Quality of governments’ financial reporting

Financial reporting is one of the foundations of good fiscal management. High-quality financial reports are essential to ensure that government’s fiscal decisions are based on the most up-to-date and accurate understanding of its financial position. Financial reports are also the mechanism through which legislators, auditors and the public at large hold governments accountable for their financial performance. Finally, financial reports are a critical source of information for markets and other stakeholders to understand the government’s financial operations and their implications for their own economic decisions.

There are three main criteria for high-quality financial reports: their completeness, in terms of the nature of financial operations reported; their comprehensiveness, in terms of entities covered; and their integrity, in terms of the degree of external validation.

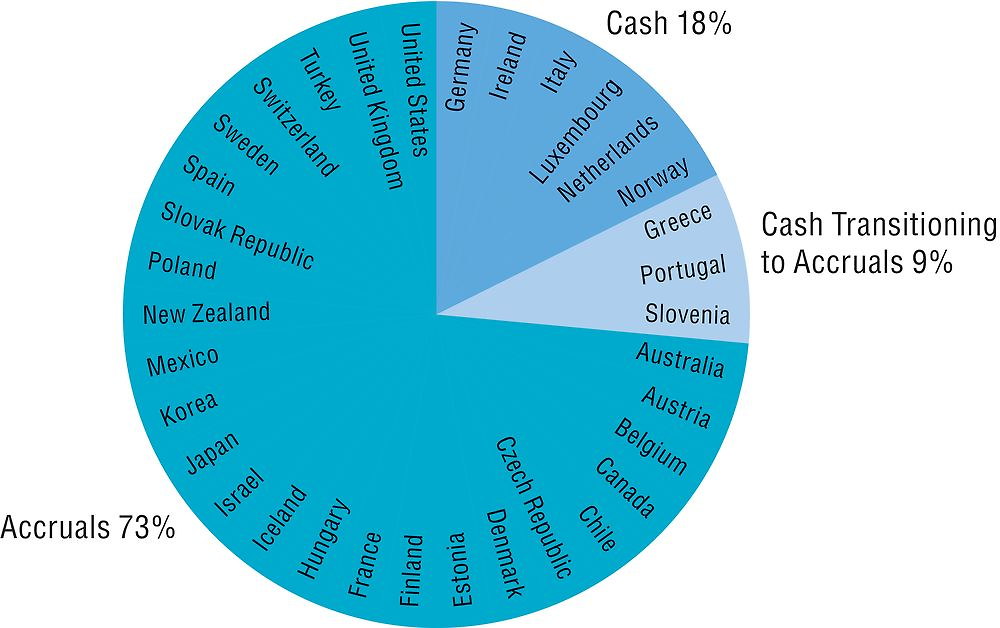

In around three-quarters of OECD countries, governments have improved the completeness of their financial reports by moving away from pure cash accounting toward accrual accounting. Governments that have adopted accrual accounting establish balance sheets that: report on their stocks of assets and liabilities; show whether liabilities are matched by corresponding assets; and measure whether their activities and decisions generate a fiscal burden. However, countries have progressed to different levels in populating their balance sheet. For example, civil service pensions and natural resources are reported in the balance sheet by 11 and 3 OECD countries respectively.

