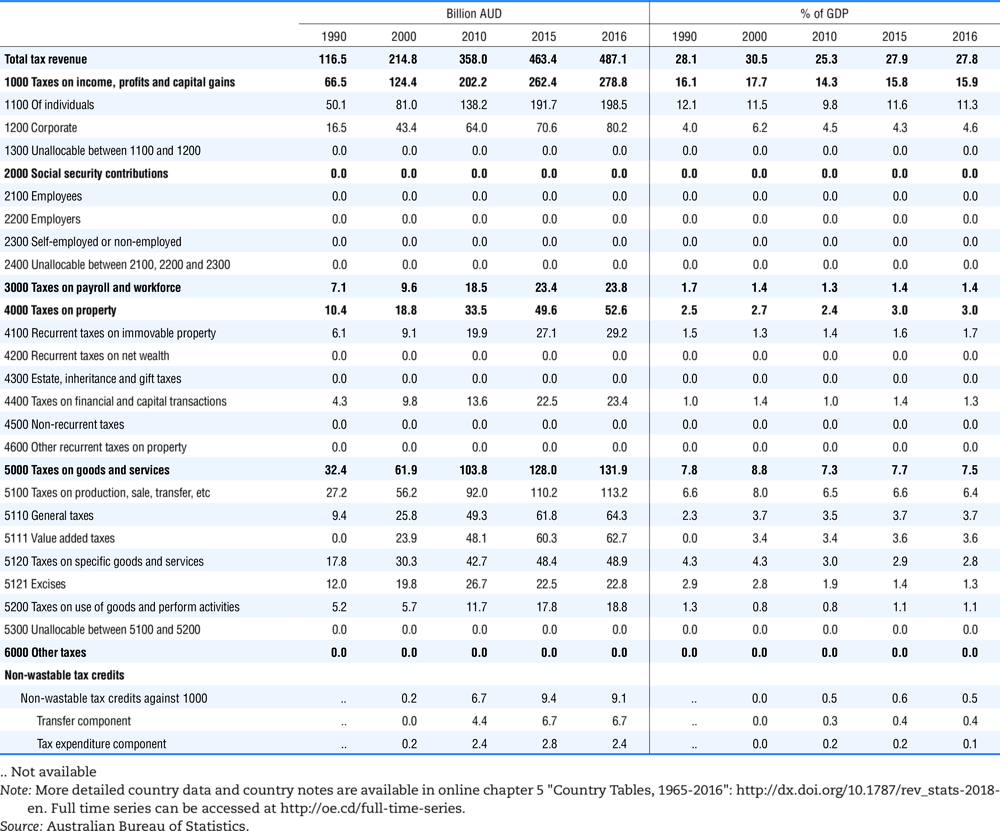

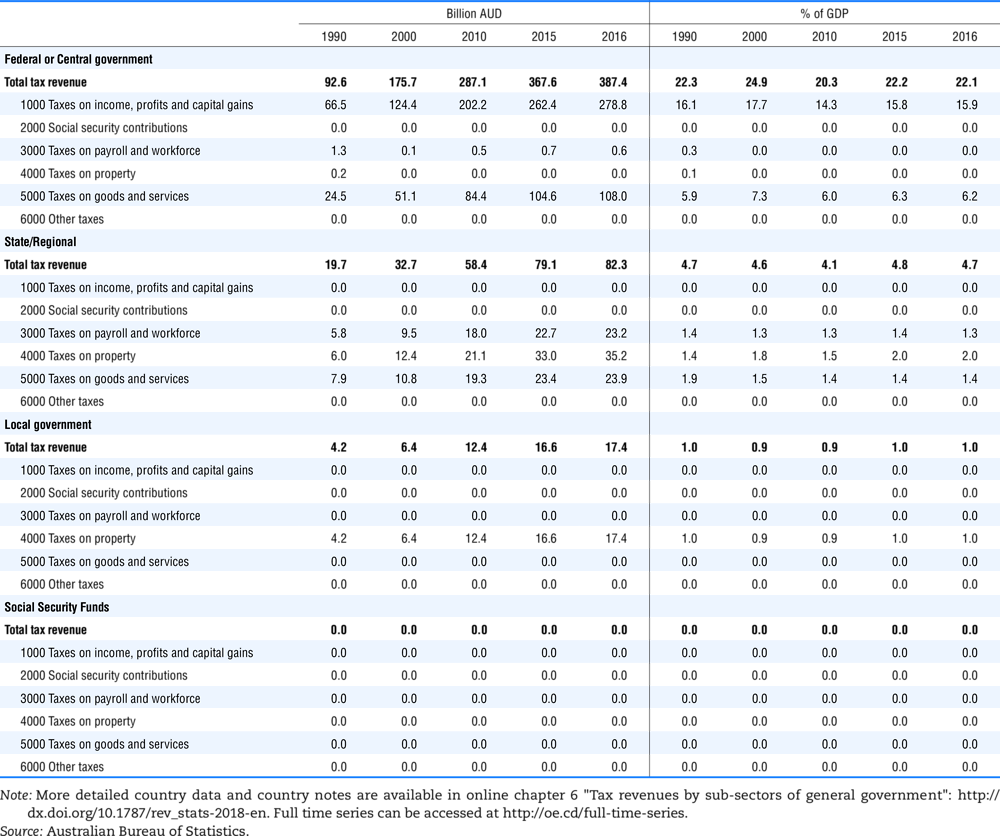

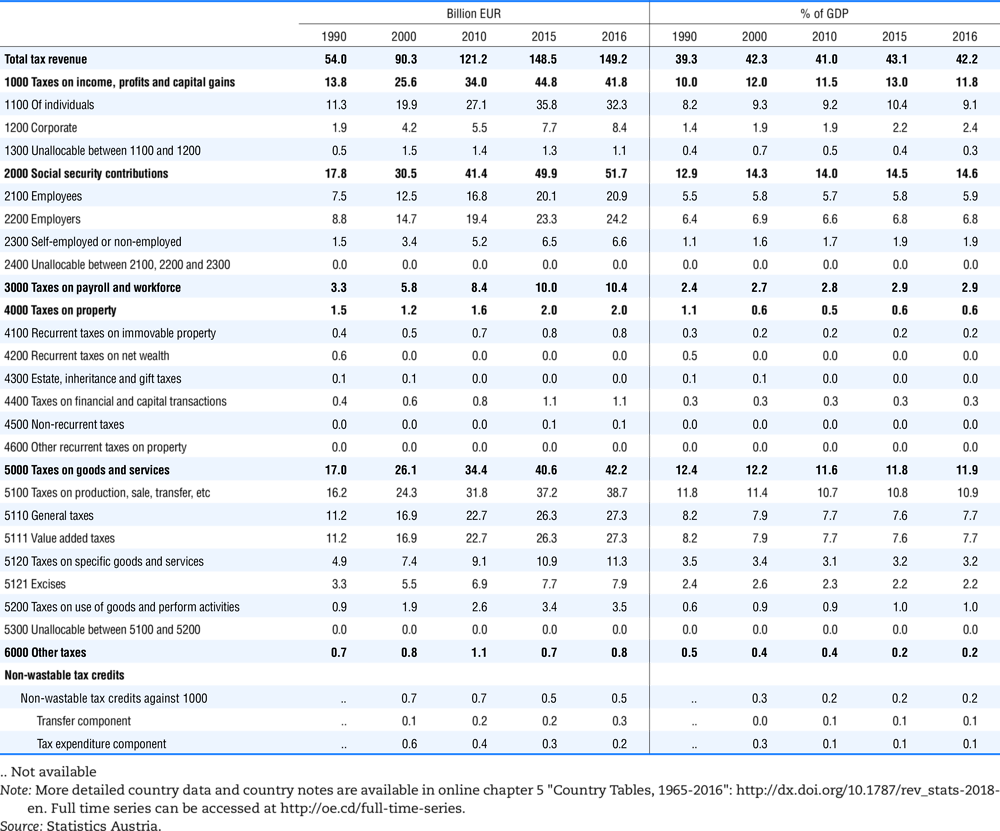

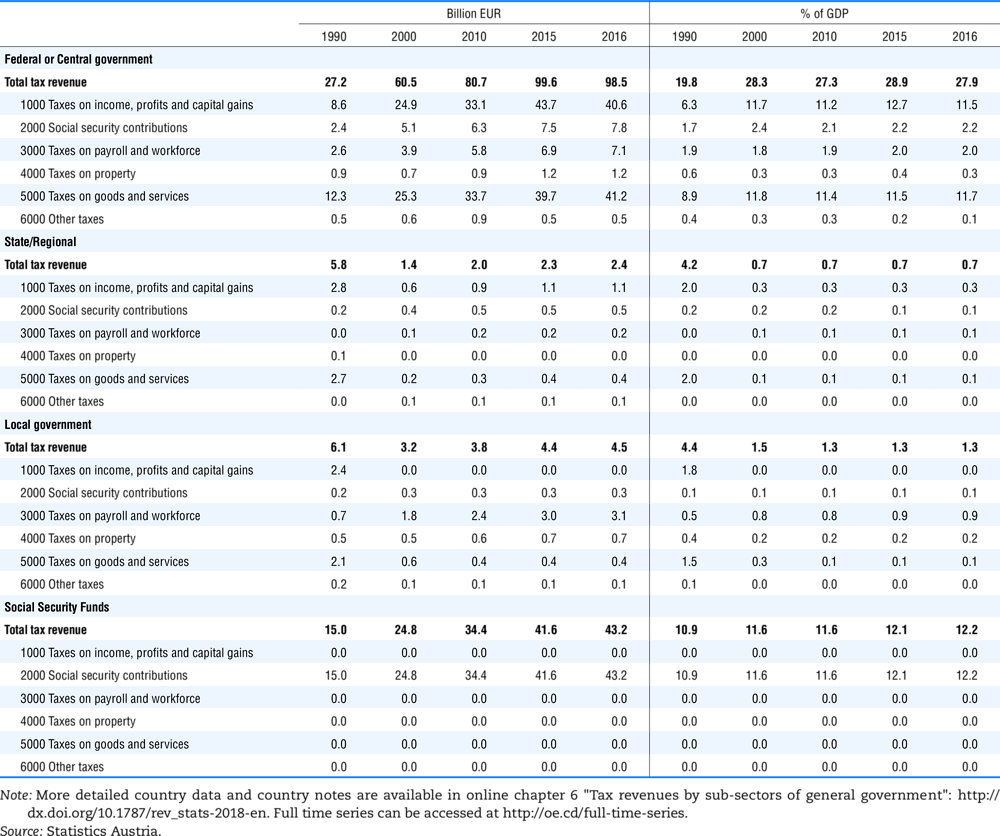

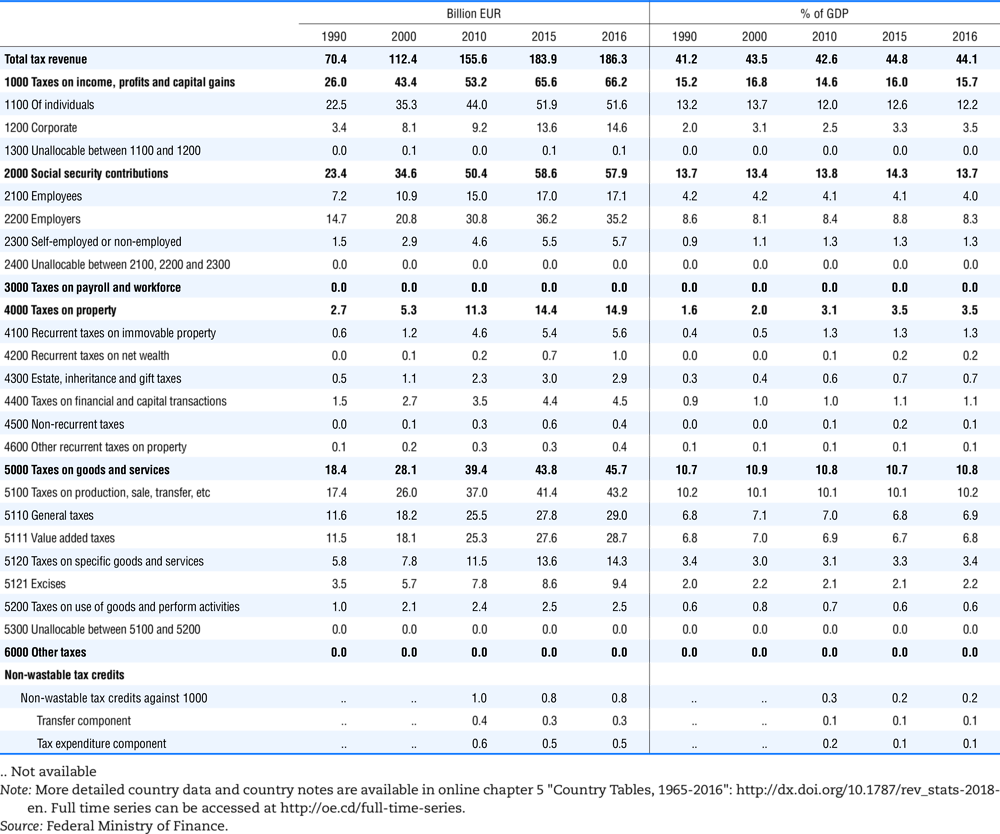

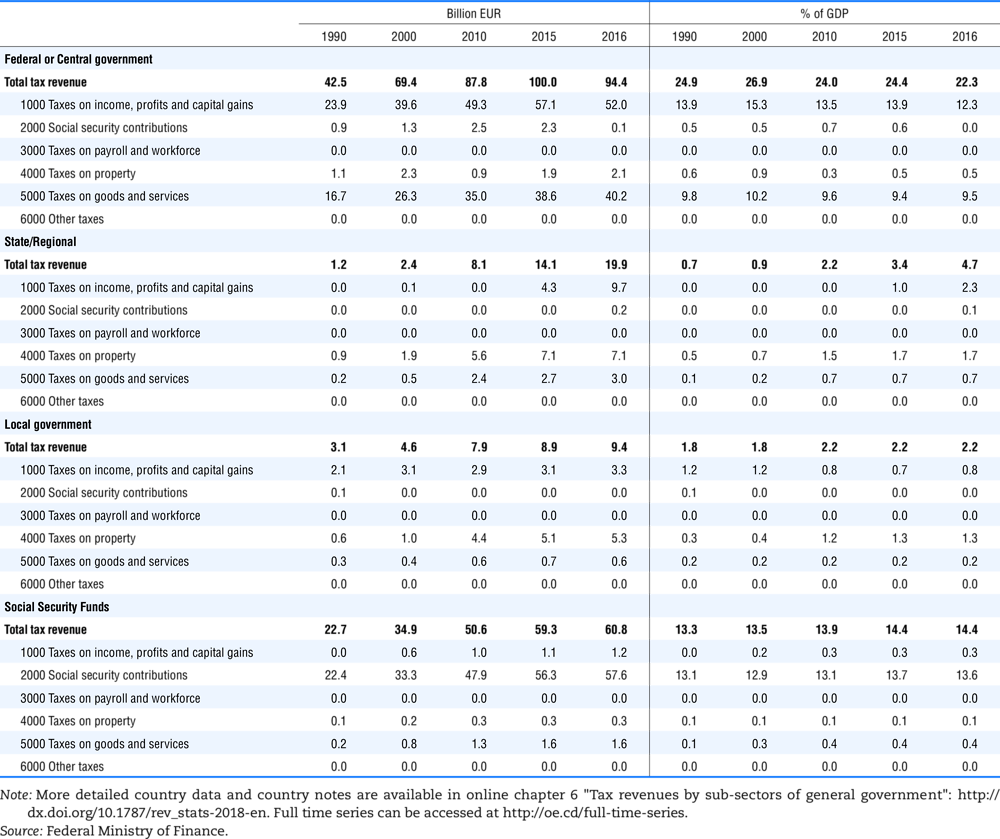

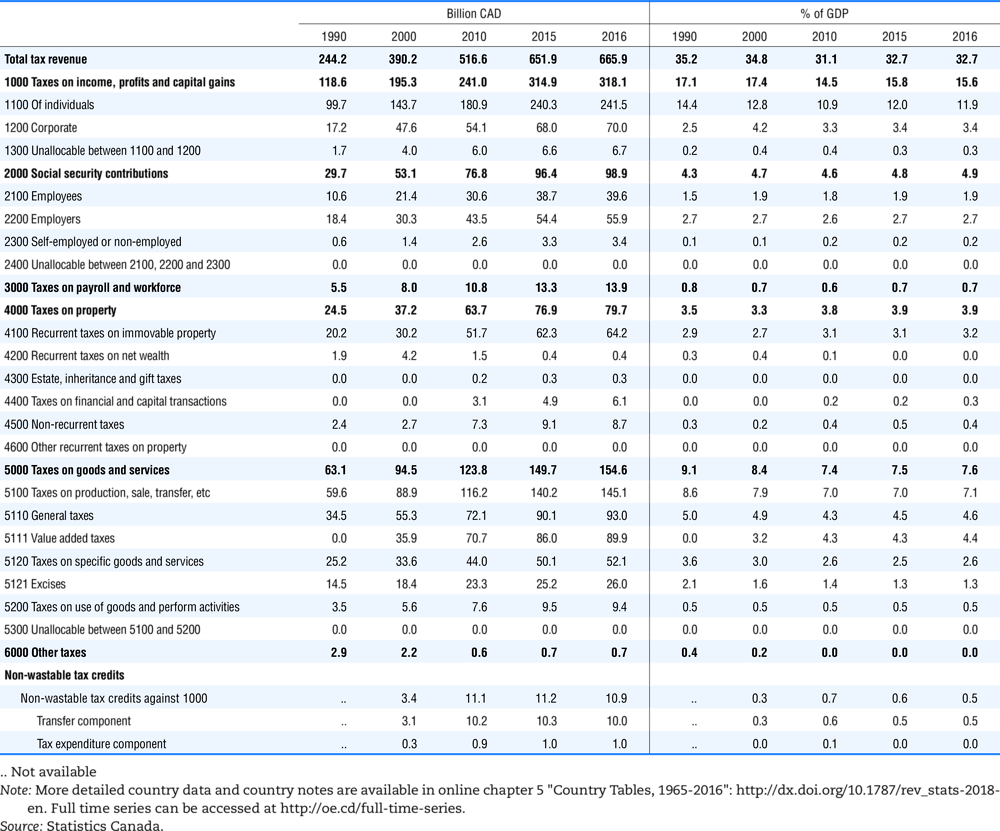

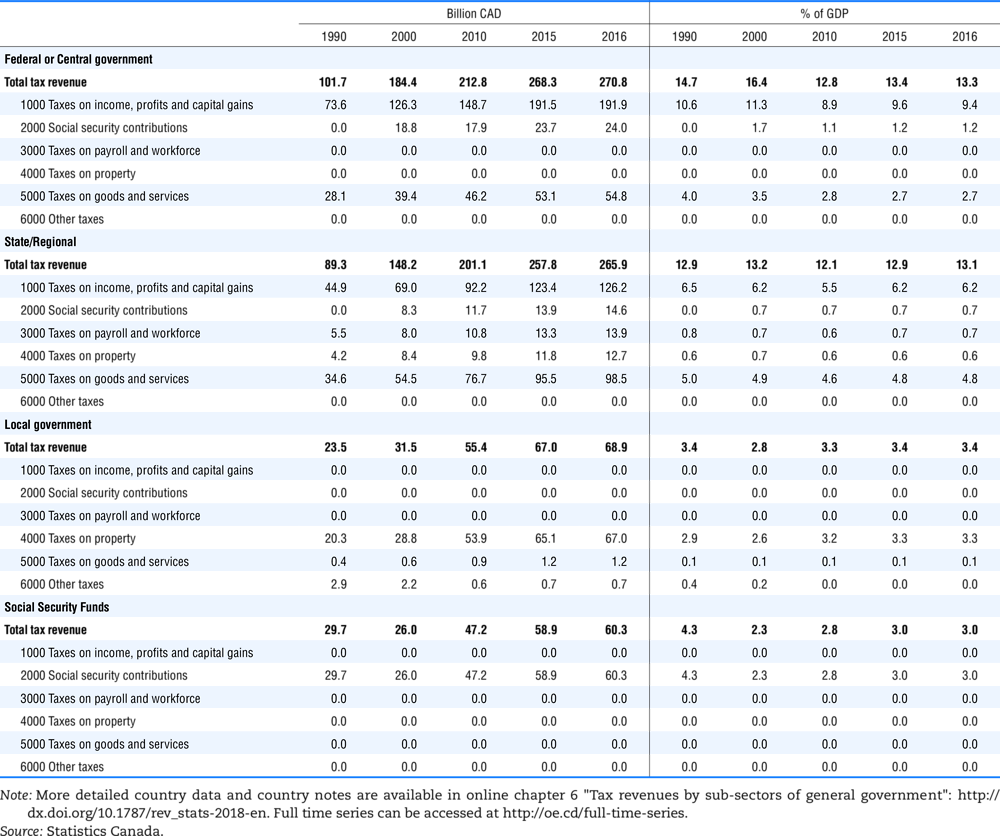

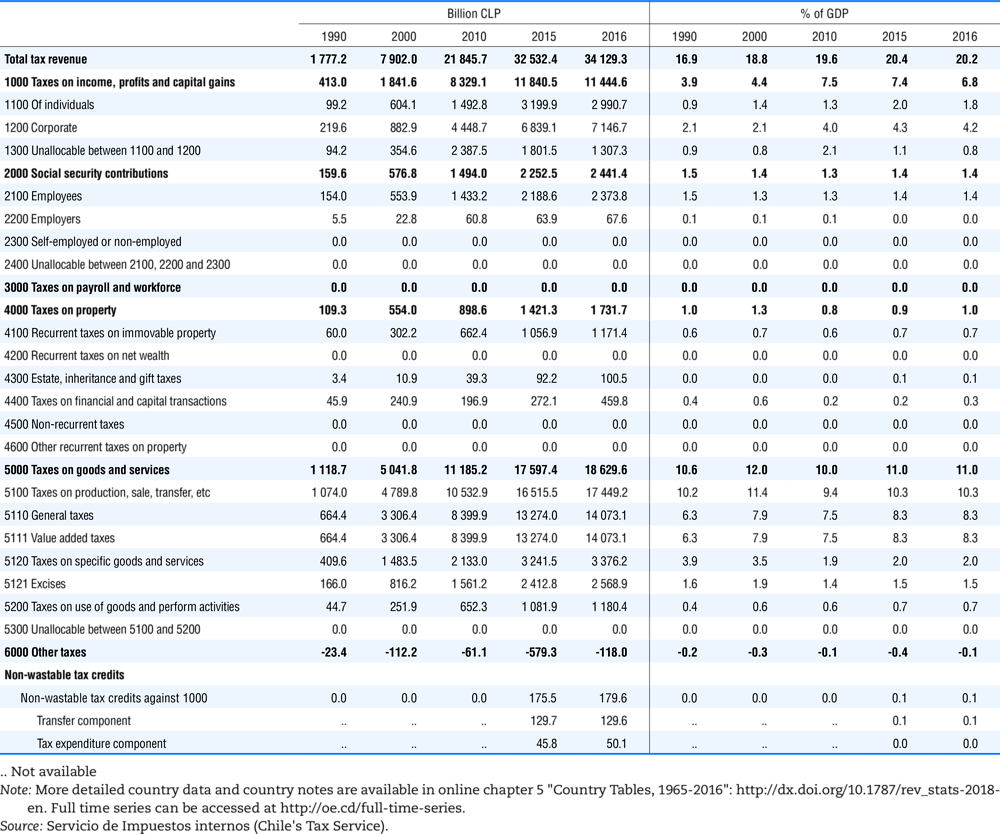

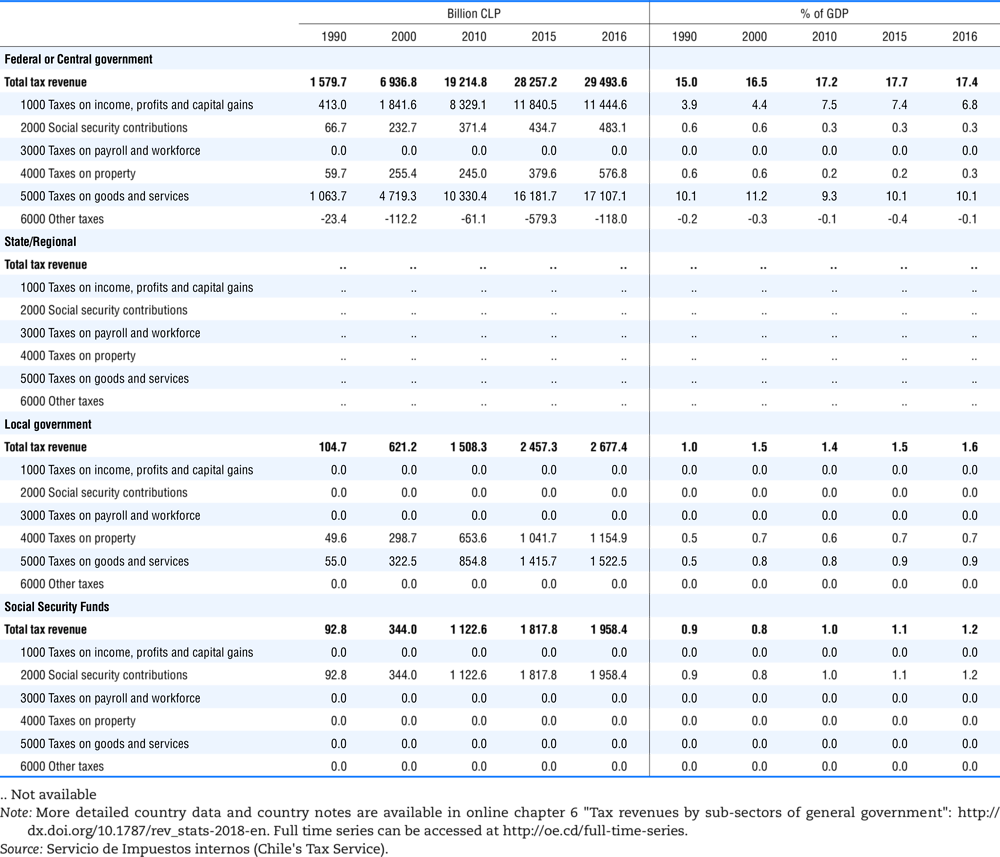

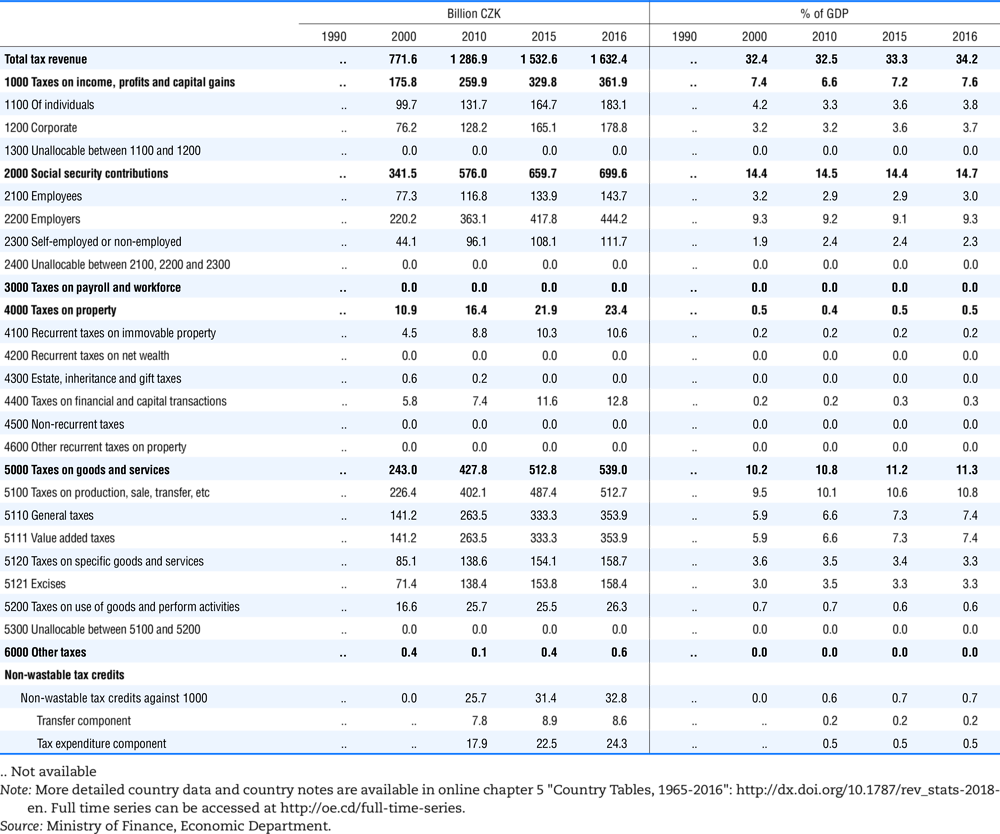

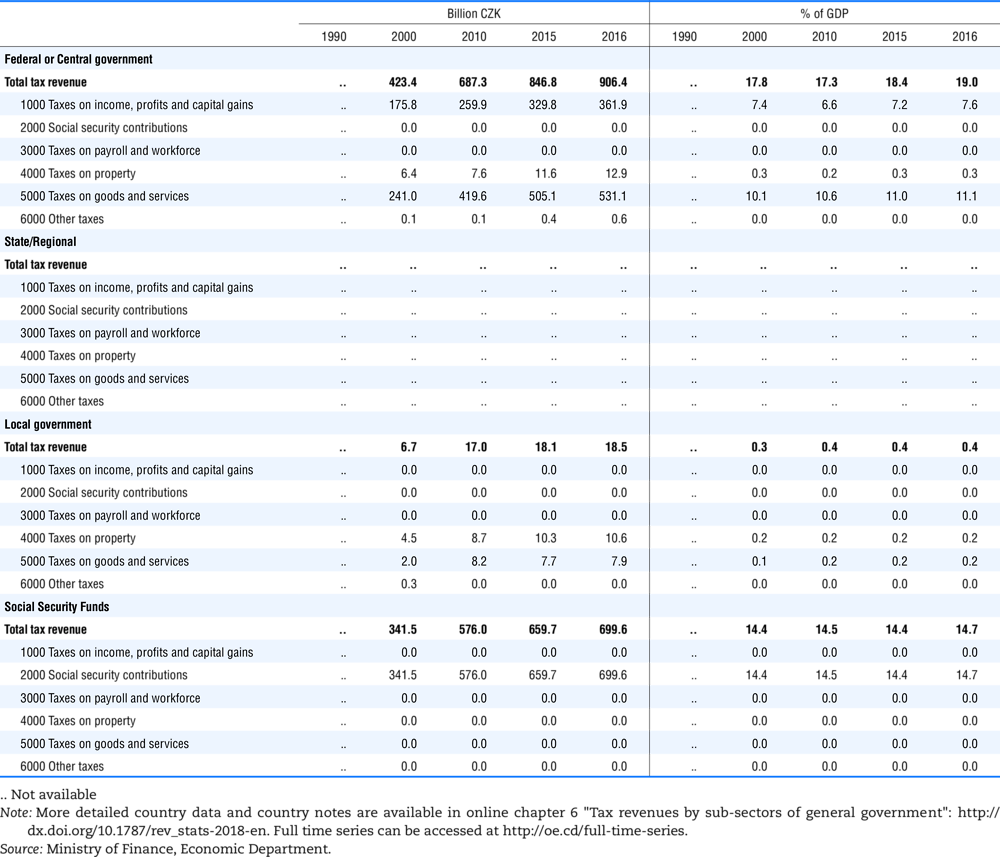

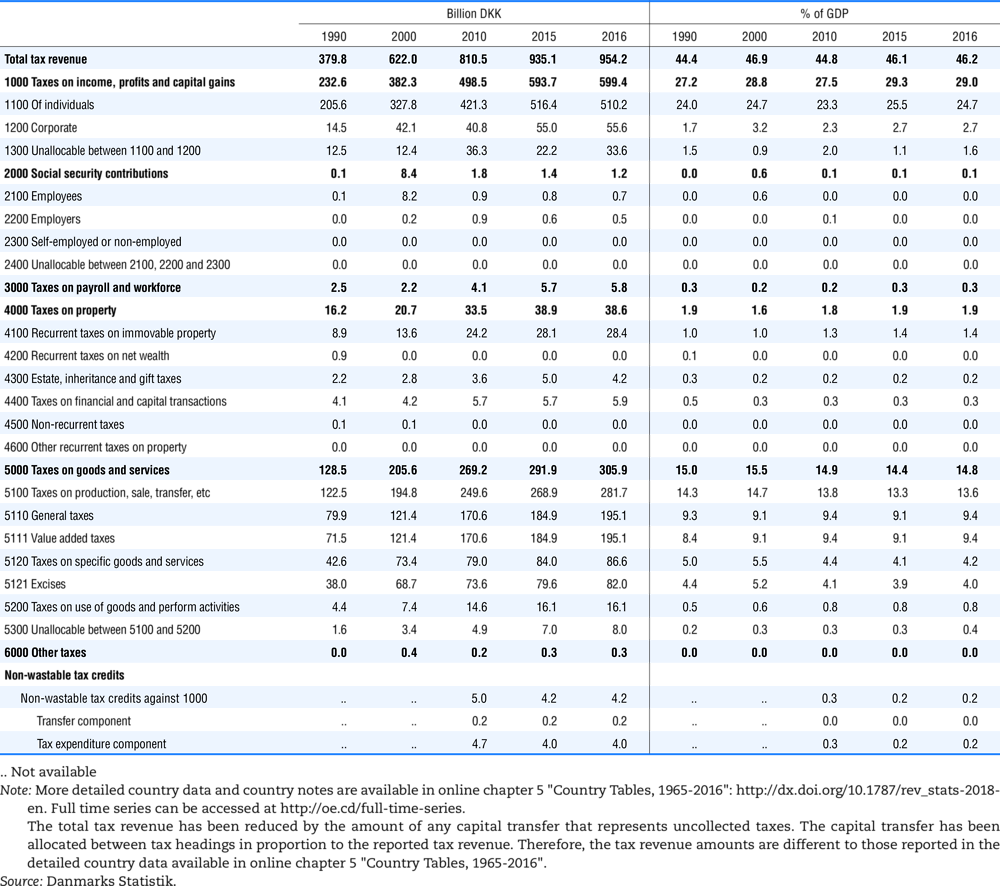

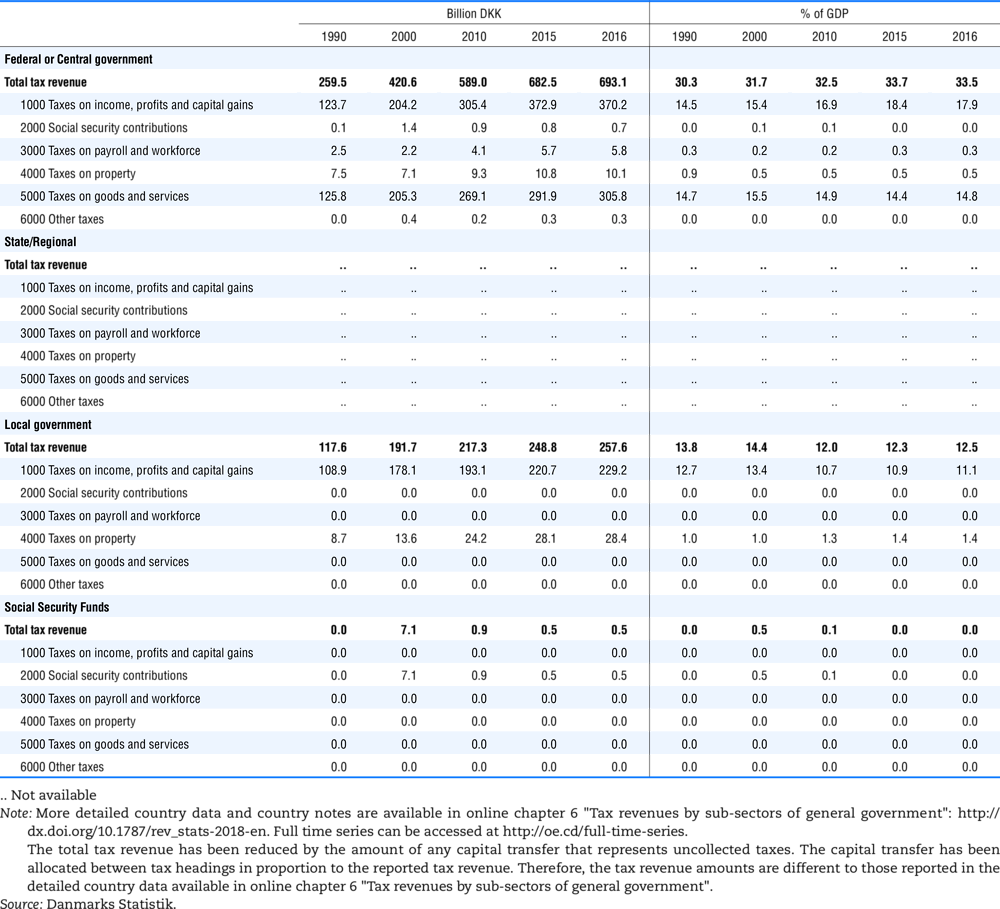

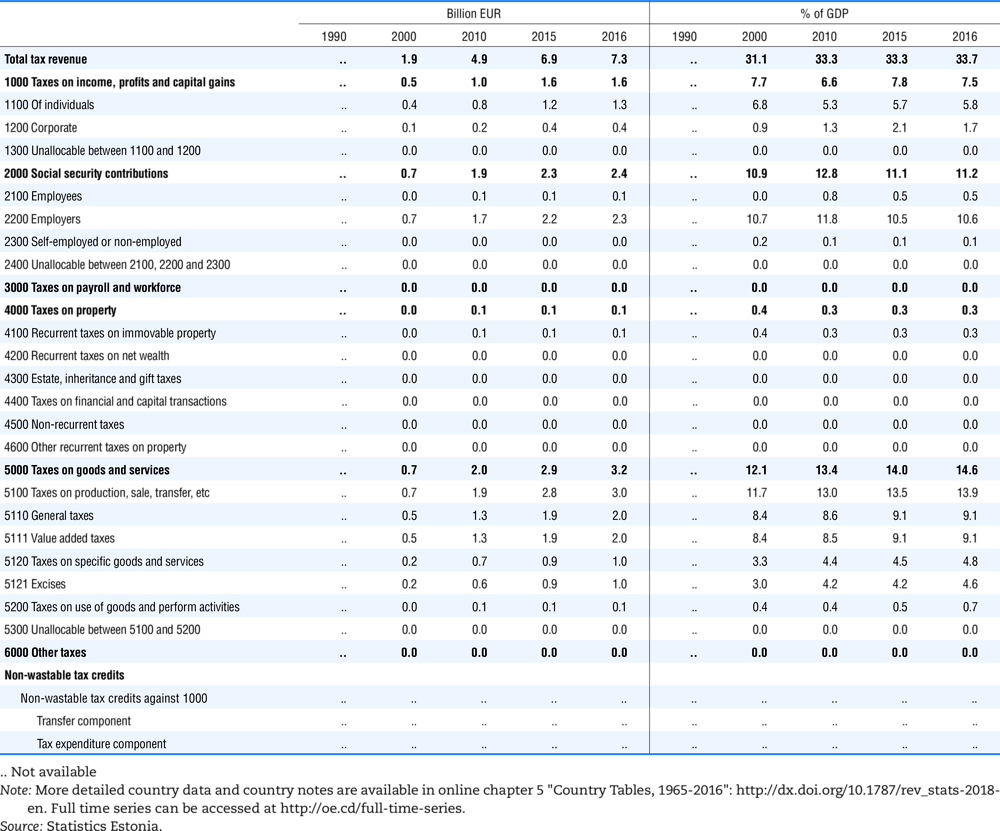

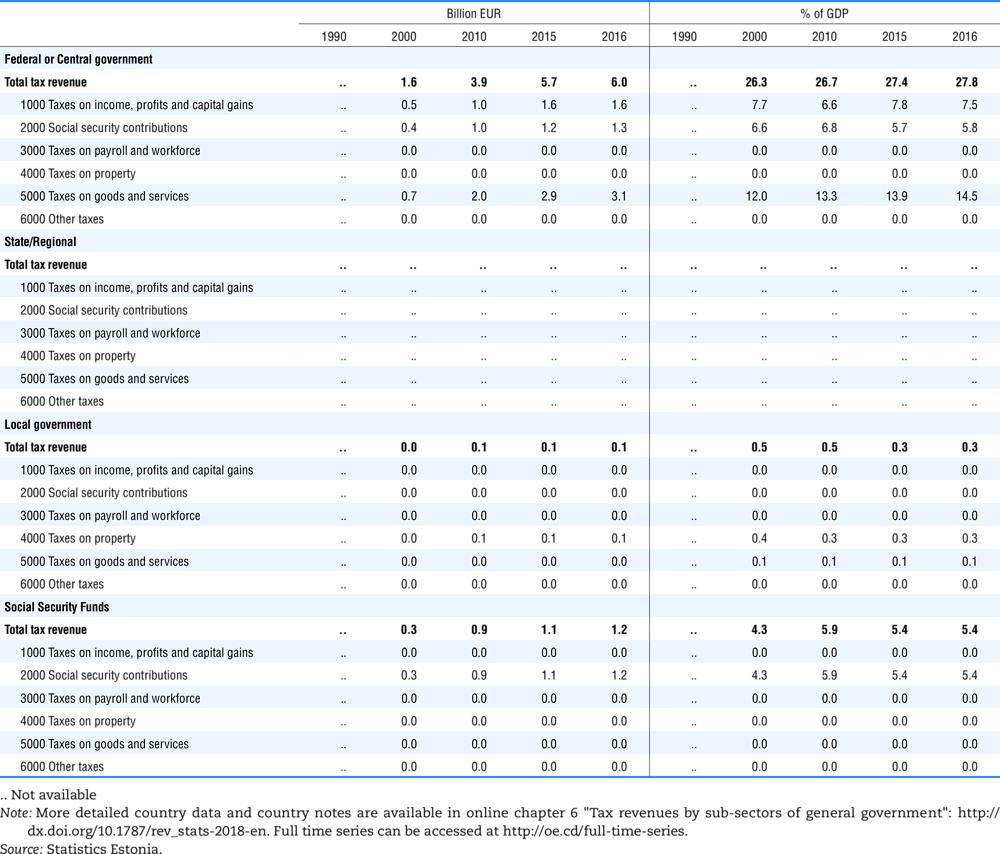

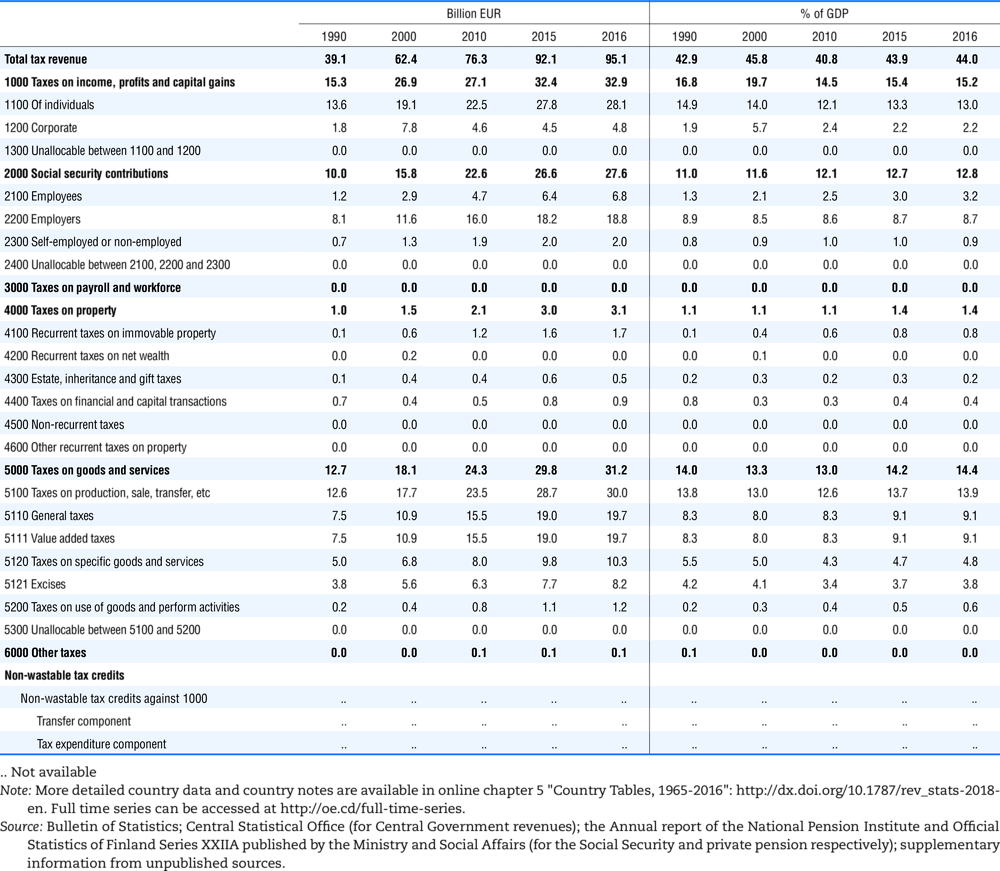

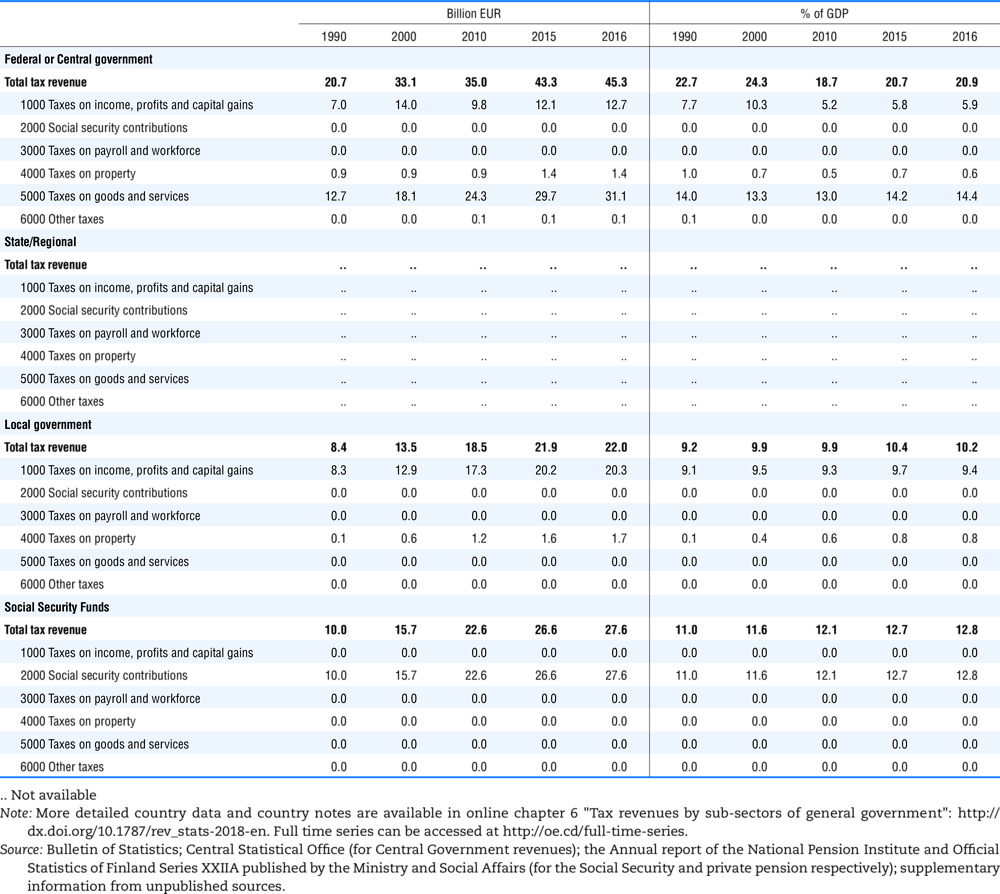

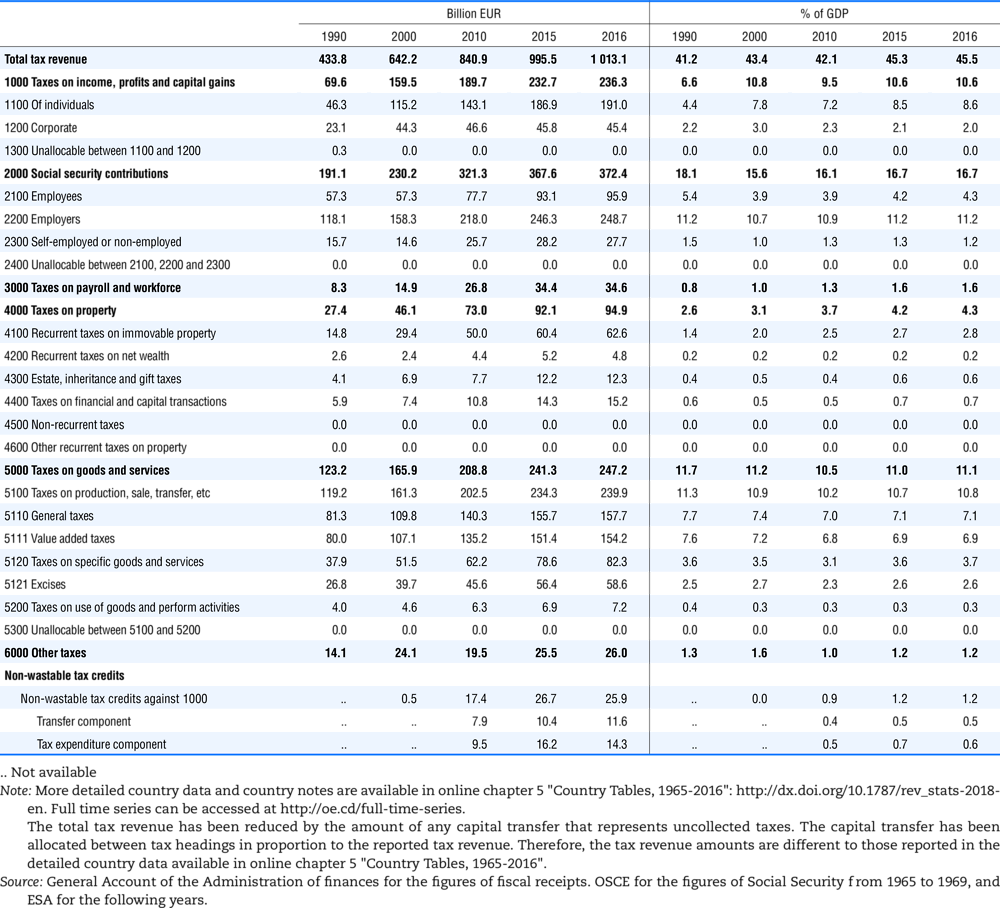

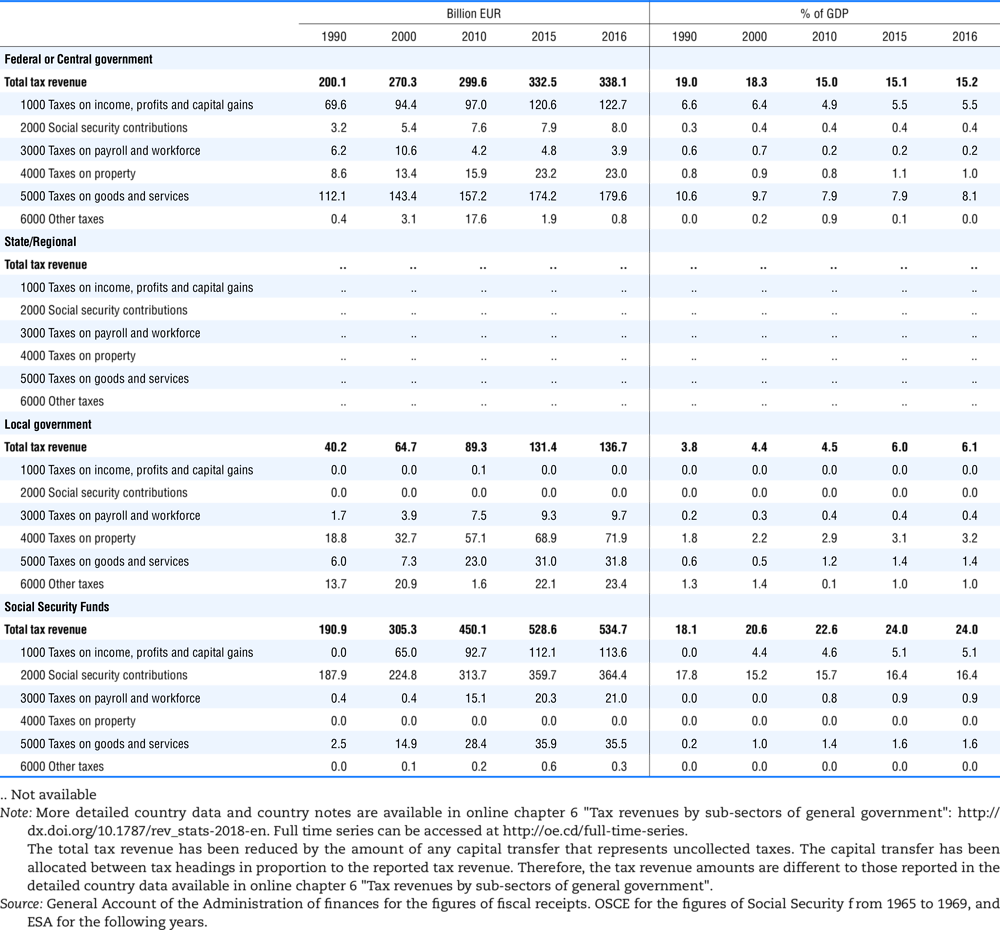

