Chapter 2. Primary market developments for government bonds1

This chapter discusses the functioning of primary markets, in particular by providing an overview of recent changes in issuing strategies, procedures and techniques, in response to regulatory changes and their impacts on issuance. Some of these changes, while understandable, might pose new challenges for debt managers. To the extent that debt managers are becoming more opportunistic, issuance programmes will be less predictable. That situation may not be desirable in the longer term. Debt management offices (DMOs) emphasize therefore that they aim at using a transparent debt management framework, supported by a strong communication policy. In this context, some DMOs took concrete steps to increase the predictability and transparency of their primary market operations.

2.1. Introduction

This chapter2 focusses on the functioning of primary markets by discussing the main empirical results from the 2015 survey on primary market developments for government bonds. As of 31 July 2015, 32 OECD countries out of 34 replied to the survey.

Key findings:

-

Debt management offices (DMOs) in OECD countries are using broadly similar issuance procedures and policies and are pursuing a high degree of transparency3 and predictability that facilitate and encourage liquid markets. Broad and deep primary and secondary markets, in turn, are instrumental in lowering the cost of borrowing for the government.4

-

The global financial and economic crisis had, and is having, an important impact on sovereign debt markets and borrowing activities and has led to changes in (the use of) issuance procedures and techniques. However, since issuance conditions vary among countries, the overall policy response and/or (changes in) the use of issuance techniques may differ. Most of DMOs have increased frequency of auctions, while some of them introduced post auction option facility and mini-tenders to the investors.

-

DMOs consider issuing new instruments for various reasons including diversification of the investor base and enhancing liquidity of the government securities. Since January 2014, 18 OECD DMOs have started to issue new funding instruments such as inflation linked bonds, floating rate notes (FRN) and ultra-long bonds.

-

Country overview of the potential implications of the new regulations such as Basel III, Volcker Rule and Solvency II on the functioning of the primary markets suggests that these new regulations could adversely affect market liquidity and demand for government securities. There are examples of banks, who have decided to downscale fixed income business including primary dealer activities in Belgium, Finland, Ireland and Denmark. However, it is difficult to quantify their full impact on primary markets of government bonds at this stage.

2.2. Overview of issuing procedures in the OECD area

The principal issuing procedure in use is auctions (Table 2.1). For example, the UK DMO is using auctions as the primary method of issuance for gilts across the maturity curve with conventional gilts and T-bills being issued via bid-price auctions. The responses show that 27 OECD countries (84%) are using auctions for issuing long-term, while 28 DMOs (88%) also are employing auctions for issuing short-term debt. 22 OECD countries (70%) show that the preferred auction type is the multiple-price format5. However, single-price6 auctions run a close second. Moreover, 12 OECD countries use both single and multiple prices, depending on the maturity or type of debt instruments. For example, some countries issue index-linked bonds using the single price format (e.g. Canada, Japan, Mexico and United Kingdom), while nominal bonds are issued via multiple price auctions. The U.S. Treasury reopens issues, but does so through regular and predictable auctions.

Table 2.1 also show that syndication is a commonly used issuance procedure (23 OECD countries are currently using syndications). For example, a programme of syndications was introduced by the UK DMO in the 2009-10 financial year and has been used every year since then.

The country notes of Table 2.1 indicate that syndication is mostly used for i) international bond issues (e.g. Canada, Czech Republic, Denmark, Hungary, Iceland, Italy, Poland, Slovak Republic, Sweden and Turkey); ii) the first-time issuance of new instruments (e.g. Australia, Austria, France, Germany, Mexico and New Zealand); iii) long(er)-dated bonds (e.g. Australia, Italy and France) and/or the sale of first tranches of benchmark issues, and iv) targeting and directly placing securities among specific investor groups.

More in general, syndications are often used on a highly selective basis. For example, it is typically undertaken by the Australian DMO when there is a higher than normal level of risk associated with the issue of a new bond line (for example when issuing a bond line that extends the yield curve) or when there is a desire to issue a large volume of bonds in order to immediately establish a large liquid bond line. In Canada, syndication are used for foreign currency debt issuance (for foreign exchange reserve funding purposes only) and for previous tactical issuances of a 50-year bond.

