France

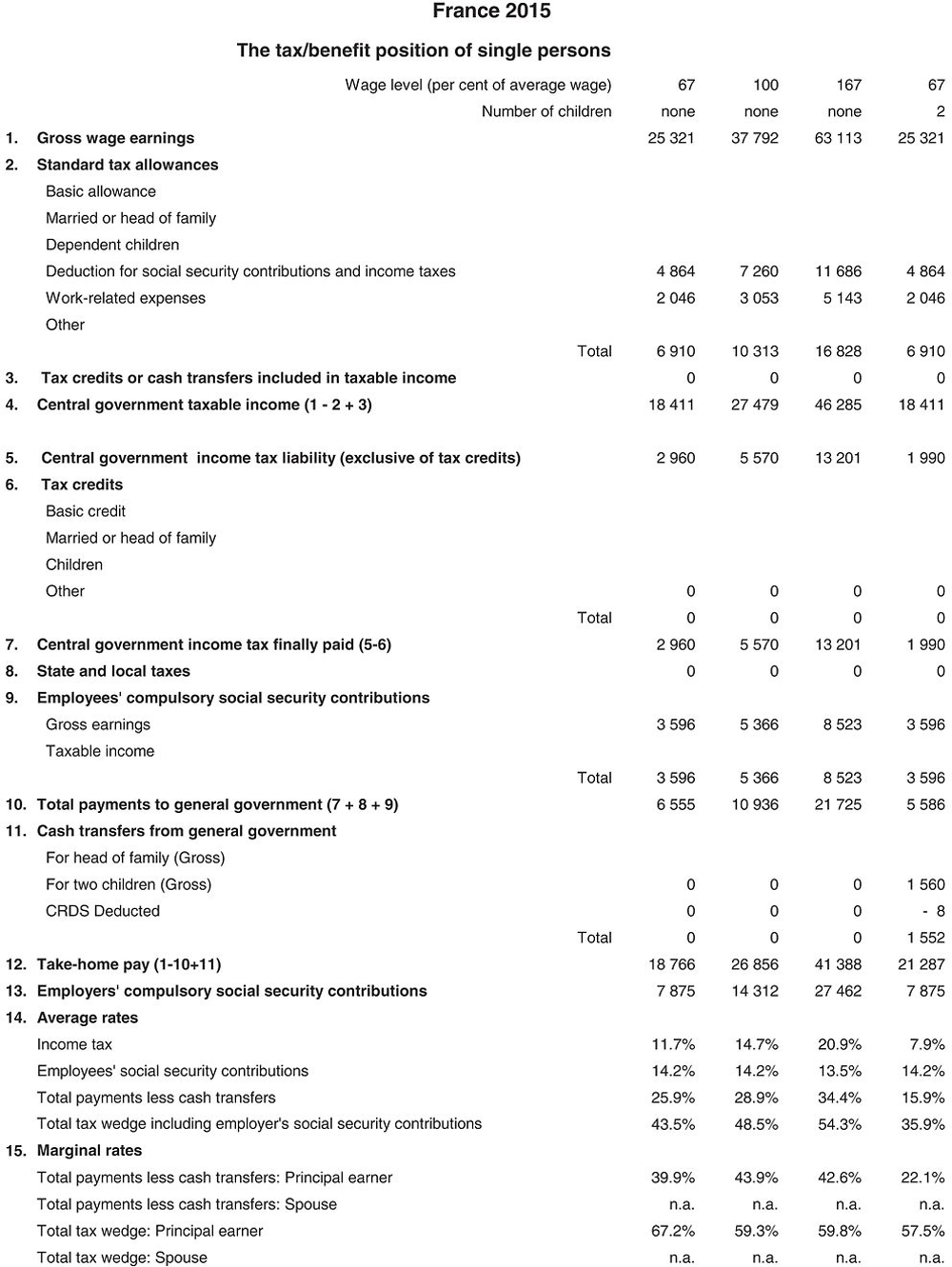

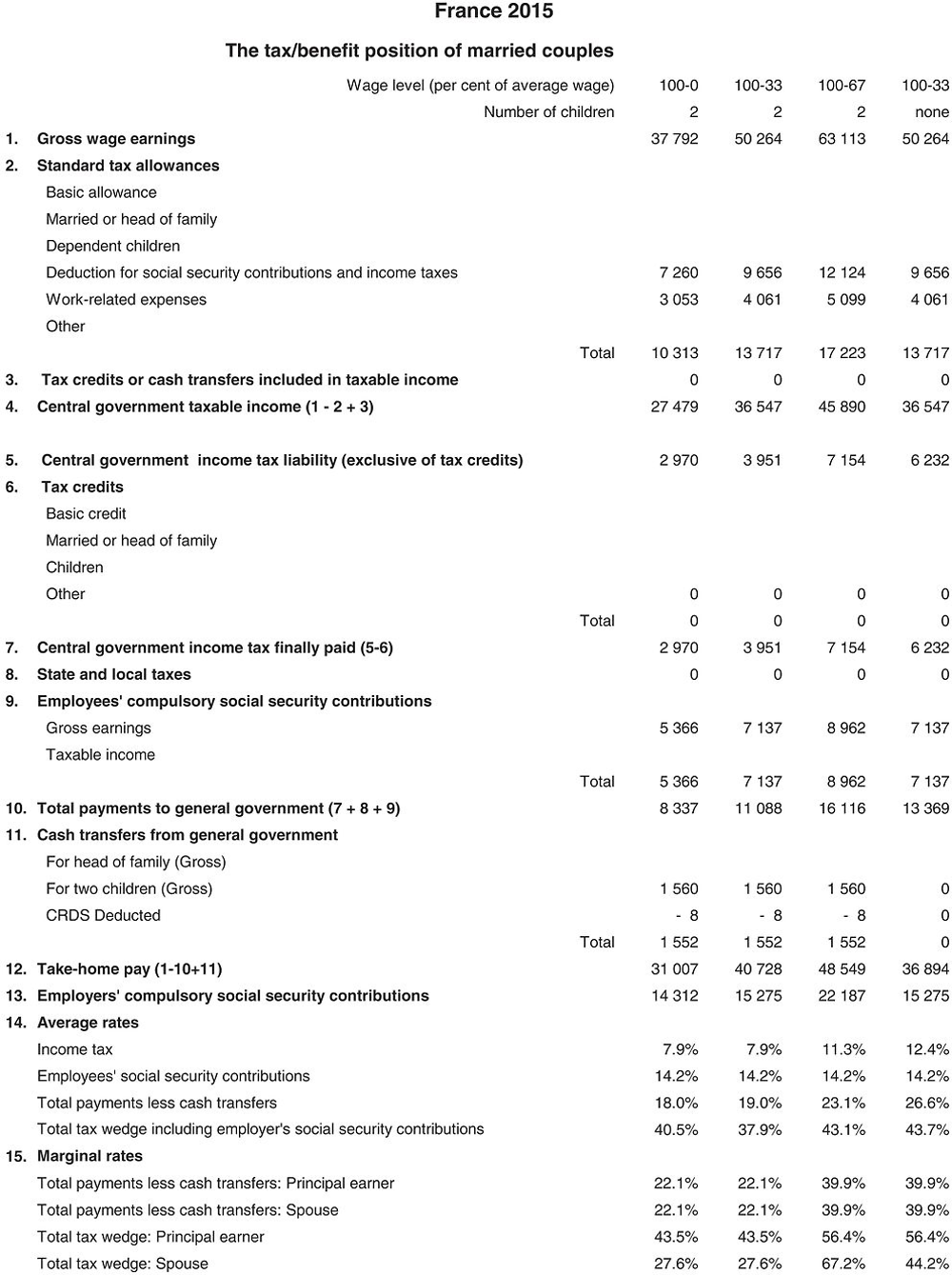

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the euro (EUR). In 2015, EUR 0.90 equalled USD 1. In that year, the average worker earned EUR 37 792 (Secretariat estimate).

