Chapter 4. Strengthening the application of OECD Core Principles of Private Pension Regulation: Lessons from Investment Institutions

This chapter considers how the governance frameworks and investment policies of several nationally significant investment institutions contribute to realising the missions of these institutions. It maps the set-up and practices of the different institutions against the recommendations of the OECD Core Principles of Private Pension Regulation, especially Core Principle 3: Governance and Core Principle 4: Investment and Risk Management. The chapter builds on this analysis to determine how the application of the recommendations might be strengthened to help improve outcomes for members of private pension schemes. The institutions examined include pension funds, reserve funds and sovereign wealth funds.

The OECD Core Principles of Private Pension Regulation (“Core Principles”) provide governments, regulators and supervisors with a common benchmark and high-level guidance on the design and operation of funded and private pension systems. They aim to strengthen the regulatory framework around funded pensions in order to promote the sound and reliable operation of funded and private pension plans.

Strong governance and appropriate investment strategies are essential if funded and private pensions are to generate good outcomes for plan members and generate trust and engagement by the public. Core Principle 3: Governance and Core Principle 4: Investment and Risk Management set out the characteristics and behaviours that regulators should encourage in the governance frameworks and investment policies respectively of pension providers.

Nationally significant investment institutions, such as reserve funds, pension funds and sovereign wealth funds, provide practical examples of how governance and investment standards can be framed, implemented and monitored. These institutions play different roles in their domestic pension systems, leading to different organisational structures and investment strategies. However, their governance and investment arrangements have many common features, and these correspond to the recommendations of the OECD Core Principles of Private Pension Regulation.

This chapter examines the governance frameworks and investment policies of several nationally significant investment institutions, in particular public and centralised institutions, and maps them against Core Principles 3 and 4. There is a close match between the set-up of these institutions and the recommendations of the Core Principles, demonstrating the relevance of the recommendations. The analysis also highlights key policy issues linked to the practical application of governance and investment standards, and how these investment institutions have addressed these. Based on this analysis, it proposes measures to strengthen the application of Core Principles 3 and 4 to private pension institutions.

The chapter sets out an examination of ten different investment institutions, including six pension funds, two reserve funds and two sovereign wealth funds. Five of the pension funds operate individual member accounts: the Mandatory Provident Fund (MPF) in Hong Kong (China), the Central Provident Fund (CPF) in Singapore, AP7 in Sweden, the National Employment Savings Trust (NEST) in the UK and the Thrift Savings Plan (TSP) in the USA.1 The sixth pension fund under consideration in this report, Denmark’s ATP, manages individual accounts within a common insurance scheme. The two reserve funds analysed are the Canadian Pension Plan Investment Board (CPPIB) and the funds AP1-4 in Sweden.

The chapter also examines Norway’s two sovereign wealth funds, the Government Pension Fund Global (GPFG) and the Government Pension Fund Norway (GPFN), which despite their titles are not directly linked to the domestic pension system nor earmarked for specific liabilities. It further includes some information about the Australian Future Fund (AFF) and New Zealand Superannuation Fund (NZS) – both sovereign wealth funds – where these offer relevant illustrations of the topics related to investment institutions, governance and investment policies.

4.1. Overview of institutions analysed for this report

The institutions analysed for this report are shown in Table 4.1. They have been included because they provide examples of different approaches to governance and investment.

The six pension institutions are ATP, MPF, CPF, AP7, NEST and TSP. All of these institutions receive both employee and employer contributions except AP7 (employee only).

-

ATP is a mandatory defined contribution (DC) occupational pension scheme established in 1964 under which members accrue guaranteed rights. ATP is set up as an insurance scheme and manages approximately USD 115 billion of assets.2 In addition, ATP’s 2 820 staff administer a variety of other social security benefits.3

-

The MPF was introduced in 2000. It is a fully-funded occupational DC system consisting of 32 private pension schemes operated by 14 MPF trustees that are licensed and overseen by the Mandatory Provident Fund Authority (MPFA). Total savings across all providers are approximately USD 78 billion. A regulatory requirement of the MPF is that schemes must offer a default option that complies with specific design guidelines.

-

The CPF is a mandatory retirement savings scheme set up in 1955. Members receive a guaranteed rate of return that is based on the return on Singapore government bonds. The state issues special bonds to provide this guarantee. Total assets are approximately USD 237 billion.

-

AP7 provides the default option within Sweden’s premium pension system, which is a mandatory funded pension scheme within the public system. Premium pensions were established in 2000 and employees contribute 2.5% of their pensionable income to them, bringing total assets to approximately USD 40 billion. AP7 has 27 employees.

-

NEST was set up as part of the UK’s workplace pension reforms in 2008 that included the introduction of auto-enrolment. It is a multi-employer DC pension scheme that has a public service obligation to be open to any employer that wants to use it and has a low-cost approach. Total assets are approximately USD 2.4 billion and staff numbers are around 240.

-

TSP is a voluntary DC plan for federal employees and members of the uniformed services. It was set up in 1986 and offers similar services to 401k plans for private sector employees. The assets of the TSP amounted to approximately USD 575 billion as at Q4 2017 and are administered by a government agency, the Federal Retirement Thrift Investment Board (FRTIB). From January 2018, members of the uniformed military will be auto-enrolled into the TSP, taking participants to an estimated 5.6-6.0 million people.

The two Reserve Funds are designed to back up their domestic pension systems:

-

CPPIB is an investment management organisation that was established in 1997 to invest the assets of the Canada Pension Plan. It manages an investment portfolio of approximately USD 250 billion and provides cash management services to the Canada Pension Plan. It has 1 392 staff.

-

The funds AP1-4 constitute about 15% of the assets of the Swedish pension system and act as a buffer to cover future disbursements. The aim of having multiple funds is to diversify the investment risk of the buffer capital. The funds co-operate to provide transparency and cost efficiency but nevertheless are in competition with each other in terms of performance. Net inflows have been negative since 2009 and the Swedish Pension Agency expects to withdraw capital from AP1-4 over the next 25-30 years. Assets are approximately USD 152 billion; each of the funds AP1-4 has around 60 staff members.

The two sovereign wealth funds are owned by the Norwegian state.

-

The domestic fund, GPFN, was established in 1967 with funds allocated from the national insurance scheme. No further inflows or outflows have occurred since then and returns are retained by the fund. Assets under management were approximately USD 29 billion at the end of 2017. GPFN is managed by the Folketrygdfondet, a special legislation company with 50 employees that is wholly owned by the State of Norway through the Ministry of Finance.

