Iceland

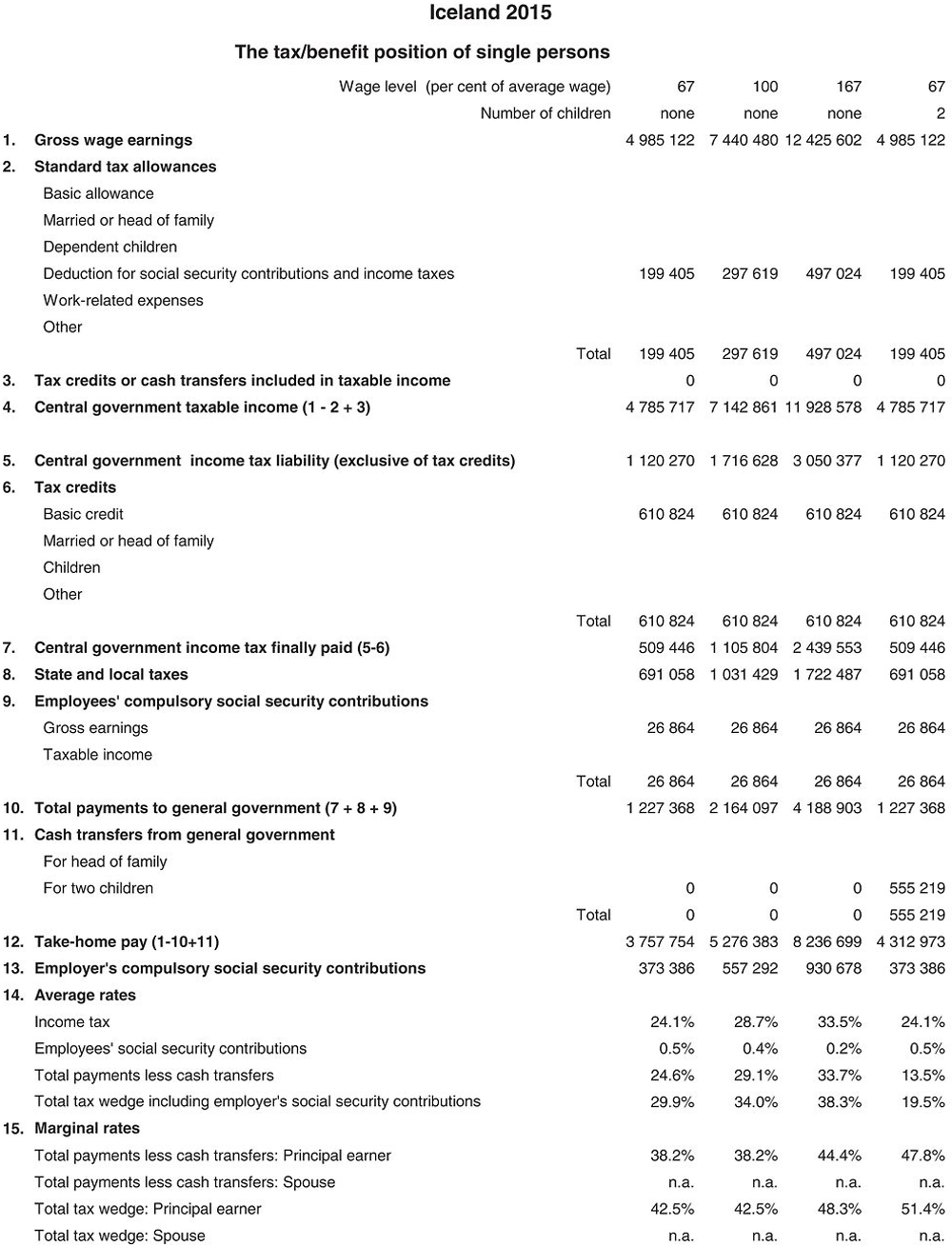

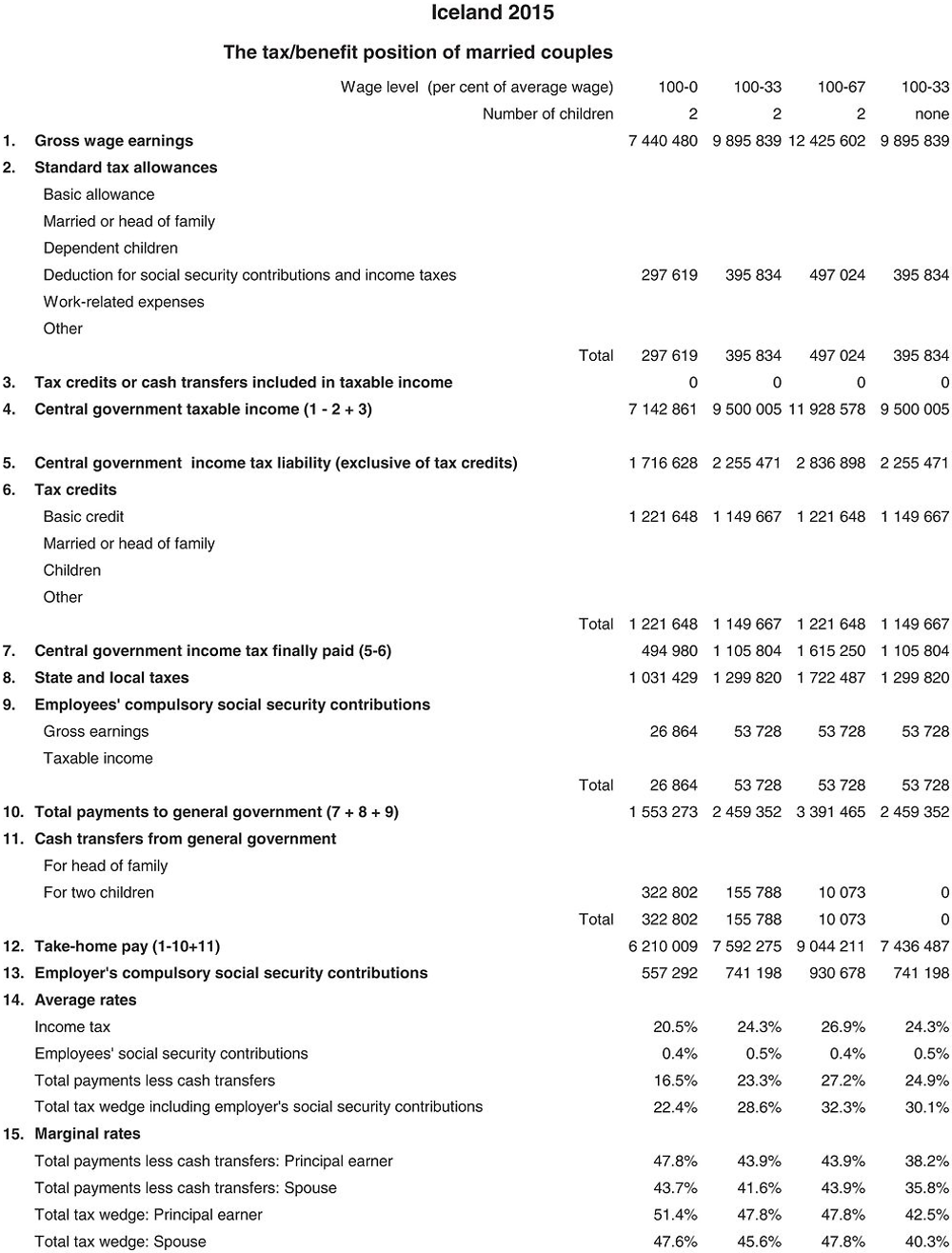

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Króna (plural: Krónur) (ISK). In 2015, ISK 131.90 was equal to USD 1. In 2015, the average worker is expected to earn ISK 7 440 480 (Secretariat estimate).1

1. Personal income tax system

1.1. Central government income taxes

1.1.1. Tax unit

Income is taxed on an individual basis, except for capital income of married couples which is taxed jointly.

1.1.2. Tax allowances and credits

1.1.2.1. Standard reliefs

-

Basic tax credit: A fixed tax credit, amounting to ISK 610 824 in 2015, is granted to all individuals 16 years and older, regardless of their marital status. The tax credit is deducted from levied central and local government taxes. Unutilised tax credits or portions thereof are wastable, i.e. non-refundable and non-transferable between tax years.

-

Standard marital status relief: Married couples may utilise up to 100% of each spouses’ unutilised portion of his/her basic tax credit.

-

Relief(s) for children: None.

-

Relief(s) for compulsory pension contributions: The compulsory payment to pension funds amounts to 4% of wages and is deductible. In addition, an optional payment of up to 4% of wages may also be deducted. As the additional 4% contribution is optional, it is viewed as a non-standard relief in this Report.