1. Personal income tax system

1.1. Tax levied by the central government on 2015 income

1.1.1. Tax unit

The tax unit is aggregate family income, but children over 18 are included only if their parents claim them as dependants. Other persons may be fiscally attached on certain conditions: unlike spouses, who are always taxed jointly, children over 18 and other members of the household may opt to be taxed separately. Beginning with the taxation of 2004 income, the law provides for joint taxation of partners in a French civil union (pacte civil de solidarité, or PACS), as soon as the PACS is signed. Reporting obligations for ”PACSed” partners are similar to those of married couples.

Earned income is reported net of compulsory employer and employee payroll deductions, except for 2.4 percentage points’ worth of CSG (contribution sociale généralisée) and the 0.5 % CRDS (contribution pour le remboursement de la dette sociale), which are not deductible from the income tax base.

1.1.2. Tax reliefs and tax credits

1.1.2.1. Standard tax reliefs

-

Work-related expenses, corresponding to actual amounts or a standard allowance of 10% of net pay (with a minimum of EUR 426 and a ceiling of EUR 12 169 per earner).

-

Family status: The ”family quotient” (quotient familial) system takes a taxpayer’s marital status and family responsibilities into account. It involves dividing net taxable income into a certain number of shares [two shares for a married (or ”PACSed”) couple, one share for a single person, one half-share for each dependent child, an additional half-share for the third and each subsequent dependent child, an additional half-share for single parent, and so on]: the total tax due is equal to the amount of tax corresponding to one share multiplied by the total number of shares. The tax benefit for a half-share is limited, however, to EUR 1 510 per half-share in excess of two shares for a couple, or one share for a single person, except for the first two half-shares granted for the first child of a single parent, in which case the maximum benefit is EUR 3 562.

1.1.2.2. Main non-standard reliefs available to the average worker

Certain expenditures to improve or maintain the taxpayer’s primary residence, including outlays for heat insulation or heating adjustments, major capital expenditures and money spent to equip a home to produce energy from a renewable source (30% tax credits, subject to a multi-year maximum); compensatory allowances in case of divorce if paid in a lump sum (25% reduction, capped at EUR 30 500); child care costs for children under seven (50% reduction, up to annual expenditure of EUR 2 300); dependent children attending secondary school or in higher education; donations to charities or other organisations assisting those in needs; trade union dues, etc. The exemption of the employer’s participation to the collective contracts of supplementary health cover is abolished in the budget act for 2014 (i.e. income earned in 2013).

1.1.2.3. Refundable tax credit: employment premium (prime pour l’emploi, or PPE)

This is a tax credit for households comprising wage-earners whose equivalent full-time net taxable earned income was between EUR 3 743 and EUR 26 572. The credit is determined in a multi-step calculation. First, the amount of the premium is calculated for each eligible wage-earner, and then the individual amounts are aggregated. The resulting amount may then be increased under certain conditions (dependent children or single-parent wage-earner). It is this final amount that is deducted from the family’s tax liability. However, the credit is attributed only if the household’s reference taxable income does not exceed the following limits: EUR 16 251 for a single person, EUR 25 231 for a single-parent family with two children, EUR 32 498 for a married or PACSed couple with no children, EUR 41 478 for a married or PACSed couple with two children. The credit was increased sharply, since the maximum individual amount was raised to EUR 960 in 2008. The PPE is not paid if it is less than EUR 30.

In the event of part-time work, the income used to compute the amount of the credit is converted to a full-time equivalent, and the resulting credit is then adjusted to the actual amount of time worked and increased The increase has been raised: in 2007 (2006 income), the PPE of persons whose work ratio is 50% (persons working half-time all year or full-time for six months) amounts to 92.5% of the PPE of persons working full-time all year, versus 82.5% in 2006.