-

The global fund, GPFG, was set up in 1990 to accumulate the country's surplus petroleum revenues. Assets are approximately USD 1 000 billion and are managed by Norges Bank, the Norwegian Central Bank, through its asset management unit, NBIM, which has close to 600 employees.

Some additional information about the Australian Future Fund (129 employees) and the New Zealand Superannuation Fund (over 100 employees) has been included. These institutions have not been presented in detail as their governance structures and investment practices are very similar to those of their peers listed in Table 4.1.

4.2. Governance frameworks

This section analyses the governance frameworks of the reference group of public investment institutions. It considers the different governance models of the selected institutions based on a mapping of the key features of their governance frameworks against the Implementing Guidelines (IG) of Core Principle 3 of the OECD Core Principles of Private Pension Regulation, which are described in Table 4.2.

Identification of responsibilities

Core Principle 3 recommends that governance frameworks clearly separate oversight and operational activities (IG 3.1), and that a governing body is established with responsibility for oversight (IG 3.2). All the institutions analysed in this document follow this recommendation and have a Board of Directors, Trustee or other governing body (hereafter "the Board") entrusted with oversight. The Board is usually responsible for hiring the Chief Executive and setting out written descriptions of his or her duties, but leaves the day-to-day running of the institution to the executive team.

Governing body

One of the chief responsibilities of the governing body of a pension fund is to set out the fund’s mission (IG 3.3). This is not the case for the Boards of the investment institutions examined: their missions are established by the state in accordance with their role in their domestic pension system and the Board’s role is to interpret the mission or objective of the institution and transform it into a set of operating and investment strategies. The mission of these investment institutions may be specified in legislation or otherwise publicly stated, as shown in Table 4.3.

Governing bodies must observe prudential and fiduciary standards in carrying out their responsibilities, as outlined in IG 3.4. The way they meet these standards differs because their responsibilities can differ. In private pensions, their duties are towards members and beneficiaries, while in public institutions the Board must take into account the requirements of the state. The purpose of a Sovereign Wealth Fund is to shift public spending power from one point in time to another. There are no individual rights involved and there is no link to a specific purpose. Their Boards can fulfil their duties in this case by ensuring high professional standards and efficiency in the management of the fund’s assets. By contrast, Reserve Funds are earmarked for specific uses and their mandates often reflect the needs of government, for example they may stipulate a liquidity requirement. Pension funds with individual accounts have a duty towards each member.4 Boards must therefore additionally concern themselves with ensuring that such funds are protected from political interference in violation of the mission.

There may be instances when the state decides to change the mission of a public investment institution, as occurred in France and Ireland. The Fonds de Réserve pour les Retraites was established by the French government in 2001 as a reserve fund for the pension system. In 2010 its role became more like that of a sovereign wealth fund. Ireland’s National Pension Reserve Fund was transformed into the Ireland Strategic Investment Fund in 2014 with a mandate to support local economic activity and employment.

In both cases, the new mission implied a meaningful change in the contributions and payments of the fund and in the investment horizon. Both institutions have been successful in implementing their new mission, but with some discontinuity in terms of the Board. These examples may be of relevance to private pension funds that are considering structural changes, for example introducing risk-sharing features into defined benefit schemes. Regulators should be confident that the funds’ governing bodies can demonstrate that they are able to articulate the new mission and introduce new operating and investment strategies without disruption.

Accountability

The Boards of these investment institutions are accountable for the delivery of their mission. The accountability frameworks of these institutions are based on the “arm's length” principle. In an arm's length relationship, the two parties to an agreement are considered to be independent and on an equal footing, so that neither has control over the other for the purposes of that agreement. This means, for example, that the state may have the final say over Board recruitment but once the Board is established the government cannot influence Board members to invest in a particular project.

The arm’s length relationship means that the Board is accountable to government, in line with IG 3.5, but has the independence to set out its strategy within the framework established by law, consistent with IG 3.4. The Board may report to Government or Parliament but it usually does not take instructions or directions from them, although the degree of independence can vary. For example, the New Zealand Minister of Finance may give directions to the Guardians of the Superannuation Fund, as long as these directions are “consistent with the duty to invest the Fund on a prudent, commercial basis”.5 Ministerial directions must be tabled in Parliament. Similarly, the Board of the US Thrift must seek Congressional approval for any changes to the investment instruments permitted in the TSP.

For such an arrangement to work, the mission of the institution must be clearly defined. This enables the Board to put in place appropriate policies and the competent authorities to spot inconsistencies even from an arm’s length. Regulators may wish to consider whether the private pension funds under their supervision similarly have clearly stated objectives and coherent operating policies.

Suitability

As specified by IG 3.6 for private pension institutions, Board members (and senior managers) are expected to meet fit and proper criteria. These are spelled out in differing levels of detail according to the jurisdiction, but in general the criteria cover personal and financial integrity, conflicts of interest and business conduct. All institutions require that Board members have relevant experience, insight and professional background.

-

ATP requires that Board members and managers have sufficient experience to undertake his/her responsibilities. Candidates cannot 1) have been guilty of specific offences; 2) be subject to liquidation, petition of bankruptcy or similar; 3) be involved in business activities that have led to losses for ATP; or 4) have demonstrated unsuitable behaviour.

-

The AP funds apply a general standard requiring the Government to appoint board members based on their ability to advance the management of the fund.

If Board members no longer meet the relevant criteria, they are typically required to report the situation to the Chairman of the Board, the Regulator or other competent authority. The expectation is that the member will resign if required, therefore only a few of the institutions have a formal procedure for removing Board members. This procedure is carefully defined to avoid it being abused.

-

The Canadian Governor in Council can remove Board members of CCPIB “for cause” (i.e. for misconduct or breach of duty).

-

If the Danish regulator considers that an individual board member at ATP no longer meets the required standards, it should inform the Minister of Employment who will decide whether or not the individual can continue to serve.

-

The Swedish Government has the authority to terminate Board members of the AP funds if it assesses that they no longer meet the required standards.

IG 3.6 also stipulates that “the governing body should collectively have the necessary skills and knowledge to oversee all functions”. ATP, CPPIB, NEST, CPF, NZS and FRTIB require that the Board as a whole possesses a specific mix of skills and experience.

-

The CPPIB applies a general behavioural standard and sets criteria related to the different competences of the Board overall.

-

The Secretary of State for Work and Pensions selects Trustee Members for NEST on the basis of merit, fairness and openness and considering that the Board of Trustees overall should have experience of investment, portfolio management, member representation, finance, auditing, governance, and business management.

It is customary for Boards to conduct annual self-assessments and verifications of Board member suitability. This type of information could be valuable to regulators of private pensions, as it would help to identify areas where members of governing bodies needed extra technical advice or training as well as potential sources of governance failings.

