Norway

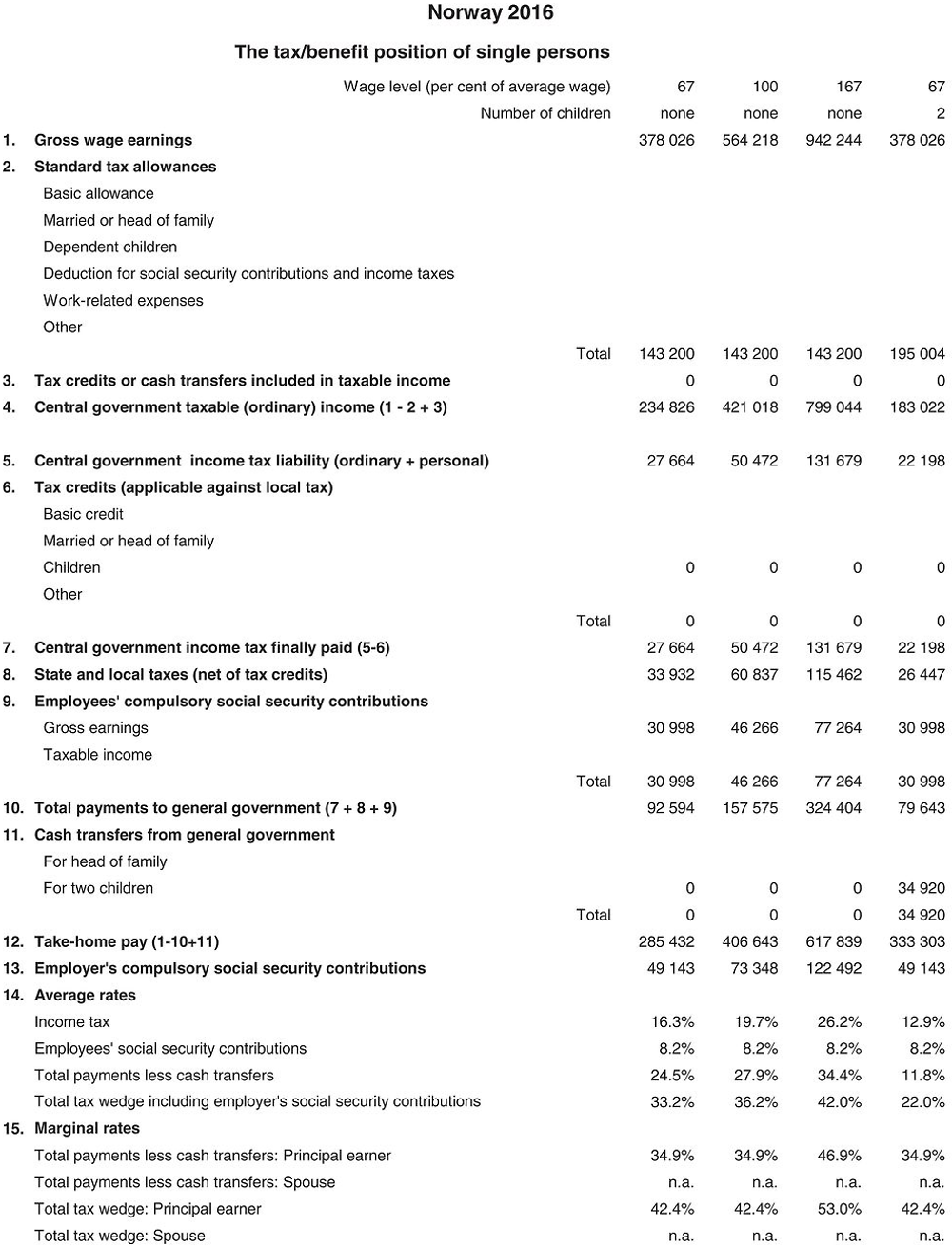

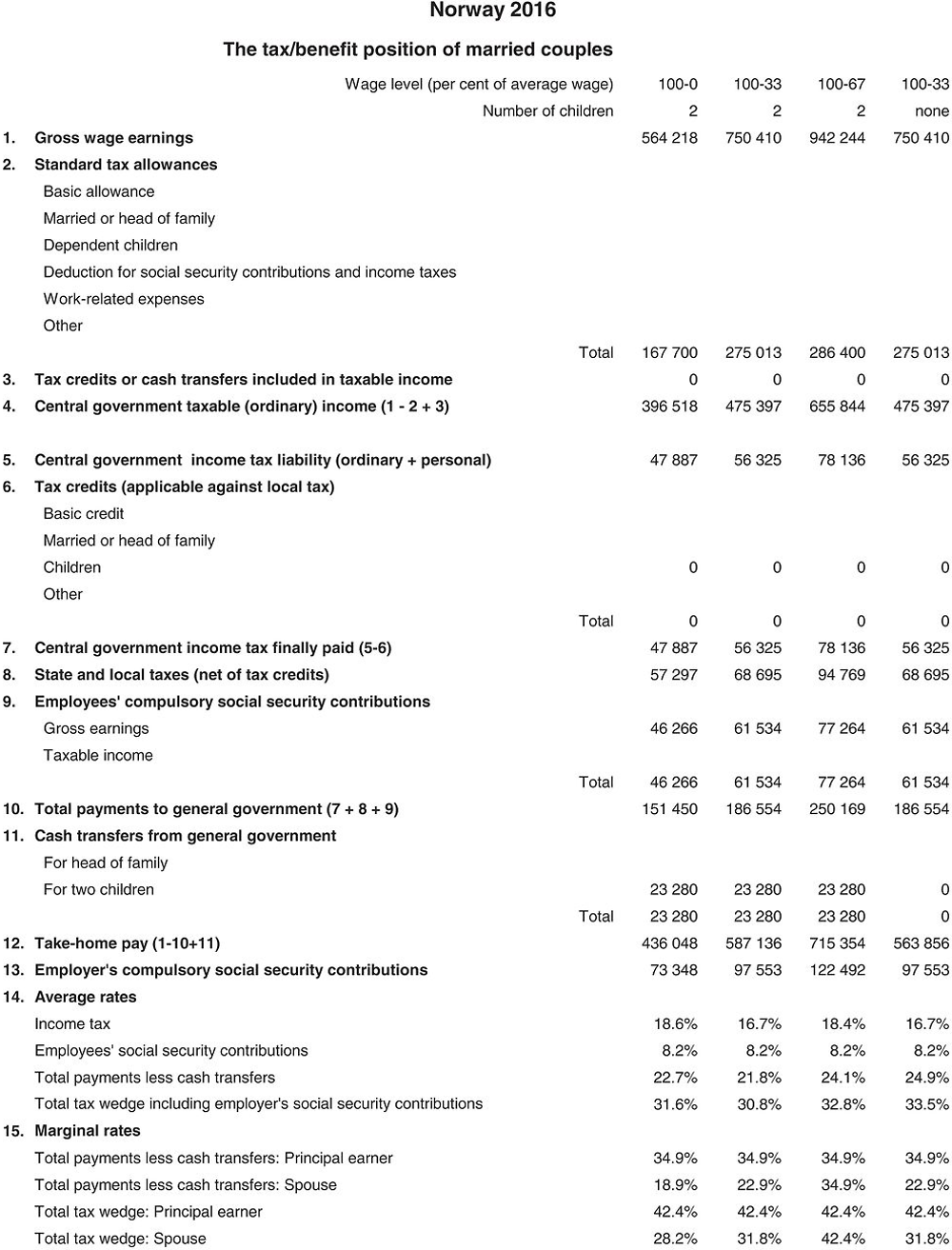

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for Personal income tax systems, Compulsory social security contributions to schemes operated within the government sector, Universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Kroner (NOK). In 2016, NOK 8.40 was equal to 1 USD. In that year the average worker earned NOK 564 218 (Secretariat estimate).

1. Personal income tax system

The personal income tax has two tax bases: personal income and ordinary income. Personal income is defined as income from labour and pensions. Personal income is a gross income base from which no deductions are made. Ordinary income includes all types of taxable income from labour, pensions, business and capital. Certain costs and expenses, including interest paid on debt, are deductible in the computation of ordinary income.

1.1. Central government income tax

1.1.1. Tax unit

The tax unit is in most cases the individual (tax class 1), but joint taxation (tax class 2) is also possible. Children aged below 17 are generally taxed together with their parents, but they may be taxed individually. All other income earners are taxed on an individual basis (class 1).

1.1.2. Tax allowances applicable to an AW

There are no tax allowances applicable to an AW under the central government income bracket tax. The tax base is personal income from which no deductions are allowed. As part of the overall tax rate of 25% on ordinary income, 10.55% is considered to be the central government income tax.

1.1.3. Rate schedule of the bracket tax

1.2. Local government income tax

The overall tax rate on ordinary income is 25%. The local government (municipal and county) income tax is 14.45% points of the overall rate. Tax on ordinary income is levied after taking into account a standard allowance of NOK 51 750 (class 1) and NOK 76 250 (class 2) in 2016. Single parents are eligible to an additional special tax allowance of NOK 51 804. The deductions in the computation of ordinary income are:

1.2.1. Standard reliefs

-

Basic allowance: each individual receives a minimum allowance equal to 43% of personal income, with a minimum of NOK 4 000 and a maximum of NOK 91 450. For wage income each individual can choose a separate allowance of NOK 31 800 instead of the basic allowance. Hence, wage earners would opt to choose this separate allowance as long as it exceeds the basic allowance to which they are entitled.