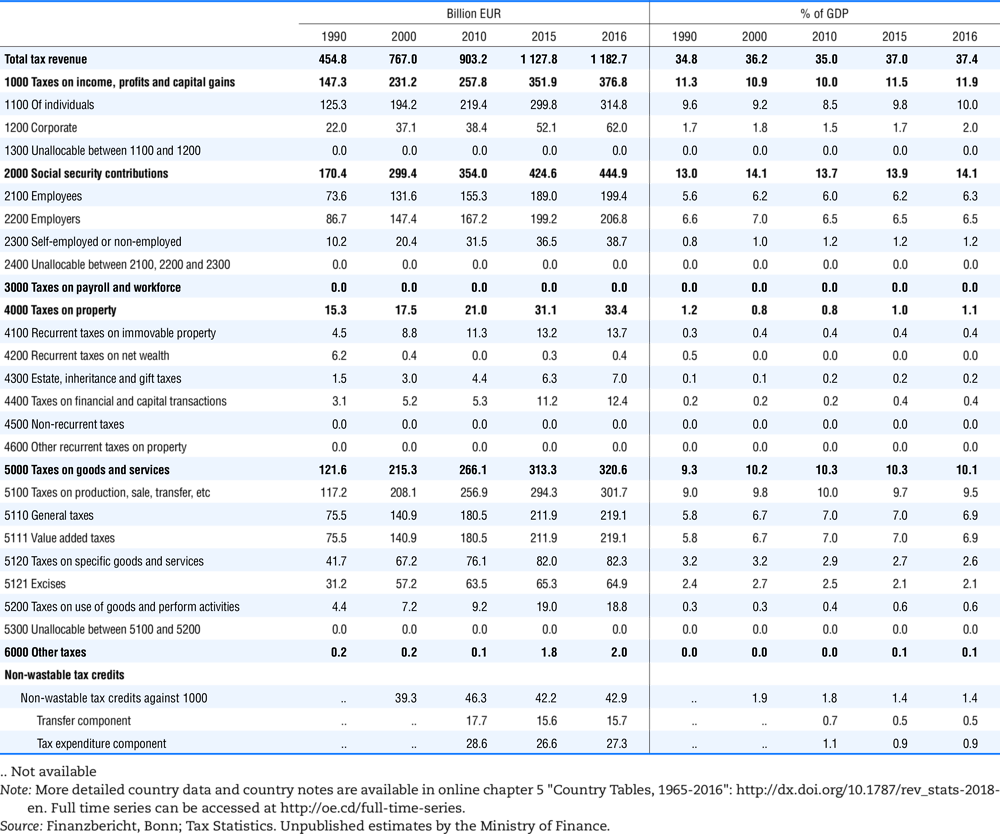

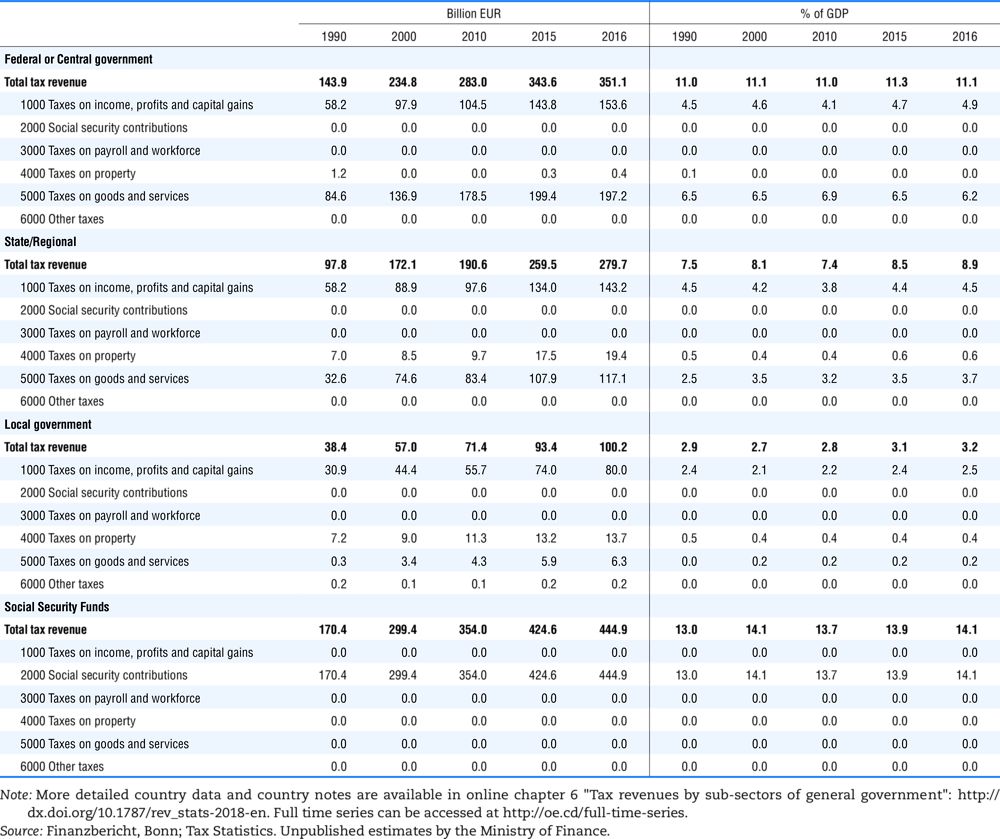

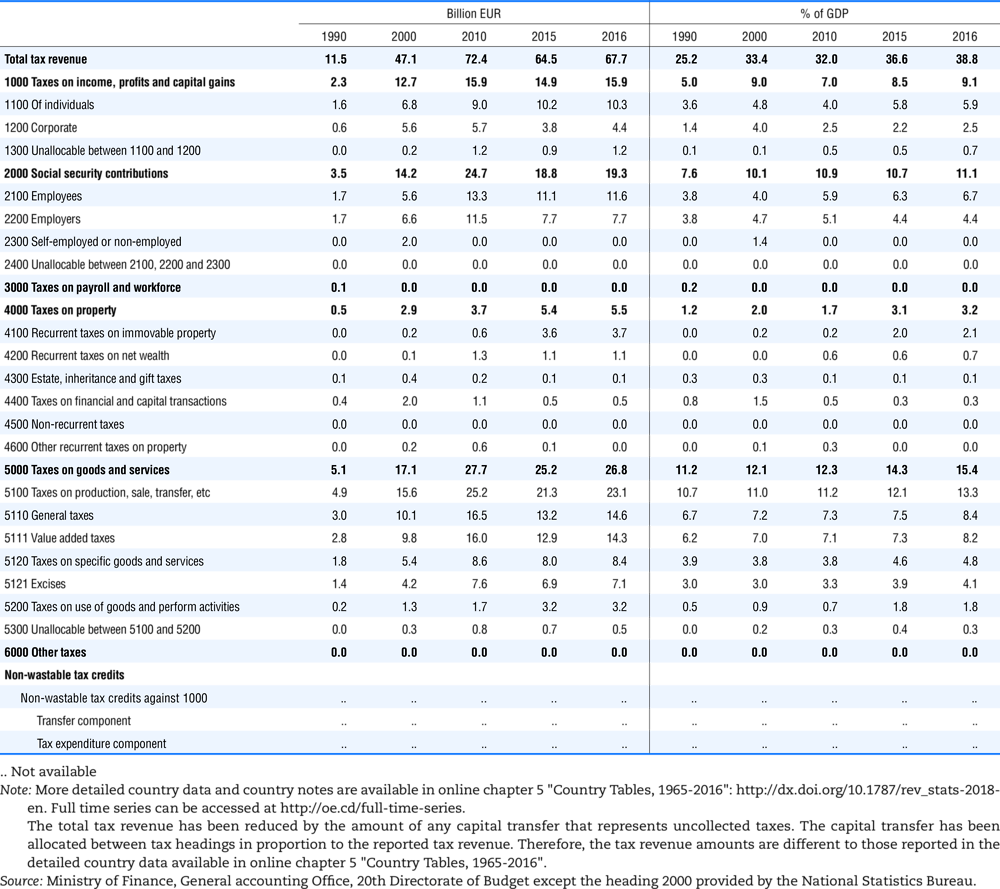

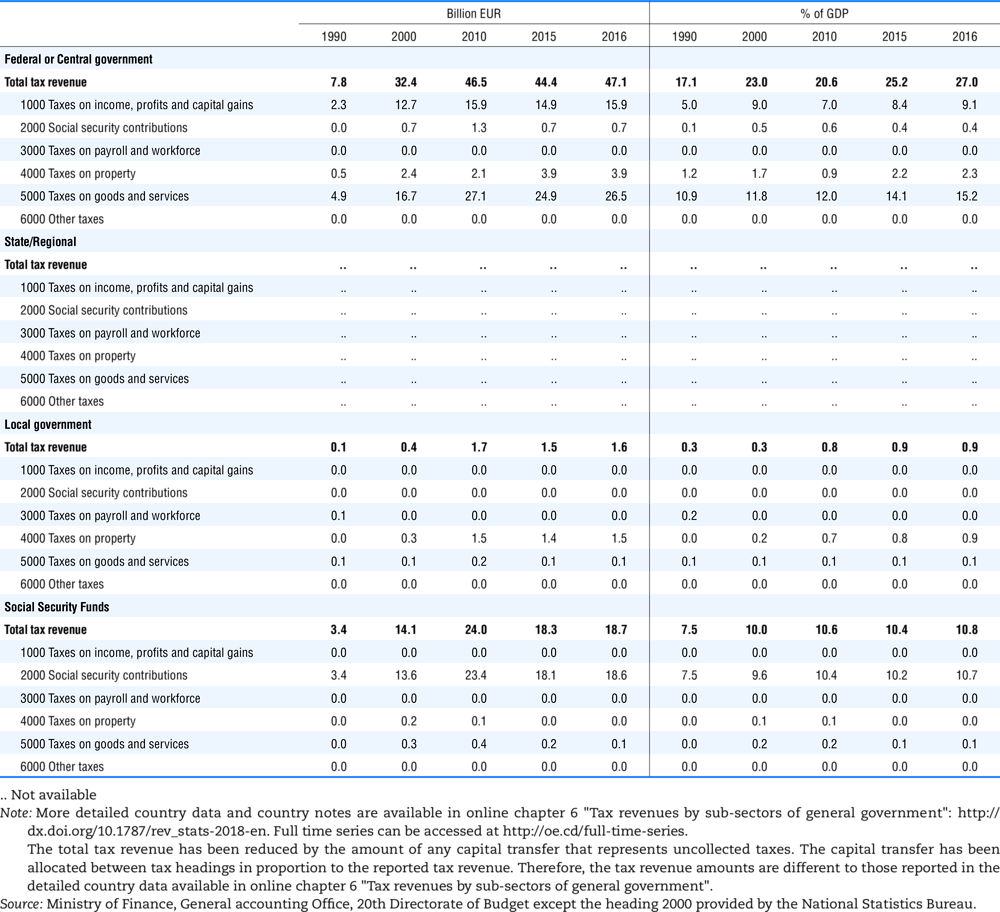

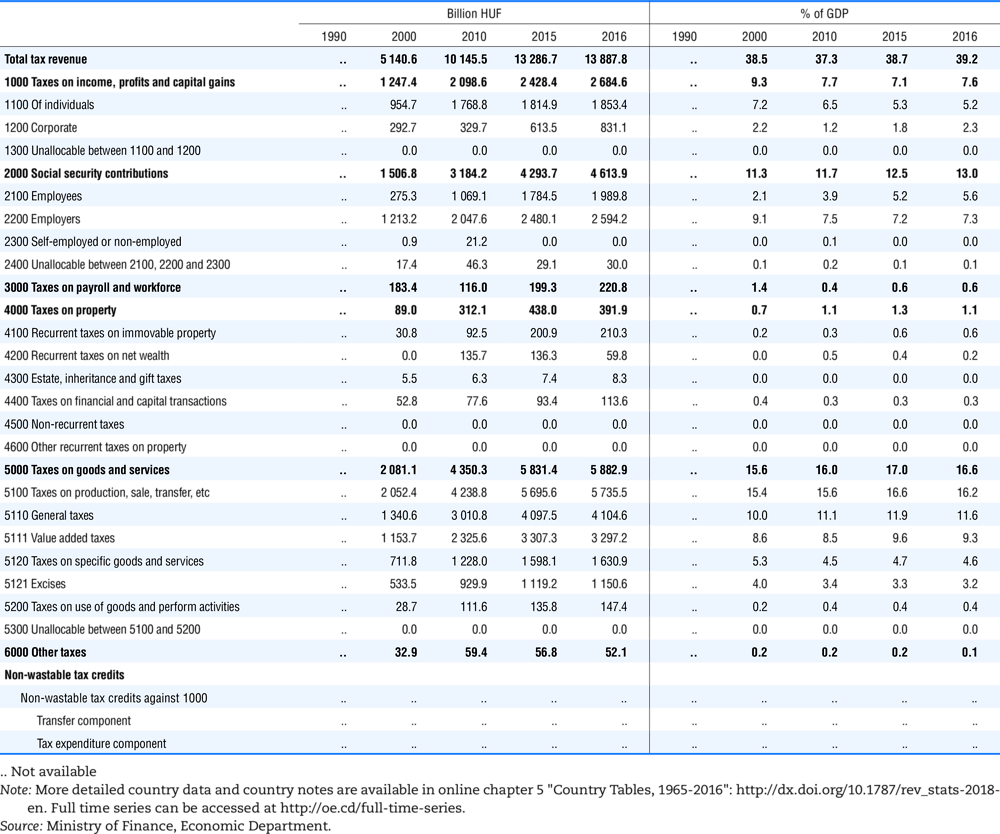

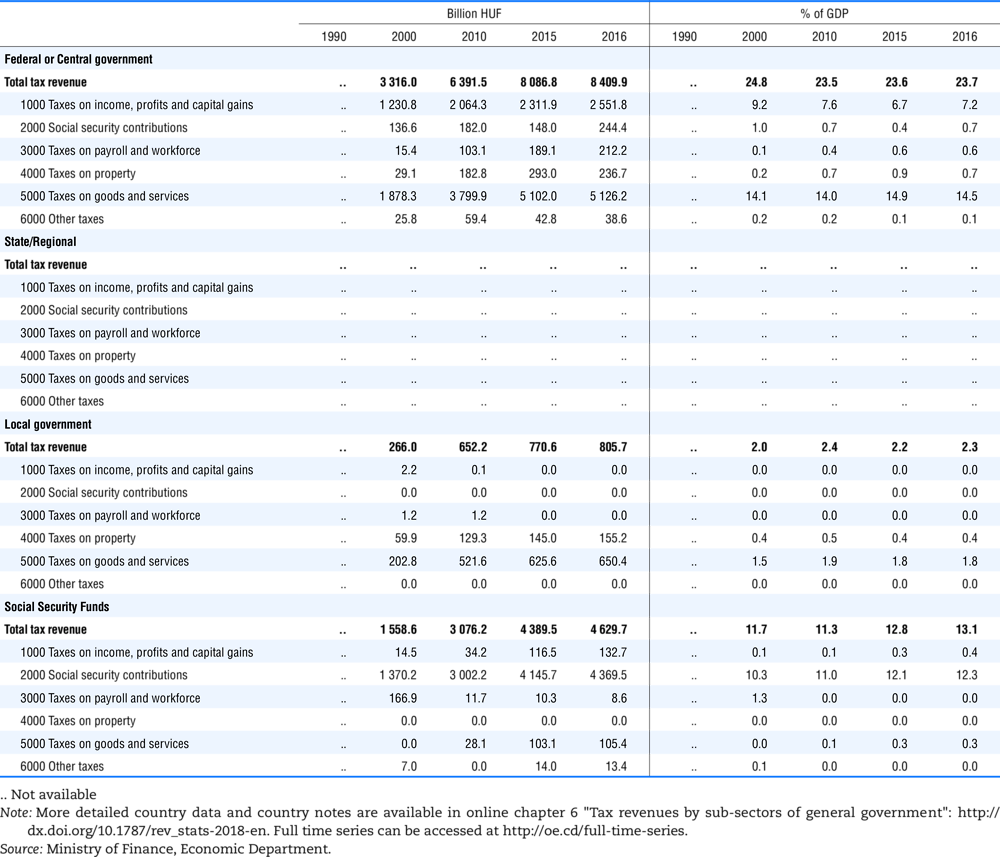

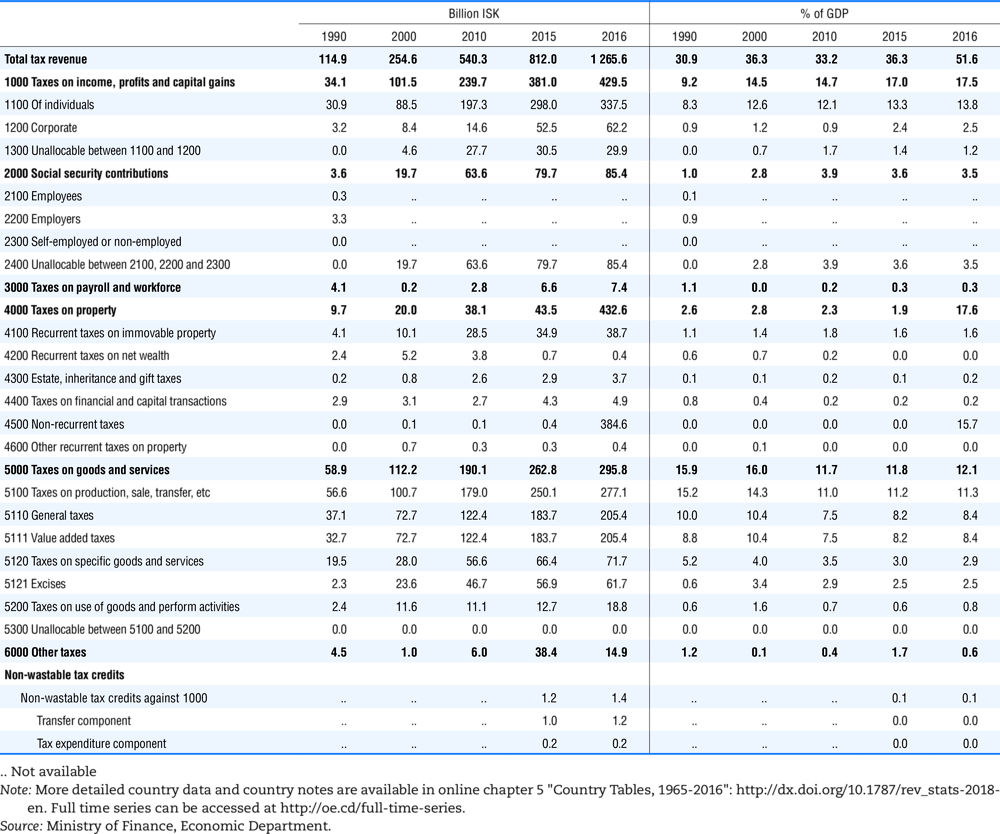

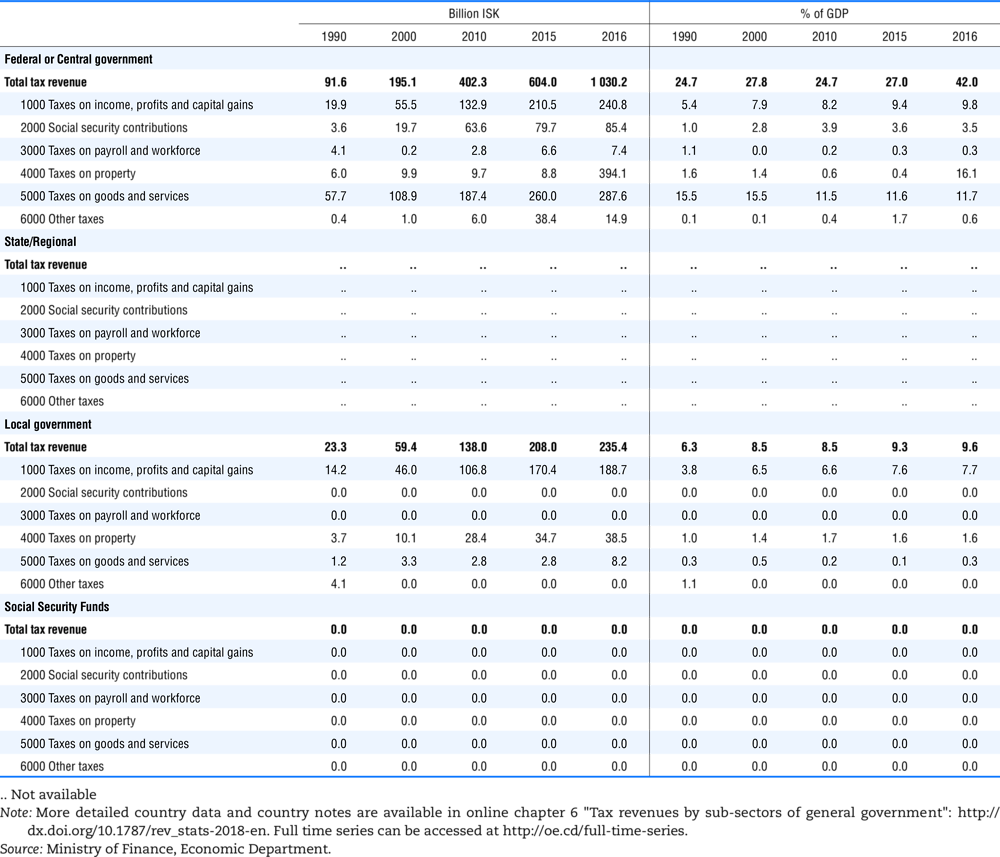

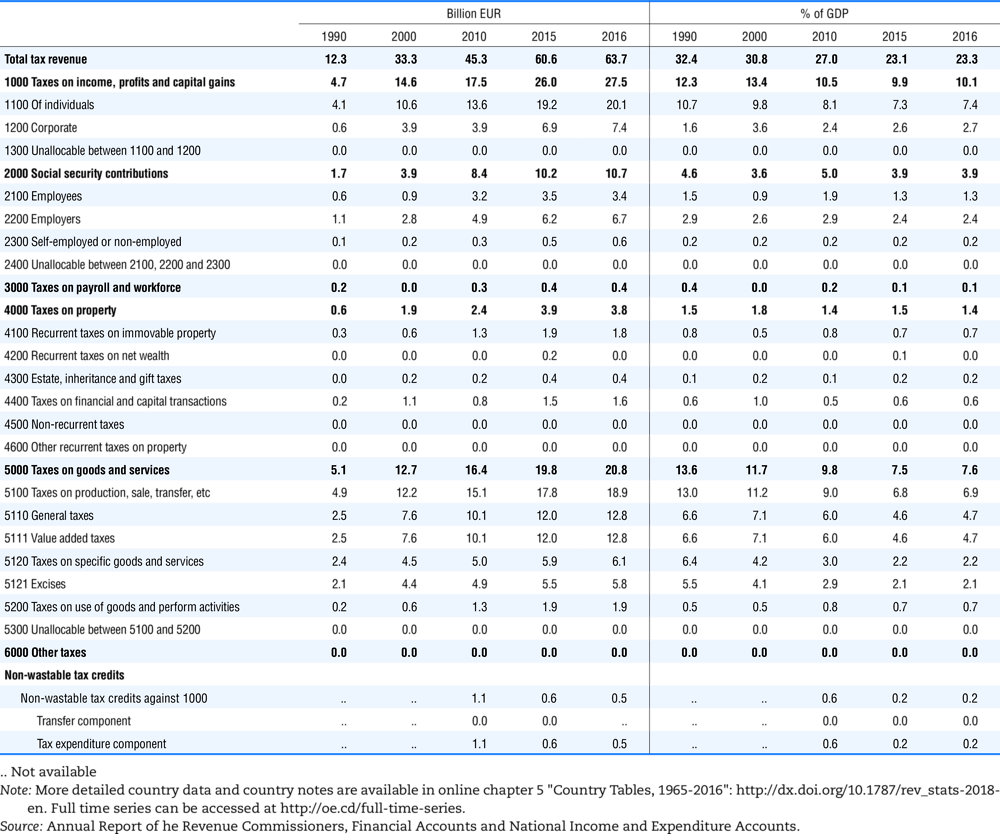

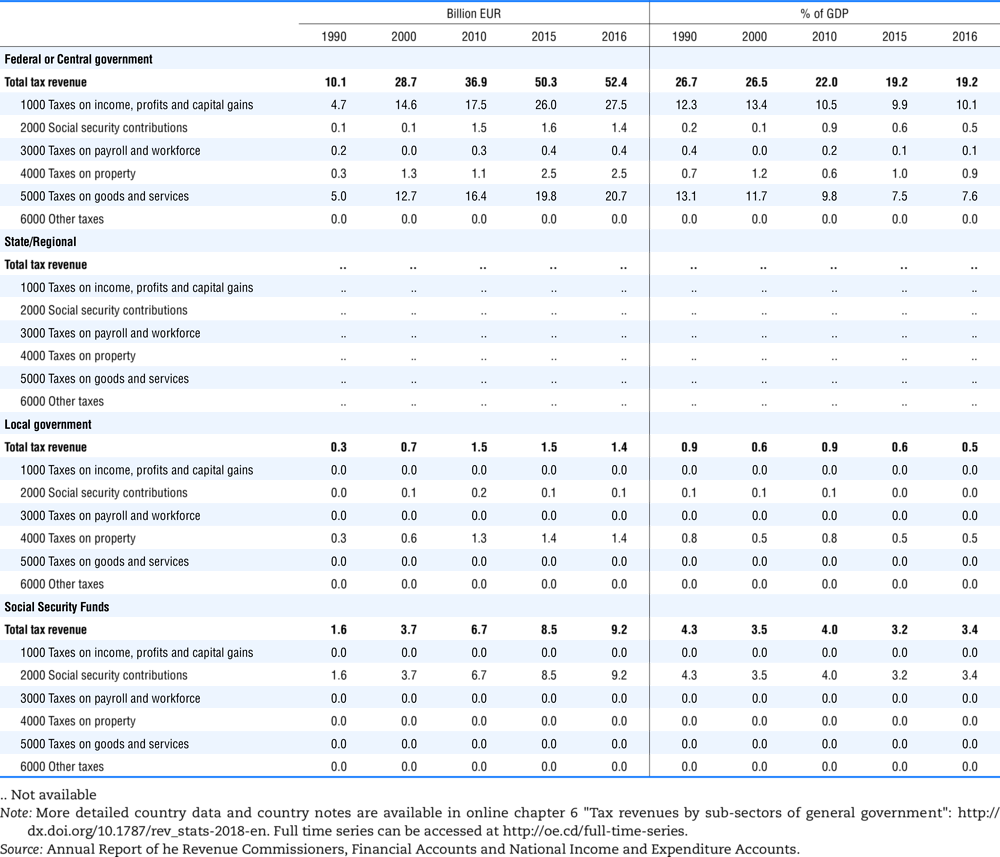

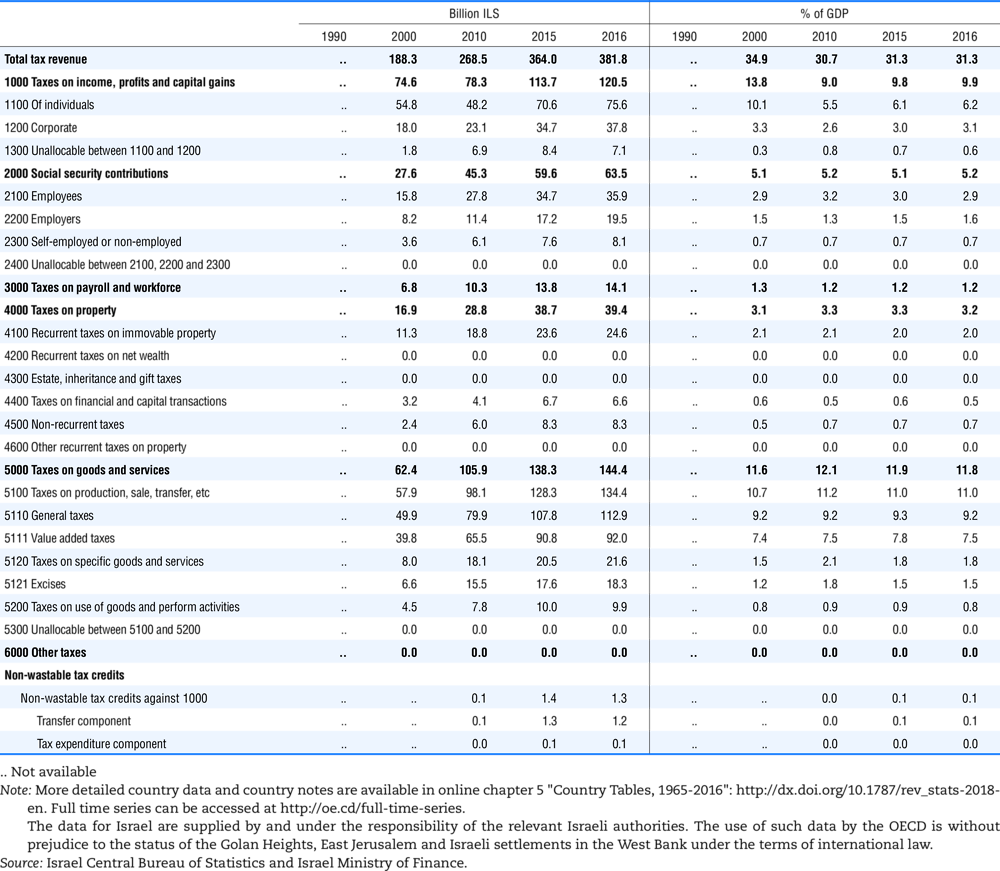

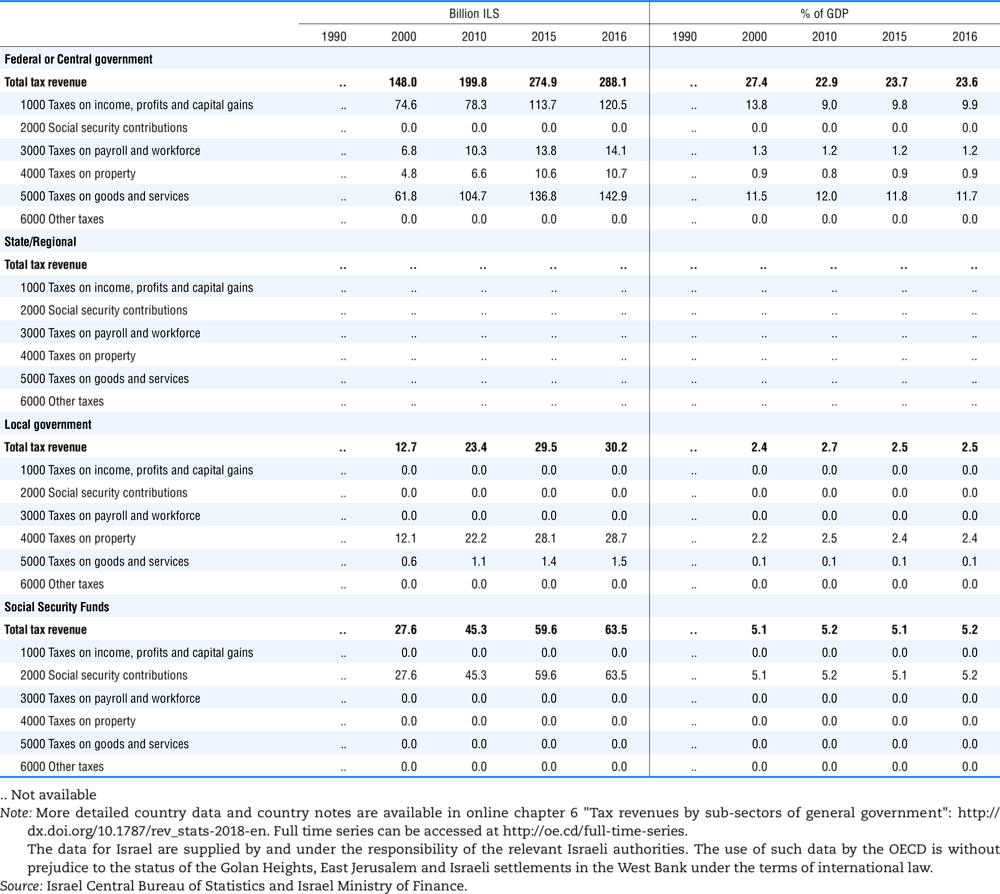

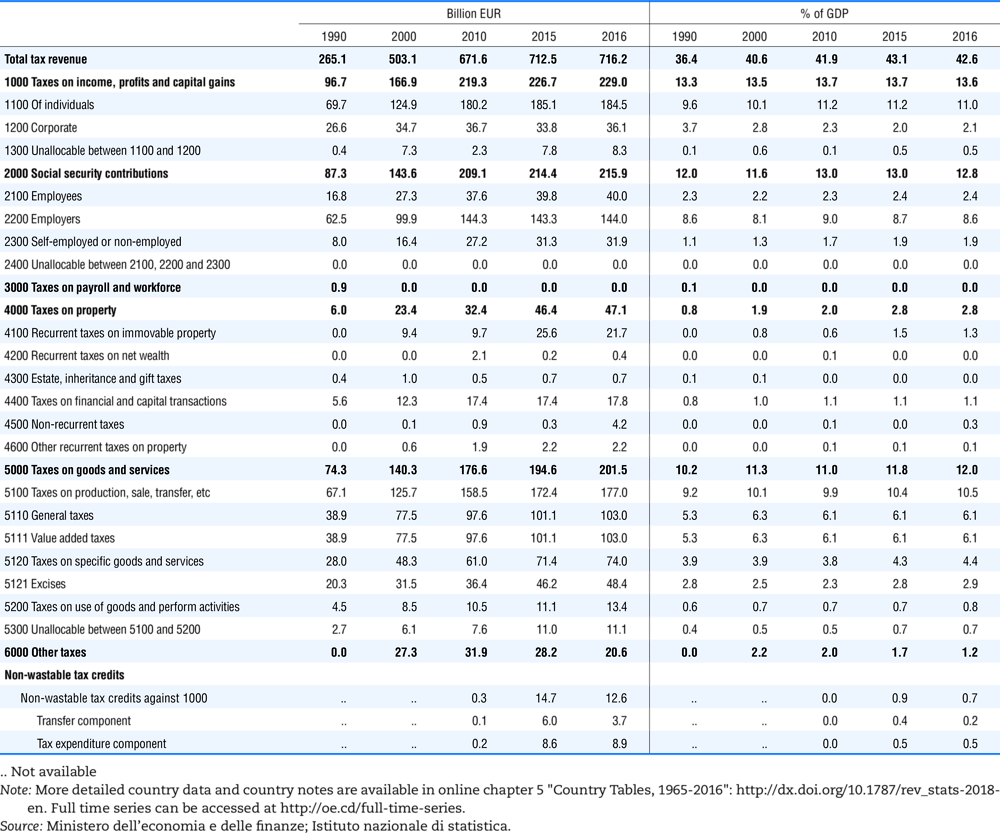

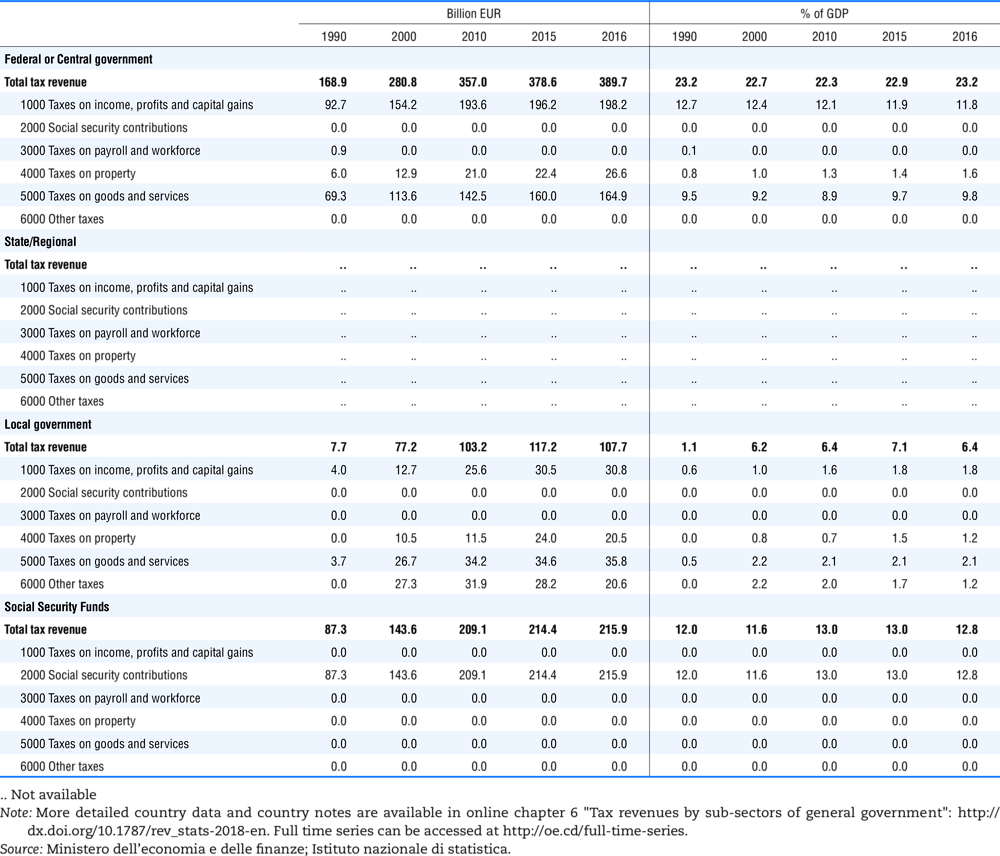

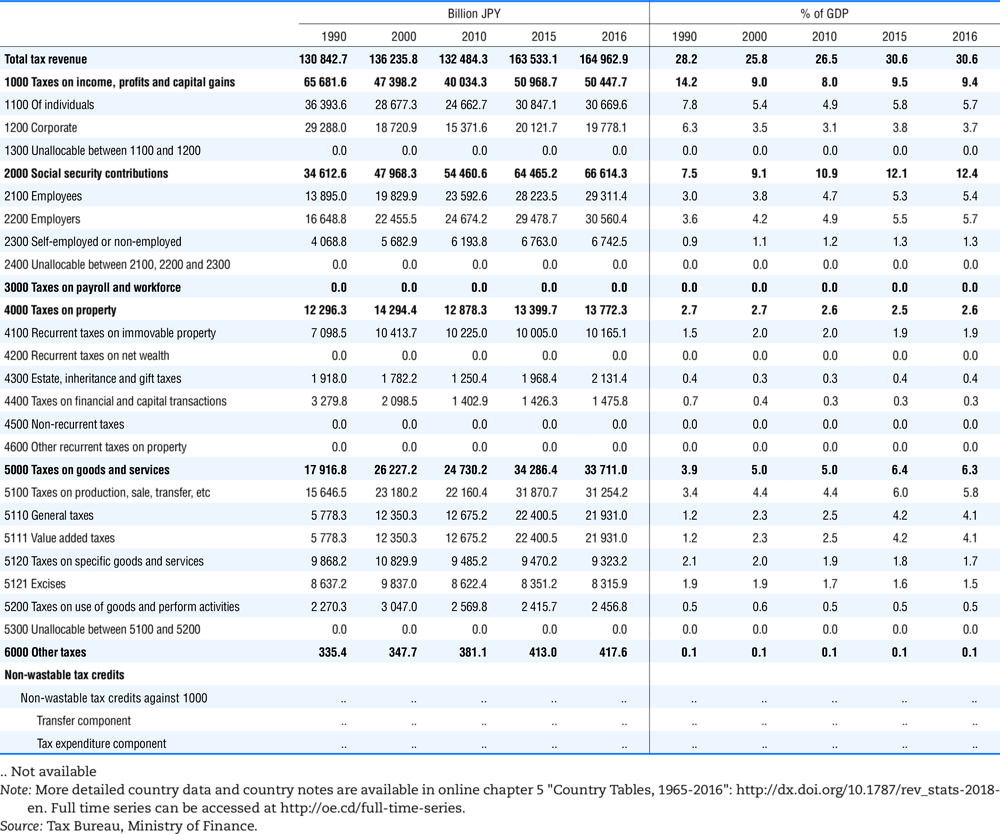

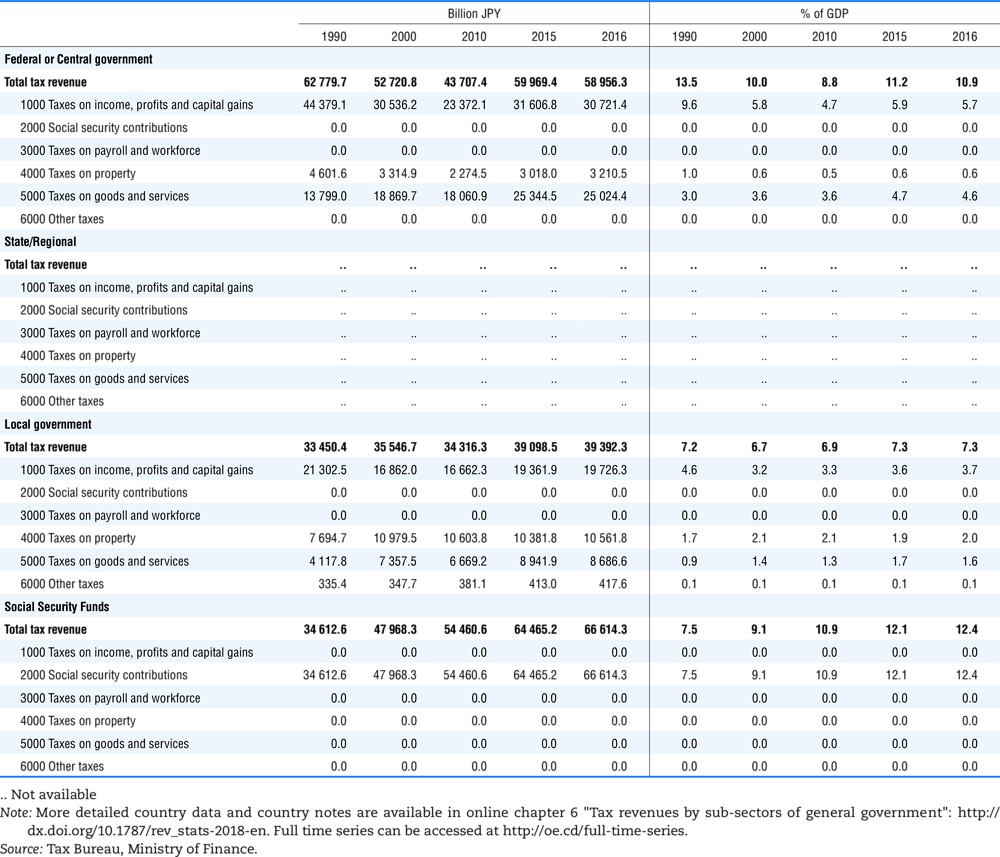

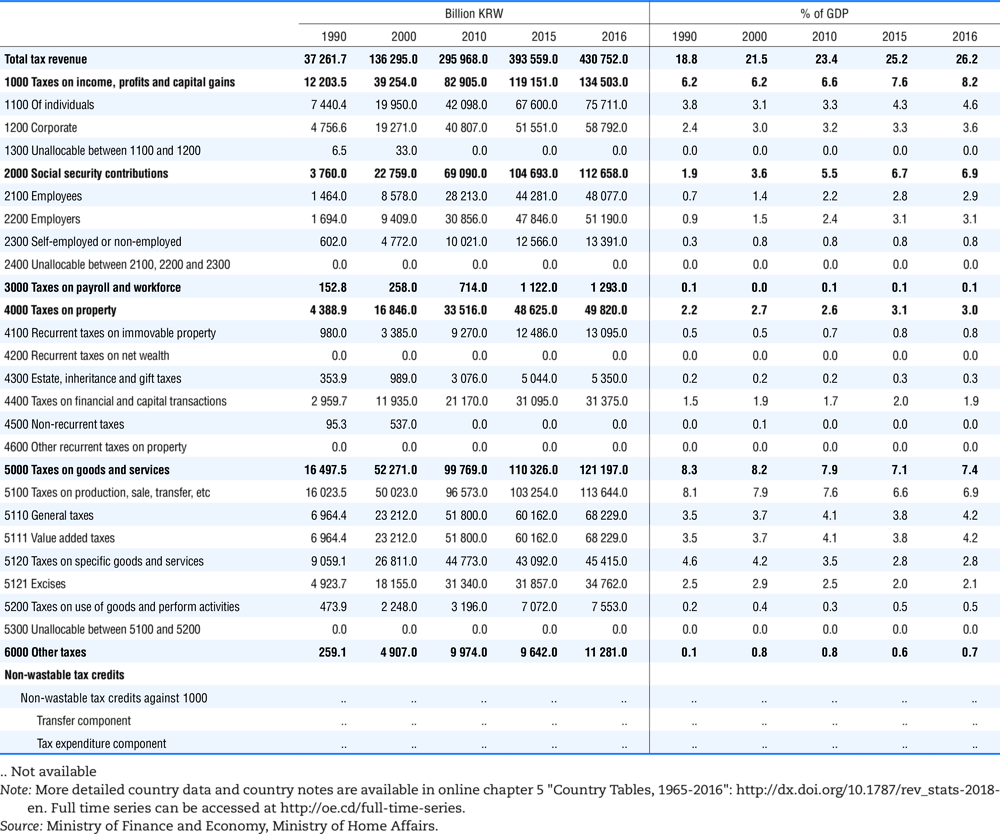

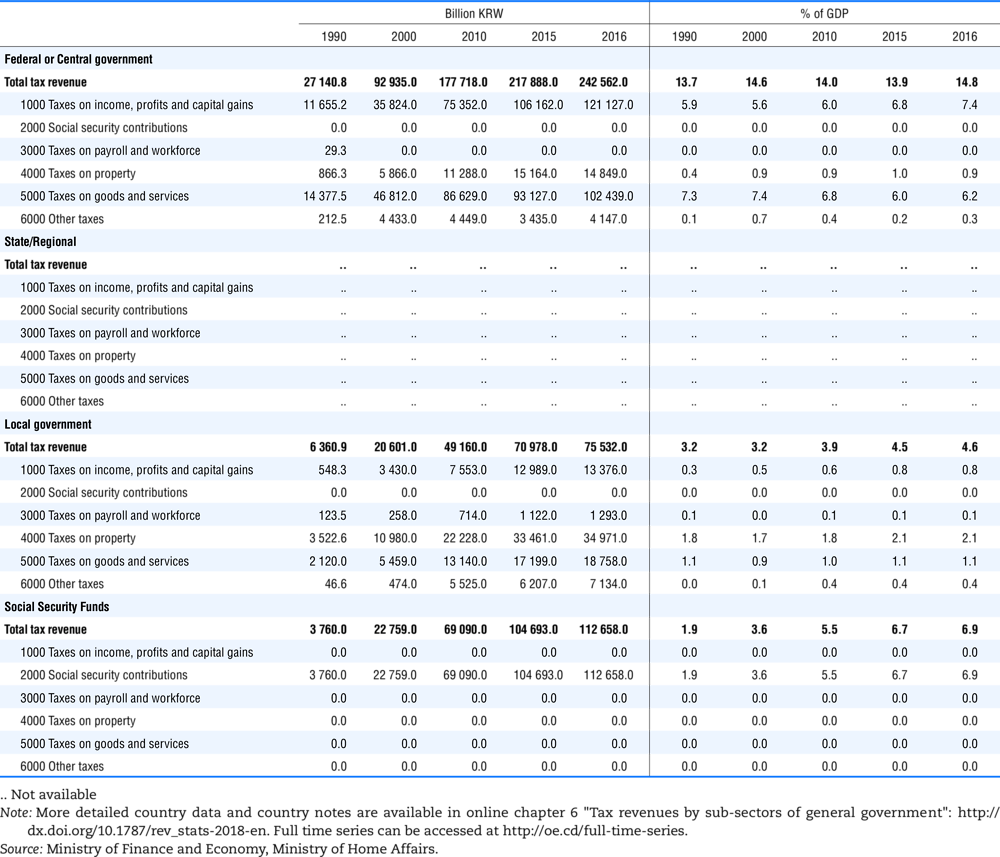

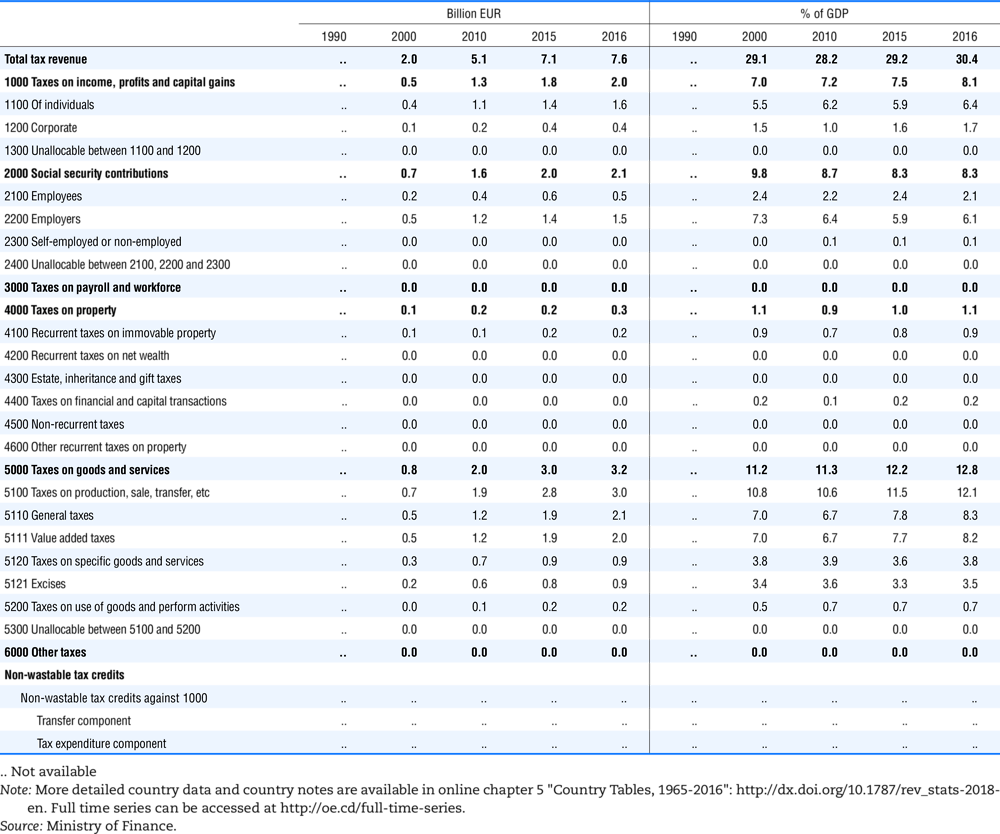

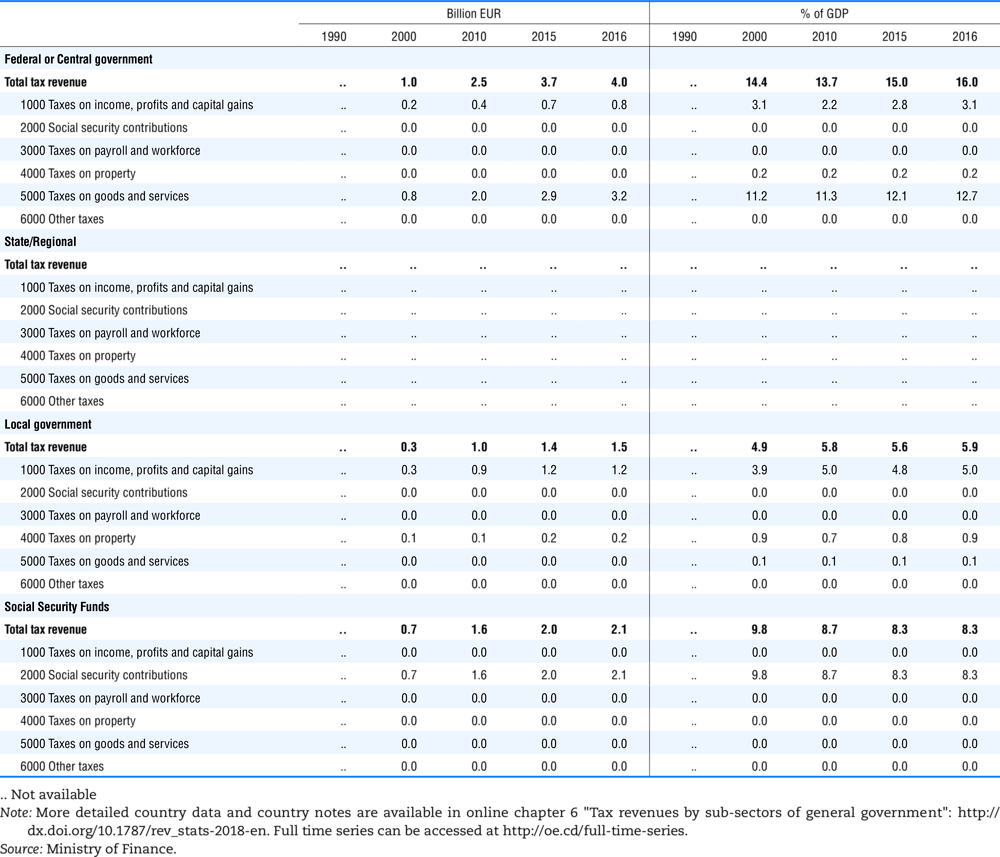