Delegation and expert advice

The majority of Boards have established committees with mandates to work on specific aspects of the operations of the institution, as described in IG 3.7. These committees are intended to strengthen the Board’s control and strategic foresight and to enable them to work more closely with management on specific issues. In some cases, the committees are mandated by law. Forming committees is an important way to ensure depth and continuity in the Board’s work on particular aspects. A risk related to the use of committees - and particularly so if the number of committees becomes high - is that the Board and its individual members become distanced from their collective and personal responsibility.

-

The Board of CPPIB is legally required to form an Investment Committee and an Audit Committee.

-

The Board of ATP has formed a Management Committee, an Audit Committee and an ORSA (Own Risk and Solvency Assessment) committee. It has delegated the typical responsibilities of a Remuneration Committee to its Management Committee.

-

The Board of MPFA has established a large number of committees: Administration, Audit, Finance, Guidelines and Remuneration Committees, Tender Board, Working Group on MPF Reform Issues, and Working Group on Review of Adjustment Mechanism for Minimum and Maximum Levels of Relevant Income.

-

The Boards of GPFN and GPFG have formed Risk Management Committees, Audit Committees and Remuneration Committees. The Board of GPFG has also formed an Ownership Committee.

Consistent with IG 3.7, where external experts or investment managers are hired, the Board has ultimate responsibility for the terms of their contracts.

Actuary, auditor, custodian

As part of their internal control and verification system all institutions examined are subject to external audit and many of them have created special functions to facilitate this process – e.g. Internal Auditor, Appointed Actuary, Chief Risk Officer and Risk Unit. In most cases such special functions are set up and appointed by the Board and they report directly to it. This is in keeping with IG 3.8 – 3.10.

Risk-based internal controls

Just as the Boards of the examined investment institutions operate at arm’s length from government, their management operates at arm's length from the Board. Executive management is responsible for the day-to-day management of the institution and the execution of the investment strategy.6 The Board is not involved in these tasks but it puts in place sufficient guidelines and control procedures to be able to monitor the activities of the management team, in line with IG 3.11 and 3.12. In the majority of cases, the chief risk officer is a member of the executive committee and in some cases the internal control teams report directly to the Board of Directors or to the relevant sub-committee of the Board.

Several schemes have internal and external whistle-blower schemes in place, a more rigorous control mechanism than those suggested by the Core Principles. It is usually a requirement for the Board to establish and enforce a code of ethics, a code of conduct or a framework of policies or guidelines for management and staff.

Disclosure

IG 3.13 states that the governing body should make accurate and timely disclosures to all relevant parties. The type and extent of the disclosure made by these investment institutions depends on how they are supervised, but in general these institutions are subject to stringent reporting requirements to both members and supervisors, and their detailed financial information is publicly available.

Funded public pension schemes with individual accounts tend to be supervised in the same way as their private equivalents. For example, ATP is supervised by the Danish financial services regulator on an equivalent basis to a commercial insurance company; AP7 is supervised by the Swedish financial services regulator similarly to a private fund management company; and the Pensions Regulator supervises NEST in the same way as other trust-based occupational schemes. This creates a level playing field between the public and private sectors and reinforces the arm’s-length relationship between the institution and the government.

Reserve funds and Sovereign Wealth Funds are subject to other supervisory arrangements, typically involving direct supervision by a Government ministry. For example, all AP funds report to the Swedish Government that in turn reports to Parliament. CPPIB is accountable to, but not supervised by, Parliament: it submits its annual report to the Minister of Finance and to the appropriate provincial ministers. The Minister of Finance puts the report before Parliament. The Minister must undertake a special examination at least once every six years.

All the institutions examined submit audited annual accounts to government (some also submit quarterly reports). Most provide additional qualitative reporting on the operations, performance and strategic outlook for the business. Most of the institutions publish detailed data on the investment portfolio, risk measures and management and responsible investment practices. Supervisors of private pension systems should be able to request the same amount and type of information from the private sector, with the caveat that they must therefore also have the capacity to analyse and act on this information.

In most cases these reports are issued shortly after the end of the reporting period. In the case of the FRTIB, the financial report is issued within the statutory time frame, more than a year, after the end of the reporting period although fund information is published more regularly.

In addition to government, these reports are directed at a professional audience such as financial analysts, peers, policy makers and the financial press. This audience can provide a useful service in terms of performance evaluation, policy evaluation and peer pressure, compensating for the lack of direct competitive pressures on a number of the institutions. Providing transparency about the state of the public institution can help to build its credibility. In the case of private pension funds, it may not be appropriate to release detailed information to the public, especially where it is financially sensitive or may confuse members of the scheme.

Those institutions that operate schemes with individual accounts issue regular policy/account statements to their clients. Statements include information on contributions, accrued rights/savings, current risk choices if relevant, returns on investments, individual costs, benefit forecast and other benefits. They also direct members to sources of further information. In the case of ATP and AP7 the statement also includes a link to web-based national integrated pension rights and pension overview services where the individual can get a complete overview of his or her expected financial situation in old age across all public and private pension schemes and savings arrangements. Regulators may use such statements as a basis for comparison for private pension funds’ communications with members.

Appointment of Board members

The Board plays the key role in ensuring effective governance of investment institutions. It is therefore essential that the institutions are able to attract and recruit suitable candidates to their Boards. Regulators may wish to consider whether the recruitment criteria and remuneration policies of the different investment institutions examined here could usefully be applied to private pension institutions, especially in jurisdictions where there is a shortage of qualified candidates.

Appointments procedure

In the case of the public institutions discussed in this report, the government has an important role in Board appointments, but Board members are not political appointees. Other stakeholders are usually involved in the appointment process and there is no instance of Board members being removed following a change of government.7

In Norway, Singapore, Sweden and the United States, the appointments procedure is consultative but driven primarily by the government:

-

Board members of Folketrygdfondet and Norges Bank, (the managers of GPFN and GPFG) are appointed by the Ministry of Finance and the King in Council respectively.

-

In Singapore, the Minister of Finance appoints the Board of the CPF in consultation with the President.

-

Board members of the AP funds in Sweden are appointed by the government; for some of the positions other stakeholders are consulted. For AP1-4, social partners can propose two board members each.

-

In the USA, the President appoints the Board members of the FRTIB (which manages the assets of the Thrift Savings Plan) and the appointments are confirmed by the Senate. Three Board members are appointed by the President and two are appointed by the President in consultation with the minority leader in the House of Representatives and the majority leader in the Senate.