Syndications are likely to yield better results (higher placing certainty) in difficult market conditions. On the other hand, syndications are less transparent than auctions.

Tap issues are less frequently used, with 16 OECD DMOs (50%) using taps for issuing short-term debt and 18 DMOs (56%) for issuing long-term debt. In the UK, taps for market management are reserved for exceptional circumstances only. (Taps are distinct from mini-tenders, which were introduced by the UK DMO in October 2008 as one of the supplementary methods for distributing gilts.) In addition, a few countries use other techniques like private placement (e.g. Italy and Spain).

Lastly, issuance procedures and choice of instruments usually reflect the underlying debt management strategy. For example, the New Zealand DMO continues to focus on extending the average maturity of the debt portfolio, in part by committing to the inflation-indexed bond market through developing new maturities and regular tender issuance. Syndication continues to be a feature of new bond launches. In addition, 2014 New Zealand introduced a buy-back programme for the next maturing nominal bond (15 April 2015), which resulted in nearly NZD 4.0 billion being repurchased to help manage the maturity down from a record NZD 10.8 billion to NZD 7.2 billion. For the new issuance of longer dated bonds, the Dutch DMO uses the Dutch Direct Auction (DDA) system. The DDA system is implemented as a rule-based auction in which the DMO is the book runner.

2.3. Overview of recent changes in issuing procedures and techniques in OECD countries

As noted, issuance strategies and associated procedures are broadly similar (Table 2.1). However, they may vary greatly in terms of operational and technical details. Moreover, as a result of the great financial crisis and, later on, because of responses to the economic crisis, many countries have changed one or more (technical or operational) features of their issuance procedures. Table 2.2 provides a country-by-country overview of important changes made in issuance procedures and techniques.

Many DMOs have initially adopted changes in issuance procedures so as to address (some of) the issuance challenges associated with the strong increase in borrowing needs in the wake of the great crisis. Other sources of issuance challenges emerged later on and include QE programmes and concerns about the adverse impact of new regulations on market-making by primary dealers and market liquidity. Some countries have adopted issuing rules and special auctions outside the regular auction calendar so as to enhance liquidity in their government bond markets.

More specifically, delegates from the OECD Working Party on Public Debt Management confirmed the following trends and developments:

-

Changes in issuance methods and procedures, including more flexible auction calendars (weekly or monthly instead of quarterly/annual) and using other distribution methods than “regular” auctions including mini-tenders, syndication, Dutch Direct Auction (DDA) procedures and private placement. (See Table 2.2 for a country-by-country overview.)

-

In response to uncertainty and market volatility, auction calendars have become more flexible in most jurisdictions; auctions were held more frequently (e.g. Denmark and Iceland); and more bond lines, issued at each auction, were introduced (e.g. France and Iceland). The UKDMO noted that auctions remain the primary method of issuance for gilts across the maturity curve. But the DMO also introduced new issuing procedures such as a post auction option facility; this facility allows successful bidders to purchase additional stock of up to 10% of the amount allocated at auction; it was introduced with effect from June 2009 and has continued to be offered since then. Moreover, with effect from October 2008 the UKDMO introduced mini-tenders as a more flexible supplementary distribution method.

-

In order to smooth the redemption profile, some countries introduced new maturities. For example:

-

Germany introduced a new structure of maturities for 30-years segment for inflation linked federal securities.

-

Canada began issuing a 50-year bond.

-

France introduced more new issues of long-term bonds (more than 30 years).

-

-

Some countries also issue more frequently off-the-run bonds in order to provide liquidity and create smooth redemption flows. For example, Belgium, France and Japan have increased the number of re-openings (of off-the-run bonds that have sufficient market demand) so as to reduce market volatility, and (in the case of Japan) to enhance liquidity of the JGB market.

-

Ireland saw the return to full market access following exit from EU/IMF programme at the end of 2013, with the Irish DMO using a regular schedule of single price auctions.

