5. Mixed modes of innovation

Note: International comparability may be limited due to differences in innovation survey methodologies and country-specific response patterns. European countries follow harmonised survey guidelines with the Community Innovation Survey.

Source: OECD, based on the 2017 OECD survey of national innovation statistics and the Eurostat, Community Innovation Survey (CIS-2014), http://oe.cd/inno-stats, June 2017. StatLink contains more data. See chapter notes.

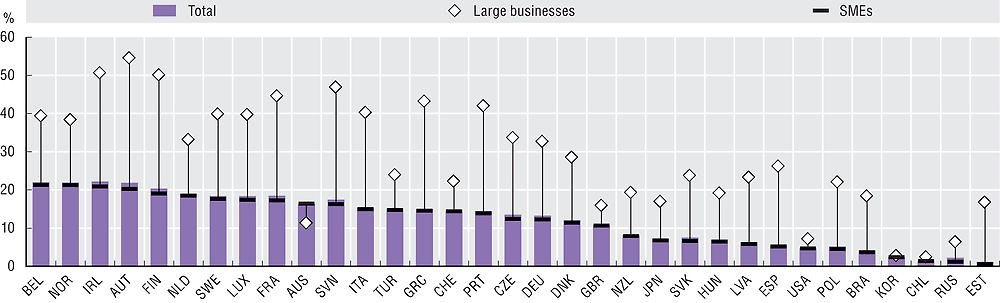

In most countries, large businesses are between two to three times more likely than SMEs to introduce products that are new to market.

Business-level data reveal that businesses adopt innovation strategies combining different and complementary types (“mixed modes”) of innovation. Innovative firms – both large firms and SMEs – tend to introduce new marketing or organisational methods alongside product or process innovations.

The indicators, which show the percentage of businesses that introduced at least one innovation over the reference period, reveal a considerable gap between SMEs and large firms across all countries. Reported product or process innovation incidence rates are generally lower in services than in manufacturing firms.

Identifying the subset of new-to-market product innovators provides a quality-adjusted measure of product innovation by businesses. Overall, new-to-market product innovations are more common for manufacturing than services. In Germany, new-to-market product innovation rates for manufacturing are almost twice as large as for services. Innovation in the manufacturing sector is overall on the rise within a majority of OECD countries.

Differences in new-to-market product innovation rates are very marked between large businesses and SMEs (i.e. those with less than 250 employees). For many countries, new-to-market product innovation is a rare event in the general SME population. This may reflect challenges to the scaling-up of such firms, which affects their ability to transform or disrupt markets.

Definitions

The 2005 edition of the Oslo Manual (OECD and Eurostat, 2005), currently undergoing revision, identifies four types of innovation by object:

Product innovation: the introduction of a good or service that is new or significantly improved with respect to its characteristics or intended uses. This includes changes in technical specifications, incorporated software or components, user friendliness or other functional characteristics.

Process innovation: the implementation of a new or significantly improved production or delivery method. This includes changes in techniques, equipment and/or software.

Marketing innovation: the implementation of a new marketing method involving changes in product design or packaging, product placement, product promotion or pricing.

Organisational innovation: the implementation of a new organisational method in the firm’s business practices, workplace organisation or external relations.

New-to-market product innovation refers to the introduction of a new or significantly improved product into the firm’s market before any other competitors (the product may have already been available in other markets).

Note: International comparability may be limited due to differences in innovation survey methodologies and country-specific response patterns. European countries follow harmonised survey guidelines with the Community Innovation Survey.

Source: OECD, based on the 2017 OECD survey of national innovation statistics and the Eurostat, Community Innovation Survey (CIS-2014), http://oe.cd/inno-stats, June 2017. StatLink contains more data. See chapter notes.

Note: International comparability may be limited due to differences in innovation survey methodologies and country-specific response patterns. European countries follow harmonised survey guidelines with the Community Innovation Survey.

Source: OECD, based on the 2017 OECD survey of national innovation statistics and the Eurostat, Community Innovation Survey (CIS-2014), http://oe.cd/inno-stats, June 2017. StatLink contains more data. See chapter notes.

A wide range of methodological features impact on the comparability of innovation indicators, in particular those relating to the incidence of innovations. Major drivers of challenges to international comparability include whether countries collect information on innovation within R&D surveys or not (which influences how respondents frame new and improved products and processes), and differences in the extent to which survey response is mandatory. Although an effort has been made by national correspondents to align differences in reference period, as well as sectoral and firm size coverage for non-European countries with the “core” coverage of the Community Innovation Survey (CIS), this was not always possible. Qualitative incidence indicators based on the concept of at least one innovation of a given type do not provide a full view of an economy’s innovation intensity, especially if results are weighted on the basis of counts of businesses. These issues are being addressed as part of the ongoing revision of the Oslo Manual.