In Canada and Denmark the appointments procedure is driven primarily by other stakeholders who propose candidates to the government. Such a process helps to create confidence and ownership in the institution among stakeholders. Stakeholders must respect all professional and other criteria when proposing candidates.

-

In Canada, appointments are made by the Governor in Council on the recommendation of the Finance Minister. The Minister can form an advisory committee with one representative from each of the participating provinces and must consult the appropriate provincial Ministers of the participating provinces before making any recommendations on Board appointment.

-

Board members of ATP are formally appointed by Denmark's Minister of Employment but candidates are proposed by the two parties to the labour market. Each party nominates 15 members to a Board of Representatives and 6 members from each side are selected for the Board of Directors (specific organisations have the right to propose members).

Trustees of NEST in the UK are currently appointed by the Secretary of State for Work and Pensions but it is intended in future that Trustee members are appointed by NEST itself based on input from the Members Panel (an advisory body designed to provide NEST with members' views and considerations). This corresponds to the proposal in IG 3.5 that the accountability of the governing body is improved when plan members and beneficiaries can nominate members.

Recruitment criteria for Board members at the institutions under review also pay close attention to potential conflicts of interest. This issue is addressed in several of the Core Principles, notably in IG 3.1, which highlights the importance of setting out clear contractual responsibilities when a pension fund is managed by a financial institution. This reduces the risks of a conflict in cases where a financial institution appoints the members of the governing body of pension funds that it administers, and there is a clash between the commercial interests of the financial institution and the fiduciary responsibilities of the pension funds. The examined investment institutions additionally apply specific conflict of interest rules to Board members and emphasise transparency to reduce conflicts.

-

Directors of the MPFA (who are unpaid) are required to make a general declaration of their interests, and to report any pecuniary interest in a matter placed before the management board. These reports are available for public inspection.

-

The Board of the New Zealand Future Fund has set up a Conflicts Committee to address possible conflicts of interest for Board members.

Board size and structure

The number of Board members appointed varies across the institutions analysed, depending on the mandate of the institution and the range of competences needed for the Board to deliver that mandate. The size of the Board of the institutions examined ranges from 5 (FRTIB, which manages the assets of the TSP) to 15 (NEST, CPF). The FRTIB is responsible for investment strategies that are externally managed, and its mandate is quite constrained (the legislation gives the Board very little leeway in setting investment policy). While a small Board may have gaps in expertise (which could be filled by using external advisers), a large Board may face logistical problems in trying to organise regular meetings.

Some countries apply additional political or social criteria when determining the composition of the Board:

-

ATP targets equal gender representation on the Board.

-

GPFN and GPFG have a quota of 40% female Board members.

-

The AP funds require members of the Board to be Swedish citizens.

-

A maximum of three of the Board members of CPPIB can reside outside Canada; the Board must have regard to the desirability of having directors representative of various regions of Canada.

Duration of terms, timing of appointments and re-appointment

The different institutions apply similar policies to ensure continuity and avoid having to replace several Board members at the same time. This is not a matter addressed by the Core Principles.

-

CPPIB, ATP and the AP funds all set three-year terms for Board members and allow multiple re-appointments.

-

Folketrygfondet (GPFN) sets four-year terms and allows re-appointment for up to 12 years.

-

FRTIB members are appointed for four years terms.

-

Some institutions have legal limits on the number of Board members they can replace at one time; others set practical limits.

Remuneration of the Board and management

Most of the institutions under review publish details of the remuneration of Board members and top executive management in their annual report.8 The remuneration of Board members among the different institutions ranges from pay scales in line with market standards to zero or very low payments. None of the institutions examined allows performance-related pay for the Board. In all cases, non-executive Board members are permitted to hold positions in other organisations. In most cases, Board members hold non-executive positions elsewhere but in some instances (e.g. the CPF) they have executive functions.

Market-matching remuneration may help to attract good candidates. Table 4.4 has examples of market-matching remunerations. A number of the institutions that pay their Board members at market rates specify that this is to enable them to recruit suitable people, as well as being an appropriate reward for the responsibilities and time commitment involved in the role. They also specify that the institution should not drive market rates higher. For example, the remuneration of Board members at CPPIB is set out in the bye-laws and takes account of the remuneration of persons with similar responsibilities and activities. A similar approach is followed in ATP through a remuneration policy set out by the Board.

However in several jurisdictions salary limits are placed on public functions, so offering high market-rate remuneration to Board members could be controversial. Their respective governments set the remuneration for Board members of the AP funds and the GPFN. The remuneration of the Board of the Australian Future Fund is determined by the public sector remuneration tribunal, but is at the top end of the public sector scale so corresponds to market-matching rates.

The Board usually has the authority to establish the remuneration of senior management.

-

In GPFN the Board sets the remuneration of the Executive Director and informs the Ministry of Finance.

-

In the AP funds the Board sets the remuneration of the Executive Director and other senior managers; Government guidelines exist for the remuneration of senior managers of the AP funds.

-

The Board of Directors sets the remuneration of the senior management team in ATP and in CPPIB taking account of market comparisons.

Executive management all receive market-based pay. Many of the institutions under review are market leaders in terms of their asset base and their role within the investment community, and this is reflected in their compensation structures.

-

NZS considers that it is competing in a global market for executive talent.

-

ATP offers market-level compensation based on national and international standards and taking into account the size and scope of the institution.

-

AP4 aims to pay salaries that are competitive but not market-leading.

-

The levels of executive compensation at CPPIB are consistent with those at other comparable Canadian financial institutions. The government of Canada actively monitors executive compensation in relation to the size of assets under management.

Table 4.5 shows some examples of executive pay. There is a wide range of both fixed and variable compensation. Some institutions offer performance-based remuneration as part of their senior managers’ remuneration. Others believe that such incentives may lead to suboptimal and short-term business conduct and they exclude their senior managers from any performance-based remuneration.

-

GPFN does not allow performance-related pay for its Chief Executive but it does apply performance-based incentives to other senior managers.

-

CPPIB has an extensive and quite complex incentive programme for senior managers. Its managers are among the highest paid in the pensions industry globally, reflecting their expertise in managing a very large, actively-managed portfolio.

-

ATP, AP4 and AP7 do not allow performance-based pay for senior managers.

-

All staff – including non-investment staff – at the Australian Future Fund have some element of their variable pay linked to the performance of the investment portfolio. This helps to keep them focused on the mission of the AFF.

Summary of key policy issues: governance frameworks

The nationally significant investment institutions analysed fulfil different roles in their domestic pension systems, and this is reflected in differences in their governance frameworks. Nevertheless, they have a number of features in common that are relevant to the regulation of private pensions:

-

The governance frameworks of these investment institutions closely reflect the recommendations of Core Principle 3, especially in the establishment of an oversight Board that is accountable to the competent authorities as well as to members.