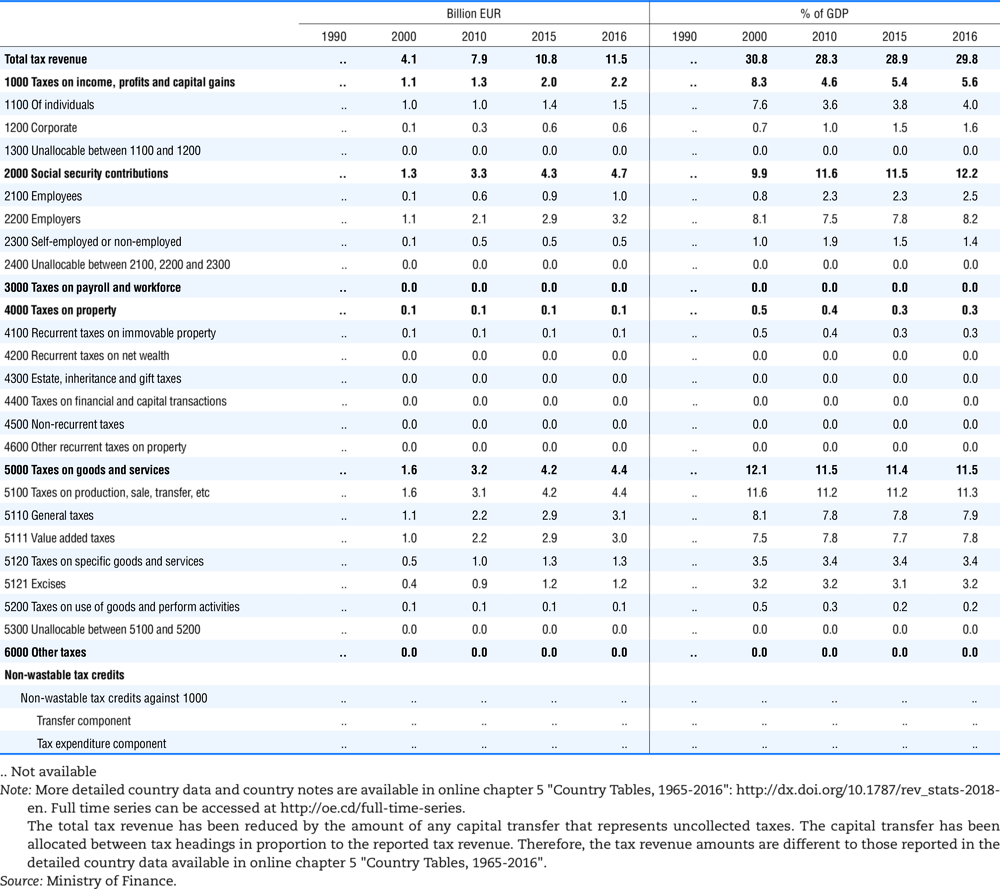

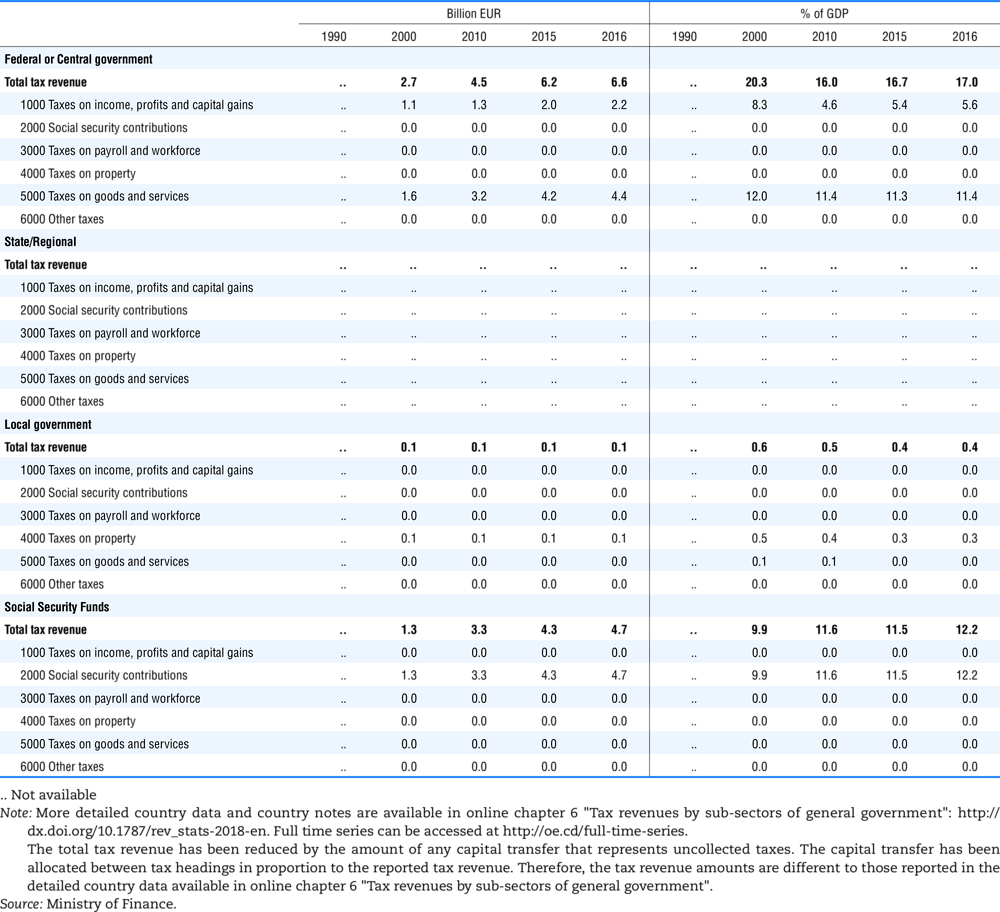

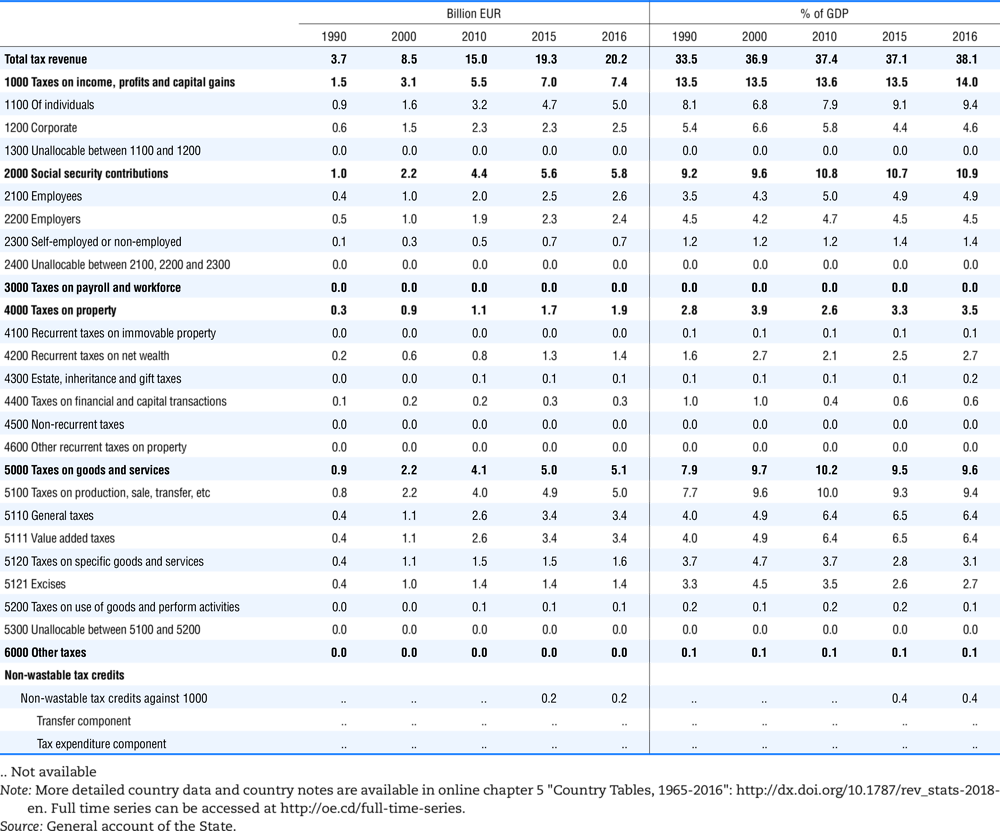

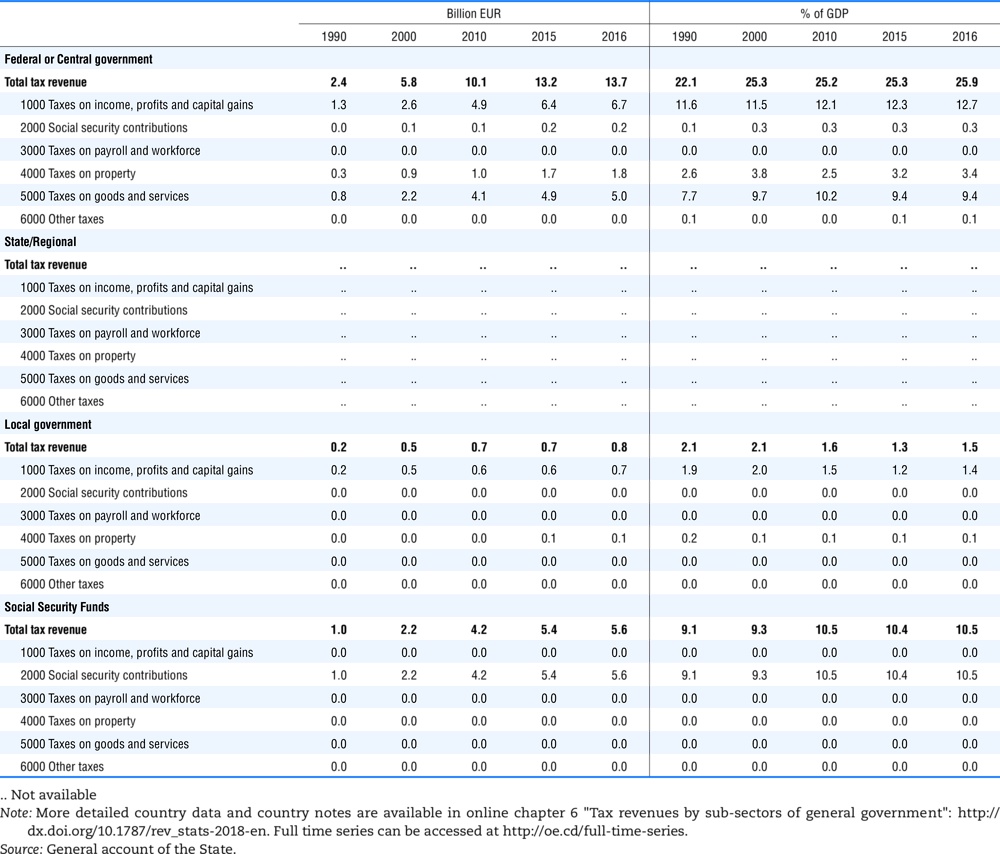

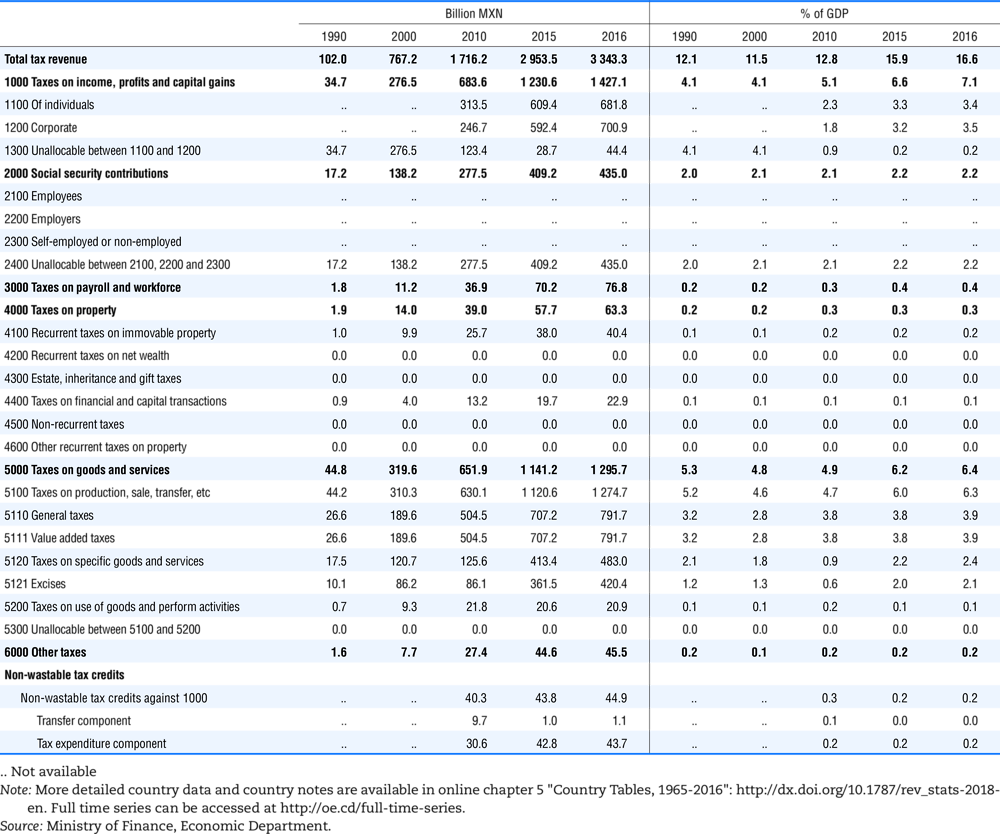

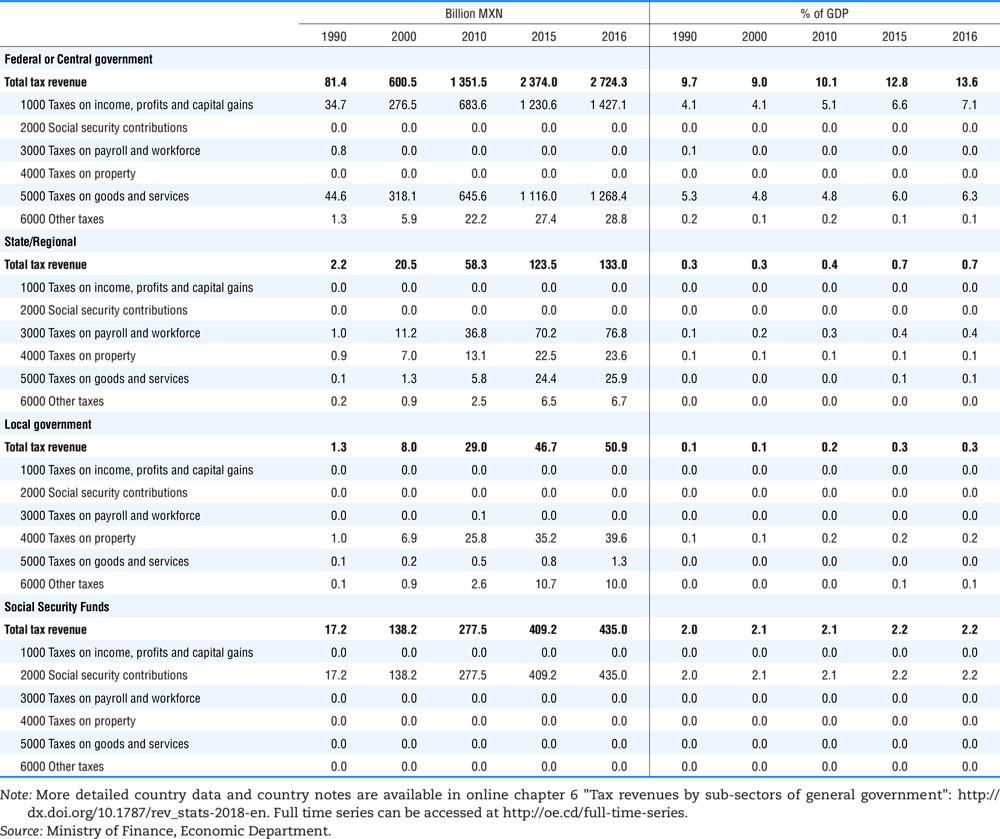

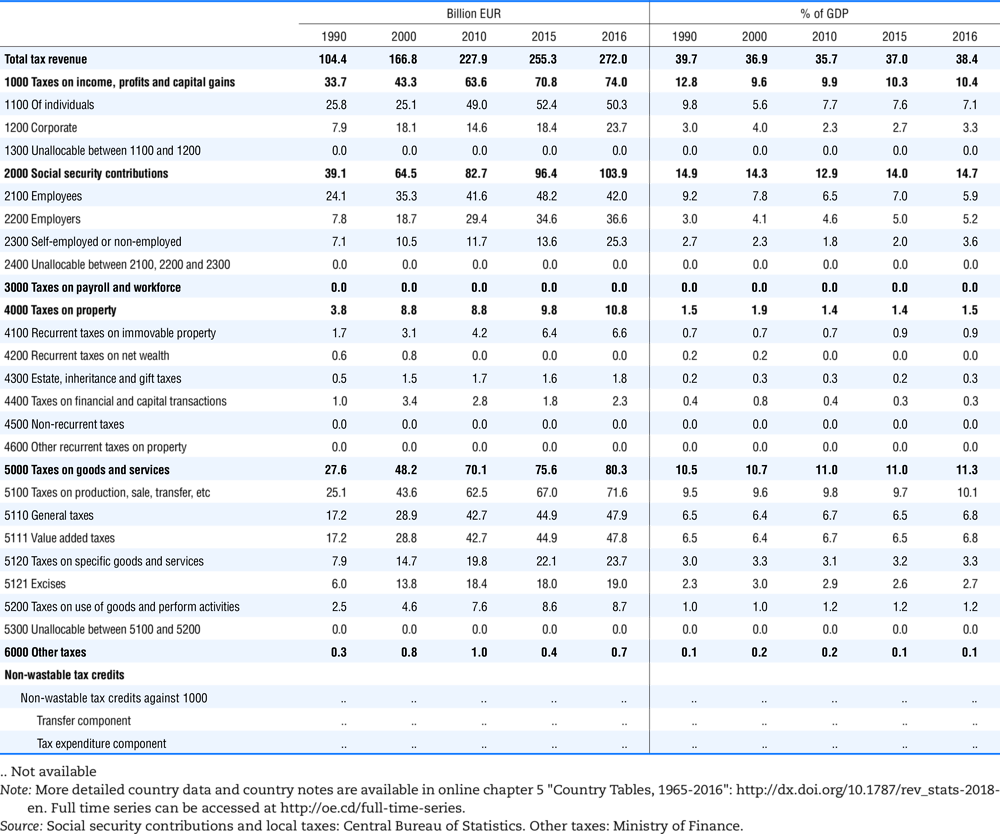

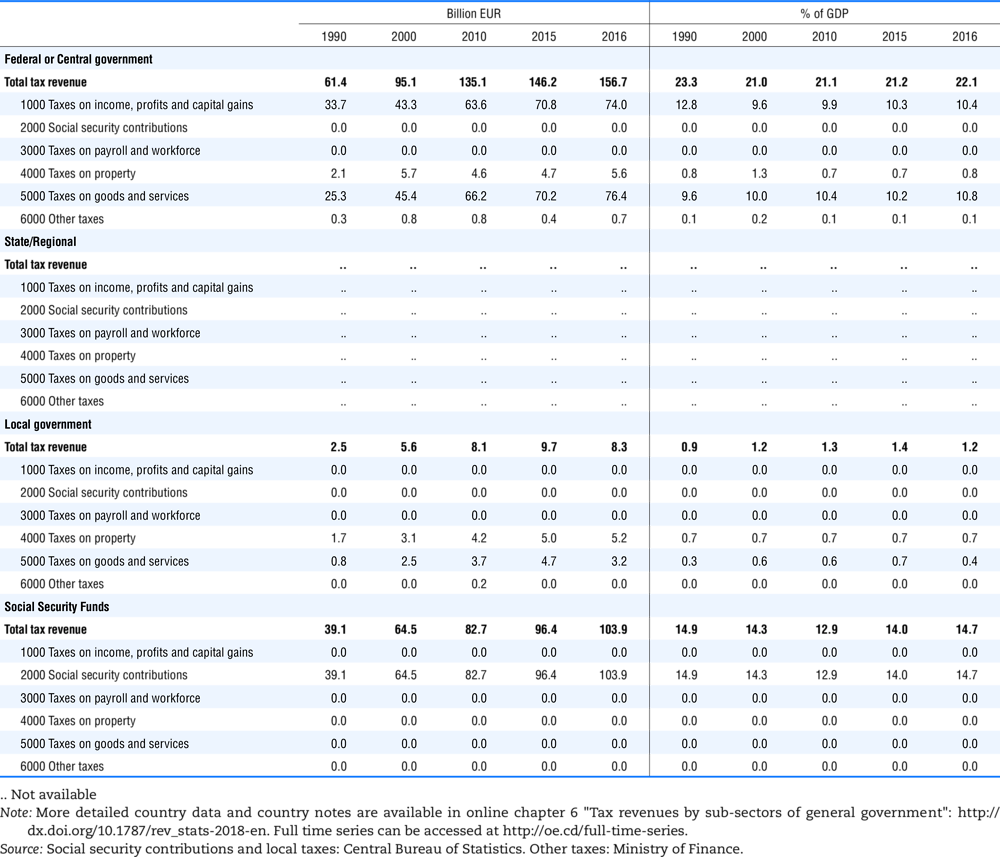

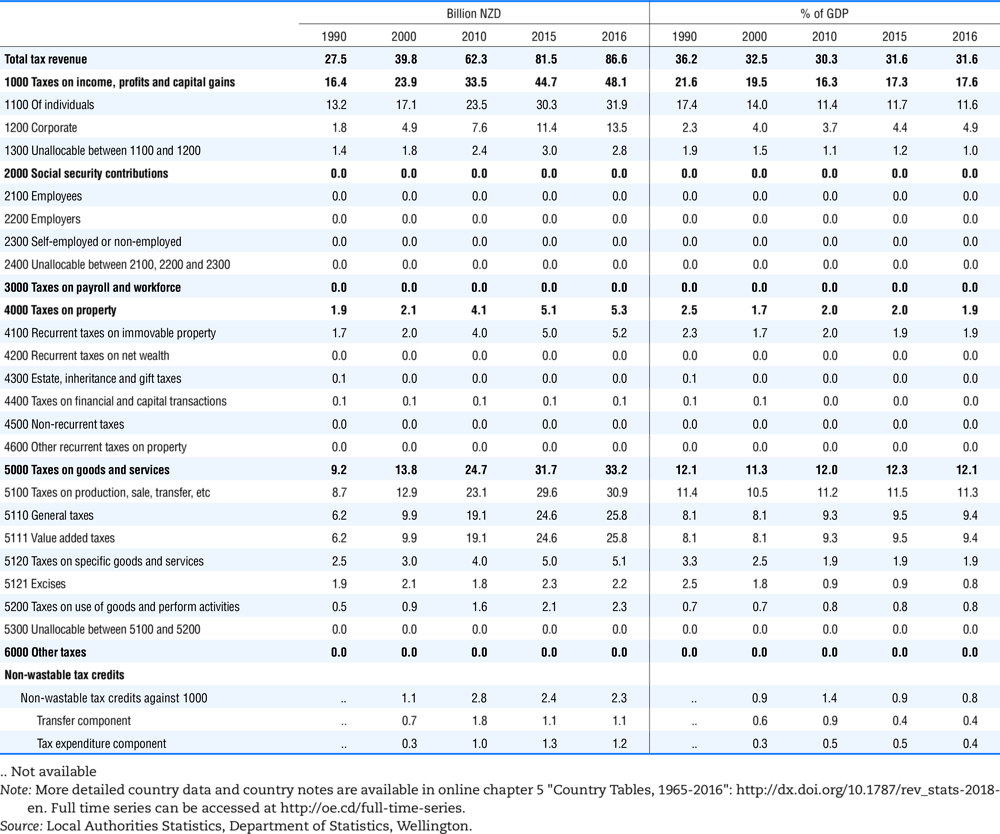

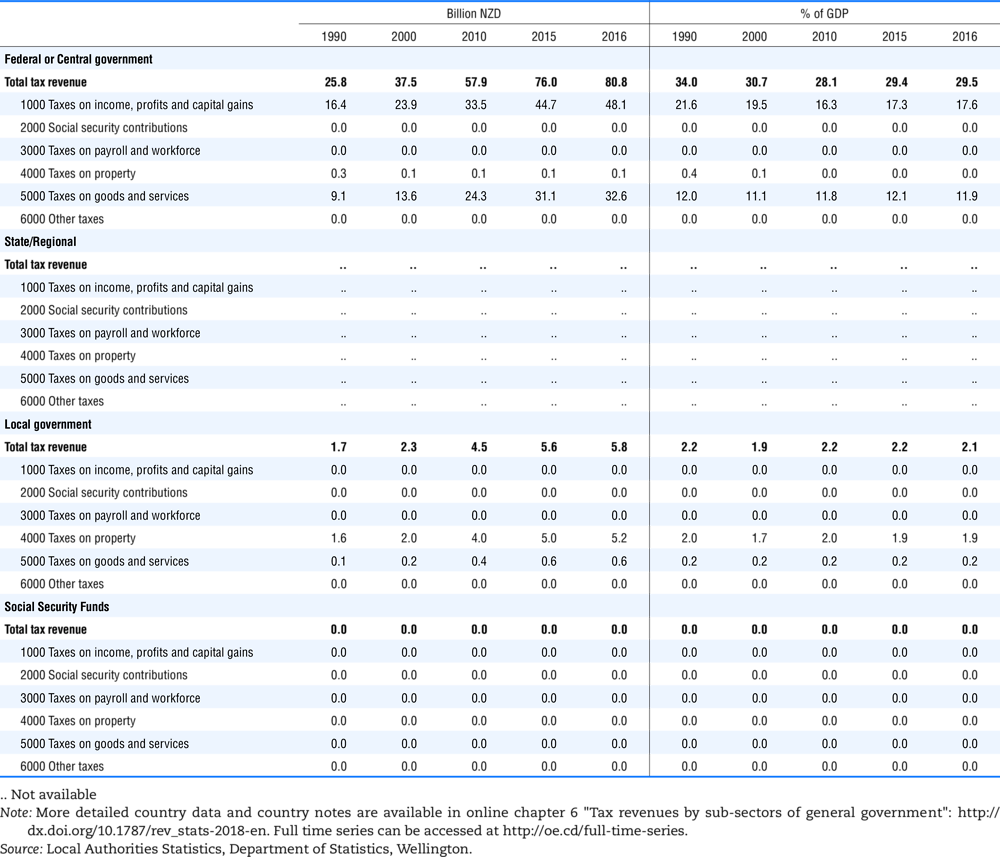

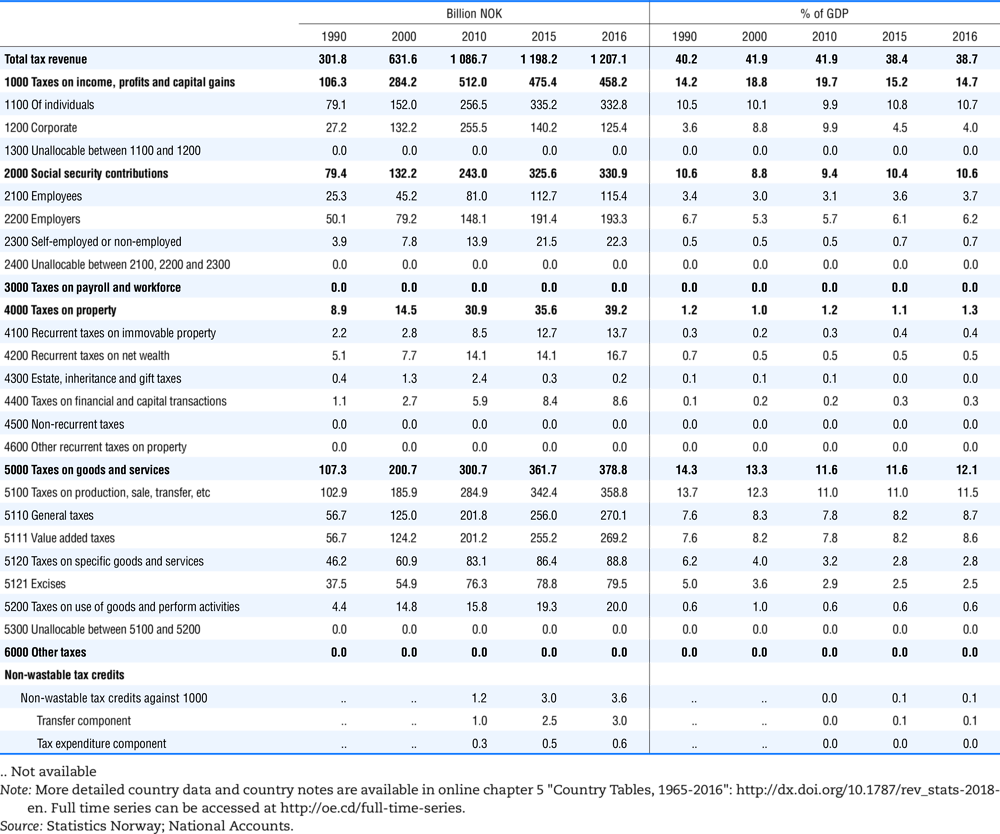

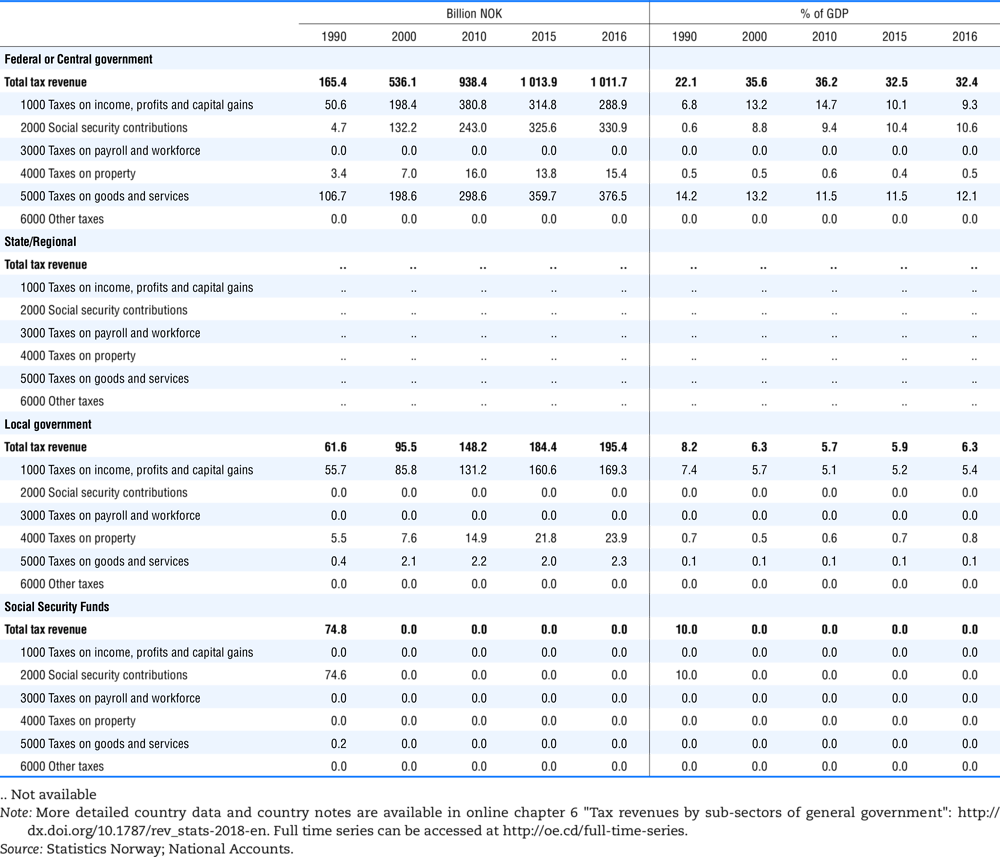

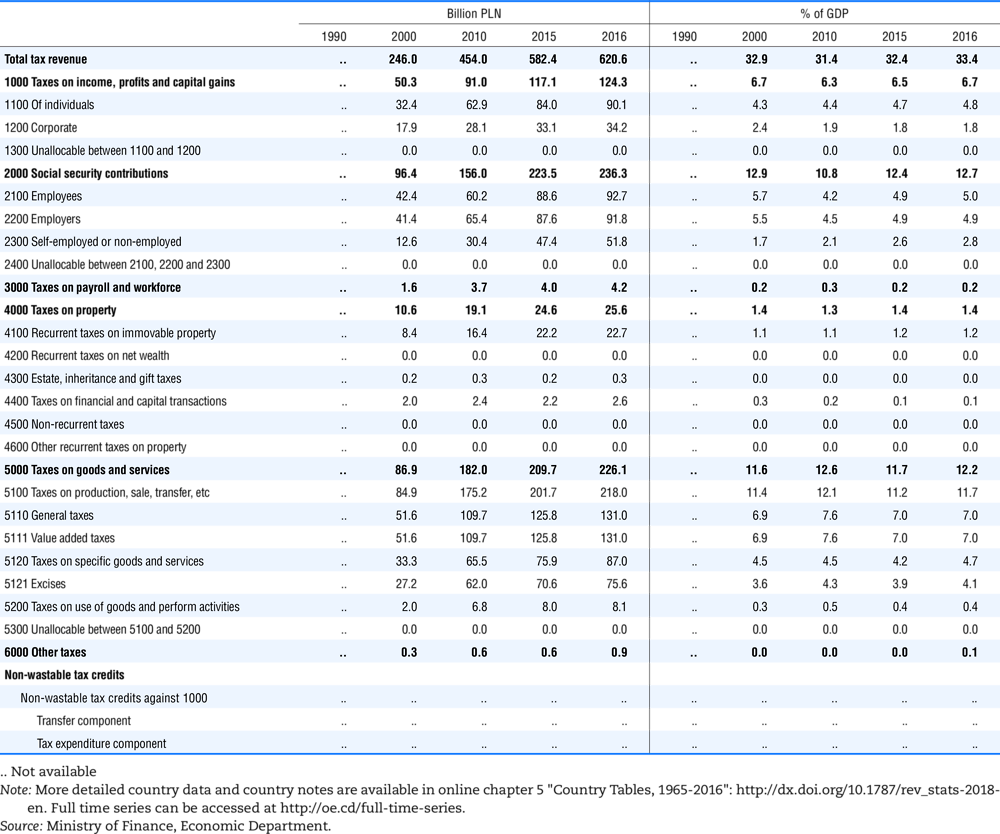

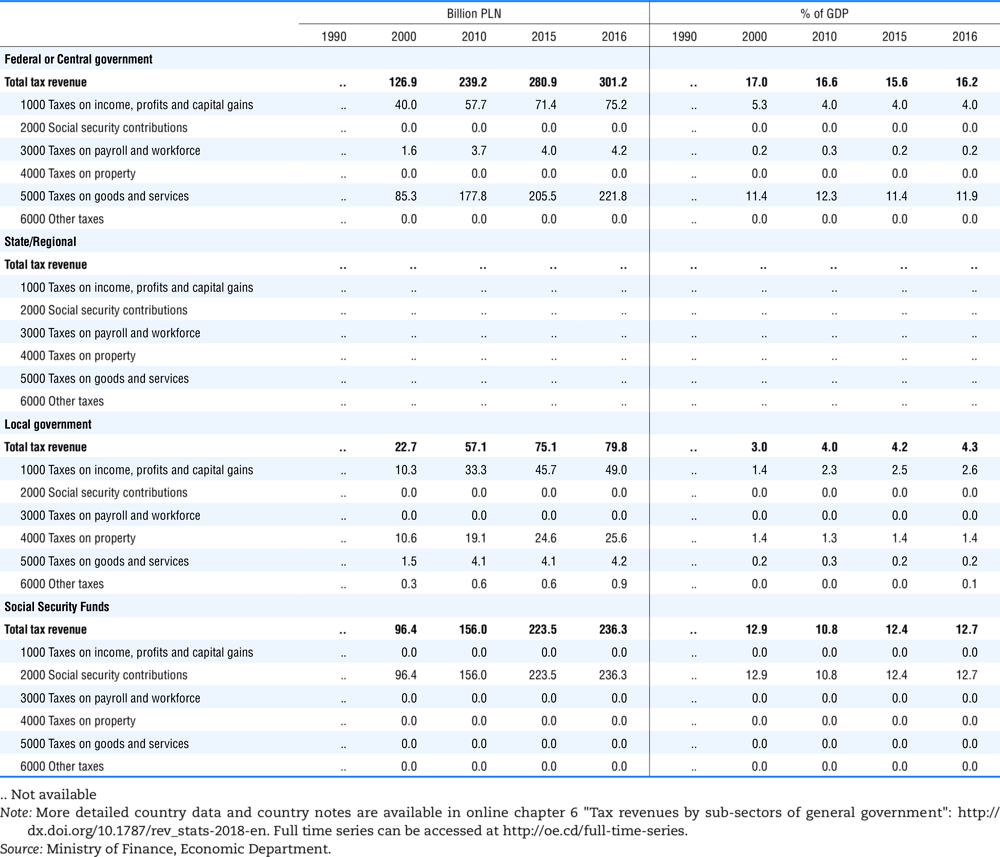

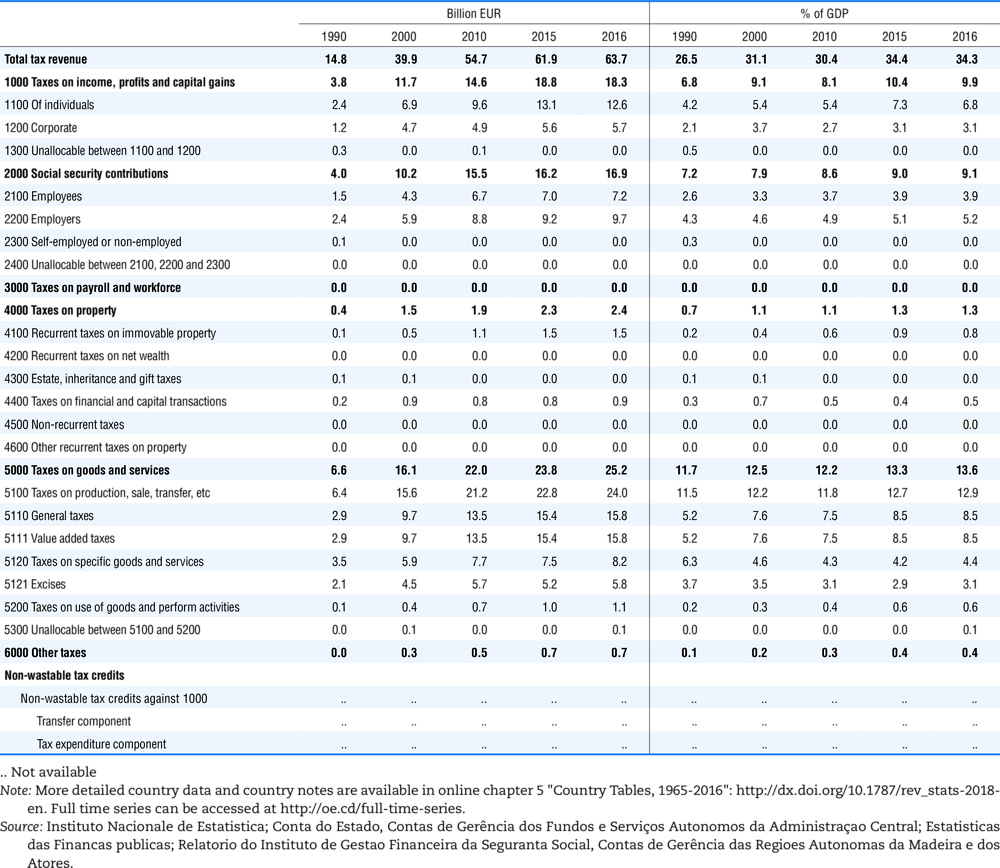

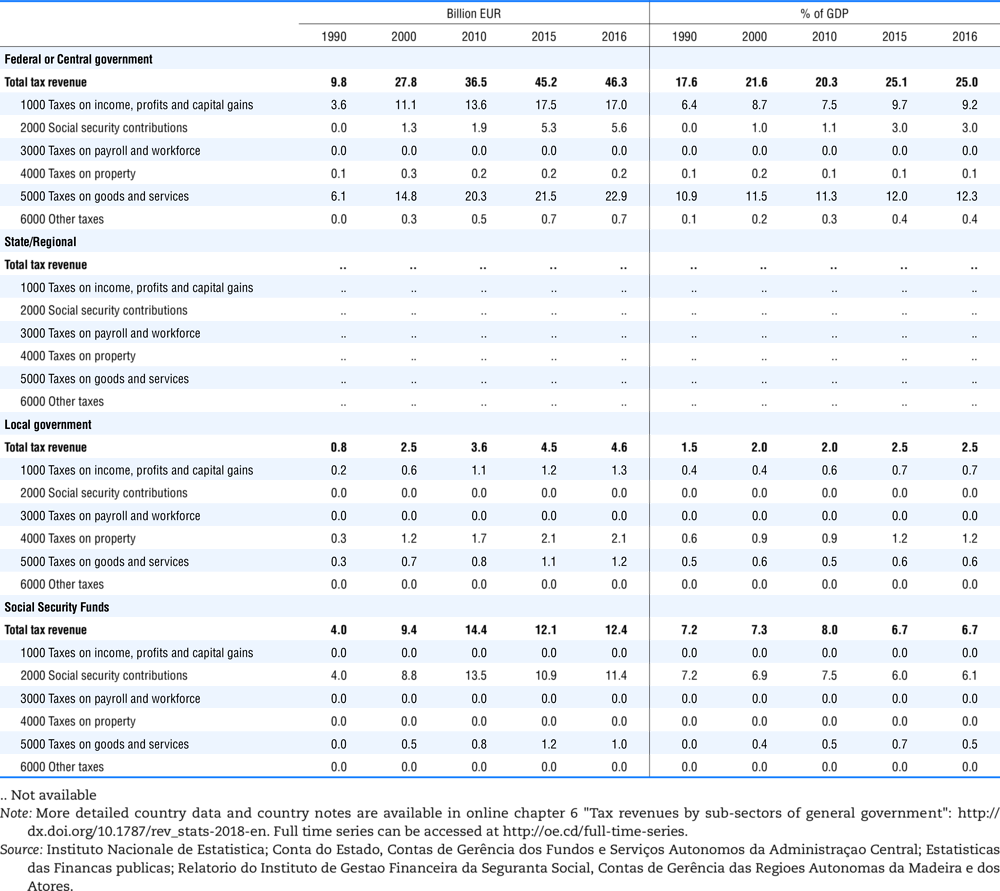

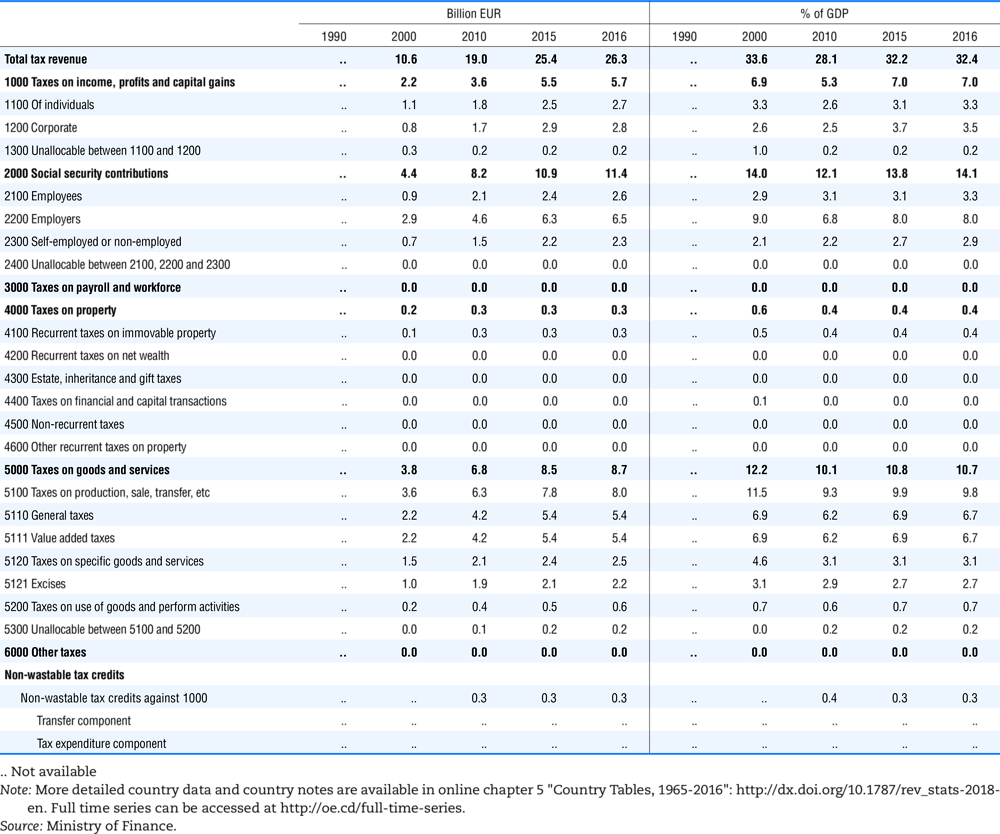

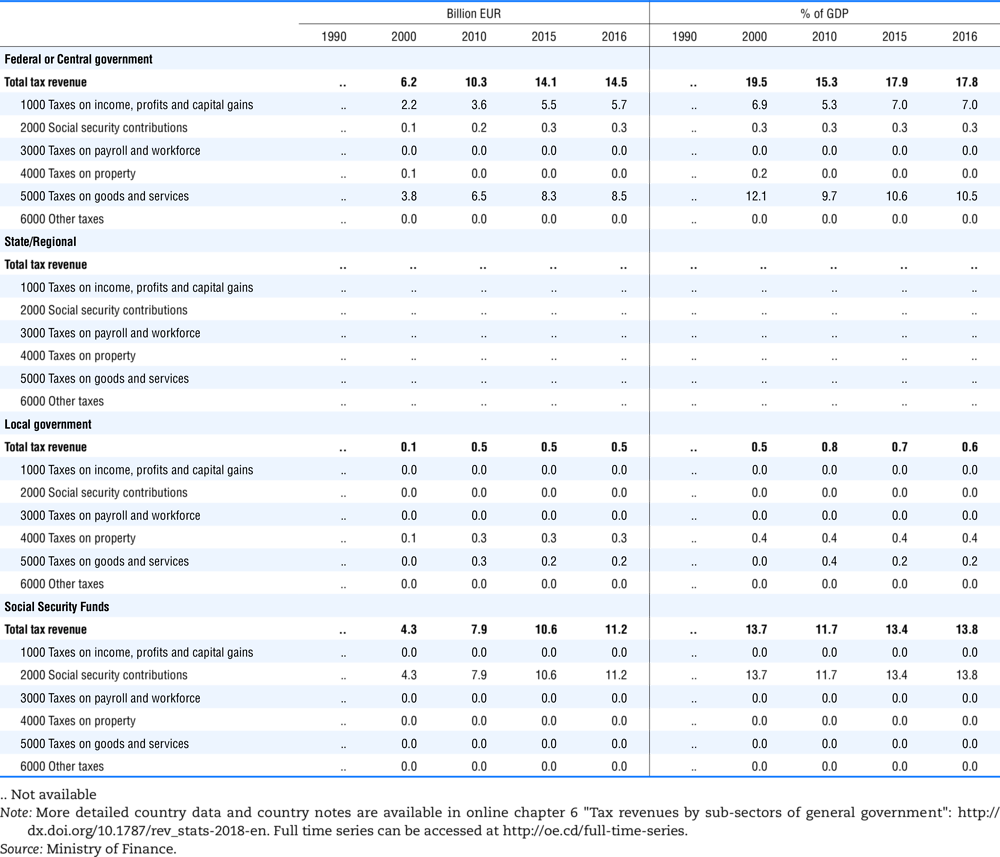

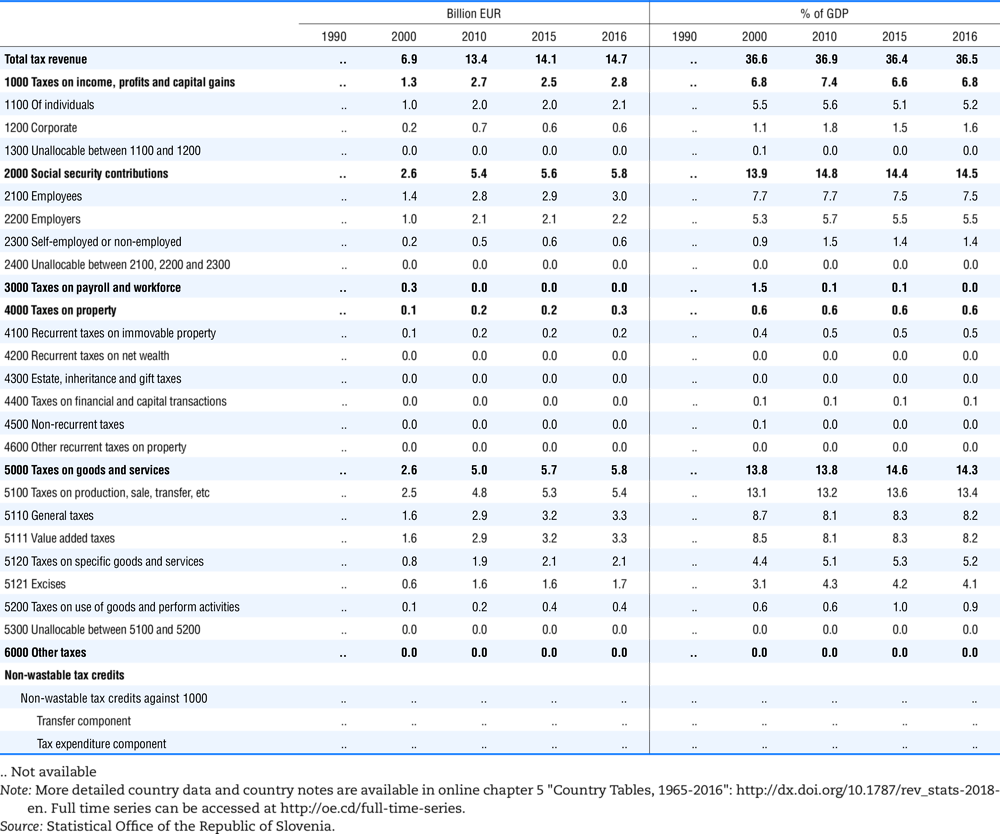

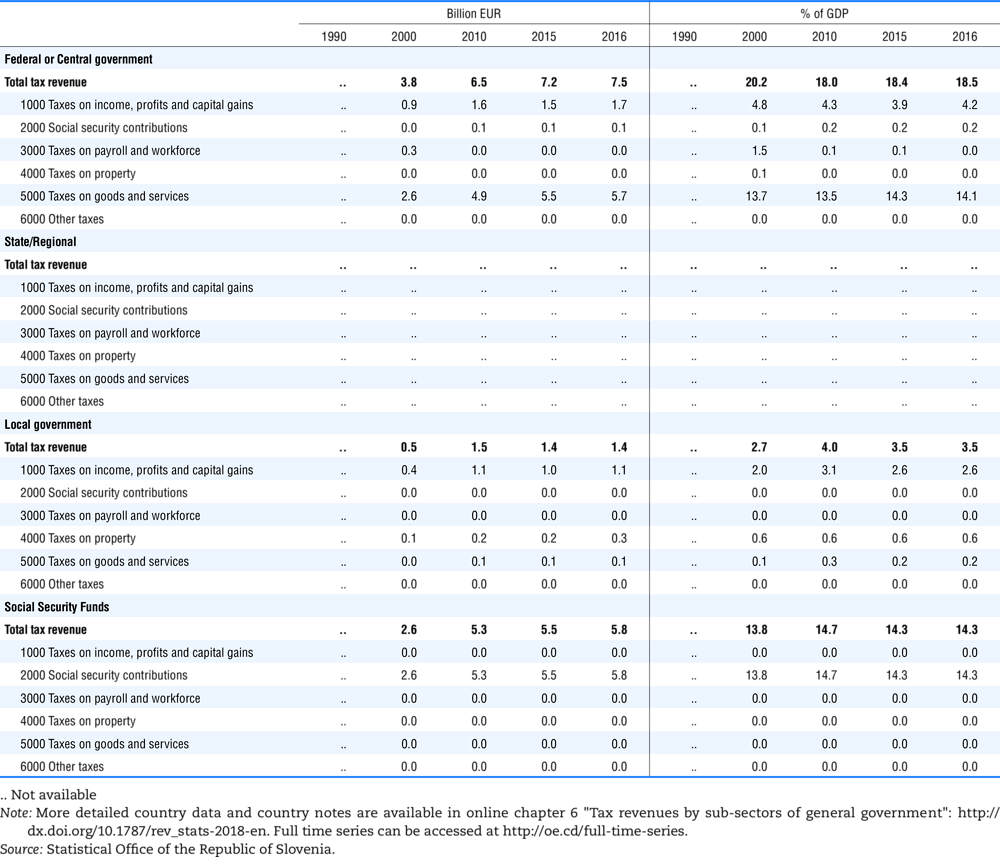

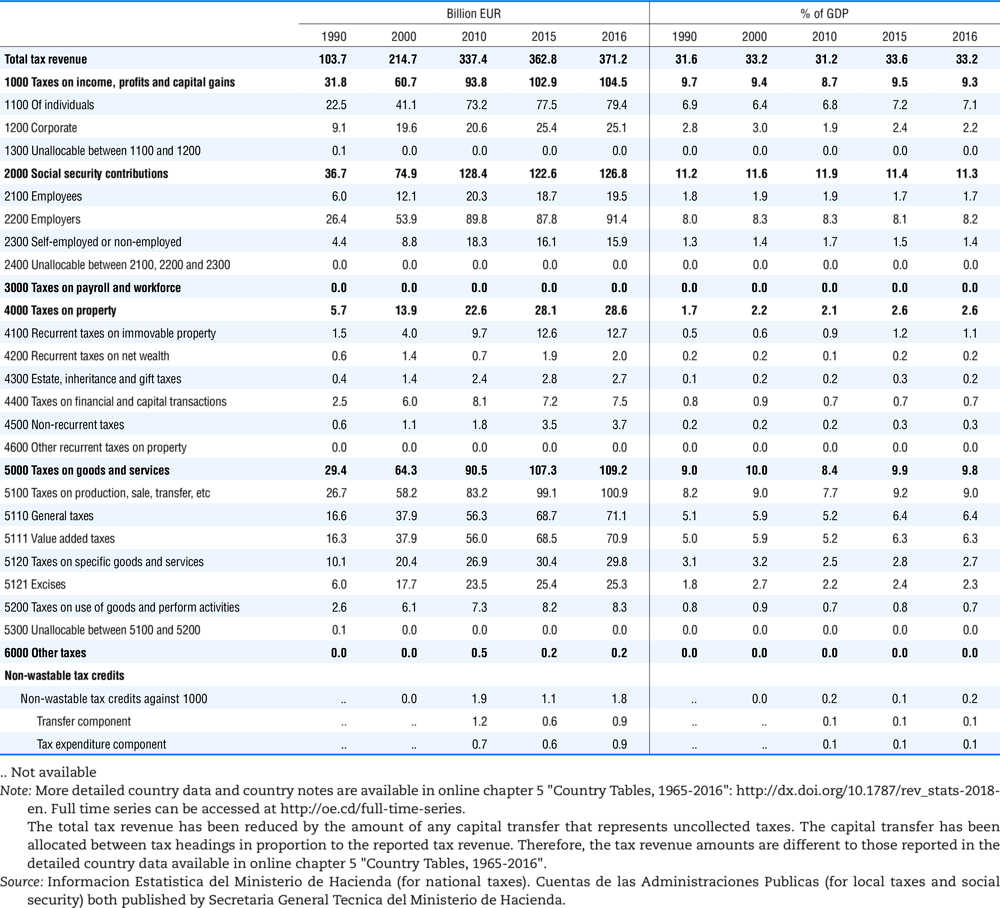

