Thailand

SMEs in the national economy

There were 2.7 million SMEs (firms with less than 200 employees) in Thailand in 2012, constituting 99.7% of all enterprises and employing 78% of the labour force, including agriculture. Most banks do not use the national SME definition. Instead, they use the loan size as a proxy, and definitions vary across banks.

SME lending

The economy of Thailand was hit by two major events during the period under study: political instability and the financial crisis originating in the West. In Studies on SME and Entrepreneurship: Thailand. Key Issues and Policies (2011), the OECD found that less than half of the 2.9 million SMEs can access formal finance. This problem was compounded in Thailand by systemic volatility in financial markets. The Asian financial crisis and the recent global financial crisis have made it difficult for Thai banks to accept risky loans, not least because they were often burdened with extremely high non-performing loan rates. The lesson learned from the Asian crisis in 1997 was that adequate capital alone cannot encourage bank lending. Banks will only lend when they are comfortable with the level of credit risk.

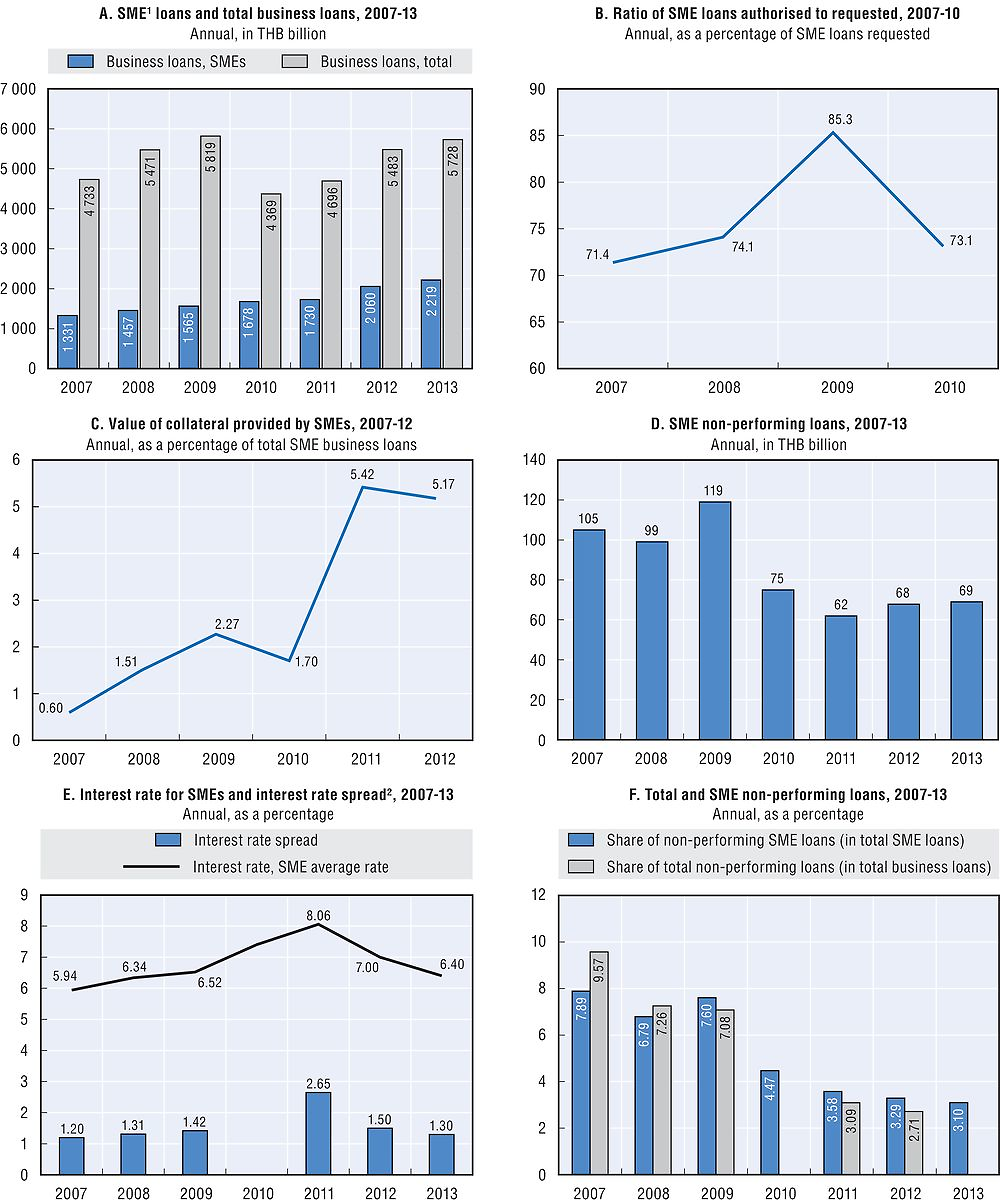

Loans to SMEs increased by 67% over the 2007-13 period. Since 2008, the share of bank loans to SMEs as a proportion of all business loans rose year after year from 26.6% in 2008 to 38.7% in 2013. Bank lending to businesses in general languished at two-thirds of the 1990s levels. While long-term lending declined somewhat year-on-year in 2013, short term lending increased by more than 60% in one year time. Short term lending made up 61.4% of all SME loans in 2013, up from 48.1% in 2012. The percentage of SME non-performing loans more than halved between 2007 (7.9%) and 2013 (3.1%).

The ratio of loans authorised vs. requested rose from 71.5% (2007) to 73.1% (2010), indicating that banks were continuing to provide credit although the terms were tightening.

Credit conditions

Interest rates for SMEs peaked in 2011 at 8.1%, mostly because Thailand did not engage in monetary easing. Interest rate spreads between small and large enterprises also increased from 1.2% (2007) to 2.7% (2011). In the last two years, both interest rates charged to SMEs and the interest rate spread dropped markedly. In 2013, the average interest rate for SMEs stood at 6.4% and the spread charged between large firms and SMEs narrowed to 1.3%.

More importantly, the value of collateral required increased to more than five times the value of SME loans in 2011, due to extreme risk aversion on the part of banks, and remained at a similarly high level in 2012 (while data for 2013 is not yet available). However, this was not entirely surprising given the historically high rate of non-performing SME loans.

Equity financing

