Korea

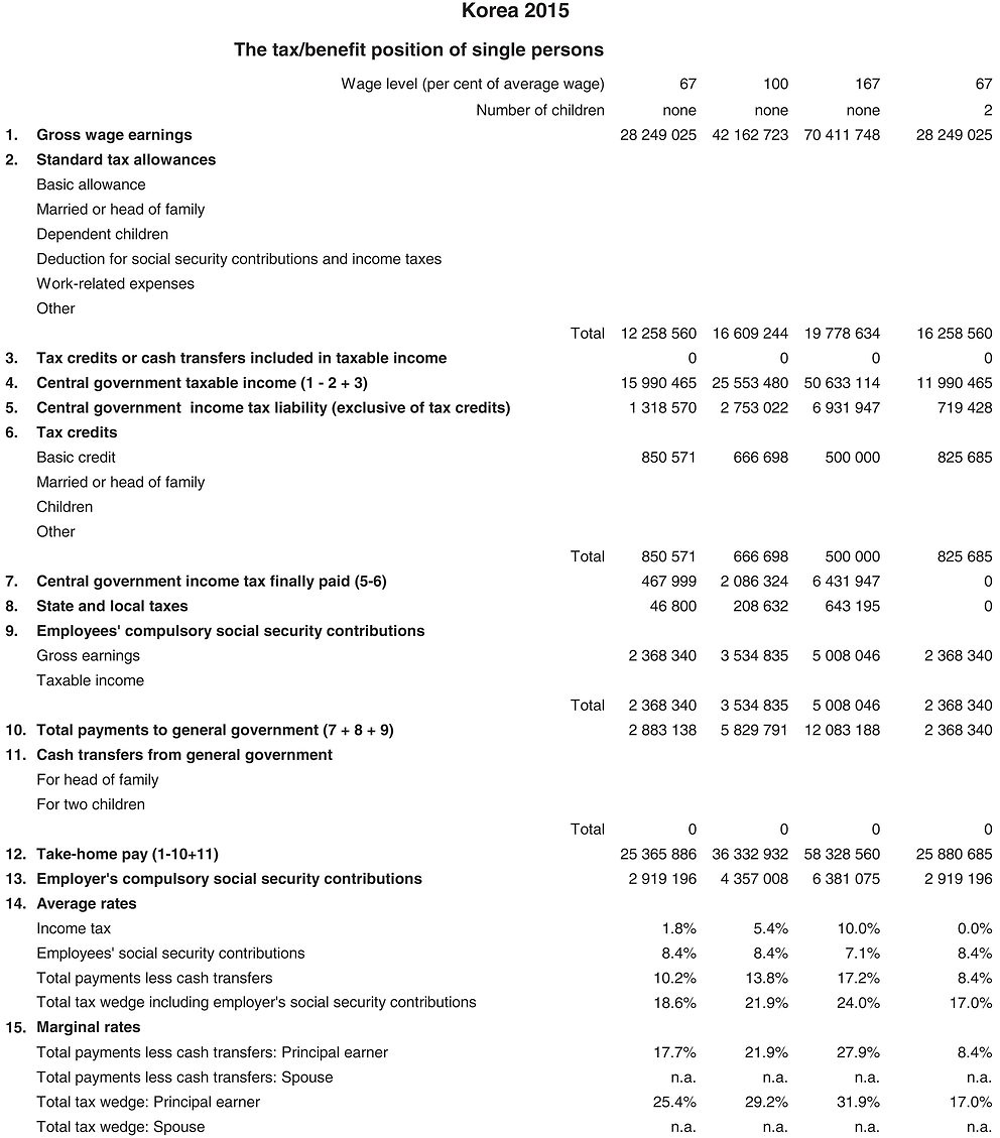

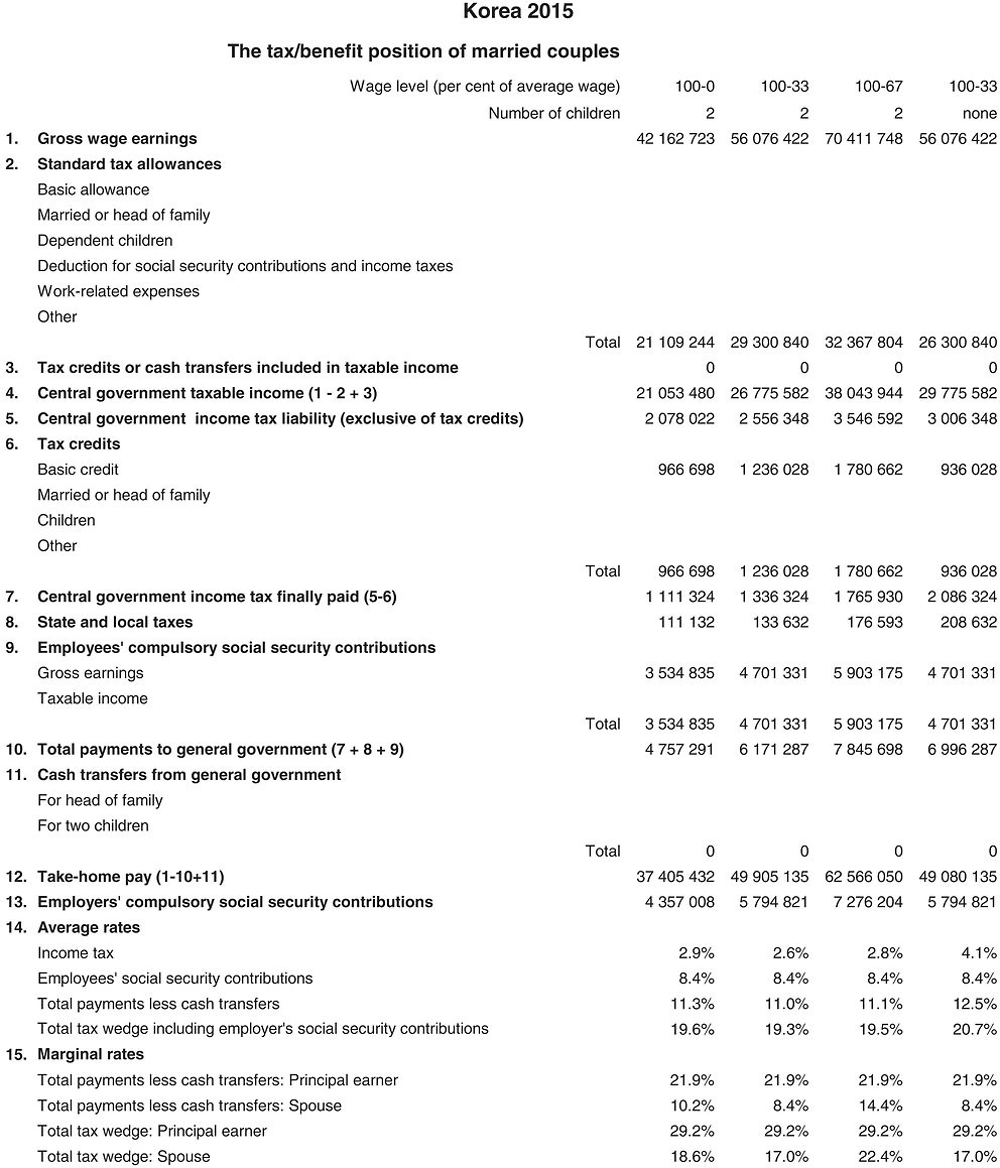

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Won (KRW). In 2015, KRW 1 131.31 was equal to USD 1. In this year, the average worker is expected to earn KRW 42 162 723 (Secretariat estimate).

1. Personal income tax system

1.1. Central government income tax system

1.1.1. Tax unit

Each individual is taxed on his/her own income.

Non-taxable wage income includes the:

-

national pension, medical insurance, unemployment insurance and work injury insurance that are borne by employer;

-

overtime payment to productive workers: up to KRW 2 400 000 of overwork payment of productive workers in manufacturing and mining sectors whose monthly wage is less than KRW 1 500 000 and whose yearly wage is less than KRW 25 000 000.

1.1.2. Allowances and tax credits

1.1.2.1. Standard reliefs

-

Employment income deduction: the following deduction from gross income is provided to wage and salary income earners:

-

Basic allowance: a taxpayer can deduct KRW 1 500 000 from his/her income for each person who meets one of following conditions:

-

the taxpayer him/herself;

-

the taxpayer’s spouse whose taxable income (gross earnings net of employment income deduction) is less than KRW 1 000 000;

-

the taxpayer’s (including the spouse’s) dependents (parents, siblings, children) within the same household whose income after accounting for the employment income deduction is less than KRW 1 000 000 and whose age is:

-

parents: 60 years or older;

-

brother/sister: 60 years or older or 20 years or younger;

-

children: 20 years or younger (if both partners in the household earn wage-income, this Report assumes that the principal wage earner will claim the allowance).

