs: In 2016 a married couple filing a joint tax return is entitled to a standard deduction of USD 12 600. The standard deduction is USD 9 300 for heads of households and USD 6 300 for single individuals. This relief is indexed for inflation. More liberal standard deductions are available for taxpayers who are age 65 or older and taxpayers who are blind. Special rules apply to children who have sufficient income to pay tax and are also claimed as dependents by their parents.

-

In addition to the standard deduction, in 2016 a USD 4 050 personal exemption is given to every taxpayer (including both husband and wife filing a joint return). The personal exemption is indexed annually for inflation. In 2016, there is a phase out for personal exemptions.

-

Personal exemption phase out: Personal exemptions are phased out in 50 steps for taxpayers with incomes in excess of certain amounts. All of a taxpayer’s exemptions are phased out simultaneously. For each USD 2 500 or fraction thereof by which income exceeds the beginning of the phase out range, personal exemptions are phased down by two percentage points.

-

Standard marital status reliefs: Married couples generally benefit from a more favourable schedule of tax rates for joint returns of spouses (see Section 1.1.3). There are no other general tax reliefs for marriage.

-

Relief for children: For each child and other person claimed as a dependent on a taxpayer’s return, the taxpayer is entitled to a personal exemption of USD 4 050 in 2016. Low income workers with dependents are allowed a refundable (non-wastable) earned income credit. For taxpayers with one child, the credit is 34% of up to USD 9 920 of earned income in 2016. The credit phases down when income exceeds USD 18 190 (23 740 for married taxpayers) and phases out when it reaches USD 39 296 (44 846 for married taxpayers). The earned income threshold and the phase-out threshold are indexed for inflation. For taxpayers with two children, the credit is 40% of up to USD 13 930 of earned income in 2016. The credit phases down when income exceeds USD 18 190 (23 740 for married taxpayers) and phases out when it reaches USD 44 648 (50 198 for married taxpayers). For taxpayers with three or more children the credit is 45% of up to USD 13 930 of earned income. The credit phases down when income exceeds USD 18 190 (23 740 for married taxpayers) and phases out when it reaches USD 47 955 (53 505 for married taxpayers).

-

Since 1998, taxpayers are permitted a tax credit for each qualifying child under the age of 17. In 2016 the maximum credit is USD 1 000. The maximum credit is reduced for taxpayers with income in excess of certain thresholds. The credit is reduced by USD 50 for each USD 1 000 of income in excess of USD 110 000 for married taxpayers (USD 75 000 for single and head of household taxpayers). These threshold amounts are not indexed for inflation. The child credit is refundable (non-wastable) to the extent of 15% of earned income in excess of USD 3 000. A taxpayer with three or more qualifying children may be allowed a supplemental refundable (non-wastable) child credit, subject to certain restrictions. The refundable credit is the excess of the taxpayer’s share of social security (including Medicare) taxes over his earned income tax credit for the year not used to offset income tax liability.

-

Relief for low income workers without children: In 1994 and thereafter, low income workers without children are eligible for the earned income credit. In 2016 low income workers without children are permitted a non-wastable earned income credit of 7.65% of up to USD 6 610 of earned income. The credit phases down when income exceeds USD 8 270 (13 820 for married taxpayers) and phases out when income reaches USD 14 880 (20 430 for married taxpayers). This credit is available for taxpayers at least 25 years old and under 65 years old.

-

Relief for social security and other taxes. In 2016, the withholding rate for Social Security taxes for employees is 6.2%. The earned income credits described above are sometimes considered an offset to social security contributions made by eligible employees. Furthermore, only a portion of social security benefits are subject to tax.

1.1.2.2. Main non-standard reliefs applicable to an AW

-

The basic non-standard relief is the deduction of certain expenses to the extent that, when itemised, they exceed in aggregate the standard deduction. For the purposes of this Report, it is assumed that workers claim the standard deduction. The principal itemised deductions claimed by individuals where the standard deduction is not being claimed are:

-

Medical and dental expenses that exceed 10% of income (7.5% for taxpayers age 65 and over);

-

State and local income taxes, real property taxes, and personal property taxes. Home mortgage interest;

-

Investment interest expense up to investment income with an indefinite carry forward of disallowed investment interest expense;

-

Contributions to qualified charitable organisations (including religious and educational institutions);

-

Casualty and theft losses to the extent that each loss exceeds USD 100 and that all such losses combined exceed 10% of income; and

-

Miscellaneous expenses such as non-reimbursed employee business expenses (union dues, work shoes, etc.), investment expenses, tax return preparation fees and educational expenses required by employment, to the extent that, in aggregate; they exceed 2% of income.

