Financial burden of out-of-pocket expenditure

People experience financial hardship when direct out-of-pocket payments – formal and informal – are large in relation to their ability to pay for health care. Even small out-of-pocket payments can cause financial hardship for poor households and those who have to pay for long-term treatment such as medicines for chronic illness. Where health systems fail to provide adequate financial protection, people may not have enough money to pay for health care or to meet other basic needs. As a result, lack of financial protection may reduce access to health care, undermine health status, deepen poverty and exacerbate health and socioeconomic inequalities. Because all health systems involve a degree of out-of-pocket payments, financial hardship can be a problem in any country.

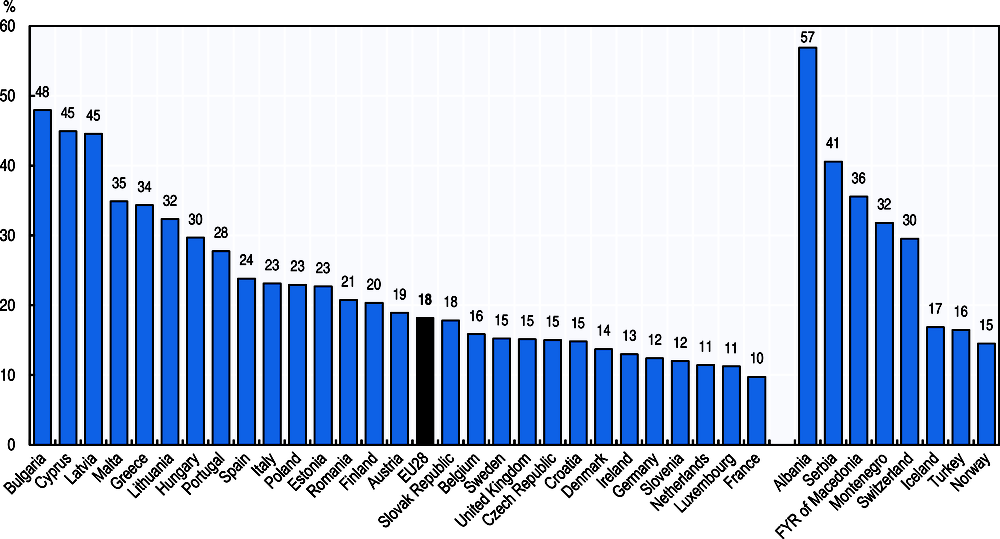

At an aggregate level, the share of out-of-pocket spending in total health spending reflects the degree of financial protection in a country along the three dimensions of coverage – the share of the population covered, the range of services included in a public benefit basket and the proportion of costs covered by collective third-party payer schemes for each service. Thus, the share of out-of-pocket payments are higher in those countries where significant groups of the population are excluded from coverage, important health services not included in the public benefit package or the cost-sharing of public payers limited for some services. Across the EU, around a fifth of all health spending is borne directly by private households (Figure 7.5). This figure ranges from around 10% in France, Luxembourg or the Netherlands to over 40% in Bulgaria, Latvia and Cyprus.

