Costa Rica

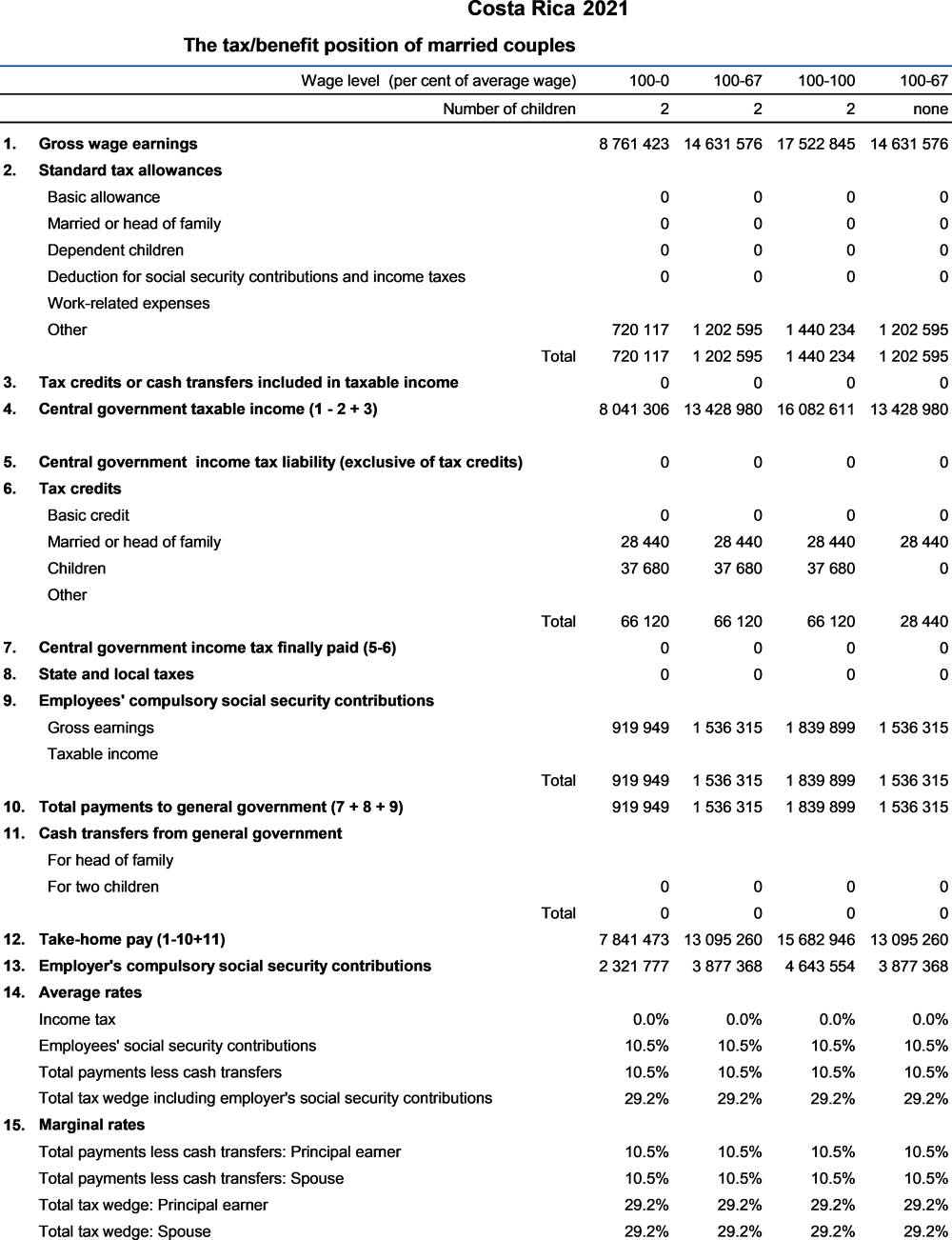

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Costa Rican colon. In 2021, in average the CRC 621.86 equalled a 1 US dollar. The average worker earned CRC 8.761.423 on an annual basis.

The fiscal year begins on January 1st and ends the following December 31th.

1.1. Central government income tax

The Costa Rica Income tax is applied to the income in cash or in kind, continuous or occasional, from any Costa Rican source perceived or accrued by individuals or legal entities domiciled in the country;

Costa Rica's labor legislation provides for payment of an additional salary or "bonus" paid in December of each year, the benefit is determined on the monthly average wage of the worker's other concepts be paid as overtime. This concept is not subject to social security contributions and is not taxed on the income tax.

The most noteworthy types of exempt income include:

1.1.1. Tax unit

Domestic natural persons who receive income of Costa Rican source, whether or not they have resided in the country during the respective fiscal period. Resident individuals are also subject to social security contributions to the Costa Rican Social Security Fund (CCSS) and fees to the Popular Bank.

5.1. Identification of an average worker

The average worker’s wage was calculated according to the official data of the CCSS that represents the official salaries of the formal sector.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.