Korea

SMEs in the national economy

SMEs constituted 99.9% of Korean enterprises in 2013, with the vast majority being micro enterprises employing up to 9 employees (93.2% of employer enterprises). Small and medium enterprises accounted for another 6.7% of all employer enterprises. Large enterprises with more than 250 employees constitute only 0.1% of all employer enterprises.

With the services industry in Korea growing at a high pace, and with the government focusing its efforts on nurturing and supporting SMEs, the status of SMEs is becoming increasingly more important for the country. In 2011, SMEs employed for the first time more than 50% of the country’s economically active population, with the number of SME employees standing at 1.3 million, according to Statistics Korea. SME employees stood at 39.2% of the total workforce in 2000 and grew to 50.3% in 2011, following a consistent pattern of growth throughout this period.

SME lending

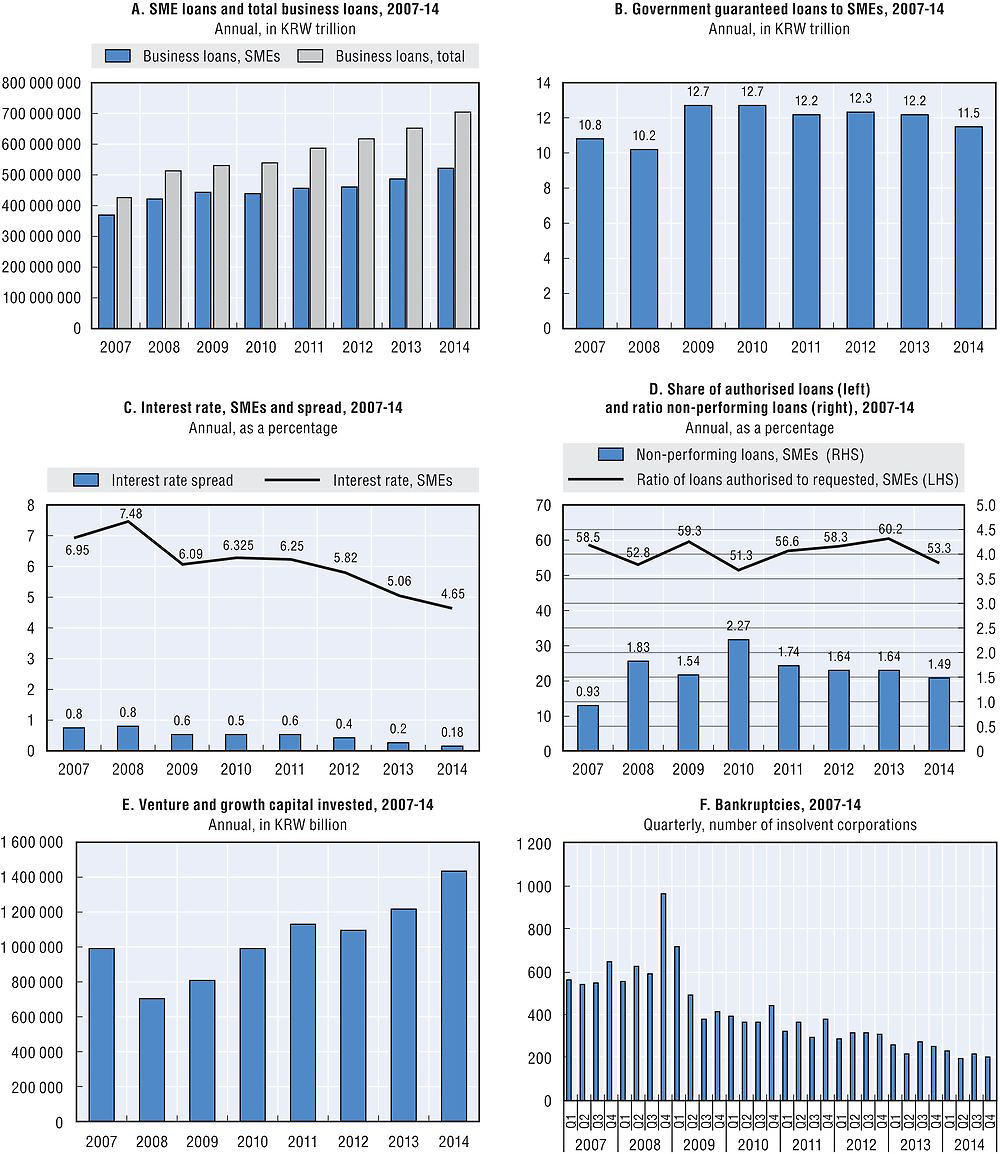

Korea’s definition of an SME varies by sector (see Box 22.1). SME and total business loans increased over the period 2007-14 by 41.2% and 66.2%, respectively. SME loan shares were calculated on the basis of total outstanding business loans (i.e. stocks). As loan growth for all business loans outpaced SME loan growth, the SME share of business loans declined from 86.8% in 2007 to 74% in 2014, which is still a high percentage by international standards. The proportion of short term lending to total business lending continuously declined from 2007 (75%) to 61.9% in 2013, and further to 59.4% in 2014.

The above figures were probably due to the more conservative attitude of the banks at the end of the review period. At the beginning of the crisis, SMEs had access to credit despite the somewhat alarming rates of increase in non-performing SME loans (NPLs), which roughly doubled from 0.9% of all SME loans to 1.8% in 2008, and even further to 2.3% in 2010 (but still well below the levels observed in many other OECD countries). The proportion of NPLs decreased sharply in 2011, decreased modestly in 2012 and 2013, and slightly decreased to 1.5% in 2014. Data for non-performing loans include domestic and foreign currency loans.

