Pakistan

Pakistan: Pension system in 2016

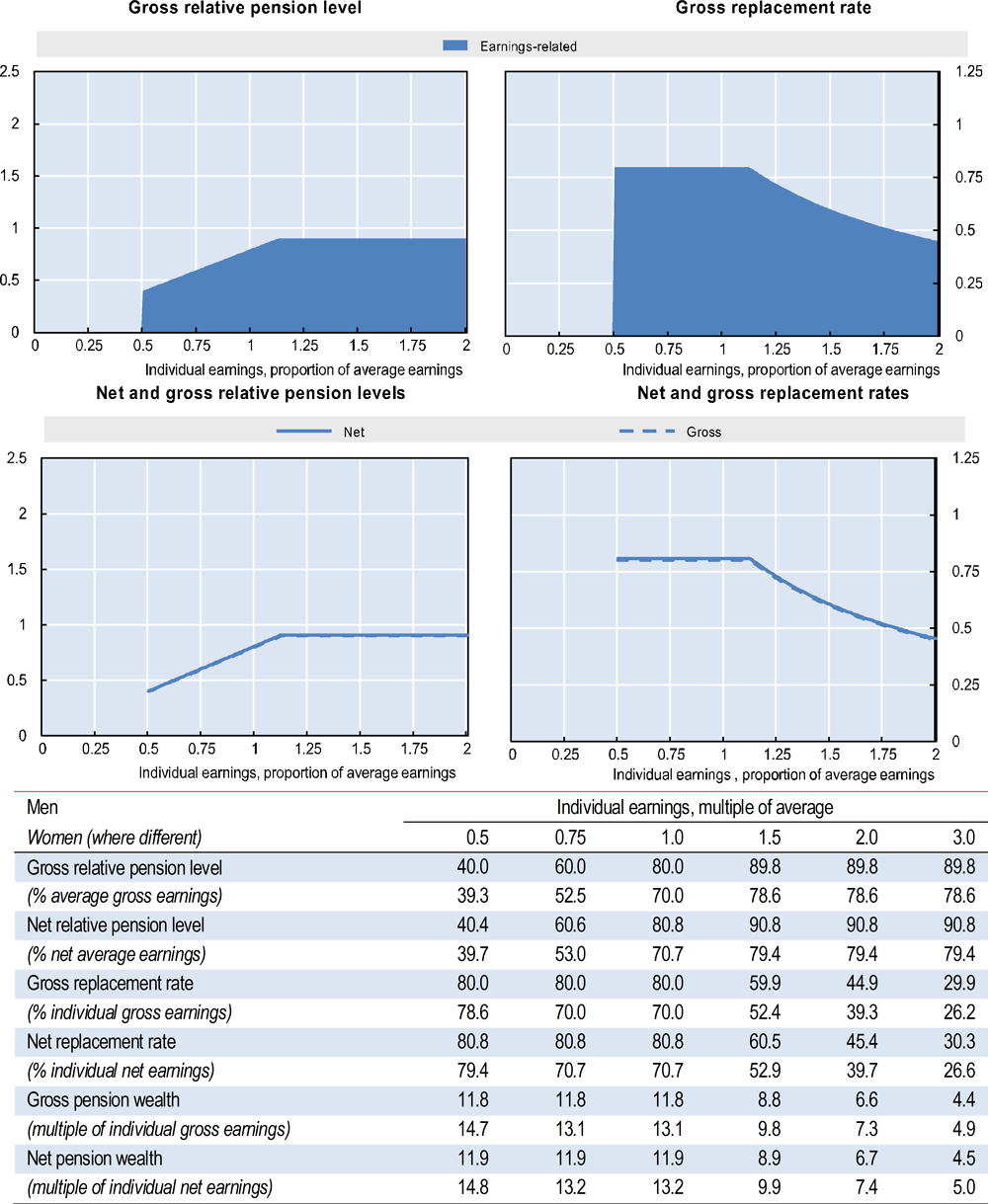

Workers of an industry or establishment with five or more employees are required to be insured under earnings-related pension called employees’ old-age benefit scheme.

The model assumes that workers are covered by the earnings-related pension (EOBI).

Qualifying conditions

Normal pension age for earnings-related private sector pension is age 60 for men and 55 for women with 15 years of contribution (relaxation is provided for those joining the scheme at older ages).

Benefit calculation

Earnings-related

The pension is calculated as 2% of the insured’s average monthly earnings in the last 12 months multiplied by the number of years of covered employment. Indexation rule for pension in payment is discretionary and the model assumes price-indexation.

Minimum pension

Minimum pension is PKR 5 250 per month. Indexation for pension in payment is discretionary and the model assumes price-indexation.

The amount of (both maximum and minimum) insured monthly wage is PKR 15 000.

Old-age grant

A lump sum of one month of the insured's average monthly earnings for each year of contributions is paid for those with at least two but fewer than 15 years of contributions.

Variant careers

Early retirement

The earliest age at which men can start claiming pension is 55 and this is 50 for women.

The reduction applied is 0.5% for each completed month by which age at retirement falls short of 60 (55 years for women). This reduction is also applicable to the minimum pension.

Late retirement

It is possible to start receiving pension after normal pension age.

Personal income tax and social security contributions

Taxation of workers

Social security contributions payable by workers

Employer pays 5% of the minimum wage (PKR 15 000) and employee pays contribution at the rate of 1% of minimum wage.

Taxation of pensioners

The additional tax relief for older people is 50% for taxable income less than or equal to PKR 1000 000.

Taxation of pension income

All benefits received from the EOBI on retirement or death are not taxed. Lump-sum benefit from Voluntary Pension System is exempt however, pension payments are taxed.

Social security contributions payable by pensioners

Pensioners do not pay any social security contributions.