1.1.2.2. Main non-standard tax reliefs applicable to an AW

-

Interest payment relief: A fully refundable tax credit is granted to purchasers of personal dwellings (homes) to recuperate a part of mortgage-related interest expenses. The maximum tax-related interest credit in 2015 is ISK 400 000 for a single person, ISK 500 000 for a single parent and ISK 600 000 for a married couple. The following constraints apply to interest rebates: 1) they cannot exceed 7.0% of the remaining debt balance incurred in buying a home for one’s own use. 2) The maximum amount of interest payments that qualify for an interest rebate calculation is ISK 800 000 for an individual, ISK 1 000 000 for a single parent and ISK 1 200 000 for a couple. 3) 8.5% of taxable income is subtracted from the interest expense. 4) The rebates begin to be curtailed at a net worth threshold of ISK 4 000 000 for a single individual and a single parent and ISK 6 500 000 for a couple and are eliminated altogether at a 60% higher amount, or ISK 6 400 000 and 10 400 000, respectively. (These amounts are based on income in the year 2015 but are paid out in 2016. These numbers are estimates; final figures will be available once the 2016 budget has been passed).

1.1.3. Tax schedule

The income tax base is composed of personal income (e.g. wages, salaries, fringe benefits, pensions, etc.), which is taxed on an individual basis, and capital income which is taxed jointly for married couples.

The tax on personal income is triple-rated. The central government income tax rate in 2015 is 22.86% for income up to ISK 309 140 per month. A 25.3% tax rate applies to the next ISK 527 264 or up to ISK 836 404. For income exceeding ISK 836 404 the tax rate is 31.8%. The income tax rate applies to all personal income in excess of ISK 142 153 per month (ISK 1 705 836 per year). Tax relief is provided by the basic credit described in Section 1.121.

The tax on capital income is 20%. It is levied on all capital income of individuals, such as interest, dividends, rents etc. Interest income up to ISK 125 000 per year and 30% of income from rent of residential property is tax free.

1.2. Local government income tax

The local government income tax base is the same as the central government’s personal income tax base.

The local governments’ income tax is single-rated, but the rate varies between 12.44 and 14.52% between municipalities. The average rate in 2015 is 14.44%.

2. Compulsory social security contributions to schemes operated within the government sector

2.1. Employees’ contributions

Fee to the Retiree Investment Fund: 16 to 70 year-old individuals are subject to a fixed tax of ISK 10 464 in 2015, provided the individual’s taxable income is at least ISK 1 637 598 for the year. This tax will be collected in 2016.

Fee to the broadcast media: 16 to 70 year-old individuals with taxable income over ISK 1 637 598 for the year are subject to a fixed tax of ISK 16 400 in 2015, which will be collected in 2016.

These amounts are estimates and thus subject to change as the fees are payable in 2016.

2.2. Employers’ contributions

Employers have to pay a social security tax on total wages of 7.49%. In addition, 0.65% is levied on the wages of fishermen as a premium for their government accident insurance. Furthermore, a new financial activities tax was introduced in 2012, which requires financial and insurance companies to pay an additional 5.5% payroll tax in 2015.

3. Universal cash transfers

3.1. Marital status related transfers

None.

3.2. Transfers for dependent children

Child benefits are granted for each child, subject to income thresholds. In 2014 they are as follows (in ISK per year):

Note that child benefits in this Report are based on income in the year 2015 but are paid out in 2016 (see also indicateur 4.4). These numbers are estimates and thus subject to change.

4. Main changes in the tax/benefit system since 1998

4.1. The deductibility of the payment to pension funds

All employees are required to participate in pension funds. The employee contribution is generally 4% of wages and the employer contribution was 6%, and increased to 8% as of beginning 2007. Both contributions are deductible from income before tax. In some cases, the contributions of employees and employers are higher. An optional, additional payment from employees of up to 4% of wages is also deductible and goes into an individual retirement account. However, from 2012 to mid-2014, this additional payment was temporarily set at 2 %.

This voluntary pension savings option was first introduced in 1999 in order to encourage personal saving. At the time the contribution rate was 2% for employees and 0.2% for employers. In May 2000 these rates were doubled to 4 and 0.4%, respectively, as noted above. In addition, some employers, such as the central government, have increased their employer counter-contribution by agreement with employees. The central government contributed 1% against a voluntary employee contribution of 4% in 2001 and 2% as of the beginning of 2002. All such contributions are tax-deductible, both with the employer and the employee at the time the contribution is made. The actual pension is taxed as personal income when it is drawn. As of the beginning of 2004, the employer option of deducting the above 0.4% against the social security tax was abolished. Since such employer counter-contributions had become part of wage agreements in most cases, it was no longer felt that such a tax incentive was needed.