-

Other changes in issuance strategies include: i) a stronger emphasis on retail issuance (e.g. in Italy where a new bond is issued through a regulated retail platform) so as to broaden and to increase the stability of the investor base; ii) in order to attract foreign investors, several DMOs have reduced the number of auctions while the amount per auction has been increased (e.g. Chile); and iii) more emphasis on investor relations via:

-

more frequent meetings with investors,

-

more frequent participations in investor-focused events such as conferences on public borrowing operations and government debt issues,

-

more frequent updates of specific websites focused on investor relations,

-

and via regular publication of newsletters, distributed via regular mail or via individual electronic distribution to investors (e.g. Czech Republic, Israel, Slovenia, France and Iceland).

-

Some of these changes, while understandable, might create risks. To the extent that debt managers are becoming more opportunistic, issuance programmes will be less predictable. That situation may not be desirable in the longer term. DMOs emphasise therefore that they aim at using a transparent debt management framework, supported by a strong communication policy. In this context, some DMOs took concrete steps to increase the predictability and transparency of their primary market operations. For example, the New Zealand DMO recently made changes to the quarterly bond tender schedule by including the specific maturity likely to be offered at tender, thereby providing additional predictability to their issuance activity.

Transparency and predictability are instrumental in reducing the type of market noise that may unnecessarily increase borrowing costs. In this context, DMOs are using issuance strategies that reflect a balance between predictability and flexibility. The latter feature contributes to an opportunistic response to a changing market environment, while predictability is meant to reduce uncertainty for dealers and investors. From this perspective changes in issuing procedures and techniques mirror changes in the balance between predictability and flexibility.

For example, the syndication programme of the UKDMO will continue to be used in 2015-16 to launch new gilts and/or for re-openings of high duration gilts. Syndications enable the DMO to retain flexibility in aligning demand with supply as each syndication is sized taking into account the size and quality of end-investor demand.

2.4. Issuance of new instruments

In this part of the survey, DMOs were asked whether they have issued new types of securities such as inflation-linked bonds, variable rate notes, longer dated securities, etc. since January 2014. However, some countries reported also funding instruments that were introduced at a somewhat earlier stage. For example, Japan reported that new types of securities were issued between September 2013 and December 2013.

New instruments are issued for various reasons, but mostly for the widening and diversification of the investor base. Enhancing liquidity at various points of the yield curve was also mentioned in some cases. The strong increase in borrowing needs played an important role in aiming for a broader investor base in quite a few jurisdictions.

In the period September 2013-July 2015, 58% of OECD issuers (18 countries) have introduced new instruments (see Table 2.3).

2.5. Which new types of funding instruments were issued (since January 2014)?

Table 2.4 refers to the issuance of new funding instruments by 18 OECD DMOs such as (long-term) linker issuance, floating rate notes (FRNs), and ultra-long instruments. In addition, some OECD countries began to issue “Sukuk” bonds (i.e. Luxembourg, Turkey and United Kingdom) which were sold to a wide range of investors including sovereign wealth funds, central banks and domestic and international financial institutions.

For some governments, the issuance of Sukuk bonds is not part of the government’s regular or normal debt management policy. For example, the United Kingdom has started to issue sovereign “Sukuks” but this issuance programme is not associated with the UK’s debt financing objectives. Instead, it is designed to deliver wider benefits like promoting greater trade and investment, largely driven by the Government’s desire to cement the position of London and the UK as a centre of international – and Islamic – finance (see also Table 2.4).

The U.S. Treasury auctioned its first floating-rate note (FRN) in January 2014. With this sale, the government auctioned the first new marketable debt instrument since linkers (inflation-protected securities) were introduced in 1997. The new two-year FRN is a fixed-principal security with quarterly interest payments and interest rates indexed to the thirteen-week Treasury bill.

By adding this new product, the investor base will expand, which is likely to lower the government’s borrowing cost.7

2.6. Plans of DMOs to sell in the future new types of securities

DMOs were also asked whether they are planning to issue new types of securities like inflation linked bonds, variable rate notes, longer dated securities, etc.

