Greece

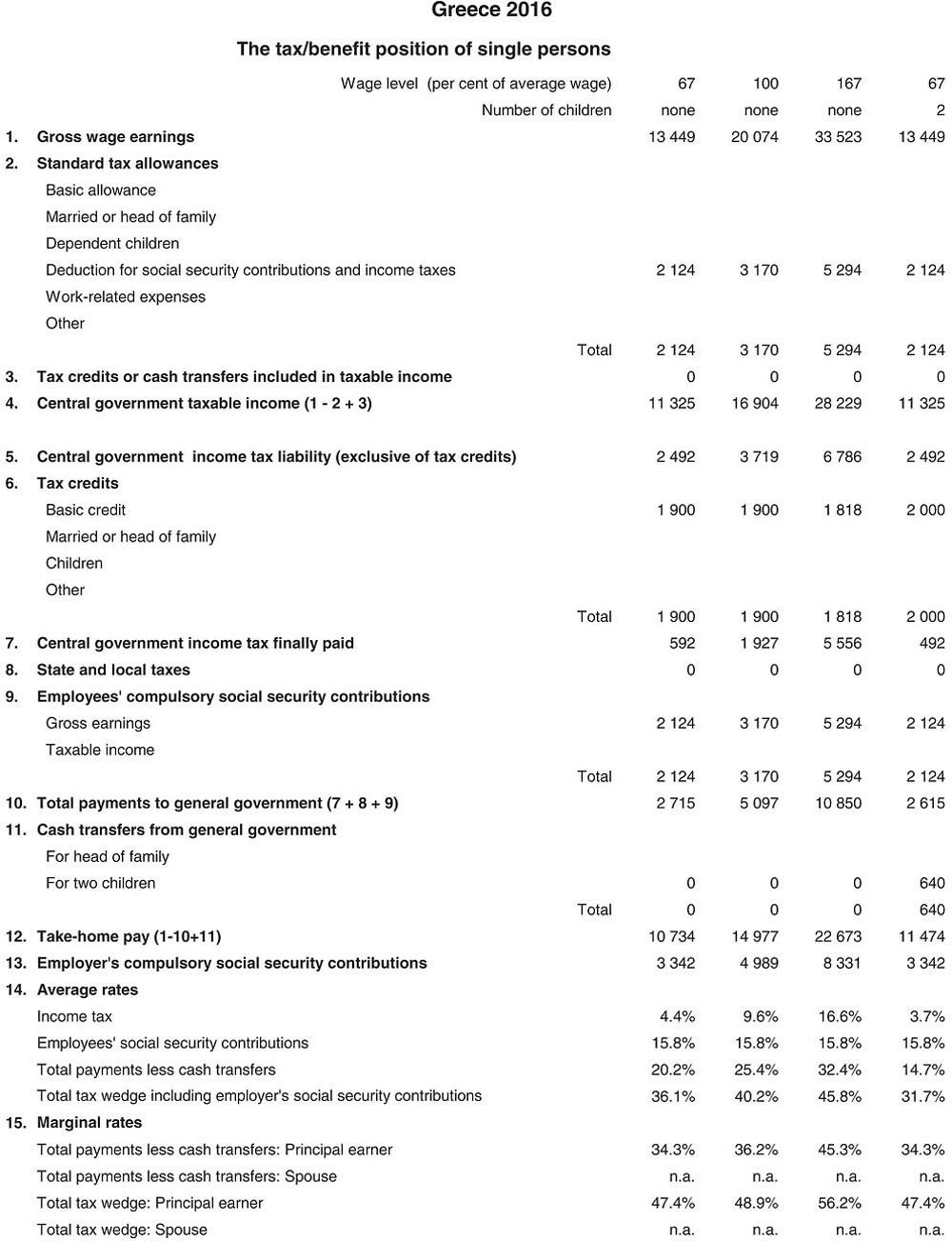

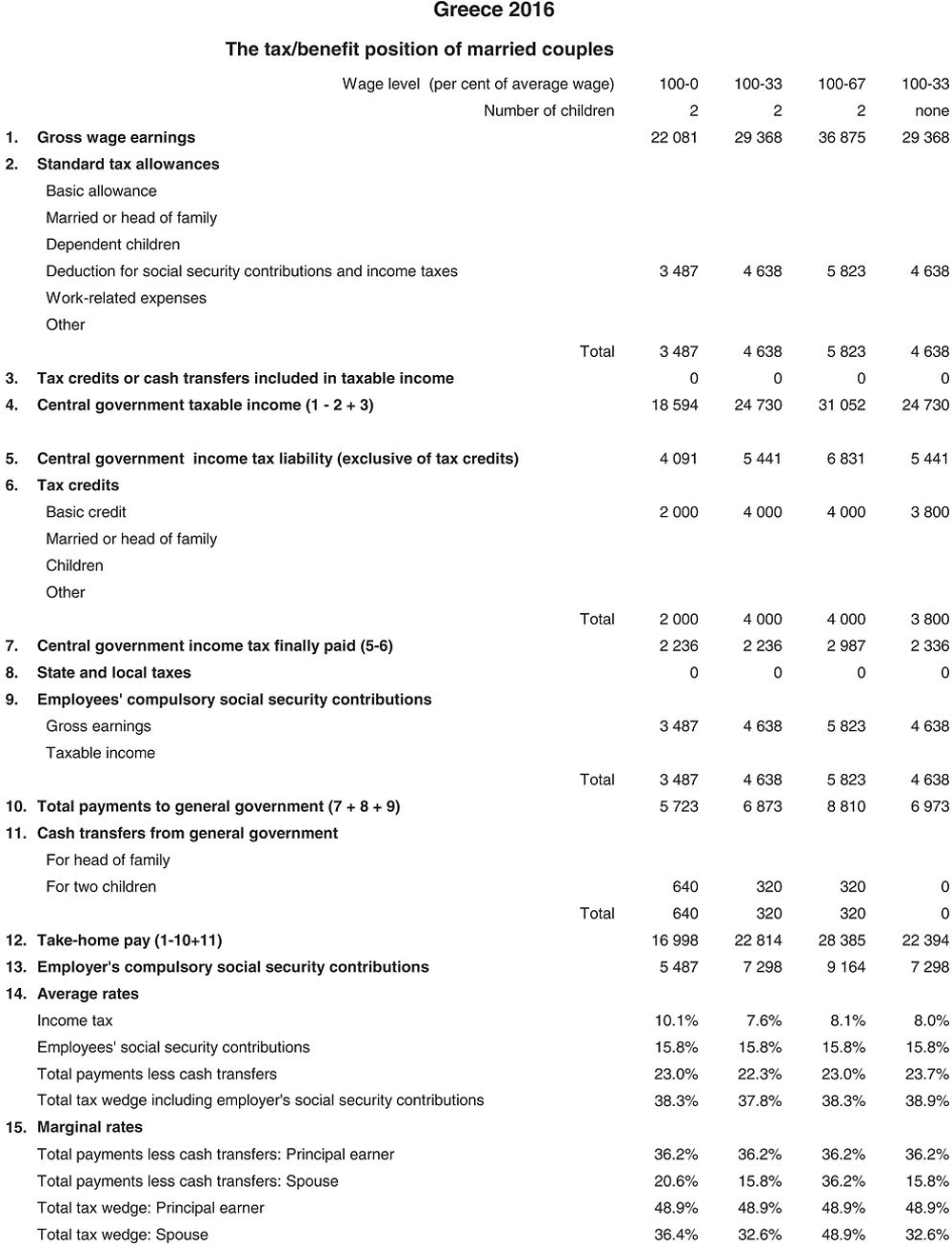

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for Personal income tax systems, Compulsory social security contributions to schemes operated within the government sector, Universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Euro (EUR). In 2016, EUR 0.90 was equal to USD 1. In 2016, the estimated gross earnings of the average worker are EUR 20 074 (Secretariat estimate).

1. Personal income tax system

1.1. Central government income tax

1.1.1. Tax unit

Individuals are subject to national income tax. Every individual who derives income from sources in Greece is subject to tax irrespective of his nationality, place of domicile or residence. Moreover, every individual with domicile in Greece (more than 183 days) is subject to tax on his/her worldwide income irrespective of the individual’s nationality. Due consideration is given to bilateral conventions designed to obviate double taxation.

All individuals who have completed 18 years of age are obliged to file a tax return regardless of having taxable income or not. Regarding income derived by minor children, the parent who has the custody is liable for filing a tax return. The income of minor children is added to the income of the parent who has the custody and is taxed in the name of the parent who is in principle liable for tax filing. This provision does not apply to the following types of income, in respect of which the minor child has a personal tax obligation: a) employment income and b) pensions due to the death of his father or mother.The minimum imputed income, which is required to cover the taxpayer’s main living expenses is EUR 3 000 for a single individual and EUR 5 000 for spouses (in the case that any real or presumptive income is declared).