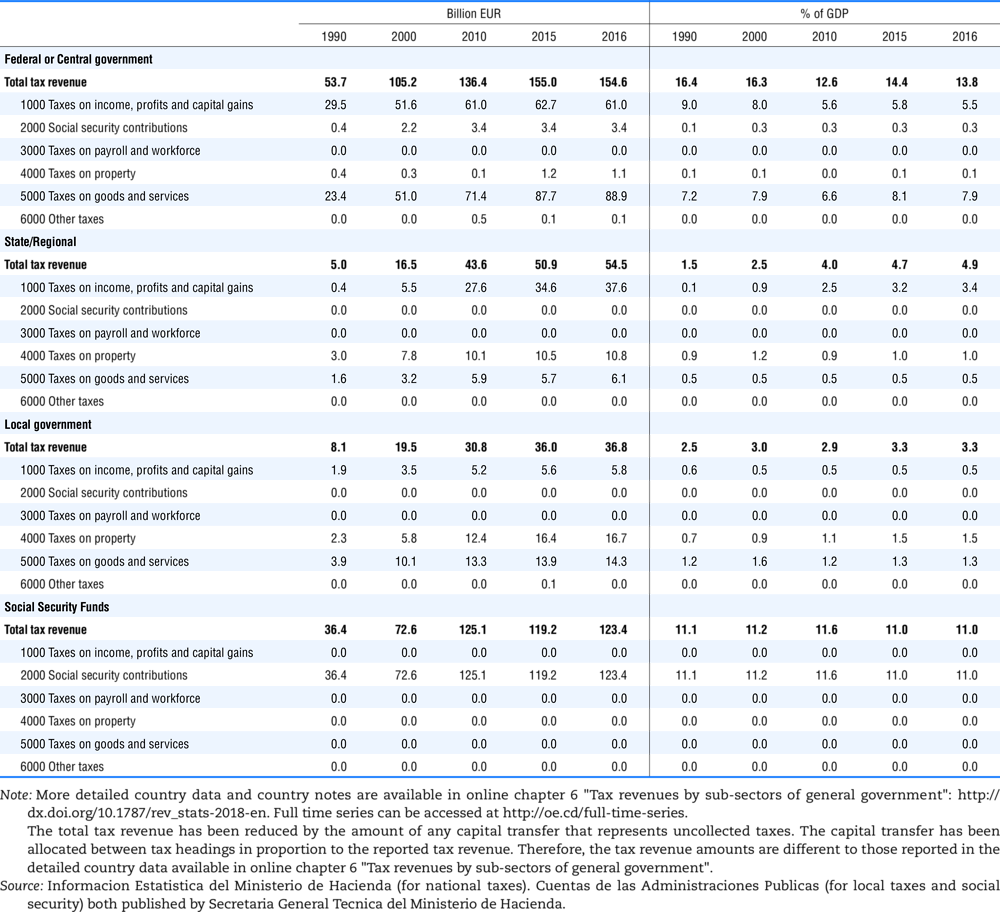

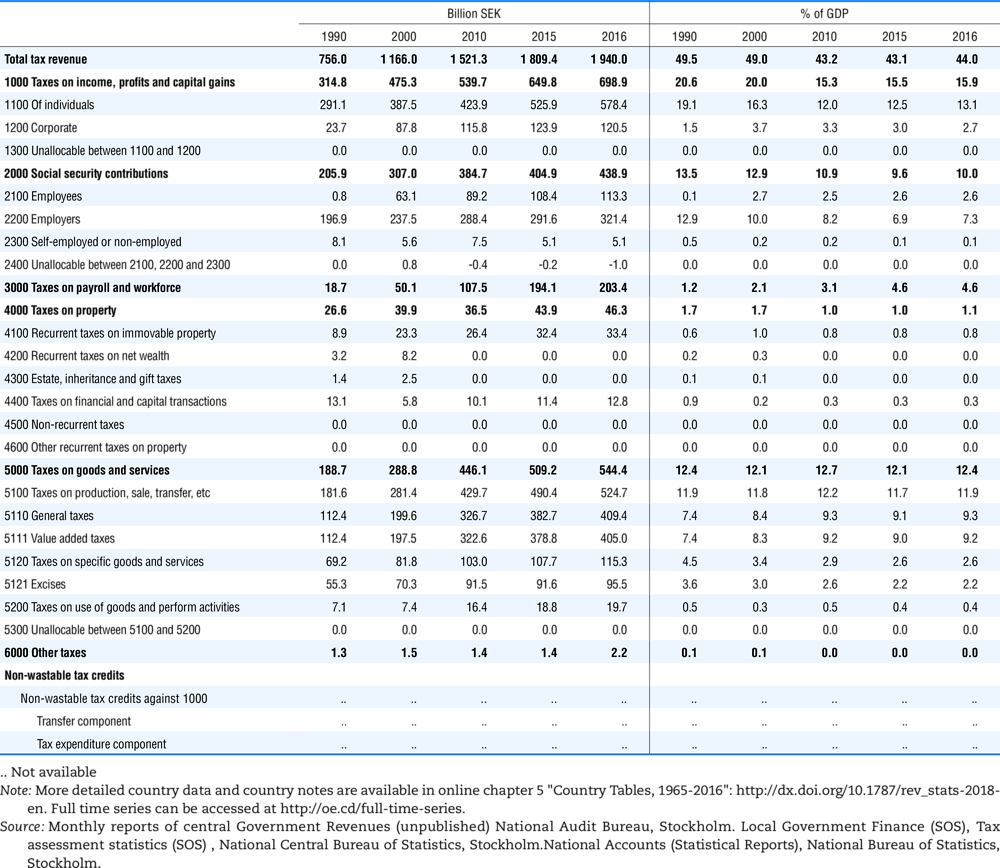

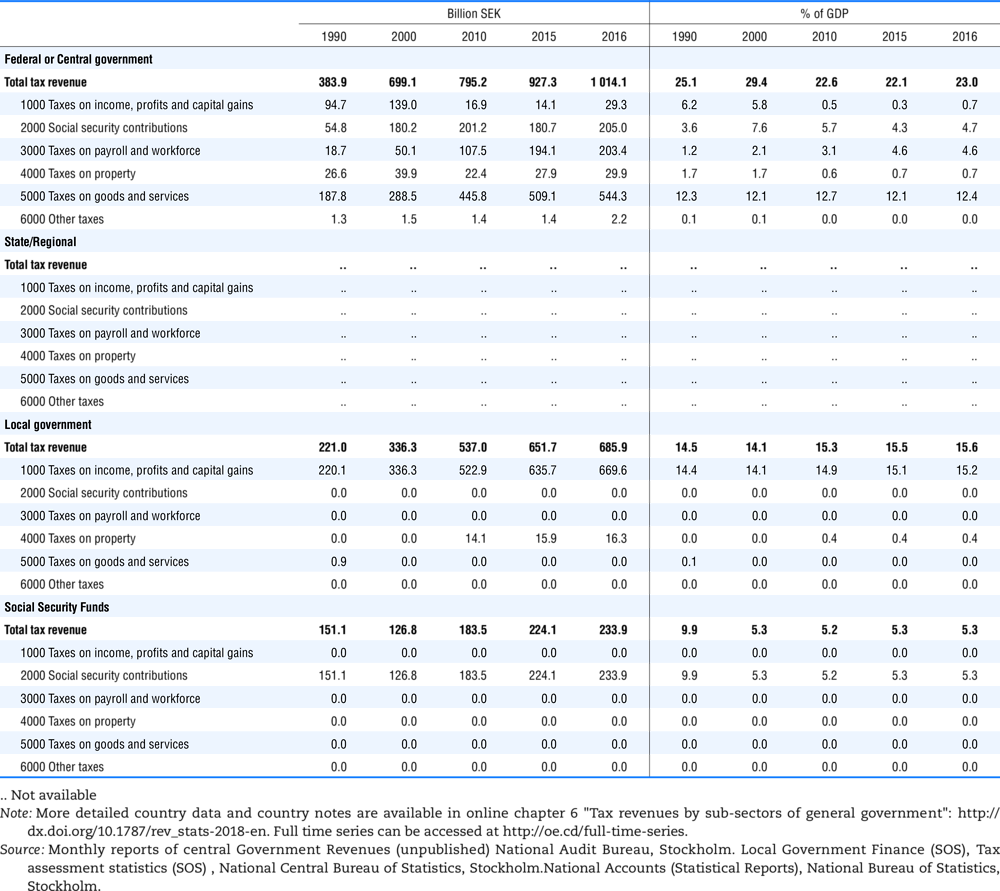

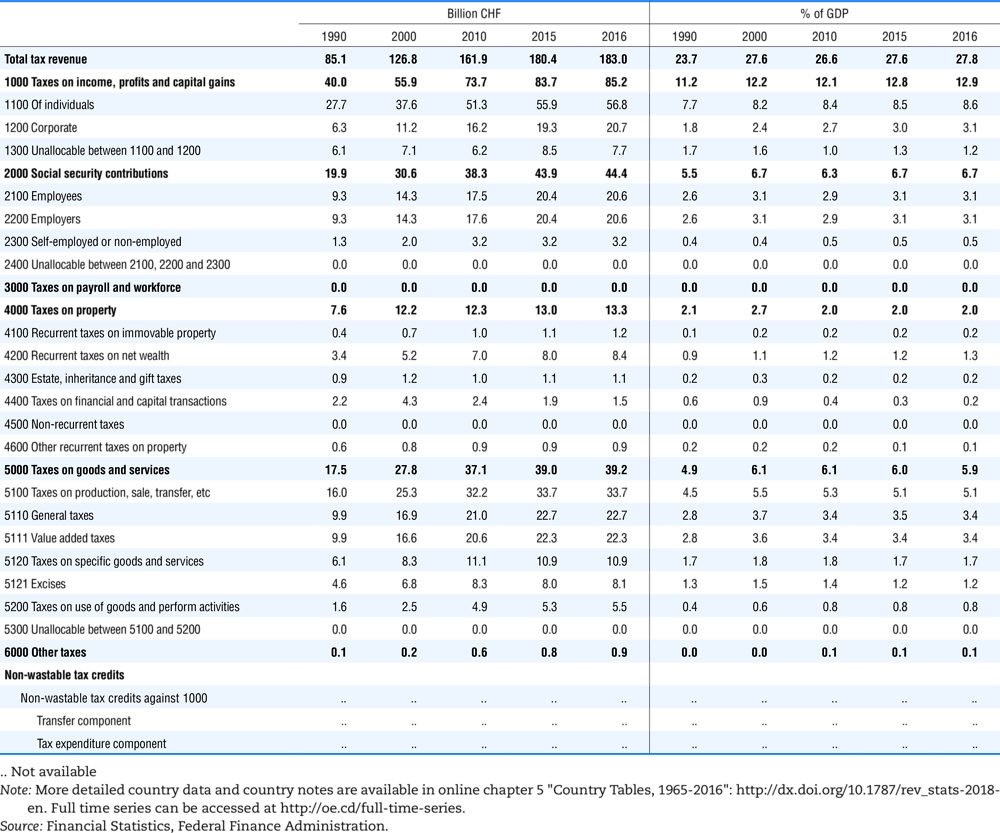

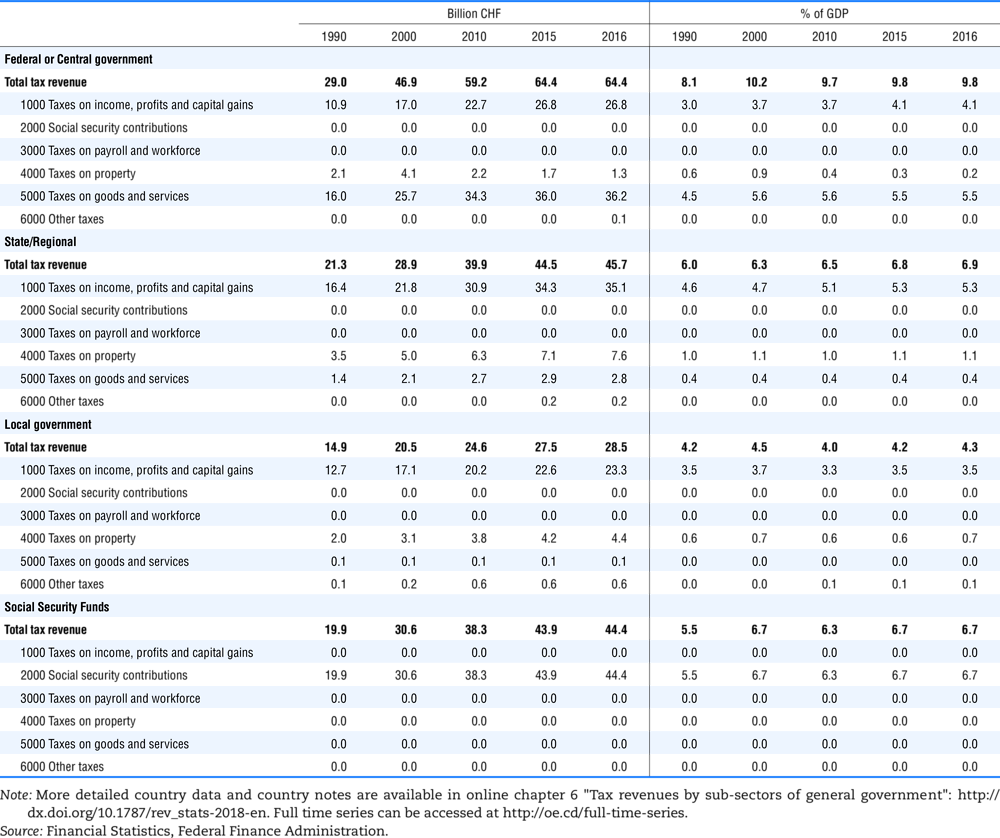

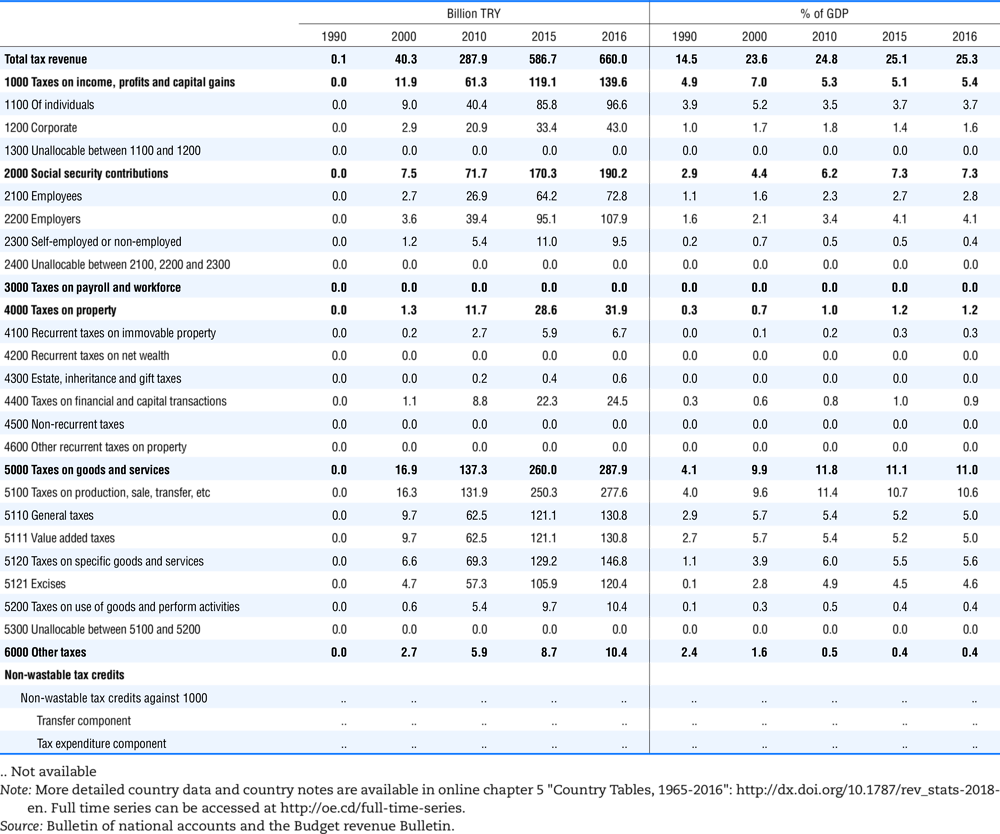

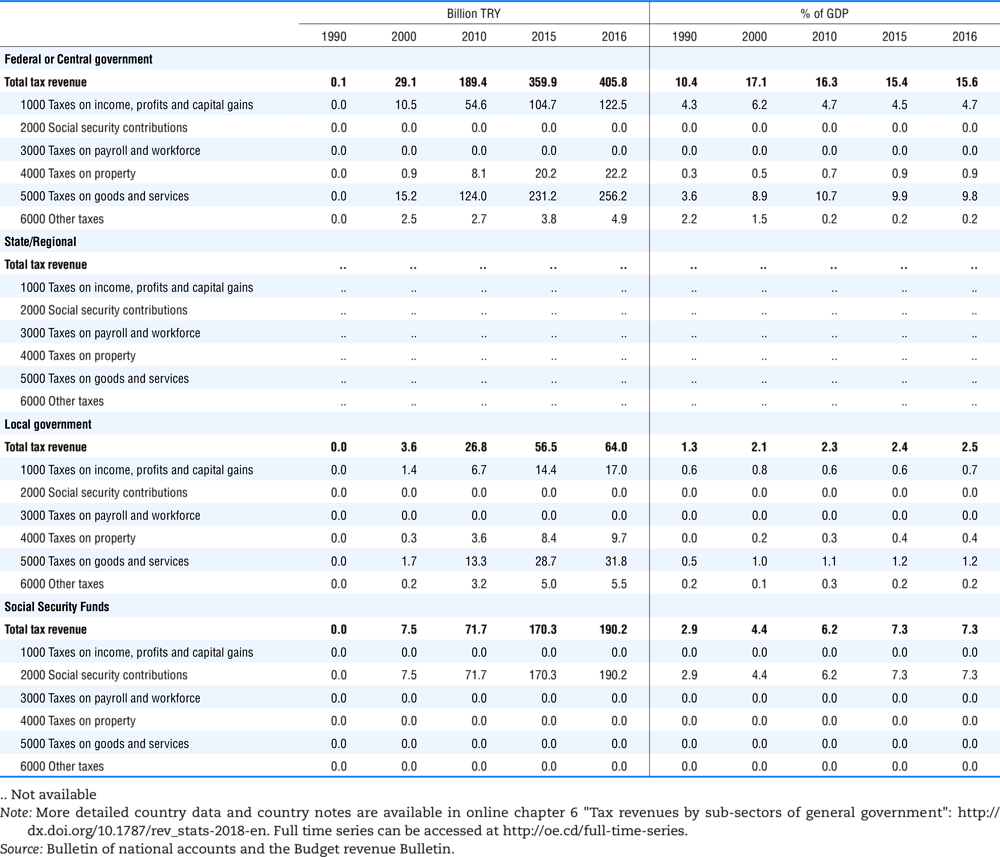

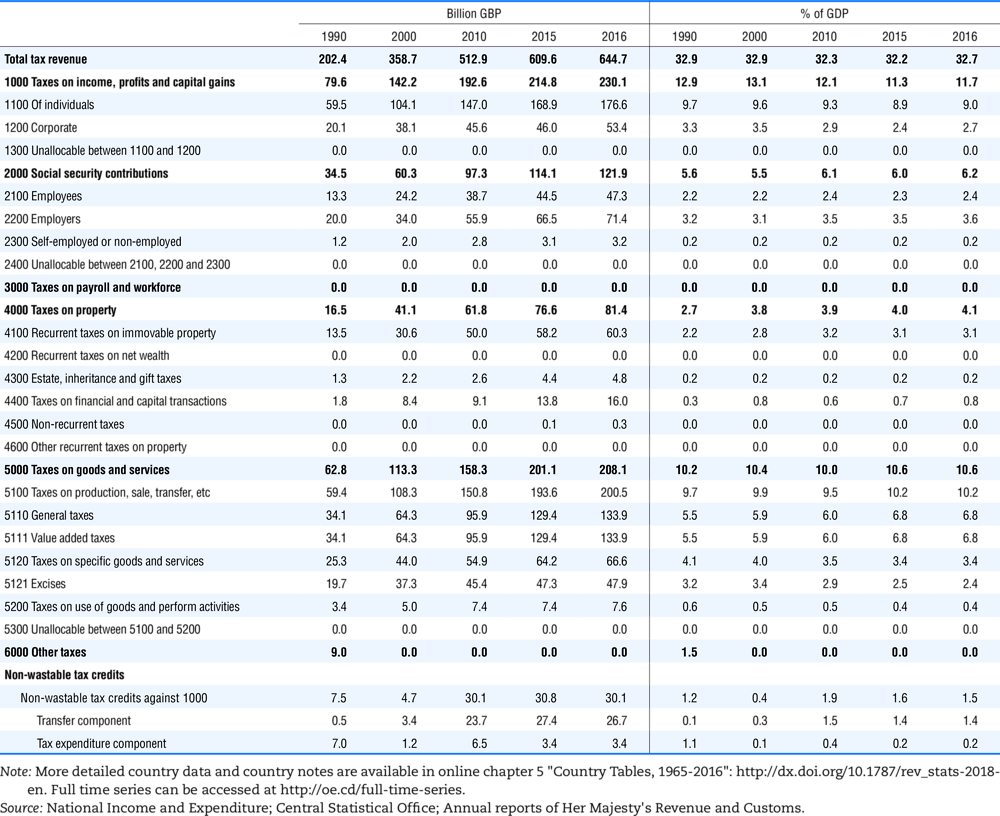

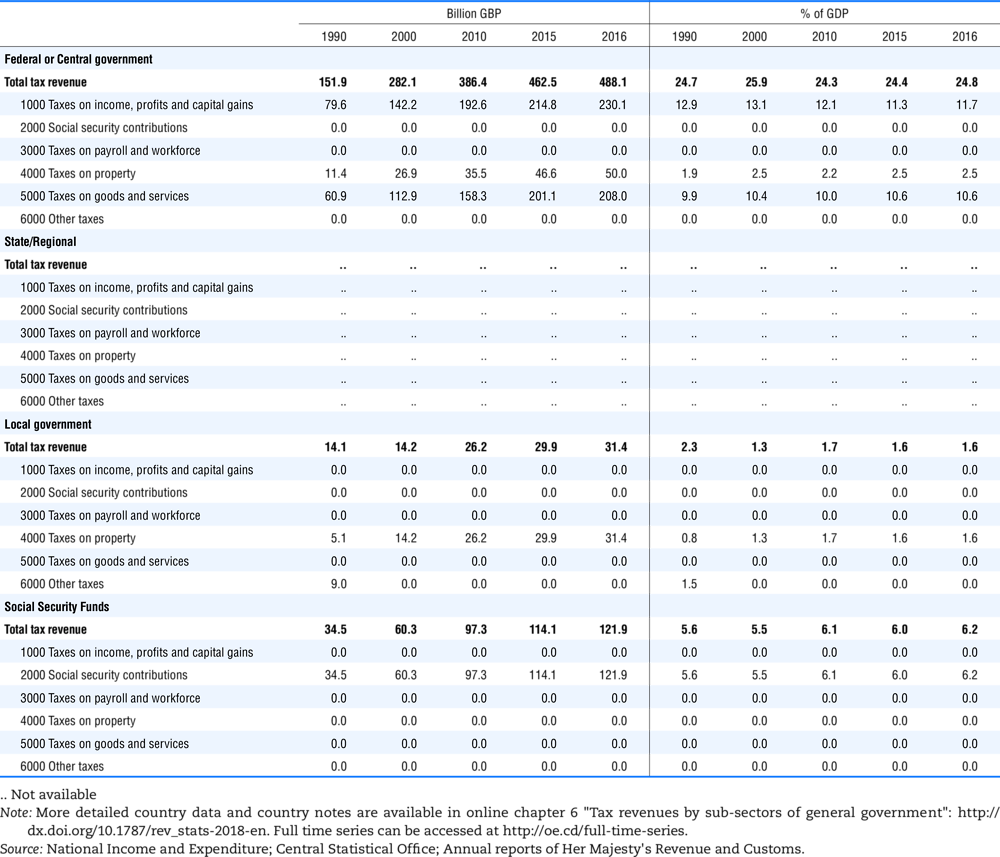

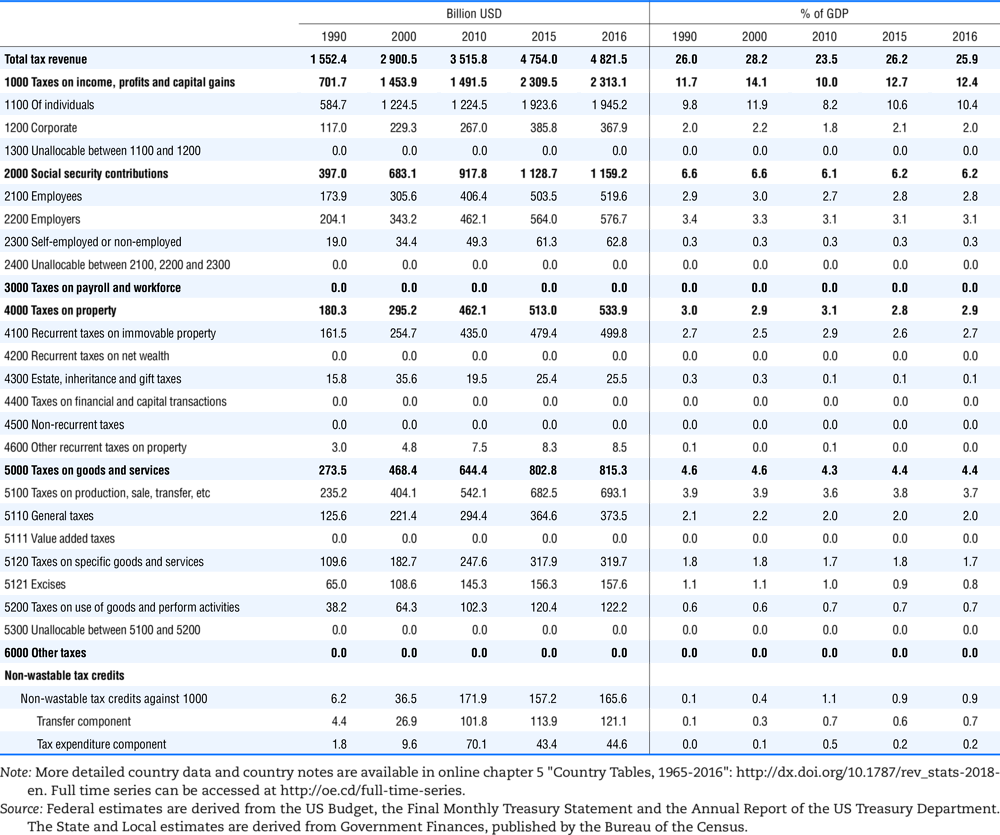

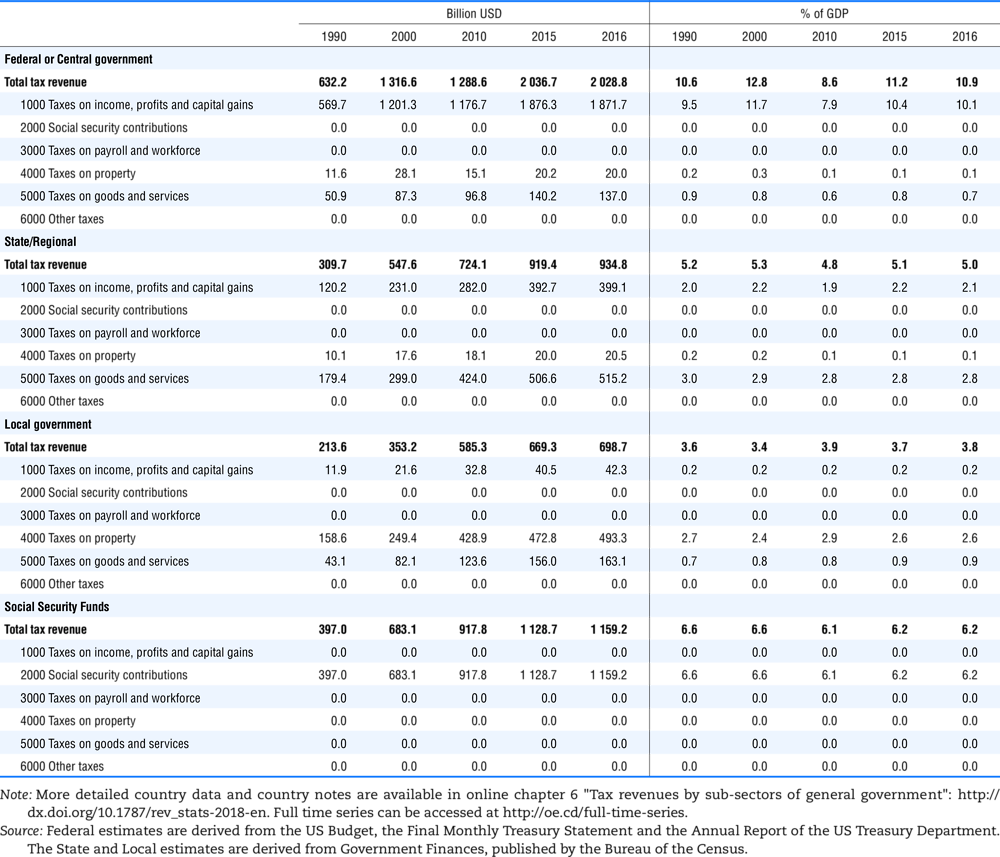

Chapter 4. Country tables, 1990-2016

Chapter 4 provides a summary of tax revenues by category and by level of government for each OECD country from 1990-2016.

4.1. Tax revenue and % of GDP by selected tax category and by level of government

In all of the following tables the symbol (…) indicates not available/or not applicable. The main series in this chapter cover the