The following table shows the applicable schedule for computing the employment premium by income level and type of family, as selected by the OECD:

The PPE is increased for dependants in a household, and whether a married/PACSed couple has one or two earners can also affect the amount of the credit (with the amount for single-earner couples increased by EUR 83). The PPE is increased by EUR 36 for each dependent child, except in special cases (e.g. single-earner married/PACSed PPE recipients in the top two income brackets).

For the seventh consecutive year, the government decided to continue the freeze on the PPE scale for 2014.

Since 2010 personal income tax, the PPE is partly replaced by a new cash transfer benefit implemented in July 2009: the RSA (active solidarity income). This cash transfer ensures households earn a minimum income that increases with the number of hours worked. The RSA is not assessed here because to do so the knowledge of every cash transfer of the households (such as cash transfers for housing, unemployment etc.) is needed. The RSA is designed to meet three goals:

-

encourage people to enter or return to the labour market, by guaranteeing them a lasting improvement in income;

-

reduce poverty by providing recipients with a decent income;

-

improve social support and occupational reintegration.

The RSA is a benefit that supersedes two existing basic welfare payments, the so called ”revenu minimum d’insertion” (minimum unemployment benefit – RMI) and the so called ”allocation de parent isolé” (single-parent allowance – API). It also replaces temporary payments for welfare recipients who return to work (”prime de retour à l’emploi”, ”prime forfaitaire de retour à l’emploi” bonuses and the ”intéressement proportionnel” system of benefits combined with part-time work). However, the eight family types studied here earn too high an income to benefit from this credit.

Starting from 2016, the PPE and the part of the RSA dedicated to workers (”RSA activité”) will be replaced by the ”prime d’activité”. It will be a cash transfer benefit (as the RSA). It has not been included in the model as it concerns incomes earned starting from 2016. In the model, the removal of the PPE is not compensated by the creation of the ”prime d’activité”.

1.1.3. Tax schedule

A special rebate for taxpayers with a low tax liability is applied to the amount of tax resulting from the above schedule before reductions and tax credits. To be eligible, the tax on the household’s income must be less than EUR 1 553 for single households and less than 2 560 for the couples. The rebate is equal to the three-quarter of the difference between this ceiling and the amount of tax before the rebate. If the final tax is less than EUR 61, no tax is payable.

1.1.4. Exceptional contribution on high revenues

An exceptional contribution on high revenues is based on the reference taxable income (”revenu fiscal de référence”). The tax rates are 3% from EUR 250 000 to EUR 500 0000 (single person), 4% over EUR 500 0000 (single person), 3% from EUR 500 000 to EUR 1 000 000 (married couple or civil union) and 4% over EUR 1 000 000 (married couple or civil unions).

1.2. Taxes levied by decentralised authorities

Local taxes levied on working households are:

-

Residency tax (taxe d’habitation), which is set by local authorities;

-

Property taxes on developed and undeveloped land;

-

There are common rules for each type of tax, to which certain municipalities make certain adjustments.

These local taxes, the rates of which vary widely, depending on the municipality, are not assessed here.

1.3. Universal social contribution (contribution sociale généralisée, or CSG)

The universal social contribution (CSG) was introduced on 1 February 1991. Since 1 January 1998, the rate of CSG has been 7.5%. This rate has been applied to a base of 98.25% as of 1 January 2012. The CSG is deductible against taxable income, but at a lower rate of 5.1%.

1.4. Contribution to the reimbursement of social debt (contribution au remboursement de la dette sociale, or CRDS)

The contribution to the reimbursement of social debt has been in effect since 1 February 1997. Like the universal social contribution, its base has passed to 98.25% of gross pay as of 1 January 2012. The rate is set at 0.5%. Unlike social security contributions, CRDS payments are not deductible from taxable income.

2. Compulsory social security contributions to schemes operated within the government sector

Some contributions are levied on a capped portion of monthly earnings. Since 1997, this ceiling has been adjusted once a year on 1 January. In January 2015, the ceiling was EUR 3 170 (or EUR 38 040 per year).