-

-

-

Additional allowance: a taxpayer can deduct KRW 1 000 000 (500 000 in the case of [c], KRW 2 000 000 in the case of[b])from his/her gross income when the taxpayer or his/her dependents fall into one of the following categories (for this report, only cases [c] are modelled):

-

a person aged 70 years or older(a)

-

a handicapped person (b)

-

a female wage earner who is the head of a household with dependents (but without spouse) or a female wage earner with spouse when her taxable income is not more than KRW 30 million(c)

-

a single parent with descendants including adoptees1(f)

-

-

National pension deduction: employees can deduct 100% of their National Pension contributions

-

Working Tax credit: wage and salary income earners obtain the following tax credit, :

1.1.2.2. Main non-standard tax reliefs

Wage and salary income earners may deduct from gross income the expenses for the following items during the tax year:

-

Insurance premiums: the Medical insurance premium and the Unemployment insurance premium can be entirely (100%) deducted from taxable income.

-

Saving/Payment for housing: 40% of deposits of an account for purchasing a house, which is held by a person who does not own a house, or owns only one house that is smaller than 85 square miles in size and whose price is KRW 300 million or less, 40% of repayments of loans including interest borrowed for the purpose of the lease by a person owning no house may be deducted up to three million won per year.

-

Credit card purchases: Employees may deduct 15% of their credit card (30% of their debit card, prepaid card or cash receipt) purchases that exceed 25% of their total income up to lesser of KRW 3 000 000 or 20% of their total income. However, for expenditures spent for traditional markets and public transportation, the allowed deduction is equivalent to 30% of the expenditure and the ceiling is raised by an additional KRW 1 000 000 respectively.

1.1.2.3. Child tax credit

-

Where a resident with taxable income has dependent children including adoption, he/she gets annual tax credit of KRW 150 000 for having a child, KRW 300 000 for having two children and KRW 300 000 plus KRW 300 000 per an excess child over two children in case of having more than three children.

-

Resident gets additional tax credit of KRW 150 000 per a child who is under 6 years of age from second child;

-

Resident gets tax credit of KRW 300 000 per child for birth and adoption of the year;

1.1.2.4. Credit for Pension insurance premiums

-

A resident who paid pension contributions to a pension account may deduct the amount equal to 12% of the premiums paid from his/her global income tax amount, only up to KRW 4 million for pension account as well as KRW 7 million for sum of the pension account and retirement –pension account

-

A resident whose labour income is not exceeding KRW 55 million when he has labour income only or whose global income is not exceeding KRW 40 million would deduct 15% of the premium.

1.1.2.5. Special tax credit

Wage and salary income earners may obtain following tax credit during the tax year:

-

Insurance premiums (a):12% of the general insurance premium up to KRW 1 000 000 can be deducted from his/her income tax amount.

-

Medical expenses (b):15% of the medical expenses exceeding 3% of taxable income can be deducted from his/her income tax amount. The medical expenses for taxpayer’s dependents who are eligible for the basic deduction is limited KRW 7 000 000 and the medical expenses for the taxpayer himself, taxpayer’s dependents who are aged 65 years or older and handicapped persons is not limited.

-

Educational expenses (c):15% of tuition fees for pre-school, elementary, middle school and college (but the graduate school fee deduction is allowed only for the taxpayer himself), either for the taxpayer himself or his/her dependents (including the taxpayer’s spouse, children, and siblings), can be deducted from his/her income tax amount. The tuition fee for the taxpayer himself is not limited. For the taxpayer’s dependents, the limits of tuition fees are as follows:

-

For pre-school: up to KRW 3 000 000 per child;

-

For elementary, middle and high school: up to KRW 3 000 000 per student;

-

For college/university: up to KRW 9 000 000 per student.

-

-

Charities (d):15% of the amount of donation (in case of the donation exceeding KRW 30 million, 25% of the excess over KRW 30 million) is deducted from income tax amount. The limits of donations are as follows:

-

donations to a government body, donations for national defence, natural disaster, and certain charitable associations: up to gross income;

-

donations to public welfare or religious associations: up to 30% of gross income.

-

-

Standard Credits: Alternatively, a taxpayer may elect to choose an annual standard credit of KRW 70 000 (KRW 130 000 for wage and salary earners and KRW 120 000 for business owners meeting certain requirements), if he or she fails to claim deductions for insurance premium, saving/payment for housing and special tax credit.

1.1.3. Tax schedule

1.2. Local income tax

1.2.1. Tax base

The local income tax base is the income tax paid to the central government.

1.2.2. Tax rate

A uniform rate of 10% is applied. However, the local government can adjust the rate between the lower limit of 5% and the upper limit of 15%.