1.2.2. Non-standard reliefs

The main non-standard allowances deductible from ordinary income are:

-

Parent allowance: Documented expenses for child care limited to:

-

maximum NOK 25 000 for one child

-

plus NOK 15 000 for each subsequent child.

-

The allowance applies in general to the spouse who has the highest income. Unused parent allowance may be transferred to the other spouse. The allowance is also applicable to single parents.

-

Travel expenses related to work exceeding NOK 22 000;

-

Labour union fees up to NOK 3 850;

-

Donations to voluntary organisations up to NOK 25 000;

-

Contributions to individual pension agreement schemes, maximum NOK 15 000;

-

Premiums and contributions to occupational pension schemes in the private and public sector, unlimited;

-

Unlimited deduction for interest payments.

The main non-standard tax credits are:

-

Home savings scheme (BSU): The BSU scheme aims to encourage young people (under 34 years old) to save for a future home purchase. A wastable tax credit of 20% of annual savings up to NOK 25 000 in special accounts is granted. Total savings may not exceed NOK 300 000.

2. Social security contributions

2.1. Contributions to the national insurance scheme

2.1.1. Employees’ contributions

Employees’ contributions to the National Insurance Scheme generally amount to 8.2% of personal wage income. Employees do not make contributions if their wage income is less than NOK 49 650. Once wage income exceeds this floor, an alternative calculation is made where the contributions equal 25% of the wage income in excess of the floor. The actual contributions made would represent the minimum between the alternative calculation and 8.2% of the total wage income.

Contributions from the self-employed are 11.4% of personal income attributable to labour.

2.1.2. Employers’ contributions

Employer’s social security contributions are due for all employees in both the private and the public sector. The contribution is geographically differentiated according to the municipality where the work-place is. The standard rates are 14.1%, 10.6%, 7.9%, 6.4%, 5.1% or 0% of gross wages. The highest rate applies to central parts of southern Norway. Lower rates may apply under certain circumstances. The weighted average rate is approximately 13%.

3. Universal cash transfers

3.1. Transfers related to marital status

None.

3.2. Transfers for dependent children (child support)

The following transfers are available:

NOK 11 640 per child aged 0-18 years.

Single parents receive transfers for one more child than their actual number of children.

4. Main changes in tax/benefit systems since 2002

-

Most important changes related to wage taxation in 2016:

-

The general tax rate on ordinary income was reduced from 27% to 25%.

-

A bracket tax with on personal income with 4 tax brackets was introduced and replaced the former surtax on personal income.

-

-

Most important changes related to wage taxation in 2015:

-

The threshold in surtax bracket 1 was increased by NOK 5 750.

-

The upper limit of the basic allowance for wage income/social security benefits was increased by NOK 2 100.

-

The lower threshold for the payment of employee’s social security contributions was increased from NOK 39 600 to NOK 49 650.

-

-

Most important changes related to wage taxation in 2014:

-

The general tax rate on ordinary income was reduced from 28% to 27%.

-

The employee’s social security contributions were increased by 0.4 percentage points.

-

The rate in the basic allowance against wage income was increased to 43%.

-

Tax class 2 for married couples was reduced.

-

-

Most important changes in 2013:

-

The personal allowance for labour income was increased for low income earners (below NOK 213 950) by 2 percentage points from 38% to 40% of their labour income.

-

The taxable value of second homes and commercial property for the purposes of net wealth tax was increased from 40% to 50% of estimated market value.

-

The basic allowance in the net wealth tax was increased from NOK 750 000 to NOK 870 000. Married couples will thus have a total basic allowance of NOK 1 740 000.

-

The current class 2 for sole providers was replaced by a special allowance for ordinary income which provides an equivalent tax benefit.

-

The maximum deduction for labour union fees was increased from NOK 3 750 to NOK 3 850.

-

-

Most important changes in 2012:

-

The personal allowance for labour income was increased for low income earners (below NOK 217 000) by 2 percentage points from 36% to 38% of their labour income.

-

For self-employed the wage allowance was abolished to eliminate residual discrimination between sole proprietorships with employees and limited companies.

-

In the deduction for travel expenses for travels between home and work the deduction rate per kilometre was increased for tax payers travelling between 35 000 km and 50 000 km per year.

-

The maximum deduction for labour union fees was increased by NOK 90 to NOK 3 750.