2.1. Employee contributions

2.1.1. Pension

-

6.85% on earnings up to the ceiling (6.80% in 2014).

-

0.30% on total earnings (0.25 in 2014).

2.1.2. Illness, pregnancy, disability, death

-

0.75% on total earnings.

2.1.3. Unemployment

-

2.4% on earnings up to 4 times the ceiling.

2.1.4. Others

-

Supplemental pension1 for non-managers: minimum 3.1% (3.05 in 2014) up to the ceiling and 8.1% between one and three times the ceiling; for managers, 3.23% (3.18 in 2014) up to the ceiling and 7.93% (7.88 in 2014) between one and four times the ceiling.2

-

The AGFF (Association pour la gestion du fonds de financement) contribution replaces ASF (Association pour la gestion de la structure financière), which had previously been included in ”unemployment” levies. The rate of this contribution for non-managerial workers is 0.8% of earnings up to the social security ceiling plus 0.9% of any income in excess of the ceiling but not exceeding triple the amount of the ceiling.

2.2. Employer contributions

2.2.1. Pensions

8.5% (8.45% in 2014) of gross pay, up to the ceiling, plus a 1.80% (1.75 in 2014) levy on total pay.

2.2.2. Illness, pregnancy, disability, death

12.8% of total earnings.

An additional contribution of 0.3% (contribution de solidarité autonomie – (CSA) is levied on total salary.

2.2.3. Unemployment

4% of earnings (4.5%, 5.5% or 7% for some temporary contracts), up to four times the ceiling; in addition, 0.3% up to four times the ceiling to endow the salary guarantee fund (AGS).

2.2.4. Work-related accidents

Contribution rates for work-related accidents vary by line of business and are published annually in the official gazette (Journal officiel de la République française). In 2015, the average rate is 2.44%.

2.2.5. Family allowances

5.25% of total pay. The rate has been reduced to 3.45% up to 1.6 times the minimum wage from 2015 with the responsibility pact.

2.2.6. Others

-

Supplemental pension: for non-managers, 4.65% (4.58 in 2014) up to the ceiling and 12.15% (12.08 in 2014) between one and three times the ceiling; for managers, 4.87% up (4.80 in 2014) to the ceiling and 12.97% (12.90 in 2014) between one and four times the ceiling.

-

The AGFF contribution is 1.2% for non-managers or managers up to the ceiling, 1.3% for non-managers between one and three times the ceiling and 1.3% for managers between one and four times the ceiling. In the table, this is combined with the rates for supplemental pensions.

-

Others (construction, housing, apprenticeship, further training): 2.63% (3.23 in 2014) of pay (for enterprises with more than 20 employees). The transport tax is not included because it varies geographically.

2.2.7. Reduction of employer-paid social insurance contributions

Act No. 2003-47 of 17 January 2003 on salaries, working time and the development of employment (the ”Fillon Act”) amended how the reduction of contributions is calculated.

As a result, since 1 July 2005 the maximum reduction has been 26% (in companies with more than 20 employees) for a worker paid the minimum wage. It then declines gradually to zero at 160% of the annual minimum wage. It applies irrespective of the number of hours worked.

The Budget Act for 2007 (Article 41 V) bolsters this measure for very small enterprises with effect from 1 July 2007. For employers with between 1 and 19 employees, the maximum deduction was raised to 28.1% at the minimum wage, declining gradually – here too – to zero at 160% of the minimum wage.

In 1 January 2011 the ”Fillon act” was modified and included an annualized calculation of the general tax reliefs of employer contributions. For part-time wage-earners, the relief is computed using an equivalent full-time salary and is then adjusted proportionally to the number of hours paid.

From 2015, the Responsibility Pact (Phase 1) includes new reductions of the labour cost: total exemption of all URSSAF employer contributions on the minimum wage (except unemployment contributions); reduction of 1.8 point on employer-paid contributions for family allowance (3.45% instead of 5.25% for salary up to 1.6 times the minimum wage). The gross annual minimum wage (for 1 820 hours) in 2015 was an estimated EUR 17 490.