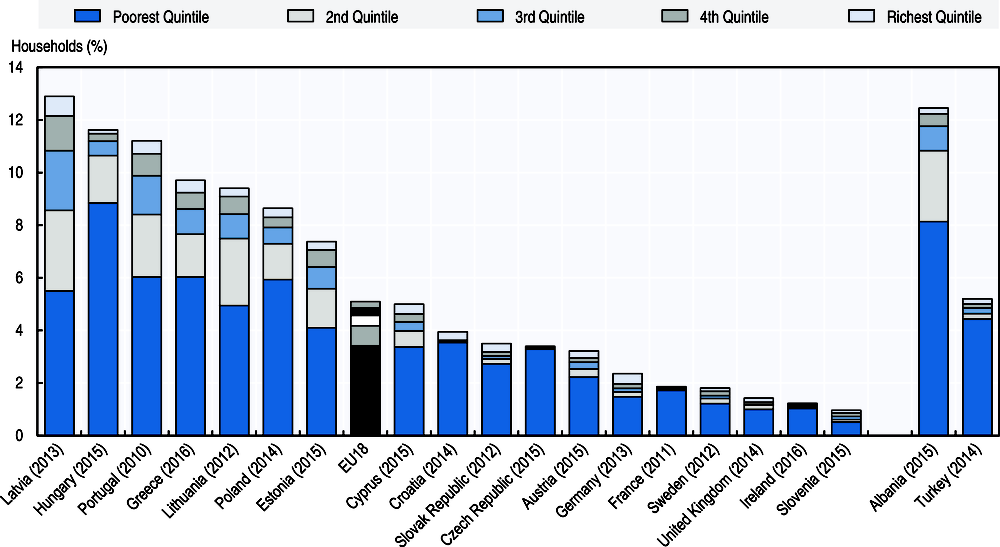

The indicator most widely used to measure the financial hardship associated with out-of-pocket payments for households is the incidence of catastrophic spending on health (Cylus et al., 2018). The incidence of catastrophic health spending varies considerably across EU countries, ranging from fewer than 2% of households in France, Ireland, Slovenia, Sweden and the United Kingdom, to over 8% of households in Greece, Hungary, Latvia, Lithuania, Poland and Portugal (Figure 7.6). Across Europe, poor households (i.e. those in the bottom quintile in terms of consumption) are most likely to experience catastrophic health spending, despite the fact that many countries have put in place policies to safeguard financial protection.

Countries with comparatively high levels of public spending on health and low levels of out-of-pocket payments typically have a lower incidence of catastrophic out-of-pocket payments. However, policy choices are also important, particularly choices around coverage policy (WHO Regional Office for Europe, 2018). Financial protection is demonstrably stronger in countries that cover the whole population, although this in itself is not enough to guarantee protection. Countries with a low incidence of catastrophic spending on health are also more likely to exempt poor people and regular users of care from co-payments; use low fixed co-payments instead of percentage co‐payments, particularly for outpatient medicines; and cap the co-payments a household has to pay over a given time period (e.g. Austria, Czech Republic, Ireland and United Kingdom).

There is clear evidence of the impact of changes in user charges policy in some countries. For example, looking at catastrophic spending over time in Latvia, the introduction of exemptions from all co-payments for very poor people in 2009, the extension of exemptions to other poor people in 2010 and the abolition of exemptions in 2012 for all except the very poorest households coincided with an improvement and then deterioration in financial protection among the poor (Thomson et al., 2018).

Out-of-pocket payments are expenditures borne directly by a patient where neither public nor private insurance cover the full cost of the health good or service. They include cost-sharing and other expenditure paid directly by private households and should also in principle include estimations of informal payments to health care providers.

Catastrophic health spending is an indicator of financial protection used to monitor progress towards universal health coverage (UHC) at global, regional and national levels. It is defined as out-of-pocket payments that exceed a predefined percentage or threshold of a household’s ability to pay for health care. Ability to pay may be defined in different ways, leading to measurement differences (Cylus et al., 2018). In the data presented here, ability to pay is defined as household consumption spending minus a standard amount representing basic spending on food, rent and utilities (water, electricity, gas and other fuels); the threshold used to define households with catastrophic spending is 40%. Microdata from national household budget surveys are used to calculate this indicator.

References

Cylus, J., S. Thomson and T. Evetovits (2018), Catastrophic health spending in Europe: Equity and policy implications of different calculation methods, Bulletin of WHO.

Thomson, S., T. Evetovits and J. Cylus (2018), Financial protection in high-income countries. A comparison of the Czech Republic, Estonia and Latvia, WHO Regional Office for Europe.

WHO Regional Office for Europe (2018), “Can people afford to pay for health care? New evidence on financial protection in Europe”, WHO Regional Office for Europe, www.euro.who.int/en/health-topics/Health-systems/health-systems-financing/universal-health-coverage-financial-protection.