Chapter. Belgium

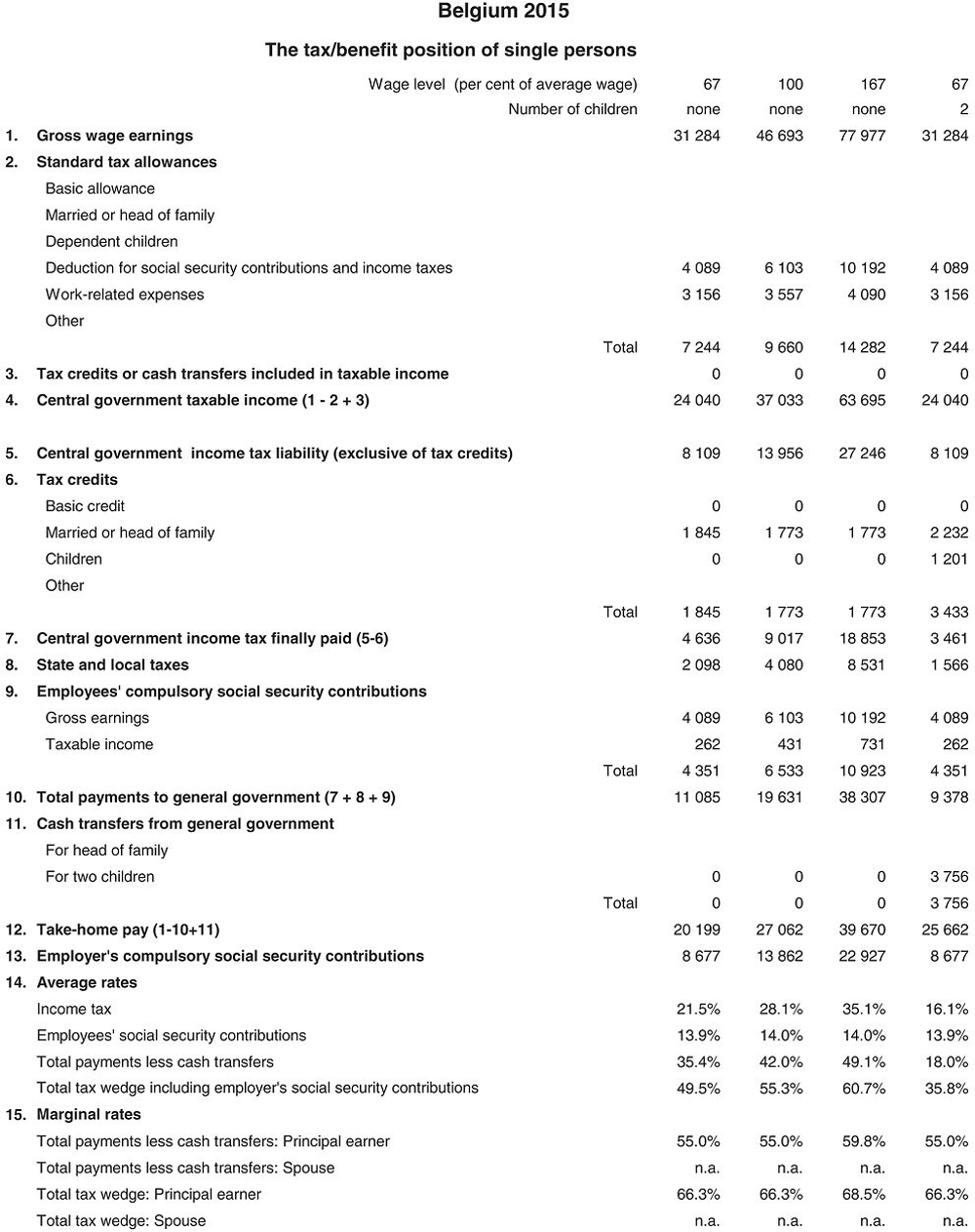

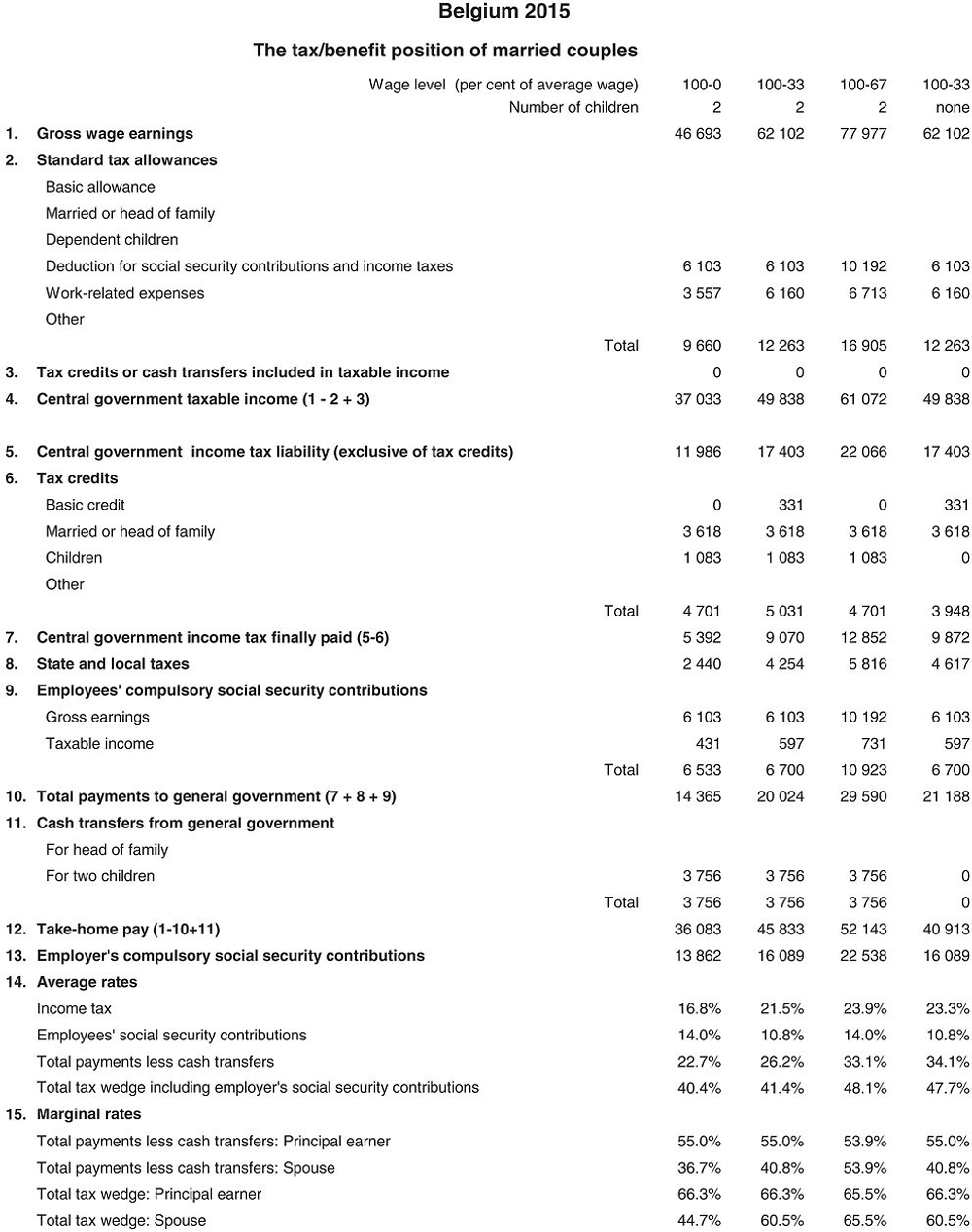

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the euro. In 2015, EUR 0.90 was equal to USD 1. The Secretariat has estimated that in that same year the average worker earned EUR 46 693 (Secretariat estimate).

1. Personal income tax system

1.1. Federal government income tax

1.1.1. Tax unit

Spouses are taxed separately. As from 2004, the principle of separate taxation applies to all categories of income. A non-earning spouse is taxed separately on a notional share of income that can be transferred to him or her (see ”non-earning spouse allowance”, below). Married couples nonetheless file joint income tax returns.