1.2.3. Tax rate (selected for this study)

A country-wide rate of 10% is used in this Report.

2. Compulsory social security contribution to schemes operated within the government sector

2.1. Employees’ contribution

2.1.1. National pension

The National pension contribution rate is 4.5% of the standardised average monthly wage income as of 2014.

The scope of the standardised average monthly wage income is from KRW 270 000 to KRW 4 210 000 as of 1 July, 2015

2.1.2. Medical insurance

The Medical insurance premium, which has a rate of 3.2337925% (Health insurance: 3.035%, Long term care insurance: 6.55% of Health insurance premium rate), is levied on average monthly wage income as of 1 January201 5.

The scope of the average monthly wage income is from KRW 280 000 to KRW 78 100 000.

2.1.3. Unemployment insurance

0.65% of gross income.

2.1.4. Industrial accident compensation insurance (premiums)

Compulsory application, premiums paid only by employers.

2.2. Employers’ contribution

2.2.1. National pension

The national pension contribution rate is 4.5% of the standardised average monthly wage income as of 2014.

The scope of the standardised average monthly wage income is from KRW 270 000 to KRW 4 210 000 as of 1 July, 2015.

If the average monthly wage income of a person is less than KRW 270 000, the average monthly wage income of the person is regarded as KRW 270 000 and the rate (0.045) is applied. If the average monthly wage income of a person is more than KRW 4 210 000, the average monthly wage income of the person is regarded as KRW 4 210 000 and the rate (0.045) is applied; so the maximum of the national pension contribution per year is KRW 2 273 400 (= KRW 4 210 000 × 0.045 × 12 months).

2.2.2. Medical insurance

The Medical insurance premium, which has a rate of 3.2337925% (Health insurance: 3.035%, Long term care insurance: 6.55% of Health insurance premium rate), is levied on average monthly wage income as of 1 January, 2015.

The scope of the average monthly wage income is from KRW 280 000 to KRW 78 100 000.

2.2.3. Unemployment insurance

-

the insurance premium is between 0.9% and 1.5% of total wage;

-

the insurance premium selected for this study is 0.9%.

2.2.4. Work injury insurance

-

the insurance premium consists of an industry-specific rate which is set by the Ministry of Employment and Labour multiplied by total wage;

-

the average rate of all industries (selected for this study) is 1.70%.

3. Universal cash transfers

Child Benefit

Child benefit is paid every month to those who have children aged 5 years or younger: KRW 200 000 for a child aged 12 months or younger, KRW 150 000 for a child aged 1 to 2 years and KRW 100 000 for a child aged 2 to 5 years.

If a child attends a nursery or pre-school, childcare benefit is paid instead every month: KRW 394 000 for a child aged 0, KRW 374 000 for a child aged 1 year, KRW 286 000 for a child aged 2 years and KRW 220 000 for a child aged 3 to 5 years.

The above child benefits are not included in the Taxing Wages calculations that consider children aged between 6 and 11 inclusive.

4. Main changes in tax/benefit system since 2000

5. Memorandum item

5.1. Identification of the Average Worker (AW)

Sectors used: industry Sectors B-N with reference to the International Standard Industrial Classification of All Economic Activities, Revision 4 (ISIC Rev. 4)

Geographical coverage: whole country

Type of workers: wage workers (male and female).

5.2. Method to calculate wages

Report on Labour Force Survey at Establishments covering data in 2014 by the Ministry of Employment and Labour is used to calculate the annual wages of the AW. The statistics were obtained through a sample survey of 12 000 firms with five or more permanent employees throughout the whole country.

Basic method of calculation used: average monthly wages multiplied by 12.

5.3. Employer’s reserve for employee’s retirement payment

An employer should pay to a retiree the retirement payment which is not less than 30 days’ wage and salary per one year of service (about 8.3% of gross income or more). An employer can contribute to the Retirement Payment Reserve Fund established within the company or Retirement Insurance Fund established outside the company to prepare for the retirement payment. Such contribution is treated as business expense under certain constraints. Because contribution to the Retirement Fund is not compulsory, this survey does not include such contribution except the contribution converted to employer’s contribution to the national pension plan (see indicateur 2.2.1).

2015 tax equations

The equations for the Korean system are independent between spouses except that the principal earner has tax allowances for the spouse and for any children.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables married and children. A reference to a variable with the affix total indicates the sum of the relevant variable values for the principal and spouse. And the affixes princ and spouse indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with spouse values taken as 0.

Note

← 1. Overlapping of deductions for (c) and (f) is not allowed. So a taxpayer should select only one.