2.2.8. Competitive tax credit (CICE – Crédit d’impôt pour la compétitivité et l’emploi)

As for 2014, the competitive tax credit (CICE – Crédit d’impôt pour la compétitivité et l’emploi) will benefit all businesses, regardless of their legal status or economic sector, that employ salaried workers and be liable for either corporation tax or income tax, based on actual profits.

The CICE is based on all wages paid to salaried employees in a given calendar year up to 2.5 times the minimum wage (without taking into account any overtime or additional hours worked). For part-time employees and seasonal workers, the minimum wage corresponding to the working hours stipulated in the contract shall be taken into account.

The rate of the tax credit shall be 6% for wages paid in 2015.

3. Universal cash transfers

Main family benefits (in respect of dependent children)

-

Family allowances: monthly base for family allowances (BMAF) = EUR 406.21 as of 1 April 2015 (as of 1 April 2014). Rate: since 1 July 2015 the family allowances are subject to revenue conditions:

-

Up to 55 950 (+5 595 per child), the rate is 32% for two children and 41% per additional child. An extra amount of 16 % of the BMAF is reversed if the child is over 14 (the extra amount is not incorporated into the model).

-

Between 55 950 (+5 595 per child) and 78 300 (+5 595 per child), the above rates are divided by 2.

-

Beyond 78 300 (+5 595 per child), the above rates are divided by 4.

-

-

ARS (Allocation de Rentrée Scolaire): The amount payable depends on the age of the child to reflect needs. The allowance is payable to families or persons with children aged 6 to 18 attending school, and whose income is below a certain level (not incorporated into the model).

-

Family supplement (Complément Familial): 41.65% of the BMAF at 1 January 2015. Subject to revenue ceilings, this is paid to families as of the third child and an extra amount (EUR 29.49/month) is reversed for families whose incomes are below the poverty line (the CF is not incorporated into the model).

-

Early childhood benefit (not incorporated in the model) known as PAJE (Prestation d’Accueil du Jeune Enfant): subject to revenue ceilings. It includes:

-

A birth grant of EUR 918.5 received at the 7th month of pregnancy.

-

A benefit (”allocation de base”) of 183.7 (or 91.8 depending on revenue) Euros a month from the birth of the child until three years of age.

-

-

The CRDS is levied on family allowances at a rate of 0.5% (no deduction). The allowances mentioned above are after deduction of the CRDS.

4. Main changes in the tax system and social benefits regime since the taxation of 2014 income

-

Tax system ( 2015 income)

-

Creation of a new cash transfer benefit for low income workers (”prime d’activité”) which replace the PPE and the RSA.3

-

Extension of the rebate for taxpayers with a low tax liability.

-

Social benefits regime

-

Reduction of employer-paid contributions for family allowance (3.45% instead of 5.25% for salary up to 1.6 times the minimum wage).

-

The modulation of family allowances based on income (divided by 2 or 4 for high-income families).

5. Memorandum items

To assess the degree of comparability between countries, the following additional information should be taken into account:

-

Coverage is of the private and semi-public sectors of NACE sections C to K up to 2007 and NACE rev. 2 sections B to N from 2008.

-

The category ”employees” encompasses all full-time dependent employees (excluding apprentices and interns).

-

The figures presented are obtained by applying income tax and social contribution scales to gross salaries as listed in annual social data reports (DADS) in NACE.

2015 tax equations

The equations for the French system are mostly calculated on a family basis. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables ”married” and ”children”. A reference to a variable with the affix ”_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes ”_princ” and ”_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with ”_spouse” values taken as 0.

Notes

← 1. The social protection scheme is named ARRCO for non-managers and AGIRC for managers.

← 2. Between four and eight times the ceiling, the repartition of the pension contributions between employee and employer contribution is not nationally decided.

← 3. In the model, for 2015 revenues, this reform only affects the income tax (no PPE in 2016) but not the benefits, since the ”prime d’activité” will be served as from the beginning of 2016.