Spouses file a joint return but each spouse is liable for the tax payable on his or her share of the joint income. A joint return can also file persons who have entered into a civil union – partnership. In this case the two parts have the same tax treatment as married couples. Losses incurred by one spouse or one part of a civil union-partnership may not be set off against the income of the other spouse or part. Spouses or parts of a civil union – partnership file a return separately if a) they have been divorced or have terminated the civil partnership at the time of the tax filing or b) one of the spouses or one part of the civil partnership is bankrupt or has been subject to guardianship.Taxpayer’s spouse can be considered as a dependent member, provided that he/she does not have any taxable income.

Single children under the age of 18, children who are adults up to 25 years old and study at the university, or serve their military service or are registered as unemployed to the Manpower Employment Organisation (OAED), taxpayers’ ascendants and spouses’ relatives (up to the 3rd degree) who are orphans are deemed to be borne by the taxpayer provided that they cohabit with the taxpayer and their annual taxable income does not exceed the amount of EUR 3 000 (alimony and disability benefits and similar allowances are not included). Single disabled children (>= 67%) or spouses’ disabled siblings (>= 67%) are also considered as dependent members, except if their annual income exceeds the amount of EUR 6 000 (alimony and disability benefits and similar allowances are not included).

1.1.2. Tax allowances and tax credits

1.1.2.1. Standard tax reliefs

-

Social security contributions: all compulsory social security contributions and optional contributions to legally constituted funds are fully deductible from taxable gross income.

1.1.2.2. Deductions from the payable amount of tax, as calculated on the basis of the scale (Non-Standard tax credits):

-

The tax arising by the tax scale for employees and pensioners is reduced as following:

-

by EUR 1 900 for annual income up to EUR 20 000, for taxpayers with no dependent children

-

by EUR 1 950 for annual income up to EUR 20 000 for taxpayers with one dependent child

-

by EUR 2 000 for annual income up to EUR 20 000 for taxpayers with two dependent children

-

by EUR 2 100 for annual income up to EUR 20 000 for taxpayers with 3 dependent children or more;

-

for income exceeding EUR 20 000, the above mentioned tax credit is being reduced by EUR 10 for every EUR 1 000 of taxable income

-

-

The following tax credits are deducted from the payable amount of tax, as calculated on the basis of the scale after applying the above tax allowance:

-

10% of the expenses of medical and hospital care of the taxpayer and his/her dependents provided they are not covered by Social Security Funds and they exceed 5% of the taxable income. The total credit cannot exceed EUR 3 000.

-

10% of the expenses of medical and hospital care of the taxpayer and his dependents, provided they are not covered by Social Security Funds and they exceed 5% of the taxable income. The total credit cannot exceed EUR 3 000. Hospital expenses in respect of unmarried or widowed children who suffer from an incurable disease, who are mentally retarded or are blind and whose total annual income does not exceed EUR 6 000 are also included.

-

-

The amount of tax derived on the basis of all scales is reduced by EUR 200 for the taxpayer himself as well as for each dependent member, provided that the taxpayer or his dependents are handicapped (over 67%) or handicapped soldiers or military personnel injured in the course of their duties or war victims or victims of terrorist attacksor in case they receive pension by the State as war victims or as handicapped.

Note: Taxpayers who reside abroad but derive taxable income from sources in Greece are not eligible for these deductions, with the exemptions of residents of the EU Member States who derive at least 90% of their total income from sources in Greece.

Spouses:

When the wife derives income taxable on the basis of the scale, then the following are deducted from her own payable amount of tax:

-

deductions related to medical and hospital expenses, donations and the lump sum of EUR 200 of the spouse;

-

deductions related to medical and hospital expenses of the spouse’s children from a former marriage, her children born out of wedlock, her parents and orphaned relatives of first and second degree of kin.

If from the joint tax return submitted the wife has no income declared then the sum of her deductions (medical and hospital expenses, lump sum of EUR 200) is attributed to the payable tax of the other spouse.

1.1.2.3. Exemptions

Some forms of income, specified by Law are exempt from the tax.