1.1.2. Tax allowances

1.1.2.1. Deduction of social security contributions

Unless stated otherwise, social insurance contributions are deductible from gross income.

1.1.2.2. Work-related expenses

Salaried employees and self-employed professionals are entitled to a standard deduction for work-related expenses. This deduction may under no circumstances exceed respectively EUR 4 090 per spouse for salaried employees and EUR 3 960 per spouse for self-employed professionals and is computed as follows:

The lump-sum deduction for business expenses for employees has been increased as of income year 2015, with also a new maximum amount. The lump-sum deduction for business expenses for self-employed professionals remains unchanged.

For salaried employees:

For self-employed professionals:

Paid company directors are also entitled to a standard deduction for work-related expenses; this is equal to 3% of gross income (less social insurance contributions) and may not exceed EUR 2 380 per spouse.

An additional allowance may be granted to wage-earners if their workplace is more than a certain distance from their home.

Actual expenses incurred in order to acquire or retain earned income are deductible if they exceed the standard deduction. The deductibility of certain categories of work-related expenses (cars, clothing, restaurant meals and business gifts) is limited, however. Taxpayers who report actual expenses may deduct EUR 0.15 per kilometre, up to 100 km per single journey, for travel between their home and their workplace by means other than private car.

1.1.2.3. Non-earning spouse allowance (quotient conjugal)

A notional amount of income can be transferred between spouses if one of them earns no more than 30% of the couple’s combined earned income. In this case, the amount transferred is limited to 30% of aggregate net earned income, less the individual income of the spouse to whom the notional share is transferred. This allowance is limited to EUR 10 230.

1.1.2.4. Exempt income

The base amount is:

These amounts vary with regards to the family situation. Additional exemptions for dependent children (a handicapped child counts as two children):

-

1 child 1 510

-

2 children 3 880

-

3 children 8 700

-

4 children 14 060

-

> 4 children 5 370 per additional child

Dependent child exemptions in excess of available income give rise to a reimbursable tax credit. This reimbursable tax credit is calculated at the marginal rate for the spouse with the highest income and capped at EUR 430 per dependent child.

Additional special exemptions are also granted for certain household members (in euro):

-

Other dependants 1 510

-

Handicapped spouse 1 510

-

Other handicapped dependants 1 510

-

Widow(er) with dependent child(ren) 1 510

-

Single father or mother 1 510

These additional exemptions are applied first to the taxable income of the spouse having the most income, with any remainder then being applied to the income of the other spouse.

The basic exemption plus any additional exemptions for dependants and single parents is applied against each bracket from the bottom up; in other words, the lowest brackets are depleted first.

1.1.2.5. Schedule

The basic exemption plus any additional exemptions is applied from the bottom up.

1.2. Regional and local government taxes

With the implementation of the sixth state reform, the Flemish Region, the Walloon Region and the Brussels-Capital Region have been delegated several important competences with regard to the individual income tax. As a result of this reform, as from 1 July 2014, the regional competences are:

-

the possibility to levy surcharges on the federal PIT (the supplementary regional tax on the personal income tax). The surcharge may be proportional or vary with income but there are limits to ensure that the tax remains progressive);

-

to grant (on the result of the surcharges) tax discounts;

-

to grant tax reductions, tax increases and tax credits;

-

to regulate exclusively some tax reductions.

Under the new tax model, the assumed federal income tax amount must first be calculated. The taxable base is reduced by the exempt income (see 1.124), the tax credits for pensions, unemployment, sickness and other social benefits and the tax credit for income taxed abroad. Additionally, it is reduced by the tax due on passive income for which the Federal State remains exclusively competent.

The remaining PIT liability is than split between the central government and the Regions according to a ratio of 0.7401 /0.2599.

Subsequently, the Regions are allowed to levy a proportional surcharge on this reduced federal income tax. This surcharge may, within certain limits and given the matters for which the Regions are competent, vary per tax bracket. The actual rate is set at 35.117% (0.2599/(1-0.2599).