Credit conditions

The average interest rate charged on outstanding SME loans peaked in 2008 at 7.5%, but then declined steadily to 5.1% in 2013 and to 4.7% in 2014, which is still a relatively high interest rate compared with Western economies, which had taken loose monetary stances, in contrast to Korea. The higher rates probably reflected the greater risks faced by Korean banks and inflation trends. The interest rate spread between SMEs and large firms also reached a maximum in 2008 at 79 basis points, and dropped substantially in the following years to a low of 18 basis points in 2014 (compared with 24 basis points in 2013), which is low by international comparison. Banks eased lending conditions for SMEs not because of their willingness to absorb SMEs’ credit risks, which were high, but because of the government’s advice to banks to automatically roll over loans to SMEs. Roll-over rates consequently reached 90%. The government justified this approach on the grounds that banks were not capable of making an accurate assessment of the viability of borrowers during the crisis. Additionally, government guarantee programmes, further discussed below, contributed to the banks’ lending behaviour to SMEs despite their own liquidity shortages and difficulty in meeting regulatory standards.

The ratio between loans requested and loans authorised declined sharply between 2007 and 2008, when almost half of all loans applications (47.2%) were rejected. The relative number of rejections improved in 2009, before reaching a low of 48.7% in 2010. Rejection rates have increased to 46.7% in 2014 from 39.8% in 2013.

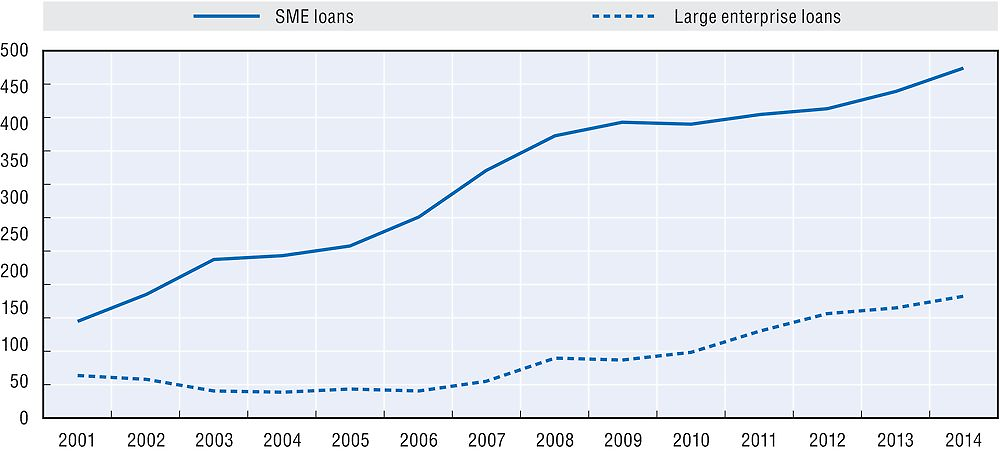

After the Korean currency crisis in 1997, the large corporations (conglomerates) accessed financing through direct financing rather than bank loans. Meanwhile, the banking sector focused on household loans as well as on SME loans covered by government guarantees. Thus, SME loans increased dramatically over the following 15 years. However, lending to large enterprises has recently increased due to the increasing concerns about SMEs’ credit risk and household debt problems.