Thirty-one (31) responses were given. A majority of twenty-five (25) countries (or around 80%) answered that they were currently not planning to issue new types of securities (see Table 2.5). In essence, most plans to sell in the future new types of instruments mirror changes in debt management strategies. However, this is not always the case. As noted, the issuance of Sukuks by the UK DMO is not part of the government’s normal debt management policy. Hence, the DMO is not envisaging an ongoing programme at this stage.

Hence, six DMOs (or nearly 20% of the respondents) indicated that they were planning to issue new types of funding instruments (Table 2.5), including variable rate notes and longer dated securities (see Table 2.6). For example, Austria is planning to issue floating rates notes under domestic law, New Zealand is planning to issue a 2033 nominal bond, while Slovenia will issue a 30-year government bond and is planning to use other instruments like the “Schuldschein8”.

In sum, higher borrowing needs have led to a greater diversification in the use of funding instruments, in particular via an increase in the issuance of inflation-linked bond issuances. This in turn has broadened the investor base. Continued funding challenges have led to a situation where a broad and diverse investor base is more essential than before. This means that it is more important to take into account the preferences of both foreign and domestic investors when making changes in issuance procedures and introducing new instruments. In this regard, most countries mention that they give a higher priority to maintaining good investor relationships.

2.7. The largest (expected) impact of new regulations on the functioning of primary markets

Table 2.7 is based on responses by DMOs to the question which new regulations have in their judgement the largest (expected or potential) impact on their primary markets. The table shows that many countries have quite different views on the severity of the impact of these regulations on their markets. Some countries (such as Chile, Hungary and Norway) expect a moderate influence of these new regulations. However, several other issuers note that, given the evolving nature of some of the regulatory changes, it is difficult to fully appreciate the effect that the new regulations will have on primary market operations. Moreover, many of the rules have not yet been implemented, thereby increasing the difficulty in ranking the impact of these new regulations.

The category, “Other Regulations” that has a significant (expected) impact on the functioning of primary markets refers to a quite diverse set of regulations. In Belgium it covers regulations concerning the risk weighting of sovereign debt. In Denmark it denotes the Leverage Ratio framework. In Germany, UK and Slovenia it designates MiFID II/MiFIR (Markets in Financial Instruments Directive II and Regulation, MiFIR). In Iceland it refers to capital control rules. In the Netherlands it denotes BSRD (Bangko Sentral Registration Document), CSDR (Central Securities Depositories Regulation) and EMIR (European Markets Infrastructure Regulation). In Portugal this category covers the ESRB (European Systemic Risk Board) report on the regulatory treatment of sovereign exposures, the MiFID II and CSDR. In the Czech Republic it refers to the regulatory treatment of sovereign debt exposures. In Mexico the category “Other Regulations” refers to “The European Commission Proposal” (ECP), which prohibits proprietary trading operations by European banks, including their overseas subsidiaries. The prohibition excludes operations involving sovereign securities of the European Union. Moreover, trading operations (including market making) may need to be separated from the bank when certain thresholds are exceeded. The Mexican DMO also notes that the ECP seems to suggest that overseas subsidiaries may be exempt from the separation requirement when the banking group operates under a decentralized business strategy and authorities have agreed to apply a multiple point of entry (MPE) resolution strategy. (For more details about this regulation see European Commission “Proposal for a Regulation of the European Parliament and of the Council on structural measures improving the resilience of EU credit institutions”, Brussels, 29.1.2014.)

Sovereign issuers have expressed on various occasions their concern about the impact (positive or negative) of new (or envisaged) financial reform measures. Most of the DMOs have expressed concerns that these new regulations could adversely affect 1) market liquidity and 2) the demand for government securities by end-investors (i.e., reduced demand by these investors). Table 2.8 provides a detailed, country-by-country overview of the largest (expected) impact of new regulations on the functioning of primary markets, including Basel III, Financial Transactions Tax (FTT), the Volcker rule, Solvency II, Shorting Restrictions, New Rules for Swaps and the category with quite diverse “Other Regulations”.