-

The missions of the institutions are clearly stated. Their Boards are held accountable for delivering the mission and are subject to extensive disclosure requirements. This enables the supervisory authorities and stakeholders to monitor performance and compliance with the mission.

-

The institutions operate within a regulatory and legal framework but at arm’s length from government. This places considerable responsibility on the Board. Board recruitment is therefore a key determinant of the success of the institution.

-

There is no consensus on the appropriate level of remuneration for Board members of the investment institutions under review, but fit and proper criteria are rigorously applied in all cases and attention is paid to the overall range of skills of the Board. Conflict-of-interest policies are transparent.

-

The Boards have oversight of operational and other internal risks and several institutions have implemented whistle-blower schemes.

4.3. Investment and risk management

The investment strategies of the nine investment institutions fall into two main types, target date/lifecycle funds and long-term return strategies. The ways in which these strategies have been formulated and are executed have been examined in light of the implementing guidelines of Core Principle 4 of the OECD Core Principles of Private Pension Regulation which addresses investment and risk management. The implementing guidelines are described in Table 4.6.

Table 4.7 provides an overview of the processes followed by each of the institutions in establishing and implementing its investment strategy. As discussed below, these processes largely cover the points raised in the Implementing Guidelines of Core Principle 4, especially IG 4.1 – 4.12 which cover the alignment of a fund’s investment policy with its objectives. The implementation of these policies, including more detailed information on portfolio design, asset allocation and risk control (IG 4.13 – 4.21) and performance assessment (IG 4.28 – 4.29), is discussed in the “Investment Strategy” section.

Retirement income objective and prudential principles

IG 4.1 stipulates that the regulation of pension fund investment should be aligned with the retirement income objective and the eventual liabilities of the fund. The equivalent for a nationally significant investment institution is that the Board of Directors be held accountable for establishing an investment policy in line with the mission of the institution. This means setting the return expectation, the risk tolerance and any asset allocation limits. This is the case for most of the institutions under review. 9

Prudent person standard

The Core Principles emphasise the obligations of pension fund governing bodies towards members and beneficiaries, especially their fiduciary duty and the expectation that they will act prudently (IG 4.2 – 4.3). As shown in Table 4.7, the investment policies of the reserve funds and the pension funds with individual accounts include the concepts of member best interest and prudential requirements.10

Investment policy

All of the institutions have a written investment policy, in keeping with IG 4.4 – 4.5, that outlines the type of investment and risk exposures the institution will take on in order to achieve its mission and objectives. It is translated into an investment strategy by the Board, usually with the advice of management, which determines the final shape of the portfolio.

-

The mission of the CPPIB is “to invest its assets with a view to achieving a maximum rate of return, without undue risk of loss, having regard to the factors that may affect the funding of the Canada Pension Plan and its ability to meet its financial obligations on any given business day.”11 It should also “provide cash management services to the Canada Pension Plan so that they can pay benefits.” The Board of Directors has translated this into a strategy of maintaining two separate portfolios, one to manage liquidity and one to seek high returns.

-

The mission of AP7 is to provide the default investment option for the Premium Pension System based on a lifecycle approach. The Board has translated this into an investment strategy of building the default fund with two underlying building block portfolios, for which it lays down the investment constraints.

-

The mission of ATP includes maintaining the real value of members’ benefits and providing insurance-like guarantees. The Board has translated this into a liability-driven strategy combining a hedging portfolio and a return-seeking portfolio.

The degree of freedom that the Board has in establishing the investment policy reflects the nature of the institution. This mirrors the requirements of IG 4.6 for private pensions, that the investment objectives be consistent with the retirement income objective and specific attributes of the fund. Pension funds are expected to provide their members with retirement income and their investment policies are designed accordingly. ATP is designed as an insurance company and its investment policy is essentially driven by its liabilities. Sovereign Wealth Funds and Reserve Funds do not face the same expectations from members, but their investment policy might be influenced by liquidity requirements. Sovereign Wealth Funds and Reserve Funds may face cash calls at relatively short notice, whereas public pension funds with individual accounts can usually plan their liquidity needs long into the future.

Similarly, the degree of risk that the institution can bear depends on its mission (IG 4.9). In general, pension institutions with individual accounts have a direct responsibility towards each member to build their retirement assets and make them available on retirement. They therefore have a lower risk tolerance as they seek to avoid capital losses and illiquidity risk.

Risk management is the chief mechanism for aligning both Board and management with the long-term investment policy. Within the limits of its mandate, the Board of Directors sets out a risk budget specifying overall risk as well as risk composition and it receives regular reports from management on whether or not it is being respected. The degree of tolerance around the risk budget (and other investment constraints) is an important determinant of the management’s ability to react to extreme events such as a market crash or significant events in particular markets or sub-markets without having to wait for approval from the Board. This could have a significant outcome on the performance of the portfolio.

IG 4.7 states that the written investment policy should include guidelines on asset allocation, overall performance objectives and monitoring, and the degree of tolerance around these guidelines. In the case of the examined investment institutions, some of these guidelines are set by the state rather than by the Board. In Sweden, the asset allocation of AP1-4 is set in legislation and the mandate of AP7 specifically includes providing lifecycle funds. By contrast, the Board of CPPIB (Canada) faces no asset allocation constraints. In the UK, it is the Board of NEST, rather than the government, that has determined that offering lifecycle funds is the best way to fulfil the mandate of the institution.

The investment institutions may have either absolute or relative performance targets. There is considerable variation in the absolute return targets: NZS’s mandate is to achieve annualised performance of 2.7% above cash over any 20-year moving average period; AFF aims to achieve annual returns of 4.5% - 5.5% above the Consumer Price Index, with an “acceptable” level of risk and while minimising the impact on Australian financial markets;12 AP4 targets real returns of 4.5% per annum. CPPIB and the Norwegian sovereign wealth funds have relative return targets, as they aim to outperform a reference portfolio with equivalent risk.

The reserve funds and sovereign wealth funds under review all integrate environmental, social and governance (ESG) factors in their investment policies. Their emphasis is on risk reduction, especially climate change-related risks. Some institutions, notably CPPIB and the Australian Future Fund, also highlight the potential return opportunities from ESG investment. The Swedish reserve funds AP1-4 have established a Council on Ethics to support their ESG activities.