Source: Financial Supervisory Service (FSS), Small and Medium Business Administration (SMBA).

Equity financing

Venture and growth capital declined between 2007 and 2008, as in other countries, but rebounded in 2009, 2010 and in 2011, exceeding its 2007 level. In 2014, venture capital investment increased by 18.4% year-on-year because another new fund of funds for “Creative Economy” (which is the current administration’s main focus) was launched and started to invest in innovative SMEs in 2014.

Venture capital was concentrated in the early and expansion stages in 2007. By 2014, venture capital investment was concentrated in the later-stage firms (44.4%), whereas the early and expansion stages were 30.7% and 24.8% respectively.

Other indicators

Data on payment delays were for loans overdue rather than for the average payment delays of customers, suppliers or government. Overdue loans declined in 2009 but rose again in 2011, only to drop to a low in 2012 (22.2% decrease compared to 2011). In 2014, payment delays again rose somewhat to 10 days, still well below the 12.1 days-level observed in 2008 and 2010. Although many SMEs in Korea were financially pinched after the outbreak of the global financial crisis, they avoided bankruptcy, thanks to financial support from the government. In 2014, bankruptcies decreased to 841 from 1 001 in 2013, by 16% year-on-year. It should be noted that while SMEs avoided bankruptcy because of the policies of the central and regional governments, they were still financially stressed due to low economic growth.

Government policy response

There was a 42% increase in the amount of government guaranteed loans during the crisis (2007-09). Moreover, the guarantee coverage ratio was raised temporarily from 85% to 95%, and even to 100% in the case of export credit guarantees. While the Small Business Corporation (SBC) increased its direct lending by only 6.2% between 2007 and 2008; there was a dramatic jump in 2009 (83%). During the recovery, direct loans declined, indicating this type of government assistance was easing off. But at the same time, the SBC loan authorisation rate remained well above 50%. The SBC decreased its direct loans of 2014 by 12% year-on-year.

In 2014, the outstanding government guaranteed loans were at KRW 60.1 trillion which included loans that were backed by two nationwide funds. Policy direct loans provided by the SBC totalled KRW 3.8 trillion in 2014. These loans try to remedy market failures and enhance the competitiveness of SMEs. The Korean Government is now actively looking for other cost effective ways to support SME lending. In addition, the Korean Government is planning on improving the policy-based financial system in order to intensively support innovative small and medium enterprises via high-quality policy rather than through quantitative expansion.

The BOK (Bank of Korea) and the FSS (Financial Supervisory Service) have the same definition of small and medium-sized enterprises (SMEs).

An SME denotes an establishment that has less than 300 regular employees or paid-in-capital less than or equal to KRW 8 billion (about USD 8 million). This definition of SMEs is based on the Article 2 of the Framework Act on Small and Medium Enterprises and Article 3 of its enforcement decree. SMEs can also be defined as follows:

Sources: Chart A: Financial Supervisory Service (FSS). Chart B: Financial Supervisory Service (FSS) & Small and Medium Business Administration (SMBA). Chart C: Bank of Korea (BOK). Chart D: Small and Medium Business Administration (SMBA). Chart E: Small Business Corporation (SBC). Chart F: Small Business Corporation (SBC).

References

Bank of Korea, “Economic Statistics System”, http://ecos.bok.or.kr/flex/EasySearch_e.jsp.

Financial Supervisory Service, “Monthly Financial Statistics Bulletin”, http://efisis.fss.or.kr/fss/fsi/id/fssview04_en.jsp.

Korea Venture Captial Association, “VC firm Summary”, http://ediva.kvca.or.kr/main/index.jsp.

OECD (2015), Entrepreneurship at a Glance 2015, OECD Publishing, Paris,: https://doi.org/10.1787/entrepreneur_aag-2015-en.

Small and Medium Business Administration (SMBA), “Statistics DB Search”, http://stat2.smba.go.kr/index.jsp.

Small Business Corporation (SBC), http://home.sbc.or.kr/sbc/index.jsp.