Examples:

-

on condition of reciprocity, income of all kinds derived abroad by foreign ambassadors and diplomatic representatives, consulate agents and employees of embassies and consulates that have the nationality of the represented State as well as by individuals working in the EU Institutions or other International Organizations;

-

alimony received by the beneficiary according to the Court adjudication or notary Document;

-

all forms of pensions and relief provided to war victims and their families, as well as to soldiers and military personnel injured in the course of their duties in times of peace;

-

benefits and similar allowances provided to special categories of handicapped people;

-

salaries, pensions etc. paid to handicapped people (over 80%);

-

unemployment benefits granted by the National Employment Organisation (OAED) provided that the total annual income of the beneficiary does not exceed the amount of EUR 10 000;

-

the social solidarity benefit (E.K.A.S.) of pensioners;

-

financial aid to recognized political refugees, to people residing temporarily in Greece for humanitarian reasons and to persons that have submitted the relevant application to the competent Greek authorities, paid by bodies carrying out refugee aid schemes financed by the UN and the EU;

-

the benefit for hazardous labor provided to employees working in the armed forces, the police, the fire and port departments as well as the special allowance to medical, nursing and ambulance staff up to 65%;

1.1.2.4. Tax calculation

Taxable income is derived from the following sources:

-

Income from employment and pensions

-

Income from business activities, which also includes income from self-employed

-

Income from agricultural activities as

-

Rental Income

-

Investment Income which includes income from dividends, interests and loyalties and

-

Income from capital gains, which includes income deriving on transfer of real estate or securities.

Net income is computed separately within each category with tax rules that vary across income categoriesIf the declared income is not accepted as the base for the tax assessment, the tax authorities can base the assessment on the presumptive income, which is the minimum amount of income required to cover the taxpayer’s main living expenses.

Employment income is subject to withholding tax. The tax is withheld by the employer and is calculated by applying the taxpayer’s progressive income tax schedule. The employer calculates the withholding tax on the basis of the taxpayer’s annual net salary (net of social security contributions). The withholding tax is then reduced by 1.5% of the total amount of taxes due. The resulting tax is the annual tax due, 1/14 of which constitutes the monthly withholding tax for the private sector’s employees (every employee in the private sector receives 14 monthly salaries per year, i.e. 12 monthly wages plus 1 salary as Christmas bonus, ½ salary as Easter bonus and ½ salary as summer vacation bonus). For the employees of the public sector, the monthly withholding tax is calculated as 1/12 of the annual tax due, because of the fact that bonuses in the public sector have been eliminated. If the taxpayer’s final tax liability (derived from the annual declared income) exceeds the aggregate of the amounts already withheld or prepaid, the remaining tax is generally payable in three equal bimonthly instalments. Any excess tax paid or withheld will be refunded.

1.1.3. Rate schedule

Depending on the income category the following tax schedules apply:

Income from employment and pensions is pooled together with income from business activity and is taxed at the following rates:

The above tax scale does not apply for employment income acquired by:

-

Officers working in ships of the merchant marine, whose income is taxed at a 15% flat rate and

-

Low-income crew working in ships of the merchant marine, whose income is taxed at a 10% flat rate.

For deductions see above: 1.1.2.2 Deductions from the payable amount of tax, as calculated on the basis of the scale

Income from agricultural business is taxed separately but with the same tax schedule. The previously described tax credit is granted to farmers as well. In the case where a farmer is earning income from employment/pension, only one tax credit is given.

Rental Income is taxed at the following rates:

Solidarity contribution is included in the Income Tax Code with a separate article. Income up to EUR 12 000 is not subject to solidarity contribution. For income exceeding EUR 12 000, solidarity contribution applies with the following marginal rates:

Solidarity Contribution Marginal Tax Rates

1.2. State and local income taxes

There are no local income taxes in Greece. Municipalities (the local authorities) receive 20% of the national income tax revenues.

2. Compulsory social security contributions to schemes operated within the government sector

The great majority of individuals who are employed in the private sector and render dependent personal services are principally, directly and compulsorily insured in the Social Insurance Organisation (IKA). Apart from the main contribution, IKA compulsorily collects contributions for other minor Funds created for the employee’s benefit (Unemployment Benefits Funds, etc.). A subsidiary Social Insurance Fund (ETEA) for employees who are principally insured in IKA has been established since 2012.

The average rates of contributions payable by white-collar employees as a percentage of gross earnings are as follows (%):

Between 1st January and 31st May, 2016

From 1 June 2016

Higher contributions are due (18.95% paid by the employee and 26.71% paid by the employer) in case of blue-collar workers who are engaged in heavy work (unhealthy, dangerous, etc. work) as they are entitled to a pension five years earlier than the other workers. In the industrial sector, the employer pays an additional occupational risk contribution at a rate of 1% because these workers are more vulnerable to labour accidents and occupational diseases.

Contributions are calculated on the basis of the monthly salary or wages paid but within the limits specified in the National General Collective Labour Agreement. Monthly gross remuneration includes salaries and wages, fringe benefits and bonuses and any profit distributions to employees. From 2013 onwards, an equalized ceiling of EUR 5 546.80 applies for all categories of employees.