Among the institutions with individual accounts, Denmark’s ATP and the UK’s NEST point to ESG factors as drivers of long-term risk-adjusted performance. AP7 is an “active owner”, engaging with its portfolio holdings on ESG issues. ESG integration is not addressed in the Core Principles, although Core Principle 4 draws attention to the long-term nature of pension fund investment and refers regulators to the G20/OECD High-Level Principles of Long-Term Investment Financing by Institutional Investors in this regard.

Portfolio limits and other quantitative requirements

The quantitative restrictions placed on the investment institutions are consistent with their risk-return objectives and with prudential requirements (IG 4.13 – 4.21). With the exception of the Norwegian domestic fund, their asset allocations are relatively unconstrained. This may reflect the high level of investment expertise of these institutions and their relatively large asset base, which means that they are able to take advantage of investment opportunities across a wide range of asset classes. Notably, the CPPIB invests over 20% of its portfolio in real assets, whereas direct investment in real estate is prohibited in six OECD countries and a number of jurisdictions restrict investment in other less liquid asset classes.13

Valuation of pension assets

The institutions all use market value to measure their assets and have established transparent procedures for valuing assets where no market price is available (IG 4.22-4.27).

4.4. Investment strategy

The institutions considered in this report primarily use one of two types of long term investment strategy: target date/lifecycle funds (which have a multi-year investment horizon and become more conservative over time), or long-term return strategies (which have a multi-generational investment strategy and no pre-determined evolution in their risk profile. ATP (Denmark) is unusual in having an insurance-based approach; this includes a long-term return-seeking portfolio, and it is therefore considered as part of the second group.

Target date and lifecycle funds

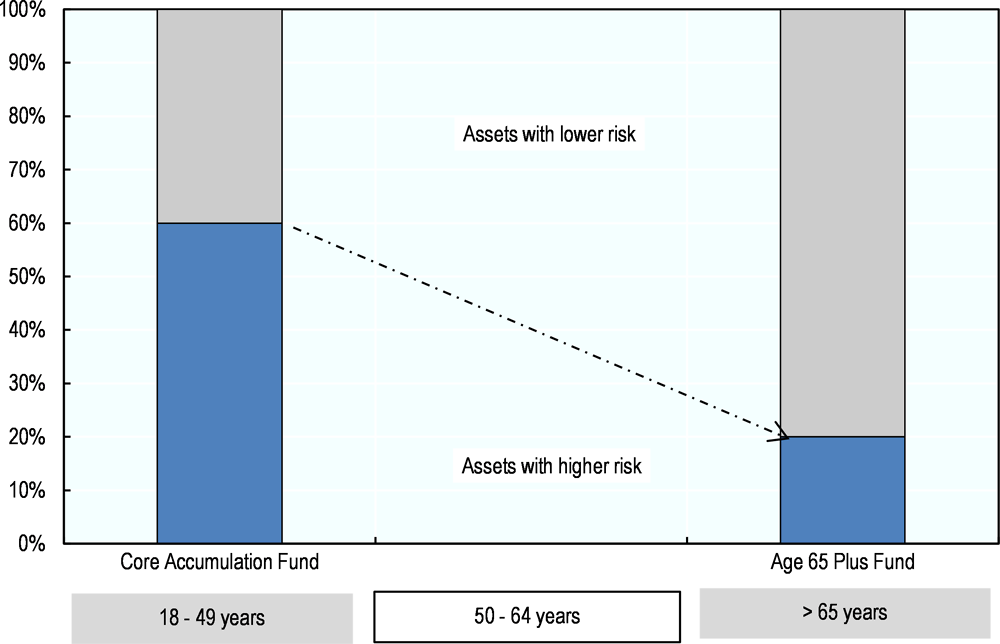

Among the pension funds with individual accounts, four out of five offer a target date or lifecycle strategy as the default option for members who do not wish to select an investment strategy for themselves (Table 4.8). In these institutions such approaches are used to obviate the need for members to make complicated decisions about their pension investments while providing a relatively high degree of certainty about future benefits. They can equally be used by schemes in which members do not have a choice about how their funds are invested. The exception is the CPF in Singapore, which offers a guaranteed rate of return on savings. Both the Core Principles (in IG 4.10) and the OECD Roadmap for the Good Design of Defined Contribution Pension Plans recommend that pension plans provide a default option, and the Roadmap recommends that the default be a lifecycle strategy.