New rules such as Basel III, Solvency II, short sale restrictions, and the Volcker rule, among others, are meant to reduce the occurrence of major financial instability episodes. On the other hand, several DMOs are arguing that they may reduce the capability of the banking system to warehouse and distribute government bonds, in particular during the first stages of their implementation and when not adequately fine-tuned. In general, the impact of these new regulations will be mostly felt in terms of higher transaction costs in the secondary market for government bonds. However, these increased costs will inevitably spill-over into the primary markets, both in terms of higher borrowing costs and lower quality in the execution of the placement of bonds.

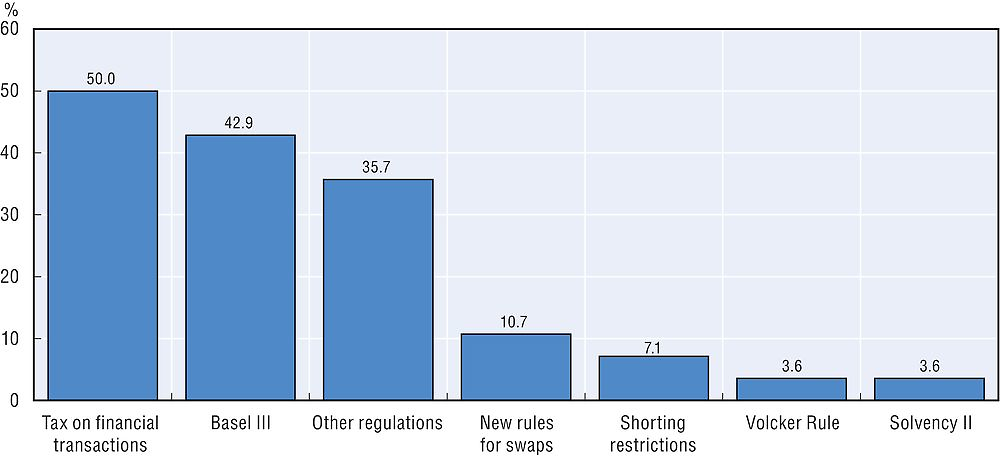

The 2015 survey responses show that DMOs are mostly concerned about the tax on financial transactions (50%), followed by Basel III (42.9%). Figure 2.1 reflects the worries of sovereign issuers that these two categories of new regulations have potentially the biggest adverse impact on the functioning of primary markets.

Interestingly, Figure 2.1 also shows that only 3.6% of the DMOs considered the Volcker rule as having the biggest (potential) impact. Not surprisingly, the category capturing a rather diverse set of new regulations (denoted here as “Other Regulations”) reflects the concerns of quite a few DMOs. (Figure 2.1 demonstrates that 35.7% of the respondents associate “Other regulations” with having potentially the biggest impact.)

← * 28 OECD countries out of 34 answered this question. Note that respondents ranked more than one regulation with having the biggest (potential) impact on primary markets.

Source: Responses to the 2015 survey on primary markets developments by OECD Working Party on Debt Management.

The Survey and debate by the OECD Working Party on Public Debt Management about the impact of (envisaged) regulatory changes indicate that these new regulations will most likely contribute to shifts in the business models of banks, although the full impact of new regulations is not easy to quantify. For that reason, also the ranking of the impact of these new regulations may also be problematic. But some of the new regulations are likely to reduce the profitability (hence the attractiveness) of being a primary dealer in government securities markets and/or reduce the ability of primary dealers to actively participate in primary issuance and/or maintain sufficient inventories in government bonds (and thus provide liquidity in the different public bond markets). Indeed, there are examples of banks, who have decided to downscale fixed income business including primary dealer activities (see, for example, the situation in Belgium, Finland, Ireland and Denmark as reported in Table 2.8).

In terms of liquidity, Basel III outlines that countries should adopt two rules – the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). Together, it is not always clear what the impact is of Basel III on primary market issuance but the adverse impact on market-making seems more evident. It may also impact the ability to hedge positions with primary dealer banks. The capital requirements and liquidity requirements of Basel III are causing dealers to hold more capital, which prevents them from cost effectively holding large amounts of securities and to act as principals in trades. As a result, investors are having a more difficult time to complete either side of a large trade.