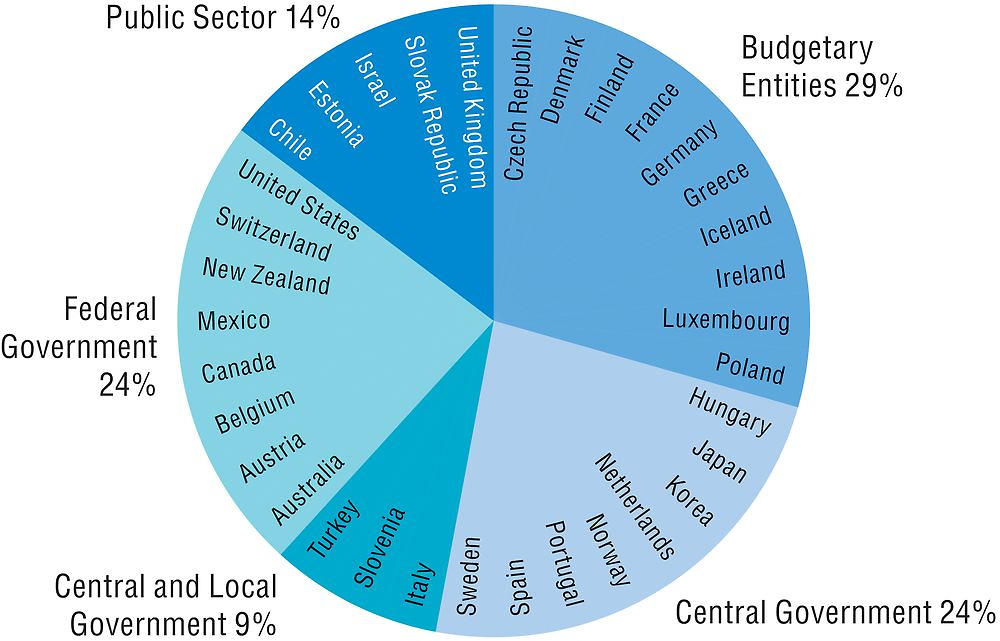

Fiscal activity is carried out by different levels of government. Government agencies, pension funds or local governments can raise, spend, and in some cases borrow significant fiscal resources. Where information on the financial situation of these public entities is not centralised, consolidated and publicly available, the transparency of public finances is more limited. However, only five OECD countries (14%) provide an overview of the public sector as a whole in their financial statements.

External independent and public assessment of the financial information prepared by the government is one of the major safeguards of financial report’ integrity. In all OECD countries, year-end financial reports are subject to independent external control or audit by national supreme audit institutions. To perform these audits, international auditing standards are used in 19 OECD countries 56%, showing that audit techniques have been modernised simultaneously with the adoption of accrual accounting by governments.

Overall, there has been clear progress in the completeness and comprehensiveness of governments’ financial reports over the last two decades. However, a high proportion of supreme audit institutions’ audit reports mentions various issues and concerns with financial reports, showing that governments still have a way to go for improving the quality of their reporting practices.

Data are from the 2016 OECD Accruals Survey. Survey respondents were senior officials from finance ministries. Responses represent the countries’ own assessment of current practices.

Accrual accounting is the method by which financial transactions are budgeted or recognised in the financial reports at the time at which the underlying economic event occurs, regardless of when the related cash is received or paid, and assets and liabilities are reported in a balance sheet.

Supreme audit institutions are independent national bodies, such as auditor general offices or courts of audit, responsible, among other tasks, for auditing or controlling the government’s annual financial report.

Further reading

OECD/IFAC (2017), “Accrual Practices and Reform Experiences in OECD Countries”, OECD Publishing, Paris, https://doi.org/10.1787/9789264270572-en.

Cavanagh J. (2016), “Implementing Accrual Accounting in the Public Sector, International Monetary Fund”, Washington, DC, www.imf.org/external/pubs/cat/longres.aspx?sk=44121.0

Figure notes

5.12: Countries that answered as having both accrual financial statements and cash financial reports (the Czech Republic and Hungary) are classified as “accruals”. Luxembourg is classified as “cash” but is planning a transition to accrual accounting.

5.13: Some countries in “central government” specified that their financial statements include social security funds (Hungary, the Netherlands, Norway, Portugal and Spain). Countries in “central and local governments” all include social security funds.

5.14: In Australia, natural resources are owned by state governments and not reported in the federal government financial statements.

Information on data for Israël : https://doi.org/10.1787/888932315602.

Source: OECD (2016), Accruals Survey, OECD, Paris.

Source: OECD (2016), Accruals Survey, OECD, Paris.