The starting point for the calculation of the municipal (and agglomeration) surcharges is the individual income tax (”impôt total”, i.e. the sum of federal PIT and regional PIT), before taking into account the surcharge resulting from insufficient prepayments, the foreign tax credit, federal and regional reimbursable tax credits (among others for children and for low-income workers), prepayments and withholding taxes. The rate of this local surtax is set by each municipality, and there is no upper limit. An additional surcharge of 1% is levied in the Brussels-Capital Region, in addition to the municipal surcharge.

The calculation of the regional and local surtax for the average worker study assumes that the worker lives in the Region of Brussels-Capital. The weighted average local surtax of the 19 municipalities which form the Brussels-Capital Region is 7.5%.

1.3. Tax credits

Refundable tax credit for low-income workers

A refundable tax credit is intended for low-income workers and company managers (subject to the employees’ social security system) entitled to the employment bonus.

The refundable tax credit amounts to 14.40% / 17.81% as of 1 August 2015 of the ”employment bonus” which is actually granted on remunerations earned during the taxable period. It cannot exceed EUR 310/EUR 360 as of 1 August 2015 per taxable period.

1.4. Rebate on the wage withholding tax

Employers benefit from a rebate on the wage withholding tax, at the rate of 1%. The rebate does not affect the PIT liability of the employee and the amount of the withholding tax he may credit on its PIT liability: it just reduces the amount of withholding tax paid by the employer to the tax administration. This means that the rebate operates like a wage subsidy, or like a negative payroll tax. The rebate is a standard one: it applies in an unconditional way to any wage earners in sectors C-K.

For employers who are either considered as small companies, as defined in article 15 of the Belgian Corporation Code, or natural persons meeting mutatis mutandis the criteria set out in the same article 15, the rate has been increased to 1.12%.

2. Compulsory social security contributions to schemes operated within the government sector

2.1. Rates and ceiling

a. Payroll deductions

The rates of employer and employee contributions are set by law. The applicable rates (in %) are as follows (for businesses having 20 or more employees):

Vacation pay is not subject to the social security contributions applicable to salaries, but a social security levy of 13.07% is deducted when the money is attributed.

b. Reduction of employer contributions

The schedule applicable as from 01.01.2014 is as follows:

c. Reduction of individual social security contributions

A reduction of individual social security contributions is granted monthly for low-income earners, depending on wage level. The schedule below is restated in annual terms.

The schedule applicable as from 01.01.2014 is as follows:

The schedule applicable as from 01.08.2015 is as follows:

d. Special social security contribution

All persons totally or partially subject to the social security scheme for salaried workers are liable for this special contribution. In theory, the amount of the contribution is determined according to aggregate household income. Aggregate household income is equal to combined gross earnings less ordinary social security contributions and work-related expenses. The amount of the contribution is as follows:

e. Work accidents

All employers are required to insure their employees against accidents that occur in the workplace or while travelling to or from the workplace. The insurance is written by a private company. The usual premiums are approximately 1% of gross pay for office workers and 3.3% for labourers. The premiums are based on capped gross wages: in 2011 these premiums apply to gross wages (including holiday pay and extra-legal remunerations) with a minimum of EUR 6 068 and a maximum of EUR 37 546 (EUR 5 949 and EUR 36 810 respectively in 2010). Higher rates apply in certain industries in which risks are greater. The premium rate for construction workers, for example, varies between 7% and 8%.

2.2. Deductions according to family status or gender

None.

3. Universal cash transfers

Family allowances are granted for children. The annual amounts of these benefits (in euro) are as follows:

To determine the resources available to the average worker, the Taxing Wages calculations assume that one child was between seven and ten years of age and that the other child was between eleven and twelve years of age.

4. Main changes in the tax/benefit system

None.

2015 tax equations

The equations for the Belgian system in 2015 are mostly calculated on an individual basis. But central government tax for a married couple is calculated on two bases and the lower value is used. One of the bases takes account of the combined income of the couple. Also, tax credits may be used against the tax liability of the secondary earner if the principal earner is unable to use them.

The functions which are used in the equations (Taper, Tax etc.) are described in the technical note about tax equations. Variable names are defined in the table of parameters above or are the standard variables ”married” and ”children”. A reference to a variable with the affix ”_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes ”_princ” and ”_spouse” indicate the value for the principal and spouse respectively. Equations for a single person are as shown for the principal with ”_spouse” values taken as 0.