-

In 2013, the most recent year for which such statistics are available, the 42% of taxpayers with income between USD 50 000 and USD 75 000 (the AW range) who itemised their deductions claimed average deductions as follows: medical expenses, USD 9 334; taxes paid, USD 5 472; charitable contributions, USD 2 863; interest expense, USD 7 327.

-

Contributions to pension and life insurance plans. No relief is provided for employee contributions to employer sponsored pension plans or for life insurance premiums. However, tax relief is provided for certain retirement savings.

1.1.3. Tax schedule

There is a 3.8% tax on certain net investment income of individuals if their income exceeds USD 200 000 (USD 250 000 for joint returns). Net investment income includes interest, dividends, capital gains, rental and royalty income, and income from businesses trading financial instruments.

1.2. State and local income taxes

1.2.1. General description of the system

The District of Columbia and 41 of the 50 States impose some form of individual income tax.1 In addition, some local governments (cities and counties) impose an individual income tax, although this is not generally the case. State individual income tax structures are usually related to the federal tax structure by the use of similar definitions of taxable income, with some appropriate adjustments. This linkage is not a legal requirement but a practical convention that functions for the convenience of the taxpayer who must fill out both federal and State income tax returns.

The AW calculations assume that the average worker lives in Detroit, Michigan. The state of Michigan permits a personal exemption of USD 4 000 for the taxpayer, the taxpayer’s spouse and each child, and taxes income at the rate of 4.25%. Michigan allows taxpayers who are eligible to claim the federal earned income tax credit to claim a Michigan earned income tax credit. The Michigan earned income tax credit is a refundable (non-wastable) credit equal to 6% of the federal earned income tax credit.

The city of Detroit permits a personal exemption of USD 600 and taxes income at the rate of 2.4%.

2. Compulsory social security contributions to schemes operated within the government sector

2.1. Employees’ contributions

2.1.1. Pensions

In 2015, the rate for employee contributions is 7.65% (6.2% for old age, survivors, and disability insurance, and 1.45% for old age hospital insurance). The 6.2% rate applies to earnings up to USD 118 500. Beginning in 1994, there is no limit on the amount of earnings subject to the 1.45% rate. There is an additional 0.9% tax on employee wages and salaries that exceed USD 200 000 (USD 250 000 for joint returns) as the additional hospital insurance tax on high-income taxpayers. The additional tax on wages and salaries is subject to withholding (but without regard to the earnings of the spouse) when wages from a particular job exceed USD 200 000 per year. These thresholds are not indexed for inflation.

There is no distinction by marital status or sex.

2.1.2. Other

No compulsory employee contributions exist.

2.2. Employers’ contributions

2.2.1. Pensions

The rate for employers’ contributions is 6.2% on earnings up to USD 118 500 and 1.45% of all earnings (without limit).

2.2.2. Unemployment

Employers are required by the federal government to pay unemployment tax of 6% on earnings up to USD 7 000. Taxes are also paid to various state-sponsored unemployment plans which may generally be credited against the required federal percentage. In 2015 the average unemployment insurance tax rate in Michigan was 3.94% of the first USD 9 500 of wages. Effective the third quarter of 2015, the taxable wage base decreased to USD 9 000 for most employers. The model considers that the Federal government allows employers to take a credit for state unemployment taxes of up to 5.4%, resulting in a net Federal tax of 0.6% on earnings up to USD 7 000.

3. Universal cash transfers

3.1. Transfers related to marital status

None.

3.2. Transfers for dependent children

No general cash transfers exist, although low-income mothers qualifying for categorical welfare grants may receive cash transfers.

4. Principal changes since 2011

None.

5. Memorandum items

5.1. Identification of an AW at the wage calculation

-

The AW is identified from monthly data compiled from establishment questionnaires covering more than 40 million non-agricultural full- and part-time workers. Beginning in March 2006, data on average weekly hours and average hourly earnings cover all employees rather than solely production or non-supervisory workers. To obtain average annual wages, the product of average weekly hours (including overtime) and average hourly earnings (including overtime) is multiplied by 52 and is adjusted to reflect a full-time equivalent worker. The AW wage is estimated to be USD 51 509 for 2015.

5.2. Employer contributions to private social security arrangements

Employers commonly contribute to private pension plans, health insurance and life insurance. Data for these contributions are available only on a total workforce basis. It is not possible to state with accuracy the levels applicable to the AW. The following are estimates for 2015 for employees in private industry:

2016 tax equations

The equations for the US system in 2016 are mostly calculated on a family basis. There is a special function EIC which is used to calculate the earned income credit. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

← 1. New Hampshire and Tennessee tax only interest and dividend income received by individuals.