Scarce supplies of venture capital stifled the business momentum of innovative firms. The venture capital and private equity industry is small in Thailand and has focused on mergers and acquisitions and restructurings, rather than start-up and mezzanine finance. The Market for Alternative Investments (MAI) was established in 1999. It provides a simpler and lower cost alternative to smaller firms than the Stock Exchange of Thailand (SET). As such, MAI provides an exit point for venture capital investors and facilitates capital raising by firms from institutional and sophisticated investors. As of 2010, the MAI had 62 companies listed; and the market capitalisation of MAI listings was at THB 43 billion. In 2009, there were only 11 members of the Thai Venture Capital Association. In addition, the weak Thai legal system and the underdeveloped capital market made exits difficult (Scheela and Jittrapanum, 2008).

Government policy response

Thailand established a five-year Portfolio Guarantee Scheme for SMEs in February 2008. All local commercial banks signed a Memorandum of Understanding to participate. It was expected that this would assure participating banks an acceptable level of risk. This supplemented the activities of the state-owned banks such as the Small Business Credit Guarantee Corporation (SBCGC).

The SBCGC provides credit guarantees to viable small businesses which do not have sufficient collateral. The SBCGC provides a letter of guarantee for approved applications to the financial institutions after the SME has paid the guarantee fee. In 2009, it had a THB 30 billion loan guarantee facility. In 2007, 2 866 SMEs were accepted for credit guarantees. The total number of loans guaranteed was an average of 7 800. This is a relatively small number compared to the total number of SMEs, pointing to an unexploited potential to ease SMEs’ access to credit. In 2011, the SBCGC had THB 89 billion in outstanding loan guarantees.

Country definition

On 11 September 2002, the Ministry of Industry introduced the definition of Thai small and medium-sized enterprises (SMEs). This definition is based on the firm’s number of employees and fixed capital. An enterprise is categorised as an SME if it has less than 200 employees and fixed capital of less than THB 200 million, excluding land and properties. SMEs in Thailand are classified along three sectors: production, service, and trading.

The SME definition used by financial institutions

The official definition for SMEs is not used by financial institutions in Thailand. In fact, each financial institution in Thailand is permitted to use their own definition of SMEs, which typically follows criteria such as sales less than THB 400-500 million and/or credit line less than THB 200 million. Therefore, data presented in Thailand’s profile does not reflect the above national definition.

Notes: 1. Firms with sales less than THB 400 million (EUR 10 million). 2. Spread between average interest rate for loans to SMEs and large firms. Banks did not provide information for 2010.

Source: Bank of Thailand.

References

OECD (2011), Thailand: Key Issues and Policies, OECD Studies on SMEs and Entrepreneurship, OECD Publishing.

Scheela, W. and Jittrapanun, T. (2008). “Impact of The Lack Of Institutional Development On The Venture Capital Industry In Thailand”, Journal of Enterprising Culture (JEC), World Scientific Publishing Co. Pte. Ltd., vol. 16(02), pages 189-204.