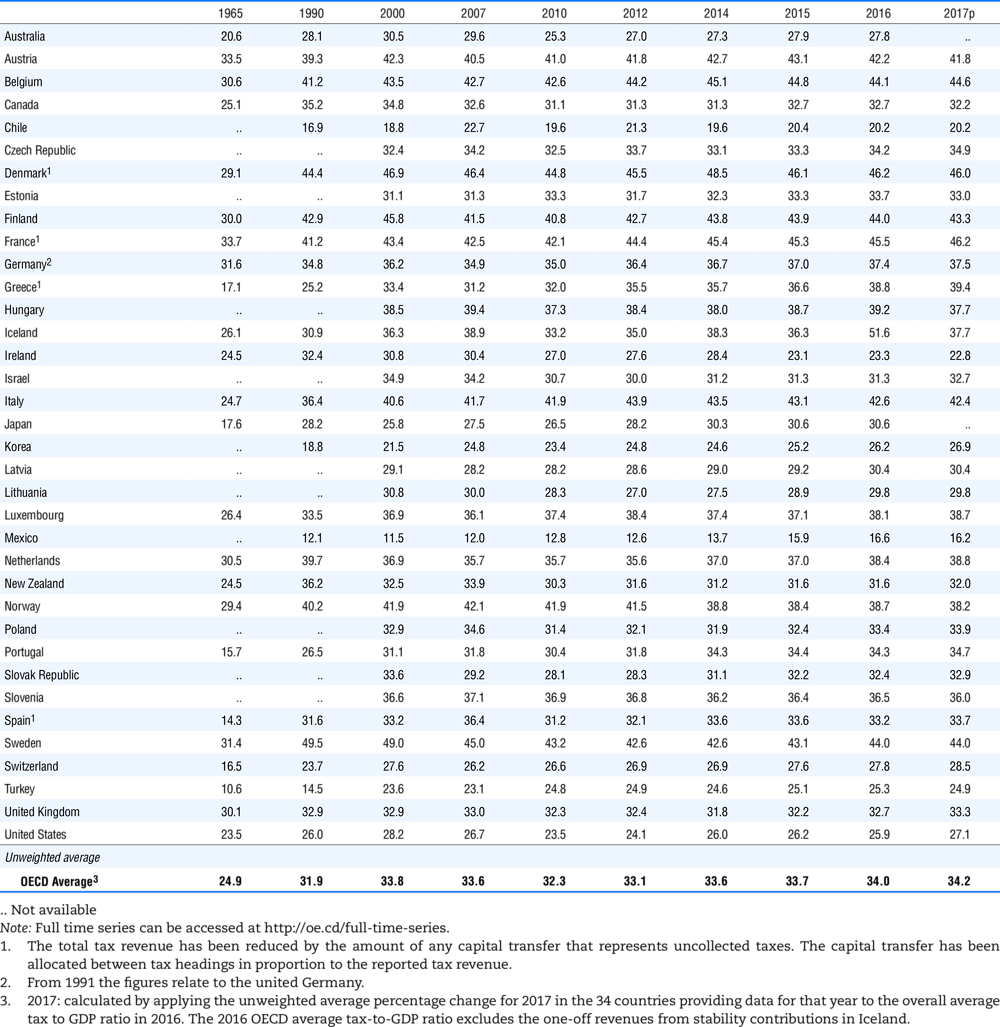

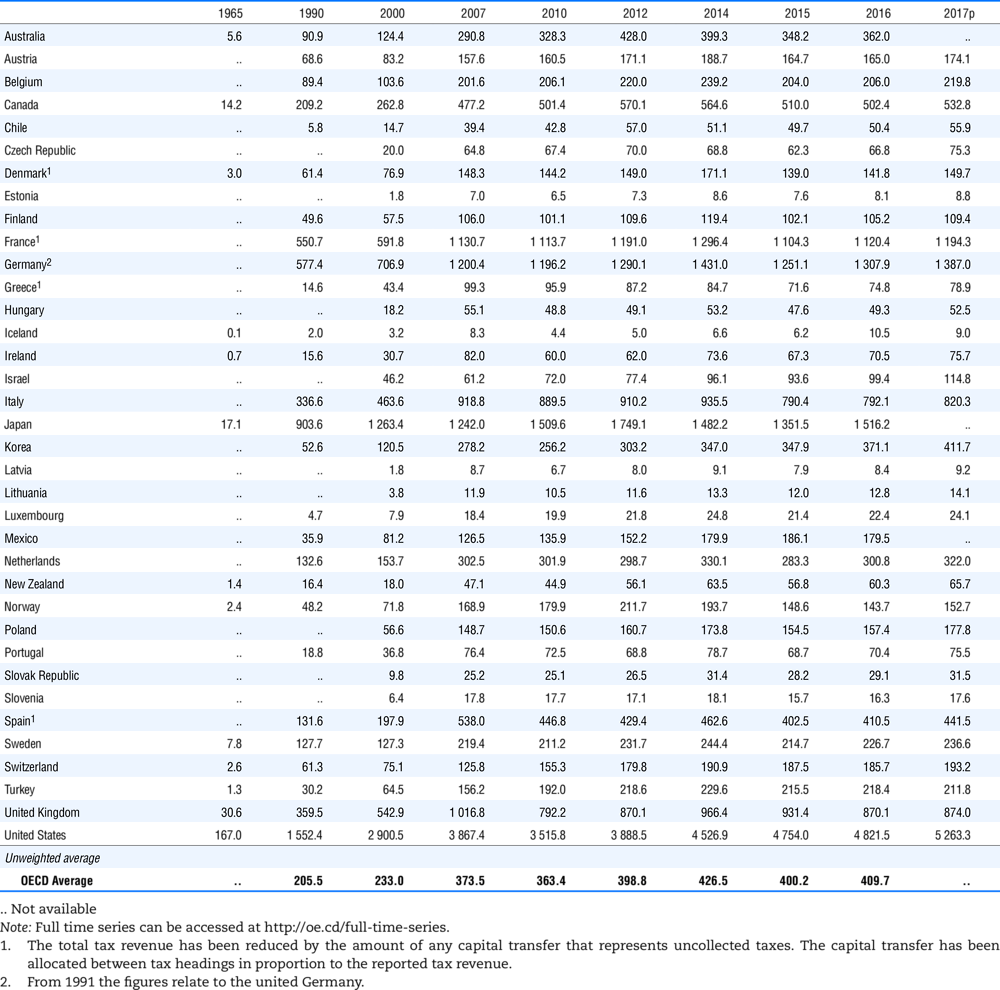

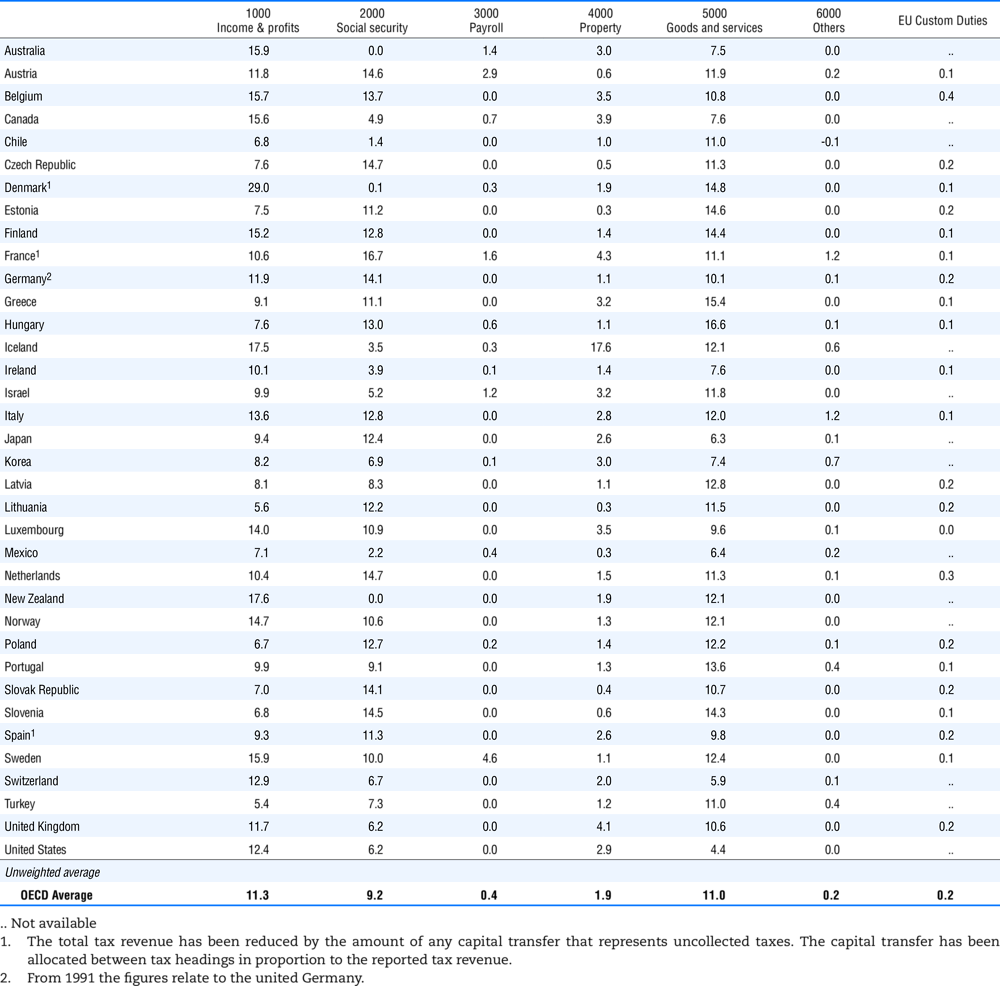

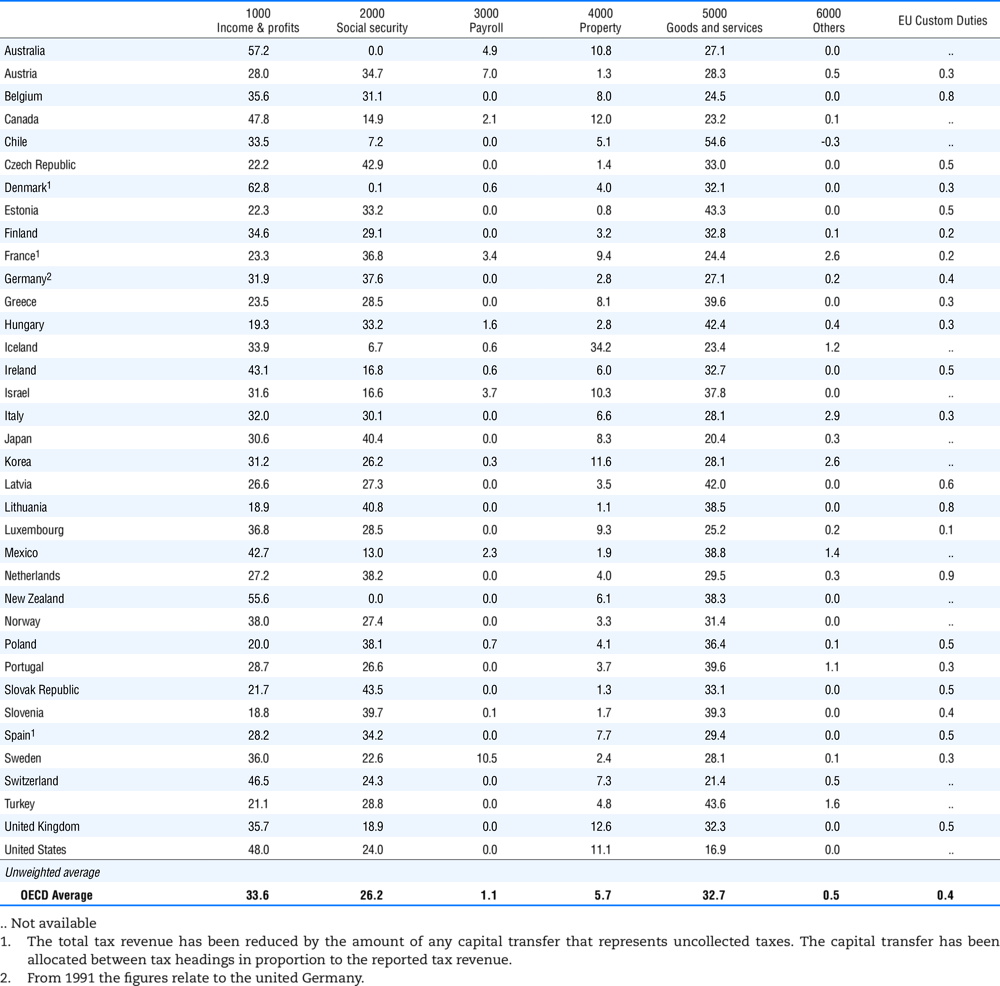

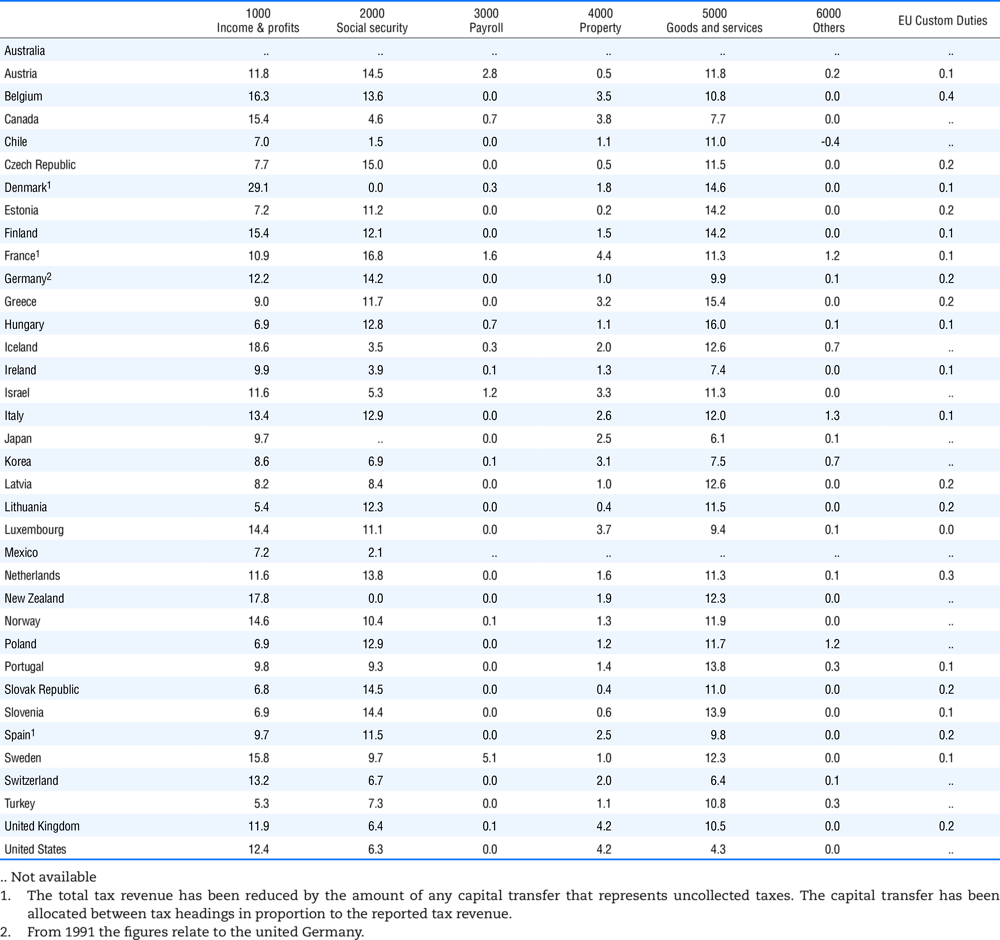

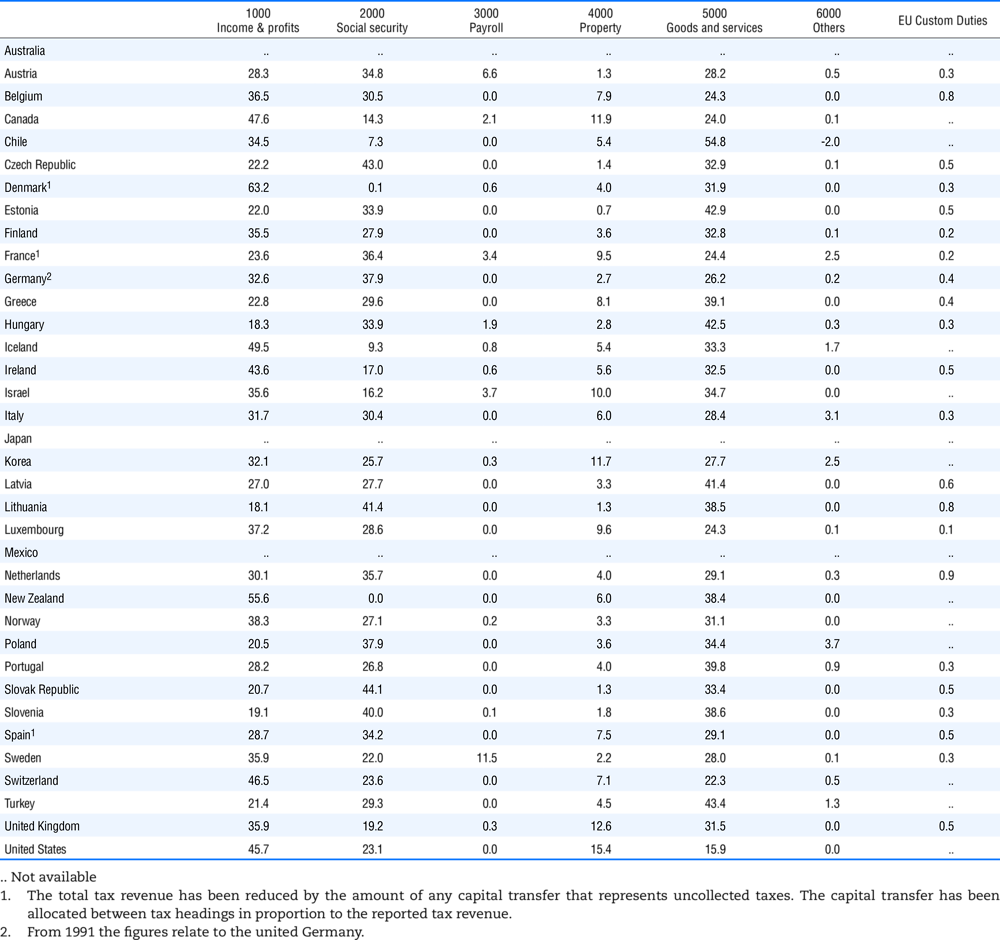