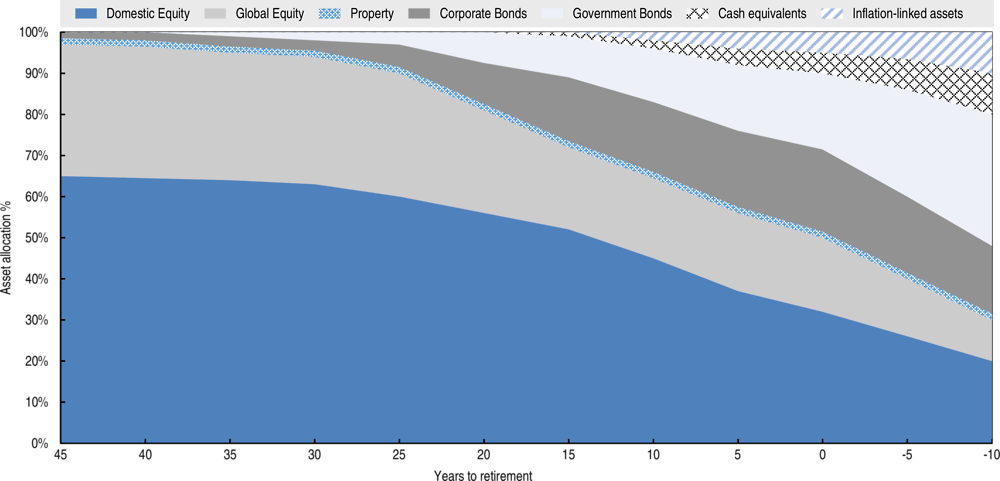

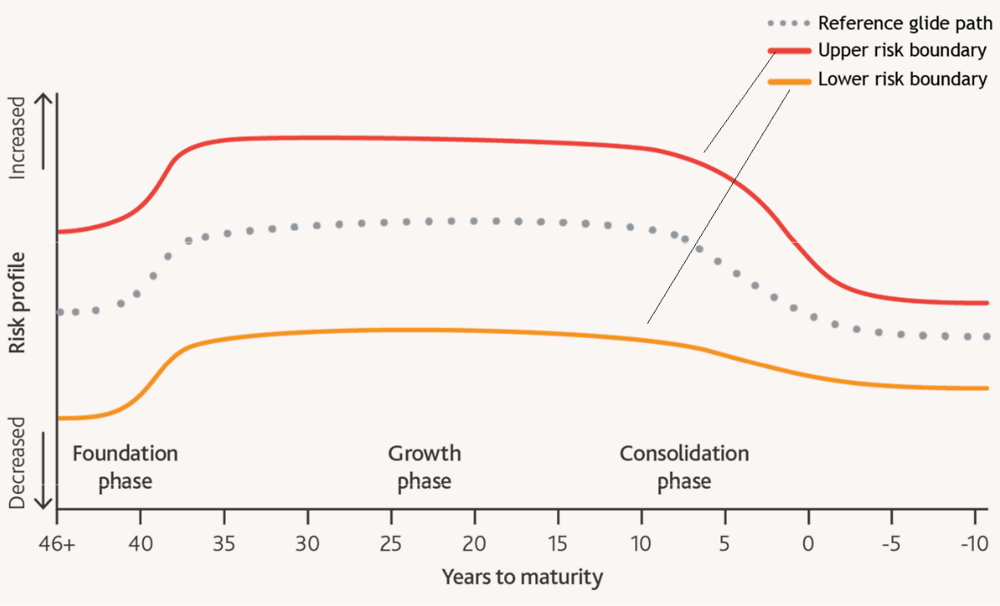

Target date funds (TDF) are multi-asset funds that reduce their weighting in riskier asset classes as a specific event – in this case the retirement date – approaches. Members are allocated to the TDF that corresponds to their retirement date, for example the NEST Retirement Fund 2021. The de-risking path is known as a "glide path". In addition to providing the benefits of a classic multi-asset strategy of diversification and rebalancing, TDF adjust automatically as the risk profile of the member evolves. In theory, members will become more risk-averse as they age, although the example of NEST shows that this may not always be the case in practice (Box 4.1).

In addition, by allocating most or all of the portfolio to low risk assets ahead of the retirement date, TDF aim to protect members from market volatility at the moment when they may want to cash in their assets to buy an annuity or, if they stay invested, have less time to recover their losses through future market growth.

The asset allocation of a target date fund typically becomes more conservative over time. Members are expected to become more risk averse as their time horizon shortens, as they have less time to make additional contributions or to recover from losses. Thus, TDF usually have a high exposure to risky assets such as equities in early periods in order to build up the asset pool and switch into safer but lower-yielding assets such as bonds over time.

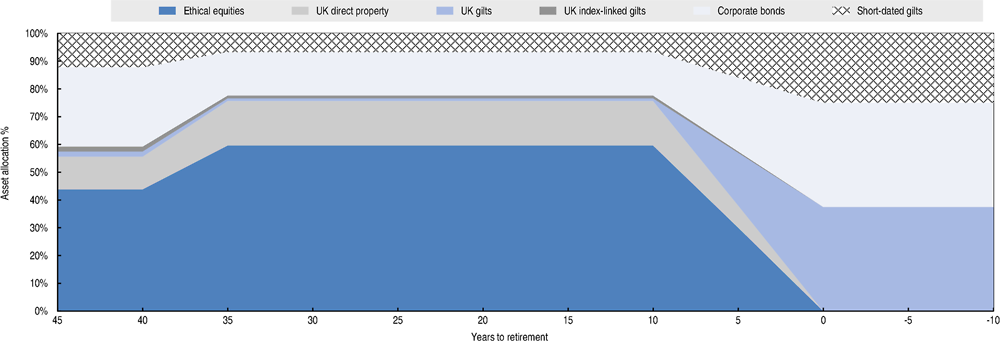

NEST, the UK auto-enrolment provider, has implemented a different glide path. Its TDF have three phases: the foundation phase (40+ years to retirement); the growth phase (from around 40 to around 10 years to retirement) and the consolidation phase (less than 10 years to retirement). NEST's research found that young savers were very concerned by the risk of extreme loss; the foundation phase therefore aims at capital preservation rather than high growth, with a target long-term volatility of 7%. This is to encourage younger members to get into the habit of saving and avoid a sharp one-off fall in their retirement pot that might make them stop contributing. The growth phase concentrates on growing the retirement pot by at least 3% per annum in real terms and has a target volatility of 10-12%. In the consolidation phase, portfolio gains are locked in via low-risk assets.

Lifecycle funds follow an equivalent approach of reallocating assets away from riskier asset classes as the member gets older. Instead of being allocated to a specific fund, the member’s own portfolio is adjusted over time. There are administrative differences between the two approaches – TDF are pooled vehicles whereas lifecycle funds are individual accounts – but the investment objective is almost identical. The key consideration is that there is effective asset allocation and risk budgeting in every period.

TDF and lifecycle funds can be more or less targeted to different cohorts. The asset allocation of the Default Investment Strategy (DIS) in Hong Kong, China is adjusted annually for members aged between 50 and 64 years; the default fund of AP7 in Sweden is adjusted annually for members aged between 56 and 75 years. NEST (UK) offers up to 50 Retirement Date Funds as its default strategy: members choose the fund that corresponds to the year they will retire, for example a member who will want to take their money out in 2040 will select the NEST 2040 Retirement Fund. The Thrift Savings Plan (USA) groups members into larger cohorts, offering TDF for 2020 (retirement date 2015-2024), 2030 (retirement date 2025-2034), 2040 (retirement date 2035-2044) and 2050 (retirement date 2045-2054).

Schemes differ in terms of the methodology used to establish the glide path, the number of different asset classes used as building blocks to construct the overall asset allocation, and the extent to which risk is managed along the glide path in response to prevailing market conditions. For members of the DIS in Hong Kong (China), the asset allocation of their portfolio is static between the ages of 18 and 49, is adjusted linearly each year between the ages of 50 and 64 and is static thereafter (Figure 4.3).

By contrast, NEST in the UK actively manages asset allocation along the glide path within pre-set risk budgets, taking account of economic and market conditions (Figure 4.4).

Schemes also differ in terms of the underlying building blocks used to create their asset allocation. The Thrift Savings Plan uses 5 underlying funds covering US and global equities, US bonds and US government bonds. NEST uses 14 underlying funds covering nine asset classes - its default funds have exposure to emerging market bonds and to property, which are not included in the asset allocation of the Thrift Savings Plan. Both NEST and TSP use passively managed funds as building blocks, to reduce costs. AP7 has two building blocks - fixed income and equity - but its equity building block itself contains a number of actively managed underlying funds. AP7's equity portfolio has very broad exposure to non-domestic equity markets and employs leverage to boost returns, making it higher risk than the equity investments of NEST and the Thrift Savings Plan.