Self-employed individuals must make monthly compulsory lump-sum contributions to OAEE (Free Professional Social Insurance Organisation); these contributions depend on the number of years that the self-employed has been insured (for more details, see the explanatory annex to table III.3 of the OECD’s Tax Database).

All these social security contributions are fully deductible for income tax purposes.

3. Universal cash transfers

3.1. Transfers related to marital status

According to the National General Collective Labour Agreement, a marriage allowance, which is set at a rate of 10% of the gross salary, is granted only to workers employed by employers that belong to the contracting employer organisations.1 For public servants no marriage benefit is granted.

3.2. Transfers for dependent children

According to the Law 4093/2012 (as amended by Law 4144/2013, Law 4111/2013 and Law 4170/2013), the “Single children support allowance” replaced the previously existing family allowances and applies since 01/01/2013. The allowance’s amount is calculated according to the number of dependent children as well as the income category of the household. More specifically the allowance provides for EUR 40/month per child.

Households that are entitled to the allowance are divided into four income categories according to their income:

-

Income of < EUR 6 000: full allowance

-

Income of EUR 6 001-12 000: 2/3 of the allowance

-

Income of EUR 12 001-18 000: 1/3 of the allowance

where the income is calculated as the net annual total family income divided by the sum of family members (where the first spouse is weighted as 1, the 2nd spouse is weighted as 1/3 and each dependent child is weighted as 1/6).

3.3. Benefits for families with three or more children

Law 4141/2013 (as amended by Law 4170/2013) introduced the “Special Allowance for families with three or more children”, which is granted to families with three or more dependent children. The Special Allowance’s amount is fixed to EUR 500/year per child, provided that the total income of the household does not exceed EUR 45 000 for families with three dependent children and EUR 48 000 for families with four dependent children, while in case of larger families the amount of EUR 45 000 is increased by EUR 4 000 per additional child.

Note 1: The Special allowance for families with three or more children is not included in the net, annual, family income and is exempt from income tax since 01-01-2013 (Law 4254/2014).

Note 2: Both Single children support allowance and the Special allowance for families with three or more children are exempt from Special Solidarity Contribution (Law 4254/2014).

4. Main changes in the tax/benefit system since 2015

A total change in the tax schedules and rates of all sources of income has been imposed, as well as the pooling of income for income derived from wages and businesses, and the integration of Solidarity Contribution in the Income Tax Code.

5. Memorandum items

5.1. Identification of an AW and method of calculations used

Methodological note for the estimation of the average annual earnings per employee, for the period 2000-15.

Terminology and coverage

The average annual earnings below refer to full time employees for Sectors C to N of ISIC Rev.3.1, before 2008, and for Sectors B to N including Division 95 and excluding Divisions 37, 39 and 75 of ISIC Rev. 4, for 2008 onwards.

Data sources

In the estimation procedure of the average annual earnings per employee, for the period 2000-14 the following data are taken into account:

-

Annual earnings and number of employees, as derived from the Structure of Earnings Survey (SES), of the years 2002, 2006 and 2010.

-

Hours worked and annual average number of employees, as derived from the Labour Force Survey (LFS), of the years 2000-14.

-

Average annual earnings indices, as derived from the Indices on Quarterly Labour Cost Survey, of the years 2000-14.

Secretariat average wage estimates for 2015 and 2016 are used in the calculations, since final average wage values are not available (see the Annex, Methodology and limitations). Those estimates are based on the percentage changes in compensation per employee that were retrieved from the OECD Economic Outlook volume 2016 (No. 100) and the final value for 2014 (EUR 20 450). They amount to EUR 20 107 for 2015 (-1.6749%) and to EUR 20 074 for 2016 (-0.1683%).

5.2. Main employers’ contributions to private pension, health, and related schemes

Contributions to private pension and sickness schemes made by employers are not added to employees’ gross earnings for tax purposes and are therefore not subject to tax. Since these contributions are not obligatory for employers, no data is provided by the National Statistical Service of Greece. Very few employers have adopted such additional insurance schemes.

2016 tax equations

The equations for the Greek system in 2016 are mostly on an individual basis. The level of gross earnings for the principal earner is increased by the spouse and child subsidy paid by the employer.

The functions which are used in the equations (Taper, MIN, Tax etc.) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

← 1. Namely the Hellenic Federation of Enterprises, the Hellenic Confederation of Professionals, Craftsmen and Merchants, the National Confederation of Hellenic Commerce and the Association of Greek Tourism Enterprises.