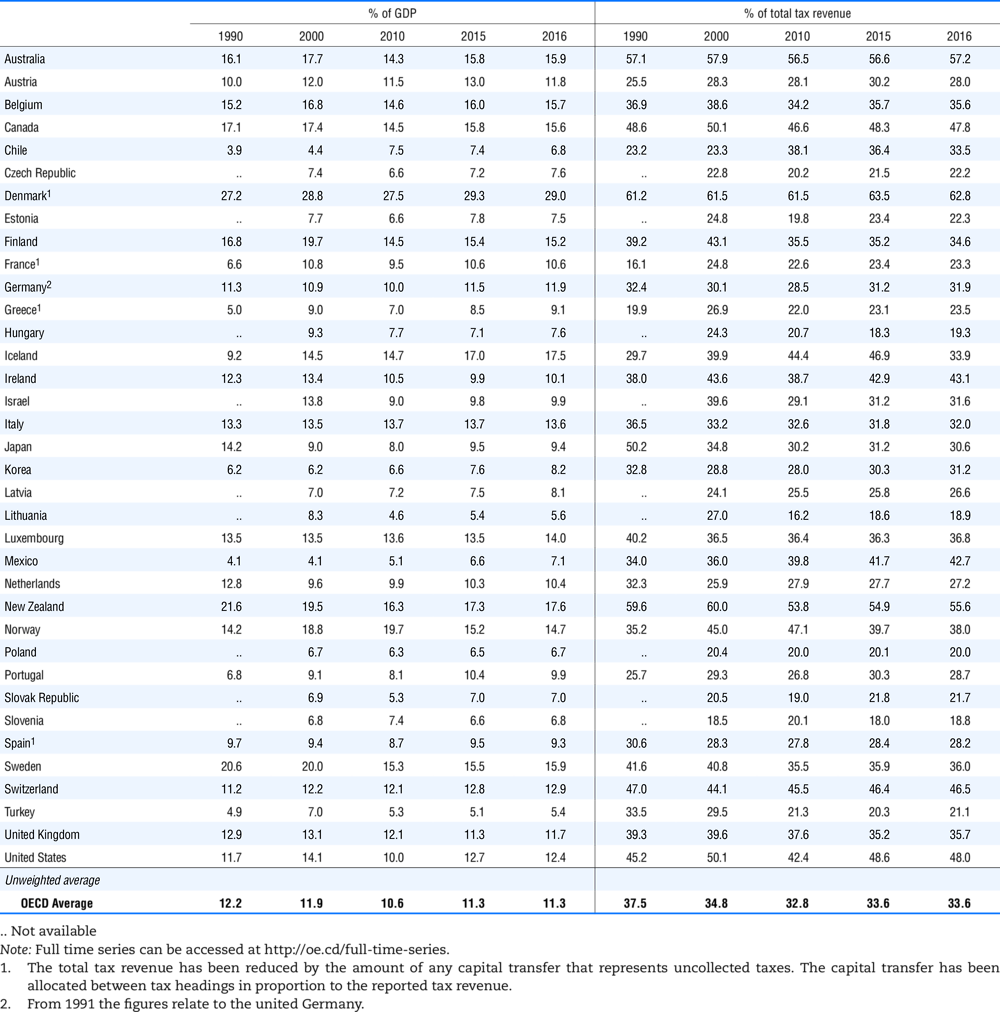

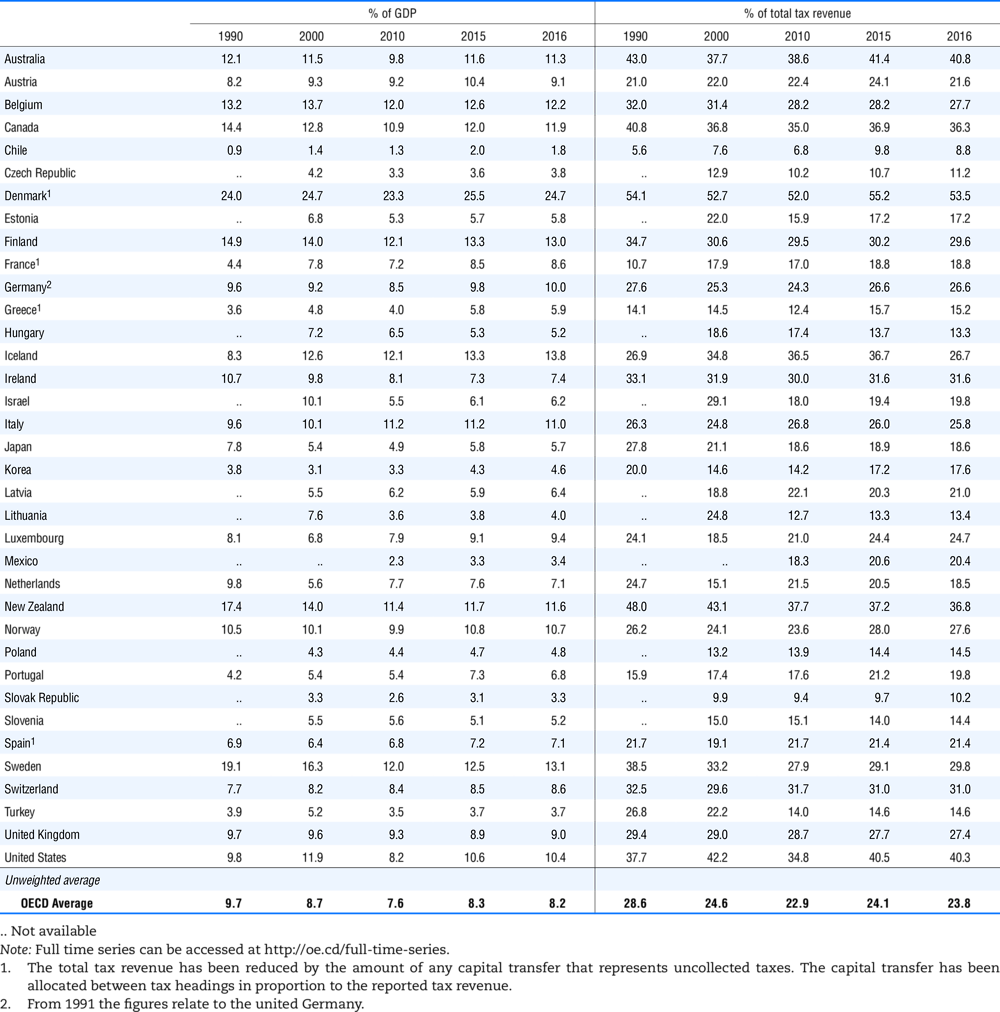

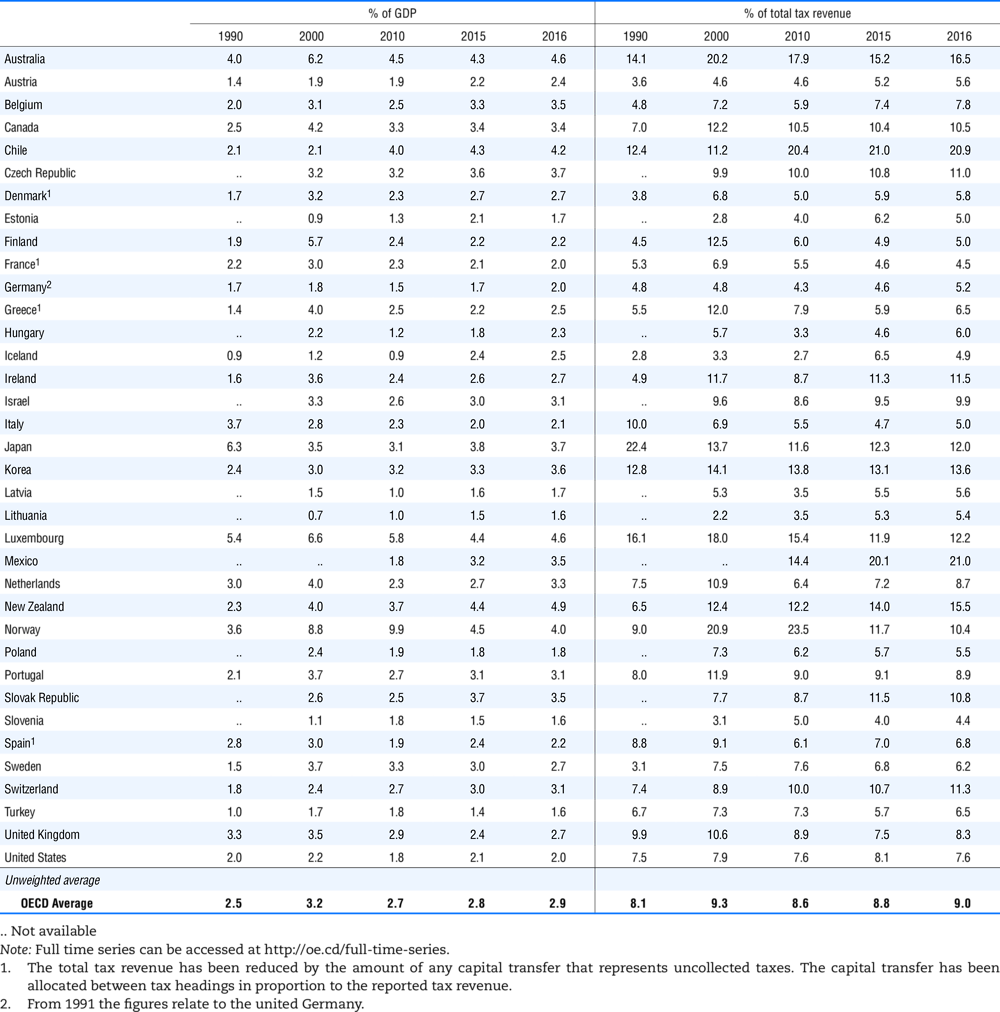

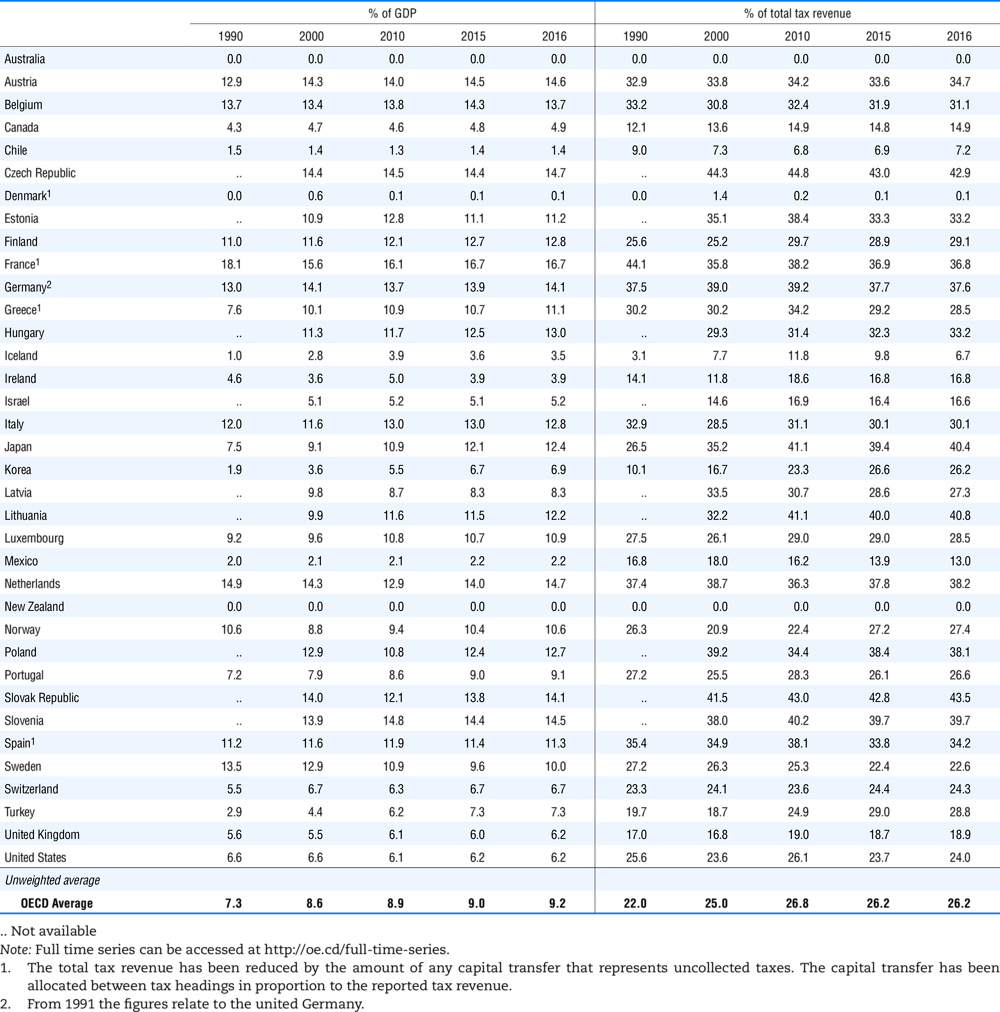

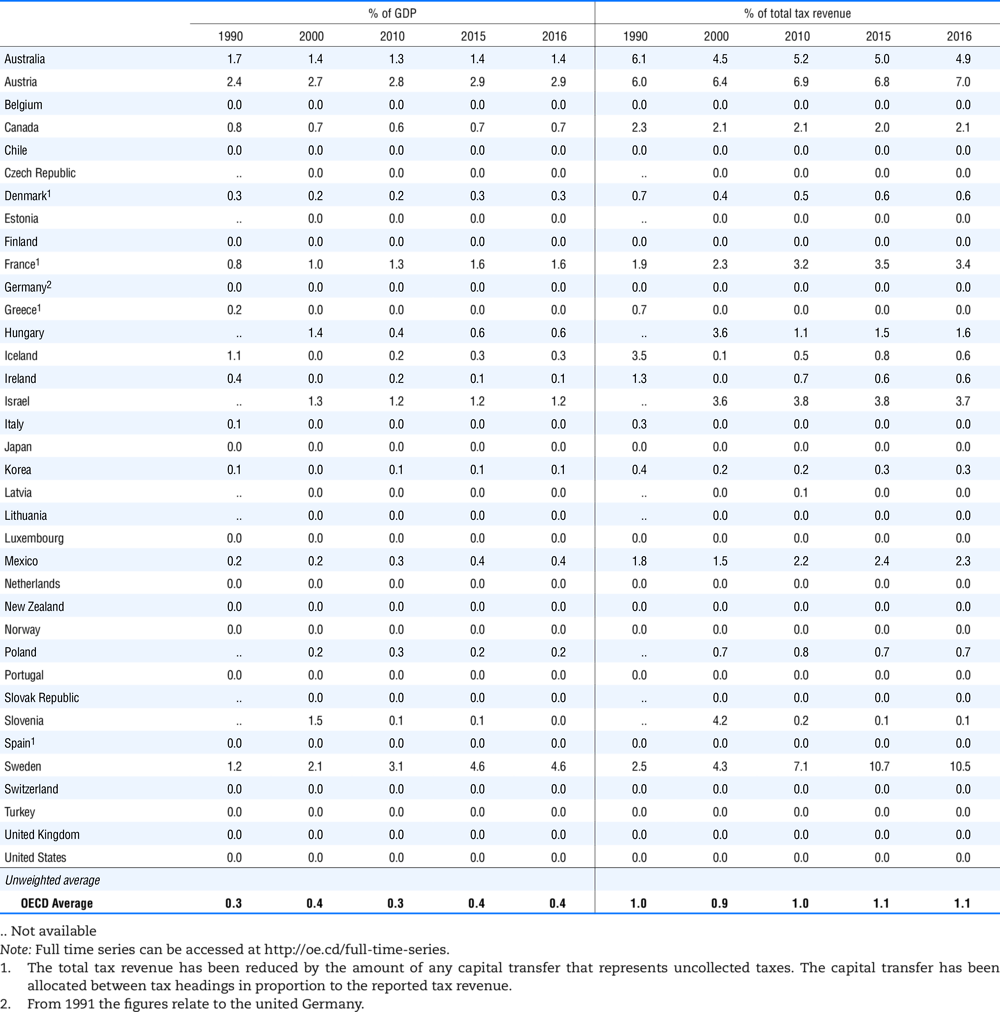

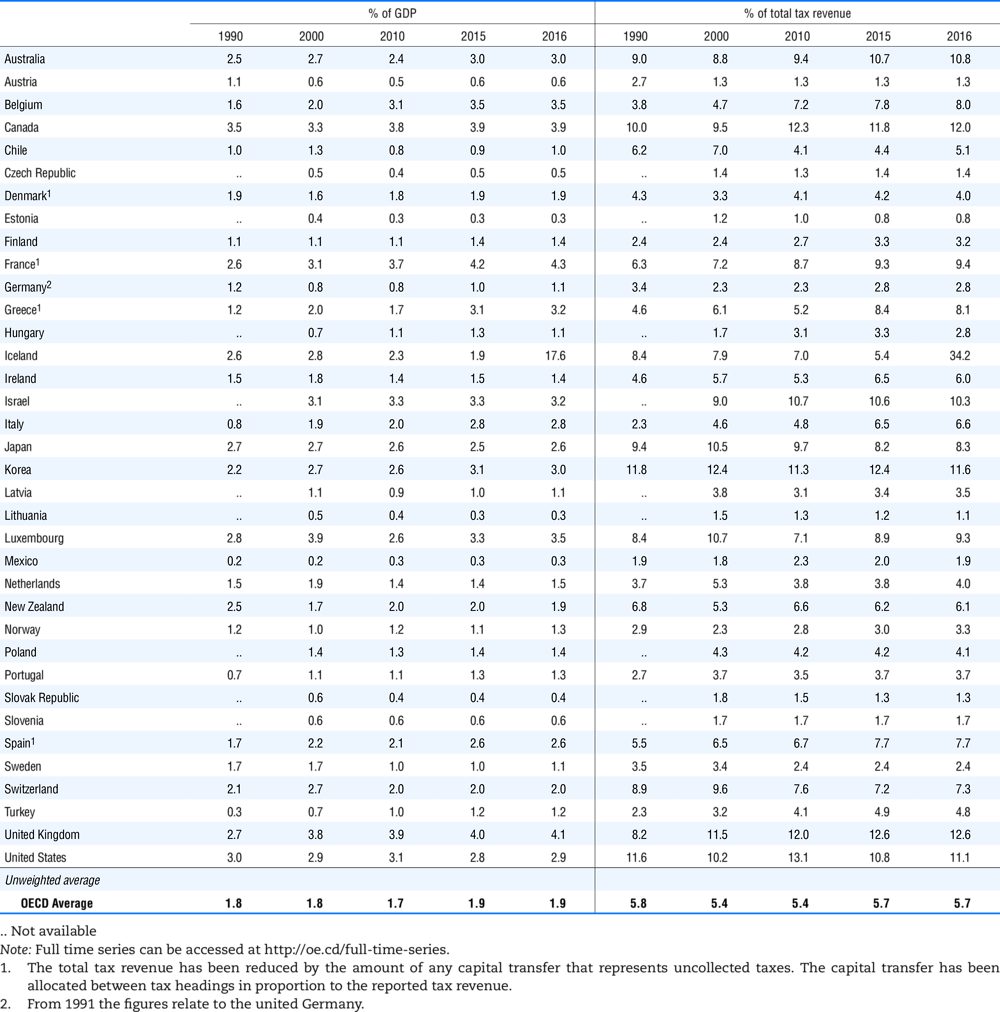