4.2. Central and local income tax rates in 1997-2015

In 1997-07, the Government pursued a policy of reducing the marginal tax rate, as can been seen in the table below. This development was reversed in 2009 when income tax was raised by 1.35 percentage points in response to the Treasury’s rising debt burden brought on by the economic crisis. At the beginning of 2010 the tax system was changed from single rated to triple rated. The tax rate was set at 24.1% for the first monthly ISK 200 000 but it was raised by 2.9% for the next ISK 450 000 and again by 6% for income in excess of ISK 650 000. In 2014, the rates are 22.86%, 25.3% and 31.8%, and the corresponding income thresholds are ISK 290 000 and 784 619 per month; see Section 1.13 for further details. From 1998 onwards, the central government and average local government personal income tax rates have been as follows:

4.3. A special tax on higher income

In 1998, the special tax on higher income was raised by 2 percentage points, from 5 to 7%. For 2003-income, it was reduced back to 5%. It was reduced to 4% for 2004 income and to 2% for 2005-income. In the fiscal year 2006, the tax was abolished. In the latter half of 2009 the special tax on higher income was introduced again at 8%. In 2010 the tax system changed to triple-rated; see indicateur 4.2 and 1.13.

4.4. A revision of child benefit system

Child benefits are granted for each child, subject to income thresholds. The amendments to tax legislation that came into effect in 2004 included a schedule for raising child benefits. As from 2007, the child benefits will be paid for children up to 18 years old instead of 16 years old. For 2008-15, benefits are as follows (in ISK per year):

The data for 2015 is subject to change as the benefits are not payable until 2016.

4.5. A revision of interest rebates

In 2004, the interest rebate was cut by 10%, effective for that year only. The ceiling on interest payments that qualify for the interest rebate was reduced from 7% to 5.5% in 2005 and the interest rate cut was reduced from 10% to 5%. As of the beginning of 2006, the ceiling was further reduced to 5%. In 2005 and again in 2007 the net worth ceiling was lifted considerably in reaction to the increase in net worth due to the house price boom in 2005-07. In 2008, as mortgage-related interest expenses surged, the ceiling on interest payments was raised back to 7% and the maximum rebate amount increased by 37%. These measures stayed in effect in 2009. In 2010 the maximum rebate amount increased by 47-62% and the net worth ceiling was reduced significantly. The rate of taxable income which is subtracted from the interest expense was increased from 6% to 8% and further to 8.5% in 2014. In addition to the ordinary interest payment relief, a temporary interest cost rebate was in effect in 2010-11; see Section 1.122.

4.6. Transferability of basic tax credit between spouses

The basic tax credit was made transferable between spouses in stages; see section 1.121 above. In fiscal year 2001, 90% of the credit became transferable, rising to 95% in 2002 and 100% in 2003.

5. Memorandum items

5.1. Identification of AW (only eight categories) and valuation of earnings

The data on average earnings refers to average workers in eight categories according to the NACE rev. 2 classification which corresponds to the ISIC rev.4 system. The categories are C – Manufacturing, D – Electricity, gas, steam and air conditioning supply (from 2008), E – Water supply; sewerage, waste management and remediation activities (from 2008) F – Construction, G – Wholesale and retail trade, repair of motor vehicles, motorcycles, H – Transport, storage, and J – Information and communication K – Financial and insurance activities. Public sector employees are not included. Together, these categories comprise approximately 80% of Iceland’s private sector labour force.

The original data are obtained from a monthly survey among Icelandic firms with 10 or more employees.

5.2. Employer contributions to private pension funds, health and related schemes

By law, all employees and employers must contribute to pension funds. These funds are private, generally linked to unions and employee associations. The private pension funds are not part of the government-run social security system, to which a payroll tax is paid as described under indicateur 2.2 above. Compulsory and voluntary payments to such funds are described in indicateur 4.1 above.

2015 tax equations

The equations for the Iceland system are mostly on an individual basis. But the tax credit for married couples is relevant only to the calculation for the principal earner and child benefit is calculated only once. This is shown by the Range indicator in the table below.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables ”married” and ”children”. A reference to a variable with the affix ”_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes ”_princ” and ”_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with ”_spouse” values taken as 0.

Note

← 1. The definition of average worker in Iceland includes workers in five categories. See indicateur 5.1.