years 1990 to 2016. Figures referring to 1965-1989, 1991-1999, 2001-2009 and 2011-2014 have been omitted because of lack of space. A complete series is, however, available on line. Data for 1955 and 1960 (for nineteen OECD countries) are provided in part V of the 1998 edition of this Report.

The Gross Domestic Product (GDP) figures are based on the 2008 System of National Accounts (SNA) for all OECD countries.

Some tables refer to the treatment of the capital transfers that some countries make to account for taxes that have been assessed but not collected. The capital transfer has been subtracted from the total tax revenue and this reduction has been allocated between tax headings in proportion to their tax revenues.

This applies to the following countries:

-

Denmark from 1971.

-

France from 1992.

-

Greece for 1999 and 2000.

-

Lithuania from 1999.

-

Spain from 1995.

4.2. Memorandum tables

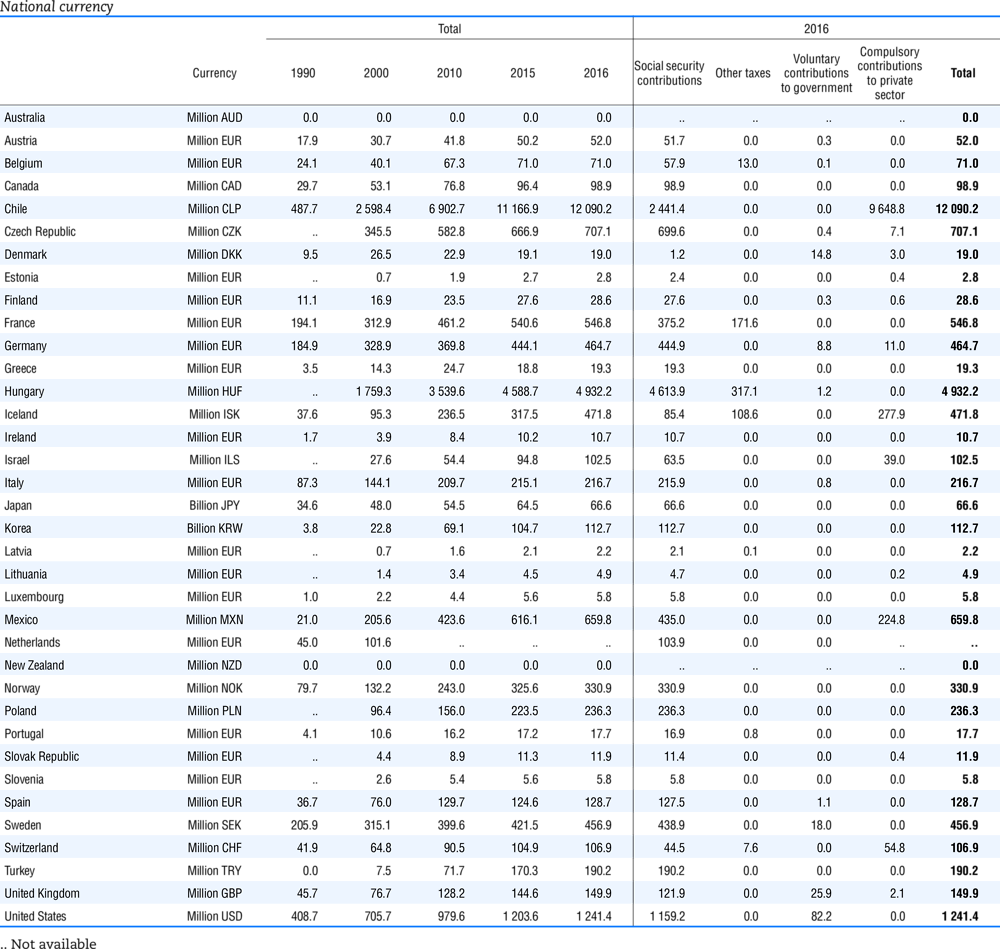

Table 4.73 shows different sources for financing social benefits, beyond compulsory social security contributions reported in section 4.1. In addition, this table shows also data on other taxes, on voluntary contributions to government and on compulsory contributions to private sector.

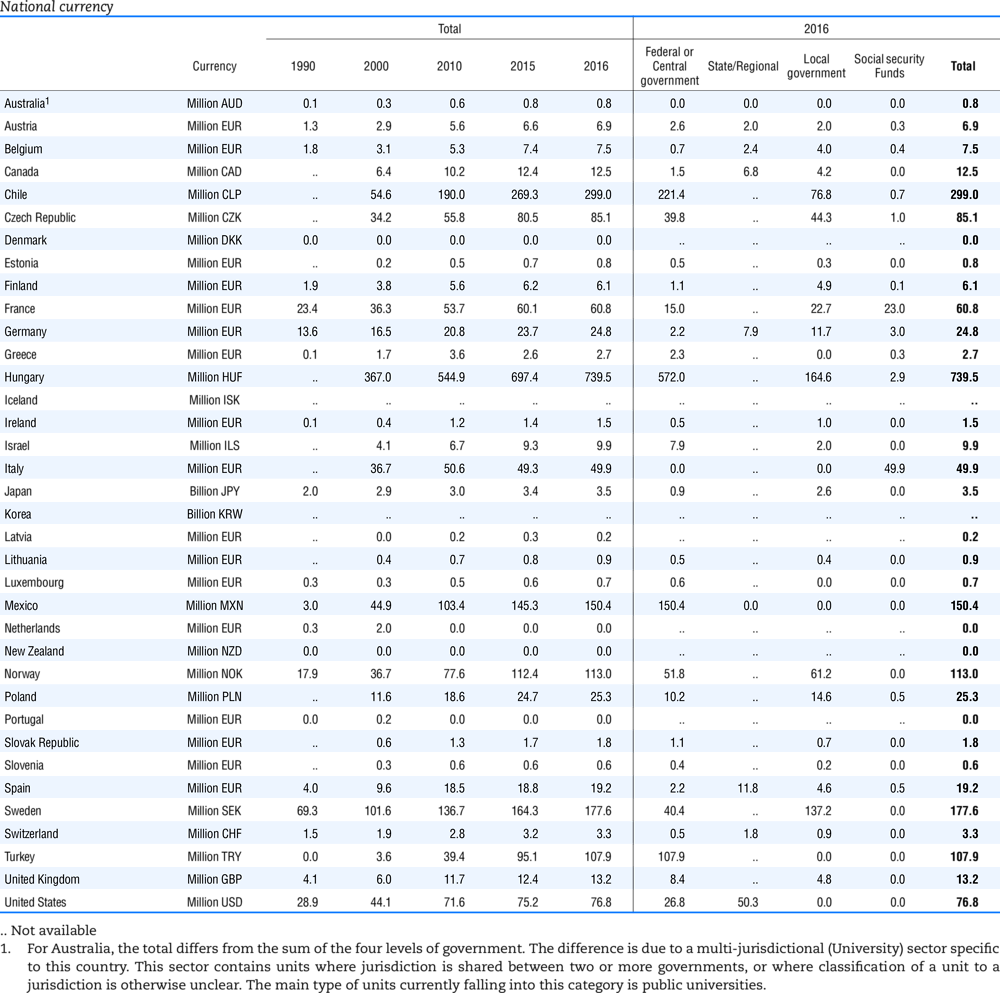

Table 4.74 shows social security contributions and payroll taxes paid by government. During the revision of the Interpretative Guide in 1984, the question arose of how to treat taxes paid by government. The two most prominent examples of such taxes are social security contributions and payroll taxes paid by government in respect of its employees. After a long discussion it was decided that the data shown in this publication should continue to include taxes paid by government (see §5 of the Interpretative Guide in annex A).

Whilst it was recognised that for certain purposes (e.g. to show the cash flow to the government sector from the private sector) it would be appropriate to eliminate taxes paid by one sector of government to another or tax payments between different units of the same sector of government, the view was taken that to record tax flows in the context of the economy as a whole required that taxes paid by government should be included in the data. This treatment ensures that the different resource flows of an economy, including the calculation of the output of government, are measured consistently in after-tax units. Nevertheless, it was decided that data on identifiable taxes paid by government should be separately identified in a memorandum item and this is the purpose of the country tables which follow.

The data that are reproduced in the following tables refer to actual compulsory payments made by general government in respect of their employees. Fictive, voluntary and imputed contributions are excluded from these data. The definitions of social security contributions, payroll taxes and general government are those set out in §35 to §41, §42 and §3 to §4 of the Interpretative Guide. Information on the other taxes paid by government (namely property taxes and consumption taxes) is not available in most countries, although it is believed that in all countries taxes based upon payroll are the most important taxes paid by government. In many cases, the data are estimates and are not always constructed on a basis consistent with that used in the main tables.