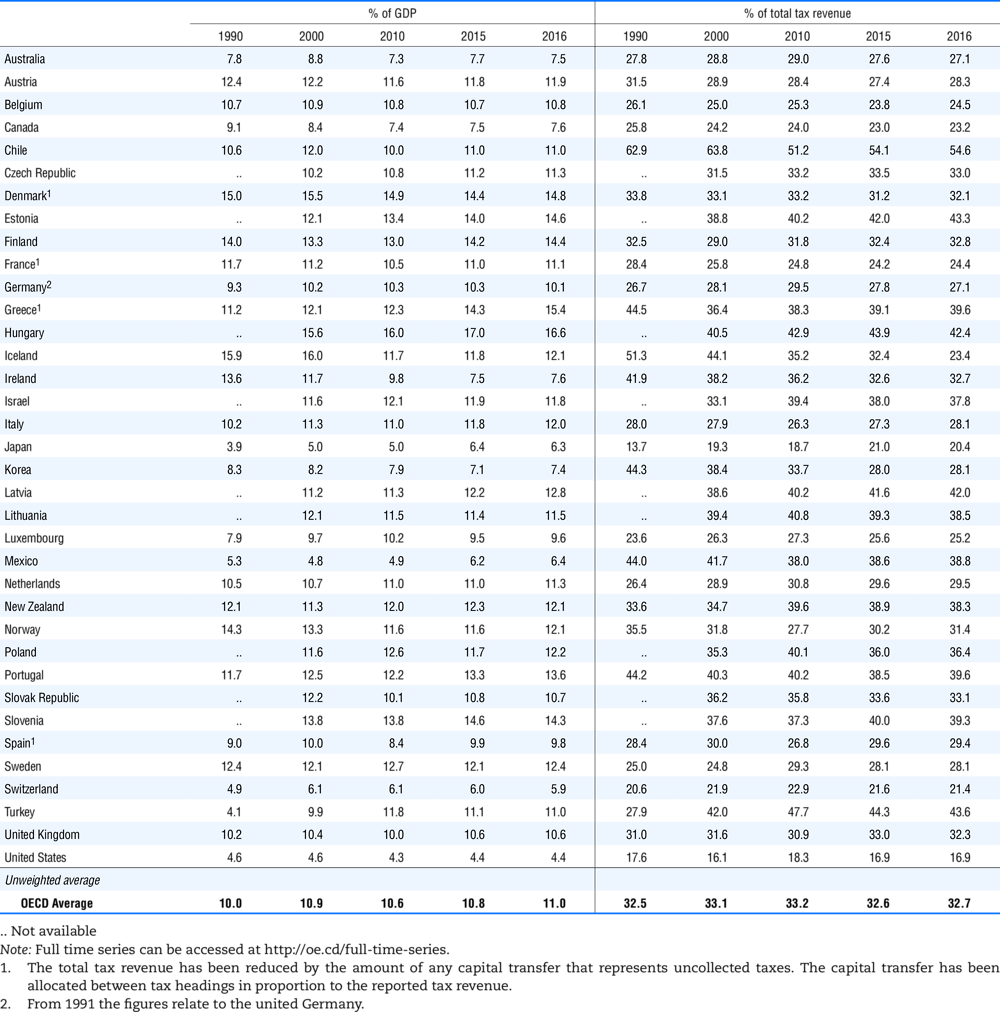

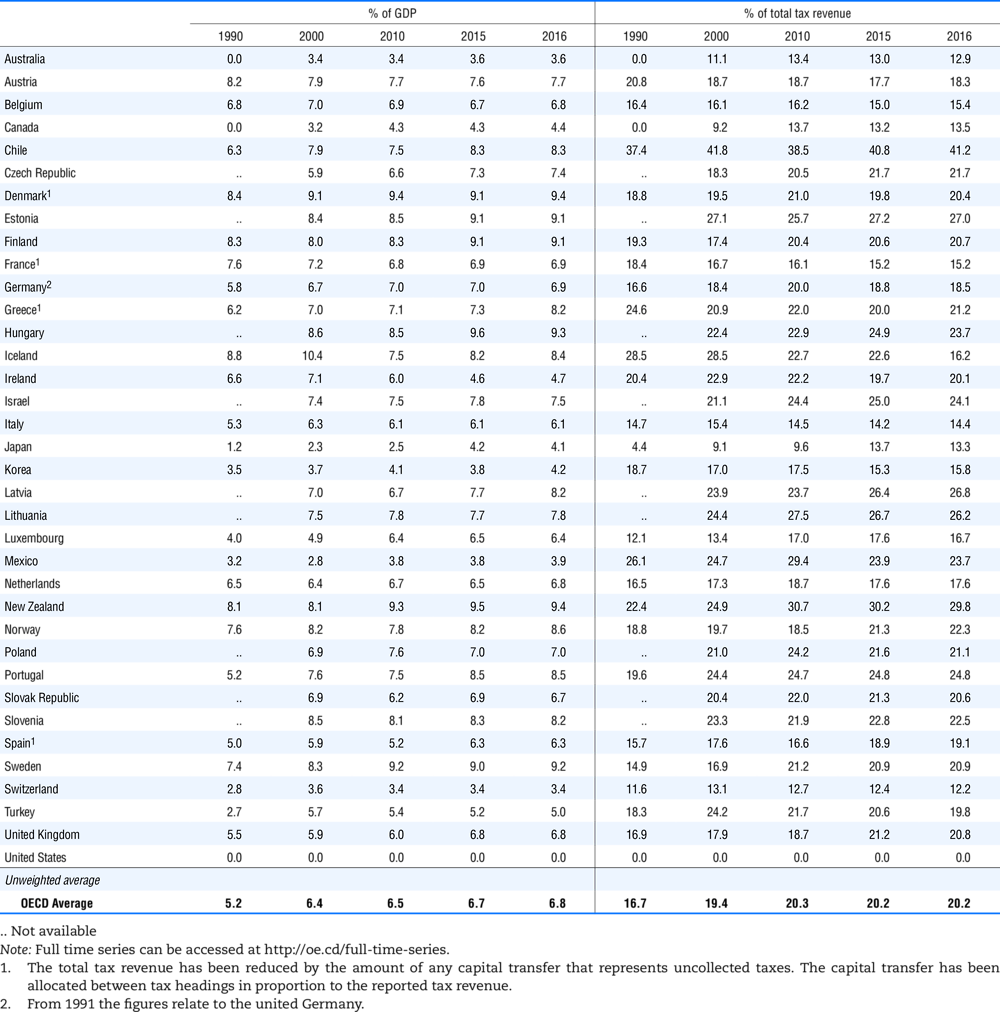

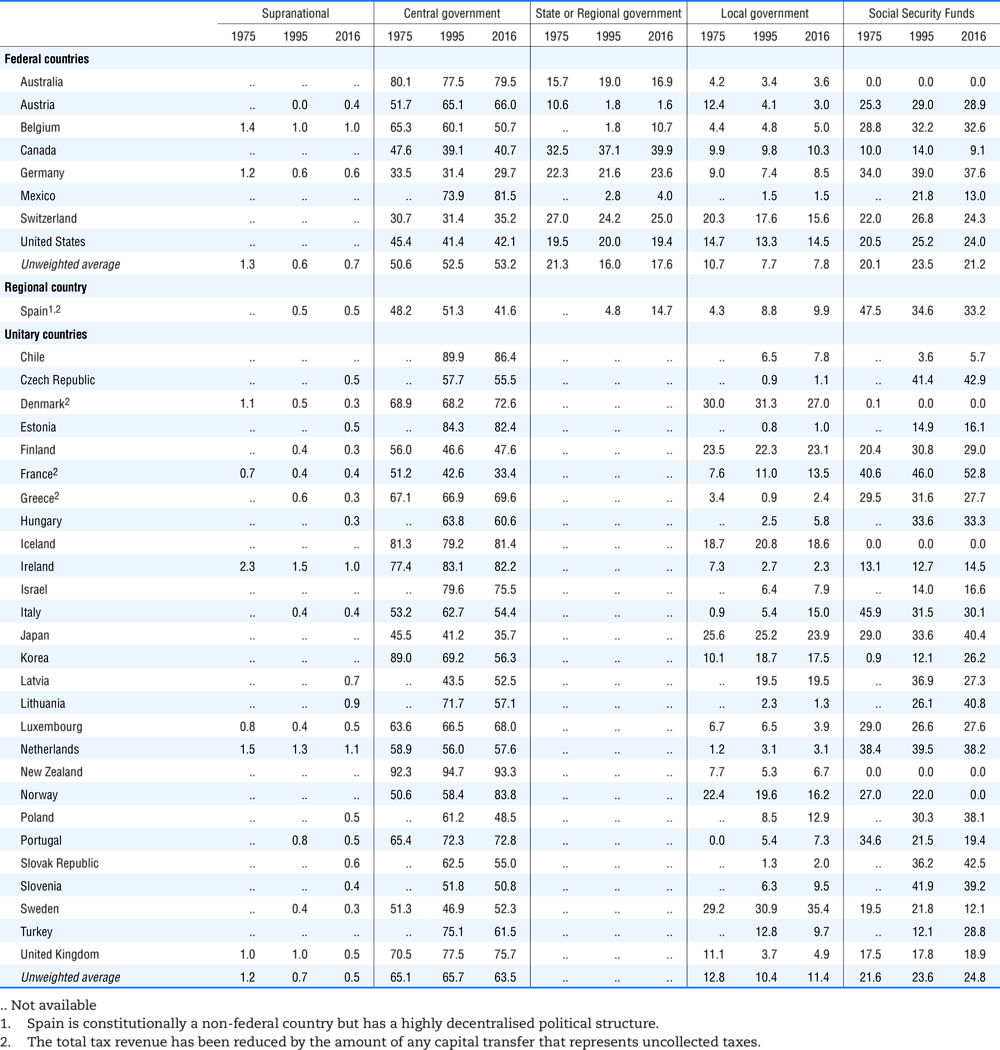

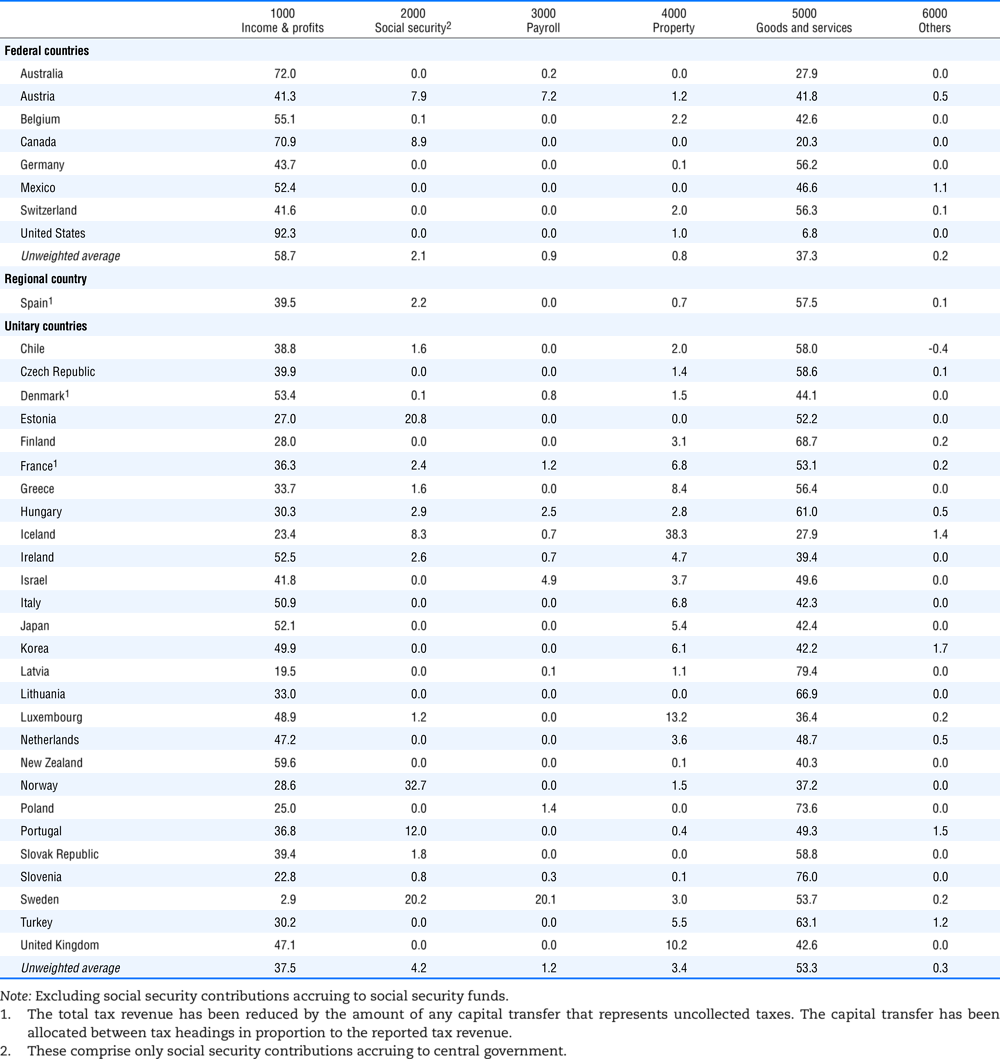

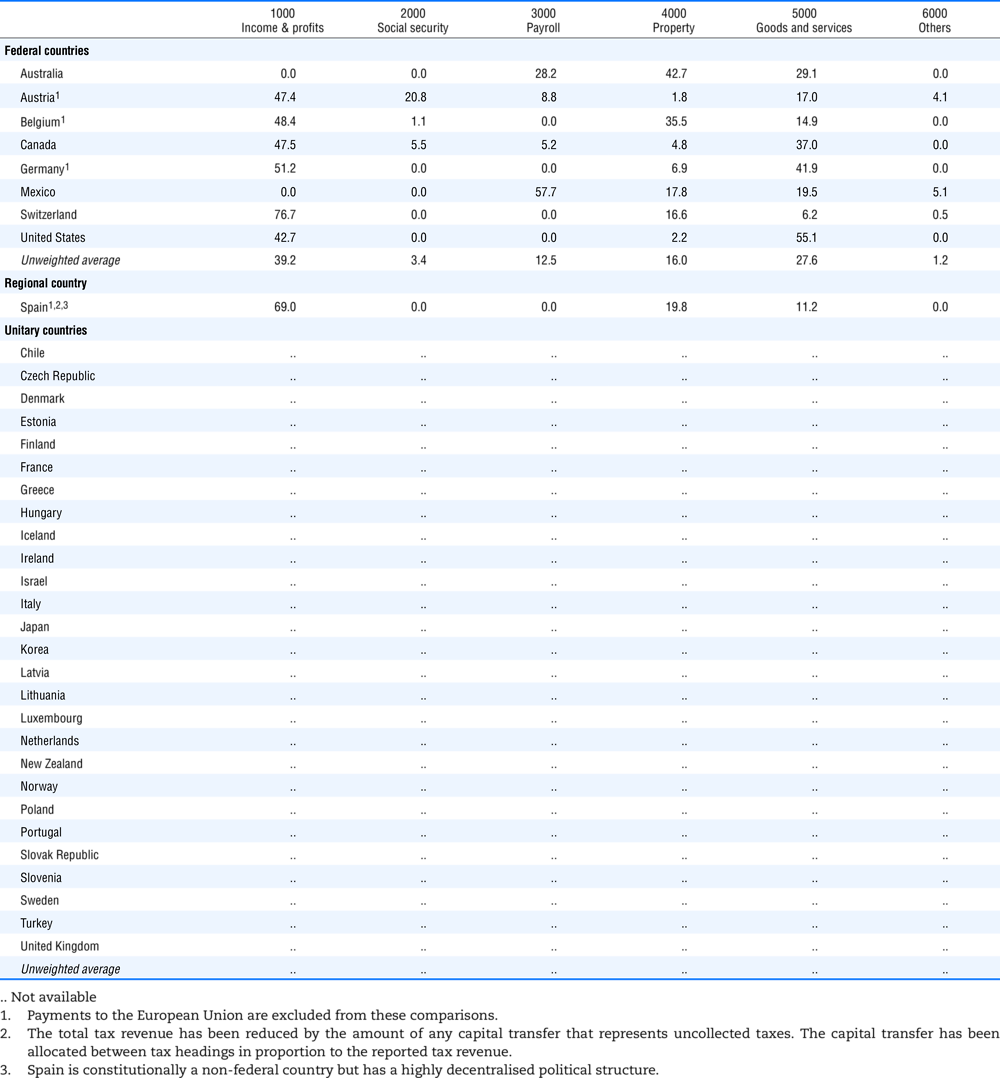

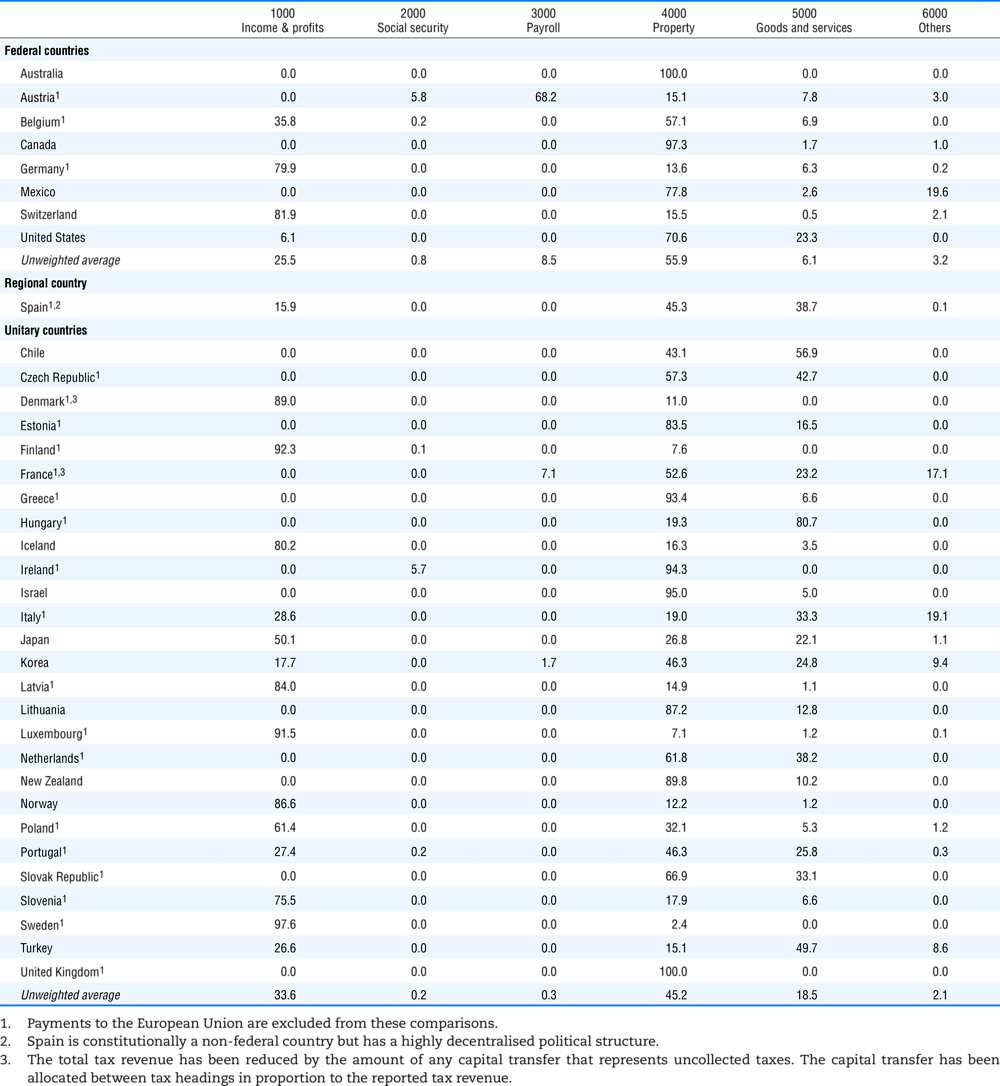