Long-term return strategies

Reserve funds and sovereign wealth funds follow long-term return investment strategies. Their focus is on asset growth at an acceptable level of risk, without the constraint placed on TDF to reduce portfolio risk as the target date approaches. The investment institution may have a higher or lower tolerance for risk depending on its mission or mandate, the source of the funds and the size of its asset base.

Of the institutions under consideration, the CPPIB has the most aggressive and diversified long-term return investment strategy. It has a large in-house investment team and considerable exposure to direct investments and illiquid asset classes. It has generated annualised net nominal returns of 6.7% over the past ten years in local currency. The GPFG, which has a different risk tolerance and follows a less diversified strategy in terms of asset classes, has returned almost 6% per year in local currency over the same period. Table 4.9 provides an overview of long-term return strategies employed by different institutions.

While long-term return strategies may generate higher absolute returns than TDF investments, they are likely to be more volatile. It may also be necessary to tie up assets in illiquid investments in order to generate performance. They are also more expensive to implement and may demand a higher degree of investment expertise of the Board as well as management.

One institution in the survey – Denmark’s ATP – applies an insurance approach to provide life-long guaranteed benefits at age 65. New contributions are converted into deferred annuity rights based on a guaranteed interest rate. ATP is subject to a regulatory framework similar to the European Solvency II requirements and is subject to absolute solvency requirements at all times on a marked-to-market basis. ATP is very sensitive to interest rate risk and the majority of its assets are allocated to the "hedging portfolio" that hedges interest rate risk on the pension liabilities (i.e. the individual annuity rights); a small portion of the assets are allocated to the "investment portfolio" that aims to generate sufficient returns to preserve the long-term purchasing power of benefits. ATP is the only institution in the reference group to have liabilities.

Summary of key policy issues: investment and risk management

The investment institutions included in this report have different missions and therefore have different investment policies. The ways in which they implement these policies are however quite similar: they primarily use one of two types of long term investment strategies, target date/lifecycle funds or long-term return strategies. Regulators may therefore wish to consider how relevant these strategies are for private pension institutions.

-

Target date funds (TDF) / lifecycle funds is the preferred strategy for institutions with individual accounts. They have two chief advantages: they preserve members’ assets ahead of their retirement date, and relieve members of the requirement to manage their own retirement funds.

-

These advantages come at the cost of lower performance potential than a long-term return strategy, reducing the target size of the retirement pot. They may be less relevant where the member is not involved in the investment decision-making process.

-

Long-term return strategies should offer better return potential than TDF/lifecycle, but their higher expected volatility makes them less suitable for individual accounts. They carry a higher risk than TDF/lifecycle funds that sufficient sums will not be available to members at the moment of retirement.

-

The institutions express their performance objectives in terms of their mission and monitor performance against this long-term goal rather than against a market benchmark. The relevant supervisory body is able to assess whether the performance objective is appropriate and whether the Board is on track to achieve it.

-

All the nationally significant investment institutions examined except the US Thrift Savings Plan integrate ESG analysis in their investment policies.15 ESG integration is not directly addressed in the Core Principles.

4.5. Conclusions

The nationally significant institutions analysed in this report have different objectives and employ different organisational and operational structures to achieve them. However, there are many common features in the approaches taken, indicating that the recommendations of the Core Principles are relevant and applicable to the full range of pension systems and institutions.

The missions of the different institutions are clearly stated, and guide the investment policy. The institutions provide a high level of transparency about their governance arrangements and their investment and risk management. This reinforces their accountability to their different stakeholders. Regulators may wish to apply similar disclosure standards to private pension institutions.

The role of the Board in ensuring that the institution achieves its mission is critical. Board members are therefore expected to have high levels of expertise in all areas related to the running of the institution. The recruitment and remuneration policies of the different institutions may provide some guidance as to how to avoid lack of experience or conflicts of interest in the Boards of private pension funds.

In terms of investment policy, the mission of each institution has implications for the type of risk-return profile it should target, and this broad profile may be included in legislation. However it is not usual for legislation to set out how that profile should be achieved - only Norway sets out investment constraints in law.

All but one of the nine investment institutions examined in this chapter integrate ESG analysis in their investment policies. Regulators may consider clarifying their approach to ESG integration.

Most institutions offering pension funds with individual accounts have opted for target date funds or lifecycle strategies. These offer a smoothed return profile to members and are especially appropriate as default investment strategies. Where the institutions are able to bear higher risk, they have implemented more aggressive, long-term return-seeking strategies and often built up significant asset management expertise in-house. Regulators might want to examine the capacity of funds in their jurisdiction to implement similar strategies.

Notes

← 1. The MPF System consists of several privately-managed schemes, rather than a single, national investor. However, the MPF is included because its Default Investment Strategy is relevant for the examination of the investment policies of the pension funds that operate individual accounts.

← 2. All AUM data as at 21 July 2017 unless otherwise stated.

← 3. Employee numbers were not found for MPF, CPF, TSP.

← 4. In the case of the MPF, it is the trustees of the constituent funds rather than the Board of the MPFA who have fiduciary responsibilities towards members.

← 5. New Zealand Superannuation Fund website

← 6. The arm’s length nature of Board relationships both upwards and downwards within the investment institutions examined in this report is one of the main lessons distilled from the analysis of their governance structure.

← 7. Hong Kong is excluded from this section as the MPF consists of private sector funds, each with its own Board structure

← 8. Board remuneration is not part of the OECD Core Principles or its implementing guidelines. However, it is an important aspect in the setting of nationally significant investment institutions and it could be considered for inclusion in a future revision of the OECD Core Principles.

← 9. In the case of GPFG, the Norges Bank is responsible for the operational implementation of the mandate laid down by the Ministry of Finance. The Ministry decides the strategic asset allocation and tracking error while Norges Bank’s executive board sets supplementary risk limits.

← 10. In the case of the MPF, fiduciary responsibilities lie with the trustees of the constituent funds. The Board of the MPFA oversees licensed providers and does not have its own investment policy.

← 11. Source: Section 5 of CPPIB Act.

← 12. The “Investment Principles” of the Korean National Pension Fund (a reserve fund) similarly include a “Principle of Public Benefit” which takes into account the potential impact of the fund on the national economy, given its size. The fund has assets of over USD 500 billion and invests almost 70% of this on the domestic market.

← 13. Source: OECD Annual Survey of Investment Regulation of Pension Funds 2017

← 14. Factor risk investing decomposes each asset class into its underlying risk factors. For example, corporate bonds contain both interest rate factor risk and equity factor risk, while government bonds contain only interest rate factor risk. This means that a portfolio made up of equity plus corporate bonds is less diversified than a portfolio made up of equity plus government bonds.

← 15. The MPFA (Hong Kong, China) does not establish an investment policy.