-

-

In 2011 changes to the tax system was made to provide better incentives for people to work when drawing a pension. The tax limitation rule for early-retirement and old-age pensioners was replaced by a new tax allowance for pension income. The allowance ensures that people who only receive the minimum pension will continue not to pay income tax. The allowance is scaled down against pension income, so that the marginal tax on earned income is reduced to the same level as for wage earners. The marginal tax on capital for low-income pensioners is also reduced to the same level as for other taxpayers. The new tax allowance is determined regardless of the spouse’s income and married early-retirement and old-age pensioners will each have their own allowance. In addition, the pension income social security contribution is increased and the special allowance for age is discontinued.

-

In 2010 a new formula-based system for determining the tax-assessed value of homes was introduced. The new tax-assessed value will be determined by multiplying the floor space of the dwelling by a square metre price based on the geographical location (neighbourhood, municipality, sparsely populated vs. densely populated area), size, age and type (detached, semi-detached, terraced, flat) of the property. For primary homes (owner-occupied), the per square metre rate will be set at 25% of the estimated sale price per square metre, whereas the rate for second homes, i.e. any other dwellings in addition to the primary home that are not defined as business or recreational properties, will be set at 40% of the estimated sale price per square metre. The current “safety valve” system is being continued so that taxpayers can appeal and have the tax-assessed value reduced to 30% of the documented fair market value (60% for second homes). In addition, the tax-assessed values of recreational properties are increased by 10%.

-

Most important changes in 2009 were the abolition of the 80% rule, which primarily reduced the wealth tax of the richest. The wealth tax on equities for those who fall within the scope of the 80% rule has been more than doubled since 2005.

-

The home savings scheme (BSU) was expanded in 2009 by increasing the annual savings amount to NOK 20 000 and the maximum aggregate savings amount to NOK 150 000.

-

The rates of the inheritance tax were reduced and the exempted amount was increased in 2009. The instalment scheme for family businesses was expanded through the abolition of the upper limit, and the payment period was increased from 7 to 12 years.

Other changes in the personal tax base in 2009:

-

The fishermen’s allowance was increased from NOK 115 000 to NOK 150 000.

-

The reindeer husbandry allowance was increased to the same level as the agriculture allowance.

-

The allowance for labour union fees was increased by NOK 450 to NOK 3 600.

-

The rate of the travel allowance was increased from NOK 1.40 per km to NOK 1.50 per km.

-

The tax-free net income thresholds under the tax limitation rule were increased such as to ensure that singles and couples who receive the minimum state pension will still not be paying tax following the favourable social security settlement they benefited from in 2008.

-

A tax favoured contributions to individual pension agreement schemes was reintroduced as of 2008.

-

From 1 January, 2008 the employees’ SSC rate for self-employed was increased from 10.7% to 11.0%.

-

The upper threshold in the surtax schedule was substantially reduced from 2006 to 2007.

-

The surtax rates were reduced in 2005 and 2006, as part of a reform of the dual income tax system. The basic allowance has been substantially increased.

-

From 1 January, 2006 the supplementary employer’s social security contribution at 12.5% for gross wage income that exceeds 16 times “G” (average “G” is estimated to be NOK 74 721 in 2010) was removed.

-

From 1 January, 2006 the class 2 in the surtax was removed.

-

From 1 January, 2005 the ceiling in the parent allowance for two and more children was removed, and the maximum allowance was increased with NOK 5 000 for each child after the first. From 2008 the maximum allowance will be increased with NOK 15 000 for each child after the first.

-

The additional child support of NOK 7 884 for children aged 1 and 2 years was abolished as of August 1, 2003.

-

An allowance of maximum NOK 6 000 for donations to voluntary organisations was introduced as of 1 January, 2003. Previously this allowance was coordinated with the allowance for labour union fees (with a combined maximum allowance). The allowance was increased to NOK 12 000 as of 1 January, 2005.

-

As of 1 July, 2002 the employer’s social security contribution rates for employees aged 62 years or older were reduced by 4 percentage points, although not below 0%. From 2007 the reduction was abolished.

5. Memorandum items

5.1. Identification of an AW and calculation of earnings

The wage series used refers to full time employees in the B-N industry group (ISIC rev.4).

The calculation of annual wage earnings is as follows:

-

Weighted average monthly wage plus overtime times 12.

The average monthly wage is agreed payment for a wage earner working a normal agreed working-year. It includes bonus payments and other allowances, but not payments for overtime, sick leave, and an establishment’s indirect wage costs. The sum is weighted with the number of persons employed in the different industry groups.

5.2. Employers’ contributions to private health and pension schemes

No information available.

2016 tax equations

The equations for the system for Norway in 2016 may be calculated on an individual or joint basis for married couples. Social security contributions are calculated on an individual basis. The calculation for Class 2 is chosen for married couples whenever this gives a lower value of tax than the corresponding Class 1 calculations. The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.