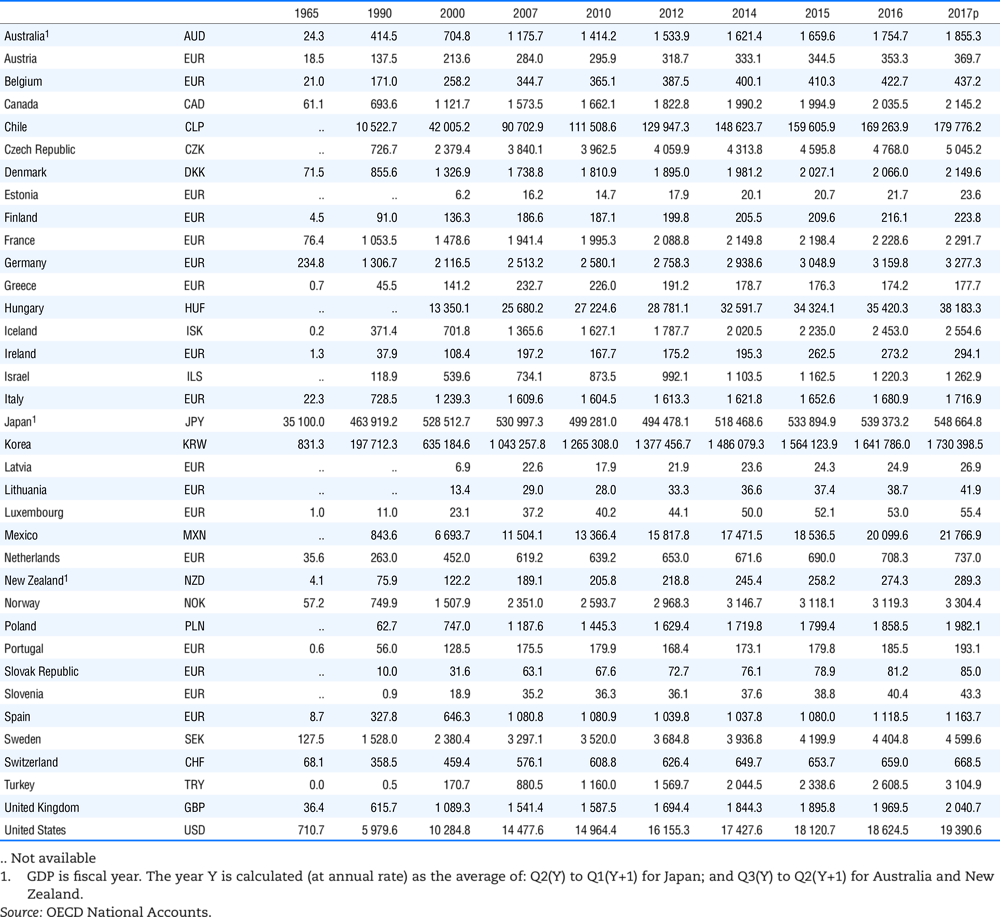

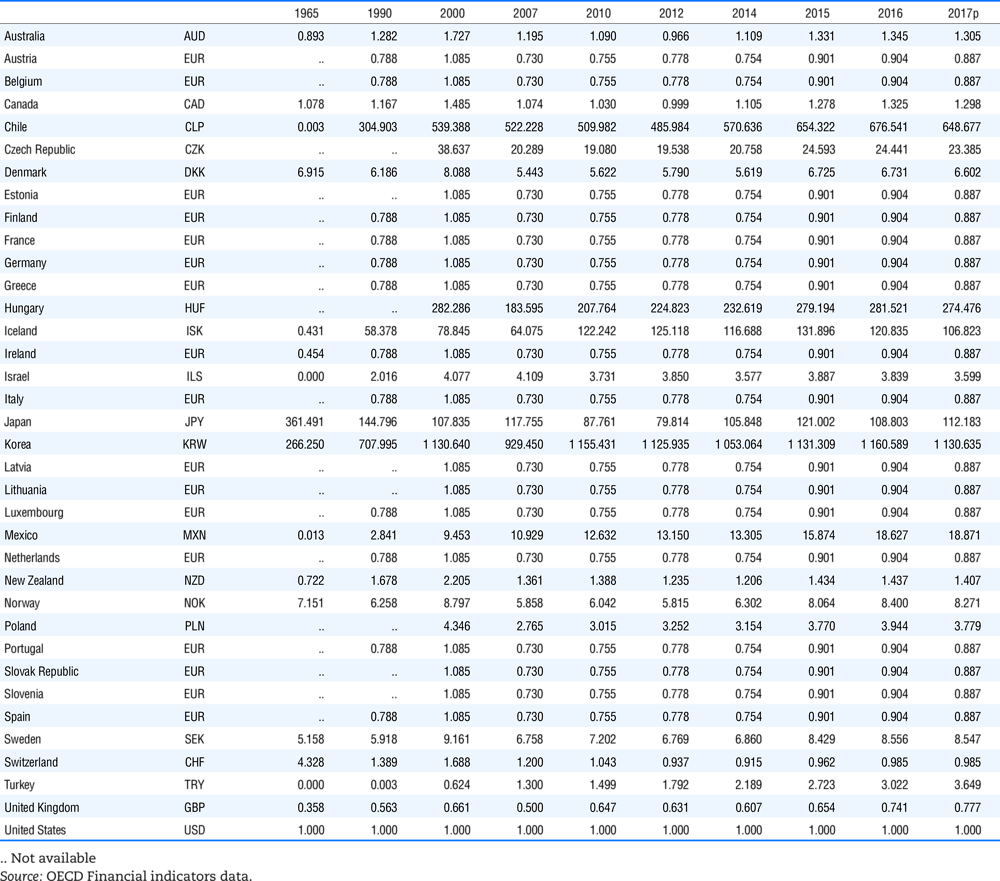

Chapter 3. Tax Levels and Tax Structures, 1965-2017

In all of the following tables the symbol (…) indicates not available/or not applicable. The main series in this chapter cover the years 1965 to 2016. A selection of years are shown in this chapter because of lack of space. The complete series is available on line. Data for 1955 and 1960 (for nineteen OECD countries) are provided in part V of the 1998 edition of this Report.

The Gross Domestic Product (GDP) figures are based on the 2008 System of National Accounts (SNA) for all OECD countries.

In this chapter, the OECD average for 2016 in all tables has been calculated excluding the one-off revenues from stability contributions in Iceland.

Footnotes to Tables 3.1 to 3.18 refer to the treatment of the capital transfers that some countries make to account for taxes that have been assessed but not collected. The capital transfer has been subtracted from the total tax revenue and this reduction has been allocated between tax headings in proportion to their tax revenues.

This applies to the following countries:

-

Denmark from 1971.

-

France from 1992.

-

Greece for 1999 and 2000.

-

Lithuania from 1999.

-

Spain from 1995.