It is very difficult to isolate all these regulatory changes and their impacts on issuance. Moreover, given the evolving nature of some of the regulatory changes, it is difficult to fully appreciate the impact that the new regulations will have on primary markets/operations in the debt management space.

Nonetheless, primary dealers have reported general concerns about the cumulative impact of regulation and the requirement for banks to hold more capital against assets including sovereign debt. Resulting balance sheet constraints could have the impact of a reduction in primary dealers’ appetite for activities such as holding inventory, provision of liquidity and market making, all with a consequent impact on the primary market. Hence, the cumulative impact of regulation on sovereign debt markets is of crucial importance for sovereign issuers but, unfortunately, its quantification is not easy. However, it is clear that, in general, the new regulations are having (or will have) a significant influence on primary dealer banks and, as a result, public debt management operations. Banks will need to adjust their business models (or are in the process of doing so) by excluding low-margin business areas which probably will affect in particular smaller, less liquid government bond markets. For example, the New Zealand DMO noted that regulation (more broadly) appears to be having an impact on liquidity and the ability of intermediaries to warehouse risk. But also in larger markets there may be an adverse impact. The Germany DMO reports that the liquidity in the cash market for German Federal securities (as well as in the repo and the futures markets) might decrease. As a result, activities in the primary market may become more challenging.

Finally, it was also noted that regulatory initiatives, either individually or cumulatively, have the potential to result in a number of unintended consequences (direct and indirect ones) for sovereign debt markets. For example, most of the countries in the survey also indicated that the Financial Transactions Tax (FTT) might lead to a substantial higher costs of secondary market trading and, hence, to a deterioration of market liquidity. It was reasoned that even while primary issuance from sovereign issuers is to be exempt, the introduction of FTT in its current form may have a major adverse impact on market liquidity. Primary market issuance is heavily reliant on properly functioning liquid secondary markets. The level of FTT proposed, along with the cascading effect, will render current market making models uneconomic, leading to significant deterioration in market liquidity. (See Chapter 3 for more details on liquidity in secondary markets for government bonds.).

Notes

← 1. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

← 2. Chapter written by Hans J. Blommestein with research and statistical support by Perla Ibarlucea Flores. Tables and figures are based on responses to the 2015 survey on “primary market developments for government bonds” by the OECD WPDM (cut-off date 31 October, 2015).

← 3. Chapter 4 discusses details on the transparency of debt management strategies, policies and operations.

← 4. It is widely recognised that issuers, investors, dealers and tax payers have benefited from transparent, efficient, robust and reliable issuance procedures for government debt (Hans J. Blommestein [2002], editor, Debt Management and Government Securities Markets in the 21st Century, OECD).

← 5. At a multiple-price auction, bonds are sold at the actual bid price of successful bidders.

← 6. At a single-price (uniform-price or Dutch) auction, all bonds are sold at the same lowest accepted price.

← 7. “From an investor perspective, FRNs have less exposure to rising rates because of the frequent rate resets, and they pay interest more frequently than current coupon two-year securities. At the same time, FRNs may offer investors a slightly higher yield and fewer transaction costs than consistently rolling over a position in the thirteen-week bill, despite providing nearly identical cash flows.” (See Copic, E., L. Gonzalez, C. Gorback, B. Gwinn and E. Schaumburg (2014), “Introduction to the Floating-Rate Note Treasury Security”, Liberty Street Economics, 21 April.)

← 8. A “Schuldschein” is a loan instrument usually governed by German law, and sometimes translated as a “certificate of indebtedness”. A “Schuldschein” is a bilateral loan, privately placed, unlisted and unregistered.They are not securities as the debt is legally constituted by the underlying loan agreement, rather than by the certificate of indebtedness itself. Historically, the largest category of issuers of a “Schuldschein” has been German public authorities, although the market has also been tapped by other borrowers.